Updated on December 27th, 2022, by Nate Parsh

Spreadsheet data updated daily

Utility stocks can make excellent investments for long-term dividend growth investors.

Durable, regulatory-based competitive advantages allow these companies to consistently raise their rates over time. In turn, this allows them to raise their dividend payments year in and year out.

Even better, many utility stocks have above-average dividend yields, providing a compelling combination of income now and growth later for long-term investors.

Because of these favorable industry characteristics, we’ve compiled a list of utility stocks. The list is derived from the major utility sector exchange-traded funds JXI, VPU and XLU.

You can download the list of all utility stocks (along with important financial ratios such as dividend yields and payout ratios) by clicking on the link below:

Keep reading this article to learn more about the benefits of investing in utility stocks.

Table Of Contents

The following table of contents provides for easy navigation:

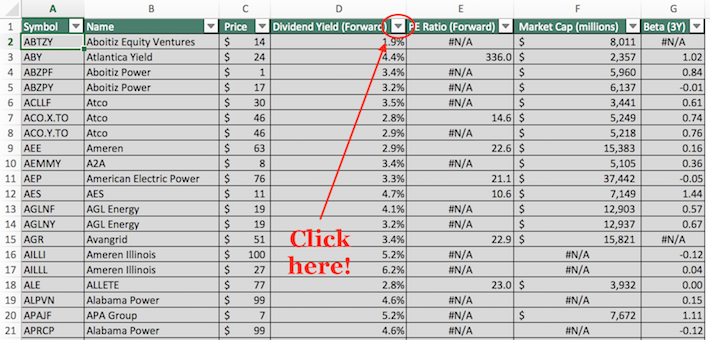

How To Use The Utility Dividend Stocks List To Find Investment Ideas

Having an Excel database of all the dividend-paying utility stocks combined with important investing metrics and ratios is very useful.

This tool becomes even more powerful when combined with knowledge of how to use Microsoft Excel to find the best investment opportunities.

With that in mind, this section will provide a quick explanation of how you can instantly search for utility stocks with particular characteristics, using two screens as an example.

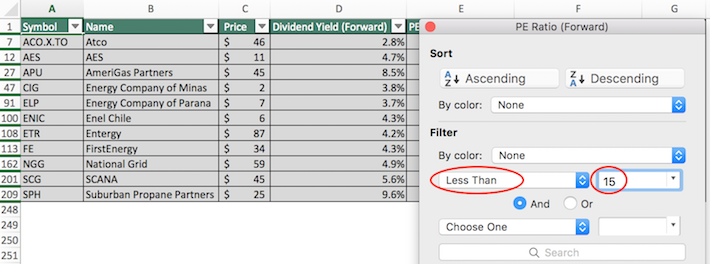

The first screen that we will implement is for utility stocks with price-to-earnings ratios below 15.

Screen 1: Low P/E Ratios

Step 1: Download the Utility Dividend Stocks Excel Spreadsheet List at the link above.

Step 2: Click the filter icon at the top of the price-to-earnings ratio column, as shown below.

Step 3: Change the filter field to “Less Than” and input “15” into the field beside it.

The remaining list of stocks contains dividend-paying utility stocks with price-to-earnings ratios less than 15. As you can see, there are relatively few securities (at the time of this writing) that meet this strict valuation cutoff.

The next section demonstrates how to screen for large-cap stocks with high dividend yields.

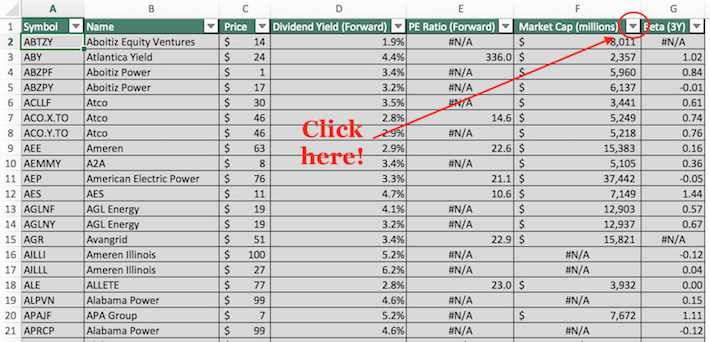

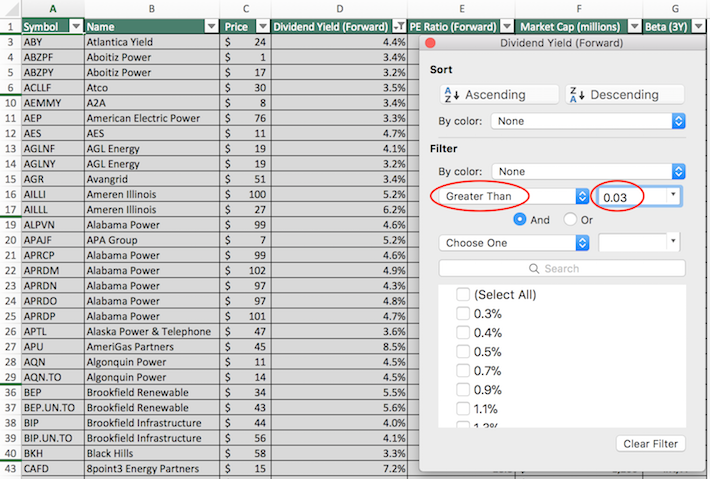

Screen 2: Large-Cap Stocks With High Dividend Yields

Businesses are often categorized based on their market capitalization. Market capitalization is calculated as stock price multiplied by the number of shares outstanding and gives a marked-to-market perception of what people think a business is worth on average.

Large-cap stocks are loosely defined as businesses with a market capitalization above $10 billion and are perceived as lower risk than their smaller counterparts. Accordingly, screening for large-cap stocks with high dividend yields could provide interesting investment opportunities for conservative, income-oriented investors.

Here’s how to use the Utility Dividend Stocks Excel Spreadsheet List to find such investment opportunities.

Step 1: Download the Utility Dividend Stocks Excel Spreadsheet List at the link above.

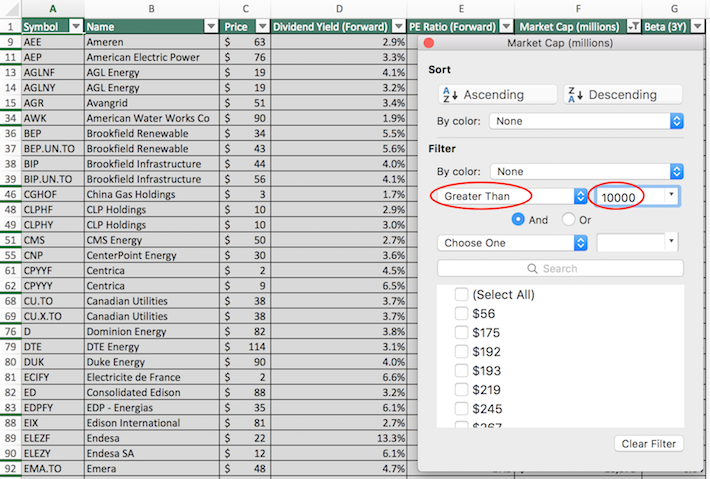

Step 2: Click the filter icon at the top of the Market Cap column, as shown below.

