“How did you go bankrupt?” Bill asked.

“Two ways,” Mike said. “Gradually, then suddenly.”

This is a fan-favorite line from The Sun Also Rises by Ernest Hemingway. It’s my favorite too.

Because gradually, then suddenly doesn’t just apply to losing money. Though in our current economy, unfortunately, it can be an apt description:

- The slow creep of rising retail and grocery prices.

- The Fed’s series of aggressive interest rate hikes.

- A record-high inflation rate, threatening a recession.

Like Mike Campbell, you might be feeling that same way. You’re thinking: How did we get here?

And perhaps more importantly: How can I be smart with my money?

Well, here’s something my dedicated readers know about me.

Through several years of honing my trade and studying the stock market, I’ve developed a four-step strategy for investing success. I’m going to share this with you, but first, let me explain something about the market.

I’ve learned that the ultimate key to investing is to identify game-changing trends. These trends always start out small, but as they gain momentum, they become the “next big thing.”

They innovate. They aim to improve our lives. And then they revolutionize existing industries, making everything that came before obsolete.

The “next big thing” is what produces major profits for the companies that make it, and their shareholders: gradually, then suddenly.

These 3 Companies Were the “Next Big Thing”… And Look What Happened Next

Let’s look at three big examples of game-changing trends — and what happened to the companies that capitalized on them.

- Smartphones.

In the early 2000s, smartphones were initially clunky and slow. My first Palm Pilot didn’t even fit in my pocket. And the chip was only as fast as a standard scientific calculator.

But that all changed when the iPhone rolled up on the scene (circa 2007). Its screen was sleek and doubled as a keyboard, leaving extra room to surf the internet, browse photos and watch YouTube videos.

Palm Pilots and Blackberrys soon became ancient relics — a footnote in the transition between landlines and touchscreens.

And within 10 years, smartphones had virtually replaced the flip phone on a global scale.

Apple has since become one of the biggest tech companies in the world.

Just to put this in perspective: In 2007, there were 122 million iPhones sold. Last year, there were over 1.5 billion.

That’s over 12X growth in 14 years!

But imagine if you had invested in Apple before the iPhone mounted its takeover. That’s over 3,200% gains!

- E-commerce.

Another great example is e-commerce.

A lot of investors were cynical. Shopping online? Too far-fetched.

But I was an early adopter back then. In fact, I made my first purchase on Amazon all the way back in 2000. (I sent my grandparents a VHS tape of Life Is Beautiful for Christmas!)

Amazon was perfectly positioned to ride that wave of early adoption. It went public right at the start of the dot-com bubble.

It rose almost 8,200% from its IPO to the peak … before falling 95% as the bubble burst.

But Amazon survived, and then thrived. Now you can buy almost anything you can think of on its revolutionary site and app — usually in two days or less.

There are thousands of other e-commerce platforms that wouldn’t exist without Amazon introducing that “next big thing.” And if you had invested in Amazon after the dot-com bubble burst, and held on … that would’ve been nearly 26,000% gains!

- Streaming.

Our last example is online streaming. Back in the day, you’d walk into Blockbuster, peruse the aisles for 30 minutes, maybe pick a snack and get ready for an awesome weekend.

But as internet streaming came into its own, one company really took the bull by the horns.

We all know this story. Netflix started as a mail-based video rental company in 1997. It struggled in the beginning, but its innovative subscription-based service soon gained momentum.

Blockbuster, its main competitor, actually had the chance to buy it out in 2000 for $50 million. But John Antioco (Blockbuster’s CEO at the time) didn’t take the prospect seriously.

And now, Netflix is worth about $125 billion. Meanwhile, Blockbuster was levelled, filing for bankruptcy in 2010.

Had you bought at its IPO in 2002 at $15 and held on until today, you’d be looking at a gain of 1,980%!

That said, technology is an enormous industry to wade through — it’s now a part of every sector. And these are only three examples!

But I discover winning investments by finding the technologies growing at a pace faster than anyone thinks.

