Source: Trepp

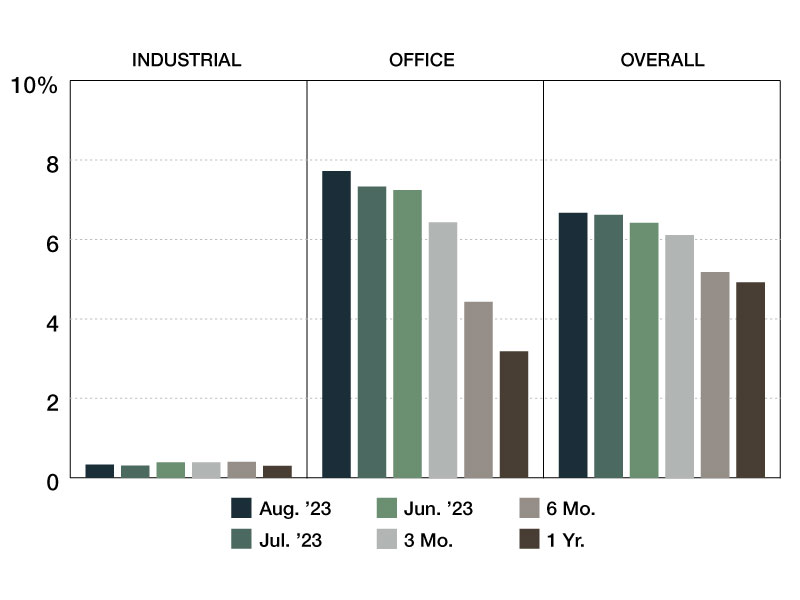

The Trepp CMBS Special Servicing Rate jumped by 20 basis points in September, rising to 6.87 percent. After falling six basis points to 5.11 percent at the beginning of the year, the rate has increased every month since.

Across property types, office experienced the largest respective increase, up 62 basis points. This is now the first time that the office special servicing rate has surpassed the 8.00 percent mark since May 2017.

Additionally, the mixed-use rate rose by 26 basis points, and the multifamily rate dropped by 44 basis points. In September, the largest loan to transfer was the $415 million Courtyard by Marriott Portfolio loan, worth 17 percent of the new transfer balance last month.

—Posted on Oct. 31, 2023

Source: Trepp

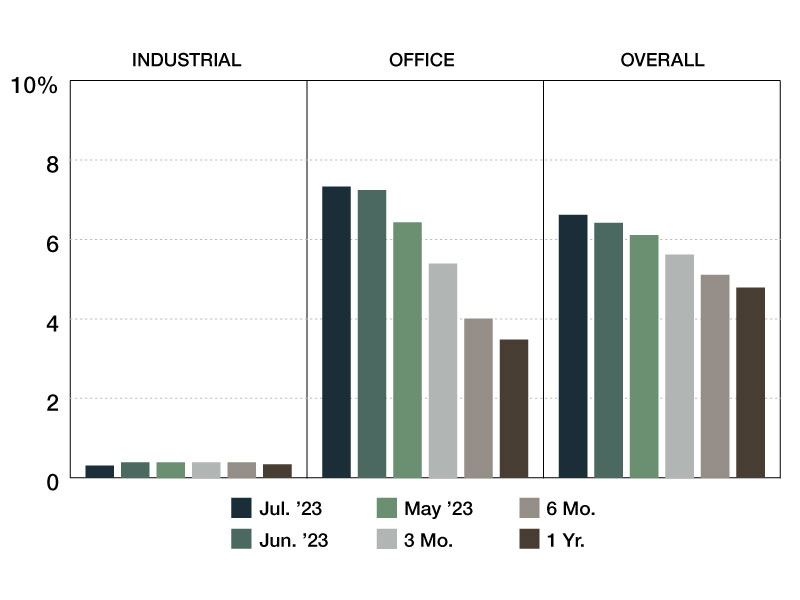

The Trepp CMBS Special Servicing Rate rose five basis points in August to 6.67 percent – the seventh consecutive increase. Six months ago, the rate was 5.18 percent, and one year ago, the rate was 4.92 percent.

As has been typical of this year, the office sector led property types with the highest monthly increase, up 39 basis points. While most other property types had negligible changes, the multifamily rate rose by 32 basis points and the retail rate fell by 80 basis points. The largest loan to transfer this month was a multifamily property in San Francisco, worth 21 percent of August’s overall new transfer balance.

—Posted on Sep. 29, 2023

Source: Trepp

The Trepp CMBS Special Servicing Rate rose 20 basis points in July to 6.62 percent – the sixth increase in a row. Six months ago, the rate was 5.11 percent, and 12 months ago, the rate was 4.79 percent.

