Final week’s feedback, Tune Out the Noise, was my suggestion that buyers mustn’t get drawn into the firehose of noise, partisan wrestling matches, and trolling generated by the brand new administration. My emphasis was on staying centered on the long run. This contains setting targets, having a monetary plan, and acknowledging our collective incapacity to foretell the outcomes of geopolitical occasions (both home or abroad).

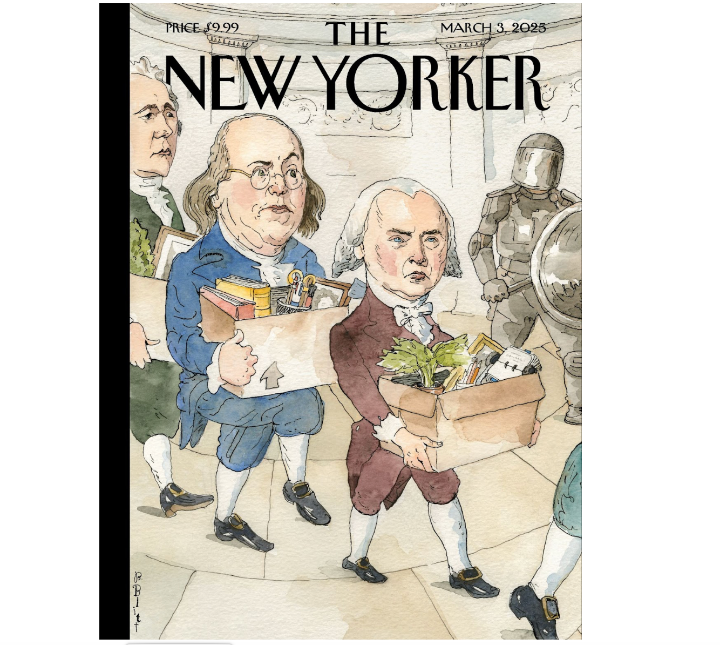

This doesn’t, nonetheless, imply we must always change into sanguine about how quickly adjustments within the U.S. authorities could also be occurring. Issues are transferring quick, and whether or not you help 47’s agenda or not, fast change can result in unintended penalties. The primary month of Trump 2.0 has seen the boundaries of govt energy examined, together with an aggressive change to the Federal workforce. How that performs out within the courts and the financial system is as but unknown.

I’m not blasé about radical change. What is going on will get portrayed within the media in a binary black-and-white style. It requires some nuance, an understanding that issues are usually not at all times what they seem. Algorithmic Social Media is, at its core, a really profitable design to study what retains you engaged after which hold feeding you that. Emotionality, angst, outrage, and even hatred are the way it captures eyeballs, hours, and clicks.

Relatively than get sucked into the emotionality of a YES or NO framework, I counsel contemplating recognizing the place danger elements are rising. “Transfer quick and break issues” may fit in Silicon Valley, however it isn’t what market contributors need from the White Home (or the Federal Reserve).

What danger elements at play? There are financial dangers, market dangers, systemic elements, forex dangers, constitutional questions, and in the end, the standing of the USA as a worldwide superpower and ally.

Threat is at all times current, and reward is a perform of taking intelligently calculated dangers. However the opportunity of a coverage mistake – both on a modest or grand scale – is on the rise. Whether or not it comes from DOGE or the Finances course of or a minor court docket case or a extra critical problem, we must always concentrate on the altering setting.