For example, this past year I’ve been writing about:

- Artificial intelligence.

- Electric vehicles (EVs).

- Robotics.

- Industrial manufacturing technology.

- 5G technology.

All of these technologies have one thing in common — they help us do more with less. As the economy is expected to slow, these trends will accelerate as businesses, governments and consumers all look for ways to optimize productivity.

And while tech is my specialty, I’ll scope out every sector for the “next big thing.”

Because all of the above technologies have the potential to skyrocket, just like Apple’s iPhone, Amazon’s e-commerce or Netflix’s streaming service. They make household names out of little-known stocks, and can hand you massive profits along the way.

So now, I’m going to break down my four-step strategy for stock trading — the simple approach that fuels my investing success.

My 4-Step Investing Strategy

First of all, there’s nothing “secret” about what I do. I just use the same, publicly available information that anyone else can find, and use that to inform my investing decisions.

However, what I do have that many people don’t is my experience (on and off Wall Street), and an amazing team of analysts that help me scour the market for companies that are poised for growth.

The details of my four-step investing strategy are usually reserved for my Strategic Fortunes readers. But I want to give you a special sneak peek today.

When I research a potential company for my Strategic Fortunes family, I look for four things:

Of course, the first step in my strategy is finding disruptive, moneymaking trends. The ones that promise to revolutionize our lives and make investors a killing at the same time (i.e. smartphones and e-commerce).

But the company leading this trend also needs an “X-factor.” It offers its customers something no one else in its industry is doing. That gives a company’s stock its edge.

Then, the company needs to demonstrate (through its financials and historical data) that it has growth momentum in its revenue earnings. This is where the most in-depth technical analysis comes in. My team and I do extensive research into the company and its competitors.

And if the company has been beating Wall Street’s projections, I know that it’s most likely undervalued. Its profits could very well take off in the near future.

The 4-Step Strategy Applied

I want to show you this strategy in action, though! So let’s use Tesla (Nasdaq: TSLA) as an example.

However you feel about Elon Musk right now (Twitter wars aside), when you hear about EVs, you probably think of Tesla.

The company revolutionized the car industry when the Model S launched in 2012.

(From Tesla.)

EVs were already around … but they weren’t all that popular — especially since they couldn’t go very far on battery power.

But Model S had the edge. It was sleek and powerful (0-60 mph in 1.99 seconds). It also had a longer battery life than other EVs (315 miles on a single charge).

It boasted features that hadn’t been seen before, like customizable horns, sophisticated internal software and autonomous driving capabilities.

This jump-started the rise of EVs. And now, even traditional car companies like General Motors want in on the EV market.

So right there, you have the trend: electric vehicles.

You have the X-factor: a car with features that hadn’t been done before.

I predicted its momentum rising and that it would beat the Street’s estimates in a few years.

So I told my Strategic Fortunes readers to buy shares in August of 2019. I watched my strategy (and the stock) closely for the perfect time to exit.

And I found it. We sold the first half of our position on July 15, 2020, for a whopping 552% gain!

But that wasn’t the last gain Tesla delivered. On September 1, 2020, I alerted readers once again it was time to sell. And on the last half of our position, we locked in 919%!

Overall, that’s a 735% return on TSLA. And it’s now almost 20% lower than where I recommended selling it.

Tesla is just one example. It’s far from the only life-changing profit I’ve locked in for my subscribers.

Since I joined Banyan Hill in 2018, my readers have had the chance to collect gains of:

- 147% on Qualcomm.

- 302% on Generac.

- And 780% on a half position in SunPower.

I’ll use this strategy to share my market insights and recommendations with you here in Banyan Edge, once a week.

But if you’d like full access to my strategy and portfolio, I suggest you check out my Strategic Fortunes service right here.

Big Things Ahead for Banyan Edge

What I’ve shared with you today is just the beginning.

As Charles Sizemore pointed out yesterday, this new format lets me bring you my top moneymaking ideas every Tuesday. Plus, my thoughts on what’s going on in the market, and even possible predictions on where it will turn.

