Published on October 24th, 2022 by Samuel Smith

Real Estate Investment Trusts (i.e., “REITs”) are tax-advantaged income vehicles that have become increasingly popular with investors and institutions in recent years. The reason for this is that they do not have to pay any income tax at the corporate level, but instead serve as pass through entities.

In exchange for this benefit, they are required to meet certain guidelines, including paying out at least 90% of taxable income to shareholders in the form of dividends. As a result, high yield and dividend growth investors generally love REITs and dedicate a considerable portion of their portfolios to them.

You can download your free 200+ REIT list (along with important financial metrics like dividend yields and payout ratios) by clicking on the link below:

Certainly, high dividend REITs are attractive for dividend investors looking for income right now.

However, not all REITs are high yielding and in fact, some of them boast impressive growth track records. This makes them a best of both worlds type investment, where investors can enjoy a rapidly growing dividend alongside high capital appreciation potential.

In this article, we will look at seven REITs that have robust growth potential for the foreseeable future.

Table of Contents

#1. Innovative Industrial Properties Inc. (IIPR)

IIPR focuses on owning marijuana cultivation and production properties, where it provides crucial access to capital for marijuana businesses.

Related: 2022 Marijuana Stocks List | The Best Marijuana Stocks To Invest In Now

IIPR benefits from being the sole publicly traded REIT of its kind in the United States and has enjoyed robust growth as a result. It currently owns well over 100 properties across 19 states.

Source: Investor Presentation

Its business model is quite lucrative and provides attractive risk-adjusted returns thanks to the 15-20 initial lease terms that are 100% triple net and typically come with strong initial rental yields and annual escalations.

The REIT has an impressive growth track record as its AFFO per share has soared from $0.67 in 2017 to $5.55 in 2021 and an expected AFFO per share tally of $8.00 in 2022. Its dividend has also grown rapidly, increasing from $0.55 in 2017 to $5.72 in 2021 and a current annualized payout rate of $7.00 per share. NOI has increased at a whopping 137% CAGR over this time period while economies of scale have improved immensely as reflected in its G&A as a percentage of NOI plummeting from 89% in 2017 to a mere 11.5% in 2021.

Moving forward, it continues to have an incredible growth profile, with the main constraint being the legal/regulatory environment. The legal and regulatory uncertainties notwithstanding, analysts are overall still bullish on IIPR’s potential to continue growing. They expect the REIT to grow dividends per share at a 6% CAGR through 2024 and FFO per share at a 9.6% CAGR over the same time span. However, if the regulatory environment improves faster than expected, IIPR could potentially deliver much faster growth than this already strong forecast.

#2. Rexford Industrial Realty, Inc. (REXR)

REXR focuses on owning and operating industrial properties located in Southern California. Its portfolio currently consists of nearly 42 million square feet. The REIT was founded in 2001 and has generated very strong growth in recent years. Since 2018 it has generated a 32% NOI CAGR and a 15% FFO per share CAGR. Since 2017, its dividend has grown at an 18% CAGR and since 2017 the REIT has generated a 15% total return CAGR. Over the past three years, it has posted a 32% consolidated NOI CAGR, a 22% FFO per share CAGR, and a 17% dividend per share CAGR.

Its Q3 numbers came in very strong as well, with 98.6% portfolio occupancy, 40.1% consolidated NOI growth, 44.5% core FFO growth, and 16.3% FFO per share growth. Meanwhile, its balance sheet remains in solid shape, with about $1.2 billion in total liquidity a BBB+ credit rating from S&P and a mere 15.9% net debt to total enterprise value ratio.

Looking ahead, analysts expect REXT to continue generating strong growth numbers. Through 2026, analysts forecast a 13.2% AFFO per share CAGR, a 12.8% FFO per share CAGR, and a 15.5% dividend per share CAGR.

