Published on December 28th, 2022 by Nate Parsh

Healthcare hasn’t been spared in the sell-off in markets over the last year. The markets have faced multiple headwinds during this period, including aggressive tightening of fiscal policy by the Federal Reserve, the Russian invasion of Ukraine, and severe Covid-19 restrictions in China, among others.

That said, the healthcare sector is usually one of the safest places to invest. The products, medicines, and medical devices provided by the companies in this sector often remain in high demand during recessionary periods.

This ability to thrive in a difficult economic environment is evidence of a very strong business model and is a major reason why a number of healthcare companies have attained Dividend Aristocrat status.

The Dividend Aristocrats are a select group of 65 stocks in the S&P 500 Index, with 25+ consecutive years of dividend increases.

You can download an Excel spreadsheet of all 65 Dividend Aristocrats (with metrics that matter such as dividend yields and price-to-earnings ratios) by clicking the link below:

This article will examine three names in the healthcare sector that have a trailing one-year total return of at least -10% or worse, but offer at least 10% total returns over the next five years. Each stock also pays a market-beating dividend that appears to be very safe.

Top Beaten Up Healthcare Stock #1: Walgreens Boots Alliance Inc. (WBA)

- 5-year expected total return: 11.6%

- 1-year total return: -19.9%

Walgreens is a top name in retail pharmacy, having the largest footprint of any such company in both the U.S. and Europe. The company has operations in more than 9 countries, employs more than 315,000 people, and has more than 13,000 stores across the U.S., Europe, and Latin America.

This large-scale operation allows Walgreens to address a sizeable customer pool that most competitors cannot match. Such an operation is attractive to partners. For example, the company and AmerisourceBergen Corporation (ABC) have an agreement in place for Walgreens to be the primary distributor for branded and generic drugs for the company until at least 2029.

This unmatched size and scale will be beneficial to the company as the world’s population continues to age. According to the World Health Organization, the number of people over the age of 60 outnumbered the children under the age of 5 in 2020. By 2050, the percentage of the world’s population over the age of 60 years will almost double to 22% from 2015 levels.

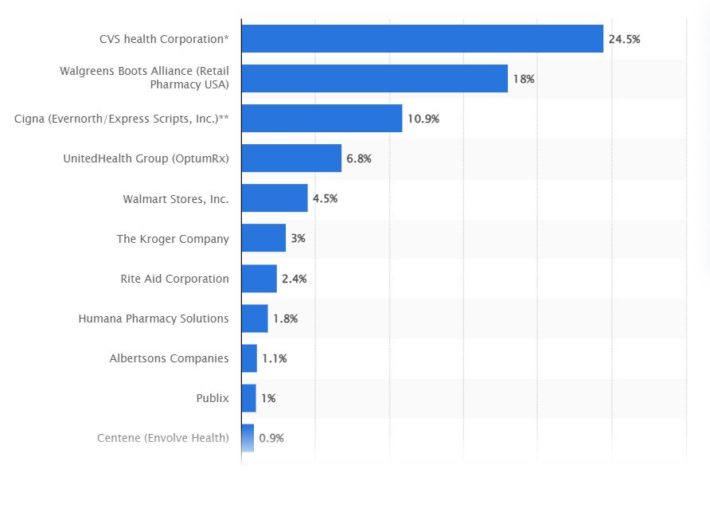

As people age, they tend to require more health care solutions. This will benefit the sector in general, but Walgreens in particular because off the number of prescriptions and immunizations the company fills every year. For example, Walgreens filled 820 million prescriptions and immunizations in the U.S. alone during fiscal year 2022. As a result, Walgreens trails just CVS Health Corporation (CVS) in terms of prescription drug market share.

Source: Statista

These catalysts should allow for Walgreens to grow at least 4% annually through fiscal year 2028.

Walgreens has raised its dividend for 47 years in a row, making the company a Dividend Aristocrat and just three years away from becoming a Dividend King. Walgreens offers a yield of 5.0% that easily tops the average yield of 1.7% for the S&P 500 Index. The projected payout ratio is just 42% for this year.

Walgreens has a price-to-earnings ratio of 8.5, below our target of 10 times earnings. Reaching our valuation target by fiscal year 2028 could add 3.6% to annual returns.

Therefore, we expect that Walgreens will return 11.6% annually over the next five years due to 4% earnings growth, the 5.0% dividend yield, and a 3.6% tailwind from multiple expansion.