Step 3: Change the filter setting to “Greater Than”, and input 10000 into the field beside it. Note that since market capitalization is measured in millions of dollars in this Excel sheet, filtering for stocks with market capitalizations greater than “$10,000 millions” is equivalent for screening for those with market capitalizations exceeding $10 billion.

Step 4: Close that filter window (by exiting it, not by clicking ‘clear filter’) and click on the filter icon for the “dividend yield” column, as shown below.

Step 5: Change the filter setting to “Greater Than” and input 0.03 into the column beside it. Note that 0.03 is equivalent to 3%.

The remaining stocks in this list are those with market capitalizations above $10 billion and dividend yields above 3%. This narrowed investment universe is suitable for investors looking for low-risk, high-yield securities.

You now have a solid fundamental understanding of how to use the Utility Dividend Stocks Excel Spreadsheet List to its fullest potential. The remainder of this article will discuss the characteristics that make the utility sector attractive for dividend growth investors.

Why Utility Dividend Stocks Make Attractive Investments

The word “utility” describes a wide variety of business models but is usually used as a reference to electric utilities — companies that engage in the generation, transmission, and distribution of electricity.

Other types of utilities include propane utilities and water utilities.

So why do these businesses make for attractive investments?

Utilities usually conduct business in highly regulated markets, complying with rules set by federal, state, and municipal governments.

While this sounds highly unattractive on the surface, what it means in practice is that utilities are basically legal monopolies.

The strict regulatory environment that utility businesses operate in creates a strong and durable competitive advantage for existing industry participants.

For this reason, electric utilities are among the most popular stocks for long-term dividend growth investors — especially because they tend to offer above-average dividend yields.

Indeed, the regulatory-based competitive advantages available to utility stocks give them the consistency to raise their dividends regularly.

Simply put, utility stocks are some of the most dependable dividend stocks around.

To provide a few examples, the following utility stocks have exceptionally long streaks of consecutive dividend increases:

- Consolidated Edison (ED) — more than 25 years of consecutive dividend increases

- American States Water (AWR) — a water utility — more than 50 years of consecutive dividend increases

- SJW Group (SJW) — another water utility — more than 50 years of consecutive dividend increases

The long streak of consecutive dividend increases is possible only because of their unique industry-specific competitive advantages.

Clearly, the utility sector is very stable. People are going to need electricity and water in ever-increasing amounts for the foreseeable future.

One characteristic that does not describe utility stocks is high growth. One of the regulatory constraints imposed upon utility companies is the pace at which they can increase the fees paid by their customers.

These rate increases are usually in the low-single-digits, which provides a cap on the revenue growth experienced by these companies.

Utility stocks typically don’t offer strong total returns, but there are exceptions.

The Top 10 Utility Stocks Now

Taking all of the above into consideration, the following section discusses our top 10 list of North American utility stocks today, based on their expected annual returns over the next five years.

The rankings in this article are derived from our expected total return estimates from the Sure Analysis Research Database.

The top 10 list was additionally screened to include only Dividend Risk scores of A or B, to focus on quality companies with safe dividends.

The 10 utility stocks with the highest projected five-year total returns are ranked in this article, from lowest to highest.

Related: Watch the video below to learn how to calculate expected total return for any stock.

Rankings are compiled based upon the combination of current dividend yield, expected change in valuation, as well as expected annual earnings-per-share growth.

This determines which utility stocks offer the best total return potential for shareholders.

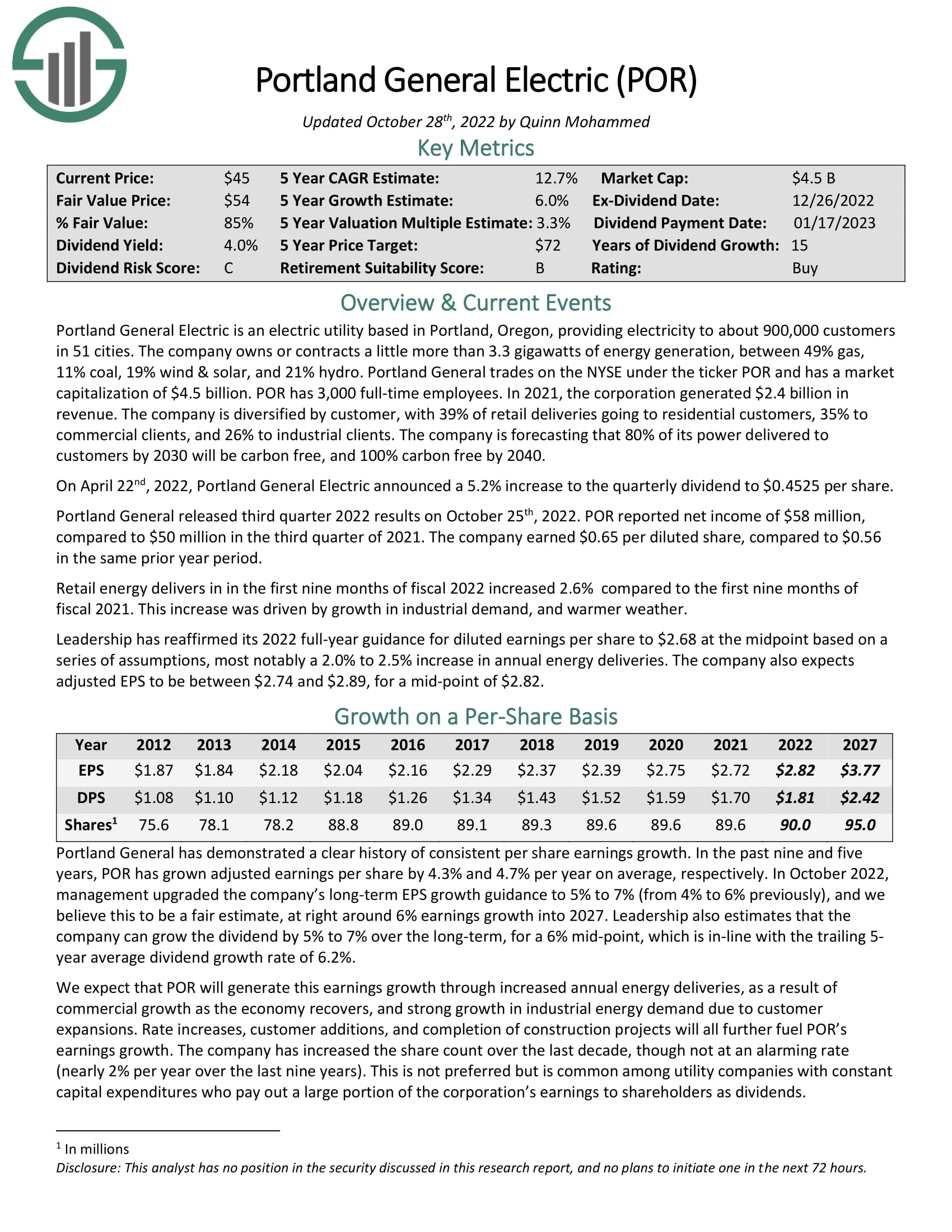

Top Utility Stock #10: Portland General Electric Company (POR)

- 5-year expected annual returns: 11.1%

Portland General Electric is an electric utility based in Portland, Oregon. The company is on the smaller side, as it provides electricity to nearly 900,000 customers and 2 million residents in 51 cities.

Source: Investor Presentation

The customer base is very diversified, with 30% of retail delivers going to residential customers, 35% to commercial clients, and 26% to industrial clients.

