Printed on February thirteenth, 2025 by Bob Ciura

Spreadsheet knowledge up to date each day

The Dividend Kings are the best-of-the-best in dividend longevity.

What’s a Dividend King? A inventory with 50 or extra consecutive years of dividend will increase.

We’ve compiled an inventory that features each Dividend King.

You’ll be able to see the complete downloadable spreadsheet of all 54 Dividend Kings (together with vital monetary metrics comparable to dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the hyperlink under:

The Dividend Kings checklist consists of a number of mega-cap shares which have huge companies, comparable to Walmart Inc. (WMT) and Coca-Cola (KO).

And, there are lots of high quality dividend shares that haven’t but reached the 50-year threshold. Nevertheless, their robust enterprise fashions and sturdy aggressive benefits make it extraordinarily seemingly they may grow to be Dividend Kings.

The next 9 shares have at the least 45 years of dividend will increase, that means it’s only a matter of time till they attain the Dividend Kings checklist.

Desk of Contents

Dividend Kings Overview

The necessities to be a Dividend King are comparatively easy: 50 consecutive years of dividend will increase. In contrast to the Dividend Aristocrats, there aren’t any different necessities.

There are at present 54 Dividend Kings.

The Dividend Kings are obese within the Industrials, Shopper Staples, and Utilities sectors. On the similar time, the Dividend Kings checklist is underweight the know-how sector.

The next part lists 9 dividend shares that ought to attain the Dividend Kings checklist throughout the subsequent 5 years.

Dividend King In The Making: Franklin Assets (BEN)

- Years Of Dividend Will increase: 45

Franklin Assets, based in 1947 and headquartered in San Mateo, CA, is a world asset supervisor with an extended and profitable historical past.

The corporate gives funding administration (which makes up the majority of charges the corporate collects) and associated companies to its clients, together with gross sales, distribution, and shareholder servicing.

On November 4th, 2024, Franklin Assets reported fourth quarter 2024 outcomes for the interval ending September thirtieth, 2024.

Complete belongings underneath administration equaled $1.679 trillion, up $32 billion sequentially, because of $63.5 billion of internet market change, distributions, and different, partly offset by 31.3 billion of long-term internet outflows and $0.2 billion of money administration internet outflows.

For the quarter, working income totaled $2.211 billion, up 11% year-over-year. On an adjusted foundation, internet revenue equaled $315 million or $0.59 per share, a 30% decline from $0.84 in Q3 2023.

Throughout This fall, Franklin repurchased 4.9 million shares of inventory for $102.4 million.

Click on right here to obtain our most up-to-date Certain Evaluation report on BEN (preview of web page 1 of three proven under):

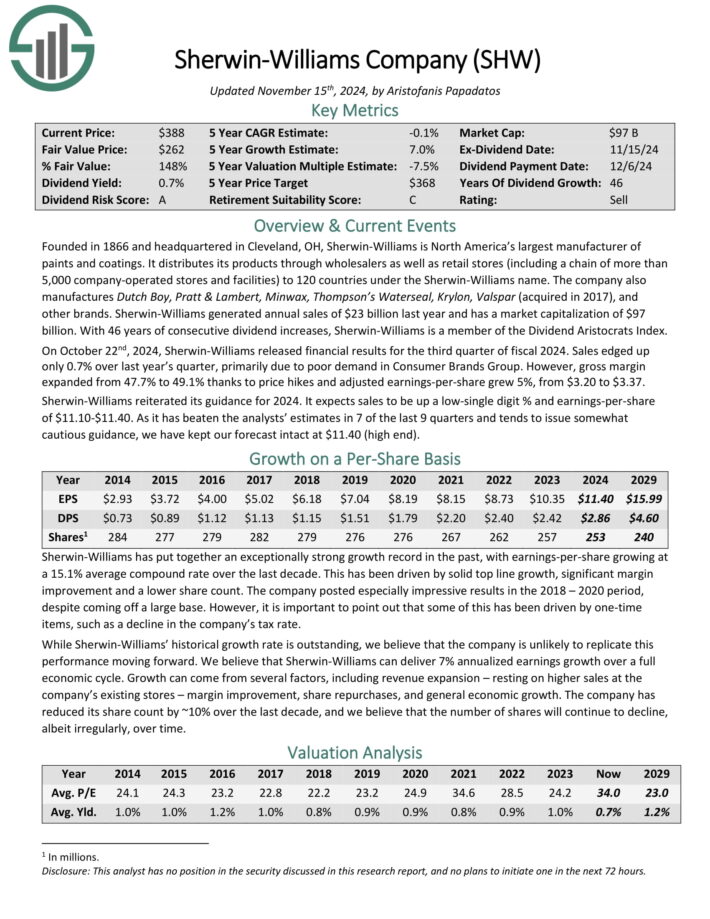

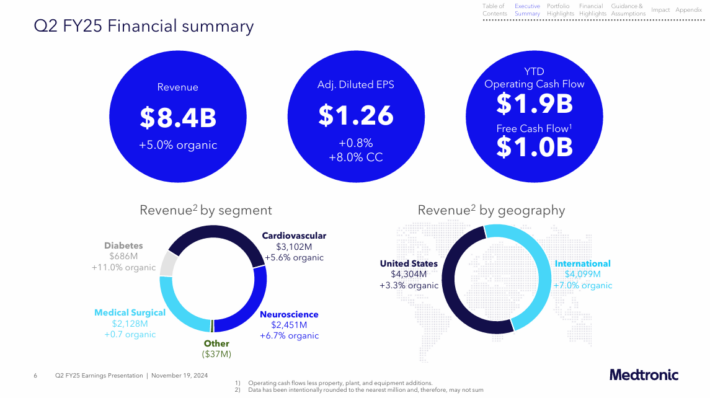

Dividend King In The Making: Sherwin-Williams Co. (SHW)

- Years Of Dividend Will increase: 46

Sherwin-Williams, based in 1866, is North America’s largest producer of paints and coatings.