Let’s take into account seven potential risks that, whereas nonetheless presently small, are additionally growing over the following 12 months:

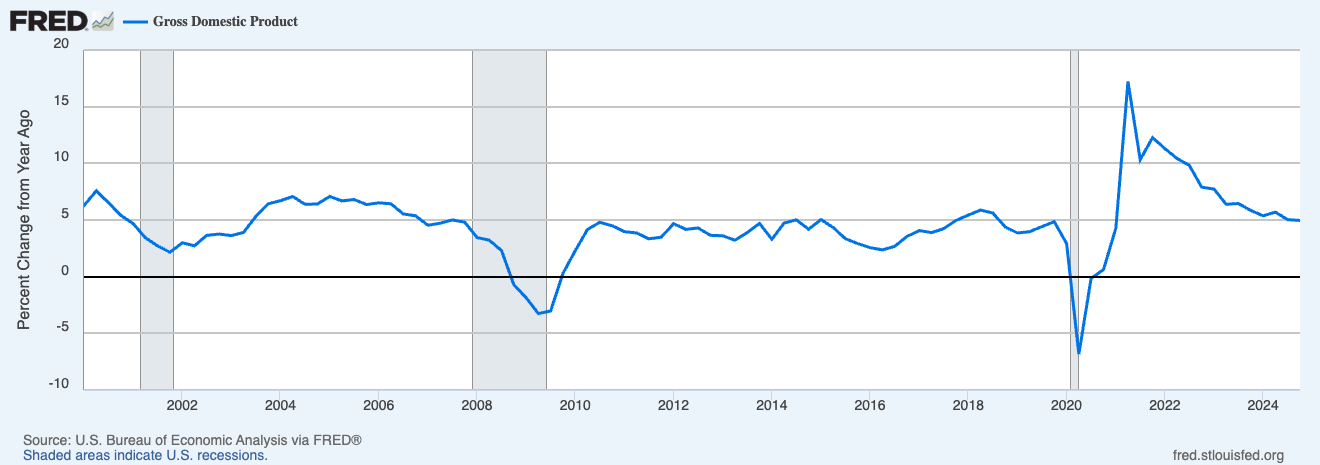

Recession: After a number of years of incorrectly forecasting a recession, Wall Road has lastly acknowledged the energy of the underlying financial system. However there are indicators of moderation (not contraction) value noting: Retail gross sales are softening, and sturdy items haven’t finished particularly nicely recently (blame restricted housing gross sales). Sentiment has been a drag for some time.

None of those counsel a recession is imminent. They do improve the vulnerability of the financial system to a shock, and that’s the danger issue right here.

