Published by Nathan Parsh on November 11th, 2022

Interest rate hikes have dominated financial conversation since the Federal Open Market Committee (FOMC) began raising the fed funds target rate in March of this year. The Federal Reserve has a dual mandate set by Congress to keep prices stable and maximize employment.

The Consumer Price Index (CPI) has reached levels not seen since the 1980s. There have been a variety of factors that led the yearly inflation rate to hit a high of 9.1% in June, including ongoing supply constraints related to COVID-19 and the sanctions on Russian following that country’s invasion of Ukraine. Rising wages in the U.S. as businesses have scrambled to fill what has been, at times, more than one million open jobs have also played a role in the increase in basic needs ranging from energy to food to housing.

In order to tame inflation, the Federal Reserve has the federal funds rate six times already in 2022. The last four have been of the 75-basis point variety. The target federal funds rate is now 3.75% to 4.00%.

A quick historical review of rate hikes. The number and size of the increases in 2022 may not seem significant, but it should be noted that rates were kept at or near 0% from December 2008 to November 2015 as the economy dealt with the aftermath of the Great Recession.

Prior to 2022, the last time that rate hikes occurred on a monthly basis was in June of 2006, which was the eve of what is possibly the worst recession since the Great Depression. The size of the last four increases is also higher than any since at least 1990. Simply put, the Fed’s pace and size of interest rate hikes have been unprecedented over the past three decades.

These hikes aim to quickly get inflation down from its current level of 8.2% as of September to the Fed’s target rate of 2.0%. Inflation eats into purchasing power, which could ultimately lead to a recession as consumers can acquire fewer goods and services per unit of currency.

The rising interest rate could also cause a recession as the Fed overreaches and chokes off growth completely. Companies have largely been borrowing capital at historically low rates for much of the last 15 years, helping them to expand their businesses and hire more employees.

With a higher federal funds rate comes higher borrowing costs. This would make businesses that are heavily indebted, need to refinance expiring debt, or typically use debt issuance to fund growth likely experience some pain, which could lead to a recession.

There are, however, sectors of the economy where rising interest rates could be a tailwind. The financial sector, particularly the banking industry, should be a prime beneficiary of rate hikes as this directly impacts their net interest income. If a company is earning more on its loans while paying its depositors the same or even a slightly higher rate for savings accounts, checking accounts, and CDs, then net interest income is going to rise.

This article will examine eight companies that are seeing a material benefit from interest rate hikes, all of which pay dividends to shareholders and have a buy rating from Sure Dividend.

With that in mind, we’ve compiled a list of more than 200 financial stocks, along with important investing metrics. The database is available for download below:

Dividend Stock for Rising Interest Rates #1: JPMorgan & Chase Co. (JPM)

Our first stock is JPMorgan, which was founded in 1799 as the first commercial bank in the U.S. Since then, the company has grown into a global banking behemoth with a market capitalization of $386 billion that has annual sales of nearly $130 billion. JPMorgan competes in every major segment of financial services, including consumer banking, commercial banking, home lending, credit cards, asset management, and investment banking.

