Lurin/iStock through Getty Pictures

U.S. markets started the week on a quiet be aware with all three indexes wavering between small good points and losses all through the day on Monday. U.S. authorities bonds continued to tumble sending yields to their highest closing stage since December 2018. That didn’t, nonetheless, elicit as a lot motion in equities as in prior days.

On Tuesday, markets got here out roaring for the perfect day in a month for all three indexes, led by the DJIA, which ended greater by almost 500 factors. The keenness was due partially to the overruling of the federal masks mandate on public transportation by U.S. District Choose Kathryn Kimball Mizelle of Tampa. The ruling despatched shares in travel-related shares surging, carrying a lot of the market greater with them. Positive aspects, total, have been broad-based with 10 of the S&P 500’s 11 sectors advancing.

Whereas the DJIA continued its rise on Wednesday, the tech-focused Nasdaq ended decrease, pushed by the cratering of Netflix (NFLX) after they reported declining subscribership and predicted additional losses forward. The shockwaves from NFLX despatched different streaming and stay-at-home names broadly decrease for the day. Regardless of the declines in tech, the Dow remained supported by a robust day from IBM (IBM) and Procter & Gamble (PG), who each reported sturdy earnings. On the information entrance, a report launched from the Nationwide Affiliation of Realtors confirmed that the median existing-home worth rose to a document $373,300 in March.

Volatility elevated on Thursday because the day started with good points however ended sharply decrease after feedback from Fed Chairman Jerome Powell signaled that the central financial institution was more likely to elevate charges by a half share level at its assembly subsequent month. Fears over the inevitable fee enhance despatched yields on the 10-year U.S. Treasury be aware surging to 2.917% from 2.836%. This dragged all three indexes down, with the heaviest losses within the DJIA, which ended decrease by about 370 factors.

Equities continued to edge decrease firstly of the day on Friday as yields continued their rise upwards. The shortage of main developments on Friday morning recommended that markets have been set for a blended or muted end to the week, with the DJIA on tempo pre-market to finish the week with a 1% acquire, regardless of the heavy losses from Thursday.

The week provided potential shopping for alternatives on many shares. For long-term, income-focused traders who search upside at cheap danger, there are 5 shares this week that may match properly on the watchlist of any diversified portfolio.

Starbucks Company (SBUX)

SBUX is a world chief in specialty espresso, with operations in 84 markets. Since their founding, they’ve grown to be one of the vital well known and revered manufacturers on the earth. In fiscal 12 months 2021, they reported complete revenues of almost +$30B, which was 24% greater than 2020 and 10% better than 2019. Whereas income development was solely 10% greater than 2019, web revenue was almost 20% greater due partially to the corporate’s price mitigation efforts.

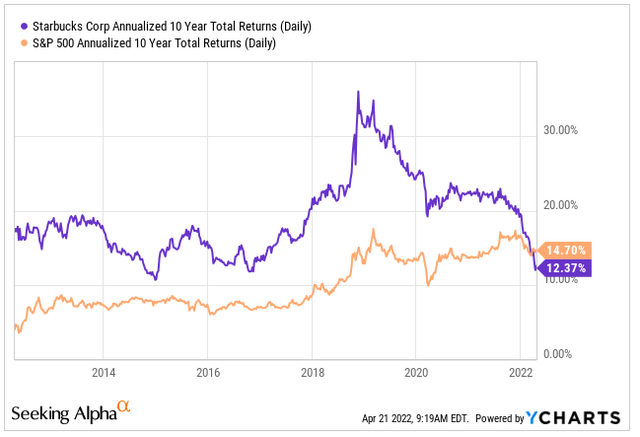

Over a ten-year timespan, SBUX has considerably outperformed the broader S&P yearly previous to 2022.

Annualized 10-12 months Returns of SBUX In comparison with S&P 500

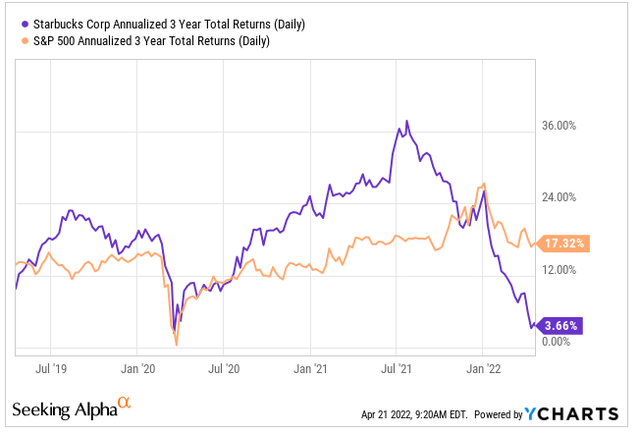

SBUX’s annualized returns over the previous three years, nonetheless, is simply 3.7% versus returns of 17.3% for the S&P. The underperformance is almost all attributable to occasions which have occurred since January 2022. On this timeframe, there have been management adjustments, such because the departure of Kevin Johnson and the return of Howard Schultz. As well as, the corporate halted their repurchase program in order that they may allocate money to extra employee-centric functions in response to union mobilization efforts at a number of of their shops.

