AI is reigniting industries that are long overdue for an upgrade.

AI agriculture is helping our farmers grow our food with better quality and more efficiency.

AI in health care is helping doctors diagnose and detect cancer earlier.

And AI’s next big disruption? The construction industry.

Not only is it reducing costs and creating more efficient architecture, but it’s also improving safety on construction sites and solving the labor shortage problem.

Find out how you can invest in the technology powering the “AI construction” trend in two great ways:

All in today’s video…

(Or read the transcript here.)

🔥Hot Topics in Today’s Video:

- Market News: Wage growth is finally outpacing inflation! The latest U.S. jobs report shows good news for the labor market (and potentially for the U.S. economy). [1:15]

- Mega Trend: AI construction! From lowered costs to architectural design, we break down how AI’s disrupting this industry, and breaking down the toughest aspects of building homes. [7:35]

- Investing Opportunity #1: I’ve discovered a company — and my next stock pick — that has the right tools to disrupt the construction industry. (Be sure you don’t miss it by clicking here!) [9:50]

- Investing Opportunity #2: If you want to invest in AI and robotics automation, here’s our top recommended ETF. [10:30]

- World of Crypto: Jane has a great crypto question about the safety and security of the Coinbase Wallet. [15:30]

- Reader Shoutout: Sarah sent us a nice message that we just had to share. [21:40]

Want us to answer your question in next week’s video? Send it to us here: [email protected].

See you next week,

Ian KingEditor, Strategic Fortunes

Bill Ackman Weighs In on “Bondland”

(From MSN.)

If you’re looking for a reason to explain the stock market’s rough start to August, look no further than its cousin, the bond market.

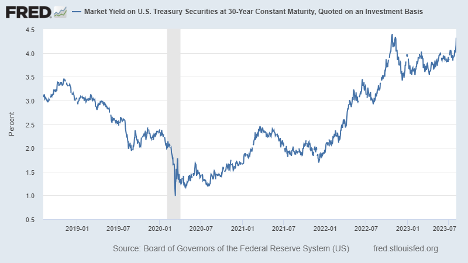

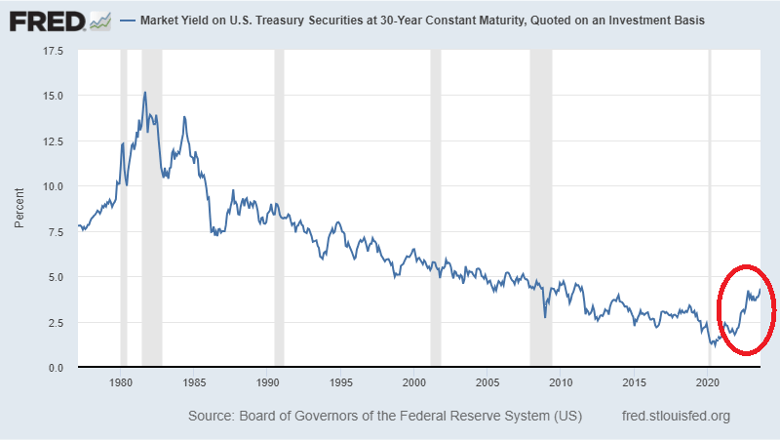

The sleepy world of bonds doesn’t quite get the media attention the stock market does. So you might not have noticed that the 30-year Treasury yield has been creeping higher all year.

And after a spike over the past few weeks, yields are approaching the decade-highs hit last October.

This matters for several reasons. To start, pricing in the capital markets is relative. You can’t say that stocks are “cheap” or “expensive” in an absolute sense.

Stock prices are cheap or expensive relative to something, whether that something is earnings, sales (i.e., the price/earnings/sales ratios) or competing asset classes, like bonds.

The higher bond yields go, the cheaper bond prices go. So after the recent spike, bonds have gotten relatively cheaper compared to stocks.

Relative pricing isn’t the only variable though. Most companies regularly borrow to fund growth and to juice their returns. Well, the higher interest rates go, the more that these companies have to pay in interest. And every dollar paid in interest is a dollar that doesn’t flow through to earnings.

There are also secondary and tertiary effects. Higher interest rates affect how much debt consumers can realistically carry. With all else equal, an extra dollar spent servicing a mortgage, a car payment or a credit card bill is a dollar not available to be spent on that next latte at Starbucks or that next pair of Air Jordans.

So, higher bond yields also potentially precede a slowdown in corporate sales.

The question now becomes: How high do yields go from here?

That’s a tough question to answer with any certainty. A longer view of Treasury yields shows that something really did change after the pandemic. Yields had been steadily falling since the early 1980s, and that trend abruptly reversed near the end of 2020.

As Ian has pointed out repeatedly over the past year, we’re now in a period of deglobalization. We’re “firing China,” so to speak, and that puts us in a very different macro regime. There isn’t an obvious cap here.

Hedge fund manager Bill Ackman recently said he expects the 30-year yield to top 5.5%. That’s just one man’s guess, of course. But it’s probably a good one, coming from Ackman.

If that’s where yields go from here, that would mean a roughly 18% decline in bond prices.

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge

**Disclaimer: We will not track any stocks in The Banyan Edge. We are just sharing our opinions, not advice. We will, however, provide tracking, updates and buy/sell guidance for the model portfolio in your service subscription.