Ирина Мещерякова

Foreword

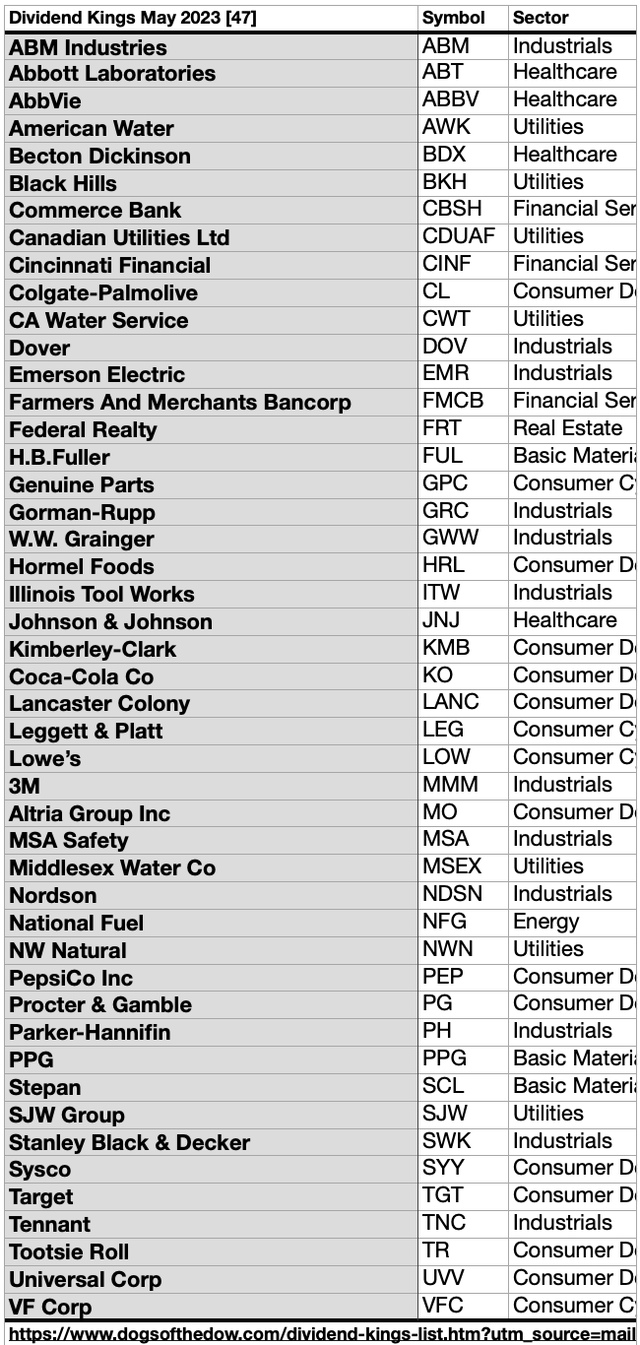

As a supplement to this article, please note that Dogs of the Dow has published a 2023 list detailing the latest 47 Dividend Kings. The article, entitled 2023 Dividend Kings List, is online now.

