Updated on April 26th, 2023 by Bob Ciura

Investors looking to generate higher income levels from their investment portfolios should look at Real Estate Investment Trusts or REITs. These are companies that own real estate properties and lease them to tenants or invest in real estate backed loans, both of which generate a steady stream of income.

The bulk of their income is then passed on to shareholders through dividends. You can see all 200+ REITs here.

You can download our full list of REITs, along with important metrics such as dividend yields and market capitalizations, by clicking on the link below:

The beauty of REITs for income investors is that they are required to distribute 90% of their taxable income to shareholders annually in the form of dividends. In return, REITs typically do not pay corporate taxes.

As a result, many of the 200+ REITs we track offer high dividend yields.

But not all high-yielding stocks are automatic buys. Investors should carefully assess the fundamentals to ensure that high yields are sustainable. Many (but not all) high-yield securities have a significant risk of a dividend reduction and/or deteriorating business results.

With that in mind, we created a list of safe REITs that have premier business models and strong property portfolios. In turn, their dividends should be considered more sustainable than the vast majority of REITs.

In particular, the following 9 safe REITs have at least 10 years of annual dividend increases, Dividend Risk Scores of ‘C’ or better, dividend yields above 3% using data from the Sure Analysis Research Database.

The stocks are ranked by dividend yield, from lowest to highest. The table of contents below allows for easy navigation.

Table of Contents

You can instantly jump to any specific section of the article by using the links below:

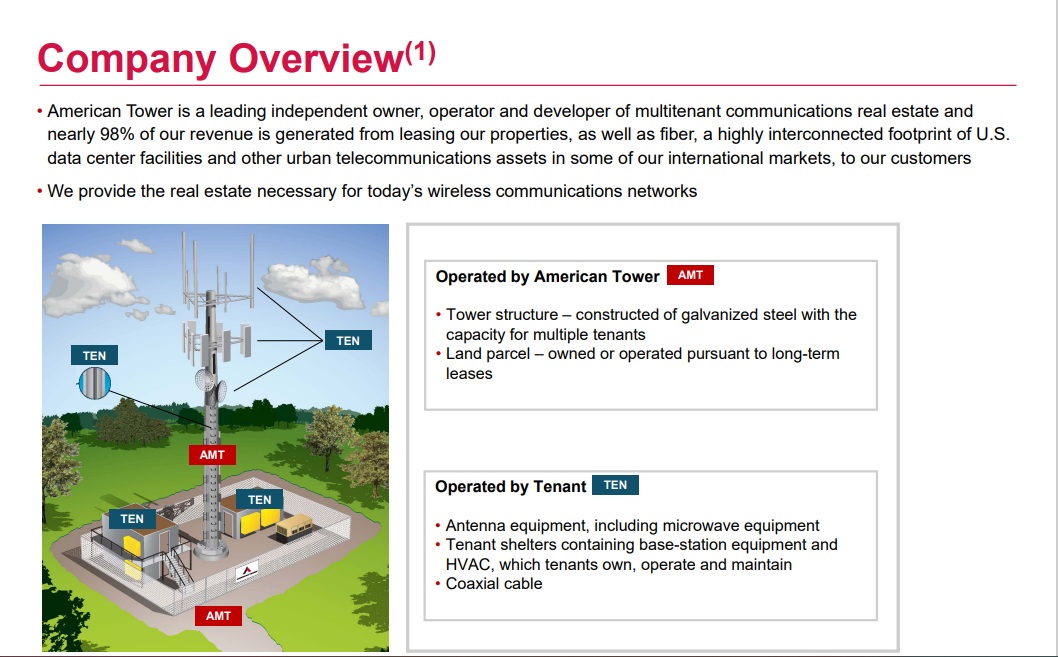

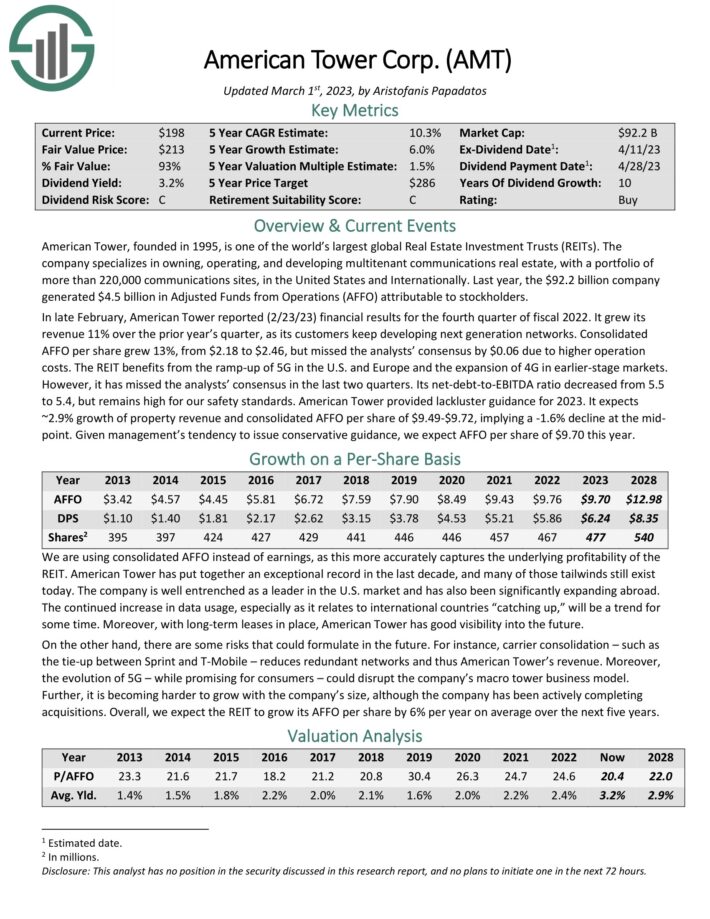

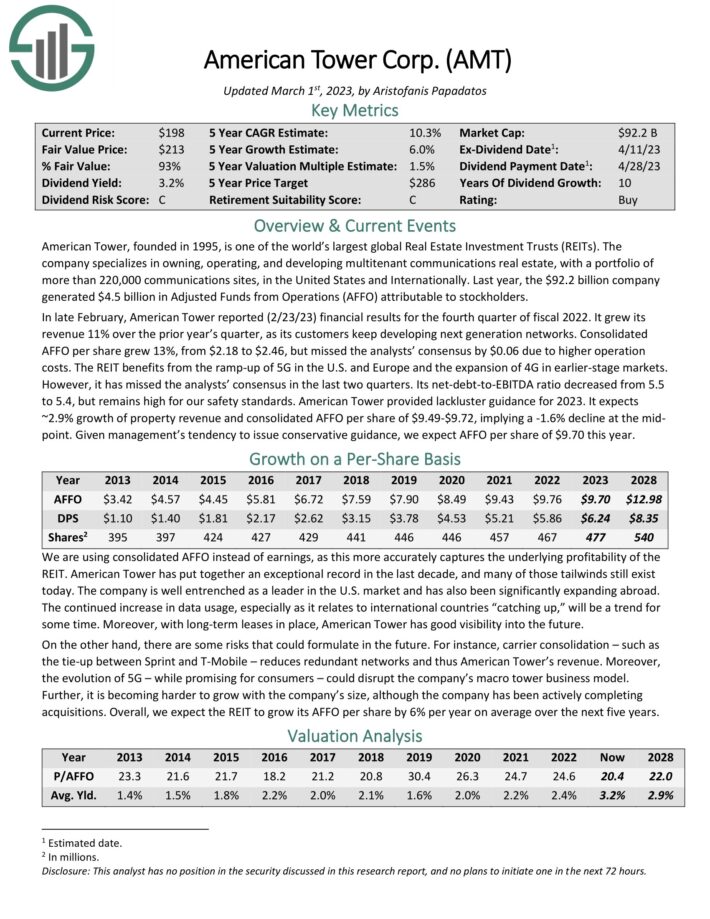

Safe REIT No. 9: American Tower Corp. (AMT)

American Tower specializes in owning, operating, and developing multi-tenant communications real estate, with a portfolio of more than 220,000 communications sites, in the United States and Internationally. Last year, the $92.2 billion company generated $4.5 billion in Adjusted Funds from Operations (AFFO) attributable to stockholders.

Source: Investor Presentation

In late February, American Tower reported (2/23/23) financial results for the fourth quarter of fiscal 2022. It grew its revenue 11% over the prior year’s quarter, as its customers keep developing next generation networks. Consolidated AFFO per share grew 13%, from $2.18 to $2.46, but missed the analysts’ consensus by $0.06 due to higher operation costs.

The REIT benefits from the ramp-up of 5G in the U.S. and Europe and the expansion of 4G in earlier-stage markets. Its net-debt-to-EBITDA ratio decreased from 5.5 to 5.4.

American Tower provided guidance for 2023. It expects ~2.9% growth of property revenue and consolidated AFFO per share of $9.49-$9.72, implying a -1.6% decline at the midpoint.

Click here to download our most recent Sure Analysis report on American Tower (preview of page 1 of 3 shown below):

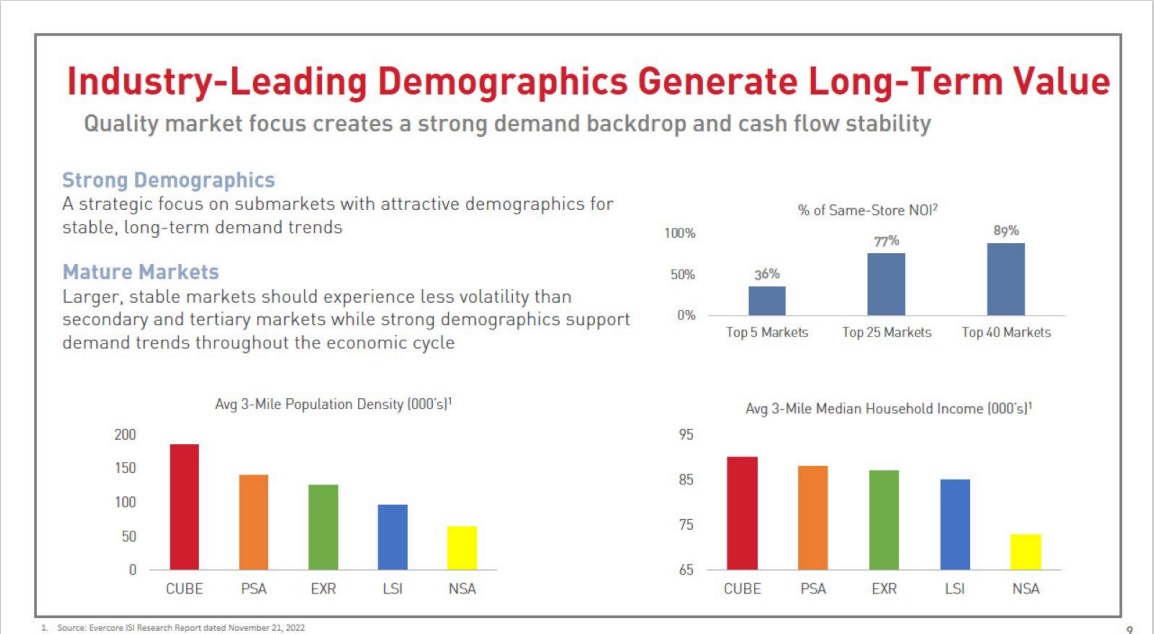

High-Yield REIT No. 8: CubeSmart (CUBE)

CubeSmart is a self-managed REIT focused primarily on the ownership, operation, management, acquisition, and development of self-storage properties in the United States. The company owns 611 self-storage properties, totaling approximately 44.1 million rentable square feet in the District of Columbia and 24 other states.

In addition, the company manages 663 stores for third parties bringing the total number of stores that it owns and/or manages to 1,279. CubeSmart has over 340,000 customers and generated around $1 billion in revenues last year.

Source: Investor Presentation

On December 7th, 2022, CubeSmart raised its dividend by 14% to a quarterly rate of $0.49. On February 23rd, 2023, CubeSmart reported its Q4-2022 and full-year results for the period ending December 31st, 2022. For the quarter, revenues grew by 9.5% to $200.7 million year-over-year.

Higher revenues were primarily attributable to increased rental rates on our same-store portfolio as well as revenues generated from property acquisitions and recently opened development properties.