Portland General Electric owns or contracts 3.3 gigawatts of energy generation through gas (49% of total), hydro (21%) wind and solar (19%), and coal (11%). From this breakdown, it is clear that the company is investing heavily in renewable energy sources. To that end, Portland General Electric expects to be carbon free by 2040.

We expect annual returns of 11.1% per year, due to 6.0% EPS growth, the 3.7% dividend yield, and a 2.0% tailwind from multiple expansion.

Click here to download our most recent Sure Analysis report on Portland General Electric (preview of page 1 of 3 shown below):

Top Utility Stock #9: Evergy Inc. (EVRG)

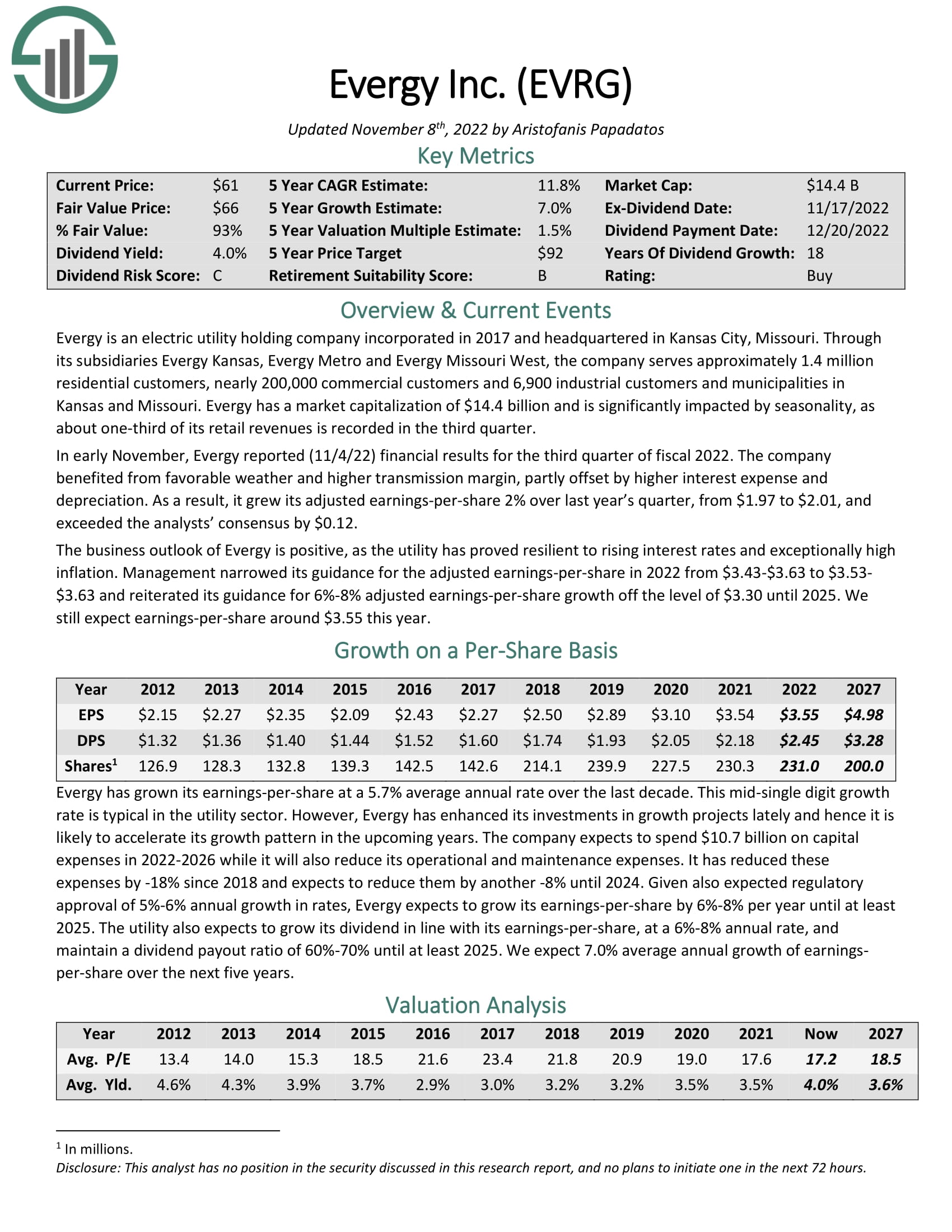

- 5-year expected annual returns: 11.1%

Evergy is an electric utility holding company incorporated in 2017 and headquartered in Kansas City, Missouri. Through its subsidiaries Evergy Kansas, Evergy Metro and Evergy Missouri West, the company serves approximately 1.4 million residential customers, nearly 200,000 commercial customers and 6,900 industrial customers and municipalities in Kansas and Missouri. Evergy has a market capitalization of $15 billion and is significantly impacted by seasonality, as about one-third of its retail revenue is recorded in the third quarter.

Evergy has grown its earnings-per-share at a 5.7% average annual rate over the last decade. This mid-single digit growth rate is typical in the utility sector. However, Evergy has enhanced its investments in growth projects lately and hence it is likely to accelerate its growth pattern in the upcoming years. The company expects to spend $10.7 billion on capital expenses in 2022-2026 while it will also reduce its operational and maintenance expenses.

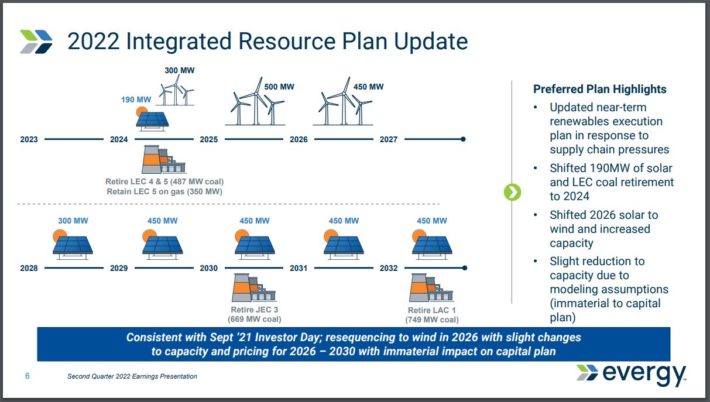

Some of this investment will be focused on renewable energy sources.

Source: Investor Presentation

The subsidiaries of Evergy operate on a fully regulated retail utility model in Missouri and Kansas and thus they do not face any competition in these markets. This typical utility model, which generates reliable and growing earnings, is undoubtedly a strong competitive advantage

We expect annual returns of 11.1% per year, due to 7.0% EPS growth, the 3.9% dividend yield, and a 0.8% contribution from multiple expansion.