Chance of a recession: 15%, up from 5%

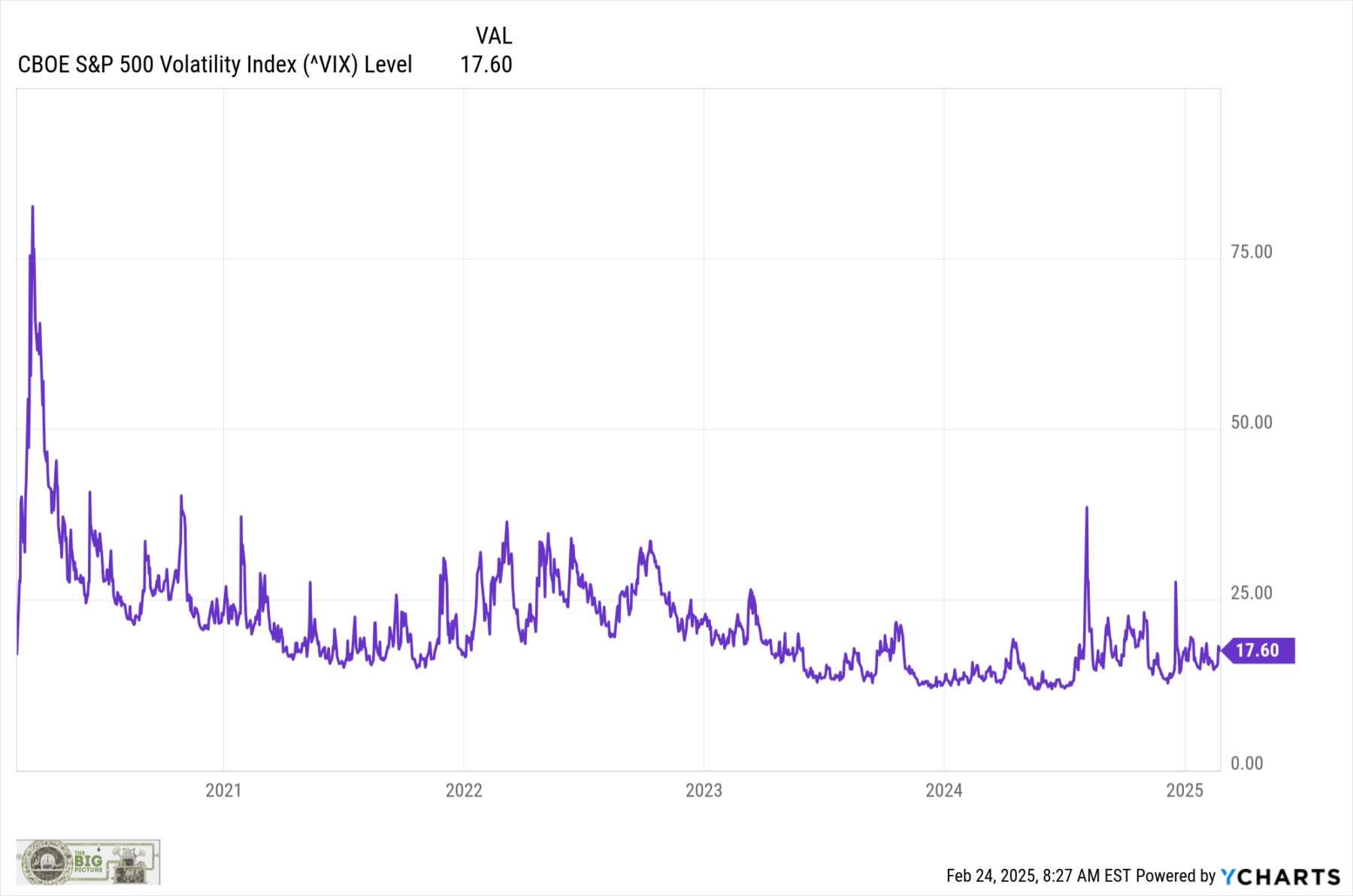

Volatility: We’ve got already seen an uptick in fairness worth volatility regardless of notching a brand new all-time excessive within the S&P 500 index 9chart under). I consider ATH’s are essentially the most bullish market indicator of all. Its the one on the finish of the bull market that fails that take a look at.

5 years after the beginning of the pandemic, the CBOE S&P 500 Volatility Index (VIX chart above) was spiky however settling down. It’s beginning to creep up in the direction of 20. That is nothing too harmful, but it surely raises the opportunity of extra turmoil forward.

Bond yields proceed to swing. What has been unusual about this cycle is that shopper lending for automobiles and houses has seen rates of interest go up because the FOMC has reduce charges. The Bloomberg Mixture Bond worth (inverse to yield) has moved loads over the previous three years, and worth swings are prone to getting even wilder.