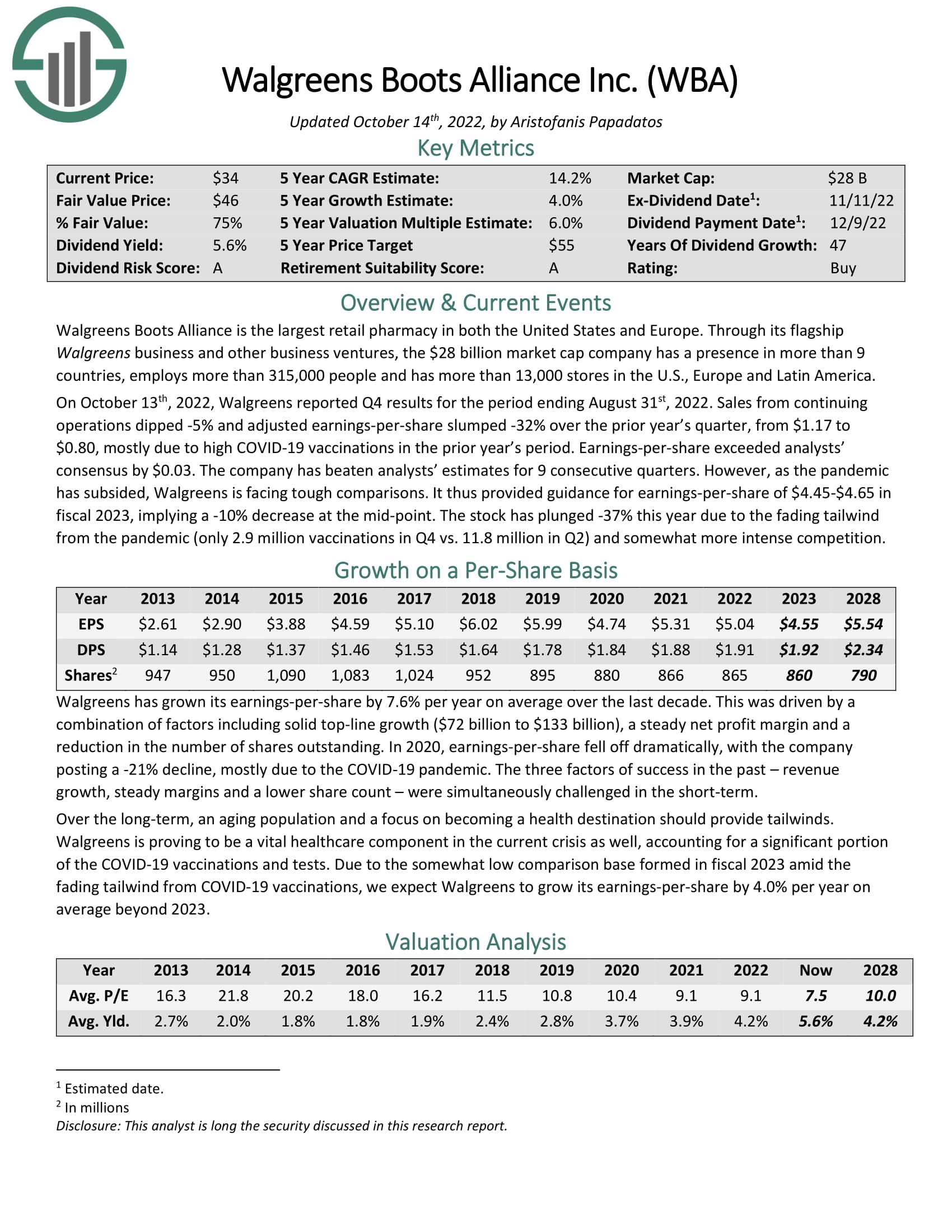

Click here to download our most recent Sure Analysis report on Walgreens Boots Alliance Inc. (preview of page 1 of 3 shown below):

Top Beaten Up Healthcare Stock #2: Medtronic plc (MDT)

- 5-year expected total return: 12.1%

- 1-year total return: -22.4%

Medtronic is the largest manufacture of biomedical devices and implantable technologies in the world. This gives the company a scale unmatched by most peers as Medtronic’s products are sold in more than 150 countries.

The company is composed of four segments, including Cardiovascular, Medical Surgical, Neuroscience, and Diabetes. The company’s product includes implantable pacemakers, defibrillators, valves, stapling devices, sealing instruments, robotic-assisted surgery products, insulin pumps, and glucose monitoring systems. This offers some diversification for Medtronic if an individual segment or product line faces headwinds while providing customers with a long list of products. This could make Medtronic a one-stop for major customers looking to acquire the products that they need.

