Dilok Klaisataporn

Civilization thrives in vigilance — not complacency. ― Michael C. Haymes

There are many potential adjectives that could describe the current state of the market. Overbought, momentum driven, and frothy come to mind. However, the best word to describe the average market participant to me today is ‘complacent‘.

We entered 2024 with the expectation (according to the futures at the time) that the Federal Reserve would cut the Fed Funds rate five to six times by 25bps a pop. These cuts were supposed to start in March. Now futures are projecting the first cut to happen is a coin flip to start in June. Inflation has proven to be much ‘stickier’ than hoped so far in 2024. More proof of this came last week in the form of hotter than expected CPI and PPI reports, which pushed the yield on the 10-Year Treasury up over 20bps on the week to 4.3%.

Despite this, equities have continued in the strong rally they have been in since the lows of late October. The gains in 2024 to be fair, have largely been powered by good fourth quarter earnings reports, solid GDP growth figures and massive enthusiasm for all things AI related.

Equities have risen despite growing risks to the economy, the geopolitical landscape and the credit markets. Today, we take a look at three of those risks that investors are ignoring right now but shouldn’t be.

We took a look at the deterioration across much of the commercial real estate [CRE] space and the potential impacts to the regional banking system last week in an article entitled ‘Fed Rate Cuts Won’t Save The Commercial Real Estate Space’.

I am going to revisit this topic briefly, because the negative headlines around this part of the market seem to be rapidly accelerating. Let’s just take a look at a few of these that have hit the press just in the first few trading days of this week.

The owner of the Four Seasons in San Francisco is now technically in default having not made a payment on the property they bought in 2019 (wonderful timing dept.). They now have 90 days to bring their account current with its lender or face foreclosure.

Last year, the two largest hotels in San Francisco by key count went into default and were taken over by lenders. Of the 22 CMBS loans coming due on hotels in San Francisco over the next two years, 17 are on the ‘watch list’ for potential delinquency according to CoStar. The sector is suffering from many well-known ills in the city, one of which is a reduced convention schedule compared to previous years.

A $130.1 million commercial mortgage-backed securities [CMBS] hotel loan backed by the 1,004-room Los Angeles Airport Marriott went on its servicer’s watchlist this week after a drop in debt service coverage ratio, according to an alert earlier this week from Trepp.

Tuesday, the Pittsburgh Post-Gazette estimated that nearly half of all office real estate in Downtown Pittsburgh could be vacant four years from now. The information they gathered found 17 office buildings are in “significant distress“. In addition, another nine are in “pending distress” meaning they are either approaching foreclosure or at risk of foreclosure. These 26 buildings account for over 60% of the office footprint in downtown Pittsburgh to put in perspective.

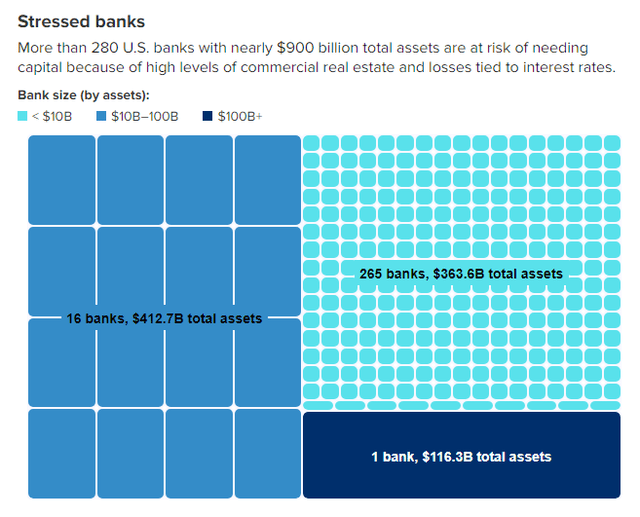

Klaros Group

Also on Tuesday, CNBC ran a piece detailing the stress in the regional banking system based on a new research report by Klaros Group. Looking at 4,000 banks, they found over 280 that had significant commercial real estate exposure and large unrealized losses on their bond portfolios thanks to the rate surge of the past two years. While none of these are major institutions and most are community banks, the report projects banks holding some $900 billion in assets potentially need significant capital infusions.

In summary, the CRE situation is one investors should keep a close eye on and the headlines are likely to get worse before they get better. I have recently added a bit to my long dated, out of the money bear put spreads against the SPDR® S&P Regional Banking ETF (KRE) due to these rising concerns.