For the first time in several months, the office sector was not leading the charge, up a modest nine basis points from June. In July, the mixed-use sector and lodging sector sustained increases of 93 and 66 basis points respectively. Interestingly, the two largest transfers this month were on loans issued to properties 0.2 miles away from each other, both in Downtown San Francisco.

—Posted on Aug. 31, 2023

Source: Trepp

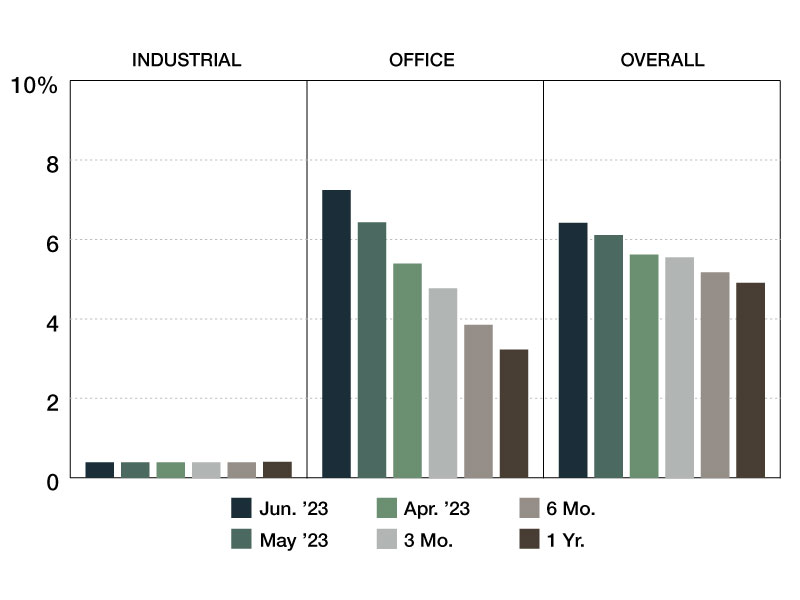

The Trepp CMBS Special Servicing Rate climbed 31 basis points in June to 6.42 percent – the fifth increase in a row and the third largest this year. Six months ago, the rate was 5.17 percent, and 12 months ago, the rate was 4.91 percent.

Most notable was the increase in the office sector, an 81-basis point increase from May to 7.24 percent. That’s the highest office rate since 2017 and it has risen 323 basis points since the start of this year.

Maturity defaults in the office sector are placing additional stress on special servicers as the appetite for refinancing wanes.

An additional $2 billion in loans were transferred to the special servicer in June, and the office sector accounted for nearly $1.1 billion of that (55.6 percent). Mixed-use (18.6 percent), retail (14.8 percent) and multifamily (10.8 percent) made up the remainder of the newly transferred special servicing balance.

—Posted on Jul. 24, 2023

Source: Trepp

The Trepp CMBS Special Servicing Rate climbed 49 basis points in May 2023 to 6.11 percent – the fourth and most significant month-to-month increase this year. Six months ago, the rate was 4.95 percent, and 12 months ago, the rate was 4.76 percent.

The two property types mainly responsible for the May special servicing spike were office and mixed-use. The office sector rose 104 basis points to 6.43 percent. To put this into perspective, this is the first time the office special servicing rate has been above 6 percent since December 2017, and this is the largest month-to-month increase in the office special servicing rate since 2010. The special servicing rate for mixed-use backed loans also jumped significantly, up 150 basis points from the month prior to 5.65 percent.