You can expect that in the form of:

- An article just like this one.

- Videos with my right-hand analyst, Amber Lancaster.

- My colleagues and me on the Banyan Edge podcast (debuting on December 12).

Navigating the current market isn’t easy. But I’m here to help you make smart choices, and find the best potential investments to protect and grow your wealth.

Stay tuned.

But before I sign off, I want to hear from you!

I just have one question: What’s the No. 1 thing you want to see from me in this newsletter?

Check out this poll and let me know!

In the meantime, if you’d like to stay in touch, make sure to follow me on Twitter: @InvestWithIan. You can also email me at [email protected].

I’m excited to have you on board for our brand-new publication. Let’s go!

See you next week,

Ian KingEditor, Strategic Fortunes

Ian KingEditor, Strategic Fortunes

Chart of the Day: The Most Inverted Yield Curve in 40 Years

By Charles Sizemore, Chief Editor, The Banyan Edge

Longer-term interest rates are supposed to be higher than shorter-term interest rates. That’s the natural order of the world.

That’s because time has value … as well as opportunity costs.

Think about the last time you bought a Certificate of Deposit (CD) at the bank. If you’re going to tie up your cash in a five-year CD rather than a one-year CD, the bank has to pay you more interest to make it worth your while.

Likewise, you probably noticed the 30-year rate was higher than the 15-year rate the last time you shopped for mortgages.

It makes sense. A lender needs to be compensated for having its money tied up for longer and assuming risks decades into the future.

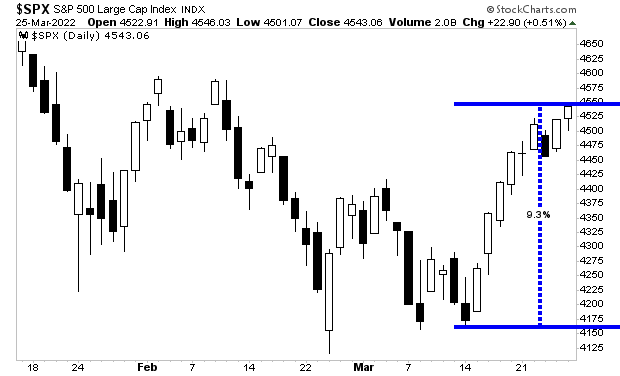

So, when short-term rates are higher than long-term rates – commonly called “yield curve inversion” — you know that something is broken.

That’s the situation we have today. Shorter-term yields are higher than longer-term yields … by the widest margin in over 40 years. And it’s a huge blaring warning sign for financial markets.

(Click here to view larger image.)

The chart compares the current yield on 2-year U.S. Treasury notes to that of 10-year Treasury notes.

As of today, the 2-year rate is higher than the 10-year by more than 0.75%.

And this isn’t cherry-picking. There are different ways to measure yield curve inversion, and the yield curve has inverted on several of them.

The spread between 2- and 10-year yields is the most common, but I’ve also seen studies using the 30-year yield on the long end and anything from three months to a year on the short end.

But they all tell essentially the same story: The bond market is flashing a huge warning sign for the economy and stock market.

The previous six times we saw a yield curve inversion, a recession followed shortly thereafter. You can see it in the gray-shaded areas of the chart. And signs are pointing that direction again today.

The Fed has made it clear that it plans to keep raising rates to tame inflation, even if it risks recession…

But as Ian pointed out today, that doesn’t mean it’s impossible to make money in stocks.

Game-changing, “next big thing” innovations occur in bull markets and bear markets … times of both boom and bust. And Ian King is working tirelessly to bring those opportunities to you right now.

If you haven’t already, do yourself a favor and check out Ian’s Strategic Fortunes service right here. Ian has a long track record of spotting huge trends before they take shape, and Strategic Fortunes is the best way for you to hear about them first. (No spoilers, but the idea Ian talks about here could make the long-term gains in bitcoin look like a drop in the bucket.)