andresr

Who would not like to purchase huge dividends?

It is what I name instantaneous gratification.

It is like going to a on line casino and placing $100 on crimson…

And watching the wheel spin…

And seeing the ball land on crimson…

Then getting $100 in earnings.

However wait.

The chances of touchdown on crimson will not be 50-50.

Assume that you simply guess $100 on crimson.

The chance of the wheel touchdown on crimson is eighteen/38 (as a result of there are 18 crimson numbers and 38 numbers in complete).

If the wheel lands on every other coloration (black or inexperienced zero), you get nothing.

Thus, on common, you’ll be able to count on to get 94.74% of your authentic $100 again.

Feels like a sucker guess?

Effectively, in my article at present, I need to spotlight three hi-flying REITs.

One is a downright Keep away from.

One other one is a speculative Purchase.

And one is a Purchase.

Hopefully, by studying this text, you’ll be able to improve your odds.

Regardless, all the time keep in mind that with regards to investing, you need to all the time keep in mind to guard your principal at ALL prices.

It is our hard-earned cash that’s in danger!

Sachem Capital Corp. (SACH)

SACH is a Connecticut-based mortgage REIT that focuses on the origination, servicing, and administration of a $490.7 million mortgage portfolio that primarily consists of secured, short-term loans on actual property principally positioned within the northeast and southeast areas of the nation.

As talked about, Sachem’s loans are short-term and sometimes have an preliminary time period of 1 to three years. The corporate’s normal mortgage bears curiosity at a hard and fast price, ranging between 10% and 13%, and a default price that goes as excessive as 24% per yr.

As normal observe, the corporate earns origination charges, sometimes between 1% to three% of the mortgage’s principal quantity, in addition to different charges associated to underwriting and managing the mortgage.

Additionally, the corporate’s loans usually have an additional layer of safety within the type of private ensures and extra collateral.

One other method the corporate mitigates danger is to restrict its typical loans to 70% of the collateral worth and 85% of the mission’s complete value.

SACH will from time-to-time situation loans with the next loan-to-cost ratio if there are different elements concerned similar to extra collateral, a robust borrower credit score profile, and the standard of the property securing the mortgage.

SACH doesn’t originate loans to proprietor / occupants. The corporate’s typical borrower is a developer or investor that makes use of the capital to fund acquisitions, developments, or renovations with the intention to carry the property for funding or sale.

The corporate presents varied mortgage merchandise together with bridge loans, building loans, refinance loans, and repair and flip loans.

SACH – IR

SACH’s loans are diversified by mortgage kind, property kind, geographic location, and borrower kind.

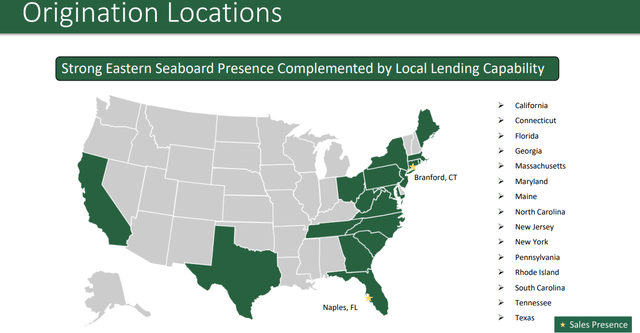

At its formation, the corporate virtually completely issued loans for tasks in Connecticut and several other surrounding states. It has been increasing its footprint over the previous a number of years, and its present mortgage mortgage portfolio is unfold throughout 15 states.

SACH’s loans proceed to be largely concentrated in Connecticut, which represented virtually 60% of the corporate’s loans by depend, and virtually 40% by mortgage stability.

SACH – IR

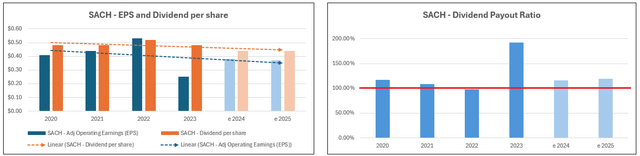

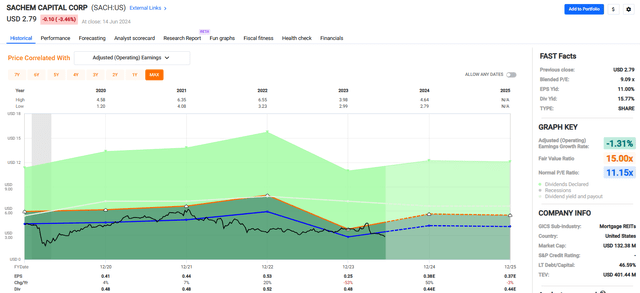

Sachem has an adjusted working earnings per share (“EPS”) development price of unfavorable -1.31% since 2020.

