RgStudio/E+ by way of Getty Pictures

My best ardour in life is instructing traders such as you the secrets and techniques to long-term riches and prosperity.

Above all this implies specializing in security and high quality first, and prudent valuation and sound risk-management at all times.

When pressured to decide on, I cannot commerce even an evening’s sleep for the prospect of additional income.” – Warren Buffett

Right this moment the market is awash in ache and anguish for a lot of new traders, who thought that 3 years of 25% annual returns may proceed perpetually.

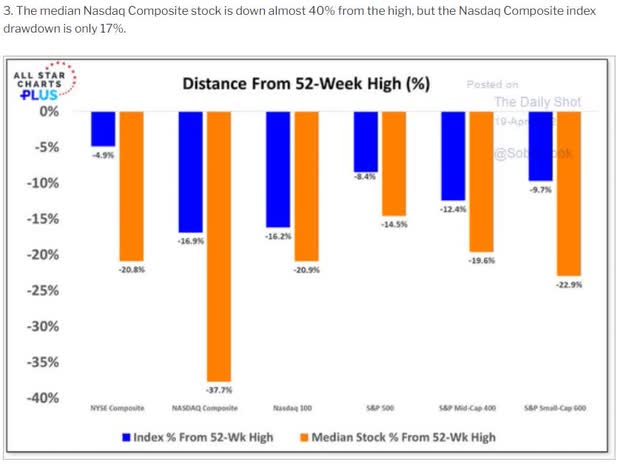

Each day Shot

The Nasdaq composite is about 2,500 firms, roughly 50% of all US-traded firms.

And the median decline proper now could be 38%. The common market decline in a recession is 36%, so successfully a lot of the inventory market is already priced as if we had been in a recession.

However such short-term ache brings the potential for long-term income.

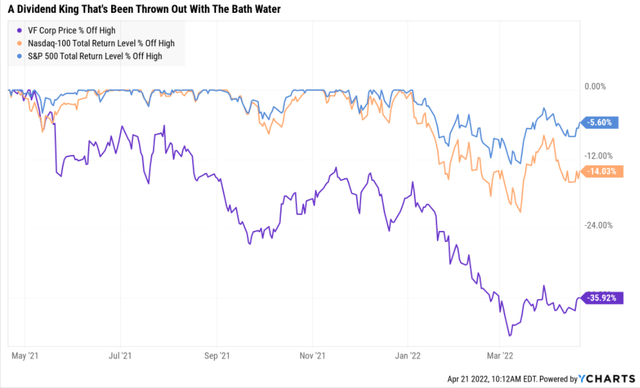

Ycharts

Right this moment I wished to spotlight why V.F Corp (NYSE:VFC) is likely one of the greatest dividend aristocrat bargains you may safely purchase at this time.

Why? As a result of VFC is likely one of the best firms on earth, and a confirmed maser of constructing long-term revenue and wealth over time.

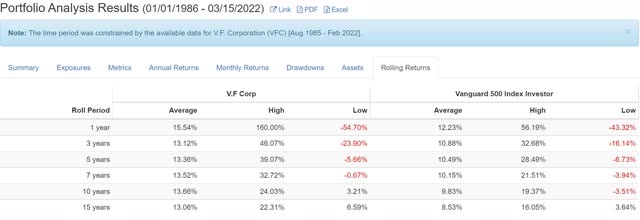

VFC Rolling Returns Since 1986

Portfolio Visualizer Premium

Shopping for VFC throughout bear markets can ship returns as robust as 22% CAGR for the subsequent 15 years.

- as much as 20X returns

- Buffett-like returns from a low-risk Extremely SWAN dividend king discount hiding in plain sight

So be part of me as I present you the three causes I have been shopping for VFC on this correction and why it may be simply what your portfolio wants that will help you retire in security and splendor.

Purpose One: World-Class High quality You Can Belief

There are a lot of methods to outline and measure high quality. So how do I do it?

The Dividend King’s total high quality scores are based mostly on a 248 level mannequin that features:

dividend security

steadiness sheet energy

credit score scores

credit score default swap medium-term chapter danger knowledge

brief and long-term chapter danger

accounting and company fraud danger

profitability and enterprise mannequin

progress consensus estimates

administration progress steering

historic earnings progress charges

historic money move progress charges

historic dividend progress charges

historic gross sales progress charges

value of capital

GF Scores

long-term risk-management scores from MSCI, Morningstar, FactSet, S&P, Reuters’/Refinitiv, and Simply Capital

administration high quality

dividend pleasant company tradition/revenue dependability

long-term whole returns (a Ben Graham signal of high quality)

analyst consensus long-term return potential

In reality, it contains over 1,000 basic metrics together with the 12 score companies we use to evaluate basic danger.

- credit score and danger administration scores make up 41% of the DK security and high quality mannequin

- dividend/steadiness sheet/danger scores make up 82% of the DK security and high quality mannequin

How do we all know that our security and high quality mannequin works effectively?

Through the two worst recessions in 75 years, our security mannequin 87% of blue-chip dividend cuts, the last word baptism by fireplace for any dividend security mannequin.

After which there’s the affirmation that our high quality scores are very correct.

DK Zen Phoenix: Superior Fundamentals Lead To Superior Lengthy-Time period Outcomes

| Metric | US Shares | 191 Actual Cash DK Phoenix Recs |

| Nice Recession Dividend Development | -25% | 0% |

| Pandemic Dividend Development | -1% | 6% |

| Constructive Whole Returns Over The Final 10 Years | 42% | 99.5% (Biggest Traders In Historical past 60% to 80% Over Time) |

| Misplaced Cash/Went Bankrupt Over The Final 10 Years | 47% | 0.5% |

| Outperformed Market Over The Final Decade (290%) | 36% | 46% |

| Bankruptcies Over The Final 10 Years | 11% | 0% |

| Everlasting 70+% Catastrophic Decline Since 1980 | 44% | 0.5% |

| 100+% Whole Return Over The Previous 10 Years | NA | 87% |

| 200+% Whole Return Over The Previous 10 Years | NA | 66% |

| 300+% Whole Return Over The Previous 10 Years | NA | 44% |

| 400+% Whole Return Over The Previous 10 Years | NA | 35% |

| 500+% Whole Return Over The Previous 10 Years | NA | 27% |

| 600+% Whole Return Over The Previous 10 Years | NA | 23% |

| 700+% Whole Return Over The Previous 10 Years | NA | 20% |

| 800+% Whole Return Over The Previous 10 Years | NA | 18% |

| 900+% Whole Return Over The Previous 10 Years | NA | 18% |

| 1000+% Whole Return Over The Previous 10 Years | NA | 16% |

| Sources: Morningstar, JPMorgan, Searching for Alpha |

Principally, historic market knowledge confirms that the DK security and high quality mannequin is likely one of the most complete and correct on this planet.

