Should you hold a stock forever? Some say that investors shouldn’t marry their stocks. I’d argue in favor of holding stocks for as long as their underlying businesses perform, which could include forever.

Admittedly, that sets the bar high. Most companies have occasional bumps and bruises. The good ones bounce back. But business is competitive, and staying atop the mountain for decades is hard.

Keeping that in mind, I set out to build a list of artificial intelligence (AI) stocks that could potentially earn a permanent spot in a diversified portfolio. After all, AI is forecast to create trillions of dollars in economic value over the coming decades. That means it should be an excellent spot for long-term thinking.

What makes a company (and its stock) likely to last for such a long time?

The recipe for forever AI stocks

Nobody knows what the future will hold. AI could look completely different in a decade than it does now. Looking for future-resistant businesses steered me to look for a few crucial traits. Specifically, investors should take a closer look at companies with:

In other words, look for situations where AI strengthens an already great company.

With that said, consider buying and keeping these three AI stocks forever:

1. Nvidia: Dominating the AI chip market

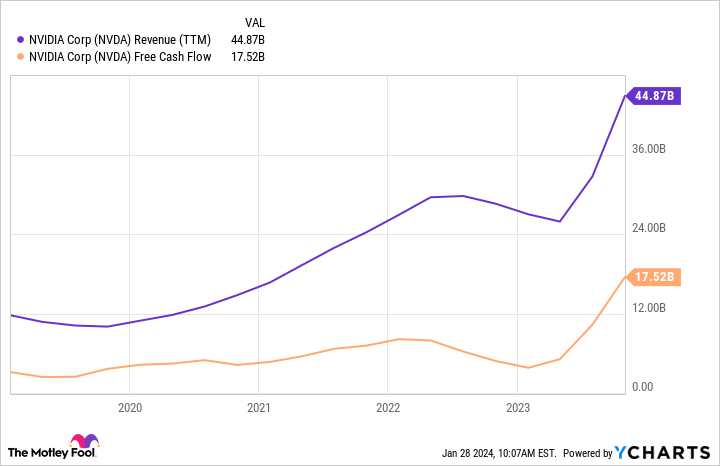

You’ve probably seen a ton of coverage on Nvidia (NASDAQ: NVDA) and most investors already know about its potential. But Nvidia is too important to leave off this list just because it isn’t the new thing. The company rapidly acquired a stranglehold on the AI chip market, and it is arguably the most essential building block of AI because the models that are essential to AI require lots of computing power to crunch data. According to analysts, Nvidia’s AI chip market share sits around 90%.

As a result, business is booming. Top and bottom-line growth rocketed off in 2023, and since the AI chip market is poised to expand tremendously moving forward, this could be the new normal for a while.

Why should investors feel optimistic that Nvidia will keep its market share? The company built an end-to-end hardware and software ecosystem that helps customers using its chips deploy and maximize their AI models. The entire platform is the secret sauce, not just the chips themselves. Are companies building within this ecosystem going to bail and use something else easily? That would be like changing all the electrical wiring in your house. It’s a messy job that’s probably not appealing to most.

2. A cloud giant distributing AI tools

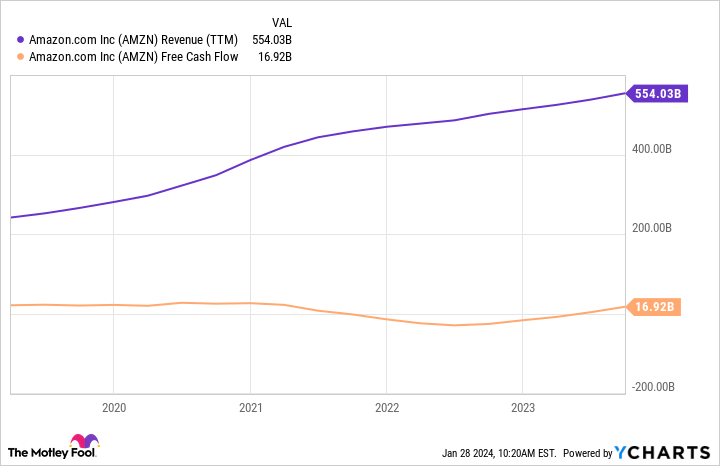

E-commerce giant and cloud leader Amazon (NASDAQ: AMZN) is known for several businesses, so its AI potential might slip under the radar a bit. But that could work in investors’ favor. Amazon has already built a trillion-dollar company on e-commerce, cloud, advertising, and streaming. Its cloud platform, Amazon Web Services (AWS), has blossomed into the world’s leader with an estimated 50% market share, according to research by HG Insights.

That same report estimates roughly 2.38 million businesses use Amazon’s cloud computing services, so that is low-hanging fruit to begin cross-selling AI products and services. Cloud computing is already projected to continue growing for years, and weaving AI and machine learning into that business may only pour gas on Amazon’s success.

Additionally, Amazon’s strong presence in e-commerce (38% market share in the U.S.) and rapidly growing advertising business are excellent safety nets for investors. AI can add to a winning business instead of putting Amazon in a make-or-break scenario. That sets a high floor, making Amazon an outstanding stock to buy and tuck away.

3. Ambitious and bold leadership drives this stock

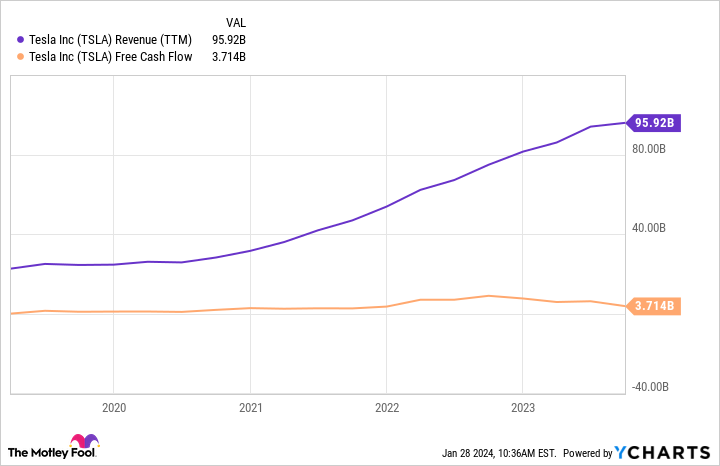

CEO and entrepreneur Elon Musk seemingly likes doing hard stuff. He built a space exploration company and led Tesla (NASDAQ: TSLA) to disrupt the automotive industry with electric vehicles. Naturally, he wouldn’t let the AI technology era arrive without tossing his hat in the ring. Tesla is investing heavily in multiple AI-related products.

Tesla’s full-self-driving (FSD) ambitions headline this list. The company has been developing FSD software for years that relies on camera imagery to process the vehicle’s surroundings. Musk himself has said that Tesla’s value depends heavily on succeeding with FSD. Additionally, the company is developing a humanoid robot that will hopefully utilize FSD’s tech to perform manual labor someday. Tesla’s Dojo supercomputer powers its AI, making the EV company a full-fledged technology powerhouse.

FSD and robotics look promising, but ambition doesn’t promise success. However, despite Musk’s claim, Tesla likely has a bright future, supported by strong leadership in EVs and a growing energy business. Investors can buy into Tesla on that alone, with FSD and AI robotics being potential catalysts for Tesla to realize its full long-term investment potential.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of January 22, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Nvidia, and Tesla. The Motley Fool has a disclosure policy.

3 Artificial Intelligence (AI) Stocks You Should Buy and Keep Forever was originally published by The Motley Fool