Revealed on February twentieth, 2025 by Bob Ciura

Spreadsheet information up to date day by day

The Dividend Aristocrats are a choose group of 69 S&P 500 shares with 25+ years of consecutive dividend will increase.

The necessities to be a Dividend Aristocrat are:

- Be within the S&P 500

- Have 25+ consecutive years of dividend will increase

- Meet sure minimal measurement & liquidity necessities

There are at the moment 69 Dividend Aristocrats.

You’ll be able to obtain an Excel spreadsheet of all 69 Dividend Aristocrats (with metrics that matter similar to dividend yields and price-to-earnings ratios) by clicking the hyperlink beneath:

Disclaimer: Certain Dividend is just not affiliated with S&P World in any manner. S&P World owns and maintains The Dividend Aristocrats Index. The data on this article and downloadable spreadsheet relies on Certain Dividend’s personal overview, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person buyers higher perceive this ETF and the index upon which it’s primarily based. Not one of the info on this article or spreadsheet is official information from S&P World. Seek the advice of S&P World for official info.

Nonetheless, even Dividend Aristocrats can fall from grace. For instance, Walgreens Boots Alliance (WBA) was faraway from the Dividend Aristocrats checklist in 2024.

The corporate slashed its dividend because of a pronounced enterprise downturn within the brick-and-mortar pharmacy retail trade, amid elevated aggressive threats from on-line pharmacies.

This was after Walgreens Boots Alliance had maintained a 40+ yr streak of consecutive dividend will increase.

Whereas dividend cuts from Dividend Aristocrats are surprising, they’ve occurred–and will occur once more. To be clear, the next 3 Dividend Aristocrats usually are not at the moment in jeopardy of slicing their dividends.

Their dividend payouts are supported with ample underlying earnings (for now). If their earnings stay steady or proceed to develop, they’ve at the very least an honest change of continuous their dividend development.

However, the three Dividend Aristocrats beneath are going through basic challenges to various levels, and at the moment obtain our lowest Dividend Danger Scores of C, D, or F.

This text will present an in depth evaluation on the three Dividend Aristocrats most in peril of a future dividend lower.

Desk of Contents

Purple Flag Dividend Aristocrat For 2025: Fastenal Co. (FAST)

- Dividend Danger Rating: C

- Dividend Yield: 2.3%

Fastenal started in 1967 when Bob Kierlin and 4 associates pooled collectively $30,000 to open the primary retailer. The unique intent was to dispense nuts and bolts through merchandising machine, however that concept bought off the bottom after 20 years.

The corporate went public in 1987 and right now supplies fasteners, instruments and provides to its clients through 1,597 public branches, 2,031 lively Onsite places and over 126,900 managed stock gadgets.