This is the reason I and my household entrust nearly 100% of my life financial savings to this mannequin and the DK Phoenix blue-chip technique.

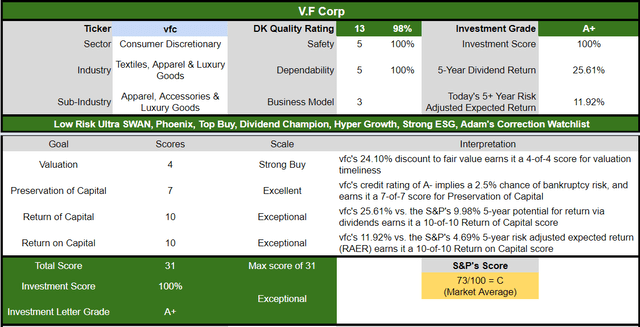

How does VFC rating on one of many world’s most complete and correct security fashions?

VFC Dividend Security

| Ranking | Dividend Kings Security Rating (161 Level Security Mannequin) | Approximate Dividend Reduce Danger (Common Recession) | Approximate Dividend Reduce Danger In Pandemic Degree Recession |

| 1 – unsafe | 0% to twenty% | over 4% | 16+% |

| 2- under common | 21% to 40% | over 2% | 8% to 16% |

| 3 – common | 41% to 60% | 2% | 4% to eight% |

| 4 – protected | 61% to 80% | 1% | 2% to 4% |

| 5- very protected | 81% to 100% | 0.5% | 1% to 2% |

| VFC | 100% | 0.5% | 1.00% |

| Danger Ranking | Low Danger (71st {industry} percentile consensus) | A- steady outlook credit standing 2.5% 30-year chapter danger | 20% OR LESS Max Danger Cap Advice |

Lengthy-Time period Dependability

| Firm | DK Lengthy-Time period Dependability Rating | Interpretation | Factors |

| Non-Reliable Firms | 21% or under | Poor Dependability | 1 |

| Low Dependability Firms | 22% to 60% | Under-Common Dependability | 2 |

| S&P 500/Business Common | 61% (58% to 70% vary) | Common Dependability | 3 |

| Above-Common | 71% to 80% | Very Reliable | 4 |

| Very Good | 81% or larger | Distinctive Dependability | 5 |

| VFC | 100% | Distinctive Dependability | 5 |

General High quality

| VFC | Last Rating | Ranking |

| Security | 100% | 5/5 very protected |

| Enterprise Mannequin | 60% | 3/3 huge moat |

| Dependability | 100% | 5/5 distinctive |

| Whole | 98% | 13/13 Extremely SWAN Dividend King |

| Danger Ranking | 3/3 Low Danger | |

| 20% OR LESS Max Danger Cap Rec | 5% Margin of Security For A Doubtlessly Good Purchase |

VFC: eleventh Highest High quality Grasp Record Firm (Out of 508) = 98th Percentile

The DK 500 Grasp Record contains the world’s highest high quality firms together with:

All dividend champions

All dividend aristocrats

All dividend kings

All international aristocrats (akin to BTI, ENB, and NVS)

All 13/13 Extremely Swans (as near excellent high quality as exists on Wall Avenue)

- 47 of the world’s greatest progress shares (on its approach to 100)

VFC’s 98% high quality rating means its comparable in high quality to such blue-chips as

- S&P World (SPGI) – dividend aristocrat

- W. W. Grainger (GWW) – dividend king

- PayPal (PYPL)

- Ilumina (ILMN)

- West Pharmaceutical Companies (WST) – dividend champion

- ASML Holding (ASML)

- Colgate-Palmolive (CL) – dividend king

- Visa (V)

- Mastercard (MA)

- Microsoft (MSFT)

Even among the many most elite firms on earth, VFC is larger high quality than 98% of them.

Why I Belief VFC And So Can You

VFC is constructed to final. How do we all know this?

- based in 1899 in Denver, Colorado

VFC has survived and thrived by means of

- 24 recessions

- two depressions

- three financial crises/panics

- inflation starting from -2.5% to twenty%

- rates of interest starting from 0% to twenty%

- 10-year Treasury yields starting from 0.5% to 16%

- 11 bear markets

- dozens of corrections and pullbacks

VFC owns 15 well-liked manufacturers of sports activities and activewear together with

- Vans

- The North Face

- Timberland

- Supreme

- and Dickies

- 50% of gross sales from the US

- 27% from central and south America

- 14% Europe

- 8% different

Funding Thesis Abstract

By inclinations and additions, VF has constructed a portfolio of robust manufacturers in a number of attire classes. We view the three manufacturers that account for about 80% of its gross sales (Vans, Timberland, and The North Face) as supporting VF’s slim moat based mostly on a model intangible asset. Regardless of short-term disruption from the COVID-19 disaster and financial weak spot in China, we consider VF will develop quicker than most opponents in the long term and preserve its aggressive edge.” – Morningstar

Distinctive Administration You Can Belief

We assign a capital allocation score of Exemplary to VF. We consider the agency has produced robust returns for shareholders….

VF has a robust steadiness sheet and capability for additional acquisitions. The agency constantly generates greater than $1 billion per yr in free money move to fairness, and its capital expenditures have solely averaged 2% of gross sales over the previous decade. Thus, it accumulates important money for funding and may borrow cash at low charges….

