Due to floating charges, dividend yields on these most well-liked shares are set to climb. RichVintage/E+ through Getty Photos

Prepare for charts, pictures, and tables as a result of they’re higher than phrases. The scores and outlooks we spotlight right here come after Scott Kennedy’s weekly updates within the REIT Discussion board. Your continued suggestions is vastly appreciated, so please depart a remark with ideas.

To date in 2022 we have seen abnormally excessive volatility within the mortgage REIT most well-liked shares. That has been a blessing to discovering alternatives to open new positions.

There are fairly a number of choices within the sector immediately, however I need to spotlight a number of specifically. The one which stands out essentially the most to me proper now could be NLY-F (NLY.PF). The shares with a danger score of 1 have smaller goal ranges, to allow them to transfer into the strong-buy class on a smaller motion. That is smart should you agree that these shares needs to be much less risky.

NLY-F

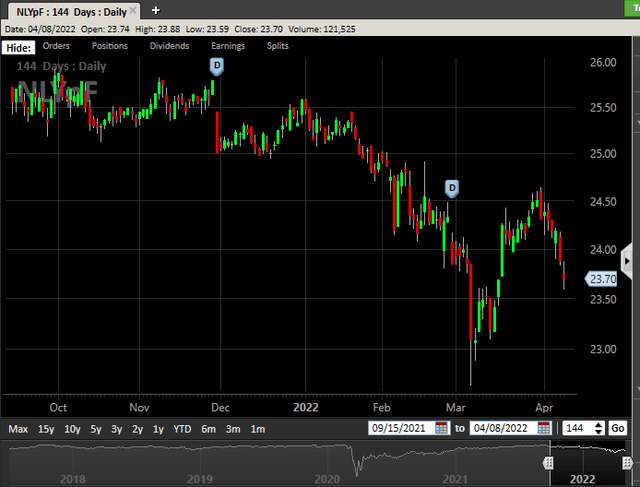

Shares of NLY-F are down $.18 on the day, which is about .76%. It is not an enormous motion, however it’s materials for shares that normally commerce in such a decent vary. This brings them a lot nearer to the degrees they noticed in early March:

StreetSmart Edge

For slightly over every week in March, shares have been averaging slightly below $23.50. At $23.70, they are not a lot greater. Additionally they have $.19 in dividend accrual now, as in comparison with just a few cents again then. That is a fairly good deal.