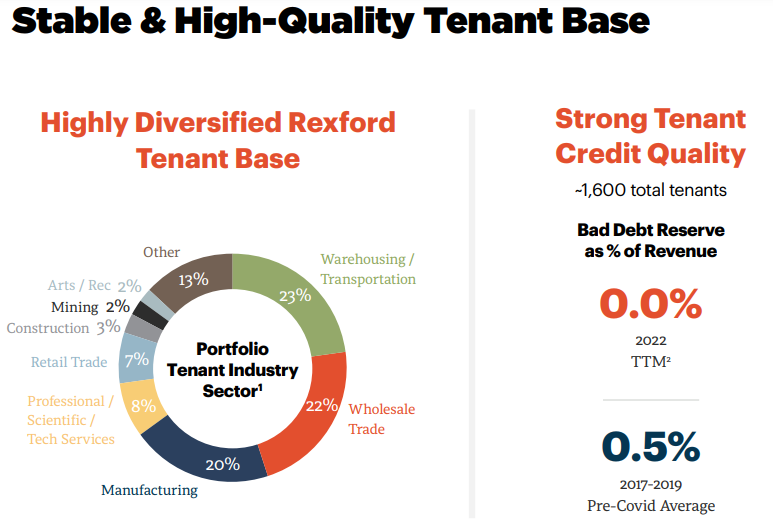

This bullish outlook is partly due to its well diversified and high-quality tenant base that should lead to lower downside risk and numerous growth opportunities.

Source: Investor Presentation

On top of that, REXR also implements a value-add approach to its asset management in order to drive superior leasing spreads. Last, but not least, REXR benefits from its singular focus on the largest U.S. industrial market and the fourth largest overall industrial market in the world as Southern California has the largest ports in the country, representing 40% of all U.S. containerized imports.

#3. Independence Realty Trust, Inc. (IRT)

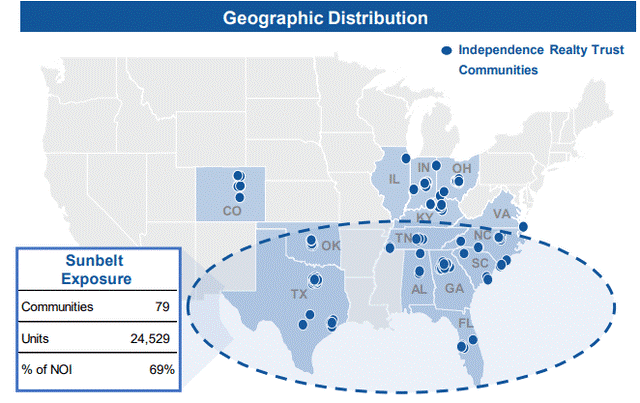

IIRT focuses on multifamily apartment communities in sunbelt markets. While the REIT was plagued by its lower quality asset portfolio and higher leverage in its early years after going public in 2013, management has since then transformed the business. It has acquired numerous higher quality apartment communities, significantly deleveraged the balance sheet, and incorporated value-add operations to its tool kit in order to boost returns on investment.

Source: Investor Presentation

While its past track record has been less than stellar with FFO per share only improving to $0.84 in 2021 relative to its $0.81 number in 2013, the forward outlook for the business is much better. FFO and AFFO per share are expected to grow at a 10% CAGR through 2026 while dividends per share are expected to increase at an 11% CAGR over that same period.

This strong growth will likely be fueled by IRT’s combination of substantial retained cash flows, strong same-store NOI growth rate, and value add business, making it one of the most intriguing multifamily investment opportunities at the moment.

#4. UMH Properties, Inc. (UMH)