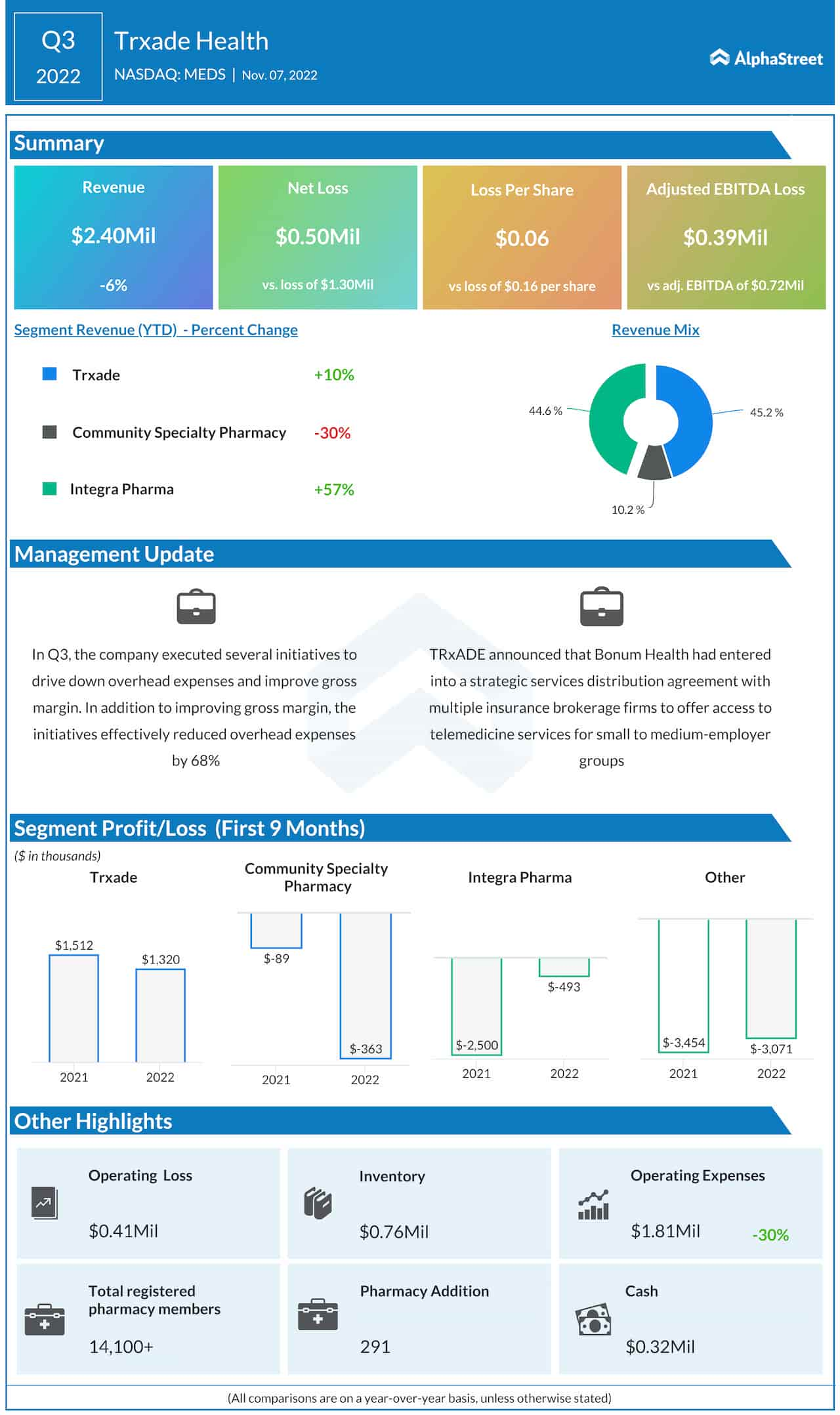

Source: Investor Presentation

JPMorgan reported third-quarter earnings results on October 14th, 2022. Revenue grew 10% to $32.7 billion, while earnings-per-share of $3.12 was lower than the prior year but above analysts’ estimates.

Net interest income of $17.5 billion compared favorably to $15.1 billion in the second quarter of 2022 and $13.1 billion in the third quarter of 2021. Loans of $1.11 trillion were flat on a sequential basis. The company expects net interest income of $19 billion for the fourth quarter and close to $66 billion for the year. If achieved, JPMorgan’s net interest income for 2022 would be a 25% improvement from the prior year.

Following the results, we reiterate our 6% earnings growth forecast for JPMorgan through 2027.

JPMorgan currently yields 3.0%, has raised its dividend for 11 consecutive years, and has a projected payout ratio of 35% for the year. The stock’s yield is almost twice that of the average yield of 1.7% for the S&P 500.

At 11.3 times our expected earnings-per-share of $11.60, shares of the company are trading close to our projected price-to-earnings ratio of 12.0. Multiple expansions could add 1.1% to annual returns over the next five years.

JPMorgan is projected to return 9.7% per year through 2027 from 6% earnings growth, 3% starting yield, and a small contribution from multiple expansions.

Click here to download our most recent Sure Analysis report on JPMorgan & Chase Co. (preview of page 1 of 3 shown below):

Dividend Stock for Rising Interest Rates #2: Synchrony Financial (SYF)

Next is Synchrony Financial, a consumer financial services company that operates three business segments, including Payment Solutions, Retail Credit, and CareCredit. The company offers a range of services to its customers, including, but not limited to, private label credit cards, small-size business credit products, promotional financing for higher-priced consumer goods, and promotional financing for healthcare products. The company had its IPO in 2014. Synchrony Financial is valued at $16 billion and has annual revenue of more than $10 billion.