—Posted on Jun. 26, 2023

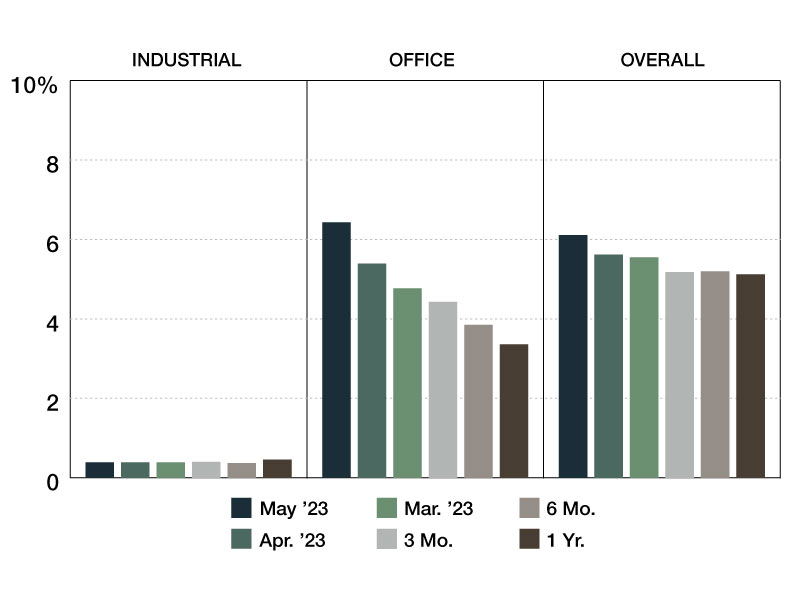

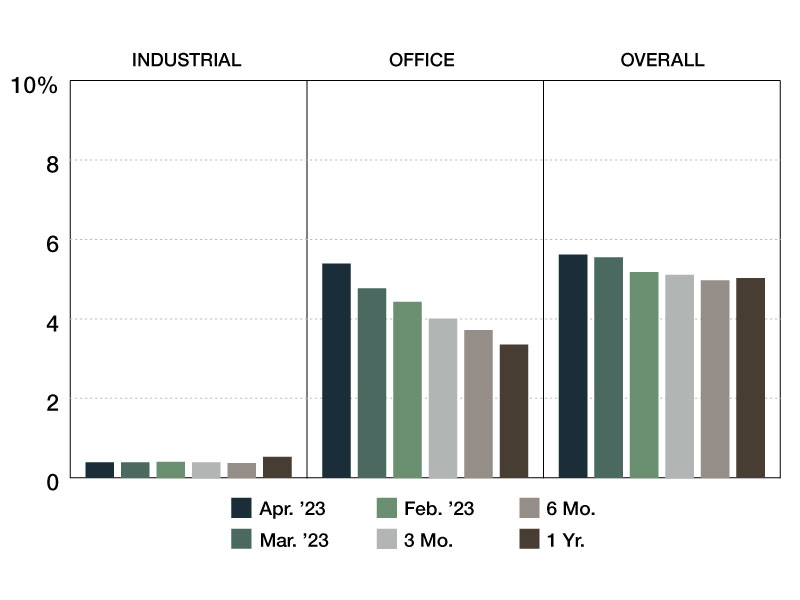

Source: Trepp

The Trepp CMBS Special Servicing Rate rose seven basis points in April to 5.62 percent – the third increase month-to-month this year. Six months ago, the rate was 4.97 percent, and 12 months ago, the rate was 5.30 percent.

The April increase was marked by a number of large office transfers and one large lodging portfolio transferred, split into six different pools of CMBS debt. In April 2023, two of the major commercial real estate property types faced increases in delinquency rates, while two other property types saw decreases, and one was unchanged. The most notable movements were in the office and lodging sectors, which had rate increases of 62 and 17 basis points, respectively. The retail special servicing rate declined by 67 basis points.

—Posted on May 31, 2023

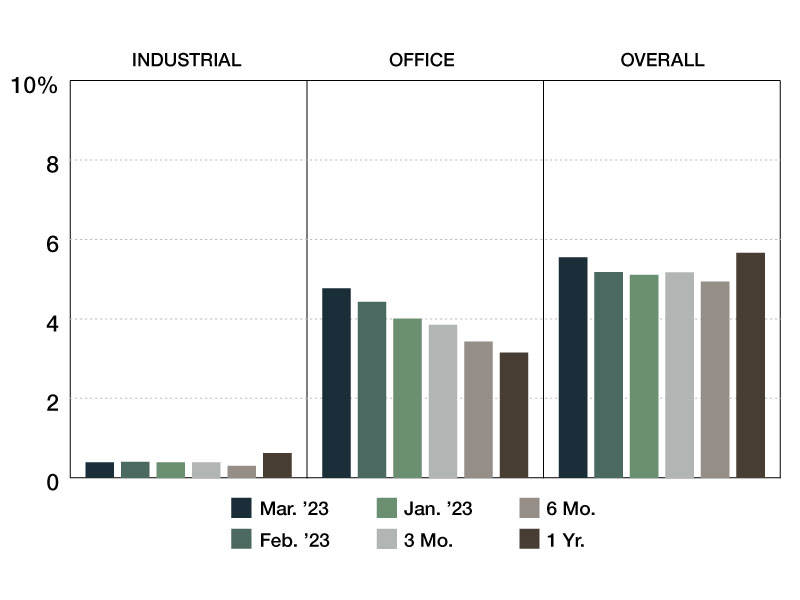

Source: Trepp

The Trepp CMBS Special Servicing Rate rose 37 basis points in March to 5.55 percent – the largest month-over-month increase since August of 2020. Six months ago, the rate was 4.94 percent, and 12 months ago, the rate was 5.66 percent.

The March increase was significant for many reasons. The volume of large loans to transfer was higher, as nine loans with an outstanding loan balance of at least $100 million were transferred. Also, three of the five major property types saw significant increases in the special servicing rate.

The retail rate went up 84 basis points, while multifamily and office both increased by 34 basis points.