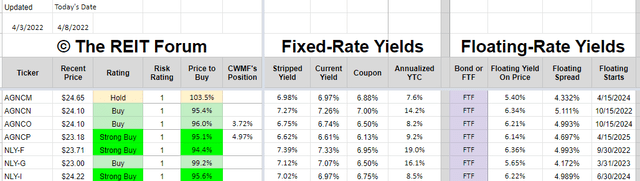

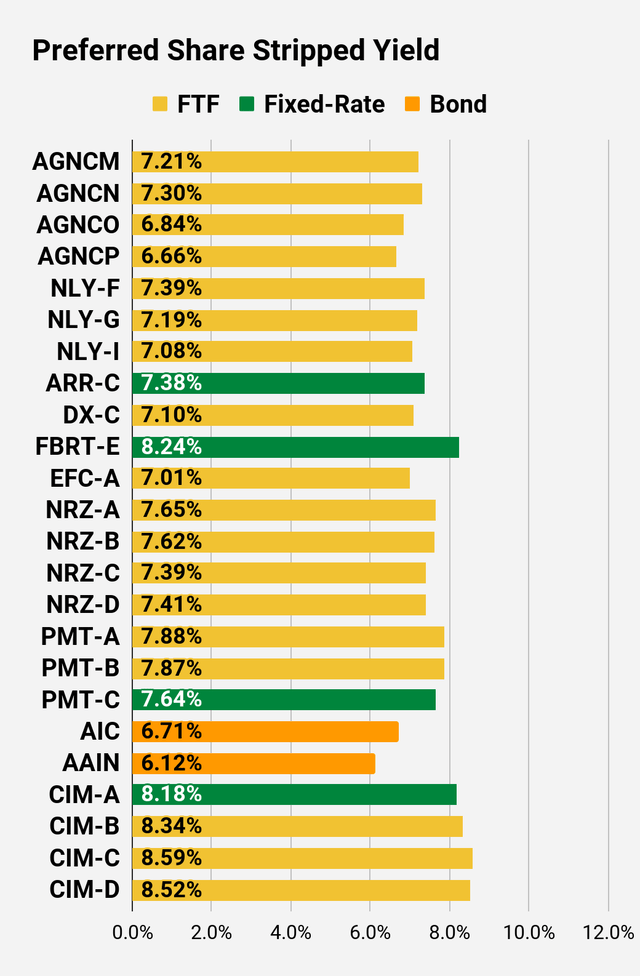

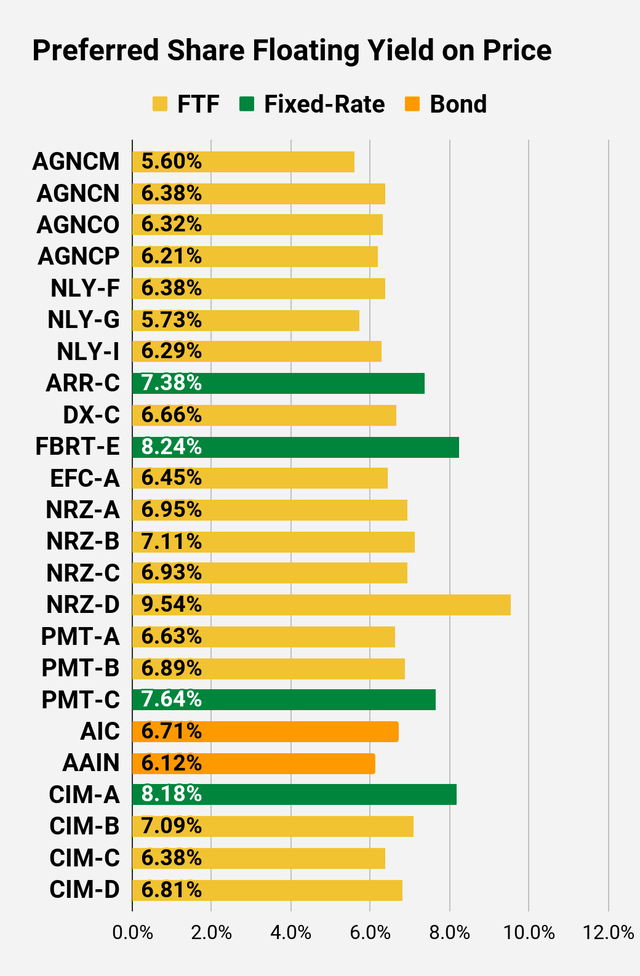

Brief-Time period Charges

NLY-F is the primary share to change over to floating charges and can carry a variety of 4.993%. If shares have been floating immediately, we’d count on the stripped yield to be about 6.36% (in comparison with 7.39% with the fixed-rate). Nevertheless, if short-term charges enhance by one other 100 foundation factors, the stripped yield could be greater than 7.39%. Bear in mind that you’d be shopping for the shares for lower than $25.00. Counting dividend accrual, the $23.71 comes out to a stripped worth of about $23.52.

If short-term charges go up 100 foundation factors, the annualized dividend fee would enhance by $.25. On a stripped worth of $23.52, the $.25 would add 106 foundation factors to the yield. That might deliver 6.36% as much as 7.42%.

Ought to we actually count on short-term charges to extend by 100 foundation factors or extra that rapidly? I’ll name it a “perhaps”. I might rank it as a medium chance, round 50-50. Nevertheless, if we glance one other 3 to six months into the long run, the percentages of short-term charges being up 100 foundation factors turns into higher than 50%. Due to this fact, there is a fairly good shot that the Q1 2023 dividend for NLY-F could be greater than the present dividend.

Name Threat

Annaly Capital Administration (NLY) may merely name the popular shares when name safety ends. That is the identical day they change over to a floating fee. The decision could be at $25.00 plus any dividend accrual. Present worth is $23.71 with $.19 in dividend accrual (so $23.52 stripped). Does getting a number of dividends and being referred to as sound horrible? No, it does not. At the least to not me. Then again, I feel there is a fairly good probability NLY doesn’t name the popular share. At the least given the spreads between MBS and Treasuries proper now, calling would not make sense. These spreads may tighten, stay the identical, or widen through the subsequent a number of months.

Except spreads tighten considerably, I feel NLY would in all probability simply depart NLY-F excellent. Is {that a} horrible deal for traders? I do not assume so, for the reason that investor would in all probability be incomes a yield round 7.4% on immediately’s stripped worth.

Yield to Name Flaws

One other potential issue that may push the value of NLY-F greater is traders incorrectly evaluating the yield to name. In my expertise, shares that are already callable usually tend to be overvalued throughout a dip. Think about that nothing modified about NLY-F besides the present name safety disappeared. What would occur to the yield to name. It will enhance. Similar worth. Similar dividend. Larger yield to name.

Nevertheless, the investor wouldn’t even have a greater place. The one factor that may have modified about their money flows is that NLY would have the proper to push them out of their place. But traders (or early-stage laptop algorithms) are likely to overvalue these shares as a result of they see the excessive yield to name. In that context, as NLY-F will get nearer to the decision date, both the value will increase or the yield to name retains getting greater and making the shares look extra interesting.

Different NLY Most well-liked Share Alternatives

NLY-I (NLY.PI) additionally hit the strong-buy vary, however I consider NLY-F is the higher deal. Traders get a much bigger low cost to name worth by about $.51. NLY-F has the next stripped yield immediately utilizing the mounted fee, however that does not actually matter for the reason that fixed-rate ends quickly anyway. The larger challenge is that NLY-F has an excellent shot for the floating fee dividends to rapidly surpass the present fixed-rate dividend.

NLY-I will get an additional 21 months of name safety, however I do not assume that is value paying an additional $.51 and when NLY-F when short-term charges have risen so considerably.

NLY-G (NLY.PG) is again within the “purchase below” vary (by lower than 1%), however I feel it is a a lot weaker deal than NLY-F. In the event that they each switched to floating charges immediately, NLY-F could be at a 6.36% yield and NYL-G could be at 5.65% yield. The investor in NLY-G will get an additional $.71 low cost to the decision worth, however I feel the percentages of NLY-G getting referred to as are low. Not not possible, however I might actually contemplate it a stunning occasion.

