Up to date on June fifteenth, 2022 by Bob Ciura

Observe: This text was initially titled ‘Bear Market Shares: The Dividend Traders Information’. It has been expanded and up to date.

The S&P 500 has formally entered bear market territory. However for long-term buyers, the decline in inventory costs may very well be seen as a possibility to purchase.

For that reason, we steer buyers towards high-quality dividend development shares such because the Dividend Aristocrats.

The Dividend Aristocrats are a choose group of 65 S&P 500 shares with 25+ years of consecutive dividend will increase.

There are presently 65 Dividend Aristocrats. You may obtain an Excel spreadsheet of all 65 (with metrics that matter similar to dividend yields and price-to-earnings ratios) by clicking the hyperlink under:

Bear markets are uncomfortable, however might be a lot simpler to tolerate by proudly owning high-quality dividend development shares.

Desk Of Contents

You may immediately bounce to any explicit part of the article by using the hyperlinks under:

What Is A Bear Market?

The identify ‘bear market’ invokes concern, and for good cause. Market-wide inventory declines are referred to as ‘bear markets’.

What’s a bear market? Investopedia defines a bear market as (hyperlinks added):

A market situation by which the costs of securities are falling, and widespread pessimism causes the adverse sentiment to be self-sustaining. As buyers anticipate losses in a bear market and promoting continues, pessimism solely grows. Though figures can range, for a lot of, a downturn of 20% or extra in a number of broad market indexes, such because the Dow Jones Industrial Common or Commonplace & Poor’s 500 Index, over a minimum of a two-month interval, is taken into account an entry right into a bear market.

The 20% decline threshold is what differentiates a bear market kind a mere pullback or market correction.

- Pullback: Market lack of 0% to 10%

- Correction: Market lack of 10% to twenty%

- Bear Market: Market Lack of 20% or extra

Bear markets ship shivers down the spines of timid buyers… And for good cause. Seeing the worth of your shares falling is unnerving.

There may be nonetheless a silver-lining (silver fur?) to bear markets.

Bear Markets present buyers with alternatives to purchase shares at cut price costs.

Dividend buyers particularly must be completely satisfied to see bear markets. The decrease inventory costs go, the larger dividend yield new purchases can have.

Greater dividend yields imply a shorter dividend payback interval. Your investments pays you extra when bought in a bear market.

What shares you buy earlier than a bear market issues. Should you put money into top quality companies which might be more likely to pay rising dividends by the bear market, then you’ll really feel assured in your portfolio. It’s also possible to reinvest these dividends into shares which have seen their costs fall considerably.

Right here’s an instance of the kind of bargains accessible throughout recessions…

Aflac (AFL) inventory briefly traded for dividend yields over 7% throughout 2009. The inventory presently has a 3% dividend yield. Click on right here for detailed Aflac evaluation.

You may think about how a lot of a steal the inventory was when it yielded greater than 7%.

This text examines bear markets intimately and offers 3 high-quality dividend development funding concepts to recession-proof your portfolio.

The S&P 500 Formally Enters A Bear Market

On June thirteenth 2022, the S&P 500 Index formally entered a bear market.

Now, the large query is whether or not the U.S. economic system will enter a recession.

When the subsequent recession will happen is one other query solely. No one is aware of precisely when a recession will happen. The economic system (and the inventory market) is a posh dynamic system. It’s not predictable.

Whereas it’s inconceivable to know precisely when a recession will happen, we will analyze historical past to see if we’re in a time interval that has the next likelihood of a recession occurring within the close to future.

The primary signal we have been due for a bear market was the excessive valuation of the inventory market heading into the yr. The historic common price-to-earnings (P/E) ratio of the S&P 500 is 16. It was buying and selling for a price-to-earnings ratio above 35 not too long ago.

There may be one caveat to this straightforward price-to-earnings evaluation: rates of interest have been close to historic lows.

Low rates of interest trigger increased valuations. When financial savings accounts are yielding close to 0%, the inventory market seems like a relatively favorable funding. This will increase demand for shares, and due to this fact the price-to-earnings a number of of the market.

Now that rates of interest are rising to fight inflation, it is sensible that the SP 500’s price-to-earnings ratio has fallen to the present stage of 19. Nonetheless, if the valuation a number of of the S&P continues to drop in the direction of its long-term common, this might suggest ~16% additional draw back.

The excellent news is, buyers can psychologically put together themselves to deal with bear markets.

The Mindset Wanted To Beat Bear Markets

When the market falls, issues get ugly in a rush. Traders can recall the Nice Recession and bear market of 2007-2009 as a great instance.

You may see that from these 3 bear market inventory charts from October of 2007 by March of 2009.