The Ukrainian Conflict:

The second risk investors are much too complacent about in my opinion, is the situation in Ukraine. As the conflict rolls into its third year, it has moved somewhat off the radar as the war has been mostly stalemated over the past year. However, that could change in the coming months. Russian armed forces recently took back the last major fortress/best defensible line in the Donbas region after a bloody months long battle.

Ukrainians are short of manpower and ammunition, and $60 billion in additional funding remains in limbo from the U.S. However, even if that aid is eventually approved, it may not alter the situation on the ground. This has become a war of attrition. This puts Ukraine at a severe disadvantage given Russia is four times larger, enjoys air superiority and has a massive artillery advantage. It is hard to see the Russian army not consolidating the remaining part of the Donbas region it doesn’t control at the very least in the next few months.

Britannia

Hopefully, this leads to peace talks as it seems beyond obvious now that Ukraine is incapable of expelling Russia militarily from the territory it has taken. An armistice, ala what still exists between South Korea and North Korea is probably the second-best scenario, as focus might eventually be able to shift to reconstruction.

However, it is quite possible Russian forces will use the ideal battle conditions of late spring and early summer, where the ground is hard and the weather is good, allowing for full mobility of heavy vehicles like tanks, to mount a significant offensive. If they achieve a major breakthrough or advance significantly towards the last major port Ukraine controls in Odessa, it could signal a whole new ball game.

Given the average age of a Ukrainian soldier is north of 40 years old and after more than two years of constant war, a collapse of parts of Ukrainian armed forces cannot be discounted entirely. Even the NY Times recently mentioned that as one potential outcome. In either scenario, what would be the response of NATO and the West be? Leaders of France and Poland have recently stated that the potential for NATO boots on the ground should not be discounted. If the war escalates and the potential for a direct conflict between Russia and the West grows, how big of an impact would that have on the markets and the global economy? My guess is it would be hugely significant and very negative.

The Debt Bomb:

Then there is the massive amount of debt that has been accumulated in many parts of the system, and the impacts higher interest rates will have as debt maturities need to be rolled over at much higher rates.

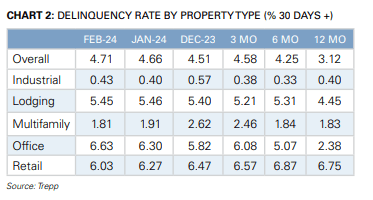

CMBS Delinquency Rates For February 2024 (Trepp)

On the CRE side, more than $900 billion of CRE debt needs to be refinanced in 2024. Delinquency rates on CMBS continues to increase in some sectors of CRE like on office properties. Trepp posted its February summary of delinquency rates across CRE sub-sectors on Wednesday. As can be seen above, it showed office delinquency rates rose another 33bps on a month-over-month basis last month. They now stand over 6.6%.

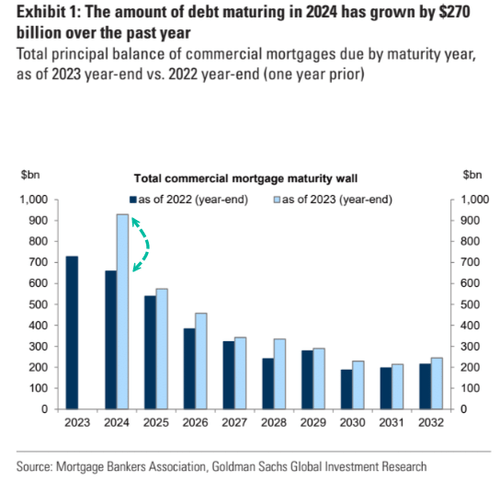

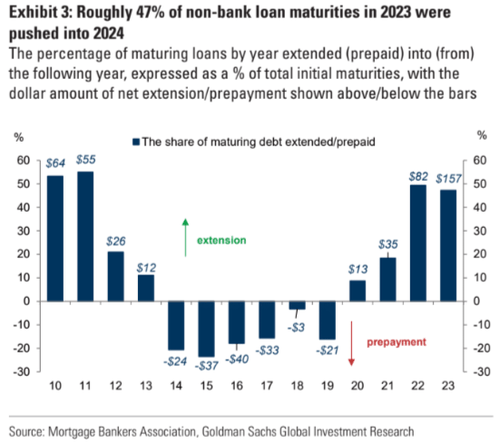

Mortgage Bankers Association, Goldman Sachs Investment (Commentary via ZeroHedge)Research

Delinquency rates might even be worse, as an increasing amount of loans are being ‘modified‘ or what used to be called ‘extend and pretend‘ during the financial crisis of a decade and a half ago.