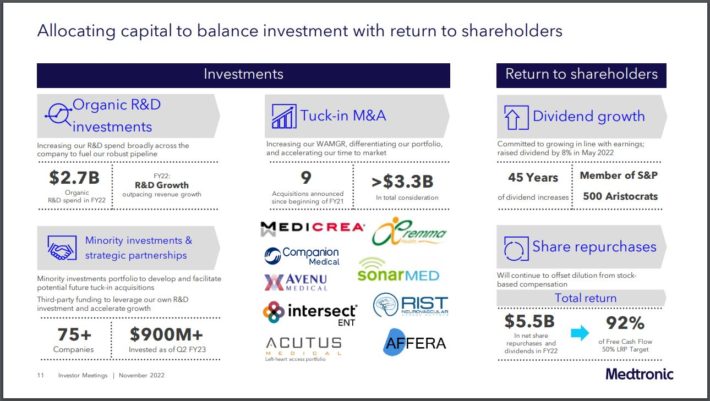

Medtronic has also been active on the acquisition front in order to improve its positioning in a host of categories.

Source: Investor Presentation

The company has announced nine acquisitions over the last two fiscal years alone. Most of these have been of the bolt-on variety, helping to improve Medtronic’s leadership position. For example, the company completed its purchase of Affera, Inc. on August, 30th, 2022. The addition of Affera brings to Medtronic’s portfolio the first-ever cardiac mapping and navigation platform, which will help provide solutions for patients with irregular heartbeats and will be compatible with the company’s existing technology.

Acquisitions have caused Medtronic to issue new shares over the last decade, which has kept a lid on earnings growth over this period. Still, the fiscal years 2013 through 2022 saw earnings grow by 4.5% annually. We believe a combination of organic growth and contributions from acquisitions will drive 6.0% yearly growth over the next five fiscal years.

The decline in the share price has driven Medtronic’s yield to 3.5%, a level rarely seen in more than a decade for the stock. We forecast a payout ratio of 52%, which likely means that the company’s 45-year dividend growth streak should remain intact.

Medtronic has a price-to-earnings ratio of 14.7, one of the lowest valuations the stock has traded at since at least 2013. Our target price-to-earnings ratio is 17, which implies a tailwind from multiple expansion of 3.0% per year.

As a result, we project that shareholders of Medtronic could see annual returns totaling 12.1%, stemming from 6.0% earnings growth, the 3.5% dividend yield, and a 3.0% contribution from the expanding multiple.