Earnings elevated from $0.41 per share in 2020 to $0.53 per share in 2022.

Nonetheless, in 2023 EPS fell by -53%, to $0.25 per share.

Analysts count on 2024 EPS to extend by 50%, to $0.38 per share, however that is nonetheless nicely under its earnings per share in 2020 and never sufficient to cowl its 2024 anticipated dividend of $0.44 per share.

Between 2020 and 2023 the corporate’s dividend payout ratio exceeded 100% in annually apart from in 2022 when it got here in at 98.11%.

In 2023, its dividend payout ratio bought as excessive as 192% as a result of sharp fall in earnings, which administration primarily attributes to rising rates of interest.

Analysts count on the dividend payout ratio to exceed 110% in each 2024 and 2025 which might be a crimson flag for an upcoming dividend minimize.

FAST Graphs (compiled by iREIT®)

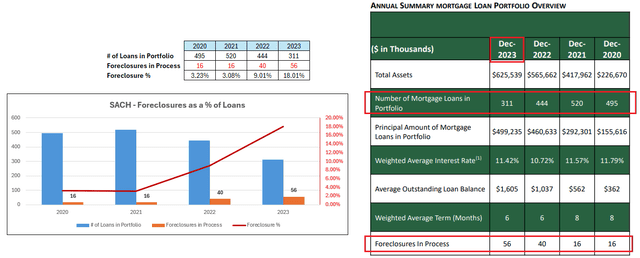

Along with SACH’s rising value of debt, its earnings are being negatively impacted by the speed of foreclosures in course of.

On the finish of 2020 the corporate had 495 mortgage loans and 16 foreclosures in course of, or 3.23% of its portfolio loans have been in foreclosures.

On the finish of 2023 the corporate had 311 mortgage loans and 56 foreclosures in course of, or 18.01% of its mortgage loans have been in foreclosures.

SACH – IR (compiled by iREIT®)

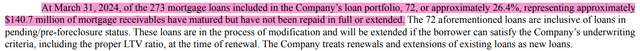

The corporate has a fabric quantity of loans that have been due in 2023, however have but to be paid in full or prolonged. Administration states the next within the firm’s 2023 Kind 10-Ok (emphasis added):

“Of the 311 mortgage loans that made up our mortgage portfolio at December 31, 2023, 89, or roughly 28.6%, had matured in 2023 however haven’t been repaid in full or prolonged. These loans are within the means of modification and shall be prolonged if the borrower can fulfill our underwriting standards, together with the right loan-to-value ratio, on the time of renewal. If the mortgage doesn’t meet our underwriting standards, we are going to deal with the mortgage as in default and take the mandatory steps to gather the stability due.”

In its 1Q-24 earnings report, the corporate disclosed that 72 out of its 273 mortgage loans (26.4%) have matured however haven’t been absolutely repaid or prolonged. This represents roughly $140 million of mortgage receivables.

SACH – Kind 10-Q

The inventory pays a 15.77% dividend yield, however this might very nicely be a sucker yield.

As beforehand talked about, analysts count on the dividend payout ratio to exceed 100% over the subsequent a number of years, however of bigger concern are the issues “below the hood” which have but to totally materialize.

The uptick in foreclosures is important, and roughly 26.4% of its portfolio mortgage loans have matured however haven’t been paid.

The inventory is buying and selling discounted with a present blended P/E of 9.09x, in comparison with its common P/E ratio of 11.15x.

Nonetheless, we really feel the low cost will not be sufficient to compensate for the added danger given the unsure macro surroundings together with the corporate’s rising checklist of foreclosures.

We advise buyers AVOID Sachem Capital.

FAST Graphs

Medical Properties Belief, Inc. (MPW)

MPW is an internally managed REIT that was fashioned in 2003 and operates within the healthcare sector.

The corporate makes a speciality of growing and buying healthcare amenities, primarily hospitals, which can be net-leased to healthcare operators all through the US, in addition to 7 nations throughout Europe and Colombia in South America.