Mortgage Bankers Association, Goldman Sachs Investment (Commentary via ZeroHedge)

Corporations will face significant increases in interest costs as portions of their balance sheets roll over. This will add additional stress to the system after corporate debt defaults already soared 80% in 2023. Fortunately, most corporations will maintain good credit profiles. However, they will have to pay higher interest costs resulting in lower margins and profits. A typical example is Hilton Worldwide Holdings Inc. (HLT) which, according to its 10-K, paid $464 million in net interest costs in FY2023 compared to $415 million in FY2023. Overall, long-term debt at Hilton moved up five percent on a year-over-year basis, it should be noted.

Then there is the 800lb gorilla in the room that everyone is aware of, but few want to focus on. And that is the massive amounts of debt being taken on via government entities. This is a mixed picture on the local level, with states like Texas and Florida boasting substantial surpluses this fiscal year while California is trying to plug a projected $68 billion fiscal deficit.

The picture at the federal level is crystal clear, as there is nothing but red ink far and wide. This is currently boosting economic growth significantly, but clearly is not sustainable and also is a factor in why inflation is ‘sticky‘ and the yield on the 10-Year Treasury is solidifying above the four percent level. This will mean the country will be paying north of a $1 trillion annually to service the now over $34 trillion debt in the near future.

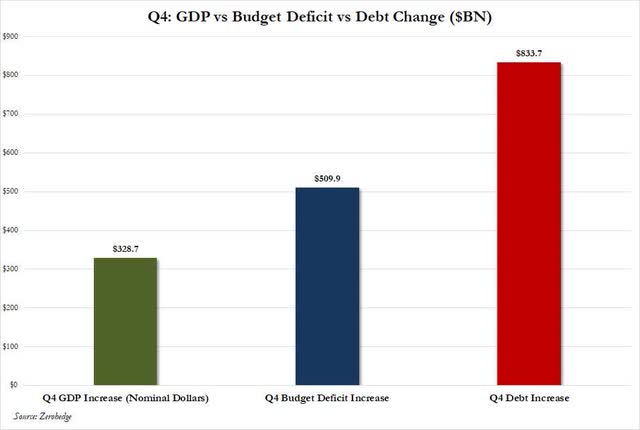

ZeroHedge

Let’s take the fourth quarter as an example of the convergence of these forces. U.S. GDP grew at 3.1% for the quarter meaning approximately $320 billion in national GDP was added during the quarter. In order to achieve this growth, the federal government ran nearly a $510 billion deficit over those three months and the Treasury Department added over $830 billion to the national debt.

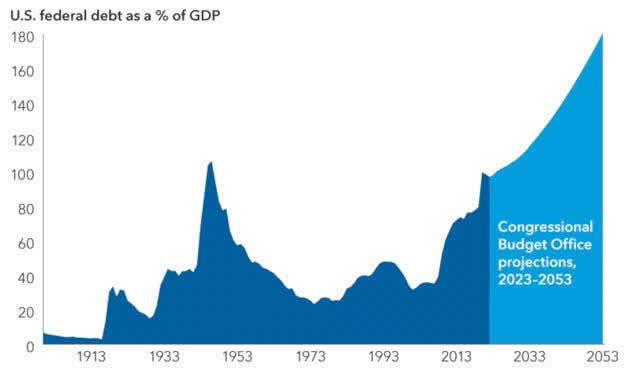

Congressional Budget Office, Capital Economics

This pace of additional debt obligations continues to spiral in the fiscal 2024 year where the federal government has run up a $830 billion deficit in the first five months of their new fiscal year. With debt to GDP ratios already at the highest in U.S. history, an investor clearly has to ask at what point do the ‘chickens come home to roost‘?

Given these concerns that the market is ignoring for the moment, I remain quite cautious on the overall market and believe there will be much better entry points in the coming quarters. Approximately half of my current portfolio is allocated to three and six-month treasuries, which yield nearly 5.4%, a good bit above the current inflation rate. These risk-free instruments are one of easiest ‘no-brainer‘ investment decisions someone who is wary of the overall market can make right now.

40% to 45% of my portfolio is within covered call holdings which provide some downside risk mitigation and will provide a more than solid return even in a sideways market. Two to three percent of my portfolio is cheap portfolio insurance in the form of long-dated, out of the money bear put spreads against the major averages that will pay off massively in a bear market scenario) is also available thanks to the historically low S&P VIX Index (VIX). The rest of the portfolio is in cash and some standalone equity holdings.

There is a time for greed and there is a time for caution. Given how investors and the market are substantially more complacent around significant risks than they should be, now is the time for the latter.