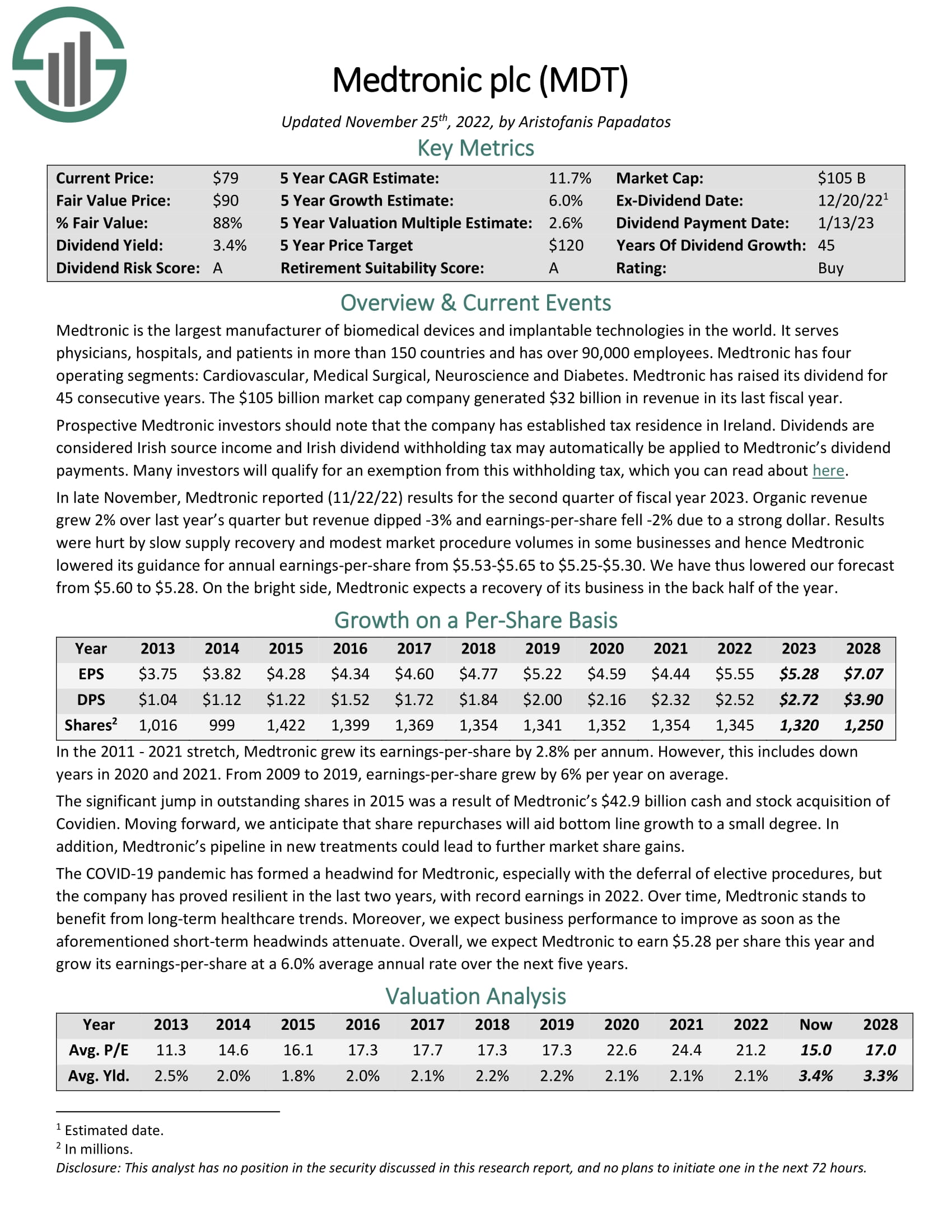

Click here to download our most recent Sure Analysis report on Medtronic plc (preview of page 1 of 3 shown below):