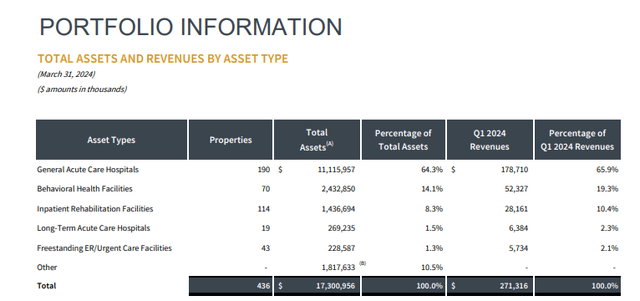

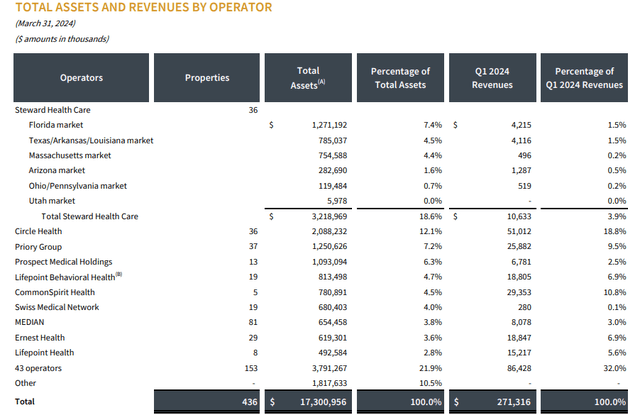

The corporate’s portfolio contains 436 healthcare properties with roughly 43,000 licensed beds which can be net-leased to 53 operators throughout 9 nations.

Normal Acute Care Hospitals constitutes the vast majority of the corporate’s portfolio and represents 65.9% of MPW’s first quarter revenues.

The hospital REIT invests in different healthcare properties similar to behavioral well being, rehabilitation, long-term care, and pressing care amenities.

Its subsequent largest property kind consists of behavioral well being clinics, which made up 19.3% of its Q1 income, adopted by rehab amenities that made up 10.4%.

Over the past yr, Medical Properties has shifted its focus from development to high quality, primarily bettering the standard of its stability sheet and liquidity place. The corporate has been actively disposing of non-core belongings and utilizing the proceeds to pay down its debt.

MPW – IR

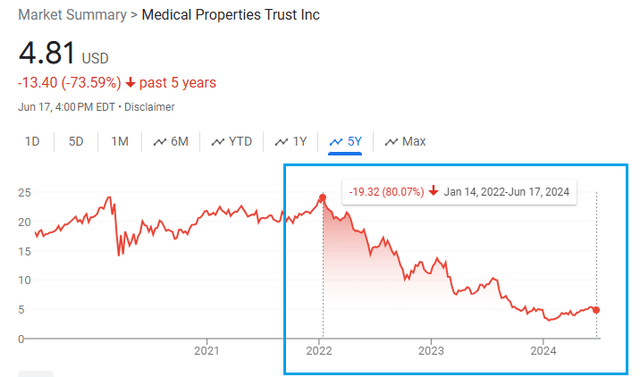

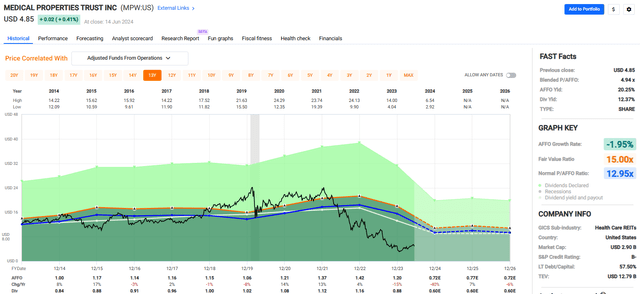

MPW’s inventory worth has been overwhelmed down for some time now, possibly “destroyed” can be a better option of phrases. The inventory has fallen 80.07% since January 2022.

Google

Our service, together with many others on Searching for Alpha, have chronicled the autumn of MPW fairly extensively, so I’ll simply sum it up right here:

- Excessive Tenant Focus

- Issues over Tenant Monetary Well being / hire protection

- Accusations of Unhealthy Administration

- Unsustainable AFFO Dividend Payout Ratios.