Chance of a Market Dislocation: 20%, up from 10%

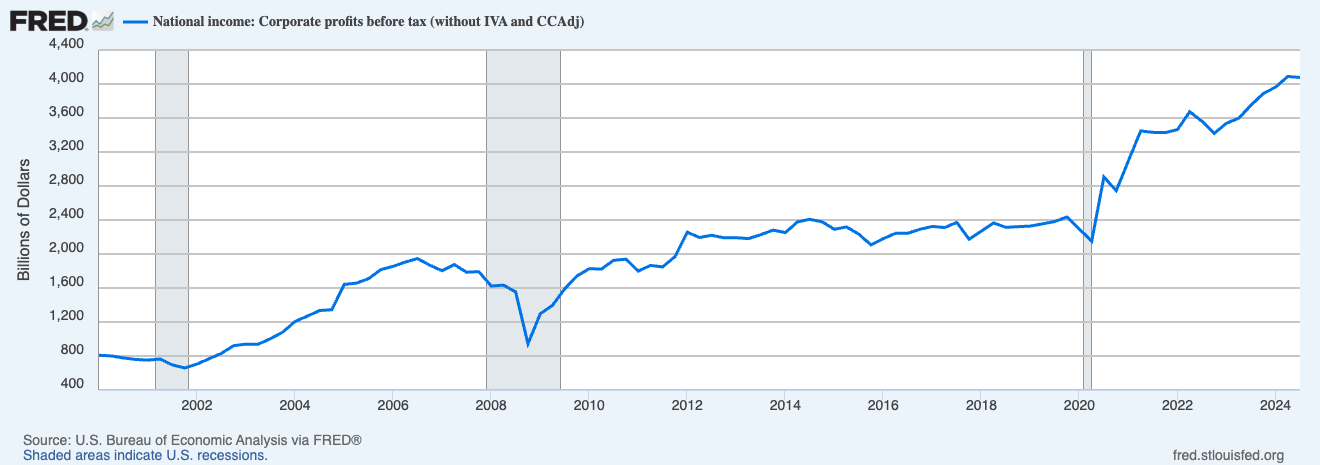

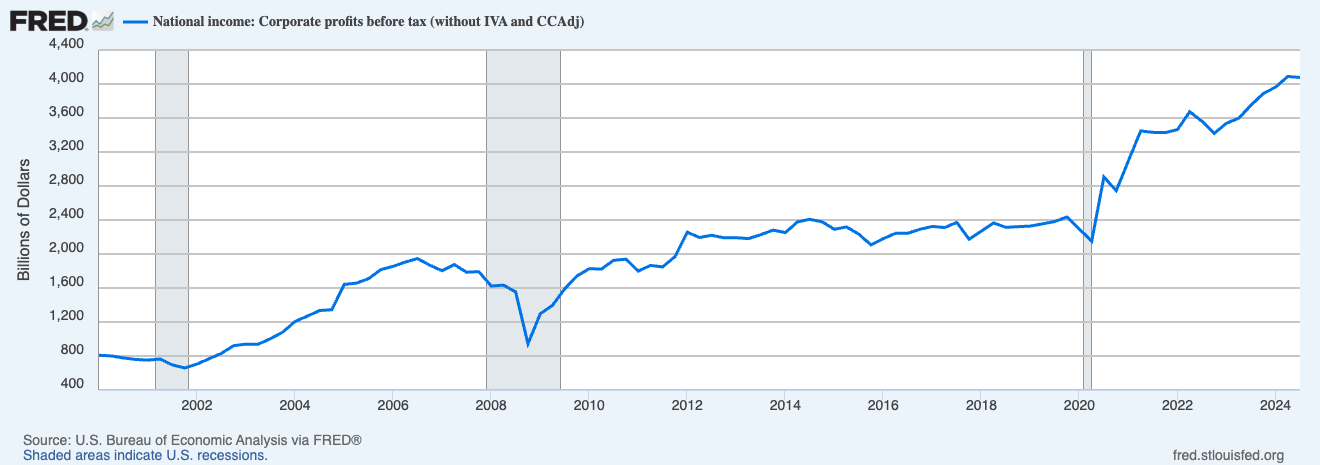

Earnings and Valuations: Not solely markets however company income are at or close to all-time highs. Buyers wish to see profitability keep up, because it results in the psychological underpinning of a wholesome market. That manifests itself in buyers’ willingness to pay increasingly more for every greenback of firm earnings, e.g., P/E a number of enlargement.

We typically neglect how a lot sentiment and luxury ranges can drive shopper spending and company revenues. Sentiment has been very powerful to learn since 2020, with partisanship driving very low shopper sentiment whereas spending remained sturdy.