Synchrony Financial reported third-quarter results on October 25th, 2022.

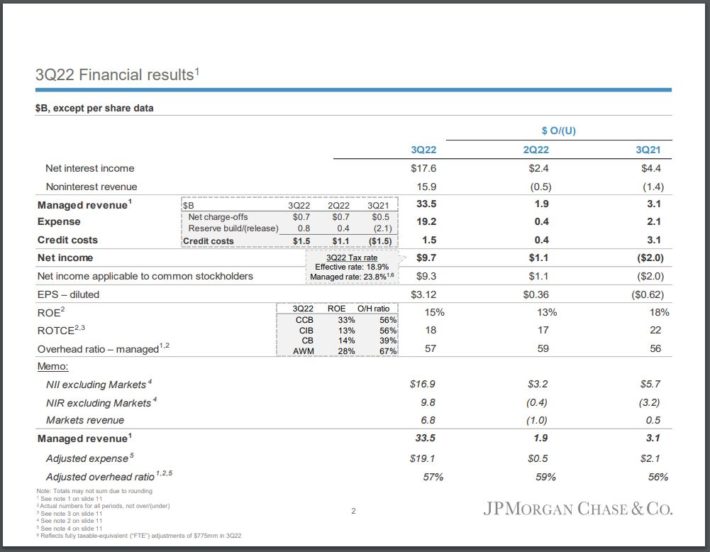

Source: Investor Presentation

Revenue grew 22% to $2.9 billion. Earnings-per-share of $1.47 compared unfavorably to $2.00 in the prior year, but the third quarter of 2021 saw a massive reserve release that added $0.33 to results. Earnings-per-share for the most recent quarter was higher than expected.

Net interest income grew 7% year-over-year to $3.9 billion while net interest margin improved 7 basis points to 15.52%. Purchase volumes improved by 6% to $44.6 billion, while loan receivables were up 13% to $86 billion. New accounts grew 6% to just under 6 million. Provisions for credit losses increased slightly from $904 million to $929 million.

Synchrony Financial is projected to grow earnings-per-share by 3% annually through 2027.

Shares of the company yield 2.5%, and the projected payout ratio for the year is very low at 16%. Synchrony Financial has a dividend growth streak of just one year after the company paused its dividend growth in 2021.

Synchrony Financial has a price-to-earnings ratio of 5.1 based on our expectations of $7.00 of earnings per share for the year. With a fair value multiple of 8 times earnings, valuation could be a 5% annual tailwind to results.

Synchrony Financial is projected to return 10.2% through 2027, driven by an expected earnings growth rate of 3%, a starting yield of 2.5%, and a mid-single-digit contribution from multiple expansions.

Click here to download our most recent Sure Analysis report on Synchrony Financial (preview of page 1 of 3 shown below):

Dividend Stock for Rising Interest Rates #3: KeyCorp (KEY)

The third stock is KeyCorp, which has been in business for 190 years and has transformed into a leading regional bank with $190 billion in assets. The company’s has operations in 15 states, providing customers with 1,300 ATMs and 1,000 full-service branches. KeyCorp offers personal, small business, commercial, and corporate banking in addition to wealth management. The $17 billion company produced revenue of $7.3 billion last year.

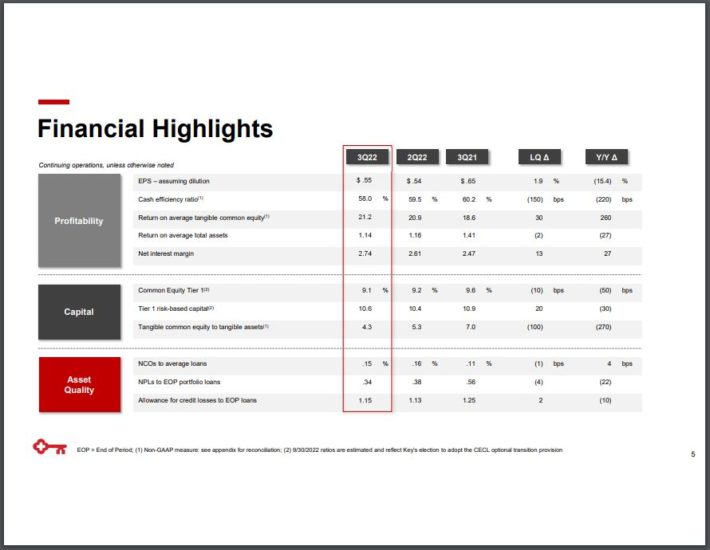

The company released earnings results on October 20th, 2022.