Click here to download our most recent Sure Analysis report on Evergy (preview of page 1 of 3 shown below):

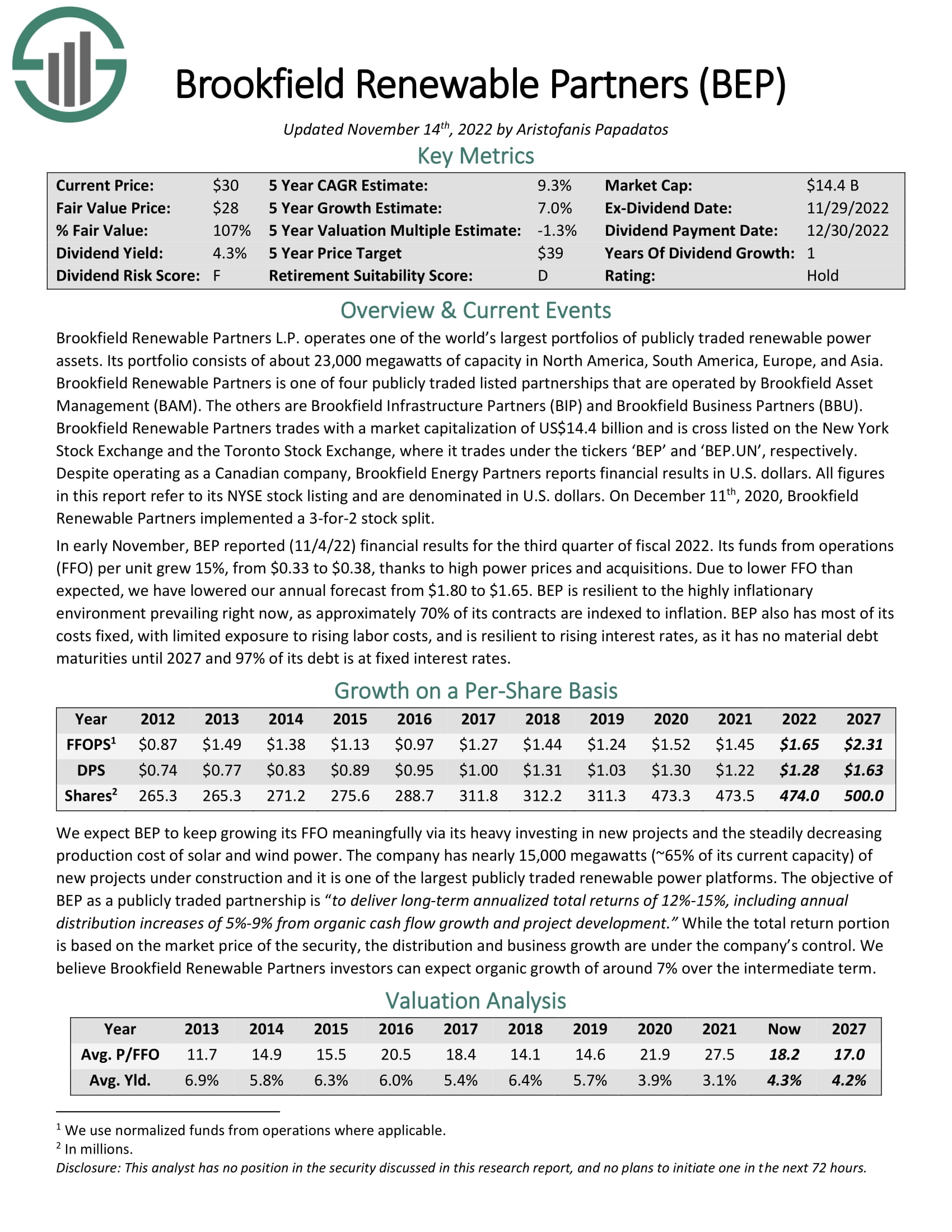

Top Utility Stock #8: Brookfield Renewable Partners LP (BEP)

- 5-year expected annual returns: 12.8%

Brookfield Renewable Partners is one of four publicly traded listed partnerships that are operated by Brookfield Asset Management (BAM). The others are Brookfield Infrastructure Partners (BIP) and Brookfield Business Partners (BBU). Brookfield Renewable Partners trades with a market capitalization of $11.6 billion and is cross listed on the New York Stock Exchange and the Toronto Stock Exchange, where is trades under the tickers ‘BEP’ and ‘BEP.UN’.

Brookfield Renewable Partners’ funds-from-operation history has been erratic over the years, but we expect that the partnership will be able to grow meaningfully due to heavy investing in new projects. Along with this, we project that production cost of solar and wind power will come down.

Brookfield Renewable Partners has an extensive foot print around the world.

Source: Investor Presentation

Brookfield Renewable Partners also has 15,000 megawatts, or almost two-thirds of its current capacity, of new projects under construction. The partnership is also protected against rising inflationary costs as 70% of contracts are indexed to inflation.

Because of these factors, the 5% dividend looks well covered. Our projected payout ratio is 78% for 2022, which would be the lowest in a decade for the partnership.

We expect 12.8% annual returns, due to 7.0% funds from operation growth, the 5.0% dividend yield, and a 1.9% contribution from an expanding valuation multiple.

Click here to download our most recent Sure Analysis report on Brookfield Renewable Partners (preview of page 1 of 3 shown below):

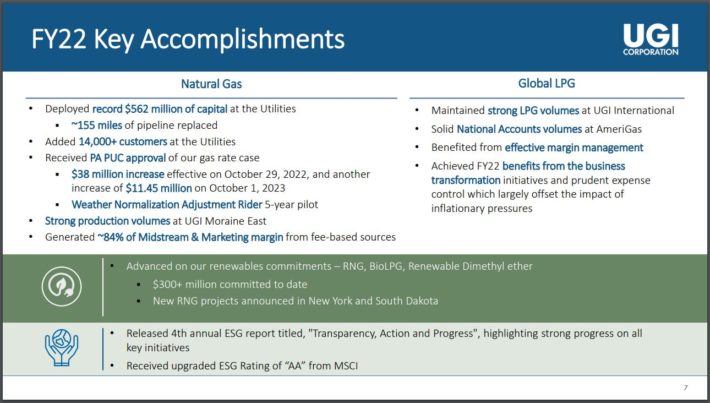

Top Utility Stock #7: UGI Corporation (UGI)

- 5-year expected annual returns: 13.8%

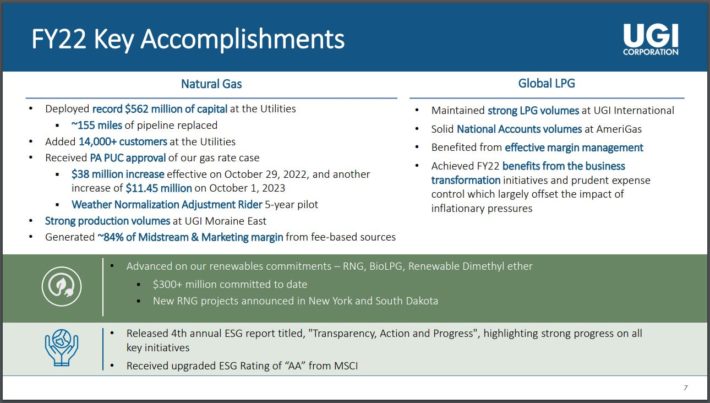

UGI Corporation is a gas and electric utility that operates in Pennsylvania, in addition to a large energy distribution business that serves the entire U.S. and other parts of the world. It was founded in 1882 and has paid consecutive dividends since 1885. It should generate about $8.2 billion in revenue this year. The company operates in four reporting segments: AmeriGas, UGI International, Midstream & Marketing, and UGI Utilities.

UGI reported FQ4 and fiscal year 2022 results on November 17th, 2022. For the fiscal year, adjusted earnings-per-diluted share for the quarter came in at $2.90, down from $2.96 in the prior period. Revenue totaled $10.1 billion.

UGI invested record amounts of capital in its utility business during the fiscal year and added more than 14,000 new customers.