VF has a strong document of returning money to shareholders. It has elevated its dividend (adjusted for the Kontoor spin) for 50 consecutive years and has usually paid shareholders 30%-50% of its earnings as dividends. We anticipate constant annual dividend will increase by means of this decade….

Over the subsequent 5 years, we forecast the corporate will generate $7.8 billion in free money move to fairness and return most of it to shareholders in dividends and, to a lesser diploma, inventory buybacks. We consider an organization will increase shareholder worth if it repurchases inventory under its intrinsic worth.

VF has managed its portfolio of manufacturers effectively and has delivered constant returns to shareholders (an annual common of 11% over the previous 15 years, as of January 2022)…

VF targets 14%-16% annualized whole shareholder return over the subsequent few years, which can be achievable. ” – Morningstar

I agree 100% with Morningstar’s view as a result of VFC is a wonderful investor in attire and life-style manufacturers, with an distinctive observe document of:

- good acquisitions

- model constructing

- very shareholder and dividend buddies

- a extremely adaptable administration workforce and company tradition

- conservative steadiness sheet and payout ratios are what has allowed it to develop into a dividend king

We delivered robust ends in Q3 with natural income progress of 16% and natural earnings progress of 32% amidst persevering with macro headwinds. Our enterprise is robust and wholesome. We achieved our Q3 plan pushed by a strong vacation efficiency and an distinctive quarter from the North Face, which gained additional momentum and surpassed $1.2 billion in income, a document in its historical past…

We proceed to see broad-based progress throughout classes with snow sports activities, sportswear and logowear, all rising over 20%…

Off-mountain life-style merchandise additionally confirmed ongoing robust momentum. The newly launched techwear line, mountain-inspired garments designed for the town grew over 60% and life-style footwear grew 30%… – CEO, Q4 convention name

VFC’s manufacturers are very talked-about and gross sales are rising quickly. Its new manufacturers are additionally experiencing blockbuster success.

The XPLR Cross loyalty program grew exponentially this quarter, including 1.1 million new members and 33% extra sign-ups throughout vacation weeks relative to final yr, pushed by the digital channel.

Whole membership is now approaching 9 million, rising about 30% fiscal year-to-date…

Transferring on to Vans, which grew 8% in Q3, representing modest progress relative to pre-pandemic ranges. World digital progress continues to be robust, up 54% relative to fiscal ’20 driving 9% D2C progress relative to pre-pandemic ranges.” – CEO, Q4 convention name

Digital and direct-to-consumer execution goes very effectively.

In 2019 VFC introduced steering for the subsequent 5 years (nonetheless in impact).

- 7% to eight% gross sales progress

- 12% to 14% EPS progress

- 14% to 16% CAGR whole returns

- again then VFC yielded 2%

- now it yields nearly twice as a lot

- whole return steering now: 15.6% to 17.6% CAGR

- on par with the best traders in historical past, like John Templeton

- 15.8% CAGR returns from 1953 to 1992

VFC has a strong plan to ship larger margins and distinctive long-term shareholder returns.

It is a grasp of profitable M&A having made 16 acquisitions within the final 21 years.

The corporate’s technique is closely targeted on:

- rising Asian gross sales

- driving extra direct-to-consumer (larger margin) gross sales (Nike’s technique)

- construct robust model loyalty (a deal with life-style manufacturers)

- preserve driving robust progress in present manufacturers and proceed buying new ones

VFC’s newest acquisition will increase its whole addressable market to $500 billion vs $11.2 billion final yr. With nearly a 2% market share, VFC’s progress runway is lengthy and huge.

Supreme is the newest model acquisition, which has a goal market of $50 billion per yr and that is rising at double-digits.

Administration thinks it may well preserve Supreme rising at 8% to 10%, barely quicker than the general firm.

And Vans which represents 33% of gross sales, continues to develop at 12% to 13% and with working margins of just about 25% (double the corporate’s total ranges).

VFC Credit score Rankings

| Ranking Company | Credit score Ranking | 30-Yr Default/Chapter Danger | Probability of Dropping 100% Of Your Funding 1 In |

| S&P | A- steady | 2.50% | 40.0 |

| Moody’s | Baa1 (BBB+ equal) | 5.00% | 20.0 |

| Consensus | A- steady | 3.75% | 26.7 |

(Sources: S&P, Moody’s)

VFC has an A-credit score from S&P and Moody’s will probably improve their score within the subsequent few years.

VFC Leverage Consensus Forecast

| Yr | Debt/EBITDA | Internet Debt/EBITDA (3.0 Or Much less Secure In accordance To Credit score Ranking Companies) | Curiosity Protection (8+ Secure) |

| 2020 | 4.53 | 3.70 | 7.90 |

| 2021 | 3.34 | 2.61 | 10.81 |

| 2022 | 2.70 | 2.01 | 14.55 |

| 2023 | 2.41 | 1.98 | 19.44 |

| 2024 | 1.95 | 2.31 | 30.51 |

| 2025 | NA | NA | 35.82 |

| Annualized Change | -18.94% | -11.05% | 40.17% |

(Supply: FactSet Analysis Terminal)

As a result of VFC’s steadiness sheet is predicted to get lots stronger after taking a beating through the pandemic.

VFC Steadiness Sheet Consensus Forecast

| Yr | Whole Debt (Hundreds of thousands) | Money | Internet Debt (Hundreds of thousands) | Curiosity Price (Hundreds of thousands) | EBITDA (Hundreds of thousands) | Working Earnings (Hundreds of thousands) | Common Curiosity Charge |

| 2020 | $5,265 | $955 | $4,301 | $113 | $1,163 | $893 | 2.15% |

| 2021 | $5,519 | $1,611 | $4,313 | $127 | $1,651 | $1,373 | 2.30% |

| 2022 | $5,452 | $2,192 | $4,061 | $118 | $2,016 | $1,717 | 2.16% |

| 2023 | $5,214 | $1,836 | $4,268 | $97 | $2,160 | $1,886 | 1.86% |

| 2024 | $4,936 | $2,301 | $5,845 | $71 | $2,525 | $2,166 | 1.44% |

| 2025 | NA | NA | NA | $62 | $2,637 | $2,221 | NA |

| Annualized Development | -1.60% | 24.59% | 7.97% | -11.31% | 17.79% | 19.99% | -9.52% |

(Supply: FactSet Analysis Terminal)

Debt is predicted to lower step by step over time whereas money grows at 25% yearly and money flows at 17% to twenty% yearly.