In response to those important adjustments inside the firm, the markets have repriced accordingly.

Annualized 3-12 months Returns of SBUX In comparison with S&P 500

Shares in SBUX are presently buying and selling close to their lows with a ahead pricing a number of of 24x, which is at a reduction to their five-year common of 28.4x. Whereas the valuation nonetheless seems excessive, different elements should be thought of as properly for his or her true worth prospects. Given their lengthy historical past and their dominant market place, the corporate is price additional examination.

Perrigo Firm (PRGO)

PRGO is a number one supplier of over-the-counter (OTC) well being and wellness options. The corporate is headquartered in Eire, and so they promote their merchandise primarily in North America and Europe. Inside North America, their product line contains quite a few private-label manufacturers that deal with all kinds of illnesses and supply self-care in numerous areas similar to digestive well being and oral care. A few of their European-branded merchandise embrace Davitamon, Panodil, and Coldrex, amongst others.

On the finish of December 31, 2021, the corporate reported +$3.9B in complete present belongings and +$1.6B in complete present liabilities. Of the full present belongings, almost 50% was held in money. As well as, the corporate generates enough money flows from operations to fund their investing and financing actions.

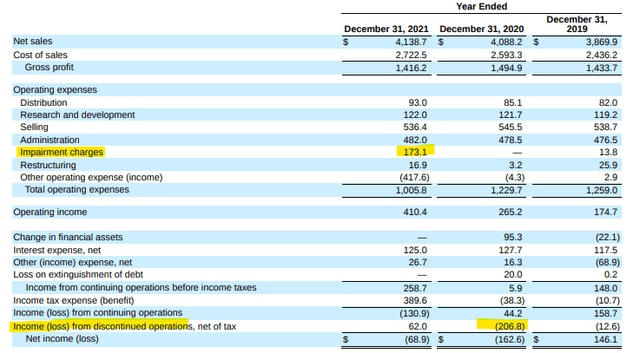

The corporate did, nonetheless, report a loss in each 2020 and 2021. However these losses have been pushed by one-time changes, similar to a big loss on discontinued operations in 2020 and a major impairment cost in 2021.

PRGO Earnings Assertion – Type 10-Ok

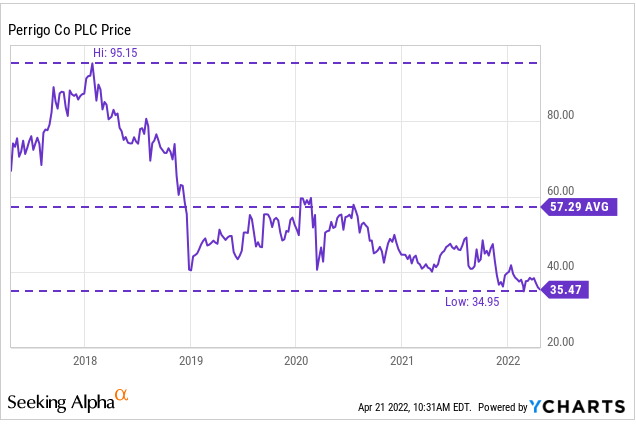

Shares within the inventory are presently buying and selling close to their 52-week lows and under their historic averages. Moreover, their worth/e book ratio is presently 0.93x, which is a reduction to their five-year common of 1.33x

YCharts – PRGO Value Historical past

At a present EV a number of of 9x and at a worth level on the decrease finish of their one 12 months vary, shares in PRGO look enticing. The corporate has a protracted historical past of dividend will increase, and the payout presently yields almost 3%. On the finish of 2021, the payout was yielding 2.5%. A return to these ranges would indicate a worth level of about $42, which signifies upside of about 16%.

Stanley Black & Decker (SWK)

SWK is a diversified world industrial with a number one share in instruments and storage, safety providers, and engineered fastening. Their hand and energy instruments are well known and utilized in industrial purposes all around the world. In 2021, the corporate reported +$15.6B in complete web gross sales, which was up about 20% from 2020.