The corporate distributes its merchandise via wholesalers in addition to retail shops (together with a sequence of greater than 4,900 company-operated shops and amenities) to 120 nations underneath the Sherwin-Williams title.

The corporate additionally manufactures Dutch Boy, Pratt & Lambert, Minwax, Thompson’s Waterseal, Krylon, Valspar (acquired in 2017), and different manufacturers.

On October twenty second, 2024, Sherwin-Williams launched monetary outcomes for the third quarter of fiscal 2024. Gross sales edged up solely 0.7% over final yr’s quarter, primarily on account of poor demand in Shopper Manufacturers Group.

Nevertheless, gross margin expanded from 47.7% to 49.1% thanks to cost hikes and adjusted earnings-per-share grew 5%, from $3.20 to $3.37.

Sherwin-Williams reiterated its steerage for 2024. It expects gross sales to be up a low-single digit % and earnings-per-share of $11.10-$11.40.

Because it has overwhelmed the analysts’ estimates in 7 of the final 9 quarters and tends to concern considerably cautious steerage, we now have saved our forecast intact at $11.40 (excessive finish).

Click on right here to obtain our most up-to-date Certain Evaluation report on SHW (preview of web page 1 of three proven under):

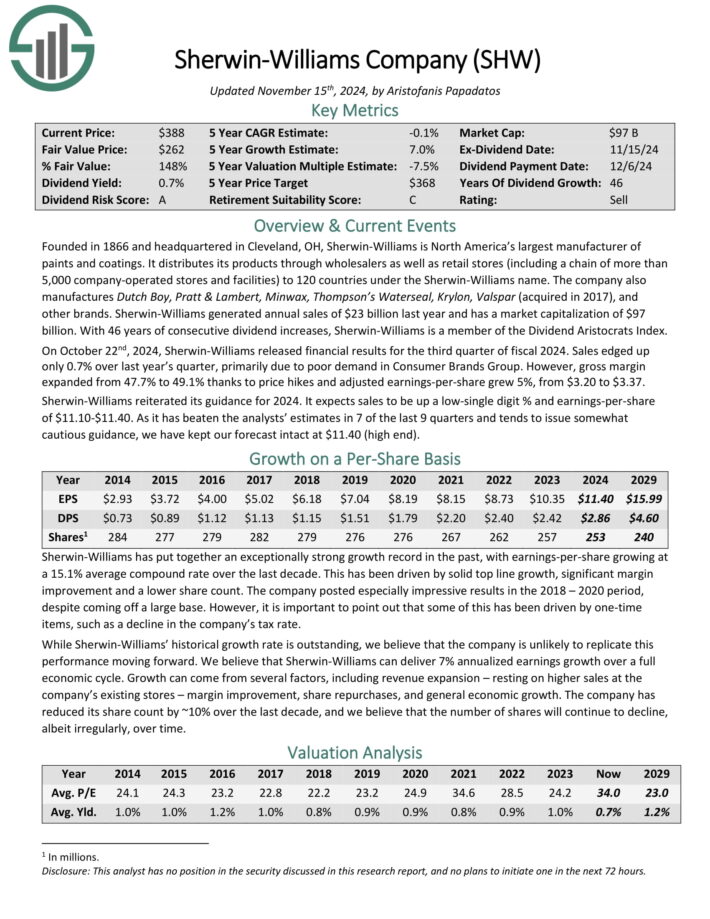

Dividend King In The Making: Medtronic plc (MDT)

- Years Of Dividend Will increase: 47

Medtronic, which has operations in additional than 150 nations, is the world’s largest producer of biomedical gadgets and implantable applied sciences.

The corporate consists of segments, together with Cardiovascular, Medical Surgical, Neuroscience, and Diabetes.

Growing older worldwide demographics ought to present a tailwind to the corporate’s enterprise as elevated entry to healthcare services and products turns into extra crucial.

There are practically 70 million Child Boomers within the U.S. alone that may want rising quantities of medical care as they age.

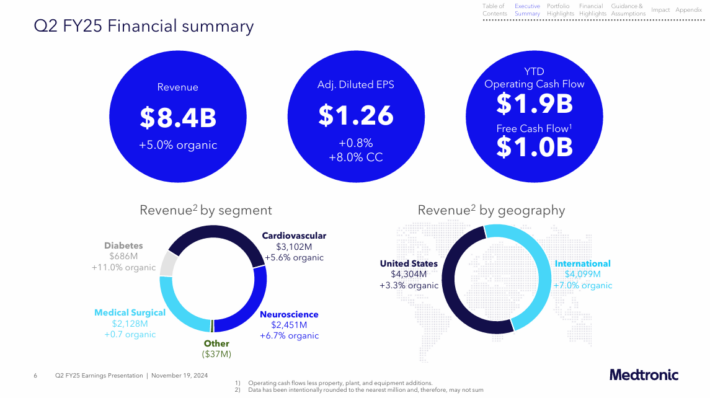

In mid-November, Medtronic reported (11/19/24) outcomes for the second quarter of fiscal 2025.

Supply: Investor Presentation

Natural income grew 5% over the prior yr’s quarter due to broad-based progress in all of the 4 segments. Earnings-per-share grew 1%, from $1.25 to $1.26, and exceeded the analysts’ consensus by $0.01.

As Medtronic carried out barely higher than anticipated within the second quarter, it marginally raised its steerage for fiscal 2025.