VFC Bond Profile

- $3.6 billion in liquidity

- effectively staggered debt maturities (little downside refinancing maturing bonds)

- 100% unsecured bonds (most monetary flexibility)

- bond traders are so assured in VFC’s long-term power transition plan they’re prepared to lend to it for 16 years at 4.6%

- 2.06% common borrowing value

- -0.1% inflation-adjusted borrowing prices vs 13.6% returns on capital

- VFC’s borrowing prices are so low that adjusted for inflation, it is being paid to borrow to develop its enterprise

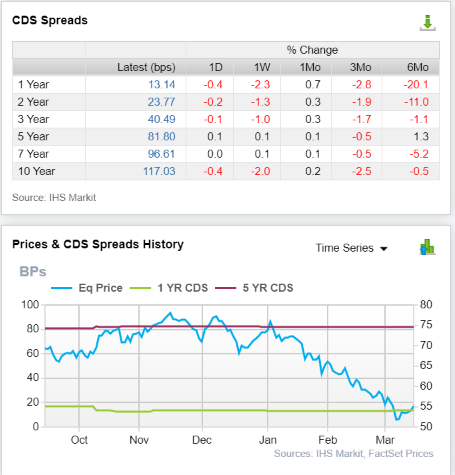

VFC Credit score Default SWAPs: Actual-Time Elementary Danger Evaluation From The Bond Market

(Supply: FactSet Analysis Terminal)

Credit score default SWAPs are the insurance coverage insurance policies bond traders take out in opposition to default.

- they characterize real-time basic danger evaluation from the “good cash” on Wall Avenue

- VFC’s basic danger has been rock regular for six months

- whereas the worth fell off a cliff

- analysts, score companies, and the bond market all agree

- VFC’s thesis is undamaged

- 25 analysts, 7 score companies, and the bond market make up our VFC professional consensus

- how we observe basic danger in real-time

- to make sure high-probability/low-risk funding suggestions

VFC Profitability: Wall Avenue’s Favourite High quality Proxy

Traditionally VFC has maintained above-average profitability in comparison with its friends.

VFC Trailing 12-Month Profitability Vs Friends

| Metric | Business Percentile | Main Attire Firms Extra Worthwhile Than VFC (Out Of 1,074) |

| Working Margin | 79.85 | 216 |

| Internet Margin | 81.50 | 199 |

| Return On Fairness | 95.90 | 44 |

| Return On Belongings | 83.33 | 179 |

| Return On Capital | 90.71 | 100 |

| Common | 86.26 | 148 |

(Supply: GuruFocus Premium)

Within the final yr, VFC’s profitability has soared to the highest 14% of its {industry}.

Adjusting for the pure cyclicality of this {industry}, VFC’s industry-leading profitability has been steady for over 30 years, confirming a large and steady moat.

VFC Revenue Margin Consensus Forecast

| Yr | FCF Margin | EBITDA Margin | EBIT (Working) Margin | Internet Margin | Return On Capital Enlargement | Return On Capital Forecast |

| 2020 | 9.2% | 12.2% | 9.3% | 6.8% | 1.16 | |

| 2021 | 8.2% | 14.7% | 12.2% | 9.6% | TTM ROC | 45.53% |

| 2022 | 8.4% | 16.1% | 13.7% | 10.9% | Newest ROC | 81.48% |

| 2023 | 9.1% | 16.0% | 14.0% | 11.2% | 2025 ROC | 52.67% |

| 2024 | 10.4% | 17.1% | 14.7% | 11.9% | 2025 ROC | 94.25% |

| 2025 | NA | 16.8% | 14.2% | 11.7% | Common | 73.46% |

| 2026 | NA | NA | NA | NA | Business Median | 9.79% |

| Annualized Development | 3.10% | 6.72% | 8.71% | 11.35% | VFC/Friends | 7.50 |

| Vs S&P | 5.03 |

(Supply: FactSet Analysis Terminal)

VFC’s margins are anticipated to get better from the pandemic and continue to grow to document highs.

Return on capital is annual pre-tax revenue/working capital (the cash it takes to run the enterprise). ROC is Greenblatt’s gold normal proxy for high quality and moatiness.

- S&P 500 ROC is 14.6%

- for every $1 it takes to run the typical S&P firm they generate $0.146 in annual pre-tax revenue

- it takes about 6.5 years for brand spanking new investments to pay for themselves

For VFC ROC was 45% within the final yr and is predicted to rise to be about 74% in 2025.

- for each $1 it takes to run VFC it’s at present producing $0.74 in annual pre-tax revenue

- investments take 16 months to pay for themselves

By the definition of one of many best traders in historical past, VFC is about 8X larger high quality than its friends and 5X larger high quality than the S&P 500.

VFC Dividend Development Consensus Forecast

| Yr | Dividend Consensus | EPS/Share Consensus | Payout Ratio | Retained (Publish-Dividend) Money Circulate | Buyback Potential | Debt Reimbursement Potential |

| 2021 | $1.95 | $2.73 | 71.4% | $303 | 1.42% | 5.5% |

| 2022 | $1.99 | $3.52 | 56.5% | $595 | 2.78% | 10.8% |

| 2023 | $2.02 | $3.94 | 51.3% | $747 | 3.49% | 13.7% |

| 2024 | $2.24 | $4.65 | 48.2% | $937 | 4.38% | 18.0% |

| 2025 | $2.75 | $4.82 | 57.1% | $805 | 3.76% | 16.3% |

| Whole 2021 By 2025 | $10.95 | $19.66 | 55.7% | $3,388.19 | 15.83% | 61.39% |

| Annualized Charge | 8.97% | 15.27% | -5.46% | 27.63% | 27.63% | 31.25% |

(Supply: FactSet Analysis Terminal)

Credit standing companies take into account 60% a protected payout ratio for this {industry}.

VFC usually maintains a really protected 40% payout ratio (30% to 50% historic vary).