Source: Investor Presentation

We see 7.2% annualized growth over the next half decade. UGI completes acquisitions periodically, further bolstering future growth. It does not buy back stock, but these initiatives should be enough to drive earnings-per-share growth over the long-term. Keep in mind that results are non-linear thanks to the weather, so UGI will almost certainly not achieve steady growth, but will go through stops and starts. Long-term, however, the growth story remains intact.

Management is dedicated to continuing the 130+ year streak of paying dividends and the 35 years of consecutive increases.

Total returns are expected to reach 13.8% per year, due to 6.5% expected EPS growth, the 3.9% dividend yield, and a 4.4% tailwind from an expanding P/E multiple.

Click here to download our most recent Sure Analysis report on UGI Corporation (preview of page 1 of 3 shown below):

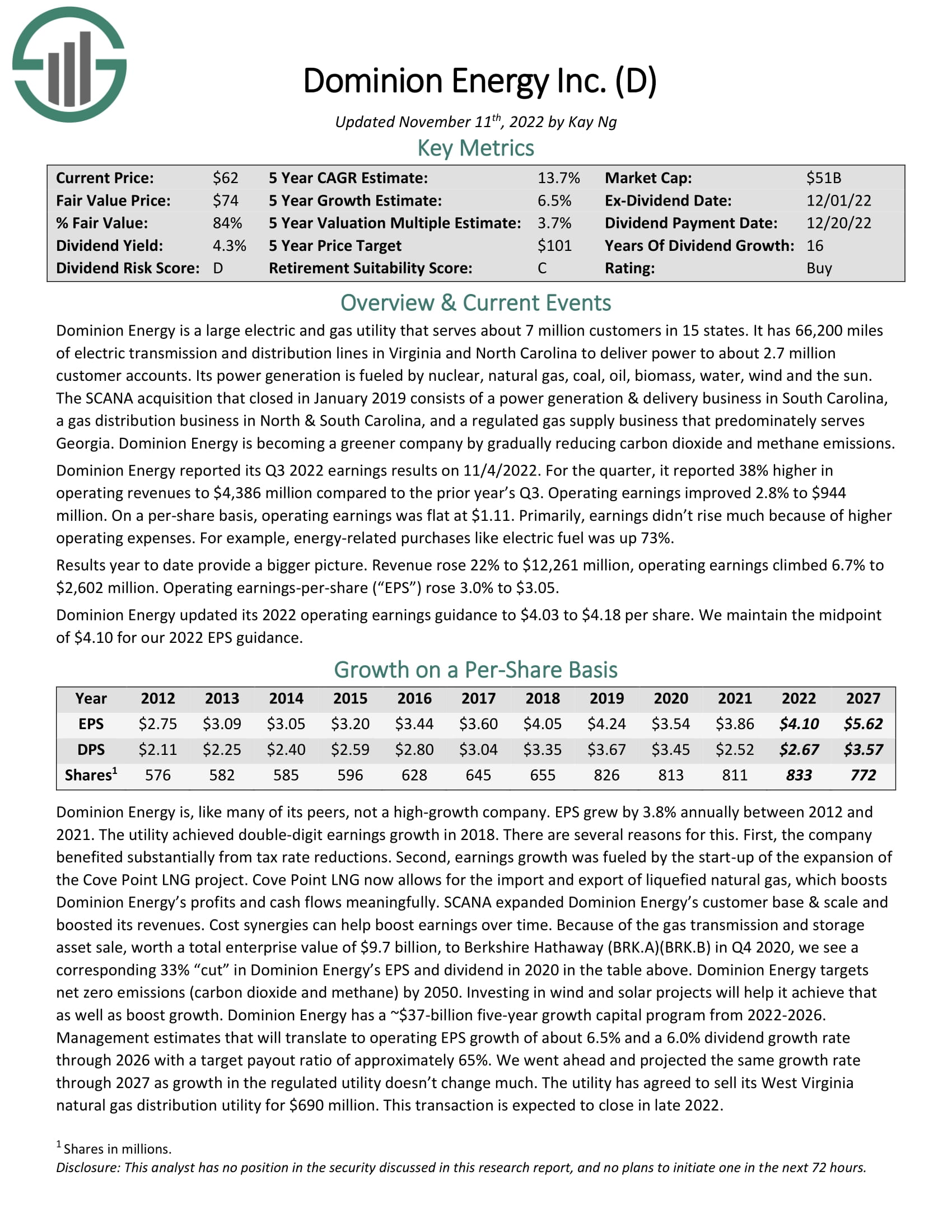

Top Utility Stock #6: Dominion Energy Inc. (D)

- 5-year expected annual returns: 14.1%

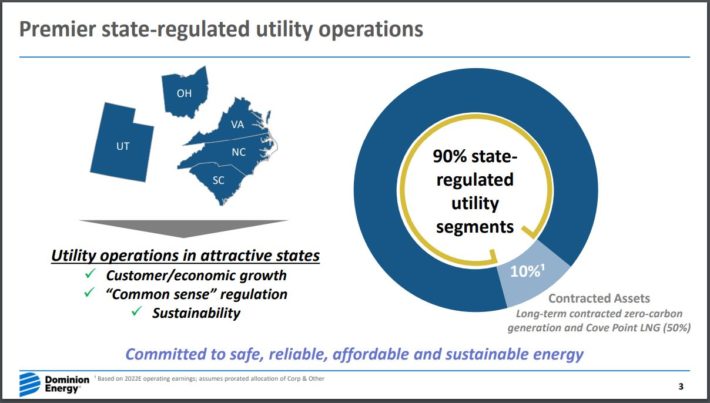

Dominion Energy is a large electric and gas utility company that serves nearly 7 million customers in 15 states. The company has more than 66,000 miles of electric transmission and distribution lines in Virginia and North Carolina to deliver power to about 2.7 million customers accounts. Dominion Energy’s power generation is fueled by nuclear, natural gas, coal, oil, biomass, water, wind, and sun.

Source: Investor Presentation

Third-quarter earnings were reported on November 4th, 2022. Revenue surged 38% to $4.4 billion while earnings-per-share of $1.11 were unchanged from the prior year. This was mostly due to higher operating costs.

After selling its gas transmission and storage business to Berkshire Hathaway (BRK.A) (BRK.B) for $9.7 billion in 2020, Dominion Energy cut its dividend by 33%.

Following the cut, the expected payout ratio for 2022 is just 65%, which would be one of the lowest for the company in more than a decade. We believe that the dividend is now much safer.

We expect annual returns of 14.1% over the next five years, driven by 6.5% earnings growth, the 4.4% yield, and a 4.0% contribution from multiple expansion.