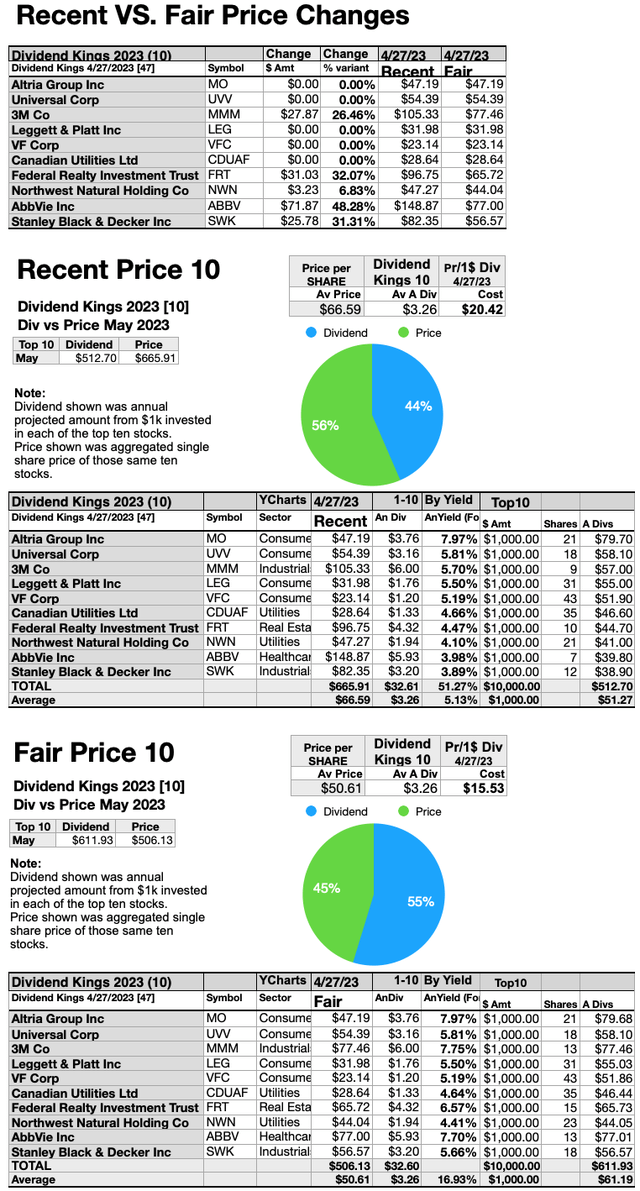

While most of this collection of 47 Kings is too pricey to justify their skinny dividends, five of the top ten, by yield, live up to the ideal of offering annual dividends (from a $1K investment) exceeding their single share prices, and this month there is one more ideal dog, outside the top ten, and there are four more to watch.

In the current market adjustment, it is now possible for Altria Group Inc. (MO), Universal Corp. (UVV), Leggett & Platt Inc. (LEG), V.F. Corp. (VFC), Canadian Utilities Ltd. (OTCPK:CDUAF), and Gorman-Rupp Co. (GRC) (the outsider), to stay fair-priced with their annual-yield (from $1K invested) meeting or exceeding their single-share prices.

The four to watch are Northwest Natural Holding Co. (NWN), 3M Co. (MMM), Stanley Black & Decker (SWK), and Federal Realty Investment Trust (FRT). NWN needs to drop just $3.23 in price or 6.83%; SWK is $25.78 high; MMM is $27.87 overweight, and FRT needs to lose $31.03 to join the ideal six.

As we have passed the three-year mark of the 2020 Ides of March dip, the time to snap up those six lingering top-yield dividend King dogs is at hand… unless another big bearish drop in price looms ahead. (At which time your strategy would be to add to your position in any of those you then hold.)

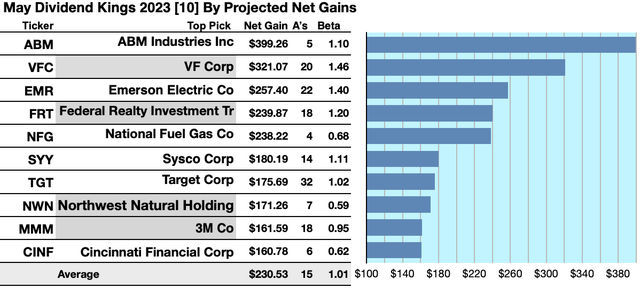

Actionable Conclusions (1-10): Analysts Predict 16.08% To 39.93% Top Ten King Net Gains To April 2024

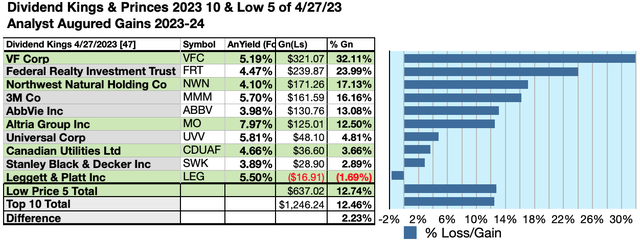

Four of the ten top Kings by yield were verified as being among the top ten gainers for the coming year based on analyst 1-year target prices. (They are tinted gray in the chart below). Thus, this yield-based April 27 forecast for Kings (as graded by Brokers) was 40% accurate.