AGNC Most well-liked Share Alternatives

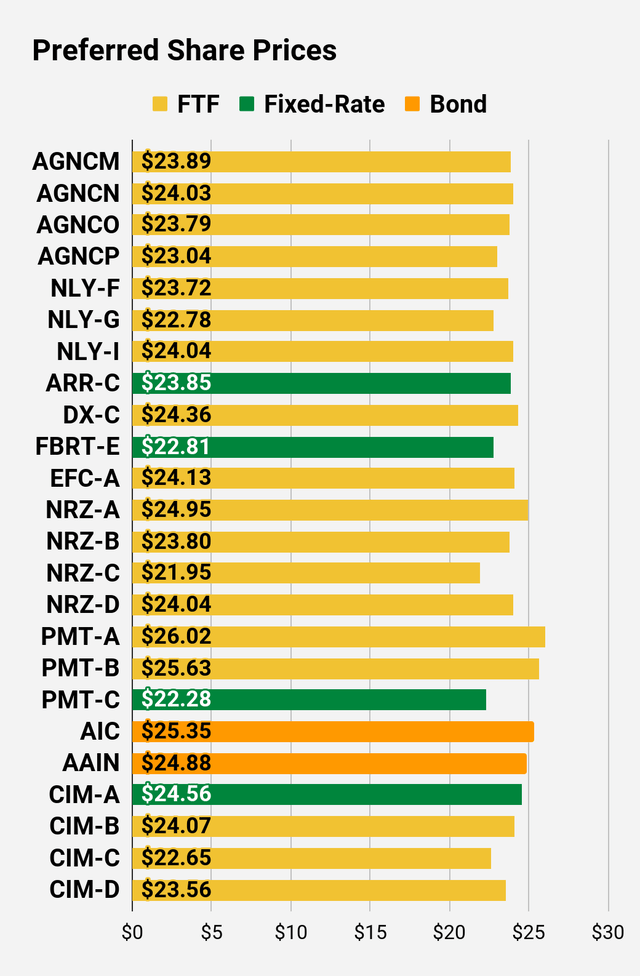

Trying on the AGNC (AGNC) most well-liked shares, I give AGNCP (AGNCP) the sting by a hair at $23.18. With AGNCN (AGNCN) and AGNCO (AGNCO) each at $24.10, it is a very shut race.

The worst deal among the many risk-rating 1 most well-liked shares is AGNCM (AGNCM) at $24.65. That is one other huge name for traders in AGNCM to swap to any of the next:

- AGNCN

- AGNCO

- AGNCP

- NLY-F

- NLY-I

Any of these 5 is a dramatically higher deal. The hole is absurd. There isn’t any viable solution to justify the distinction in danger/reward.

I’d encourage anybody to have a look at the spreadsheet and attempt to give you a situation the place AGNCM is a greater funding:

The REIT Discussion board

Yield to name? AGNCM is the worst. Floating yield on worth? AGNCM is the worst. Name safety? AGNCM is about center of the pack on the calendar, however has the smallest low cost to name worth. AGNCM can beat AGNCO and AGNCP on stripped yield, however that ends when the floating charges kick in. AGNCM’s preliminary fixed-rate dividend is only a bit greater than it needs to be. Traders who assume they will get 6.98% from AGNCM however would solely get 6.75% from AGNCO have to revise the mathematics. The distinction within the dividend fee is $.09375 per yr.

What may an investor do? Dump AGNCM and purchase AGNCO for a financial savings of about $.55 (costs might transfer after the alert), and pay your self $.09375 from the $.55 financial savings annually till name safety ends. When it ends for AGNCM (2 years), you’d nonetheless have $.36 of financial savings left. In the meantime, AGNCO’s name safety ends in 2.5 years. From that time on, AGNCO pays out an additional $.16525 in dividends yearly (in comparison with AGNCM).

What if the investor will get referred to as? Effectively, they purchased shares with a pleasant low cost to name worth so they simply should dwell with a capital achieve.

Traders completely needs to be dumping AGNCM for any of these 5. What if the investor has to eat a capital features tax? Not tax recommendation, however I might say it will nonetheless be well worth the commerce except the investor would face the tax now however has a plan to keep away from the capital features tax later (donating to charity or dying abruptly). That is proper, the situation the place holding AGNCM is best than swapping utilizing present costs from publication depends on loss of life.

Notice: Typically traders assume they might be paying 23% on all the gross sales worth. That is not how something works. We keep away from giving tax recommendation, however nobody has a price foundation of $0.00 in these shares.

Fast Replace

The evaluation above is a part of a subscriber replace posted on Friday.

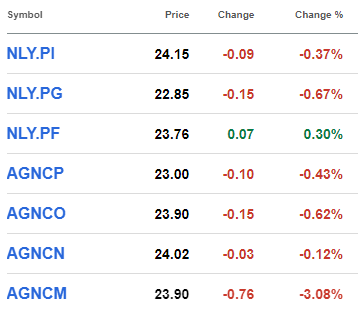

A part of the value disparity corrected on Monday, as NLY-F was the one most well-liked share from NLY or AGNC with a achieve on the day. In the meantime, AGNCM fell by 3%.

In search of Alpha

In comparison with the opposite most well-liked shares, AGNCM continues to be much less enticing on a basic foundation even after falling by 3% in at some point. I did not count on to see costs regulate a lot in at some point, however the fundamentals completely didn’t help AGNCM’s worth in comparison with friends. I attempt to offer evaluation earlier than costs transfer and succeeded with the subscriber publish. There may be naturally a delay on the general public launch and costs will usually transfer not less than barely throughout that interval.