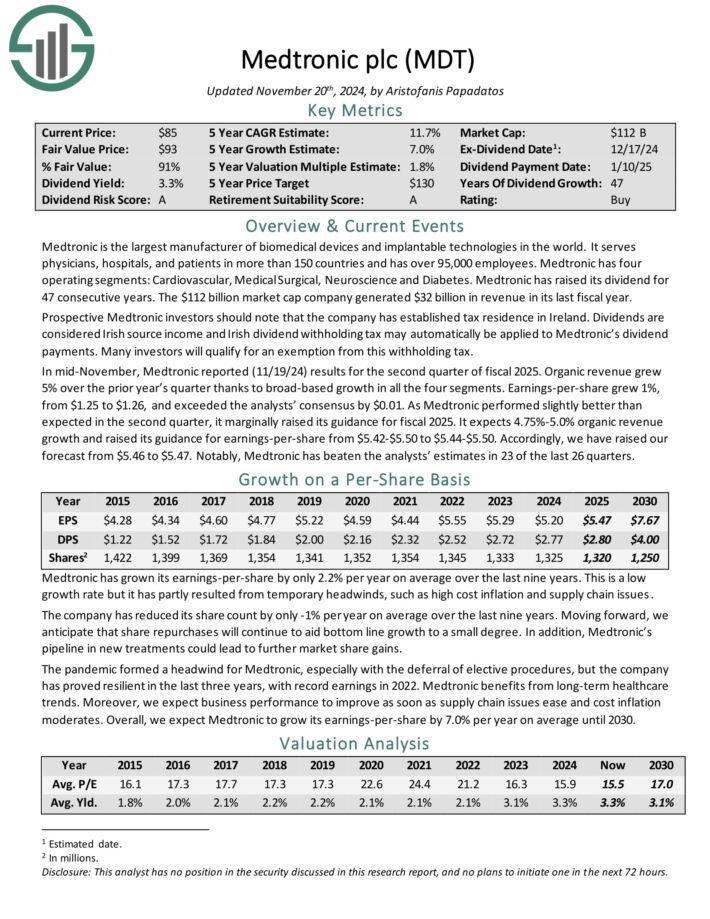

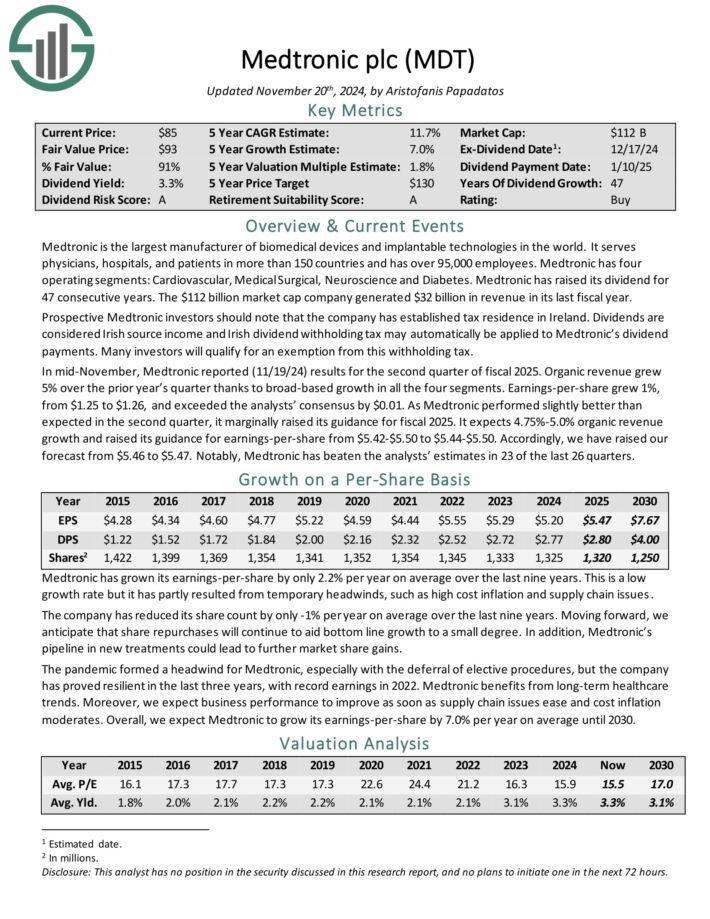

Click on right here to obtain our most up-to-date Certain Evaluation report on Medtronic plc (MDT) (preview of web page 1 of three proven under):

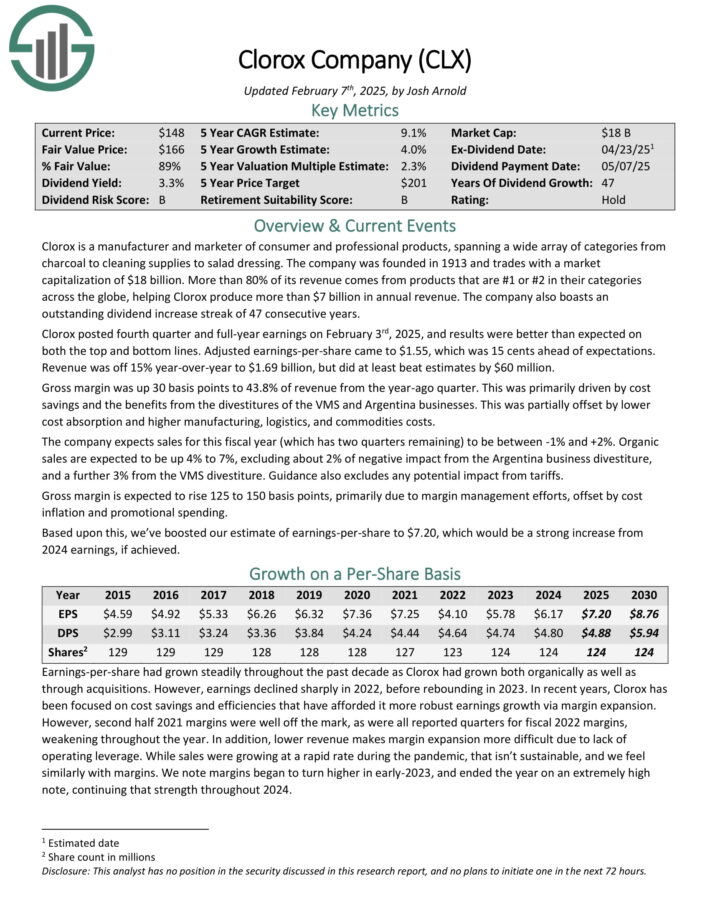

Dividend King In The Making: Clorox Firm (CLX)

- Years Of Dividend Will increase: 47

Clorox is a producer and marketer of client {and professional} merchandise, spanning a wide selection of classes from charcoal to cleansing provides to salad dressing.