Click here to download our most recent Sure Analysis report on Dominion Energy (preview of page 1 of 3 shown below):

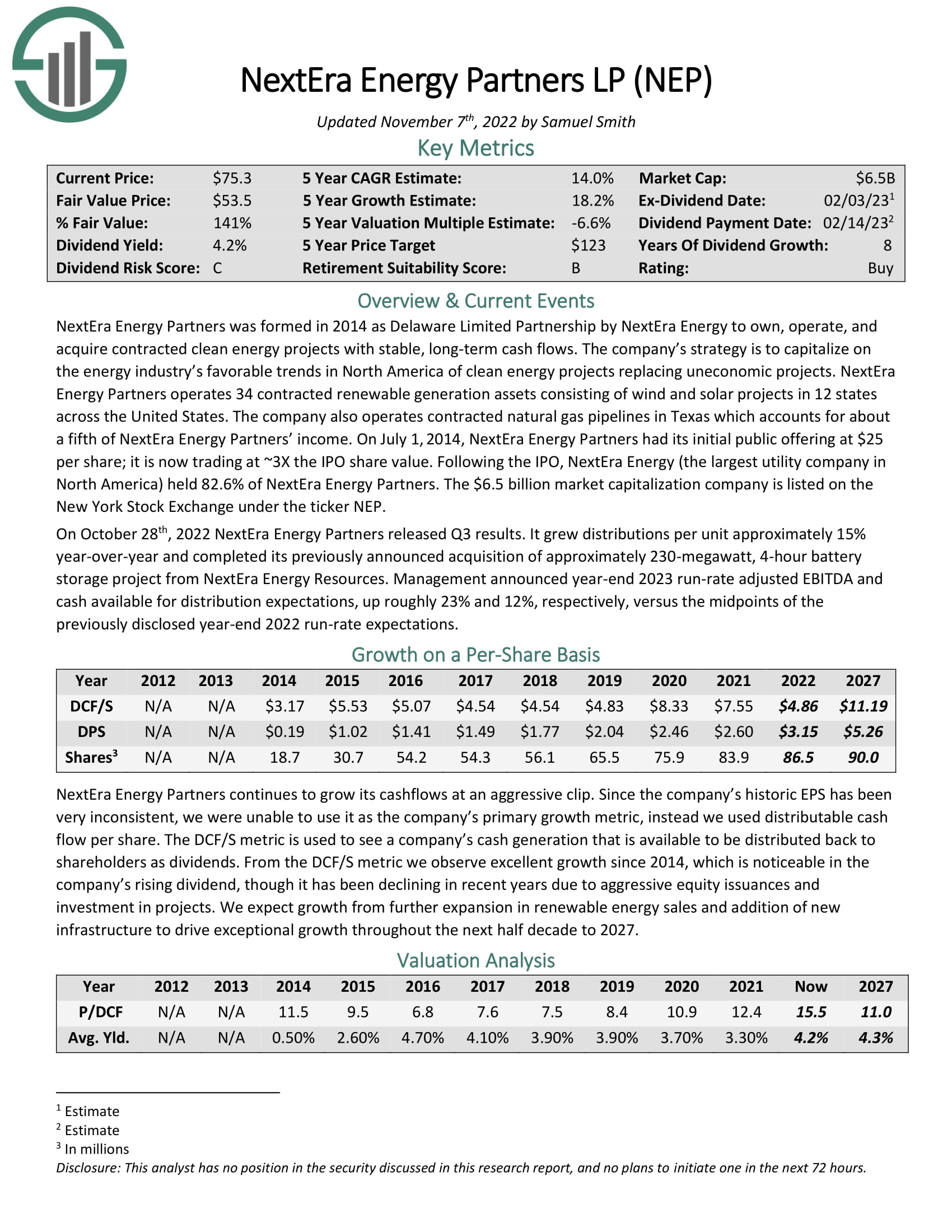

Top Utility Stock #5: NextEra Energy Partners LP (NEP)

- 5-year expected annual returns: 15.0%

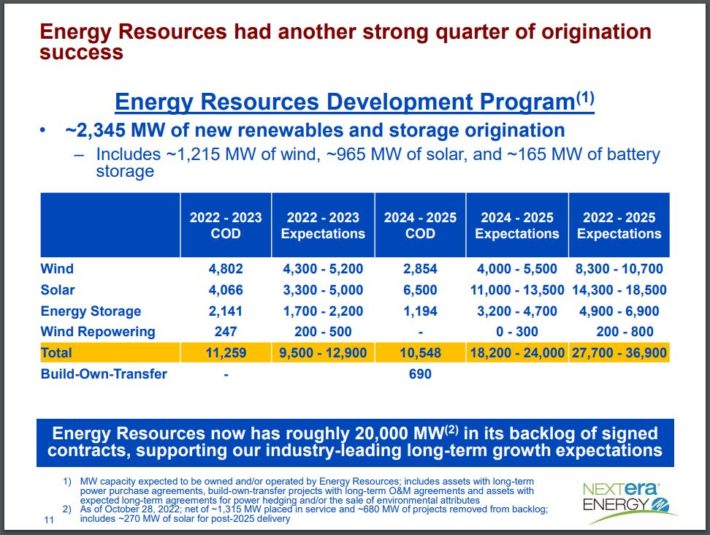

NextEra Energy Partners was formed in 2014 by NextEra Energy (NEE) in 2014 with a purpose to own, operate, and acquire contracted clean energy projects with stable, long-term cash flows. The company’s strategy is to capitalize on the energy industry’s favorable trends of clean energy projects in North America.

NextEra Energy Partners operates more than 30 contracted renewable generation assets consisting of wind and solar projects in a dozen states across the U.S. The company also operates contracted natural gas pipelines in Texas, which accounts for about a fifth of the partnership’s income.

The increase in demand for renewable energy has greatly benefited NextEra Energy Partners. The stock is now trading at almost 3x the IPO share value. Following the IPO, NextEra Energy holds a nearly 83% stack in NextEra Energy Partners.

The demand for renewable energy doesn’t appear to be slowing down either, given the extensive backlog that the partnership has.

Source: Investor Presentation

We expect annual returns of 15.0% per year, due to 18.2% expected distributable cash flow growth and the 4.4% dividend yield, offset by a 5.8% headwind from multiple compression.

Click here to download our most recent Sure Analysis report on NextEra Energy Partners (preview of page 1 of 3 shown below):