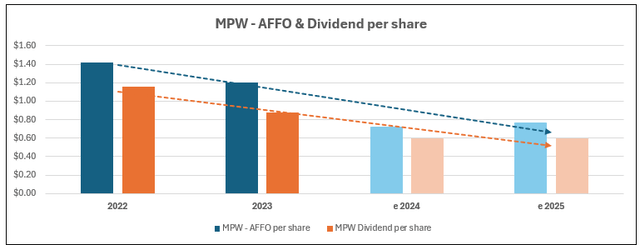

Between macroeconomic and company-specific elements, AFFO per share fell from $1.42 in 2022 to $1.20 in 2023, representing a 15% decline.

To make issues worse, MPW elected to chop its dividend by virtually half in 2023, decreasing its quarterly dividend from $0.29 to $0.15 per share.

Analysts count on AFFO to fall by -40% in 2024, to simply $0.72 per share.

FAST Graphs (compiled by iREIT®)

Round April of final yr, the corporate agreed to promote its Australia portfolio for AUD$1.2 billion, which included 11 hospitals leased to Healthscope.

Different property gross sales included 14 amenities repurchased by Prime Healthcare and the sale of MPW’s Connecticut hospitals to Yale.

Between the corporate’s property gross sales and its dividend minimize, it acknowledged a aim of accelerating incremental liquidity by $2.0 billion over the course of 2024.

Within the firm’s 1Q-24 earnings launch, it disclosed that it had executed complete liquidity transactions of $1.6 billion YTD, which represents 80% of its 2024 goal.

In fact, as MPW continues to promote its belongings, its funds from operations will take successful. Analysts count on AFFO to fall by -40% largely as a result of firm’s asset gross sales.

In Could 2024, MPW’s largest tenant, Steward Well being Care, filed for Chapter 11 chapter safety. MPW responded, saying it authorized funding for $75.0 million of debtor-in-possession financing to make sure the continuity of affected person care.

It stays to be seen how all of this may play out in courtroom, however it seems that the market was largely anticipating the transfer and that the Steward chapter was already “baked into the worth.”

At one level, Steward made up over 20% of MPW’s revenues. On the finish of Q1-24, Steward accounted for 3.9% of the corporate’s 1Q revenues.

MPW – IR

In some methods, the Steward chapter could have been a aid for MPW shareholders in that it lastly ripped the band-aid off and eliminated an overhang that has lasted for years.

The ultimate results of that is but to be decided, however the sooner MPW can re-tenant its properties, the higher.

MPW has mission-critical properties, as hospitals can not shut down or get replaced on-line.

Nonetheless, it’s the crucial nature of its properties that will get the federal government concerned, which is often not good for any enterprise within the non-public sector.

Whether or not as a consequence of delays or disputes in reimbursements for Medicare, a mandate to take care of sufferers no matter insurance coverage, or the latest instance of the federal government prohibiting elective surgical procedures, authorities regulation tends to be a headwind for personal companies.

At the moment, MPW is priced to fail with a P/AFFO of 4.94x. The inventory pays a 12.37% dividend yield that at present has ample protection with a 2023 AFFO payout ratio of 73.33%.

This has been the final word battleground inventory over the previous 2 years and can probably proceed to be extraordinarily unstable till its stability sheet is healthier positioned and the Steward chapter has been resolved.

We price Medical Properties Belief a Spec Purchase.

FAST Graphs

Arbor Realty Belief, Inc. (ABR)

Arbor Realty is a mortgage REIT that focuses on mortgage origination and different debt investments associated to actual property. The corporate operates via 2 enterprise segments, which embody its “Structured Enterprise” and its “Company Enterprise.”

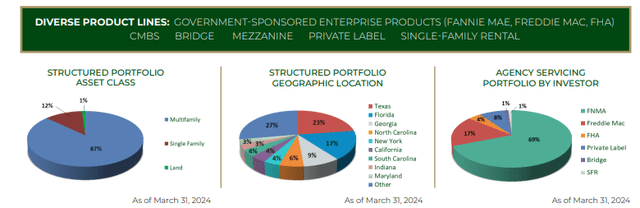

Via its Structured Enterprise the corporate invests in a portfolio of debt merchandise together with bridge loans, junior taking part curiosity in mortgages, mezzanine loans, and most popular fairness. Its structured loans are secured by a number of property varieties together with industrial, multifamily, and single-family rental.

Via the corporate’s Company Enterprise, it originates, sells, and providers multifamily company loans via government-sponsored enterprises (“GSEs”) similar to Fannie Mae and Freddie Mac. Arbor retains the servicing rights on virtually all of the loans that it originates and sells below the GSE packages.

