wellesenterprises

Thesis

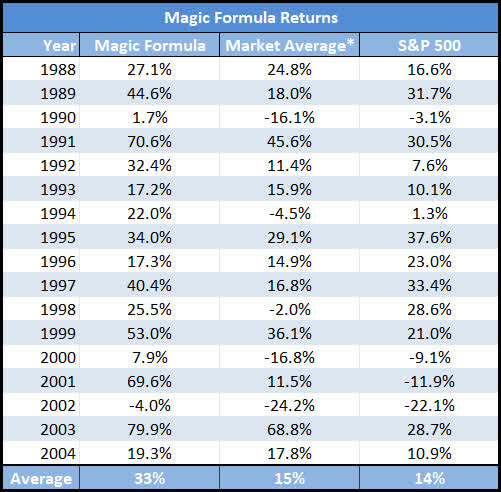

We regularly scan the stock market by the so-called Magic Formula (“MF”) method. Readers familiar with this method can skip this entire session and directly to the next section to see our detailed analysis. The MF investing method was invented by Joel Greenblatt and detailed in his book, entitled “The Little Book That Still Beats the Market”. The method uses a few simple steps to pick stocks that are an optimal combination of value and profitability. The steps are detailed in our free blog article here. The MF method has been thoroughly backtested and showed superior returns compared to the broader market as shown in the table below.

Source: The Little Book That Still Beats the Market

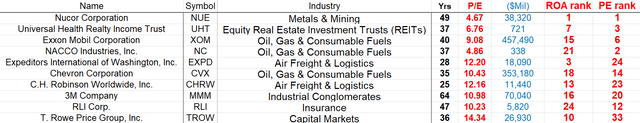

Supported by the above previous results and our own experiences, we routinely apply the MF method and have picked many successful stocks in the past. And for December, I apply the method to a total of 144 dividend champions and the top 10 candidates are shown below:

Source: Author

As seen, the 3M Company (NYSE:MMM) is ranked the 8th top candidate among all 144 dividend champs featuring the best combination of quality and valuation. It boasts the 16th most attractive profitability (measured by ROA, return on asset) within this universe and the 20th most attractive valuation as measured by P/E ratios. And next, we will examine the stock more closely. And you will see that:

- The stock indeed offers a very attractive valuation, both in absolute and relative terms, by all metrics.

- And at the same time, the stock indeed offers healthy profitability at the same time too.

- However, for investors who are unaware, MMM is entangled in lawsuits now regarding the health effects of its earplugs. And my view is that lawsuits create too many uncertainties and work against our overall philosophy of not buying into lawsuits.

Valuation is indeed attractive

As a dividend champ, it’s only fitting to start with its dividend yield as shown in the chart below. As you can see, MMM is currently yielding 4.70%. To put things under a broader perspective, its dividend yield has been a range-bound between ~2.0% and 4.0% most of the time. And its current yield is at the peak level in more than a decade. In its more recent history, its Average Dividend Yield in the past 4-years has been 3.57%. Thus, its current dividend yield is above its 4-year average by 31.6%, a discount too large to ignore.

And next, we will see that its valuation is also extremely attractive by other metrics as well.

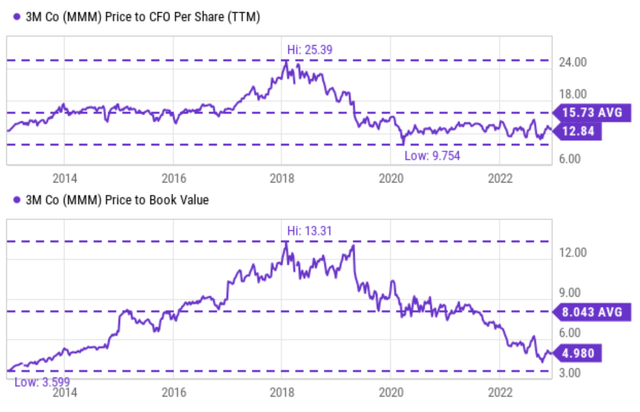

Source: Seeking Alpha data

The next chart shows its valuation in terms of price to CFO (cash from operations) and price to book value. As seen in the top panel, its P/CFO ratio has fluctuated between 9.75x and 25.4x with a 10-year average of 15.73x. Its current P/CFO is only 12.8x, which is below its historical average by almost 18.5%.

And as shown in the bottom panel, its P/BV ratio paints the same picture. Its P/BV ratio has fluctuated between 3.6x and 13.3x with a 10-year average of 8.04x. Its current P/BV ratio is only 4.98x, which is also substantially discounted from its historical average and also near a bottom level in a decade.

Next, we will see its profitability is also healthy.