Greater than 80% of its income comes from merchandise which can be #1 or #2 of their classes throughout the globe, serving to Clorox produce greater than $7 billion in annual income.

Supply: Investor Presentation

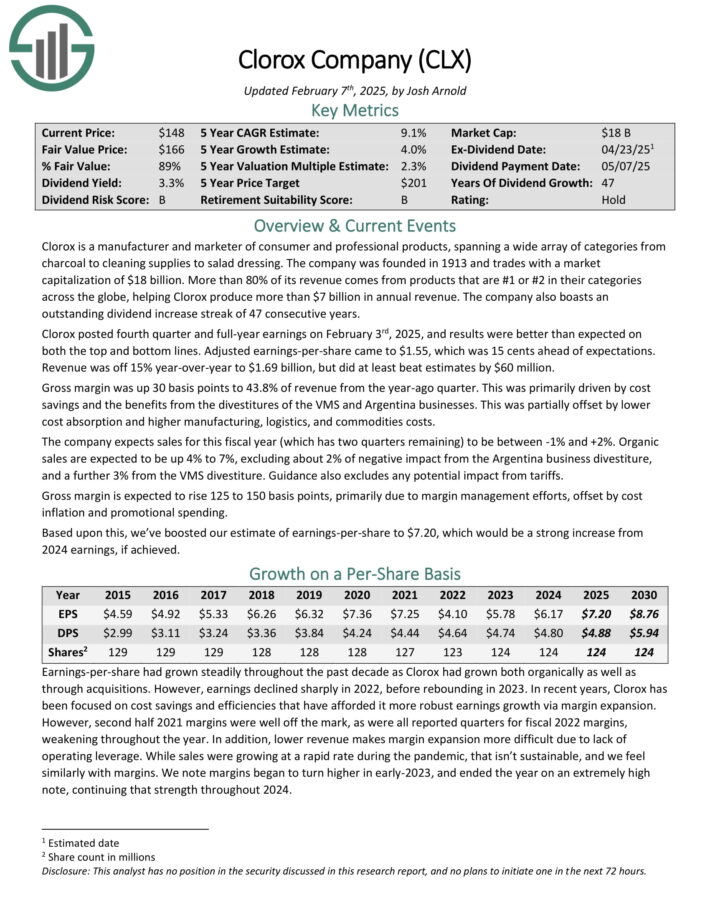

Clorox posted fourth quarter and full-year earnings on February third, 2025, and outcomes have been higher than anticipated on each the highest and backside strains. Adjusted earnings-per-share got here to $1.55, which was 15 cents forward of expectations.

Income was off 15% year-over-year to $1.69 billion, however did at the least beat estimates by $60 million. Gross margin was up 30 foundation factors to 43.8% of income from the year-ago quarter. This was primarily pushed by value financial savings and the advantages from the divestitures of the VMS and Argentina companies.

The corporate expects gross sales for this fiscal yr (which has two quarters remaining) to be between -1% and +2%. Natural gross sales are anticipated to be up 4% to 7%, excluding about 2% of unfavourable influence from the Argentina enterprise divestiture, and an additional 3% from the VMS divestiture.

Click on right here to obtain our most up-to-date Certain Evaluation report on CLX (preview of web page 1 of three proven under):