Specifically, same-store NOI rose 12.1% year-over-year, driven by 9.5% same-store revenue growth against just a 2.3% same-store increase in property operating expenses. Accordingly, FFO grew by a substantial 72.2% to $152.6 million. However, due to an increased number of shares outstanding as a resource of funds for the company’s acquisitions, FFO/share grew by 68% to $0.67. Same-store occupancy at the end of Q4 was 92.1%, slightly lower from last year’s 93.3%.

For the year, FFO/share jumped by 19.9% to $2.53. Management introduced its fiscal 2023 guidance, expecting to achieve FFO/share between $2.64 and $2.71. We have utilized the midpoint of this range in our estimates, which implies year-over-year growth of about 6%.

Click here to download our most recent Sure Analysis report on CubeSmart (preview of page 1 of 3 shown below):

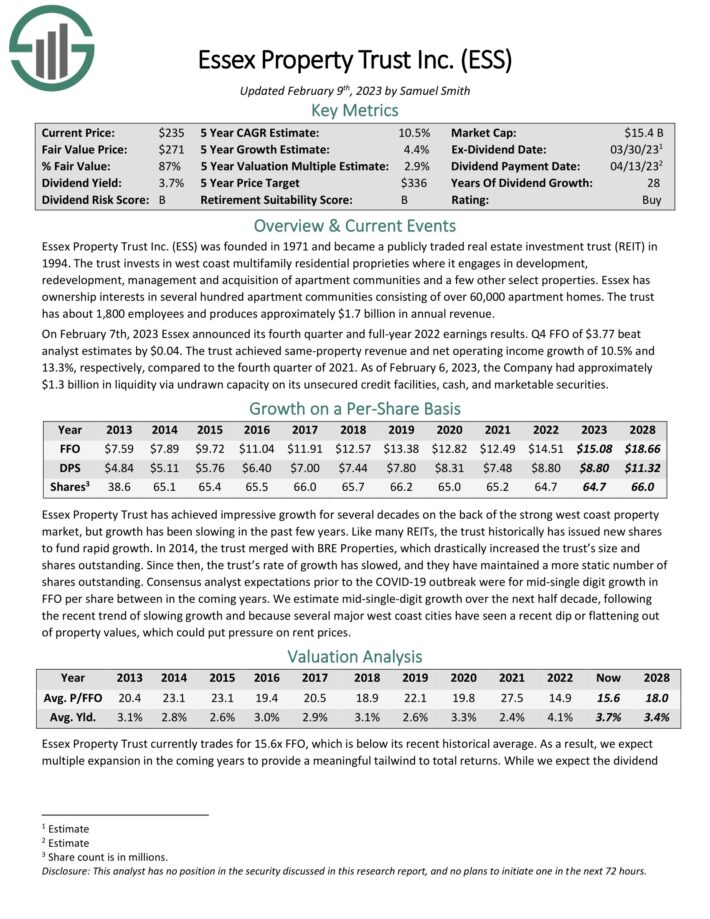

High-Yield REIT No. 7: Essex Property Trust (ESS)

Essex Property Trust was founded in 1971. The trust invests in west coast multifamily residential proprieties where it engages in development, redevelopment, management and acquisition of apartment communities and a few other select properties.

Essex has ownership interests in several hundred apartment communities consisting of over 60,000 apartment homes. The trust has about 1,800 employees and produces approximately $1.6 billion in annual revenue.

Source: Investor Presentation

On February 7th, 2023 Essex announced its fourth quarter and full-year 2022 earnings results. Q4 FFO of $3.77 beat analyst estimates by $0.04. The trust achieved same-property revenue and net operating income growth of 10.5% and 13.3%, respectively, compared to the fourth quarter of 2021.

As of February 6, 2023, the company had approximately $1.3 billion in liquidity via undrawn capacity on its unsecured credit facilities, cash, and marketable securities.

Click here to download our most recent Sure Analysis report on ESS (preview of page 1 of 3 shown below):