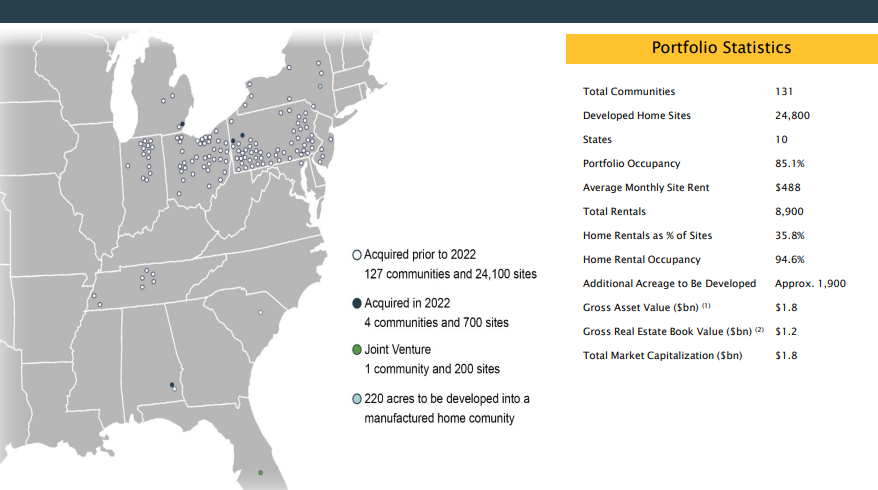

UMH focuses on owning manufactured housing communities across the United States and currently owns tens of thousands of properties in over 100 communities in the Midwest and Northeast. ‘

Source: Investor Presentation

For many years UMH struggled to grow its dividend and FFO per share, with FFO per share increasing only slightly on an annualized basis from 2012 to 2019 (from $0.62 per share in 2012 to $0.63 per share in 2019). Furthermore, the annualized dividend per share remained flat at $0.72 the entire time and was generally not covered fully by cash flows over that period.

However, since 2020 the company’s growth engine has finally kicked into high gear. FFO per share increased from $0.63 in 2019 to $0.87 in 2021 and the dividend per share finally began to grow along with it. In 2021, UMH paid out $0.76 per share in dividends and is currently paying out a $0.80 annualized dividend.

Moving forward, this robust growth momentum is expected to continue. Wall Street analysts project FFO per share to grow at a 23.3% CAGR through 2024, AFFO per share to grow at a 20.4% CAGR, and the dividend per share to grow at a ~5% CAGR. While the dividend per share growth could certainly be higher than what it is projected to be, UMH is expected to retain more capital in order to fuel further lucrative growth investments. What this does mean, however, is that UMH’s mid-single digit dividend CAGR will likely be sustainable for a long-time to come and the rate of growth may even accelerate.

#5. SBA Communications Corporation (SBAC)

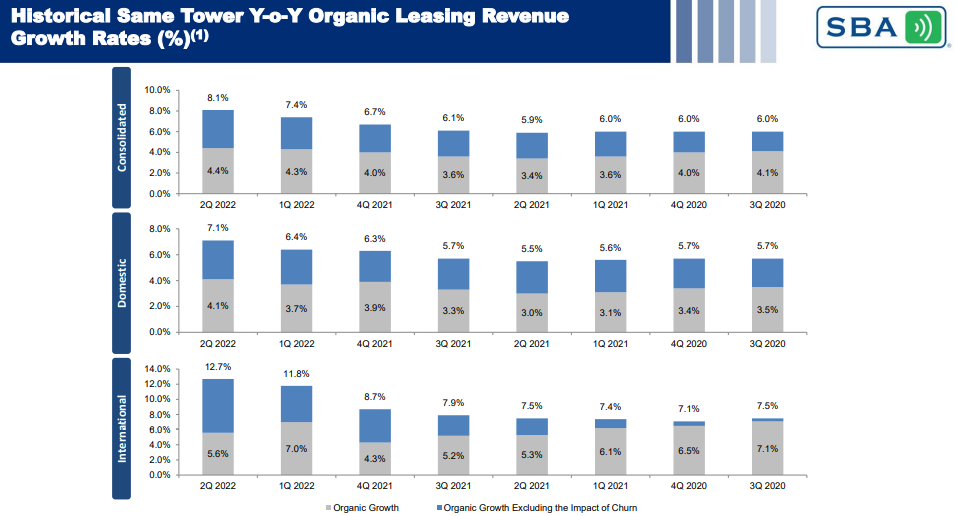

SBAC owns and operates wireless communications infrastructure such as tower structures for wireless antennas. In fact, it owns over 36,000 of these towers which it then leases out to wireless telecommunications companies.

The REIT has generated impressive growth in the past and has in fact seen it accelerate in recent quarters as the graphic below illustrates:

Source: Investor Presentation

In 2012, SBAC generated $3.09 in AFFO per share and did not pay a dividend. In 2021, it generated $10.74 per share in AFFO and paid out $2.32 in dividends per share. This year the REIT is expected to generate $12.06 in AFFO per share while paying out $2.84 per share in dividends.