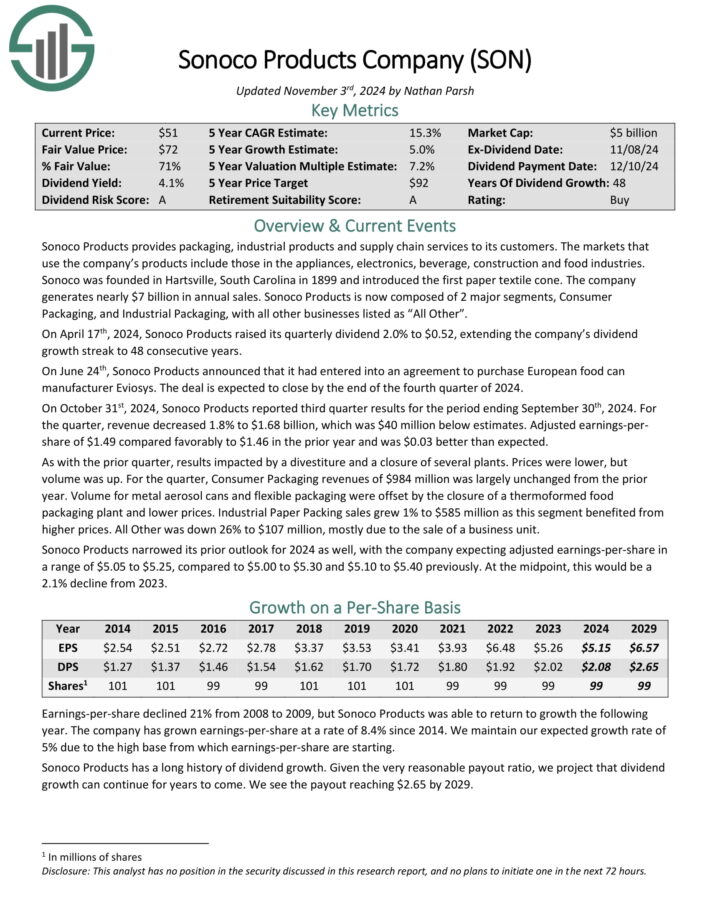

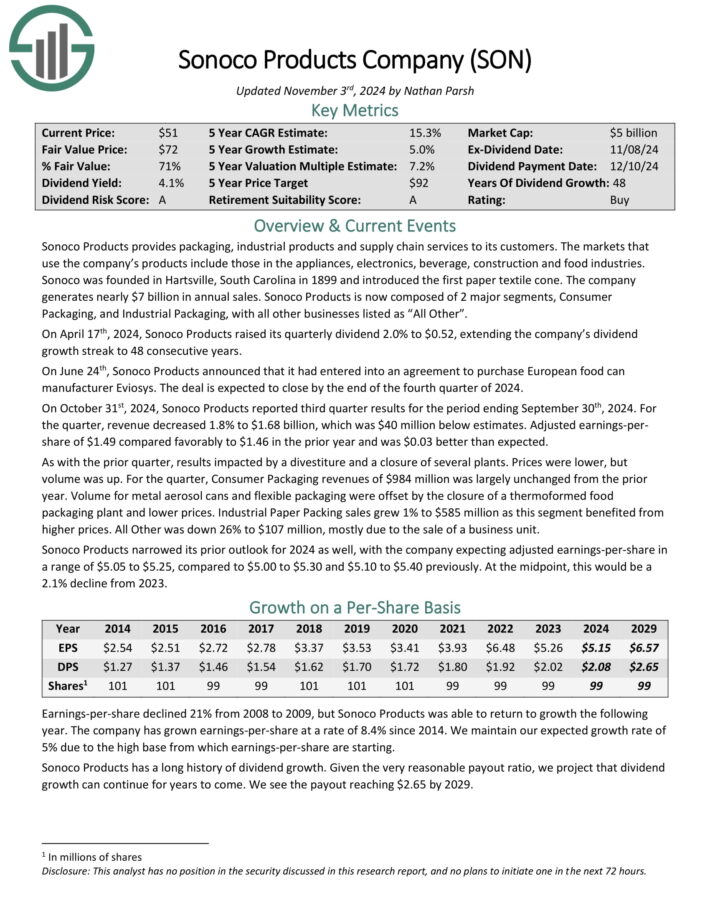

Dividend King In The Making: Sonoco Merchandise (SON)

- Years Of Dividend Will increase: 48

Sonoco Merchandise supplies packaging, industrial merchandise and provide chain companies to its clients. The markets that use the corporate’s merchandise embrace these within the home equipment, electronics, beverage, development and meals industries.

The corporate generates practically $7 billion in annual gross sales. Sonoco Merchandise is now composed of two main segments, Shopper Packaging, and Industrial Packaging, with all different companies listed as “All Different”.

Supply: Investor Presentation

On October thirty first, 2024, Sonoco Merchandise reported third quarter outcomes for the interval ending September thirtieth, 2024. For the quarter, income decreased 1.8% to $1.68 billion, which was $40 million under estimates. Adjusted earnings-per share of $1.49 in contrast favorably to $1.46 within the prior yr and was $0.03 higher than anticipated.

As with the prior quarter, outcomes impacted by a divestiture and a closure of a number of crops. Costs have been decrease, however quantity was up. For the quarter, Shopper Packaging revenues of $984 million was largely unchanged from the prior yr.

Quantity for metallic aerosol cans and versatile packaging have been offset by the closure of a thermoformed meals packaging plant and decrease costs. Industrial Paper Packing gross sales grew 1% to $585 million as this phase benefited from increased costs.

Click on right here to obtain our most up-to-date Certain Evaluation report on Sonoco (SON) (preview of web page 1 of three proven under):