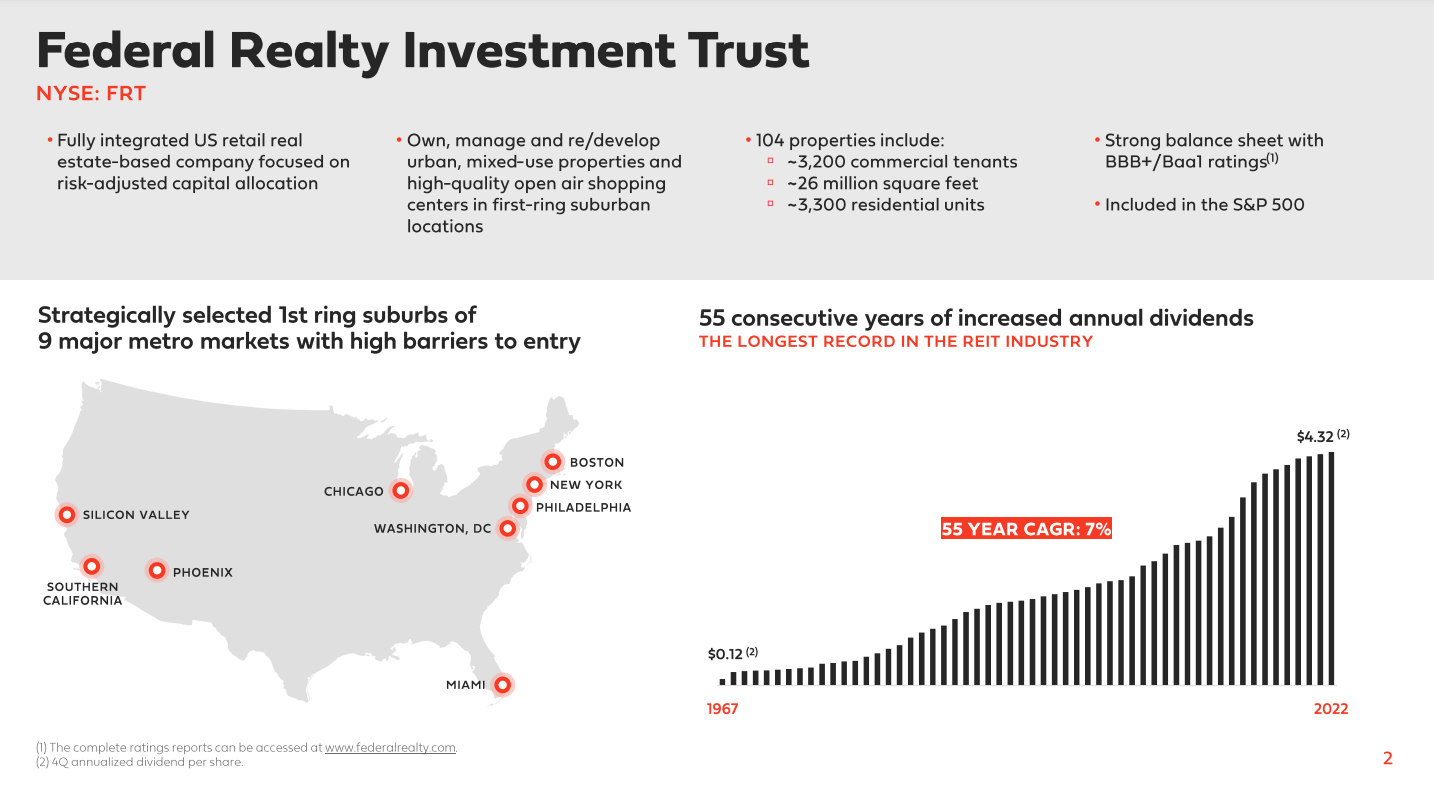

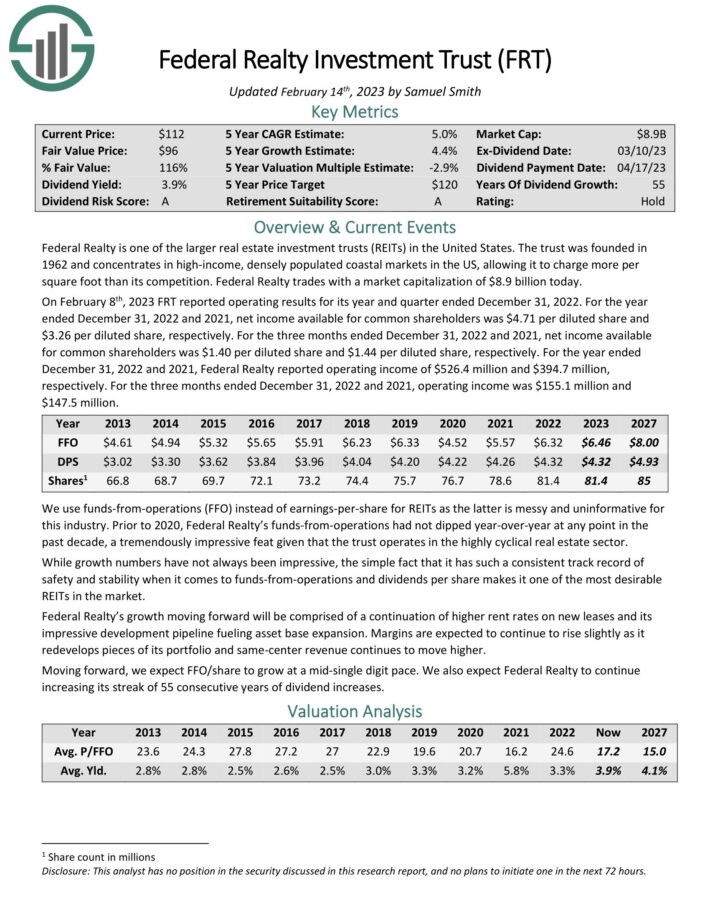

High-Yield REIT No. 6: Federal Realty Investment Trust (FRT)

Federal Realty primarily owns shopping centers. However, it also operates in redevelopment of multi-purpose properties including retail, apartments, and condominiums. The portfolio is highly diversified in terms of tenant base.

Source: Investor Presentation

On February 8th, 2023 FRT reported operating results for its year and quarter ended December 31, 2022. For the year ended December 31, 2022 and 2021, net income available for common shareholders was $4.71 per diluted share and $3.26 per diluted share, respectively. For the three months ended December 31, 2022 and 2021, net income available for common shareholders was $1.40 per diluted share and $1.44 per diluted share, respectively.

For the year ended December 31, 2022 and 2021, Federal Realty reported operating income of $526.4 million and $394.7 million, respectively. For the three months ended December 31, 2022 and 2021, operating income was $155.1 million and $147.5 million.

FRT has increased its dividend for over 50 years, making it a Dividend King. It is the only Dividend King on the list of safe REITs.

Click here to download our most recent Sure Analysis report on Federal Realty (preview of page 1 of 3 shown below):

High-Yield REIT No. 5: Realty Income (O)