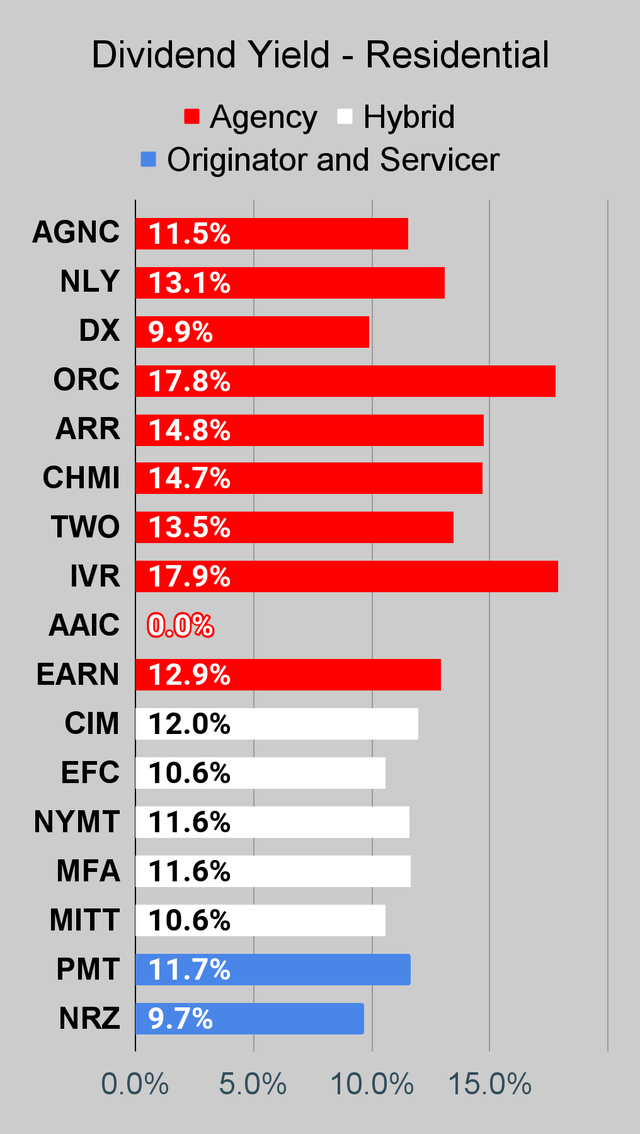

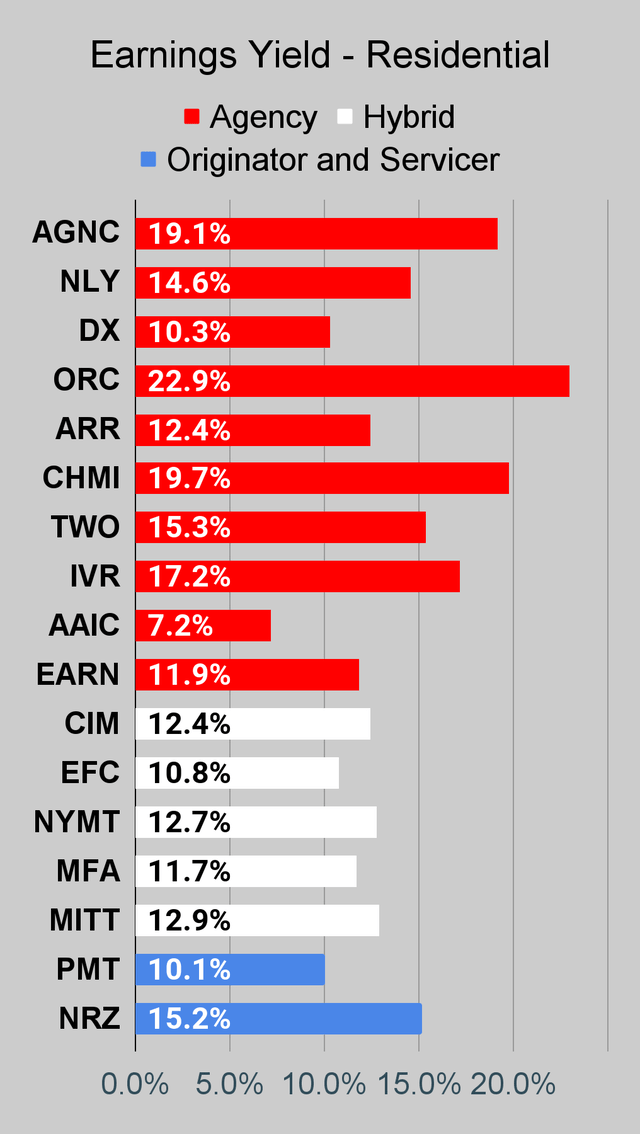

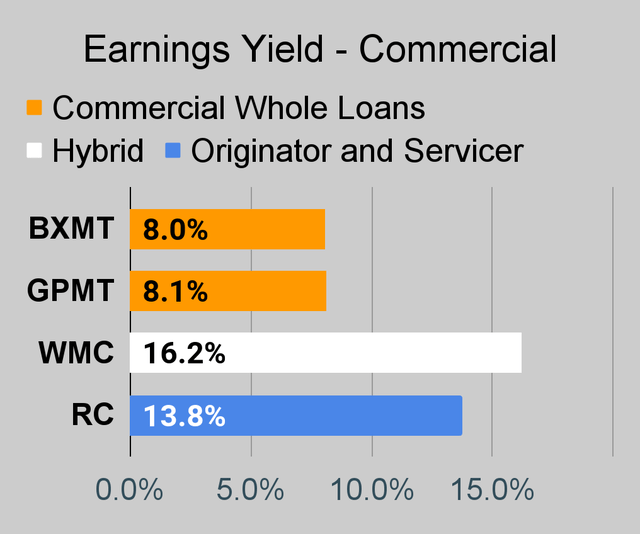

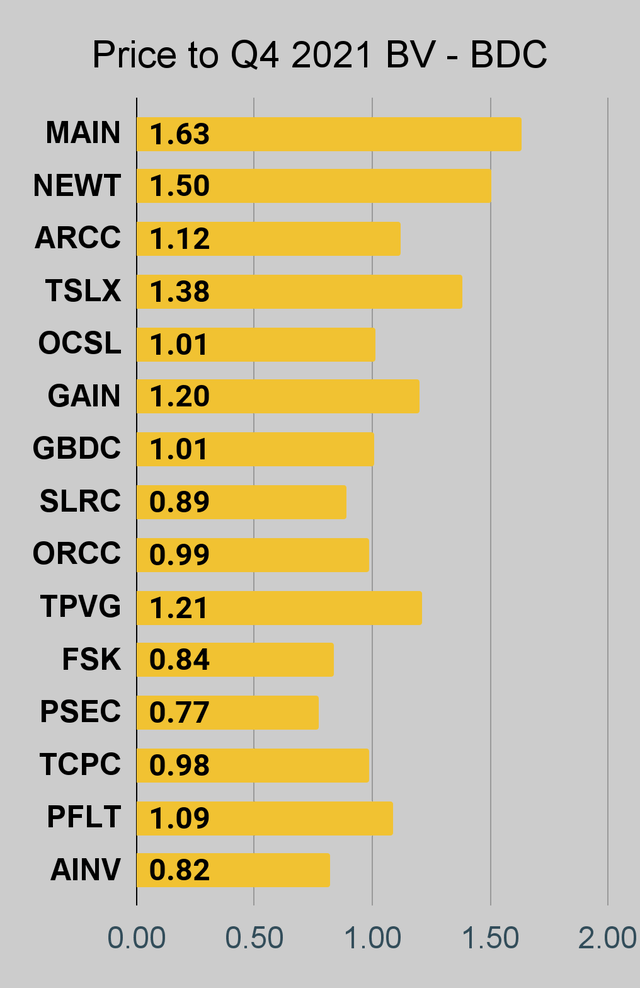

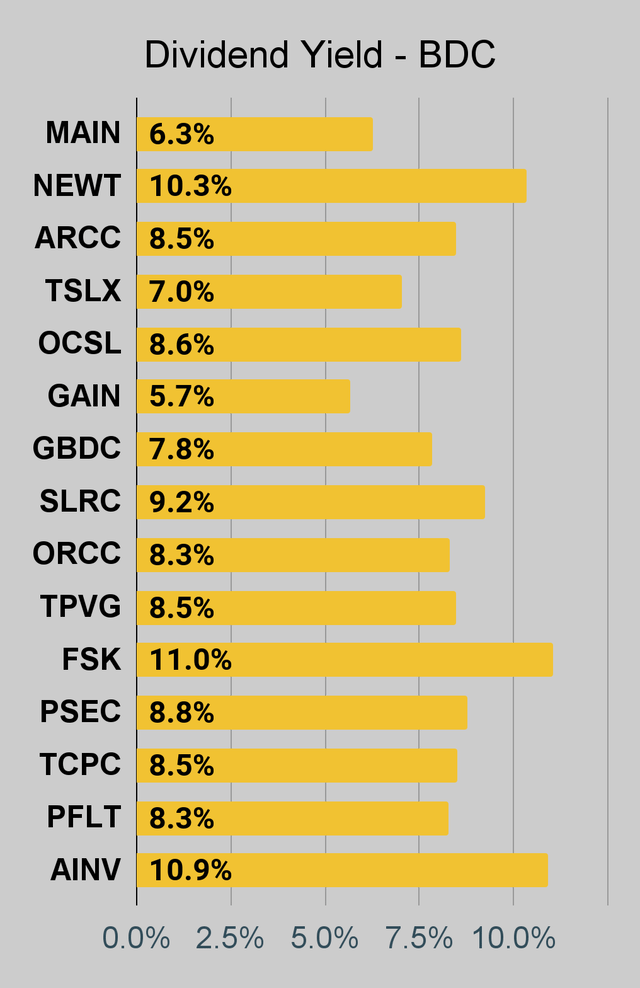

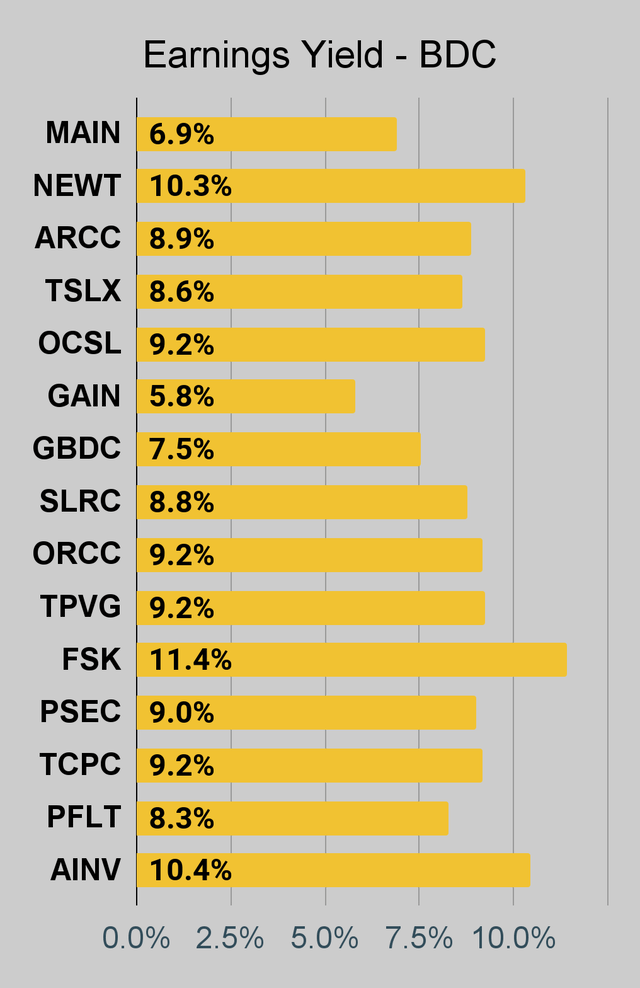

The opposite level I might like to say is that the incomes yields knowledge (within the tables under) makes use of consensus analyst estimates. In some circumstances, the “earnings yield” is