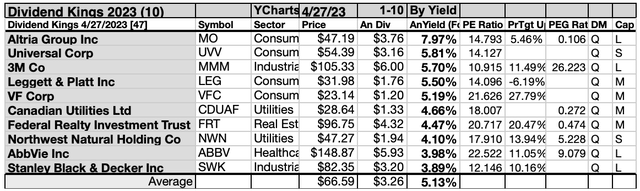

Estimated dividend returns from $1000 invested in each of these highest-yielding stocks and their aggregate one-year analyst median target prices, as reported by YCharts, produced the following 2023-24 data points. (Note: target prices from lone analysts were not used.) Ten probable profit-generating trades projected to April, 2027 were:

Source: YCharts.com

ABM Industries Inc. (ABM) was projected to net $399.26, based on dividends, plus the median of target price estimates from 5 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 10% greater than the market as a whole.

VF Corp was projected to net $321.07 based on dividends, plus the median of target price estimates from 20 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 46% more than the market as a whole.

Emerson Electric Co. (EMR) netted $257.40 based on a median target price estimate from 22 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 40% more than the market as a whole.

Federal Realty Investment Trust was projected to net $239.87 based on target price estimates from 18 analysts, plus annual dividend, less broker fees. The Beta number showed this estimate is subject to risk/volatility 20% greater than the market as a whole.

National Fuel gas Co. (NFG) was projected to net $238.22, based on the median of target price estimates from 4 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 32% less than the market as a whole.

Sysco Corp. (SYY) was projected to net $180.19, based on dividends, plus the median of target price estimates from 14 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 11% less than the market as a whole.

Target Corp. (TGT) was projected to net $175.68, based on dividends, plus the median of target price estimates from 32 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 2% greater than the market as a whole.

Northwest Natural Holding Co was projected to net $171.26, based on a median of target estimates from 7 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 41% less than the market as a whole.

3M Co was projected to net $161.59, based on the median of target price estimates from 18 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 5% less than the market as a whole.

Cincinnati Financial Corp. (CINF) was projected to net $160.78, based on the median of target price estimates from 6 analysts, plus the estimated annual dividend, less broker fees. The Beta number showed this estimate subject to risk/volatility 38% less than the market as a whole.

The average net gain in dividend and price was estimated to be 23.05% on $10k invested as $1k in each of these ten stocks. The average Beta ranking showed these estimates subject to risk/volatility 1% greater than the market as a whole.

Source: Open source dog art from dividenddogcatcher.com

The Dividend Dogs Rule

Stocks earned the “dog” moniker by exhibiting three traits: (1) paying reliable, repeating dividends, (2) their prices fell to where (3) yield (dividend/price) grew higher than their peers. Thus, the highest yielding stocks in any collection became known as “dogs.” More precisely, these are, in fact, best called, “underdogs,” even if they are “Kings” and “Princes.”

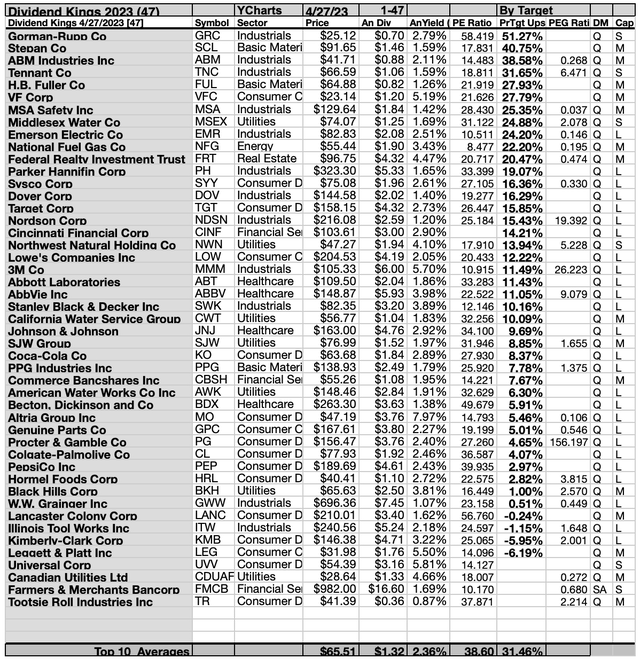

Top 47 Dividend Kings By Broker Targets

Sources: dogsofthedow.com/YCharts.com

This scale of broker-estimated upside (or downside) for stock prices provides a measure of market popularity. Note: no broker coverage or single broker coverage produced a zero score on the above scale. These broker estimates can be seen as the emotional component (as opposed to the strictly monetary and objective dividend/price yield-driven report below). As noted above, these scores may also be regarded as contrarian.