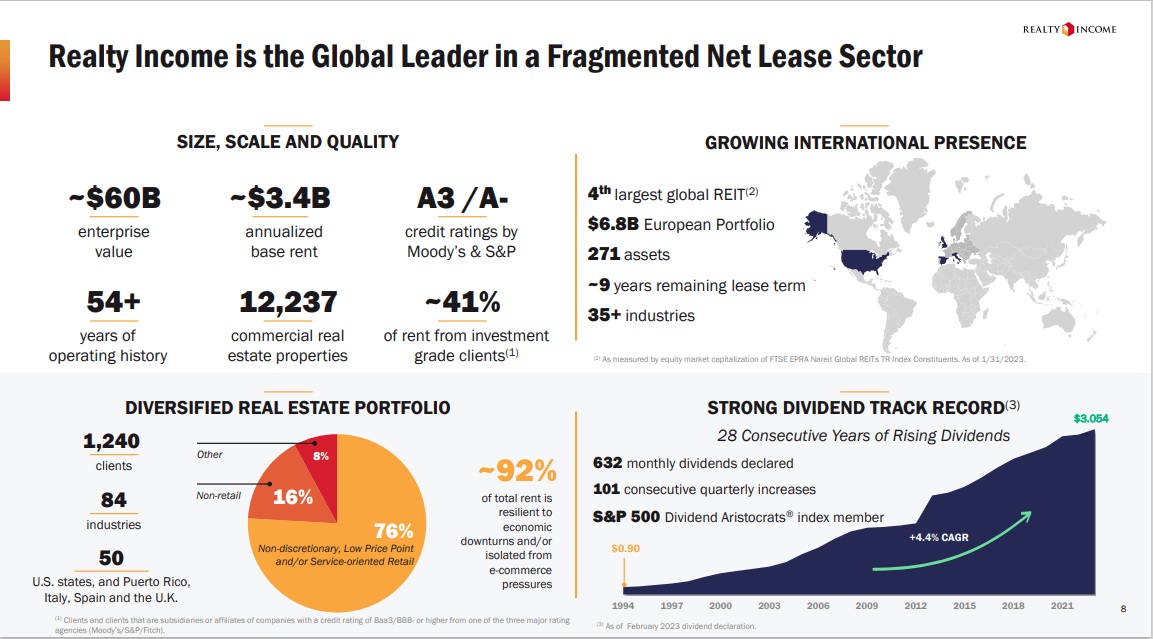

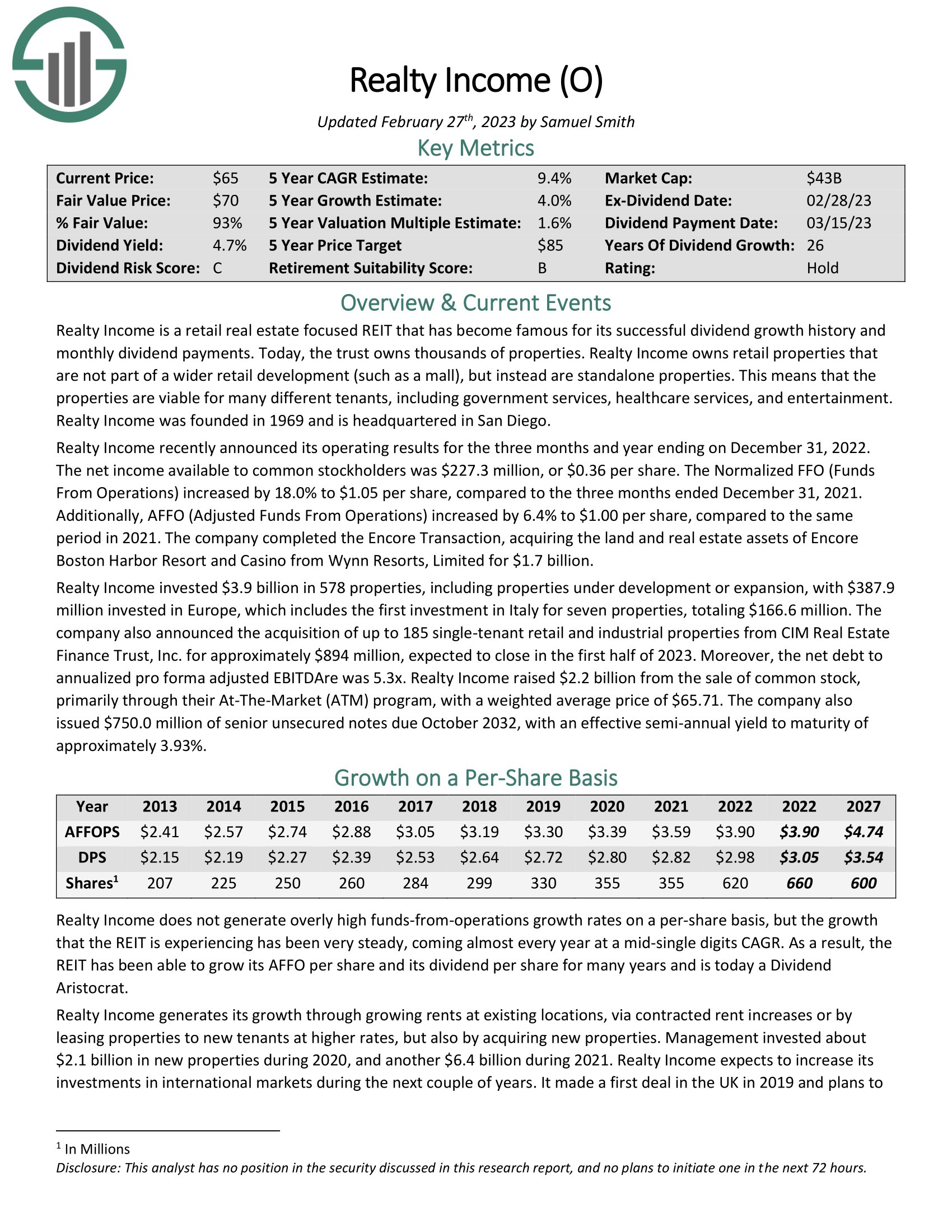

Realty Income owns more than 11,000 properties and has a market capitalization in excess of $40 billion. Realty Income focuses on standalone properties rather than ones connected to a mall, for instance. That increases the flexibility of the tenant base and helps the trust diversify its customer base.

The trust has earned a sterling reputation for its dividend growth history. Part of its appeal certainly is not only in its actual payout history but the fact that these payouts are made monthly instead of quarterly. Indeed, Realty Income has declared 633 consecutive monthly dividends, a track record that is unprecedented among safe REITs.

Impressively, the company has increased its dividend more than 120 times since its initial public offering in 1994. Consequently, Realty Income is a member of the Dividend Aristocrats.

Source: Investor Presentation

Realty Income recently announced its operating results for the three months and year ending on December 31, 2022. The net income available to common stockholders was $227.3 million, or $0.36 per share. The Normalized FFO (Funds From Operations) increased by 18.0% to $1.05 per share, compared to the three months ended December 31, 2021.

Additionally, AFFO (Adjusted Funds From Operations) increased by 6.4% to $1.00 per share, compared to the same period in 2021. The company completed the Encore Transaction, acquiring the land and real estate assets of Encore Boston Harbor Resort and Casino from Wynn Resorts, Limited for $1.7 billion.

Realty Income invested $3.9 billion in 578 properties, including properties under development or expansion, with $387.9 million invested in Europe, which includes the first investment in Italy for seven properties, totaling $166.6 million.