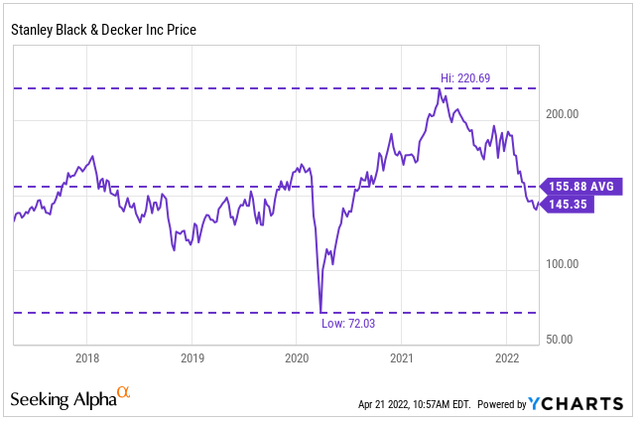

Since its low of $72 in early 2020, shares have rallied greater, supported partially by the surge in particular person housing-related initiatives. Since its peak, nonetheless, the inventory has been on a downtrend. Over the previous one 12 months, shares are down almost 30% versus a 6% acquire for the broader S&P.

YCharts – SWK Value Historical past

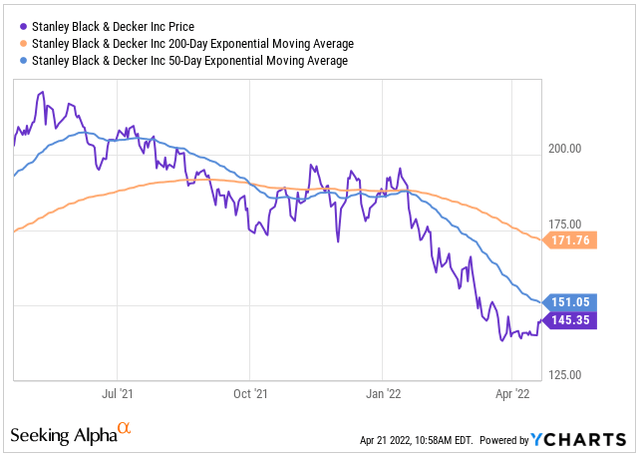

At the moment, the 200-day transferring common is buying and selling above the 50-day, which signifies bearish sentiment. The share worth declines have steepened firstly of the 12 months on the prospects of rising rates of interest and their implications on the housing market. Shares are starting to rebound, nonetheless, and look like closing in on the 50-day common. Whether or not it might probably constantly commerce above this resistance stage will probably be necessary to observe transferring ahead.

YCharts – SWK 200/50 Day Shifting Common

SWK operates a time-tested enterprise in an trade with a positive long-term outlook. Shareholders have been rewarded for a few years with modest returns and a predictable dividend payout that has been elevated for over 50 years. At its lows, shares within the inventory are definitely worth the effort of additional consideration.

Hanesbrands Inc. (HBI)

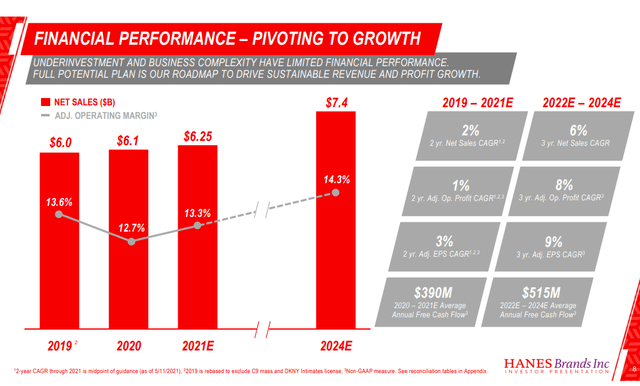

HBI is an iconic firm that provides on a regular basis fundamental innerwear and activewear attire. Notable manufacturers inside their umbrella embrace Hanes, Champion, Bali, and Playtex, amongst others. In 2021, the corporate reported +$6.8B in complete web gross sales, which was almost 10% above their estimates for the 12 months. Shifting ahead, the corporate expects a 6% CAGR in gross sales from 2022-2024, which is respectable for a mature firm, similar to Hanes.

HBI 2021 Investor Day Presentation

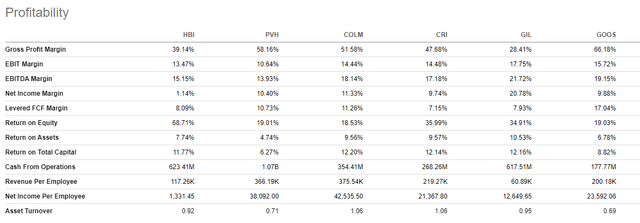

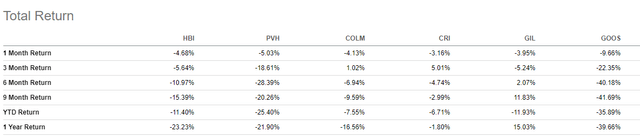

HBI’s profitability metrics in comparison with comparable names inside the trade is blended, however they’re notably outperforming on return on fairness, which is one indicator of the sustainability of the corporate’s profitability and dividend development charges. Moreover, the corporate is producing over +$500M in money from operations, which is larger than most of their friends inside the trade.

