Forward of the brand new tariff announcement subsequent week, Anil Singhvi remarks that this can be a essential week for the market.As we write Nifty as towards pattern proven on GIFT Nifty futures opened on a robust be aware, with the Nifty50 index buying and selling effectively above 23,475, whereas the smallcaps outshined with the Nifty Smallcap100 index up over 1 per cent as on the final rely.

Amid the general international subdued temper, Zee Enterprise Managing Editor Anil Singhvi believes this week to be very essential for the markets. Listed below are the important thing occasions to notice as per the market guru

- Market wizard Singhvi believes that the entire quick overlaying that has to occur will happen by the month-to-month expiry

- Within the new collection, the market will put together itself for the tariff bulletins

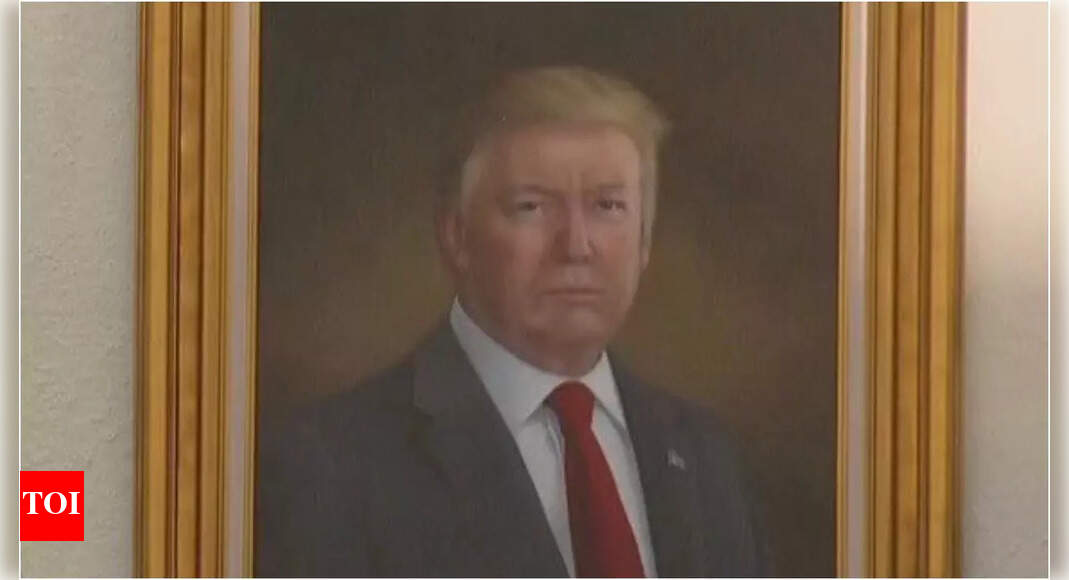

- US President Donald Trump will announce reciprocal tariffs on April 2

- And earlier than that markets may even see revenue reserving at larger ranges.

Nifty’s goal this week

Singhvi iterated that there’s a slight breather at round 23,500 ranges, and for the week 23,800-24,000 ought to be the goal. Additionally, he identified that Nifty fell from 23,800 to 22,000 in a one-way slide. And amid the restoration, it ought to cease close to 23,800 ranges.

He advises merchants to preserve stoploss at Nifty 23125, Financial institution Nifty 49700 in bullish place.

Is that this a ‘purchase on dip’ market?

Singhvi mentioned till Nifty closes beneath 22,900, one ought to interact in purchase on dips. Equally, for Financial institution Nifty- till the benchmark closes beneath 49,300- it’s a purchase on dips market. The higher stage targets for Nifty and Financial institution Nifty are positioned at 23,800-24,000 and for Financial institution Nifty it’s 51,600-51,875.

Final week, smallcap and midcap indices gained as much as 8 per cent.

Additionally Learn: CLSA sees near-term incomes downgrades factored into present valuation; TCS, Wipro could acquire as much as 22%

Which sectors and shares to wager on now?

Singhvi believes rate-sensitive shares will do effectively and amongst them banks and NBFCs are his first selection. Equally, the professional can also be bullish on energy, auto and actual property shares.

Additionally, he sees shopping for alternatives in oil & gasoline, pharma and PSU shares.

Apart from, midcap shares which haven’t posted sharp restoration will also be good bets.