Moving forward, SBAC is expected to continue its incredible growth momentum. Dividends per share are expected to grow at a 21.1% CAGR through 2026 while AFFO per share is expected to grow at an 11.2% CAGR over the same time period. As a result, SBAC is one of the most attractive growth REITs in the market today.

#6. Welltower Inc. (WELL)

WELL is a healthcare REIT that focuses on Senior Housing Operations, Senior Housing Triple-net, Outpatient Medical, Health System, and Long-Term/Post-Acute Care. Its income is fairly well diversified across these segments, with its 2021 net operating income broken down as following: 39.3% in Seniors Housing Operating (“SHO”), 23.5% in Seniors Housing Triple-net, 23.2% in Outpatient Medical (“OM”), 8.8% in Health System, and 5.2% in Long-Term / Post-Acute Care.

WELL’s track record over the past decade is less than impressive given that its FFO per share and dividend per share have actually declined slightly over that period. In 2012, FFO per share was $3.52 and dividends per share were $2.96. In 2021, FFO per share was $3.21 and dividend per share were $2.44.

However, moving forward, analysts expect WELL’s growth trajectory to pick up considerably, making it a compelling growth story. Through 2026 WELL is expected to grow its dividend per share at a 12% CAGR, its FFO per share at an 11.6% CAGR, and its AFFO per share at a 13.2% CAGR.

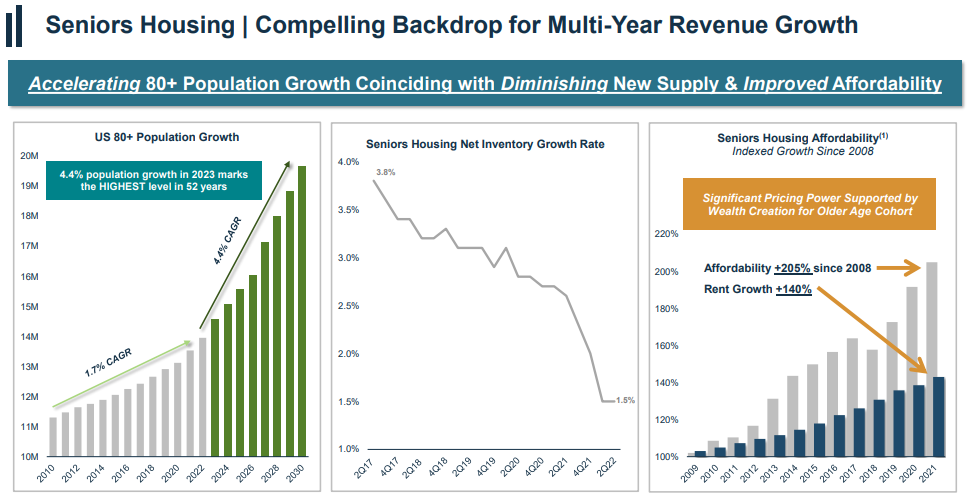

The factors behind this growth are the fact that the U.S. 80+ year old population is expected to see its annualized growth rate increase from 1.7% over the past decade to 4.4% in the coming decade. The senior housing net inventory growth rate has plummeted in recent years from 3.8% in 2017 to 1.5% this year.

Meanwhile, the massive buildup in homeowner equity and stock market returns over the past several decades means that elderly individuals looking to more to senior housing can much more easily afford it.

Source: Investor Presentation

As a result, management expects its occupancy rate and its pricing power to soar in the coming years, boosting cash flows and dividend growth along with it.