—Posted on Apr. 28, 2023

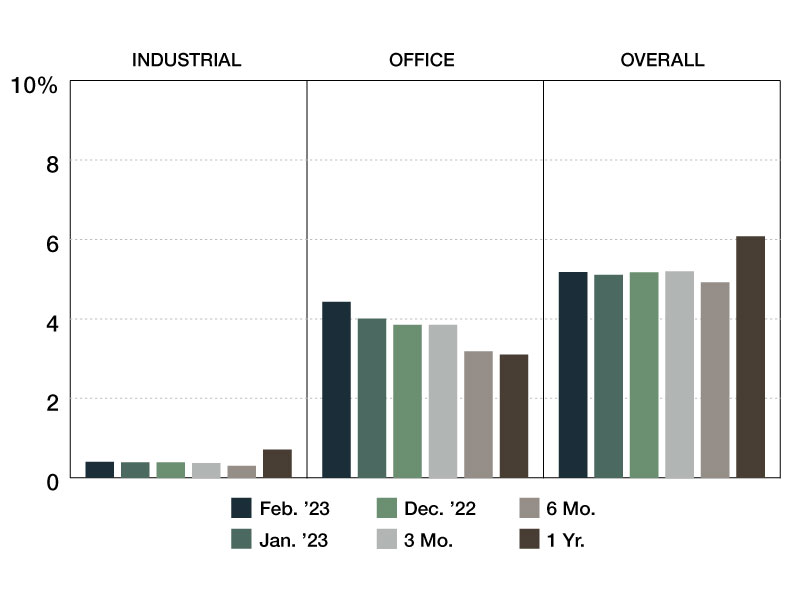

Source: Trepp

The Trepp CMBS Special Servicing Rate rose seven basis points in February to 5.18 percent – back up beyond the rate recorded at the close of 2022. Six months ago, the rate was 4.92 percent, and 12 months ago, the rate was 6.08 percent.

The February rate increase marks the fifth rise in the last seven months. In February, three of the five major property types saw increases in the special servicing rate (multifamily, office, industrial). However, it was the multifamily and office sectors that were the main drivers of the overall special servicing rate increase, both up 43 basis points respectively.

—Posted on Mar. 29, 2023

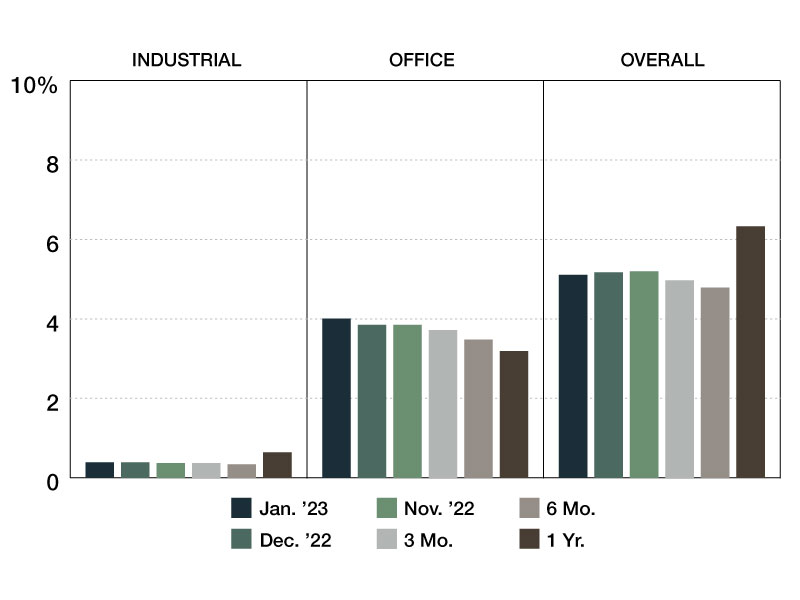

Source: Trepp

The Trepp CMBS Special Servicing Rate dropped six basis points in January to 5.11 percent – down for the second month in a row. Six months ago, the rate was 4.79 percent, and 12 months ago, the rate was 6.33 percent.

The January rate declined again after four consecutive increases from August to November. In January, three of the five major property types saw increases in the special servicing rate (multifamily, office, retail). The largest basis point decline by property type in the month of January was once again the lodging sector, down 38 basis points from the previous month. The industrial special servicing rate was unchanged.

The office sector saw a 16-basis point increase in the special servicing rate in January, and it once again led the way for all new special servicing transfers. Office properties backed 78 percent of all new special servicing transfers, most notably the $277.1 million Wells Fargo Center loan which was transferred due to maturity default. Loan maturities continue to burden office loan performance, and the office special servicing rate surpassed 4 percent for the first time since January 2019.

—Posted on Feb. 28, 2023