absurdly excessive and I’d warning traders to not deal with it as an awesome indicator of long-term earnings energy. I current it as a result of traders need to see it, however it is not one of many metrics I exploit when deciding which shares to purchase or promote.

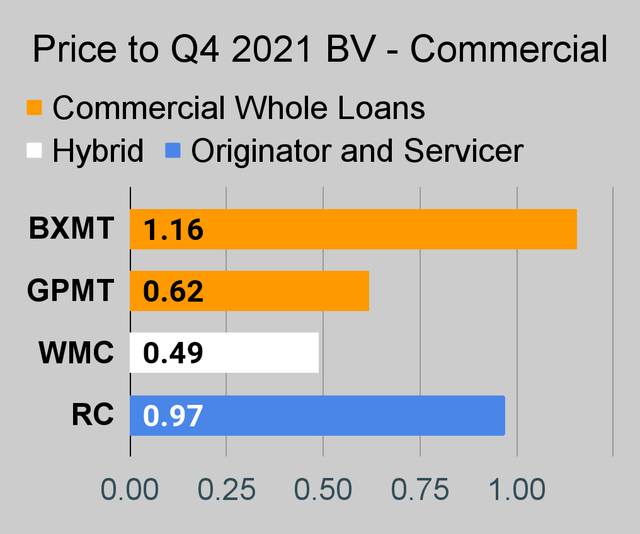

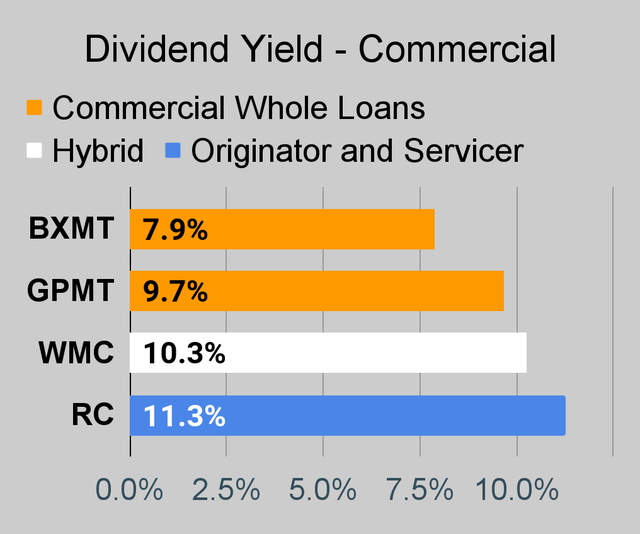

The remainder of the charts on this article could also be self-explanatory to some traders. Nevertheless, if you would like to know extra about them, you are inspired to see our notes for the collection.

Inventory Desk

We are going to shut out the remainder of the article with the tables and charts we offer for readers to assist them monitor the sector for each frequent shares and most well-liked shares.

We’re together with a fast desk for the frequent shares that shall be proven in our tables:

Let the photographs start!