#7. Essential Properties Trust (EPRT)

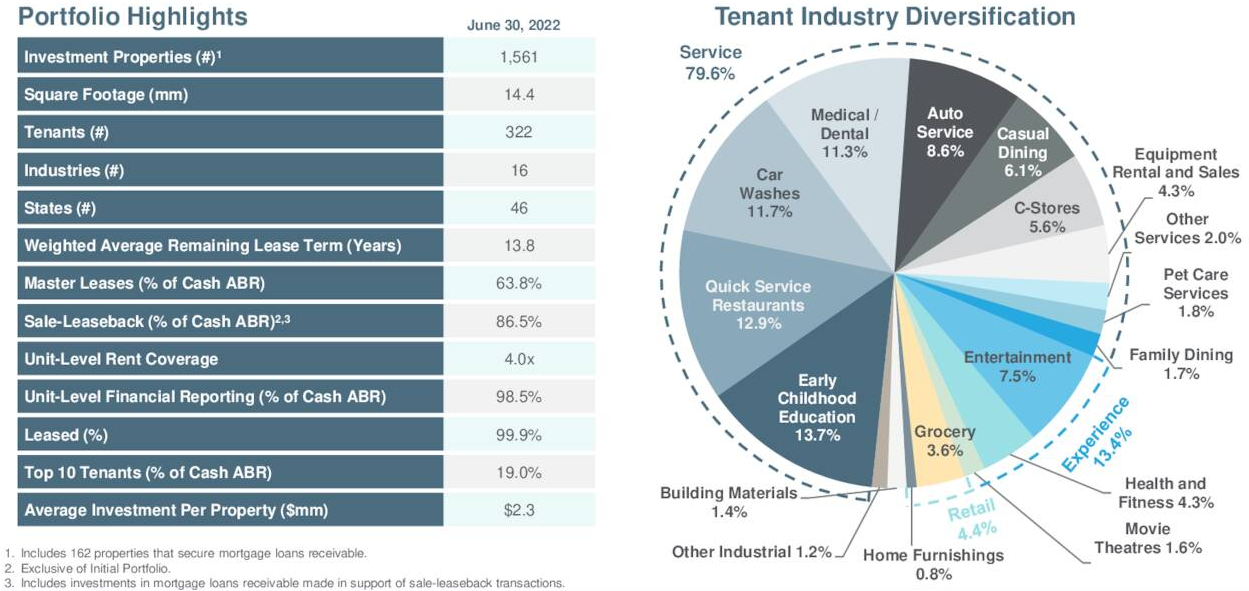

EPRT is a triple net lease REIT with focuses on single-tenant properties leased out to middle market companies that operate service-oriented or experience-based businesses such as restaurants, car washes, automotive and medical services, convenience stores, fitness centers, and early childhood education. It has a well-diversified portfolio of over 1,500 properties spread across 16 industries.

One of its biggest focuses is to purchase properties that can easily be repurposed and released to a different tenant in the event that one of its existing tenants defaults on their lease. As a result, its business model is quite low risk, especially when combined with its triple net lease structure.

Source: Investor Presentation

EPRT went public recently (2018) but has already compiled an impressive track record for generating robust growth alongside paying out an attractive dividend. In 2018, EPRT generated $0.78 in AFFO per share and paid out $0.43 in dividends per share. In 2021, it generated $1.34 in AFFO per share and paid out $0.98 in dividends per share. This year, EPRT is expected to continue its impressive growth momentum by generating $1.53 in AFFO per share while paying out $1.08 in in dividends per share.

Through 2026, it is expected to generate a ~6% AFFO per share CAGR alongside a dividend per share CAGR of ~5%. While these numbers are not quite as impressive as some of the others on this list, its recession resistance, predictable and scalable growth strategy, and current dividend yield of over 5.5% make it a compelling dividend growth REIT.

Conclusion

While REITs are not typically known – nor purchased – for their growth but rather as passive income machines, there are exceptions out there. One of the beauties of buying high growth REITs like the ones discussed in this article is that investors can achieve tremendous tax-advantaged compounding. Since REITs do not pay corporate income taxes, taxes are only paid by investors on the dividends that they receive.

As a result, high-growth REITs that retain a considerable percentage of cash flows and can reinvest it at high returns get an added boost since continued growth in income at the REIT level is tax free.

At a time when many growth-oriented investments like the REITs shared in this article have been beaten down by rising interest rates, now could be a good time to invest in these exciting wealth compounders and dividend growth machines.

Sure Dividend maintains similar databases on the following useful universes of stocks:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].