Kwarkot/iStock through Getty Photographs

Investing In Actual Property Shares to Combat Inflation

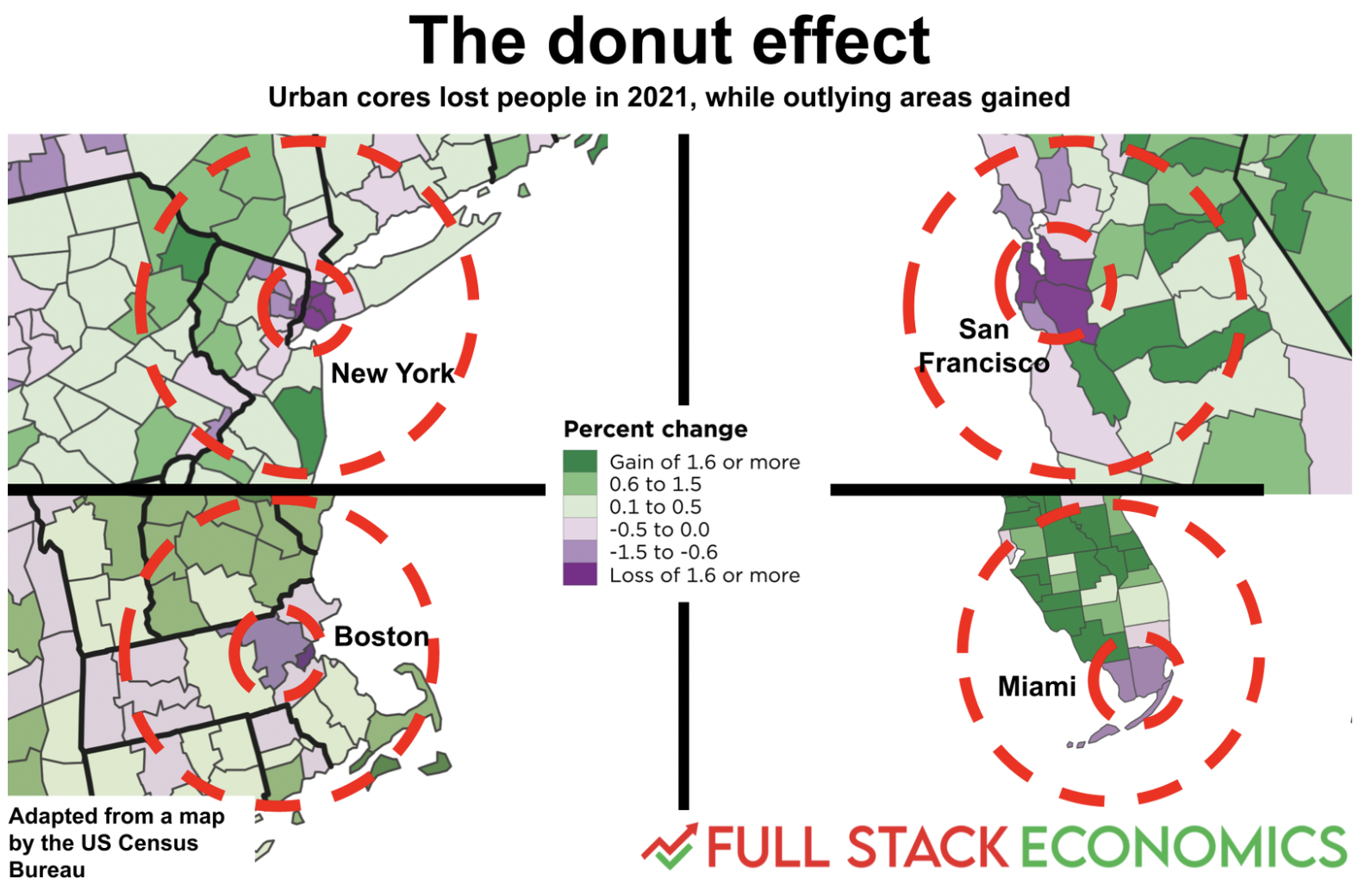

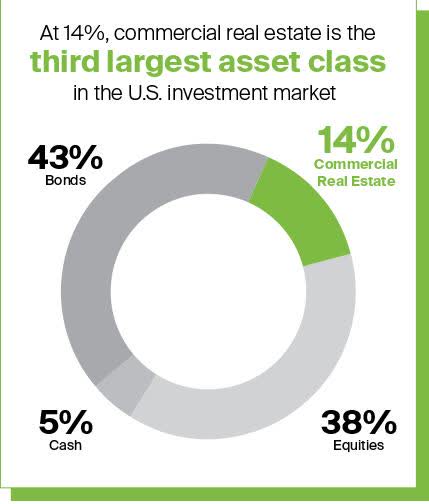

One in every of final 12 months’s top-performing sectors, actual property funding trusts (REITs), are standard amongst buyers given the bustling actual property market, dividend advantages, and portfolio diversification. The third-largest asset class within the United States, industrial actual property, REITs can supply a diversified mix of actual property property and long-term complete returns just like shares. Rising inflation can be one of many major drivers of REITs and driving inflows as buyers search choices to generate earnings and assist enhance their risk-return profiles. Together with the advantages of investing in REITs, I might be remiss to not point out potential dangers.

Largest U.S. Asset Courses

Largest U.S. Asset Courses (REIT.com)

If the Fed strikes ahead with aggressive price hikes (which they’ve indicated), we may see a slowdown in actual property. The 2 most important variables impacting actual property affordability are the underlying property’s value and the associated fee to finance the property. Rising curiosity will increase the price of debt capital, which will increase total prices. As a result of asset values have already appreciated considerably, a rise within the value of debt capital or leverage will lower the affordability of property values, therefore probably inflicting a slowdown in demand. One other fast threat entails rising bond yields.