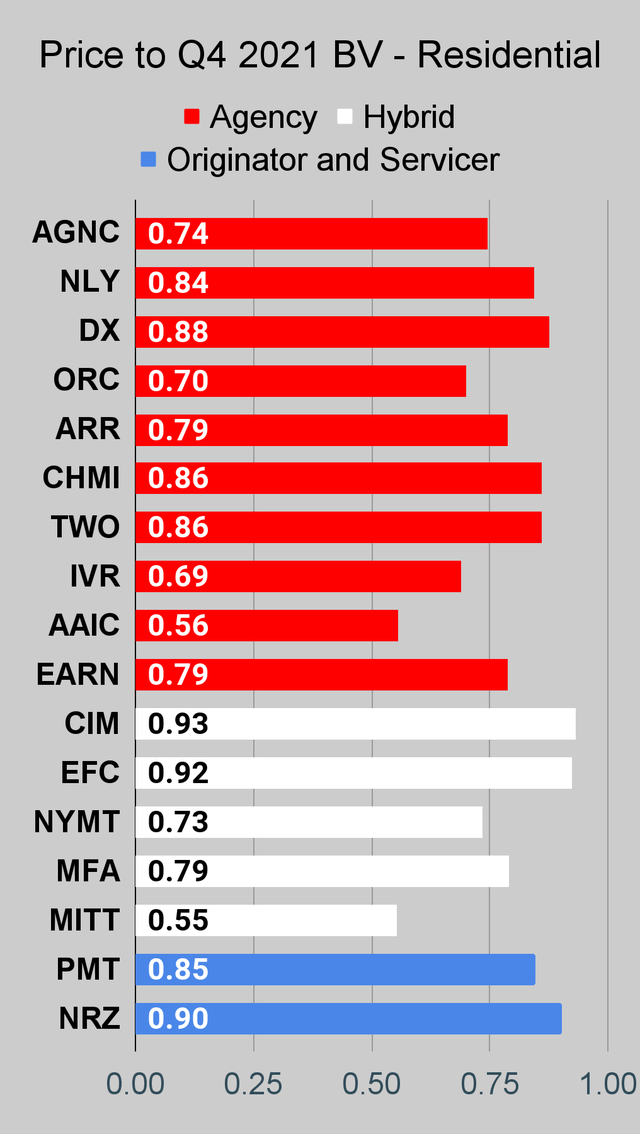

Residential Mortgage REIT Charts

Notice: We’re modeling some important modifications to BV since 12/31/2021 and a few administration groups have already publicly indicated a fabric change in BV per share. The chart for our public articles makes use of the e book worth per share from the most recent earnings launch. Present estimated e book worth per share is utilized in reaching our targets and buying and selling selections. It’s accessible in our service, however these estimates will not be included within the charts under.

The REIT Discussion board |  The REIT Discussion board |  The REIT Discussion board |

Industrial Mortgage REIT Charts

The REIT Discussion board |  The REIT Discussion board |  The REIT Discussion board |

BDC Charts

The REIT Discussion board |  The REIT Discussion board |  The REIT Discussion board |

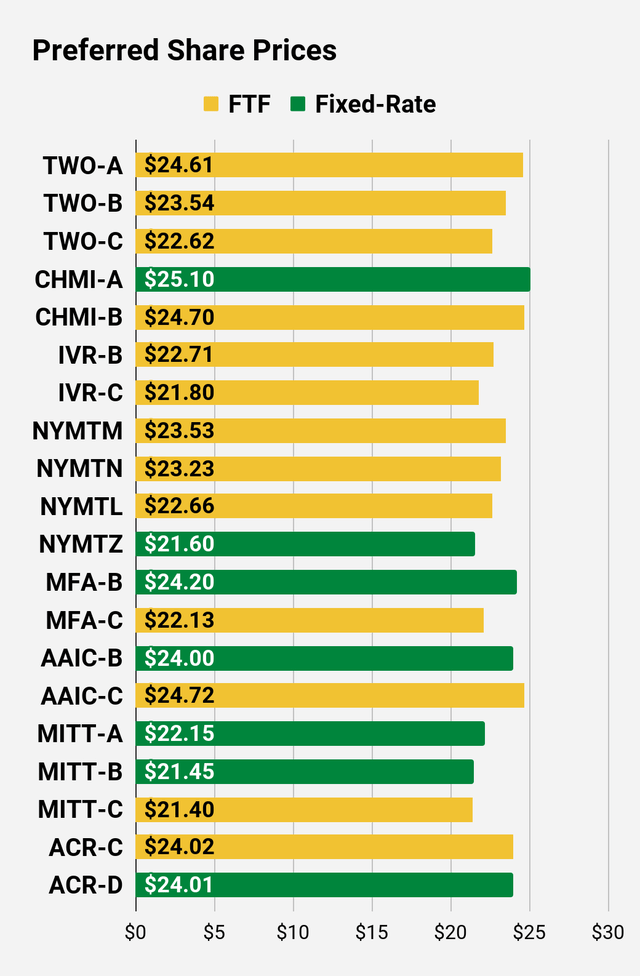

Most well-liked Share Charts

The REIT Discussion board |  The REIT Discussion board |  The REIT Discussion board |

The REIT Discussion board |  The REIT Discussion board |  The REIT Discussion board |