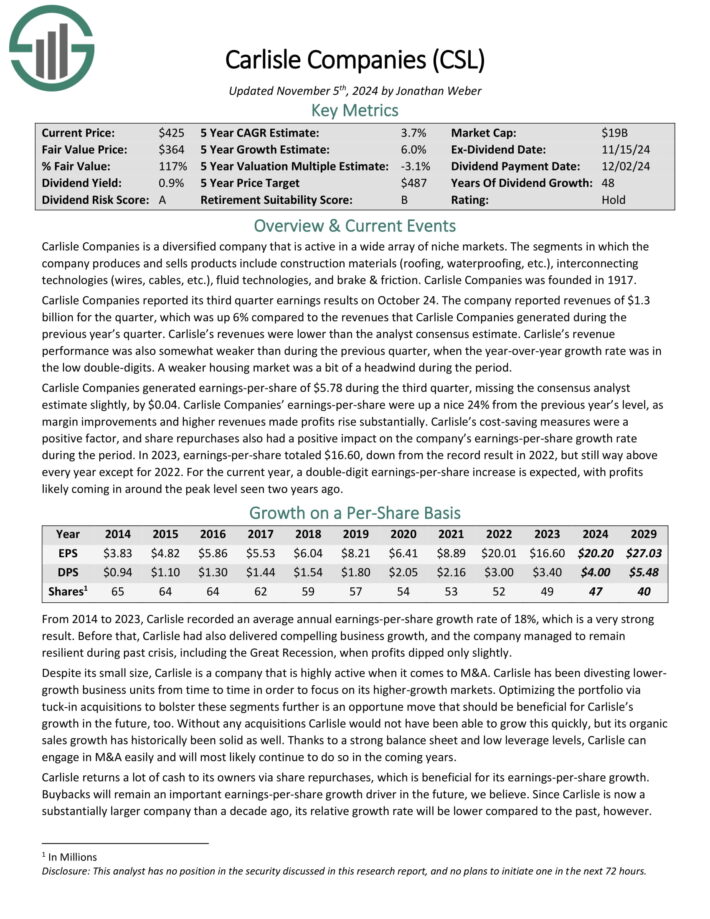

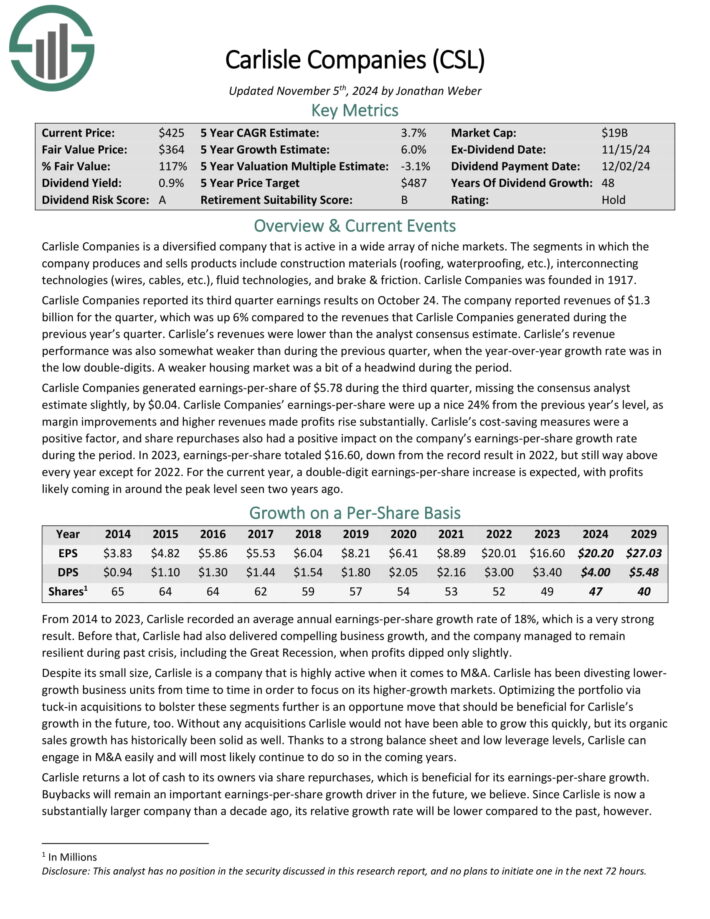

Dividend King In The Making: Carlisle Firms Inc. (CSL)

- Years Of Dividend Will increase: 48

Carlisle Firms is a diversified firm that’s energetic in a wide selection of area of interest markets.

The segments during which the corporate produces and sells merchandise embrace development supplies (roofing, waterproofing, and so on.), interconnecting applied sciences (wires, cables, and so on.), fluid applied sciences, and brake & friction.

Carlisle Firms reported its third quarter earnings outcomes on October 24. The corporate reported revenues of $1.3 billion for the quarter, which was up 6% year-over-year. A weaker housing market was a little bit of a headwind in the course of the interval.

Carlisle Firms generated earnings-per-share of $5.78 in the course of the third quarter, lacking the consensus analyst estimate barely, by $0.04. Earnings-per-share rose 24% year-over-year, as margin enhancements and better revenues made earnings rise considerably.

Price-saving measures have been a optimistic issue, and share repurchases additionally had a optimistic influence on the corporate’s earnings-per-share progress price in the course of the interval.

Click on right here to obtain our most up-to-date Certain Evaluation report on CSL (preview of web page 1 of three proven under):