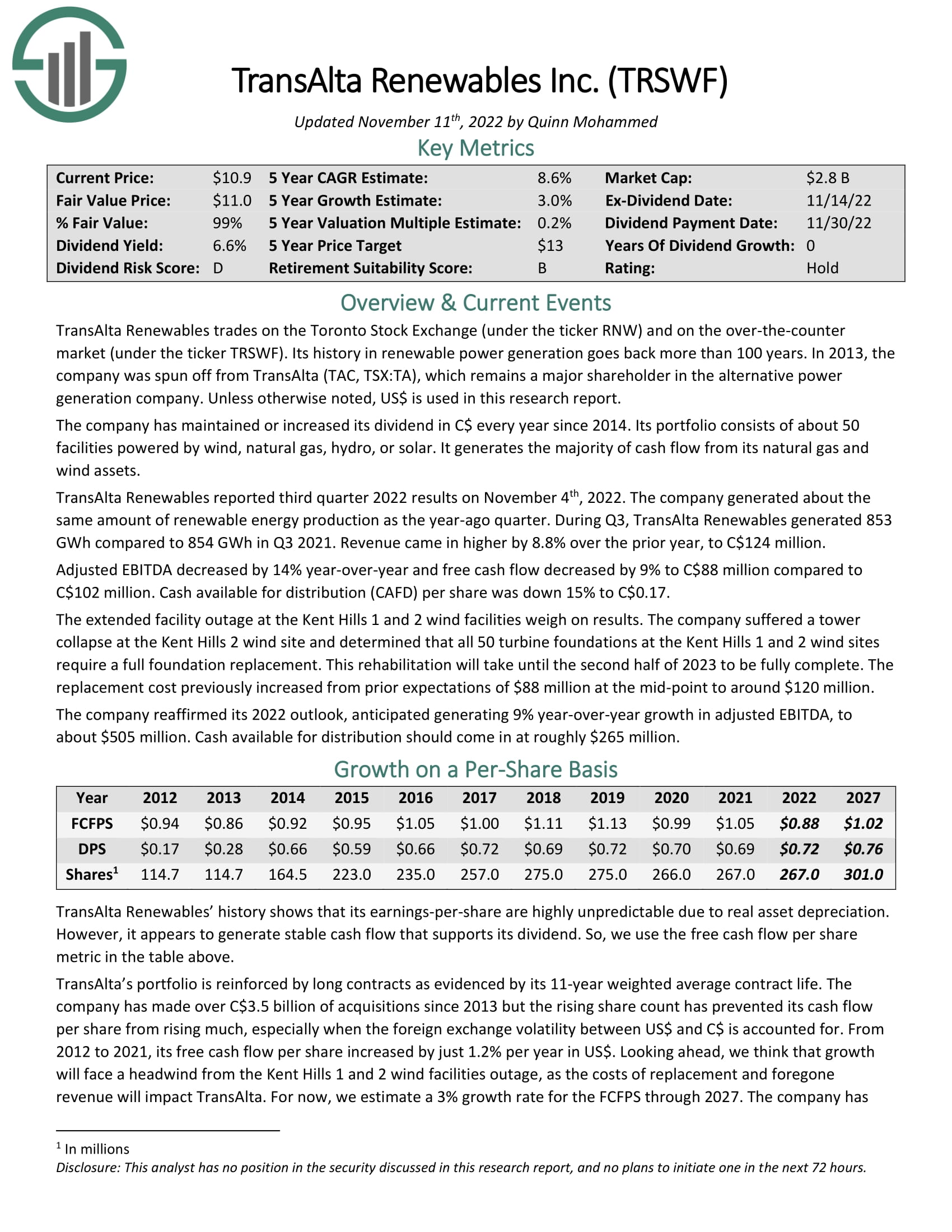

Top Utility Stock #4: TransAlta Renewables Inc. (TRSWF)

- 5-year expected annual returns: 15.5%

TransAlta Renewables trades on the Toronto Stock Exchange (under the ticker RNW) and on the over-the-counter market (under the ticker TRSWF). Its history in renewable power generation goes back more than 100 years. In 2013, the company was spun off from TransAlta (TAC, TSX:TA), which remains a major shareholder in the alternative power generation company. Unless otherwise noted, US$ is used.

TransAlta Renewables’ history shows that its earnings-per-share are highly unpredictable due to real asset depreciation. However, it appears to generate stable cash flow that supports its dividend. So, we use the free cash flow per share metric to measure growth for the company.

The company’s dividend appears well supported by the business model as TransAlta’s portfolio is reinforced by long contracts as evidenced by its 11-year weighted average contract life.

We expect 15.5% annual returns, due to 3% free cash flow per share growth, the 9.0% dividend yield, and a 6.6% contribution from an expanding P/E multiple

Click here to download our most recent Sure Analysis report on TransAlta Renewables (preview of page 1 of 3 shown below):

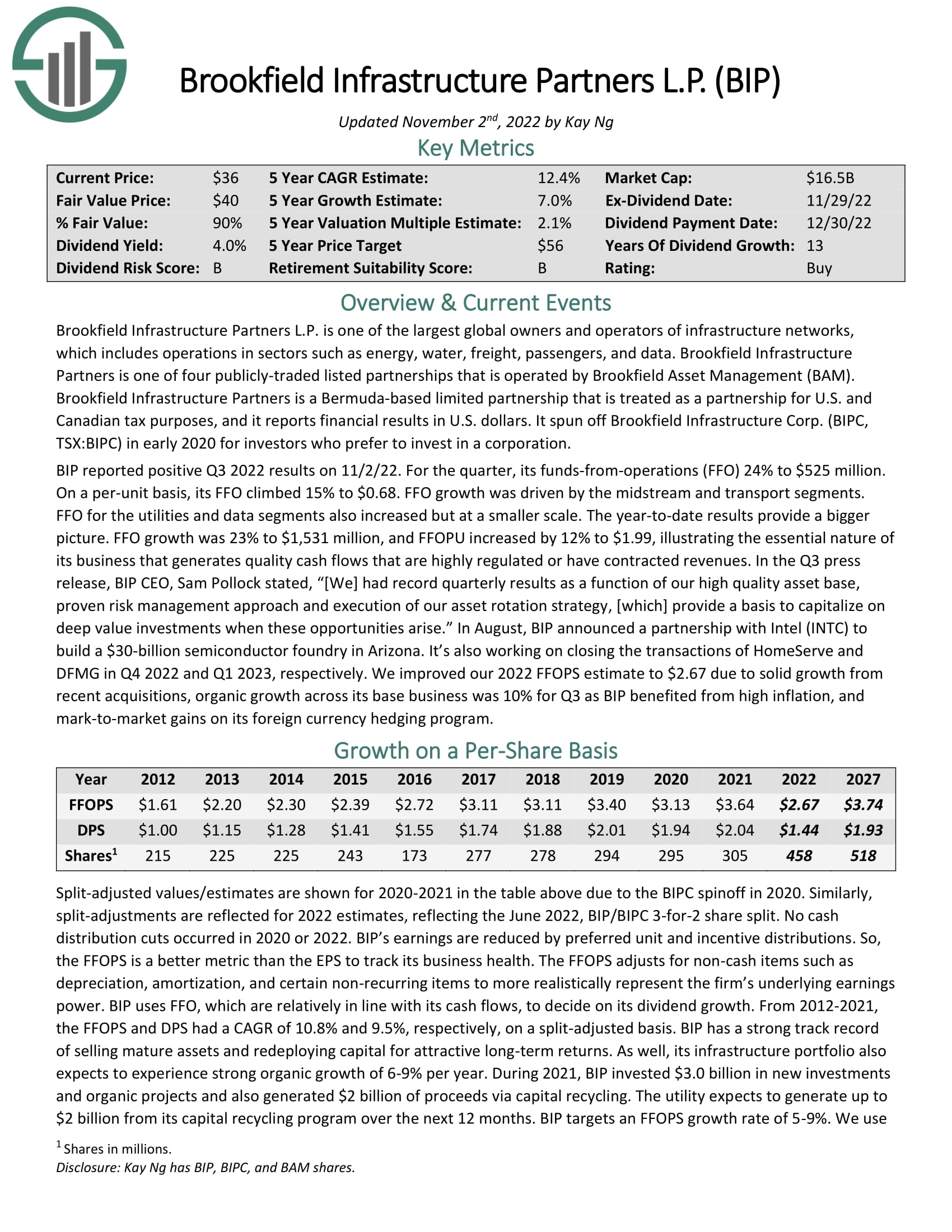

Top Utility Stock #3: Brookfield Infrastructure Partners L.P. (BIP)

- 5-year expected annual returns: 15.6%

Brookfield Infrastructure Partners is one of the largest global owners and operators of infrastructure networks that includes operations ins sectors such as energy, water, freight, passengers, and data. Brookfield Infrastructure Partners is one of four publicly-traded listed partnerships that is operated by Brookfield Asset Management. Brookfield Infrastructure Corp (BIPC) was spun off in early 2020 for investors who prefer to invest in a corporation.