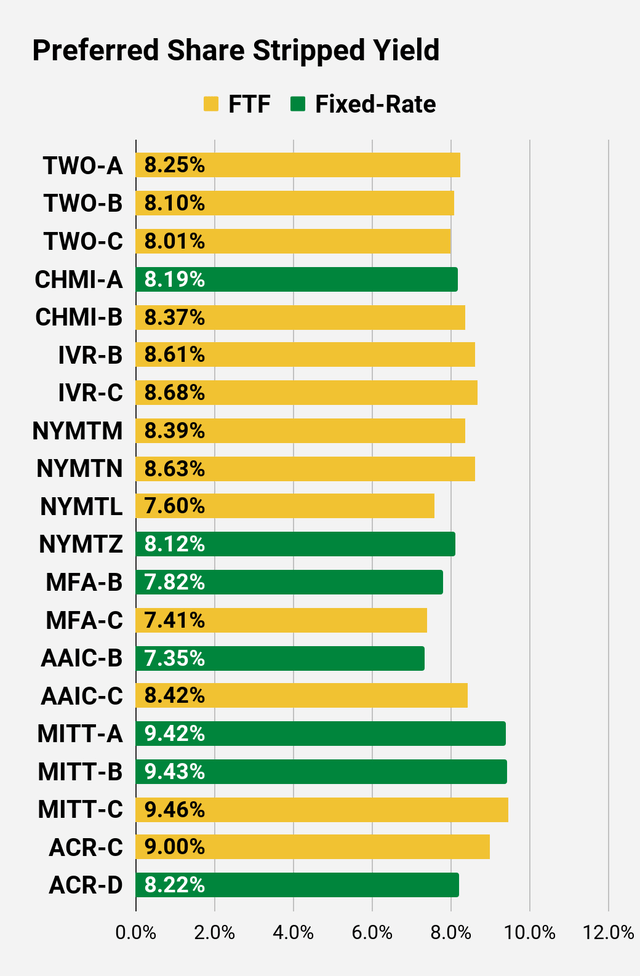

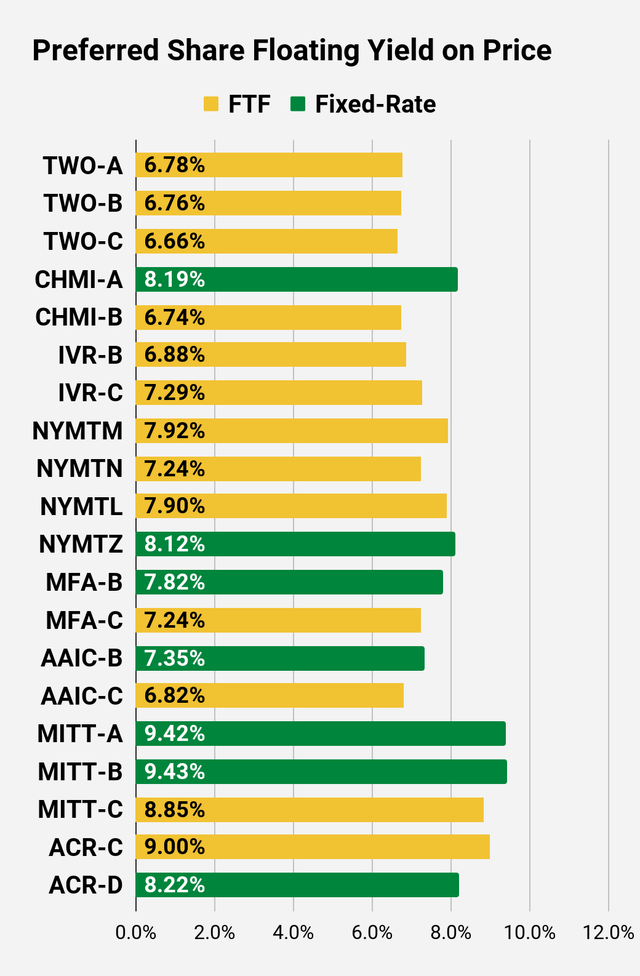

Most well-liked Share Information

Past the charts, we’re additionally offering our readers with entry to a number of different metrics for the popular shares.

After testing out a collection on most well-liked shares, we determined to strive merging it into the collection on frequent shares. In spite of everything, we’re nonetheless speaking about positions in mortgage REITs. We have no want to cowl most well-liked shares with out cumulative dividends, so any most well-liked shares you see in our column may have cumulative dividends. You may confirm that by utilizing Quantum On-line. We have included the hyperlinks within the desk under.

To raised manage the desk, we wanted to abbreviate column names as follows:

- Value = Latest Share Value – Proven in Charts

- BoF = Bond or FTF (Mounted-to-Floating)

- S-Yield = Stripped Yield – Proven in Charts

- Coupon = Preliminary Mounted-Charge Coupon

- FYoP = Floating Yield on Value – Proven in Charts

- NCD = Subsequent Name Date (the soonest shares might be referred to as)

- Notice: For all FTF points, the floating fee would begin on NCD.

- WCC = Worst Money to Name (lowest web money return attainable from a name)

- QO Hyperlink = Hyperlink to Quantum On-line Web page

Second Batch:

Technique

Our aim is to maximize whole returns. We obtain these most successfully by together with “buying and selling” methods. We recurrently commerce positions within the mortgage REIT frequent shares and BDCs as a result of:

- Costs are inefficient.

- Lengthy-term, share costs usually revolve round e book worth.

- Brief-term, price-to-book ratios can deviate materially.

- Guide worth is not the one step in evaluation, however it’s the cornerstone.

We additionally allocate to most well-liked shares and fairness REITs. We encourage buy-and-hold traders to think about using extra most well-liked shares and fairness REITs.

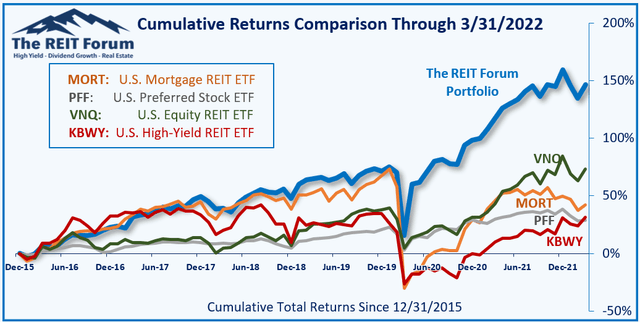

Efficiency

We evaluate our efficiency in opposition to 4 ETFs that traders may use for publicity to our sectors:

The REIT Discussion board

The 4 ETFs we use for comparability are:

Ticker | Publicity |

MORT | One of many largest mortgage REIT ETFs |

PFF | One of many largest most well-liked share ETFs |

VNQ | Largest fairness REIT ETF |

KBWY | The high-yield fairness REIT ETF. Sure, it has been dreadful. |

When traders assume it is not attainable to earn strong returns in most well-liked shares or mortgage REITs, we politely disagree. The sector has loads of alternatives, however traders nonetheless should be cautious of the dangers. We will not merely attain for yield and hope for the most effective. On the subject of frequent shares, we should be much more vigilant to guard our principal by recurrently watching costs and updating estimates for e book worth and worth targets.

Rankings: Bullish on most well-liked share NLY-F / NLY.PF.