Right here’s the S&P 500 (SPY)

And rising markets (VWO)

And small cap shares (VBR)

When markets fall, you will need to do not forget that inventory value actions aren’t your enemy. In reality, you’ll be able to profit from a recession within the inventory market.

It takes a confident investor to not panic throughout bear markets. The common particular person investor sells throughout bear markets and buys throughout bull markets. That is utterly backward – and it’s the first cause why particular person buyers have a tendency to take action poorly within the inventory market.

It takes a confident investor to not panic throughout bear markets. The common particular person investor sells throughout bear markets and buys throughout bull markets. That is utterly backward – and it’s the first cause why particular person buyers have a tendency to take action poorly within the inventory market.

I hope by studying this you’ll take motion.

I hope by studying this you’ll take motion.

When the subsequent bear market hits – and hits your portfolio (and everybody else’s) laborious, DO NOT SELL.

As a substitute, both maintain your shares (which is okay), or purchase whereas bargains can be found (which is a lot better).

Should you can alter your psychology to be excited for the bargains that bear markets present – or a minimum of be ambivalent about bear markets – you’ll tremendously outperform your investing friends.

Should you can alter your psychology to be excited for the bargains that bear markets present – or a minimum of be ambivalent about bear markets – you’ll tremendously outperform your investing friends.

Gene Walden of All Star Shares has wonderful recommendation on what to do in bear markets:

“So what must you do in a bear market? Should you’re a long-term investor you do roughly the identical factor in a bear market that you’d in a bull market. You purchase proper by it. You make a seamless sequence of small bets. You choose good high quality firms and proceed to construct a place in these firms.”

For me, the important thing to being enthusiastic about bear markets is to put money into top quality dividend development shares with a protracted historical past of accelerating dividends. These are shares which have confirmed themselves in each bull and bear markets.

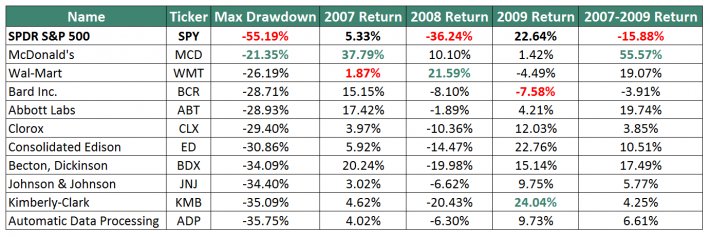

That doesn’t imply top quality dividend development shares don’t see value declines in bear markets… These shares fall as effectively, however not as a lot, on common. Case-in-point, the Dividend Aristocrats Index fell 22% in 2008, whereas the S&P 500 fell 38%.

The picture under exhibits the investing efficiency of the ten most recession-proof Dividend Aristocrats:

As you’ll be able to see, 2 Dividend Aristocrats (Walmart and McDonald’s) truly posted double-digit optimistic returns through the 2008, whereas the S&P 500 fell 36%.

Recession-Resistant Industries

Particular industries are likely to carry out higher than others throughout recessions. Among the many worst performers are airways, accommodations, and on line casino shares. Folks merely spend much less extravagantly when occasions get powerful.

Six of probably the most recession-proof industries are proven under, together with a short description of what makes them proof against recessions.

- Quick Meals Shares: Folks substitute quick meals for costlier eating places throughout recessions.

- Well being Care Shares: You can’t ‘delay’ vital medical procedures

- Low cost Retail Shares: Folks search for bargains when earnings falls

- Waste Disposal Shares: The rubbish should be collected whatever the total economic system

- Alcohol Shares & Tobacco Shares: Folks search for an escape when occasions get powerful

- Important Family Items Shares: Tissues, bathroom paper, and different staples should be bought

The 6 industries above have particular traits that assist them to combat off probably the most extreme results of recessions. The three bear market shares under are all worthy holds to guard your portfolio in opposition to recessions.

Bear Market Inventory #1: Walmart (WMT)

From the start of 2007 to the tip of 2009, the S&P 500 declined 15.9%. Walmart (WMT), then again, gained 19.1%.

Walmart is a perfect bear market inventory. The corporate is thought to supply ‘on a regular basis low costs’. When occasions get powerful, shoppers search for methods to get reductions on on a regular basis home items. In consequence, Walmart tends to do effectively throughout recessions.

Simply how effectively? The corporate’s earnings-per-share every year by the Nice Recession of 2007 to 2009 are proven under:

- 2007 earnings-per-share of $3.16

- 2008 earnings-per-share of $3.42

- 2009 earnings-per-share of $3.66

Thanks largely to its recession-resistant enterprise mannequin, Walmart has elevated its dividend every year for over 40 years. It’s on the Dividend Aristocrats checklist.