Moreover, via its Company Enterprise, ABR originates and providers “Non-public Label” loans via conduit or industrial mortgage-backed securities (“CMBS”). Usually, its Non-public Label loans are pooled and securitized after which bought as securities to third-party buyers.

Throughout 1Q, the corporate had company mortgage originations of $846.3 million and a complete servicing portfolio of roughly $31.4 billion, up 9% for the reason that first quarter of 2023.

For its Structured Enterprise, the corporate executed $255.9 million in structured mortgage originations through the first quarter and reported a structured portfolio of roughly $12.3 billion.

The overwhelming majority of the collateral securing its structured portfolio is multifamily, which represents 87% of its structured portfolio, and the vast majority of its company servicing portfolio is bought via Fannie Mae (“FNMA”) at 69%.

ABR – IR

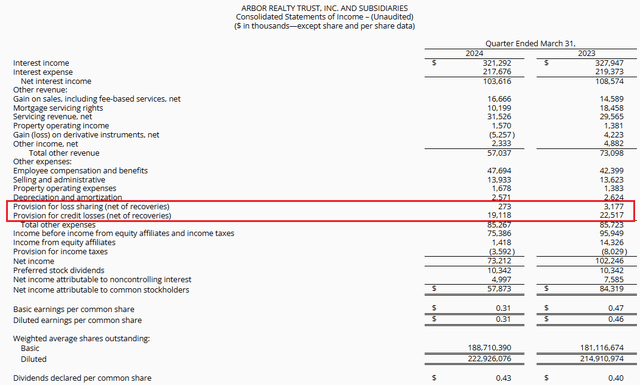

ABR launched its first quarter working ends in Could and reported web curiosity earnings of $103.6 million, down from $108.6 million in 1Q-23.

Internet earnings through the quarter was reported at $73.2 million, in comparison with web earnings of $102.2 million within the first quarter of 2023.

On a per-share foundation, the corporate reported diluted earnings of $0.31 throughout 1Q-24, in comparison with diluted EPS of $0.46 through the first quarter of 2023.

ABR’s distributable earnings (“DE”) throughout 1Q-24 got here in at $96.7 million, or $0.47 per share, in comparison with DE of $122.2 million, or $0.62 per share in 1Q-23.

Through the first quarter, the mortgage REIT declared a dividend of $0.43 per share, which represents a dividend payout ratio of ~91%.

Moreover, the corporate repurchased over $11.0 million of its widespread inventory at a median worth of $12.19 through the first quarter.

On the finish of the primary quarter, ABR reported a provision for loss sharing of $273,000, and a provision for credit score losses (web of recoveries) of $19.1 million.

This compares with a provision for loss sharing of three.2 million and a provision for credit score losses (web of recoveries) of $22.5 million within the first quarter of 2023.

ABR – IR

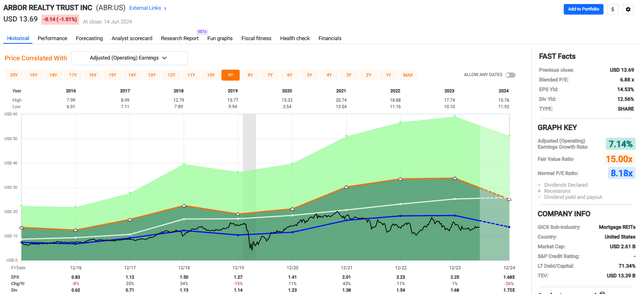

Since 2016 Arbor Realty has delivered a median adjusted working earnings development price of seven.14% and a median dividend development price of 15.28%.

The corporate had muted earnings development in 2023 and analysts count on EPS to fall by -26% in 2024 after which improve by +7% the next yr.

At its present worth, the inventory presents an EPS yield of 14.53% and a dividend yield of 12.56%, offering ample dividend protection. ABR is at present buying and selling at a P/E of 6.88x, which compares favorably to its common AFFO a number of of 8.18x.

We price Arbor Realty Belief a Tier 2 Purchase.

FAST Graphs

In Closing

I hope that you simply loved studying this text.

Please let me know for those who personal any of those REITs.

Do not forget that the sport will not be about how a lot you make.

However how a lot you’ll be able to lose.

Bear in mind to all the time shield your hard-earned principal at ALL prices.

Blissful REIT Investing!