In search of Alpha Peer Comparability Software – Profitability

Regardless of profitability that’s typically on par with the trade, shares in HBI are down over 20% previously 12 months, which is worse than all friends, besides Canada Goose (GOOS).

In search of Alpha Peer Comparability Software – Complete Returns

Shares presently are buying and selling close to their lows and at a reduction to historic valuations. Their present ahead pricing a number of, for instance, is 8x versus a five-year common of 10.2x. As a vote of confidence within the inventory, CEO Steve Bratspies not too long ago bought $500K of inventory at costs between $14.61 and $14.86. Shares have since dropped decrease. For traders fascinated with including a trusted attire title to their portfolios, HBI is one potential candidate.

Comcast Company (CMCSA)

CMCSA is a world media and expertise firm with three major companies: Comcast Cable; NBCUniversal; and Sky.

In 2021, the corporate reported +$116.4B in income, which was up 12% from 2020 and 6.8% from 2019. Moreover, money flows from operations have been virtually +$30B and money readily available was +$8.7B.

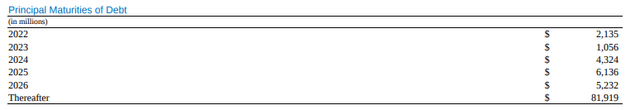

Whereas their web debt of +$98.55B seems excessive, it’s simply 2.8x TTM EBITDA, which signifies a average stage of leverage. Moreover, the huge sum of debt is due past 2026, and the quantities due previous to then seem manageable, given the corporate’s sizeable stability of money.

CMCSA’s Abstract of Debt Maturities – Type 10-Ok

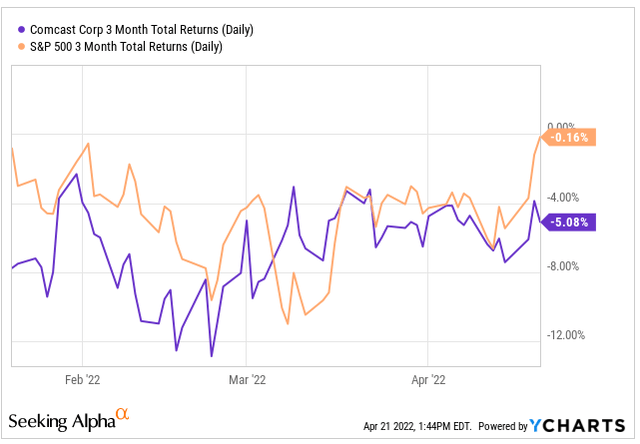

Over the previous three months, CMCSA has lagged the broader S&P, which is little modified versus a 5% decline in CMCSA.

YCharts – 3-Mth Complete Returns of CMCSA In comparison with S&P 500

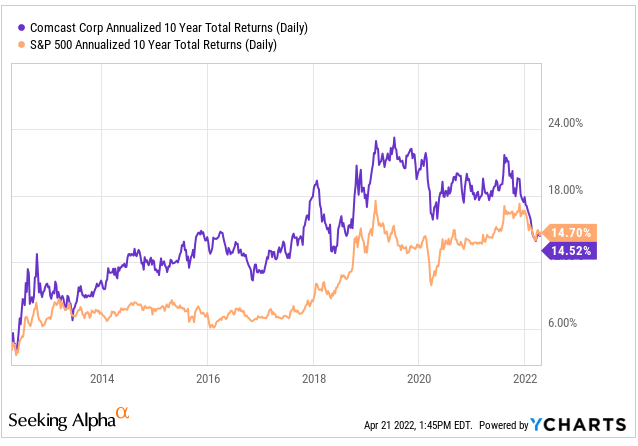

The decline within the shares is regardless of a protracted historical past of outperformance, aside from the present interval weak spot.

YCharts – 10-12 months Annualized Returns of CMCSA In comparison with S&P 500

At present valuations, CMCSA is buying and selling at 1.90x gross sales in comparison with their five-year common of two.05x. The common analyst worth goal has been lowered, however the weighting of the shares nonetheless seems to be obese at lots of the corporations. At current, the annual dividend is presently yielding 2.28%. Consensus estimates for the annual payout in 2024 is $1.27, which might be a yield of two.68%. At present yields, the inputted worth can be about $56, representing cheap upside to present pricing.

Conclusion

Established firms with stable fundamentals have traditionally carried out properly over the long run. Any declines within the worth of those firms are, subsequently, price additional examination. PRGO is one firm that warrants further consideration, given their important underperformance.

Whereas additional evaluation should be carried out to acquire a extra full image of the 5 firms talked about above, a gorgeous alternative exists for the businesses to be added to the watchlist of any long-term diversified portfolio.