At present, the inventory is providing buyers a 1.9% dividend yield. The corporate presently has a payout ratio of round 35%. Regardless of its low payout ratio, Walmart will doubtless develop its dividend according to earnings-per-share development (as an alternative of rising dividends quicker) as the corporate is plowing cash into future development initiatives.

Walmart’s e-commerce phase is booming, resulting in sturdy comparable gross sales development in america.

If we do enter into one other recession, Walmart will doubtless profit from elevated retailer visitors and larger gross sales – and earnings. Walmart is investing closely in digital gross sales and higher worker compensation. In consequence, income and comparable retailer gross sales are up.

Earnings-per-share elevated 8.2% from 2007 to 2008, and seven.0% from 2008 to 2009. Whereas these aren’t superb numbers throughout a strong economic system, they’re superb when one considers the general financial local weather. 2007 by 2009 was a time when many companies have been completely struggling.

Bear Market Inventory #2: Johnson & Johnson

Johnson & Johnson (JNJ) may have one of the best file of consistency of any publicly traded company. The corporate has paid growing dividends for over 50 consecutive years. It’s on the checklist of Dividend Kings.

As one would count on from such a secure enterprise, Johnson & Johnson marched by the Nice Recession of 2007 to 2009 with out lacking a beat. The corporate noticed earnings-per-share develop every year of the Nice Recession:

- 2007 earnings-per-share of $4.15

- 2008 earnings-per-share of $4.57

- 2009 earnings-per-share of $4.63

Moreover, the corporate’s inventory realized complete returns of 5.8% (versus -15.9% for the S&P 500) from 2007 by 2009.

Johnson & Johnson is a top quality dividend development inventory. The corporate has compounded earnings-per-share at 7.5% a yr over the past decade. That is largely due to the corporate’s diversified enterprise mannequin and its management place throughout the three core markets by which it operates–prescribed drugs, medical gadgets, and client well being merchandise.

Traders in Johnson & Johnson ought to count on dependable development of round 6% a yr mixed with the corporate’s present 2.7% dividend yield.

Johnson & Johnson is presently buying and selling at a ahead price-to-earnings a number of of 16.5, an affordable valuation in opposition to our truthful worth estimate of 17, equal to the inventory’s 10-year common. Johnson & Johnson seems considerably undervalued right now. And, there may be little doubt the corporate will be capable of proceed growing its dividend every year, even throughout a recession.

Bear Market Inventory #3: McDonald’s Company (MCD)

McDonald’s is the world’s main world foodservice retailer with about 40,000 areas in over 100 nations. Roughly 93% of the shops are independently owned and operated. The corporate has raised its dividend each yr since paying its first dividend in 1976, qualifying the corporate as a Dividend Aristocrat.

McDonald’s has a protracted and profitable development historical past with regards to each earnings-per-share and dividends. From 2008-2019 earnings-per-share compounded at a median price of seven.1% per yr.

Like Walmart and J&J, McDonald’s is among the few companies to develop earnings-per-share every year by the Nice Recession of 2007 to 2009. The corporate’s earnings-per-share by the Nice Recession are proven under:

- 2007 earnings-per-share of $2.91

- 2008 earnings-per-share of $3.67

- 2009 earnings-per-share of $3.98

The corporate’s well-branded eating places see demand enhance throughout recessions. That’s as a result of shoppers are likely to scale down their budgets when eating out throughout an financial downturn. McDonald’s dividend payout ratio has been oscillating in a spread of ~50% to ~70% all through the final decade. Because of the stability of McDonald’s throughout previous recessions, coupled with a payout ratio that’s not overly excessive, we view McDonald’s dividend as protected.

McDonald’s is presently buying and selling for an adjusted price-to-earnings ratio of 23.6. The corporate seems to be buying and selling considerably above truthful worth. Nonetheless, shares presently yield 2.3%, and the corporate may be very more likely to maintain growing its dividend every year, even throughout recessions.

Take Motion Right this moment

All 3 of the shares listed on this article carry out exceptionally effectively throughout recessions. And all 3 have lengthy histories of dividend development. In consequence, buyers seeking to enhance the efficiency of their portfolio throughout recessions ought to take into account Walmart, Johnson & Johnson, and McDonald’s.

Whether or not or not you purchase these shares at present (or within the close to future), it’s essential that you simply take motion by making ready your self for the bear market.

Some buyers will panic. Others know their portfolios are invested in top quality dividend development shares with a protracted historical past of paying regular or rising dividends by recessions.

These well-prepared buyers will reinvest their dividends at very favorable costs throughout a bear market. If they’re nonetheless saving cash, they are going to add to their portfolios fairly than promote in concern.

Be mentally ready for the subsequent recession to understand inventory market success when others are panicking.

Different Dividend Lists

The Dividend Aristocrats checklist is just not the one solution to shortly display screen for shares that frequently pay rising dividends.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].