Dilok Klaisataporn

Successful long-term fundamentals-and-value-focused dividend investing requires more than just picking the right kinds of stocks. It also requires properly diversifying your portfolio. Given that we are not macroeconomic-focused investors, we do not completely weight our portfolio towards a single sector that we think will benefit most from a certain macroeconomic outcome. Instead, we try to remain diversified to the best of our ability such that at least a portion of our portfolio will likely outperform the broader market in just about any macroeconomic scenario.

That is why, while broadly diversified dividend ETFs like the Schwab U.S. Dividend Equity ETF™ (SCHD) and the JPMorgan Equity Premium Income ETF (JEPI) certainly provide exposure to a broad range of sectors, we do not think that simply buying a broadly diversified ETF is enough to say that your portfolio is sufficiently diversified. In addition to these holdings, it may pay off to also be able to benefit from rising interest rates through securities like BDCs (BIZD) as well as have some positions that tend to hold their value well during periods of skyrocketing macroeconomic uncertainty and/or geopolitical risks like gold (GLD) and silver (SLV).

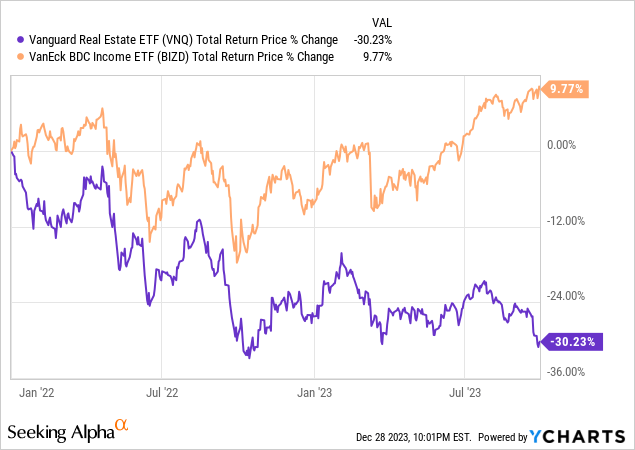

That being said, we are not completely macroeconomic agnostic and do tend to weight our portfolios slightly towards the outcomes that we think are most likely moving forward. As a result, we kept our real estate (REIT) exposure to a minimum over the past two years while investing fairly aggressively in floating-rate heavy BDCs. This move paid off handsomely for us through early October:

However, over the past few months, as we have looked ahead to 2024, our conviction that we are on the cusp of an economic slowdown and falling interest rates has grown stronger. Moreover, we also see the risks of major black swans emerging next year as also being heightened. As a result, we have been shifting our portfolio away from BDCs and loading up on undervalued utilities (XLU), MLPs (AMLP), REITs, precious metals investments, and a few other investments that are likely to outperform during a period marked by:

- A weakening economy

- Falling interest rates

- Potential spikes in volatility and sharp market drops

In this article, we will share three dividend stocks that we think will thrive in the coming year.

Top Pick #1: Energy Transfer LP (ET)

ET is a leading energy midstream company and is a compelling investment opportunity as we approach 2024 and the aforementioned macroeconomic outlook.

First of all, ET’s vast network of midstream infrastructure assets generates very stable cash flows, with approximately 90% of its EBITDA stemming from contracted assets. This makes it very defensive against a slowing economy. ET’s defensiveness against a recession is further bolstered by its recent shift towards a more conservative financial strategy, as management has rapidly paid down debt, bringing its leverage ratio close to the low end of its long-term target range of 4.0-4.5x and has also earned a credit rating upgrade to BBB.

Second, its continued focus on growth investing through organic growth projects and opportunistic acquisitions should benefit from the lower cost of capital that should come with declining interest rates.

Last, but not least, ET’s attractive 9.3% distribution yield, combined with its 3-5% expected CAGR for the foreseeable and a valuation that is both below its five-year average and at a steep discount to peers on an EV/EBITDA and P/DCF basis, gives investors considerable total return potential in 2024 and beyond while limiting downside risks from a potential economic downturn.

Top Pick #2: Realty Income Corporation (O)

Triple net lease REIT Realty Income is also well positioned to thrive as the calendar flips to 2024 as it stands to outperform the broader market if our expectations of falling interest rates and a potential economic slowdown come to fruition. Here is why:

First of all, its professional management and vast portfolio of over 13,000 properties across various geographies and industries create a very stable cash flow profile.

Second, O’s status as a Dividend Aristocrat, with 29 years of consecutive dividend growth and a track record of 642 consecutive monthly dividends, underscores its reliability as a source of passive income and should give investors confidence that this stock will continue to deliver growing dividends in the months and years to come, regardless of macroeconomic conditions.

Third, the quality of Realty Income’s portfolio, characterized by long-term triple net leases with a significant portion of revenue coming from investment-grade tenants and properties resistant to recessions and e-commerce impacts, investors should have confidence that rental income will continue to pour in, even if the economy takes a turn for the worst.

Fourth, with its A- credit rating, O can finance its operations at a significantly lower cost than many of its competitors, enhancing its ability to generate superior risk-adjusted returns and weather weaker economic conditions.

Finally, O stock currently trades at a steep discount to its historical averages across several multiples such as P/FFO, P/AFFO, EV/EBITDA, and P/NAV, offering investors an opportunity to acquire high-quality real estate assets at a bargain price. Moreover, its current dividend of 5.3% plus the expectation that the dividend will continue to grow at a rate that will likely beat inflation over the long term makes it a very attractive passive income stock.

Top Pick #3: Virtu Financial, Inc. (VIRT)

VIRT stock is a great dividend investment for boosting portfolio diversification, as in past rapid market selloffs, VIRT has seen its profits soar and – in the case of 2020 – its stock massively outperformed by soaring 60% even as the S&P 500 (SP500) pulled back sharply. In the 2008 stock market crash, VIRT saw its profits soar too (it was privately held at the time, so there is no stock performance to track there).

In addition to its diversification benefits, VIRT remains compellingly undervalued. The first symptom is that, despite substantially reducing its share count over the past few years and successfully advancing numerous growth initiatives in businesses like options, ETFs, and crypto, its share price is near the lower end of its range over that period.

Another symptom is that its price-to-earnings ratio is approximately half of its historical average. On top of that, insiders remain heavily invested in the shares themselves, and it is still run by one of its original founders, who clearly has a deep emotional investment in the firm as well. The company is buying back shares hand-over-fist instead of empire building, in a clear statement that they believe in the existing business and that the stock is significantly undervalued.

VIRT is buying back stock hand-over-fist as part of its per-share growth investment strategy. Overall, the company’s 2022 buyback yield totaled nearly 15%, bringing the full-year total capital return yield to a whopping ~20%. In 2023, management has accelerated their buybacks while shares traded at compelling valuations and have also continued to invest in organic growth initiatives.

The company’s balance sheet remains in sound shape with little exposure to floating interest rates, zero maintenance covenants on its debt, and maturities that are termed out to 2029, so short-term volatility in EBITDA for the business is of no concern for their balance sheet.

Investor Takeaway

With the outlook for 2024 clouded by a lot of uncertainty and the headlines filled with negative predictions from a wide range of leading businessmen and investors as well as ongoing threats of a world-changing and economy-crashing Chinese invasion of Taiwan, we are preparing our portfolio for several different contingencies. In particular, we believe that with dozens of stocks similar to ET, O, and VIRT in our portfolios, we will significantly outperform the market in an environment where interest rates are falling, the economy is considerably slowing, and the threat of black swan events grows ever greater.