Source: Investor Presentation

Revenue grew 3.5% to $1.89 billion while earnings-per-share of $0.55 compared to $0.65 in the prior year. Last year’s result benefited from reserve releases.

KeyCorp saw growth in market share in its consumer and commercial divisions, with total loans growing 14%. Interest income grew 17.4% to $1.2 billion. Net interest margin of 2.74% compared favorably to 2.61% in the second quarter and 2.47% in the third quarter of 2021.

The dividend yield for the stock is 4.3%. With an expected payout ratio of 35% for the year, it is likely that KeyCorp’s dividend growth streak of 11 years will continue.

We expect the company to earn $2.40 this year, giving KeyCorp a price-to-earnings ratio of 7.6. We believe the stock should be valued at 11 times earnings, leading to a potential tailwind from a valuation of 8.1% over the next half-decade.

Given the high base for earnings per share that is projected for the company, we expect earnings growth to be 0% over the medium term. Therefore, the starting yield of 4.3% and the high single-digit contribution from an expanding multiple should drive total annual returns of 12.4%.

Click here to download our most recent Sure Analysis report on KeyCorp (preview of page 1 of 3 shown below):

Dividend Stock for Rising Interest Rates #4: Toronto-Dominion Bank (TD)

The next name for consideration is Toronto-Dominion, one of the largest Canadian banks with nearly $2 trillion in assets. The company’s major segments include Canadian Retail, U.S. Retail, and Wholesale Banking. While based in Canada, Toronto-Dominion generates nearly a quarter of its annual revenue from the U.S. The company is valued at $118 billion and produced revenue of $33 billion over the past four quarters.

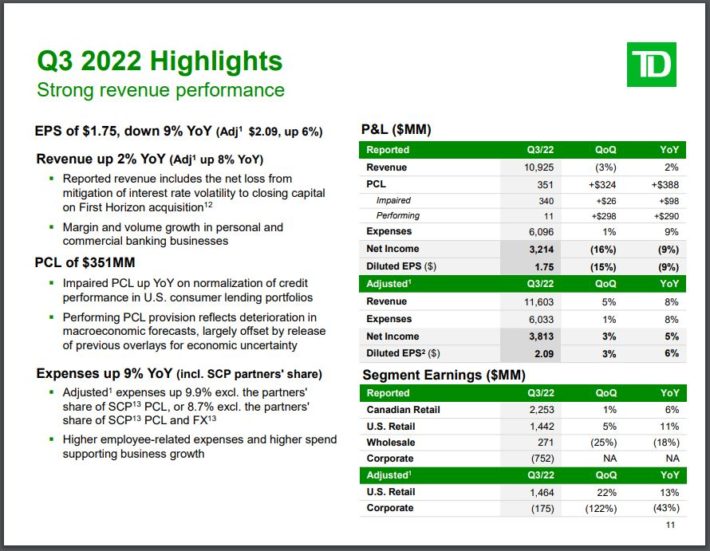

Toronto-Dominion reported third-quarter results on August 25th, 2022.

Source: Investor Presentation

Canada has also gone through its own rate hiking cycle, with the Bank of Canada raising rates six consecutive months since March. The size of the most recent increase was 50-basis points, so not yet at the level of the Fed. As a result, net interest income reached C$7.044 billion for the period, up 17.3% from the prior year and 10.5% from the previous quarter.

Elsewhere, results were strong as revenue improved by 8.3% to C$11.6 billion while adjusted earnings-per-share was higher by almost 7% to C$2.09. Total loans increased 10% to C$791 billion, and total deposits grew 7.4% to C$1.2 trillion. We have pegged earnings growth at 5.5% per year for the next half-decade.