Analysts count on the payout ratio to return to protected ranges this yr (2023 on a free money move foundation).

$3.4 billion in consensus post-dividend retained earnings is sufficient to repay 61% of present debt or purchase again 16% of shares at present valuations.

| Yr | Consensus Buybacks ($ Hundreds of thousands) | % Of Shares (At Present Valuations) | Market Cap |

| 2017 | $760.0 | 3.6% | $21,401 |

| 2018 | NA | NA | $21,401 |

| 2019 | NA | NA | $21,401 |

| 2020 | $249.0 | 1.2% | $21,401 |

| 2021 | $267.0 | 1.2% | $21,401 |

| 2022 | $552.0 | 2.6% | $21,401 |

| Whole 2017-2022 | $1,828.00 | 8.5% | $21,401 |

| Annualized Charge | 2.20% | Common Annual Buybacks | $457.00 |

(Supply: FactSet Analysis Terminal)

VFC’s historic buybacks since 1989 have averaged 1.1% of web shares every year.

Analysts count on greater than double that charge in 2022 (2.6%).

| Time Body (Years) | Internet Buyback Charge | Shares Remaining | Internet Shares Repurchased |

| 5 | 1.1% | 94.62% | 5.38% |

| 10 | 1.1% | 89.53% | 10.47% |

| 15 | 1.1% | 84.71% | 15.29% |

| 20 | 1.1% | 80.15% | 19.85% |

| 25 | 1.1% | 75.84% | 24.16% |

| 30 | 1.1% | 71.76% | 28.24% |

| 35 | 1.1% | 67.90% | 32.10% |

| 40 | 1.1% | 64.25% | 35.75% |

| 45 | 1.1% | 60.79% | 39.21% |

| 50 | 1.1% | 57.52% | 42.48% |

| 55 | 1.1% | 54.42% | 45.58% |

| 60 | 1.1% | 51.50% | 48.50% |

| 65 | 1.1% | 48.73% | 51.27% |

| 70 | 1.1% | 46.10% | 53.90% |

| 75 | 1.1% | 43.62% | 56.38% |

| 80 | 1.1% | 41.28% | 58.72% |

| 85 | 1.1% | 39.06% | 60.94% |

| 90 | 1.1% | 36.95% | 63.05% |

| 95 | 1.1% | 34.97% | 65.03% |

| 100 | 1.1% | 33.08% | 66.92% |

(Supply: DK Analysis Terminal, Ycharts)

1.1% annual web buybacks could not sound like a lot, nevertheless it provides up over time.

And buybacks are simply the cherry on high of the VFC cake.

Purpose Two: Nice Development Prospects For The Foreseeable Future

We have already seen how VFC is an {industry} chief in a $500+ billion market, with a doubtlessly decades-long progress runway forward of it. This is what analysts count on within the subsequent few years.

VFC Medium-Time period Development Consensus Forecast

| Yr | Gross sales | Free Money Circulate | EBITDA | EBIT (Working Earnings) | Internet Earnings |

| 2020 | $9,569 | $884 | $1,163 | $893 | $654 |

| 2021 | $11,209 | $923 | $1,651 | $1,373 | $1,076 |

| 2022 | $12,534 | $1,056 | $2,016 | $1,717 | $1,367 |

| 2023 | $13,477 | $1,231 | $2,160 | $1,886 | $1,511 |

| 2024 | $14,780 | $1,543 | $2,525 | $2,166 | $1,763 |

| 2025 | $15,675 | NA | $2,637 | $2,221 | $1,834 |

| Annualized Development | 10.37% | 14.94% | 17.79% | 19.99% | 22.90% |

(Supply: FactSet Analysis Terminal)

VFC’s progress is predicted to be distinctive now that the pandemic is ending.

| Metric | 2020 Development | 2021 Development Consensus | 2022 Development Consensus | 2023 Development Consensus | 2024 Development Consensus | 2025 Development Consensus |

| Gross sales | 8% | -10% | 28% | 8% | 8% | 6% |

| Dividend | 12% | 2% | 2% (official) | 2% | 11% | 23% (53-year dividend progress streak) |

| EPS | -25% | -51% | 144% | 14% | 11% | 4% |

| Working Money Circulate | -44% | 54% | -3% | 12% | 18% | NA |

| Free Money Circulate | -62% | 94% | -3% | 4% | 23% | NA |

| EBITDA | 28% | -22% | 30% | 12% | 6% | NA |

| EBIT (working revenue) | -1% | -38% | 118% | 12% | 8% | NA |

(Supply: FAST Graphs, FactSet Analysis Terminal)

VFC’s dividend progress is predicted to start out accelerating in 2024 and growth in 2025 as its payout ratio comes down.

And what in regards to the long-term?

VFC Lengthy-Time period Development Outlook

VFC’s consensus forecast is skewed by Deutsche Financial institution’s 44.5% CAGR long-term progress forecast.

- we’re utilizing administration 12% to 14% steering

- most of VFC’s analyst progress forecasts are 12%, according to administration steering

How correct is administration steering?

- Smoothing for outliers historic analyst margins-of-error are 15% to the draw back and 30% to the upside

- margin-of-error adjusted progress steering vary: 10% to 19% CAGR

- 70% statistical chance that VFC grows inside this vary

- excluding the pandemic, VFC’s historic progress charge is about 10.6% CAGR

Administration and analysts suppose barely quicker progress is probably going due to VFC’s robust model constructing and nice direct-to-consumer execution.

Purpose Three: A Great Firm At A Great Value

For the final 7 to twenty years, exterior of bear markets and bubbles, tens of thousands and thousands of traders have constantly paid between 17 and 22X earnings for VFC.