Chance of a Revenue Fall: 25%, up from 15%

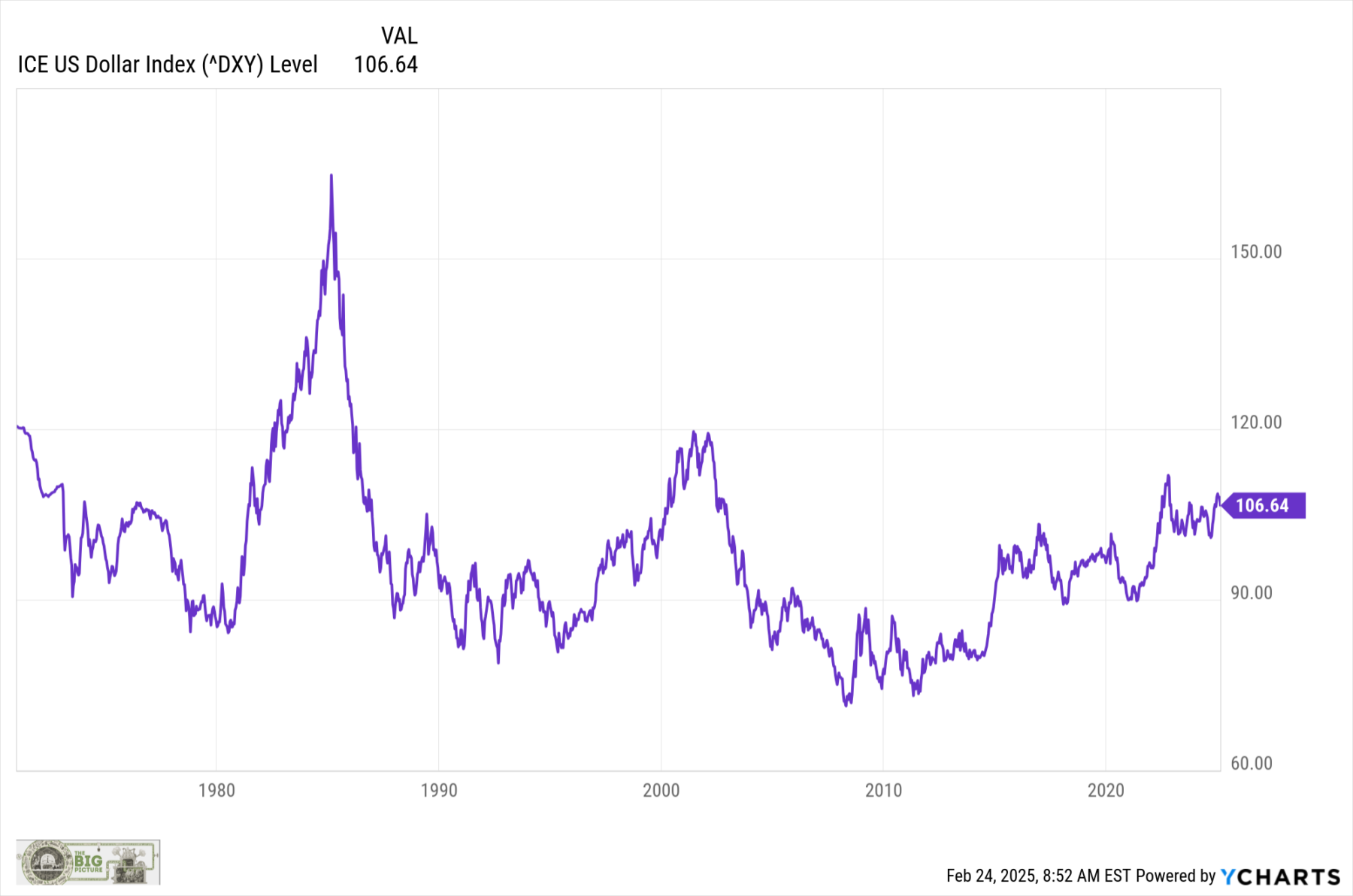

The Collapse of the US Greenback: Varied events have been forecasting the collapse of fiat forex for hundreds of years (sometimes being by accident appropriate) and the collapse of the greenback for many years. Nothing has challenged this

Because the finish of World Conflict Two, the USD has been America’s “exorbitant privilege ” because the world’s reserve forex. Nevertheless, a number of elements threaten this privilege: wide-scale tariffs, the embrace of other digital currencies, the breaking of long-standing alliances, and dallying with dictators.