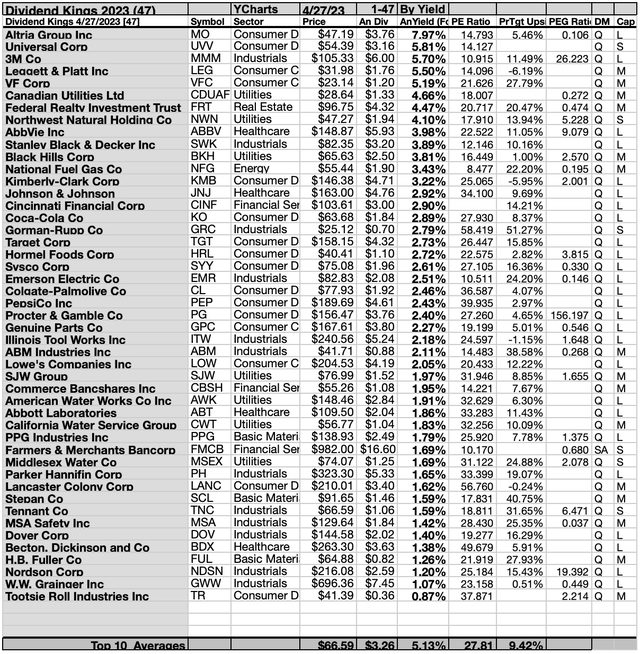

Top 47 Dividend Kings By Yield

Source: dogsofthedow.com/YCharts.com

Actionable Conclusions (11-20): Ten Top Stocks By Yield Are The May Dogs Of The Dividend Kings

Top ten Kings selected 4/27/23 by yield represented six of eleven Morningstar sectors. In first place was Altria Group Inc. [1], the tops of two consumer defensive representatives listed. The other placed second, Universal Corp. (UVV) [2].

Then, the first of two industrials sector representatives placed third, 3M Co [3], followed by Stanley Black & Decker Inc [10].

The first of two consumer cyclical representatives took fourth place, VF Corp [4]. The other placed fifth, Leggett & Platt Inc [5].

In sixth place, was the first of two utilities, Canadian Utilities Ltd [6]. Thereafter, in eighth, was Northwest Natural Holding Co [8].

Seventh place was claimed by the lone real estate representative, Federal Realty Investment Trust [7].

Finally, to complete these April top-ten Kings, by yield, the lone healthcare representative in the top ten placed ninth, AbbVie Inc. (ABBV) [9].

Source: YCharts.com

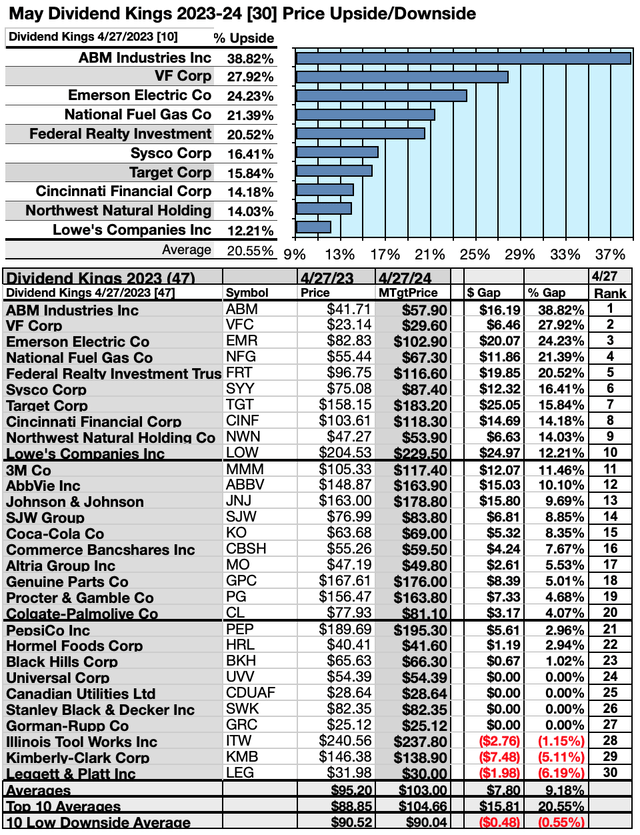

Actionable Conclusions: (21-30) Top Ten Kings Showed 20.45% To 57.87% Upsides Into May 2023; (31) On The Downside Were Three -1.15% to -6.18% Losers

To quantify top-yield rankings, analyst median price-target estimates provided a “market sentiment” gauge of upside potential. Added to the simple high-yield metrics, analyst median price target estimates became another tool to dig out bargains.