- 91% statistical chance that this vary approximates intrinsic worth

| Metric | Historic Honest Worth Multiples (14-Years) | 2021 | 2022 | 2023 | 2024 | 2025 | 12-Month Ahead Honest Worth |

| 5-Yr Common Yield | 2.47% | $78.14 | NA | NA | $90.69 | $111.34 | |

| 13-Yr Median Yield | 2.28% | $84.65 | NA | NA | $98.25 | $120.61 | |

| 25- Yr Common Yield | 2.47% | $78.14 | $80.97 | $80.97 | $90.69 | $111.34 | |

| Earnings | 19.67 | $53.70 | $69.24 | $77.50 | $91.47 | $94.81 | |

| Common | $71.39 | $74.65 | $79.20 | $92.67 | $108.69 | $76.05 | |

| Present Value | $57.63 | ||||||

Low cost To Honest Worth | 19.27% | 22.80% | 27.23% | 37.81% | 46.98% | 24.22% | |

Upside To Honest Worth (NOT Together with Dividends) | 23.87% | 29.53% | 37.42% | 60.80% | 88.60% | 31.96% (35.6% together with dividend) | |

| 2022 EPS | 2023 EPS | 2022 Weighted EPS | 12-Month Ahead EPS | 12-Month Common Honest Worth Ahead PE | Present Ahead PE | ||

| $3.52 | $3.92 | $1.21 | $3.64 | 20.9 | 15.8 |

I estimate VFC is price about 21X earnings and at this time trades at simply 15.8X, a 24% historic low cost to truthful worth.

- no long-term investor in historical past

- who prevented changing into a pressured vendor for emotional or monetary causes

- has ever regretted shopping for VFC at underneath 16X earnings.

And guess what? Adjusted for money VFC is buying and selling at simply 13.8X earnings, a PEG of simply 1.1 based mostly on administration steering.

That is Peter Lynch’s progress at an inexpensive value and much under the corporate’s historic 2.2 PEG.

Analyst Median 12-Month Value Goal | Morningstar Honest Worth Estimate |

| $73.06 (20.1 PE) | $68.00 (18.7 PE) |

Low cost To Value Goal (Not A Honest Worth Estimate) | Low cost To Honest Worth |

| 20.78% | 14.88% |

Upside To Value Goal (Not Together with Dividend) | Upside To Honest Worth (Not Together with Dividend) |

| 26.23% | 17.48% |

12-Month Median Whole Return Value (Together with Dividend) | Honest Worth + 12-Month Dividend |

| $75.06 | $70.00 |

Low cost To Whole Value Goal (Not A Honest Worth Estimate) | Low cost To Honest Worth + 12-Month Dividend |

| 22.89% | 17.31% |

Upside To Value Goal (Together with Dividend) | Upside To Honest Worth + Dividend |

| 29.68% | 20.94% |

Morningstar estimates that VFC has 21% upside to truthful worth and analysts count on it can ship 30% returns within the subsequent yr.

Given its fundamentals, as much as 36% whole returns within the subsequent yr can be justified.

In fact, I do not care about 12-month value targets, however solely whether or not VFC’s margin of security sufficiently compensates traders for its danger profile.

| Ranking | Margin Of Security For Low-Danger 13/13 Tremendous SWAN high quality firms | 2022 Value | 2023 Value | 12-Month Ahead Honest Worth |

| Doubtlessly Cheap Purchase | 0% | $74.65 | $79.20 | $76.05 |

| Doubtlessly Good Purchase | 10% | $67.18 | $71.28 | $68.44 |

| Doubtlessly Sturdy Purchase | 20% | $59.72 | $63.36 | $60.84 |

| Doubtlessly Very Sturdy Purchase | 30% | $47.03 | $55.44 | $53.23 |

| Doubtlessly Extremely-Worth Purchase | 40% | $44.79 | $47.52 | $45.63 |

| At the moment | $57.88 | 22.46% | 26.92% | 23.89% |

| Upside To Honest Worth (Not Together with Dividends) | 28.97% | 36.83% | 31.39% |

For anybody comfy with its danger profile VFC is a doubtlessly robust purchase and this is why.

Whole Return Potential That Can Assist You Retire In Security And Splendor

For context, this is the return potential of the 14% overvalued S&P 500.

| Yr | EPS Consensus | YOY Development | Ahead PE | Blended PE | Overvaluation (Ahead PE) | Overvaluation (Blended PE) |

| 2021 | $206.12 | 50.17% | 20.7 | 21.3 | 20% | 21% |

| 2022 | $226.19 | 9.74% | 19.9 | 20.3 | 16% | 15% |

| 2023 | $249.08 | 10.12% | 18.1 | 19.0 | 5% | 8% |

| 2024 | $275.28 | 10.52% | 16.3 | 17.2 | -5% | -2% |

| 12-Month ahead EPS | 12-Month Ahead PE | Historic Overvaluation | PEG | 25-Yr Common PEG | S&P 500 Dividend Yield | 25-Yr Common Dividend Yield |

| $233.83 | 19.358 | 14.88% | 2.28 | 3.62 | 1.44% | 2.01% |

(Supply: DK S&P 500 Valuation And Whole Return Instrument)

Shares have already priced in 94% EPS progress from 2020 by means of 2024 and are buying and selling at 20X ahead earnings.

- 16.85 is the 25-year common

- 16.9 is the 10-year common (low charge period)

- 16.9 is the 45-year common

- 91% chance that shares are price about 17X ahead earnings

- A 13.0% correction wanted to get again to the historic market truthful worth

S&P 500 2027 Consensus Return Potential

| Yr | Upside Potential By Finish of That Yr | Consensus CAGR Return Potential By Finish of That Yr | Likelihood-Weighted Return (Annualized) | Inflation And Danger-Adjusted Anticipated Returns | Anticipated Market Return Vs Historic Inflation-Adjusted Return |

| 2027 | 36.03% | 6.35% | 4.76% | 1.45% | 22.31% |

(Supply: DK S&P 500 Valuation And Whole Return Instrument)

Adjusted for inflation, the risk-expected returns of the S&P 500 are about 1.5% for the subsequent 5 years.

- 22% of the S&P’s historic inflation-adjusted returns of 6.5% CAGR

S&P 500 Curiosity Charge Adjusted Market Valuation

| S&P Earnings Yield | 10-Yr US Treasury Yield | Incomes Yield Danger-Premium (3.7% 10 and 20-year common) |

| 5.17% | 2.92% | 2.25% |

| Theoretical Curiosity Charge Justified Market Honest Worth Ahead PE | Present PE | Theoretically Curiosity Charge Justified Market Decline |

| 15.10 | 19.33 | 21.88% |

(Supply: DK S&P 500 Valuation And Whole Return Instrument)

Even adjusting for rates of interest, shares nonetheless require an excellent bigger 22% correction earlier than they develop into theoretically pretty valued.