Because the finish of World Conflict II in 1945, the rise of the USA because the world’s dominant financial, navy, and cultural energy has led to a comparatively peaceable 75 years within the Western Hemisphere. Pax Americana has vastly benefited the U.S. and its allies. Placing that in danger can be one in all historical past’s best unforced errors.

Chance of a Greenback Collapse: 12ish%, up from 3ish%

Geopolitical Chaos: These subsequent three are more durable to evaluate. Our first 4 dangers have been (considerably) quantifiable. We now enter the realm of squishier, more durable to evaluate danger elements. In every of the above, we’ve got a good suggestion of what the result set appears to be like like prematurely, however we have no idea what the particular outcomes might be. Now, we enter a extra unsure realm, the place we don’t know what the total vary of prospects is, however we do see better dispersion.

The Center East, Ukraine & Russia, China, Russia (alone) Europe, Canada, Greenland, Panama Canal, even Canada are potential flashpoints.

Chance of a Geopolitical Occasion: 37%, up from 20ish%

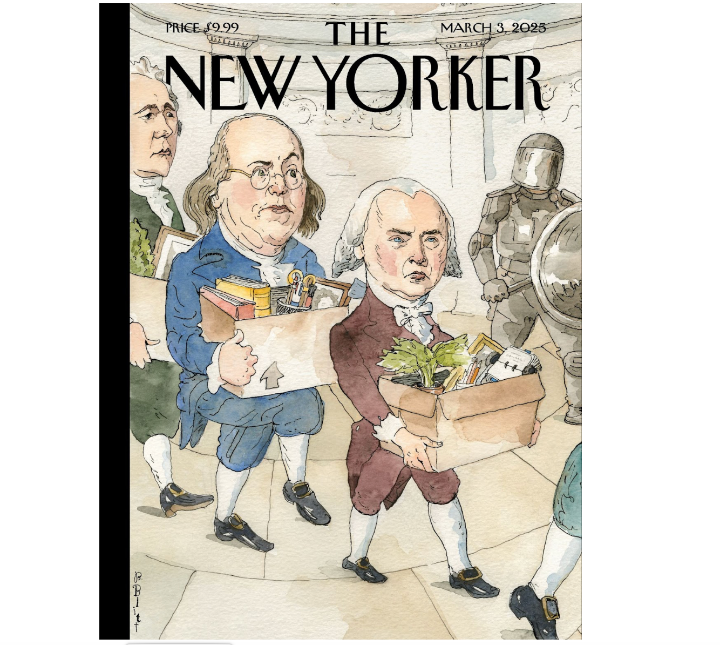

Constitutional Disaster: It’s onerous to inform what’s bluster and negotiating ways and what’s actual. However assuming we take the present development to its (il)logical conclusion, the percentages of dangerous issues taking place hold rising. The Government, Legislative, and Judicial branches are on a collision course. I don’t know how this performs out…

Chance of a Constitutional Disaster: 30%, up from 2ish%

Failed Sovereignty: May the unthinkable happen? May the experiment of self-rule and democracy come to a screeching halt? I’m detest to ponder such an final result, but it surely was unthinkable for the reason that finish of WW2. Positive, there have been crises, from the Civil Conflict to Dred Scott determination to Civil Rights motion and extra lately the challenges from GFC and the Residents United v. FEC case.

However in recent times, the concept of the USA failing as a sovereign nation failing was really unimaginable. That’s now not the case.

Finish of the USA of A: Non-Zero chance, up from unthinkable.

~~~

I have interaction in these thought experiments in order to not get too caught up in my very own bias bubble. Final week’s Tune Out the Noise was written for the aim of avoiding an emotional error. This week’s evaluation is to verify I’m contemplating the entire worst-case eventualities that emotionality may result in…

Beforehand:

Tune Out the Noise (February 20, 2025)