Analysts Estimated A 2.23% Advantage For 5 Highest Yield, Lowest Priced, of Top Ten Dividend Kings By May 2024

Ten top Kings were culled by yield for their monthly update. Yield (dividend/price) results verified by YCharts did the ranking.

Source: YCharts.com

As noted above, top ten Kings selected 4/27/23 showing the highest dividend yields represented six of eleven in the Morningstar sector scheme.

Actionable Conclusions: Analysts Estimated The 5 Lowest Priced Of Ten Highest Yield Dividend Kings (32) Delivering 12.74% Vs. (33) 12.46% Net Gains by All Ten by May 2024

Source: YCharts.com

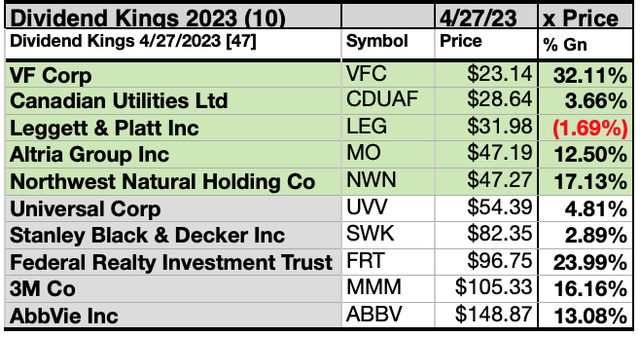

$5000 invested as $1k in each of the five lowest-priced stocks in the top ten Dividend Kings kennel by yield were predicted by analyst 1-year targets to deliver 2.23% more gain than $5,000 invested as $.5k in all ten. The very lowest-priced top-yield King stock, VF Corp, was projected to deliver the best net gain of 32.11%.

Source: YCharts.com

The five lowest-priced top-yield Dividend Kings as of April 27 were: VF Corp; Canadian Utilities Ltd; Leggett & Platt Inc; Altria Group Inc; Northwest Natural Holding Co, with prices ranging from $23.14 to $47.27

The five higher-priced top-yield Dividend Kings for April 27 were: Universal Corp; Stanley Black & Decker; Federal Realty Investment Trust; 3M Co, and AbbVie Inc, whose prices ranged from $54.39 to $148.87.

This distinction between five low-priced dividend dogs and the general field of ten reflected Michael B. O’Higgins’ “basic method” for beating the Dow. The scale of projected gains based on analyst targets added a unique element of “market sentiment” gauging upside potential. It provided a here-and-now equivalent of waiting a year to find out what might happen in the market. Caution is advised, however, since analysts are historically only 15% to 85% accurate on the direction of change and just 0% to 15% accurate on the degree of change.

Afterword

If somehow you missed the suggestion of the five stocks ripe for picking at the start of the article, here is a repeat of the list at the end:

The following 6 (as of 4/27/23) realized the ideal of offering annual dividends from a $1K investment exceeding their single share prices: Altria Group Inc, Universal Corp, Leggett & Platt Inc, VF Corp, Canadian Utilities Ltd, and Gorman-Rupp Co.

Four more bear watching, NWN needs to drop just $3.23 in price or 6.83%; SWK is $25.78 high; MMM is $27.87 overweight, and FRT needs to lose $31.03 to join the ideal six.

Price Drops or Dividend Increases Could Get All Ten Top Dividend Kings Back to “Fair Price” Rates For Investors

Source: YCharts.com

Since five of the top ten Dividend K&P shares are now priced less than the annual dividends paid out from a $1K investment, the top chart below shows the dollar and percentage differences between recent and fair prices. Note that NWN was just $3.23 over the mark. Four others are within $26 to $32 of being there. The middle chart compares the five ideals with five at recent prices. Fair pricing (when all ten top dogs conform to the ideal) is displayed in the bottom chart.

May Dividend Kings Alphabetical by Ticker Symbol

Source: Dogsofthedow.com

The net gain/loss estimates above did not factor in any foreign or domestic tax problems resulting from distributions. Consult your tax advisor regarding the source and consequences of “dividends” from any investment.

Stocks listed above were suggested only as possible reference points for your Dividend Aristocrats dog stock purchase or sale research process. These were not recommendations.