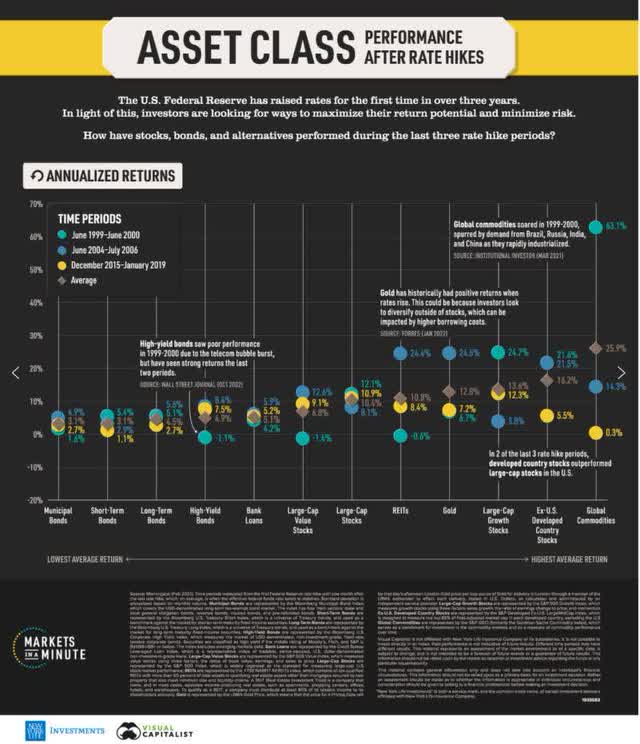

REITs’ returns are inclined to carry out higher than bond returns. The choose asset courses within the visible under over the past three price hikes clarify that REITs do effectively and bonds skilled poor efficiency throughout that interval. In a low or falling rate of interest setting, buyers are inclined to gravitate to high-income or dividend-paying shares to fulfill their earnings wants.

Asset Class Efficiency Submit Price Hikes (New York Life Investments)

When charges rise, buyers are inclined to abandon excessive dividend-paying shares for bonds that now have an analogous yield and fewer perceived threat and volatility. As we have a look at the picture under, REITs had one of many lowest common dangers, showcasing the efficiency of various asset courses over three durations following price hikes. And whereas previous efficiency is just not a assure of future outcomes, “Rising charges usually means the economic system is rising, which interprets into larger demand for actual property and the flexibility to cost greater hire. Apparently, a 40-year evaluation by Nareit discovered that REITs carried out effectively throughout each excessive inflation and low inflation durations. This implies they’re much less topic to prediction threat, or the chance that buyers accurately predict high-inflation durations,” writes Jenna Ross of Visible Capitalist.