Click here to download our most recent Sure Analysis report on O (preview of page 1 of 3 shown below):

High-Yield REIT No. 4: Digital Realty Trust (DLR)

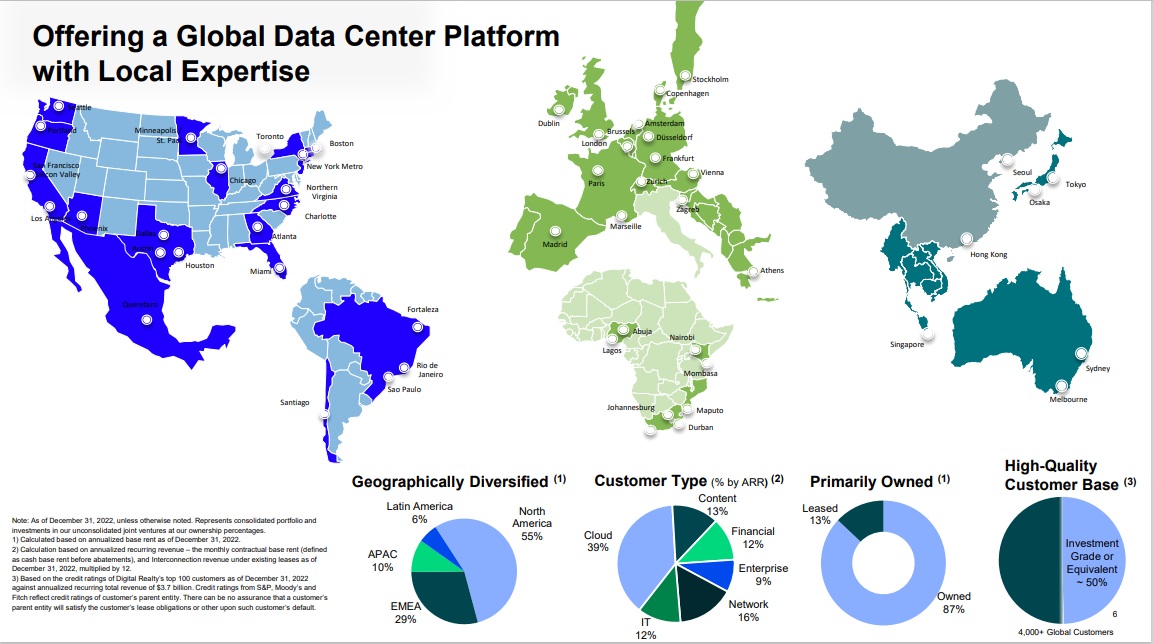

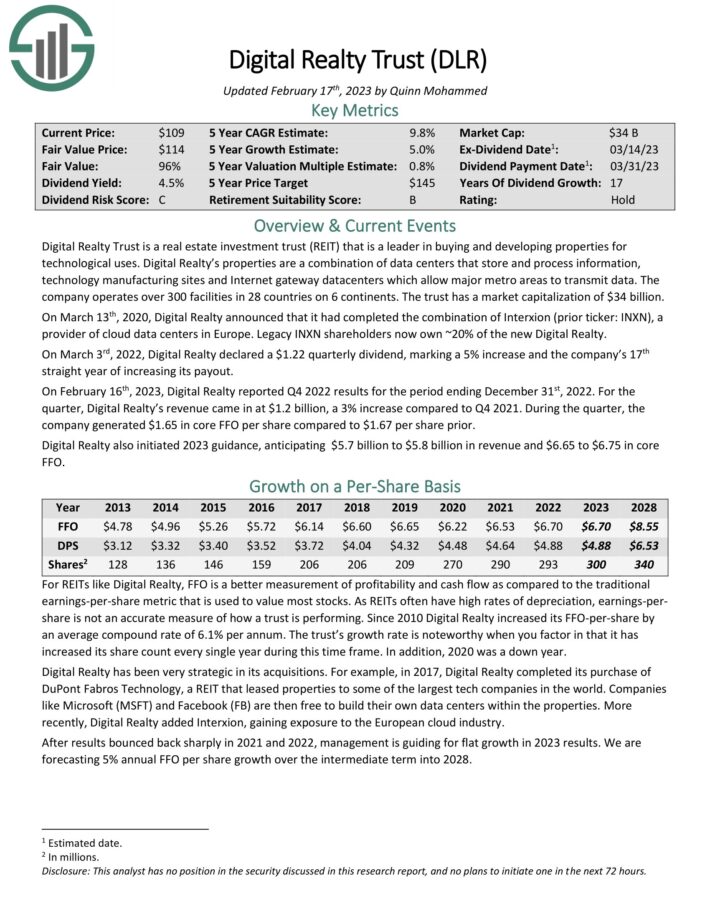

Digital Realty Trust is a REIT that is a leader in buying and developing properties for technological uses. Digital Realty’s properties are a combination of data centers that store and process information, technology manufacturing sites and Internet gateway data centers which allow major metro areas to transmit data. The company operates over 300 facilities in 28 countries on 6 continents.

Source: Investor Presentation

On March 3rd, 2022, Digital Realty declared a $1.22 quarterly dividend, marking a 5% increase and the company’s 17th straight year of increasing its payout. On February 16th, 2023, Digital Realty reported Q4 2022 results for the period ending December 31st, 2022.

For the quarter, Digital Realty’s revenue came in at $1.2 billion, a 3% increase compared to Q4 2021. During the quarter, the company generated $1.65 in core FFO per share compared to $1.67 per share prior. Digital Realty also initiated 2023 guidance, anticipating $5.7 billion to $5.8 billion in revenue and $6.65 to $6.75 in core FFO.

Digital Realty is unique among safe REITs in that it offers exposure to the technology sector.