Source: Seeking Alpha data

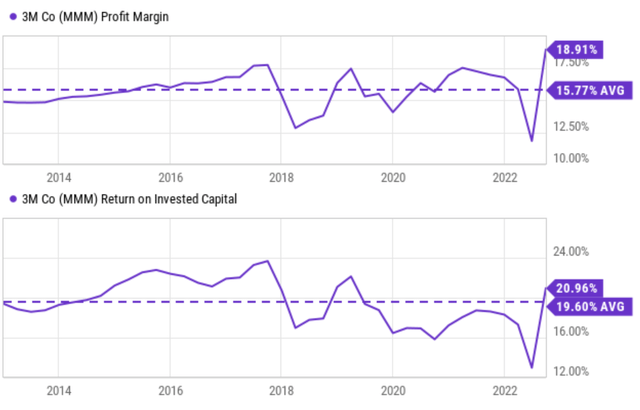

Healthy profitability

The next chart shows MMM’s profit margin (“PM”) and returns on invested capital (“ROIC”). As seen, MMM’s profit margin currently stands at 18.9%. First, it is a very healthy level compared to the overall economy (e.g., the S&P 500’s PM is about 8% on average and is currently at 8.27%). Second, when compared to its own history, the current level is far above its long-term historical average of 15.77% and also at the peak level in a decade. In terms of its ROIC, the picture is equally strong. Its ROIC currently hovers at 20.96%. This level of ROIC again compares favorably against the S&P 500 (on average about 20%) and also its own long-term average of 19.6%.

Source: Seeking Alpha data

The earplug lawsuits

Given its healthy profitability, the valuation compression is mostly caused by the uncertainties created by the ongoing lawsuits. For readers who are not familiar with the lawsuits, the following statements from its CEO Mike Roman in its recent earnings report (“ER”) provide a good background (the quotes are abridged and emphases added by me):

… to provide some context, in 2008, 3M acquired Aearo Technologies, which manufactured Combat Arms Earplugs. Since the acquisition, Aearo has continued to operate as a wholly owned subsidiary of 3M. These products provided effective hearing protection when used properly, and we stand by their performance… Nonetheless, there has been an extraordinary increase in litigation related to Combat Arms.

As of June 30, 2022, there were approximately 115,000 filed claims and an additional 120,000 claims on an administrative docket. The multi-district litigation process and the highly variable outcomes it has generated has not provided certainty or clarity. We believe that litigating these cases individually could take years, if not decades.

Indeed, the legal costs have been mounting in recent quarters. A judge recently denied a motion to move a case to bankruptcy court in which veterans claim ear plugs sold to the military by the company were defective, thereby leading to hearing loss. Damages paid on cases already settled averaged $26 million. There are said to be 230,000-plus more plaintiffs so the costs could be exorbitant. The estimated total legal costs vary widely based on different analyses and two examples are quoted below.

Seeking Alpha News: 3M could face more than $100B in losses and even bankruptcy due to lawsuits brought by veterans who blame their hearing problems on faulty earplugs.

Capital.com report: Testifying before the court last week, corporate solvency expert J.B. Heaton said he believes up to 230,000 lawsuits could eventually force 3M into bankruptcy. “It is more and more likely within the next three several years we’ll see a 3M bankruptcy,” Heaton said before the court, according to reporting from Bloomberg.

Other risks and final thoughts

Meantime, 3M also faces other legal battles. For example, while 3M seems to be on the verge of settling a class action lawsuit over the dumping of PFAS chemicals, and the proposed $54 million price tag looks to be a drop in the bucket, it is far from out of the woods. The settlement is still awaiting final approval. The company is also undergoing tremendous restructuring changes in recent quarters and its structure may change even more moving forward. In addition to the restructuring in response to the earplug lawsuits, the Food Safety business was recently split off to Neogen Corp in a tax-free Reverse Morris Trust. And now, leadership is looking to spin off its Health Care operation too. One way to interpret these moves is that 3M is looking to make the move as a way to avoid paying a good portion of the legal fees that may be on the horizon. And veterans are indeed suing to block the spin-off.

All told, MMM is undoubtedly priced at a sizable discount. Its dividend yield is near a 10-year peak and above its 4-year average by 31.6%. Its P/CFO ratio is near a 10-year bottom and below its historical average by 18.5%. And at the same time, its profitability is quite healthy. Its current PM is 2x higher than the overall economy and at the peak of its 10-year historical average.

However, my view is that the valuation discount and profitability are insufficient to compensate for the uncertainties created by its ongoing lawsuits. Of course, the current estimates of the legal cost vary widely as aforementioned, and the total cost could end up being much lower than anticipated.

However, no matter what the eventual costs, it is very likely the lawsuits could drag on for years or even decades as management mentioned during the recent earnings reports. A 31.6% or 18.5% valuation discount would contribute an annual return of about 1% to 2% if valuation reversion occurs in a decade. And I do not see such a contribution justifies the potential downsides.