90 minutes after a mediocre 2Y public sale hit the tape, the Treasury offered $70BN in 5Y paper within the day’s second public sale to start out the Fed-abbreviated week, which additionally sees a 7Y sale tomorrow earlier than the FOMC on Wednesday.

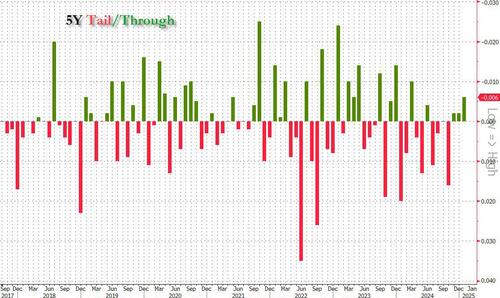

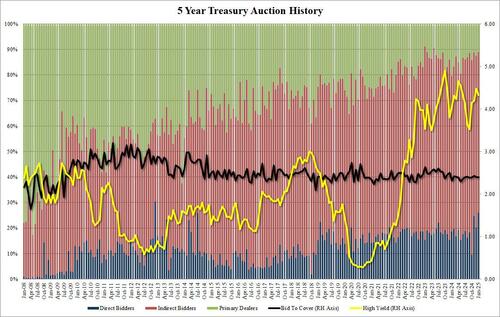

The public sale stopped at a excessive yield of 4.330% which was down from 4.478% in December, and likewise stopped by the When Issued 4.336% by 0.6bps – this was the third consecutive by public sale in a row and adopted 4 consecutive tails as sentiment has clearly improved towards the stomach of the curve.

The Bid to Cowl was unchanged, at 2.40, precisely the place it was final month, precisely the place the six-auction common is, and the place it has been inside +/- 5bps since June!

The internals have been barely weaker with Indirects awarded 62.80%, down from 67.3% and the bottom since Jan 2024 (this could possibly be some odd seasonal quirk). And with Directs awarded 26.1%, essentially the most since Dec 2012, Sellers have been left with simply 11.1%, the bottom since Could 2023.

General, a stable, and definitely stronger public sale, than the 2Y this morning and never surprisingly we now have seen yields drip by about 1-2 bps for the reason that outcomes, however it’s secure to say that different far more necessary issues are behind the transfer in charges in the present day than in the present day’s auctions.