Click here to download our most recent Sure Analysis report on Digital Realty (preview of page 1 of 3 shown below):

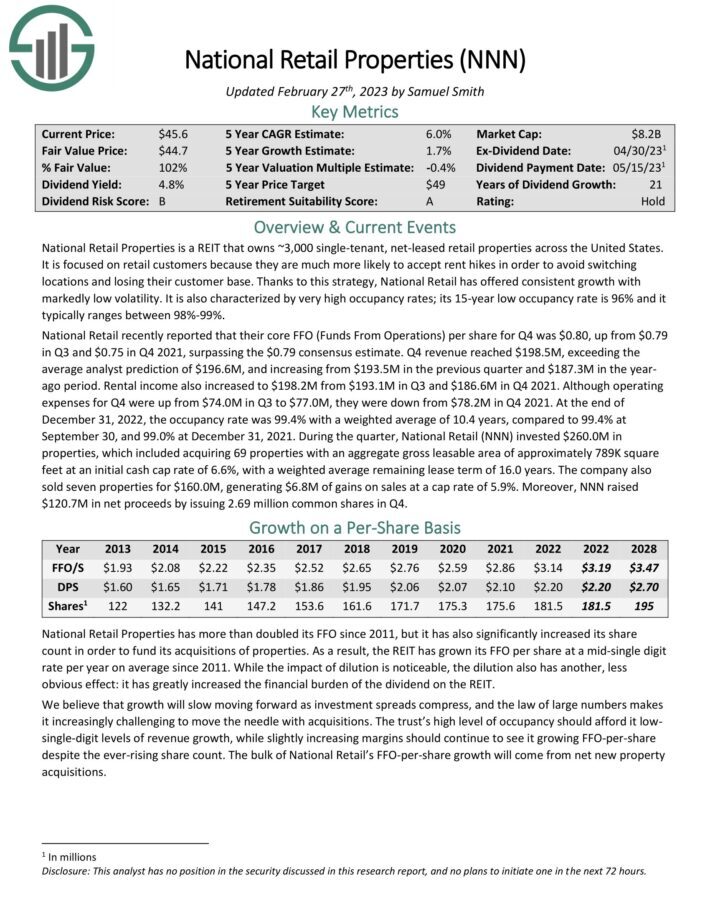

High-Yield REIT No. 3: National Retail Properties (NNN)

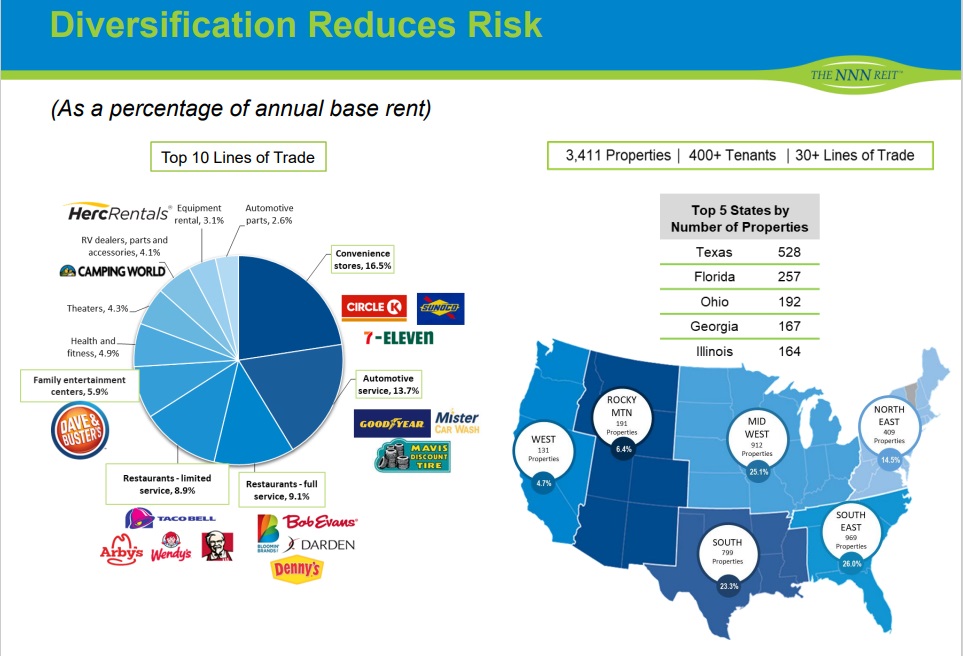

National Retail Properties is on the list of safe REITs as it owns ~3,000 single-tenant, net-leased retail properties across the United States. It is focused on retail customers because they are much more likely to accept rent hikes in order to avoid switching locations and losing their customer base.

Thanks to this strategy, National Retail has offered consistent growth with markedly low volatility. It is also characterized by very high occupancy rates; its 15-year low occupancy rate is 96% and it typically ranges between 98%-99%. This is one of the strongest occupancy rates among the safe REITs.

Source: Investor Presentation

National Retail recently reported that their core FFO (Funds From Operations) per share for Q4 was $0.80, up from $0.79 in Q3 and $0.75 in Q4 2021, surpassing the $0.79 consensus estimate. Q4 revenue reached $198.5M, exceeding the average analyst prediction of $196.6M, and increasing from $193.5M in the previous quarter and $187.3M in the yearago period.

Rental income also increased to $198.2M from $193.1M in Q3 and $186.6M in Q4 2021. Although operating expenses for Q4 were up from $74.0M in Q3 to $77.0M, they were down from $78.2M in Q4 2021.

At the end of December 31, 2022, the occupancy rate was 99.4% with a weighted average of 10.4 years, compared to 99.4% at September 30, and 99.0% at December 31, 2021. During the quarter, National Retail (NNN) invested $260.0M in properties, which included acquiring 69 properties with an aggregate gross leasable area of approximately 789K square feet at an initial cash cap rate of 6.6%, with a weighted average remaining lease term of 16.0 years. The company also sold seven properties for $160.0M, generating $6.8M of gains on sales at a cap rate of 5.9%.

Click here to download our most recent Sure Analysis report on NNN (preview of page 1 of 3 shown below):