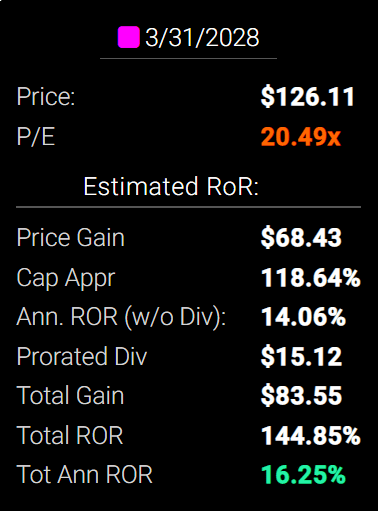

However this is what traders can moderately count on if VFC grows as anticipated over the subsequent 5 years.

- 5-year consensus return potential vary: 13% to 21% CAGR

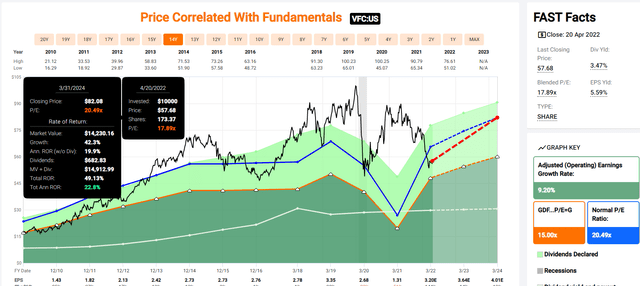

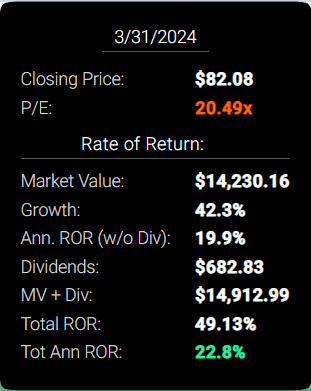

VFC 2024 Consensus Whole Return Potential

(Supply: FAST Graphs, FactSet) (Supply: FAST Graphs, FactSet)

If VFC grows as anticipated and returns to historic truthful worth it may ship 23% annual returns over the subsequent two years.

- Buffett like-return potential from a blue-chip discount hiding in plain sight

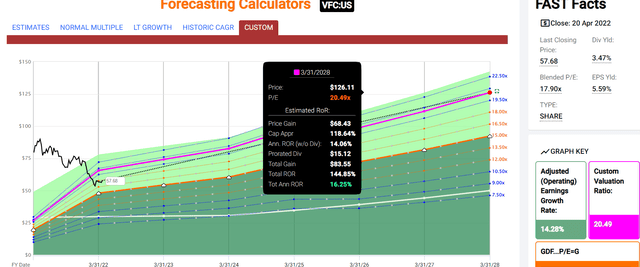

VFC 2027 Consensus Whole Return Potential

(Supply: FAST Graphs, FactSet) (Supply: FAST Graphs, FactSet)

If VFC grows as quick as analysts and administration count on then over the subsequent 5 years it may ship practically 150% whole returns or 16% yearly.

- about 4X the S&P 500 consensus

VFC Funding Resolution Rating

DK (Supply: DK Automated Funding Resolution Instrument)

For anybody comfy with its danger profile, VFC is as near an ideal dividend king funding alternative as exists on Wall Avenue.

- 24% low cost vs 15% market premium

- far superior basic high quality and security

- 2.5X the a lot safer yield

- 67% higher long-term return potential than the S&P 500

| Funding Technique | Yield | LT Consensus Development | LT Consensus Whole Return Potential | Lengthy-Time period Danger-Adjusted Anticipated Return | Lengthy-Time period Inflation And Danger-Adjusted Anticipated Returns | Years To Double Your Inflation & Danger-Adjusted Wealth | 10 Yr Inflation And Danger-Adjusted Return |

| Adam’s Deliberate Correction Buys | 3.9% | 18.9% | 22.8% | 16.0% | 13.5% | 5.3 | 3.54 |

| V.F Corp (Administration Steerage) | 3.5% | 13.0% | 16.5% | 11.6% | 9.1% | 7.9 | 2.38 |

| Nasdaq (Development) | 0.8% | 14.3% | 15.1% | 10.6% | 8.1% | 8.9 | 2.17 |

| Excessive-Yield | 2.8% | 10.3% | 13.1% | 9.2% | 6.7% | 10.8 | 1.91 |

| Dividend Aristocrats | 2.2% | 8.9% | 11.1% | 7.8% | 5.3% | 13.6 | 1.67 |

| S&P 500 | 1.4% | 8.5% | 9.9% | 7.0% | 4.5% | 16.1 | 1.55 |

(Supply: Morningstar, FactSet, Ycharts)

Administration steering is for VFC to ship superior whole returns than nearly each well-liked technique on Wall Avenue.

- larger yield than Vanguard’s high-yield ETF

- larger returns potential than the Nasdaq

- return potential that places the aristocrats to disgrace

- and runs circles across the Nasdaq

VFC Inflation-Adjusted Whole Return Potential: $1,000 Preliminary Funding

| Time Body (Years) | 7.8% CAGR Inflation-Adjusted S&P Consensus | 8.9% Inflation-Adjusted Aristocrat Consensus | 14.3% CAGR VFC Steerage | Distinction Between VFC Steerage And S&P |

| 5 | $1,453.07 | $1,531.58 | $1,961.15 | $508.07 |

| 10 | $2,111.43 | $2,345.73 | $3,846.09 | $1,734.66 |

| 15 | $3,068.06 | $3,592.68 | $7,542.74 | $4,474.68 |

| 20 | $4,458.12 | $5,502.47 | $14,792.41 | $10,334.29 |

| 25 | $6,477.98 | $8,427.47 | $29,010.06 | $22,532.08 |

| 30 | $9,412.99 | $12,907.33 | $56,892.93 | $47,479.94 |

(Supply: DK Analysis Terminal, FactSet)