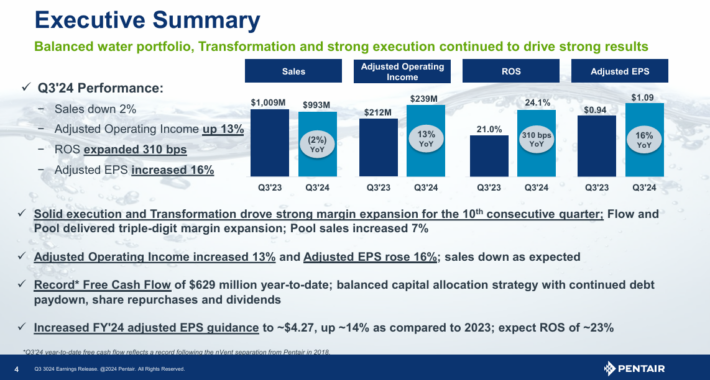

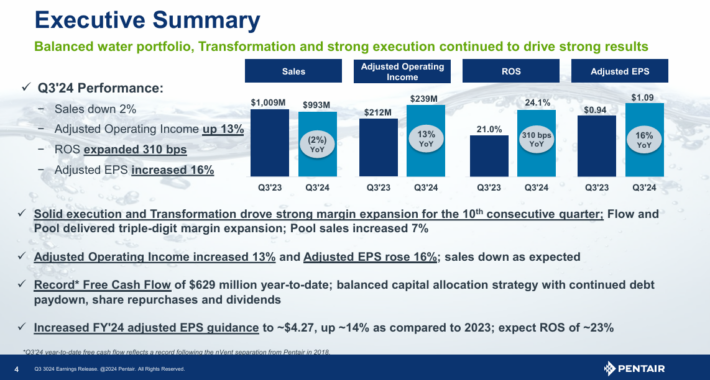

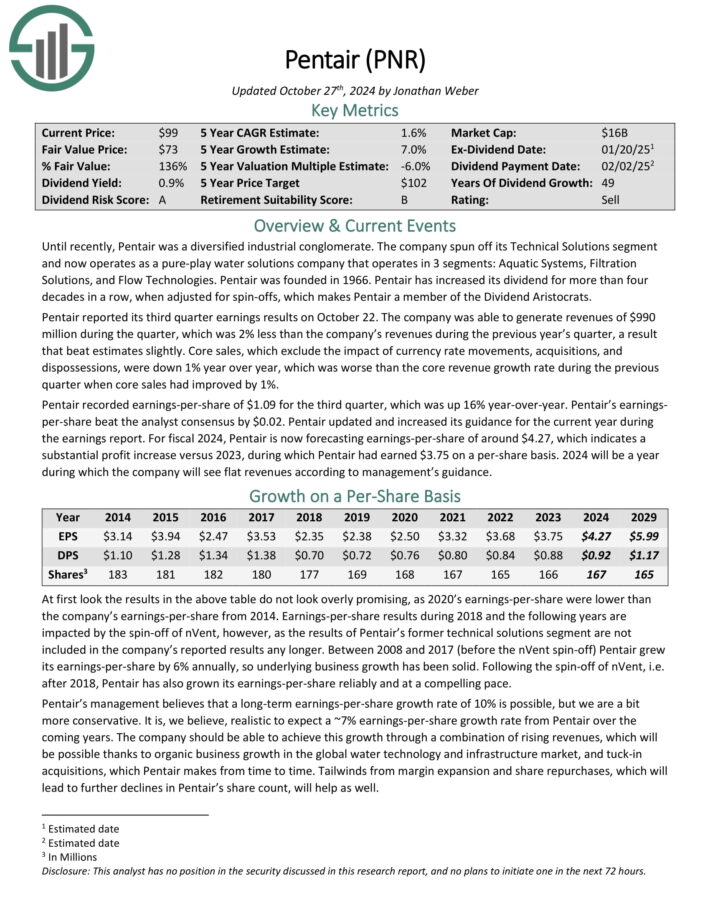

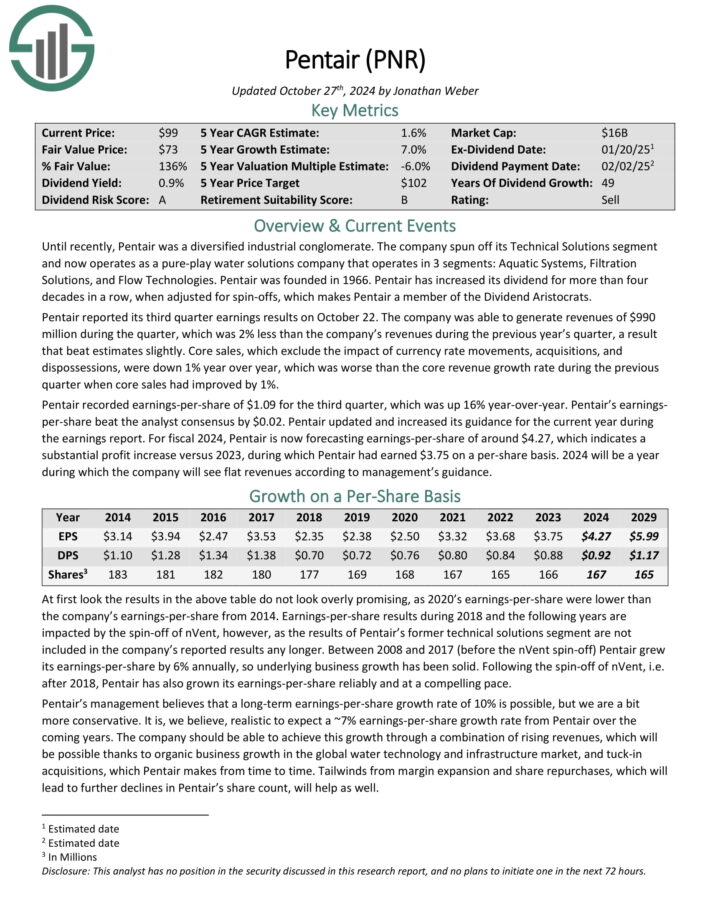

Dividend King In The Making: Pentair plc (PNR)

- Years Of Dividend Will increase: 48

Pentair is a water options firm that operates in 3 segments: Aquatic Programs, Filtration Options, and Circulation Applied sciences. It was based in 1966.

The corporate has elevated its dividend for greater than 4 a long time in a row, when adjusted for spin-offs. Pentair is among the high water shares.

Pentair reported its third quarter earnings outcomes on October 22. The corporate was capable of generate revenues of $990 million in the course of the quarter, down 2% year-over-year.

Supply: Investor Presentation

Core gross sales, which exclude the influence of foreign money price actions, acquisitions, and dispossessions, have been down 1% yr over yr.

Pentair recorded earnings-per-share of $1.09 for the third quarter, which was up 16% year-over-year. Pentair’s earnings-per-share beat the analyst consensus by $0.02.

Click on right here to obtain our most up-to-date Certain Evaluation report on Pentair (preview of web page 1 of three proven under):

Dividend King In The Making: MGE Vitality (MGEE)

- Years Of Dividend Will increase: 49

MGE Vitality has grown from a small energy station in Wisconsin inbuilt 1902 to an built-in vitality firm. The corporate has paid consecutive dividends for greater than 100 years.

MGE principally operates gasoline and electrical utilities, along with transmission and development companies.

MGE Vitality, Inc. (MGEE) reported stable Q3 outcomes because it continues to put money into rising its pure gasoline and electrical energy era companies whereas transitioning away from coal-powered energy era in the direction of renewable energy era.

It grew its diluted earnings per share from $1.05 to $1.13 year-over-year for the quarter due to improved earnings from each its electrical and gasoline utilities together with slight progress in its non-regulated vitality and transmission companies.

12 months-to-date, the corporate has additionally grown its diluted earnings per share, albeit solely barely, from $2.70 in 2023 to $2.72 this yr.

The efficiency in its electrical utility has been flat and its gasoline utility earnings have declined year-over-year, however its non-regulated vitality and transmission companies have proven stable progress.

The corporate’s electrical utility income combine is 53% business, 36% residential, 3% industrial, and eight% different. Its gasoline utility income combine is 58% residential, 38% business/industrial, and 4% different.

Click on right here to obtain our most up-to-date Certain Evaluation report on MGEE (preview of web page 1 of three proven under):