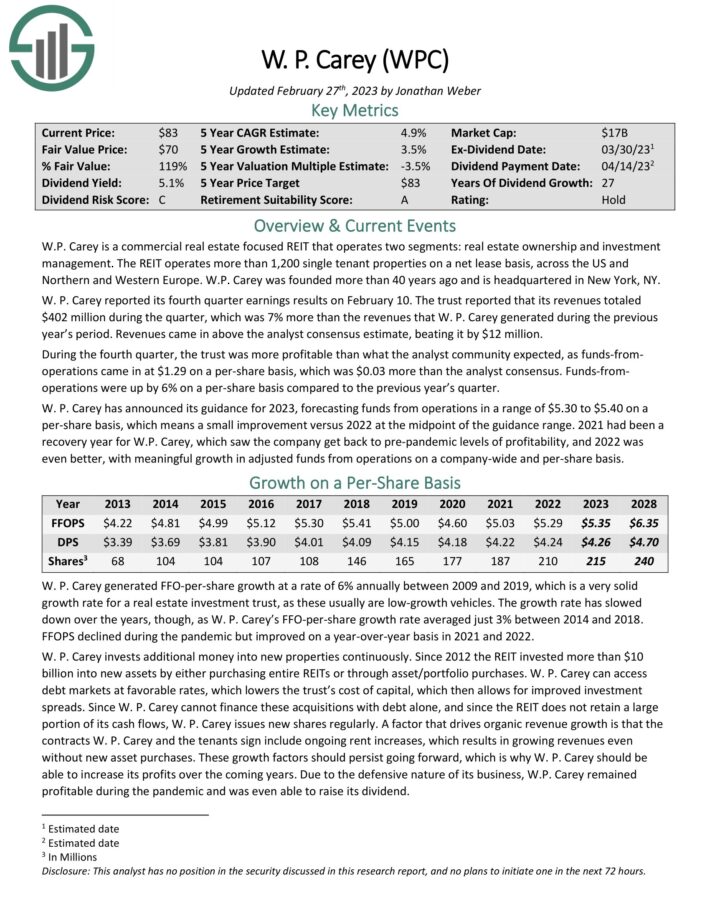

High-Yield REIT No. 2: W.P. Carey (WPC)

W.P. Carey is a Real Estate Investment Trust (or REIT) with two segments: real estate ownership and investment management. The former is the much larger of the business, with more than 1,200 single-tenant properties across the U.S. and Northern and Western Europe.

W. P. Carey reported its fourth quarter earnings results on February 10. The trust reported that its revenues totaled $402 million during the quarter, which was 7% more than the revenues that W. P. Carey generated during the previous year’s period. Revenues came in above the analyst consensus estimate by $12 million.

During the fourth quarter, funds-from operations came in at $1.29 on a per-share basis, which was $0.03 more than the analyst consensus. Funds-from operations were up by 6% on a per-share basis compared to the previous year’s quarter.

W. P. Carey has announced its guidance for 2023, forecasting funds from operations in a range of $5.30 to $5.40 on a per-share basis, which means a small improvement versus 2022 at the midpoint of the guidance range.

The trust has spent more than $10 billion over the last decade acquiring properties to grow its portfolio. Much of this acquisition spree has been through the use of share issuance, as the share count has nearly tripled since 2012. That being the case, growth has been very steady for W.P. Carey even as the float has gotten larger.

W.P. Carey raises its dividend slightly every quarter, though the five-year CAGR is under 1%. Even so, the stock has a dividend growth streak of 28 years, one of the longest streaks among the safe REITs.

Click here to download our most recent Sure Analysis report on W. P. Carey (WPC) (preview of page 1 of 3 shown below):

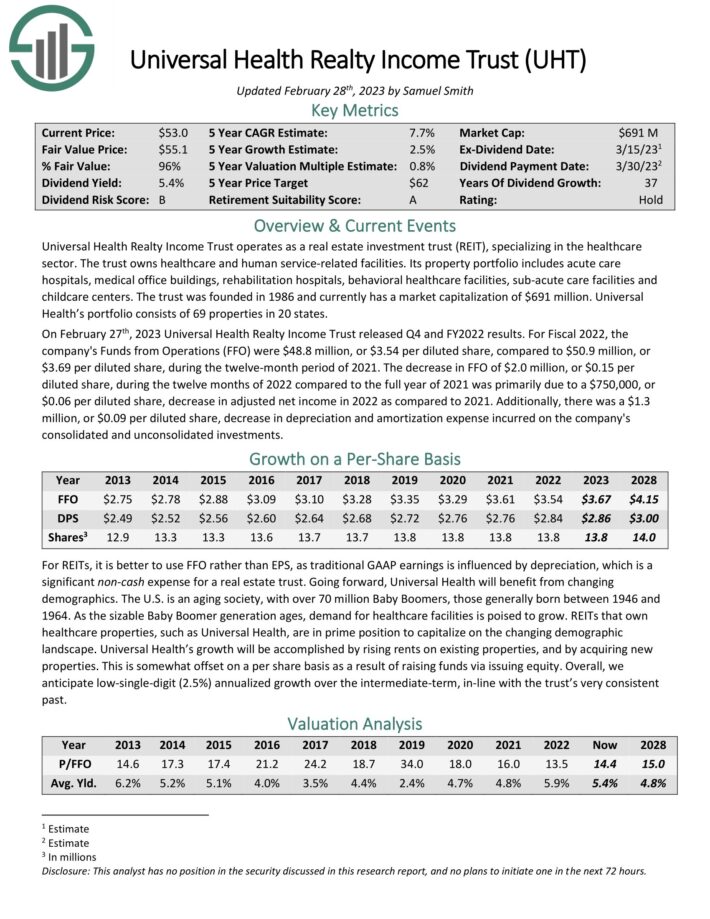

High-Yield REIT No. 1: Universal Health Realty Income Trust (UHT)

Universal Health Realty Income Trust specializes in the healthcare sector. The trust owns healthcare and human service-related facilities. Its property portfolio includes acute care hospitals, medical office buildings, rehabilitation hospitals, behavioral healthcare facilities, sub-acute care facilities and childcare centers. Universal Health’s portfolio consists of 69 properties in 20 states.

On February 27th, 2023 Universal Health Realty Income Trust released Q4 and FY2022 results. For Fiscal 2022, the company’s Funds from Operations (FFO) were $48.8 million, or $3.54 per diluted share, compared to $50.9 million, or $3.69 per diluted share, during the twelve-month period of 2021.

Going forward, Universal Health will benefit from changing demographics. The U.S. is an aging society, with over 70 million Baby Boomers, those generally born between 1946 and 1964. As the sizable Baby Boomer generation ages, demand for healthcare facilities is poised to grow.

Safe REITs that own healthcare properties, such as Universal Health, are in prime position to capitalize on the changing demographic landscape. Universal Health’s growth will be accomplished by rising rents on existing properties, and by acquiring new properties.

Click here to download our most recent Sure Analysis report on UHT (preview of page 1 of 3 shown below):

Final Thoughts

REITs are attractive for income investors as they typically have high dividend yields. However, income investors should also select safe REITs that have the ability to pay their dividends, even if a recession occurs over the next year. These 9 safe REITs have manageable debt levels, sufficient cash flow to pay their dividends, and have high yields.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].