Asset Class Efficiency Over the Final Three Curiosity Price Hikes

Asset Class Efficiency Over the Final Three Curiosity Price Hikes (Visible Capitalist)

With the 10-year U.S. Treasury yield rising to its highest stage in three years (2.79%), the bond market decline accelerated as charges elevated. Our purpose is to pinpoint investments with traits that may beat inflation, and REITs can try this. Different investments that embody tangible property can assist defend in opposition to inflation. Traditionally, REITs have benefited from surprising inflation, providing buyers a complete return funding and tax benefits. These advantages, amongst others, are why we’re recommending three prime REITs to contemplate in your portfolio.

3 Prime REIT Shares to Make investments In

As a portfolio diversifier aiding to scale back the portfolio dangers inherent in actual property or actual property shares basically, REITs traditionally present aggressive returns pushed by common dividend earnings and average to long-term capital appreciation, just like worth shares. As a result of REITs are liquid with engaging return potential in low and high-inflation environments and commerce on main inventory exchanges, listed here are three of my top-ranked REITs to assist struggle inflation.

1. Important Properties Realty Belief, Inc. (NYSE:EPRT)

Market Capitalization: $3.22B

Dividend Yield: 4.08%

P/AFFO (FWD): 16.83

Quant Ranking: Sturdy Purchase

Rents and property values have a tendency to extend when inflation is current. When rental charges improve, REITs can function a strong hedge as property values additionally rise and help their dividend progress for a secure earnings stream.

Important Properties Realty Belief (EPRT) is an actual property firm that engages within the possession, acquisition, and administration of single-tenant properties. EPRT focuses on long-term web leases to middle-market firms within the service- and experience-based sectors. Along with rental funds, web leases require tenants to pay some, or all taxes, charges, and upkeep related to the property; EPRT receives hire put up bills. A few of the notable names in EPRT’s portfolio embody restaurant chains like Taco Bell, McDonald’s, and Arby’s and firms like Marriott, Circle Ok, and Cinemark.

EPRT Valuation and Progress

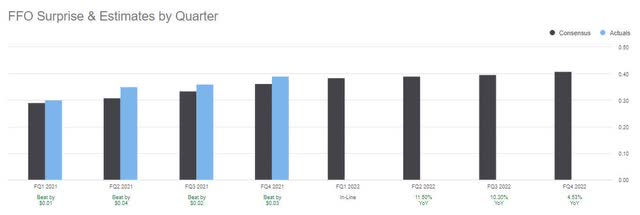

Sustaining a powerful steadiness sheet and shutting out 2021 with a report $322M of investments for This autumn and $974M for the complete 12 months, Important Properties Realty Belief ranks #2 out of 20 in its business in keeping with our quant rankings. It continues to outperform after three consecutive top- and bottom-line earnings beats, so the newest This autumn 2021 earnings ought to come as no shock. With an EPS of $0.24 beat by $0.04 and income of $65.02M outperformed by +58% ($3.83M), EPRT boasts “the very best AFFO per share progress in its peer group, and its steerage requires the very best progress amongst its friends,” writes Austin Rogers, In search of Alpha Market Writer.

EPRT FFO 2021 Quarterly Shock & Estimates

EPRT FFO 2021 Quarterly Shock & Estimates (In search of Alpha Premium)

With a ahead AFFO a number of of 16.83x, greater than 10% under the sector with expectations of 2022 main progress inside its business, EPRT comes at a pretty B- total valuation, substantiating our sturdy purchase.

EPRT Progress Grade (In search of Alpha Premium)

Paying an above-average dividend yield of 4.13% after large earnings outcomes, EPRT raised its dividend by 4% to $0.26. Though progress could average in 2022 amid the financial backdrop and geopolitical issues, EPRT’s “differentiated give attention to capital deployment methods has insulated us from the elevated competitors, which is evidenced by our preliminary money yields averaging 7.1% in 2020 and seven% in 2021,” mentioned EPRT President and CEO Peter Mavoides in the course of the This autumn Earnings Name.