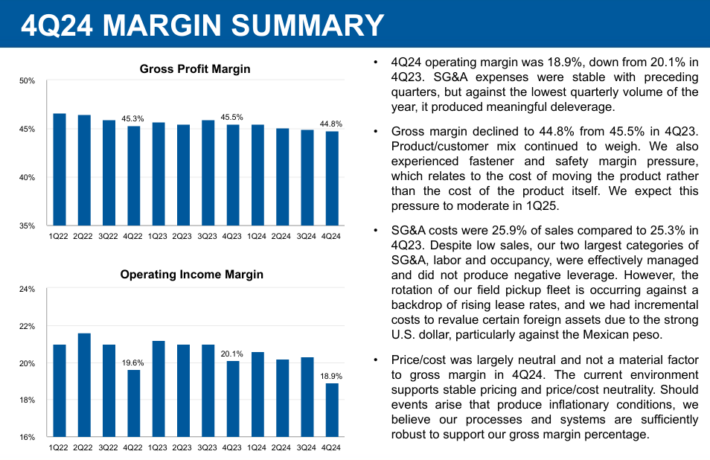

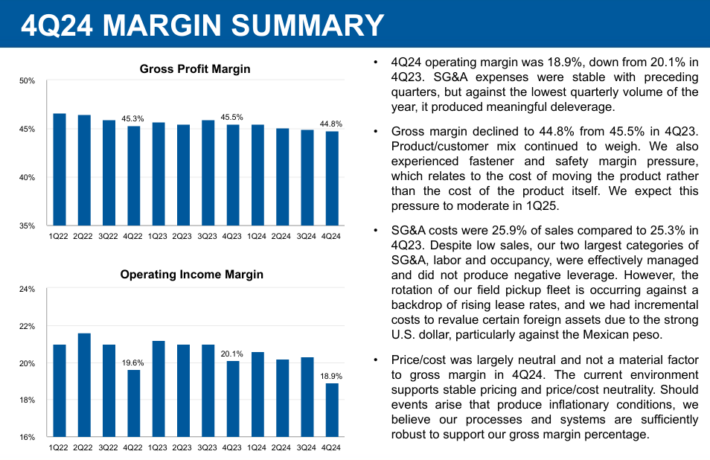

In mid-January, Fastenal reported (1/17/25) outcomes for the fourth quarter of fiscal 2024. It grew its web gross sales 4% over the prior yr’s quarter due to development in Onsite places whereas costs remained flat. Earnings-per-share remained flat at $0.46, lacking the analysts’ consensus by $0.02.

One purpose for stagnant earnings is that the corporate’s margins have steadily declined over the previous two years.

Supply: Investor Presentation

Fastenal’s earnings-per-share are anticipated to extend in 2025, however the firm’s dividend payout has elevated quicker than its earnings in recent times.

Consequently, the payout ratio is predicted to achieve 80% in 2025. It is a dangerously excessive degree that doesn’t go away a lot monetary wiggle room. If earnings unexpectedly declined, because of a recession or another excuse, the dividend payout may very well be in peril.

Click on right here to obtain our most up-to-date Certain Evaluation report on FAST (preview of web page 1 of three proven beneath):