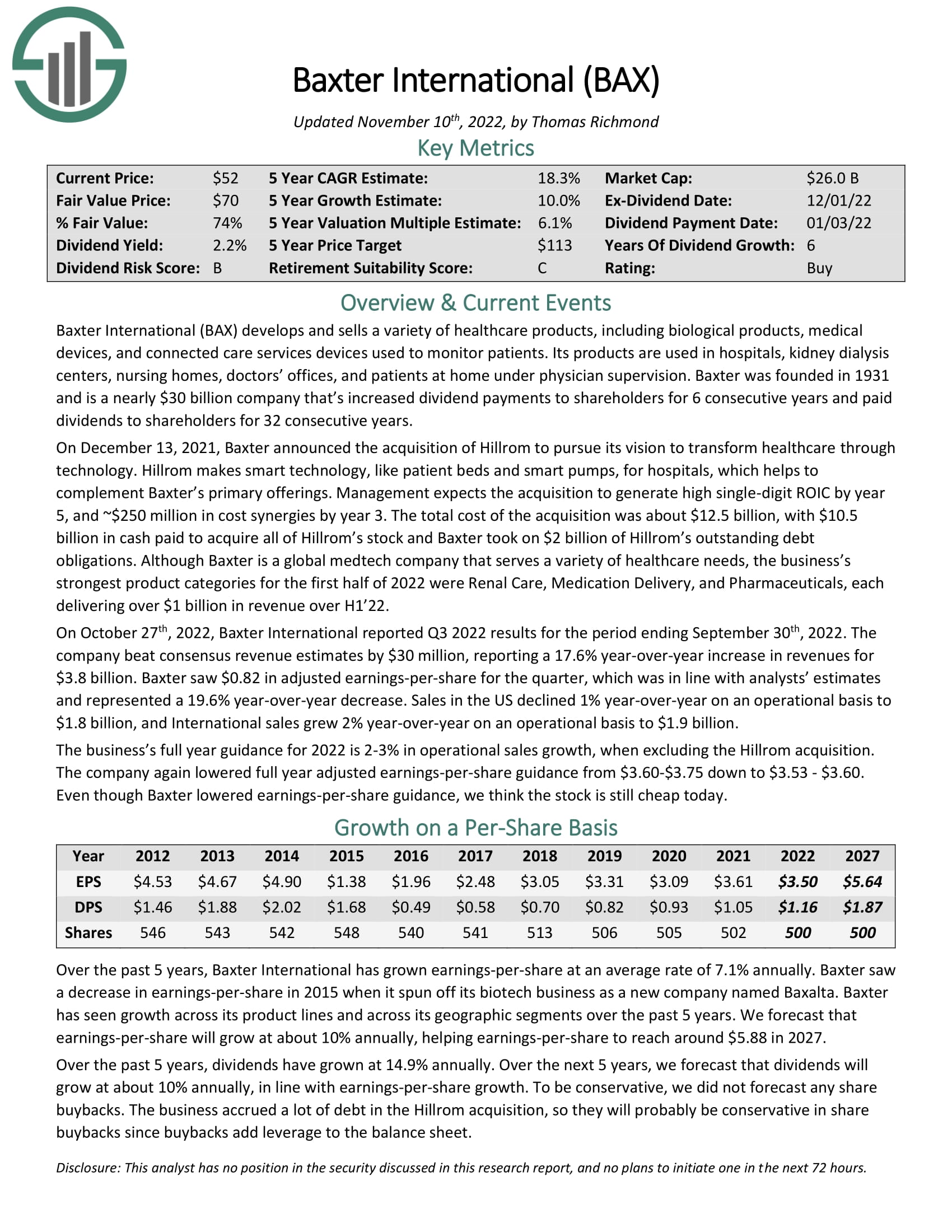

Top Beaten Up Healthcare Stock #3: Baxter International (BAX)

- 5-year expected total return: 19.2%

- 1-year total return: -40.3%

Baxter develops and sells a variety of healthcare products, which includes biological products, medical devices and connected care services devices used to monitor patients. This gives the company a fairly wide customer pool, which includes hospitals, doctors’ offices, and nursing homes. Baxter also is a leading name in the area of kidney health, making dialysis centers one of the company’s top customers. The company’s top performing businesses so far during the year have been Renal Care, Medication Delivery, and Pharmaceuticals.

The company has also used acquisitions to drive growth. For example, Baxter announced on December 13th, 2022 that it had agreed to purchase Hillrom, a maker of smart technology such as patient beds and smart pumps. The purchase cost $12.5 billion, but should provide high single-digit return on invested capital by the fifth year after closing.

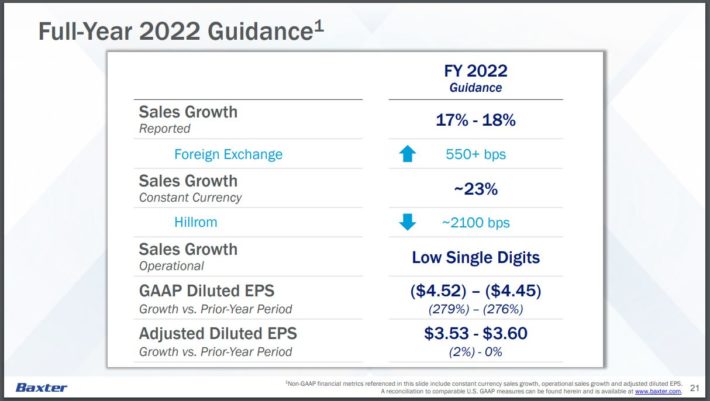

Hillrom is already factoring heavily into results as it is expected to contribute meaningfully to growth this year.

Source: Investor Presentation

Baxter spun off its biotech company Baxalta in 2015, which led to a decrease in earnings-per-share. However, the company’s earnings-per-share have increased at an annual rate of just over 7% over the past five years. This growth has been driven by gains across all products lines and in most geographic regions, demonstrating the strength of Baxter’s product portfolio as well as its reach. Therefore, we forecast earnings growth of 10% per year for the next five years.

The company has raised its dividend every year since spinning off Baxalta. Shareholders have also received a dividend for 32 consecutive years. The projected payout ratio for the current year is just 33%, making Baxter’s dividend likely very safe. Shares yield 2.2%.

Shares of Baxter are trading at just over 14 times expected earnings-per-share for the year. With a target multiple of 20 times earnings, this implies a 6.9% annual tailwind to results over the next half-decade.

In total, we project that Baxter will provide a total return of 19.2%, stemming from 10% earnings growth, the starting yield of 2.2%, and a mid-single-digit contribution from multiple expansion.

Click here to download our most recent Sure Analysis report on Baxter International (preview of page 1 of 3 shown below):

Final thoughts

The healthcare sector has seen a number of its leading names suffer significant drawdowns in the share price over the last year.

The positive side of this occurrence is that many stocks are trading with very attractive total return profiles. Even better, these stocks offer market beating dividend yields that appear to be very safe.

Walgreens, Medtronic, and Baxter all have double-digit total return potential while offering safe and secure dividend yields. Each industry leading company is also trading below our valuation target. For investors looking for value and income, these three stocks could make attractive investment options.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].