EPRT Profitability

EPRT ended This autumn with 1,451 leased properties and greater than 311 tenants, with early childhood schooling as their largest business at 14.6% of ABR, adopted by eating places (12.4%), medical services (11.9%), and automobile washes at 11%. Earnings-producing gross property elevated by $3.54B to finish 2021, and web debt to annualized adjusted EBITDA for a similar interval was 4.7x. “Our steadiness sheet and liquidity place stays extremely supportive of our funding pipeline… our portfolio outlook and our sturdy efficiency in 2021, notably in the course of the fourth quarter and now persevering with into the primary quarter of 2022, supplied us with the premise to extend our 2022 AFFO per share steerage to a spread of $1.47 to $1.51, which, as Pete famous, implies a 14% year-over-year progress on the midpoint,” mentioned Mark Patten, EPRT CFO.

EPRT Quarterly Estimates Revisions (In search of Alpha Premium)

Housing shortages all through the U.S. and report promoting pricing are driving demand and boosting money circulation for actual property firms. Wall Avenue analysts and the EPRT govt staff are optimistic that it’ll proceed to develop income and money circulation. Given the corporate’s A Revisions grade and actual property shares’ potential as dependable sources of earnings, we imagine EPRT is a powerful purchase, together with our subsequent decide, WPC.

2. W. P. Carey Inc. (NYSE:WPC)

Market Capitalization: $15.84B

Dividend Yield: 5.17%

P/AFFO (FWD): 15.68

Quant Ranking: Sturdy Purchase

W. P. Carey Inc. (WPC) may be very bullish and ranks among the many largest web lease REITs with almost a $16B market capitalization and roughly $18B in diversified industrial actual property portfolio. Invested in premier single-tenant warehouses, workplace, retail, and self-storage models, rising inflation and fears of an financial downturn make WPC a wonderful actual property inventory decide.

WPC Valuation and Progress

Like our earlier inventory decide, because the Fed raises charges, REITs like WPC can shift these prices onto their tenants in order that the value of upkeep companies and instruments related to sustaining properties and taxes don’t have an effect on their backside line. WPC’s properties embody 1,215 web leases that generate roughly $1.2B in annualized rental earnings, 352 tenants, a 98.5% occupancy price, and 99% of leases with hire escalations. With almost half of its rental income generated from industrial actual property and mission-critical logistics, WPC advantages from the availability chain headwinds that different industries are experiencing. Due to this fact, we imagine it’s a lower-risk funding relative to different sectors.

WPC Diversification Professional Forma (WPC Financials (information from 12/31/21))

As we have a look at its various tenant holdings and geographic areas, WPC ought to profit from the rising price setting, particularly as “~37% of its rental income comes from Europe and some different non-U.S. geographies. This offers it publicity to decrease rates of interest that it could actually arbitrage in opposition to the excessive inflation/rising price setting within the U.S,” writes Samuel Smith, In search of Alpha Market writer. “Greater inflation emphasised the advantages of diversification in our hire escalations—one thing our founder etched in our lease construction almost 50 years in the past,” CEO Jason Fox emphasised. Together with its geographic diversification and the sturdy demand for industrial and logistics property, WPC has showcased a strong progress pipeline with almost $2B in new property acquisitions, hire will increase for 2022, and it’s constructing on its sturdy AFFO per share progress (6.1%) from 2021. With a ahead P/AFFO grade of B, at 15.68x, which is greater than a 17% distinction to the sector, we imagine WPC is buying and selling at a reduction with ample room for continued progress. During the last 5 years, WPC’s share value has been on an upward pattern. Though solely up 1% YTD, over one 12 months, WPC’s share value is +15%, and over 5 years, +30%. As evidenced by its momentum grade under, the inventory performs effectively with gradual will increase and outperforms its sector friends.

WPC Momentum (In search of Alpha Premium)

Along with 59% of their REIT rents coming from leases tied to CPI which surged to heights not seen in 40 years, WPC is effectively positioned to capitalize within the present and future setting. Along with rating as one in all our top-rated diversified REITs, WPC raised its quarterly dividend to $1.057/share final month, indicating its present energy and future dedication to shareholders. We imagine WPC will proceed to be a powerful purchase into the longer term and earlier than we wrap up this REITs article, we have now to incorporate self-storage services.