Unlike its American peers, the Canadian banks did not cut their dividends during the Great Recession but instead paused growth. Toronto-Dominion has raised its dividend each year for the last decade. Shares yield 4.2%. The payout ratio is forecasted to be 42% year-over-year.

Toronto-Dominion is trading at 10.2 times its earnings-per-share forecast of $6.48 for 2022. This is below our target of 12 times earnings, which could lead to 3.4% being added to returns over the next five years.

Added up, we believe Toronto-Dominion can return 12.4% each year through 2027 due to 5.5% earnings growth, a starting yield of 4.2%, and a low single-digit tailwind from multiple expansions.

Click here to download our most recent Sure Analysis report on Toronto-Dominion Bank (preview of page 1 of 3 shown below):

Dividend Stock for Rising Interest Rates #5: The Bank of New York Mellow Corp (BK)

Bank of New York Mellon was founded after the American Revolution in 1784 and was the first bank ever to make a loan to the U.S. government. Since that time, the company has grown to be valued at nearly $35 billion and now generates annual revenue of $16 billion. The company offers global investment services with a stated goal of helping clients manage assets throughout their investment lifecycle.

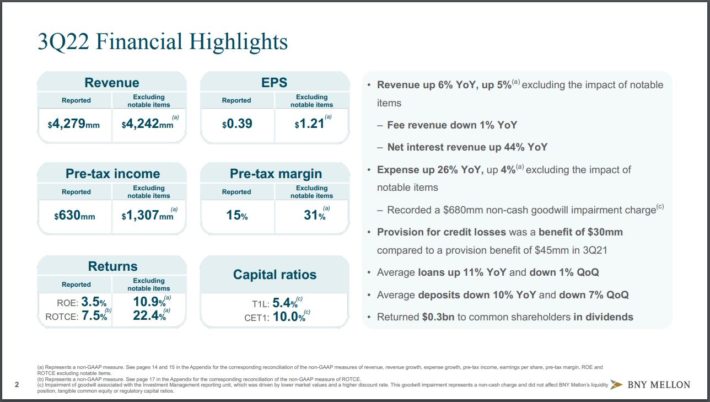

Bank of New York Mellon reported earnings results on October 17th, 2022.

Source: Investor Presentation

Revenue for the period was $4.28 billion, which was 5.9% higher than the prior year. Adjusted earnings-per-share of $1.21 topped the prior year’s result of $1.09. Both top-and-bottom-line results were higher than expected.

Net interest revenue surged 44% to $926 million compared to the same period a year ago. Sequentially, net interest revenue was up 12%. Fee revenue was down slightly to $3.24 billion, while noninterest expense rose 26% to $3.68 billion. Assets under management were down 8% to $1.78 trillion, primarily due to market deprecation.

Bank of New York Mellon is expected to grow earnings-per-share by 6% per year through 2027.

The company has a dividend growth streak of 12 years and offers a yield of 3.5% today. The payout ratio is expected to be 35% for the year.

We forecast earnings-per-share of $4.25 for 2022, giving Bank of New York Mellon a price-to-earnings ratio of 10. With a target price-to-earnings ratio of 12, we believe that the returns will be aided by a 3.6% annual tailwind from multiple expansions.

Altogether, we project annual returns of 12.5% in the medium term due to a 6% earnings growth, a starting yield of 3.5%, and a low single-digit addition from an expanding multiple.

Click here to download our most recent Sure Analysis report on The Bank of New York Mellow Corp (preview of page 1 of 3 shown below):

Dividend Stock for Rising Interest Rates #6: Royal Bank of Canada (RY)

Next is Royal Bank of Canada, or RBC, is the largest bank in Canada by market capitalization and offers banking and financial services to customers in Canada and the U.S. the company has five segments, including Personal & Commercial Banking, Wealth Management, Insurance, Investor & Treasury Services, and Capital Markets. Nearly a quarter of revenue comes from the U.S. RBC is valued at $132 billion, and the company’s revenue over the last year has totaled nearly $25 billion.