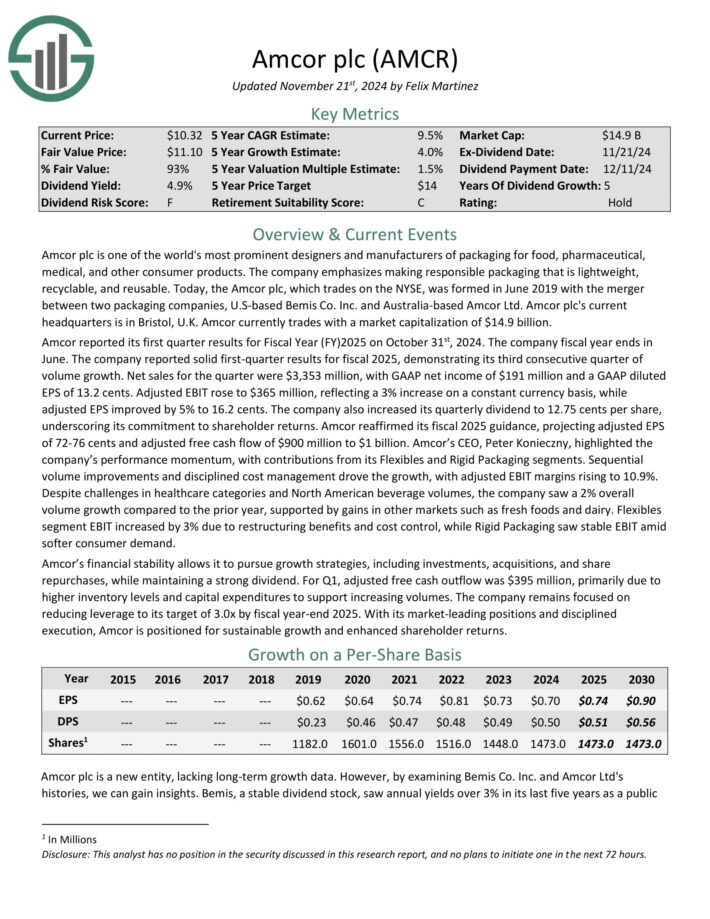

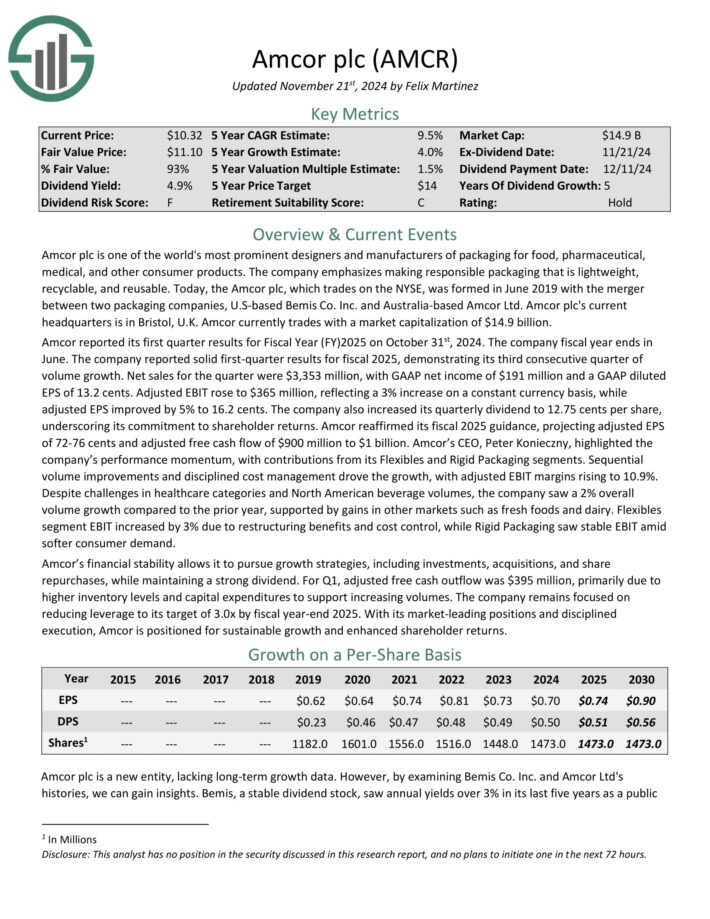

Purple Flag Dividend Aristocrat For 2025: Amcor plc (AMCR)

- Dividend Danger Rating: F

- Dividend Yield: 5.0%

Amcor plc is likely one of the world’s most distinguished designers and producers of packaging for meals, pharmaceutical, medical, and different client merchandise. The corporate emphasizes making accountable packaging that’s light-weight, recyclable, and reusable.

At present, the Amcor plc, which trades on the NYSE, was shaped in June 2019 with the merger between two packaging corporations, U.S-based Bemis Co. Inc. and Australia-based Amcor Ltd. Amcor plc’s present headquarters is in Bristol, U.Okay.

The present dividend yield is engaging in comparison with the broader market, however the payout ratio is excessive at practically 70% anticipated for 2025.

As a packaging producer, Amcor is especially uncovered to the worldwide financial system. It could be troublesome for the corporate to take care of its dividend in a steep recession consequently. AMCR inventory receives our lowest Dividend Danger Rating of ‘F’.

Click on right here to obtain our most up-to-date Certain Evaluation report on AMCR (preview of web page 1 of three proven beneath):

Purple Flag Dividend Aristocrat For 2025: Franklin Sources (BEN)

- Dividend Danger Rating: C

- Dividend Yield: 6.1%

Franklin Sources is an funding administration firm. It was based in 1947. At present, Franklin Sources manages the Franklin and Templeton households of mutual funds.

On January thirty first, 2025, Franklin Sources reported web earnings of $163.6 million, or $0.29 per diluted share, for the primary fiscal quarter ending December 31, 2024.

This marked a major enchancment from the earlier quarter’s web lack of $84.7 million, although EPS remained decrease than the $251.3 million web earnings recorded in the identical quarter final yr.

Supply: Investor presentation

The previous few years have been troublesome for Franklin Sources. Franklin Sources was gradual to adapt to the altering setting within the asset administration trade.

The explosive development in exchange-traded funds and indexing investing stunned conventional mutual funds.

ETFs have change into very talked-about with buyers due largely to their decrease charges than conventional mutual funds. In response, the asset administration trade has needed to lower charges and commissions or danger shedding consumer property.

Earnings-per-share are anticipated to say no in 2025 consequently. The corporate nonetheless maintains a manageable payout ratio of 51% anticipated for 2025, but when EPS continues to say no, the dividend payout may very well be in peril down the highway.

Click on right here to obtain our most up-to-date Certain Evaluation report on BEN (preview of web page 1 of three proven beneath):

Last Ideas

The Dividend Aristocrats are among the many finest dividend development shares available in the market.

And whereas most Dividend Aristocrats will proceed to lift their dividends annually, there may very well be some that find yourself slicing their payouts.

Whereas it’s uncommon, buyers have seen a number of Dividend Aristocrats lower their dividends over the previous a number of years, together with Walgreens Boots Alliance, 3M Firm (MMM), V.F. Corp. (VFC), and AT&T Inc. (T).

Whereas the three Dividend Aristocrats introduced right here have been profitable elevating their dividends annually thus far, all of them face various ranges of challenges to their underlying companies.

For that reason, earnings buyers ought to view the three pink flag Dividend Aristocrats on this article cautiously going ahead.

Extra Studying

Moreover, the next Certain Dividend databases include probably the most dependable dividend growers in our funding universe:

If you happen to’re searching for shares with distinctive dividend traits, take into account the next Certain Dividend databases:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].