If administration can ship its progress steering for a decade that is a possible 4X inflation-adjusted return. If it may well ship that progress for 30 years, then VFC is doubtlessly your ticket to a wealthy retirement.

| Time Body (Years) | Ratio Aristocrats/S&P | Ratio VFC Steerage and S&P |

| 5 | 1.05 | 1.35 |

| 10 | 1.11 | 1.82 |

| 15 | 1.17 | 2.46 |

| 20 | 1.23 | 3.32 |

| 25 | 1.30 | 4.48 |

| 30 | 1.37 | 6.04 |

(Supply: DK Analysis Terminal, FactSet)

Lengthy-term we’re speaking in regards to the potential to outperform the S&P 500 by 6X whereas having fun with safer, larger, and faster-growing dividends.

Danger Profile: Why V.F Corp Is not Proper For Everybody

There are not any risk-free firms and no firm is correct for everybody. You must be comfy with the basic danger profile.

VFC Danger Profile Contains

- financial cyclicality danger: gross sales may endure in a recession

- M&A danger: the lifeblood of the VF’s long-term progress technique

- margin compression danger: over 1,000 main rivals globally

- disruption danger from digital commerce: DTC is doing effectively however may endure from wholesale gross sales declines if retail companions shut shops

- labor retention danger (tightest job market in over 50 years and finance is a excessive paying {industry}) – rising wage pressures

- forex danger (rising over time attributable to worldwide growth)

- inflation danger: provide chain disruption and better enter prices have not too long ago harm margins

- shifting shopper style danger: activewear has been purple sizzling (VANs), but when shopper tastes shift then administration progress steering may fall brief

How can we quantify, monitor, and observe such a posh danger profile? By doing what huge establishments do.

Materials Monetary ESG Danger Evaluation: How Giant Establishments Measure Whole Danger

- 4 Issues You Want To Know To Revenue From ESG Investing

- What Traders Want To Know About Firm Lengthy-Time period Danger Administration (Video)

Here’s a particular report that outlines a very powerful facets of understanding long-term ESG monetary dangers on your investments.

- ESG is NOT “political or private ethics based mostly investing”

- it is whole long-term danger administration evaluation

ESG is simply regular danger by one other identify.” Simon MacMahon, head of ESG and company governance analysis, Sustainalytics” – Morningstar

ESG elements are considered, alongside all different credit score elements, after we take into account they’re related to and have or could have a fabric affect on creditworthiness.” – S&P

ESG is a measure of danger, not of ethics, political correctness, or private opinion.

S&P, Fitch, Moody’s, DBRS (Canadian score company), AMBest (insurance coverage score company), R&I Credit score Ranking (Japanese score company), and the Japan Credit score Ranking Company have been utilizing ESG fashions of their credit score scores for many years.

- credit score and danger administration scores make up 41% of the DK security and high quality mannequin

- dividend/steadiness sheet/danger scores make up 82% of the DK security and high quality mannequin

Dividend Aristocrats: 67th Business Percentile On Danger Administration (Above-Common, Medium Danger)

VFC Lengthy-Time period Danger Administration Consensus

| Ranking Company | Business Percentile | Ranking Company Classification |

| MSCI 37 Metric Mannequin | 82.0% | AA Business Chief – Steady Development |

| Morningstar/Sustainalytics 20 Metric Mannequin | 88.8% | 12.7/100 Low-Danger |

| Reuters’/Refinitiv 500+ Metric Mannequin | 88.2% | Good |

| S&P 1,000+ Metric Mannequin | 28.0% | Common- Steady Development |

| Simply Capital 19 Metric Mannequin | 88.89% | Glorious |

| FactSet | 50.0% | Common- Constructive Development |

| Consensus | 71% | Good |

(Sources: MSCI, Morningstar, Reuters’, Simply Capital, S&P, FactSet Analysis)

VFC Lengthy-Time period Danger Administration Is The 185th Greatest In The Grasp Record (63rd Percentile)

- grasp listing common: 62nd percentile

- dividend kings: 63rd percentile

- aristocrats: 67th percentile

- Extremely SWANs: 71st percentile

VFC’s risk-management consensus is within the backside high 37% of the world’s highest high quality firms and much like that of such different firms as

- United Parcel Service (UPS)

- West Pharmaceutical Companies (WST) – dividend champion

- Ecolab (ECL) – dividend aristocrat

- Kimberly-Clark (KMB) – dividend aristocrat

- Alphabet (GOOG)

The underside line is that every one firms have dangers, and VFC is nice at managing theirs.

How We Monitor VFC’s Danger Profile

- 25 analysts

- 2 credit standing companies

- 7 whole danger score companies

- 32 specialists who collectively know this enterprise higher than anybody apart from administration

- and the bond marketplace for real-time basic danger evaluation

When the info change, I alter my thoughts. What do you do sir?” – John Maynard Keynes

There are not any sacred cows at iREIT or Dividend Kings. Wherever the basics lead we at all times comply with. That is the essence of disciplined monetary science, the mathematics behind retiring wealthy and staying wealthy in retirement.

Backside Line: V.F Corp Is One Of The Greatest Dividend Aristocrat Bargains You Can Purchase

There’s nothing like trusting the world’s greatest firms to attain your long-term monetary objectives.

The one factor higher than that?

- shopping for low-risk Extremely SWANs

- which might be dividend kings

- have an A-credit score are rising at 13%

- and buying and selling at 24% historic reductions

- 13.8X cash-adjusted earnings

- and yielding a really protected 3.5%

V.F Corp is a basic Buffett-style “great firm” nevertheless it’s not buying and selling at a good value, however a beautiful value.

VFC is an instance of benefit from the market volatility that causes some to run for the hills.

Right this moment VFC is not simply probably the greatest high-yield aristocrats you may safely purchase for the long-term, it is probably the greatest firms you should buy…interval.

An organization that may make it easier to make your individual long-term luck on Wall Avenue and doubtlessly retire in security and splendor.