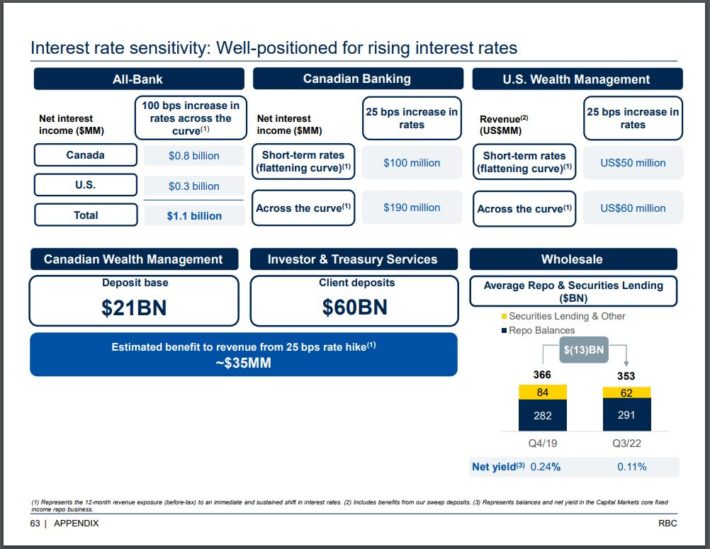

RBC reported third-quarter results on August 24th, 2022. Earnings-per-share fell 17% in the most recent quarter due to higher provisions for credit losses, while revenue was lower by 7%. Net interest income was positive for RBC in the quarter. For example, in Personal & Commercial Banking, higher rates added 14% to net interest income.

Management stated that higher rates would benefit the company’s business as a 100-basis point increase in rates would add more than $1 billion to net interest income.

Source: Investor Presentation

Given its leadership position in its region, we believe that RBC will grow earnings-per-share by 6.5% in the medium term.

RBC yields 4.2% and has an expected payout ratio of 45% for this year. The company has increased its dividend for ten consecutive years.

Shares of RBC have a price-to-earnings ratio of 10.8, using our earnings estimate of $8.85 for this year. Our forecasted price-to-earnings ratio is 12.3, which matches the average multiple for the last decade. Reaching this target by 2027 would add 2.6% to annual returns.

Therefore, RBC has a total annual return of 12.6% in the medium term, which stems from 6.5% earnings growth, the 4.2% starting yield, and a small contribution from multiple expansions.

Click here to download our most recent Sure Analysis report on Royal Bank of Canada (preview of page 1 of 3 shown below):

Dividend Stock for Rising Interest Rates #7: State Street Corp. (STT)

The next stock is State Street, another financial services company that can trace its roots back to the country’s early days, having been founded in 1792. The company is one of the largest assets management firms in the world, with more than $3 trillion of assets under management and $36 trillion of assets under custody and administration. The $28 billion company has annual revenue of $12 billion.

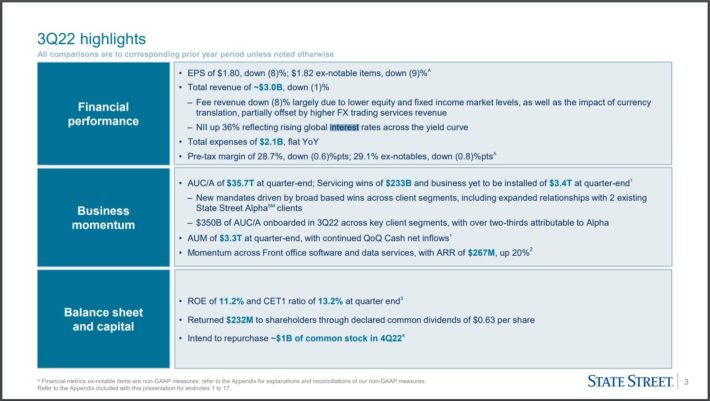

State Street released third-quarter earnings results on October 18th, 2022.

Source: Investor Presentation

Revenue fell 1% to $2.96 billion, mostly due to an 8% decrease in fee revenues that resulted from lower stock market levels and a stronger dollar. On the plus side, rising interest rates helped fuel a 36% increase in net interest income for the year. The company did keep expenses in line with the prior year, which meant that earnings-per-share declined just 7% to $1.82. Bottom-line results were ahead of what the analyst community had expected. We forecast earnings growth of 7% per year for the next five years.

Shares of State Street yield 3.3%, and the company has a dividend growth streak of 13 years, which is the longest of the names discussed in this article. That streak should continue, as the projected payout ratio for 2022 is 34%.