3. Life Storage, Inc. (NYSE:LSI)

Market Capitalization: $12.42B

Dividend Yield: 2.77%

P/AFFO (FWD): 25.41

Quant Ranking: Sturdy Purchase

Adjusted earnings storage REITs are one other good resolution. Many observe a month-to-month re-pricing mannequin, whereby they will regulate charges upwards rapidly, serving to offset the rising value of inflation. Additionally they are typically extra recession resilient than many different sectors, which is why Life Storage, Inc. (LSI) is my remaining REIT decide.

Self-storage is a distinct segment market that provides benefits like low capital and operational bills, growing money flows, and vast working margins. With greater than 1,000 areas in america and Canada, warehouse rents are nice investments, primarily as e-commerce drives warehouse demand and the necessity for storage of merchandise and the tech business homes its serves. Provide chain and labor shortages have saved occupancy and rental charges excessive, and why we imagine Life Storage has a progress benefit over many different REITs.

LSI Valuation and Progress

Though In search of Alpha’s Issue Grades give LSI a lower than ideally suited D+ valuation grade, we nonetheless imagine this actual property inventory is a powerful purchase given the collective traits that embody progress, profitability, momentum, and earnings. Yr-to-date the inventory is trending up, with a one-year value efficiency +61%, its five-year up an astounding 155%, and because the A+ momentum grade under depicts, the gradual value efficiency is outperforming its sector friends.

LSI Momentum (In search of Alpha Premium)

Over the previous few years, LSI has beat each top-and bottom-line earnings with the newest resulting in an A- revision grade and 6 FY1 Up revisions inside the final 90 days. This autumn 2021 EPS of $0.90 beat by $0.05 and income of $221.16M beat by $10.10M (+32% YoY). With a median occupancy of 94.2%, report acquisition quantity plus the addition of 144 properties to finish the 12 months, LSI continues to develop through acquisitions and plans so as to add extra shops all through the Solar Belt area within the U.S. which is characterised by excessive financial progress.

Life Storage Progress Technique and Acquisitions

LSI Progress Technique and Acquisitions (Life Storage)

During the last 5 years, LSI has seen large progress in its retailer depend, by 99%. “We’re off to a powerful begin in 2022, with January month-end occupancy of 93.6%, which is 80 foundation factors greater than January 2021. Asking charges for January are up 26% year-over-year. And just like final 12 months, we’re additionally beginning off the 12 months with a really sturdy acquisition pipeline with $483 million already closed or below contract. With reference to steerage for 2022, we estimate our adjusted funds from operations per share to be on the midpoint of $5.98 for the 12 months, which might be 18% progress over 2021,” mentioned Life Storage CEO Joseph Saffire in the course of the This autumn Earnings Name.

Though Life Storage has not minimize its dividend within the final decade, it froze it in 2018, reinstated it, and just lately declared a $1.00/share quarterly dividend, which is in keeping with earlier quarters. With a present ahead 2.77% dividend yield and wholesome steadiness sheet, we foresee the corporate benefiting from the excessive inflationary setting by persevering with to showcase strong earnings progress, prompting this REIT to achieve in recognition.

The recognition of REITs is growing as buyers search investments which might be an inflation hedge whereas providing greater dividend yields and progress with potential valuation appreciation. As a result of actual property shares usually profit from inflation, REITs are worthwhile property to contemplate in a portfolio, given hire hikes linked to the patron value index. “REIT M&A quantity has damaged a 15-year report that was set again in 2006… all main sectors have contributed to the report, which means a really favorable deal-making setting for our sector. Confidence has returned, extra REITs have sturdy currencies to make use of in strategic mergers, debt is traditionally low cost, and debt markets are liquid,” mentioned Steve Hentschel, Head of M&A and Company Advisory Group at JLL Capital Markets. We imagine our prime three picks outlined on this article are ripe for the selecting and wonderful choices to struggle inflation.

REITs Are Nice Inflation Hedges That Possess Terrific Yields

REITs can supply strong returns over lengthy durations, amid rising rates of interest, particularly within the present setting. Many REITs have confirmed resilient as inflationary hedges and income-producing as costs proceed to rise, and the three picks outlined come at affordable value factors. With sturdy dividend yields and progress and profitability prospects, buyers and these REITs will seemingly thrive.

We have now many Prime REITs so that you can select or take a look at our Prime-Rated Dividend Shares to assist inflation-proof your portfolio. Our funding analysis instruments assist to make sure you are furnished with the very best assets to make knowledgeable funding selections.