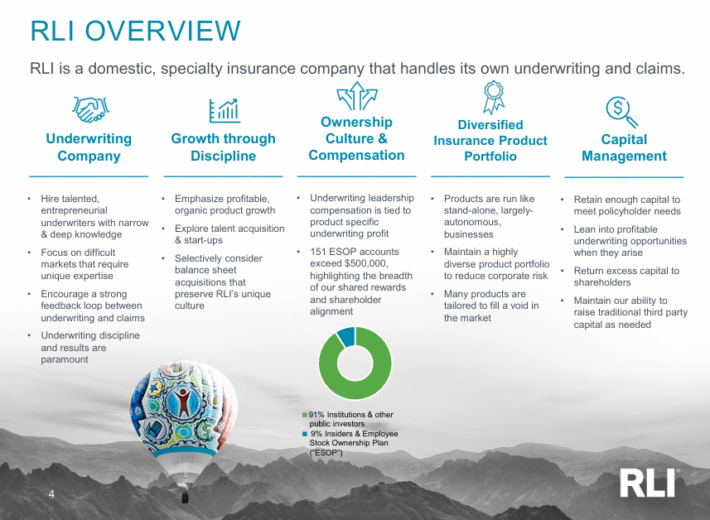

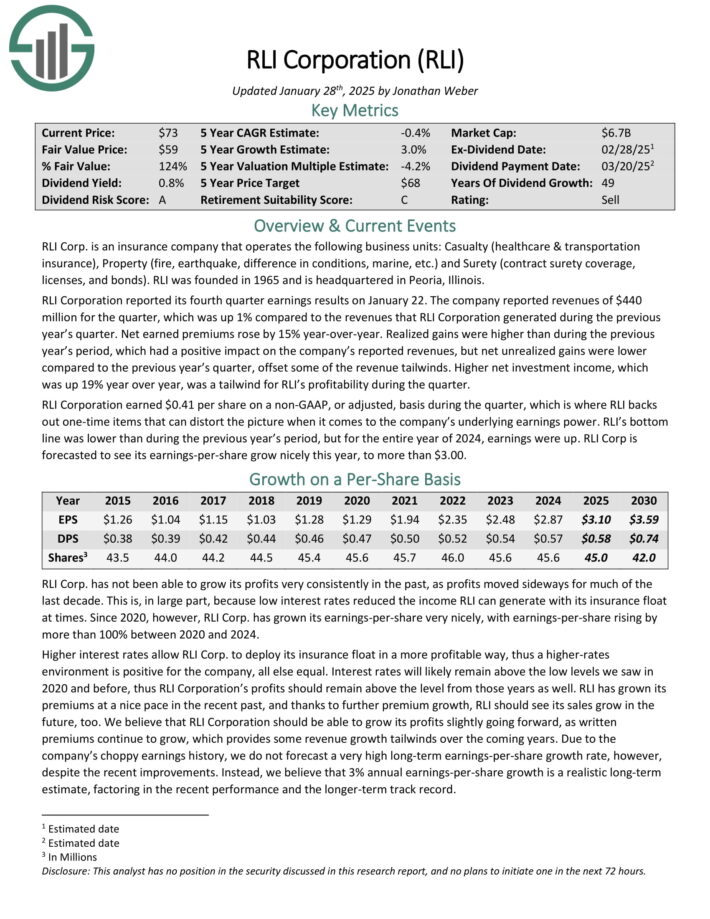

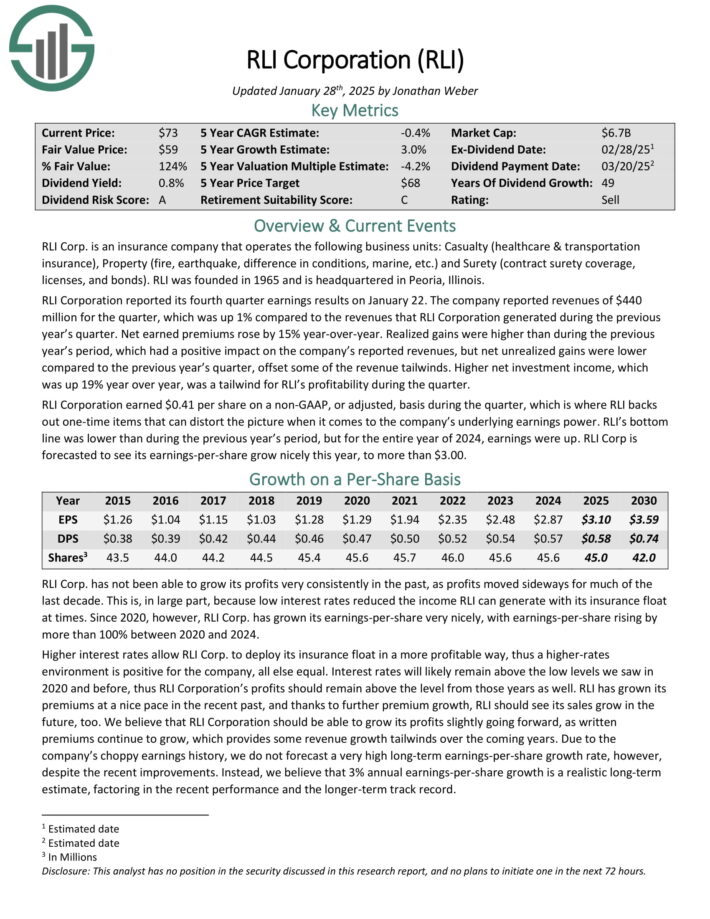

Dividend King In The Making: RLI Corp. (RLI)

- Years Of Dividend Will increase: 49

RLI Corp. is an insurance coverage firm that operates the next enterprise models: Casualty (healthcare & transportation insurance coverage), Property (hearth, earthquake, distinction in situations, marine, and so on.) and Surety (contract surety protection, licenses, and bonds).

Supply: Investor Presentation

RLI Company reported its fourth quarter earnings outcomes on January 22. The corporate reported revenues of $440 million for the quarter, which was up 1% year-over-year. Web earned premiums rose by 15% year-over-year.

Realized positive factors have been increased than in the course of the earlier yr’s interval, which had a optimistic influence on the corporate’s reported revenues, however internet unrealized positive factors have been decrease in comparison with the earlier yr’s quarter, offset a few of the income tailwinds.

Greater internet funding revenue, which was up 19% yr over yr, was a tailwind for RLI’s profitability in the course of the quarter.

RLI Company earned $0.41 per share on a non-GAAP, or adjusted, foundation in the course of the quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on RLI (preview of web page 1 of three proven under):

Further Studying

Screening to search out one of the best Dividend Kings is just not the one solution to discover high-quality dividend progress inventory concepts.

Certain Dividend maintains comparable databases on the next helpful universes of shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].