State Street should earn $7.50 per share in 2022, giving the stock a price-to-earnings ratio of 10.2 at the present time. With a fair value target of 12.5 times earnings, shareholders could see a boost of 4.3% to annual returns from multiple expansions.

State Street is expected to return 14.1% annually through 2027, which stems from 7% earnings growth, a starting yield of 3.3%, and a low single-digit annualized valuation tailwind.

Click here to download our most recent Sure Analysis report on State Street Corp. (preview of page 1 of 3 shown below):

Dividend Stock for Rising Interest Rates #8: Ally Financial Inc. (ALLY)

The final stock on our list is Ally Financial, which provides financial services to consumers, businesses, automotive dealers, and corporate clients. The company’s segments include Automotive Finance Operations, Insurance Operations, Mortgage Finance Operations, and Corporate Finance Operations. Ally Financial offers financial products such as term loans, commercial insurance, lines of credit, and vehicle financing. The company is valued at $7.5 billion and has had revenue of $8.2 billion in 2021.

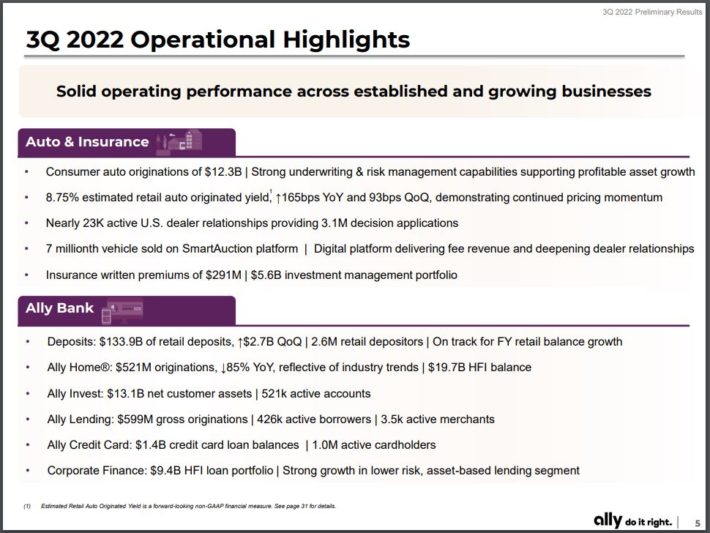

Ally Financial reported third-quarter results on October 19th, 2022.

Source: Investor Presentation

Revenue grew 2% to $2.0 billion while earnings-per-share of $1.12 fell from $2.16. Much of the decline in earnings-per-share was related to lower reserves and because provisions for credit losses increased to $438 million from $76 million in the prior year for the quarter.

Ally Financial originated $12 billion in new consumer auto loans during the period, while deposits grew 2.5% to $143 billion. Higher interest rates helped drive a 15-basis point improvement in net interest margin to 3.81% for the quarter.

We believe that the company can achieve earnings growth of 1% through 2027 off of a very high base case for the current year.

Ally Financial yields 4.7%, nearly triple the average yield of the S&P 500 Index. Investors have received a dividend increase for six consecutive years. With a projected payout ratio of 20% for the year, that growth streak should continue.

Shares have a very low price-to-earnings ratio of 4.3, using estimates of $6.00 of earnings-per-share for 2022. We believe that fair value is closer to 7 times earnings, implying a sizeable tailwind from multiple expansions. Reaching our target multiple by 2027 would add 10.2% to annual returns through 2027.

Ally Financial is anticipated to return 14.7% annually over the next five years. This stems from a 1% earnings growth rate, a nearly 5% dividend yield, and a double-digit contribution from a valuation.

Click here to download our most recent Sure Analysis report on Ally Financial Inc. (preview of page 1 of 3 shown below):

Final Thoughts

Interest rates have increased at a faster pace than the market has seen in quite some time. The size of the hikes is largely unprecedented, but the Federal Reserve has attempted to cool inflation not seen in decades.

While rising rates can negatively impact some areas of the economy, the financial sector stands to benefit immensely. Above, we identified eight stocks from the sector that have already seen a benefit from higher rates. And with rates likely to continue to go up as long as inflation is high, these names should continue to see strong growth in net interest income. All eight stocks have yields of at least 3% and have a buy rating from Sure Dividend due to projected returns.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].