Brookfield Infrastructure Partners has seen steady growth over the long-term. Funds-from-operation grew at a steady rate of nearly 11% per year for the 2012 to 2021 period. The dividend enjoyed robust growth as well, compounding at 9.5% over the same period.

Brookfield Infrastructure Partners has a strong track record of selling mature assets and redeploying capital for attractive long-term returns. For example, the partnership generated $2 billion of proceeds from selling assets in 2021 and expects a similar amount over the next year.

We project that the stock will provide annual returns of 15.6% through 2027 due to a 7.0% earnings growth rate, 4.6% dividend yield, and a 5.0% tailwind from an expanding valuation multiple.

Click here to download our most recent Sure Analysis report on Brookfield Infrastructure Partners (preview of page 1 of 3 shown below):

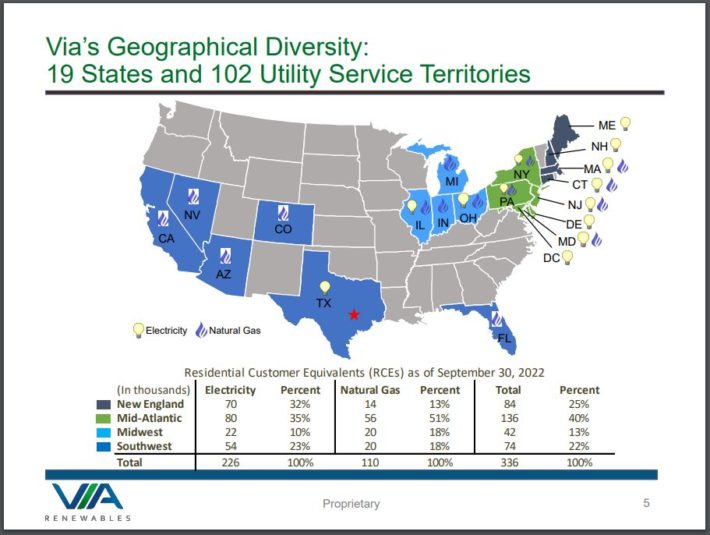

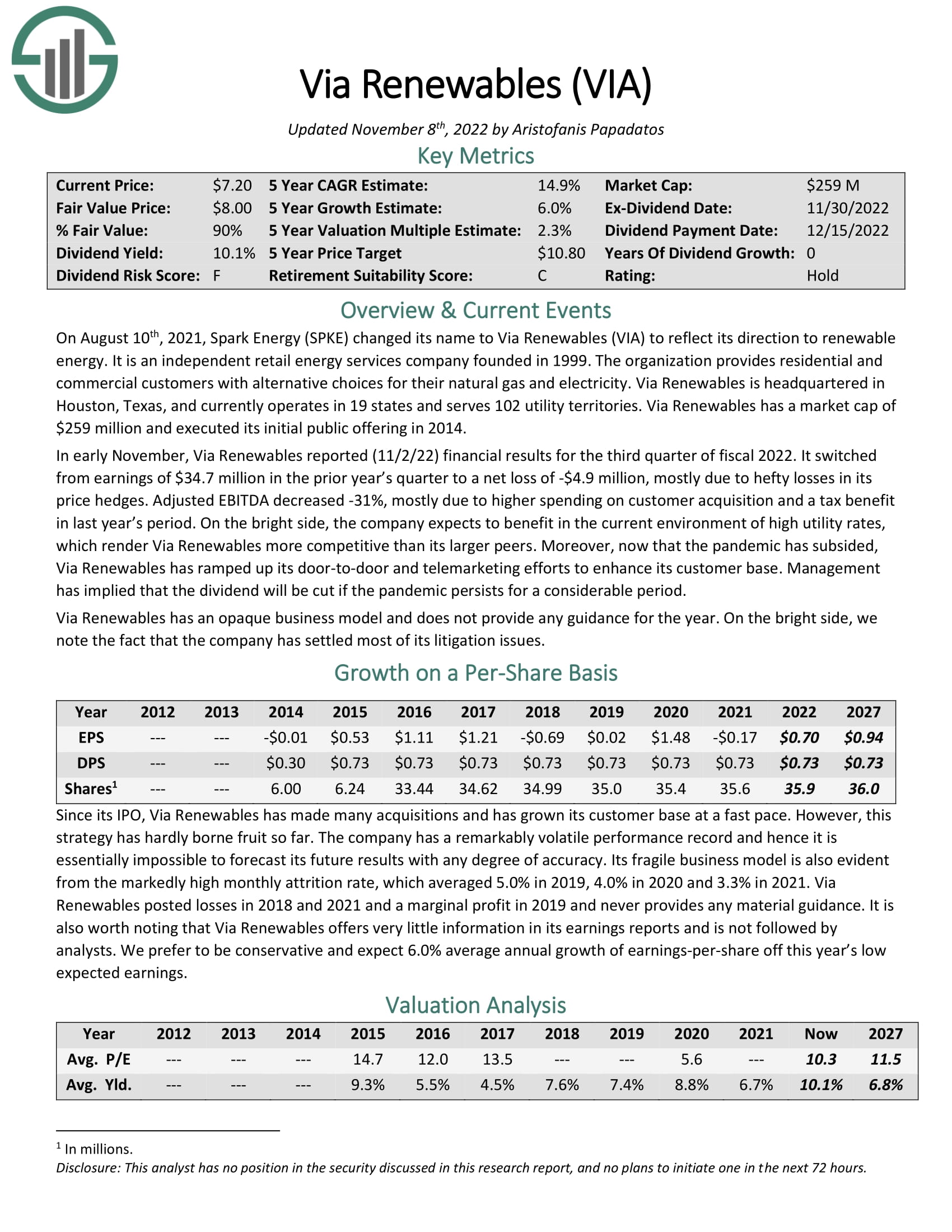

Top Utility Stock #2: Via Renewables Inc. (VIA)

- 5-year expected annual returns: 22.2%

On August 10th, 2021, Spark Energy (SPKE) changed its name to Via Renewables (VIA) to reflect its direction to renewable energy. It is an independent retail energy services company founded in 1999. The organization provides residential and commercial customers with alternative choices for their natural gas and electricity. Via Renewables is headquartered in Houston, Texas, and currently operates in 19 states and serves 102 utility territories. Via Renewables has a market cap of $189 million and executed its initial public offering in 2014.

Source: Investor Presentation

Since its IPO, Via Renewables made many acquisitions and has grown its customer base at a fast pace. However, this strategy has hardly borne fruit so far. The company has a remarkably volatile performance record and hence it is essentially impossible to forecast its future results with any degree of accuracy.

As a small-cap energy business, Via Renewables tends to be more volatile than most large cap stocks. To provide a perspective, the stock is ~56% off its peak posted about five years ago. Moreover, the stock could underperform the market during sell-off periods. In the sell-off triggered by the pandemic, the stock plunged -50% whereas the S&P 500 fell -35%. Furthermore, Via Renewables is not followed by analysts and provides little information in its reports.

That said, we expect that the stock will provide annual returns of 22.2% over the next five years due to 6.0% earnings growth, the yield of 13.9%, and an 8.7% contribution from multiple expansion. We note that the stock might be best suited for those with a higher tolerance for risk.

Click here to download our most recent Sure Analysis report on Via Renewables (preview of page 1 of 3 shown below):

Top Utility Stock #1: Algonquin Power & Utilities Corp. (AQN)

- 5-year expected annual returns: 23.2%

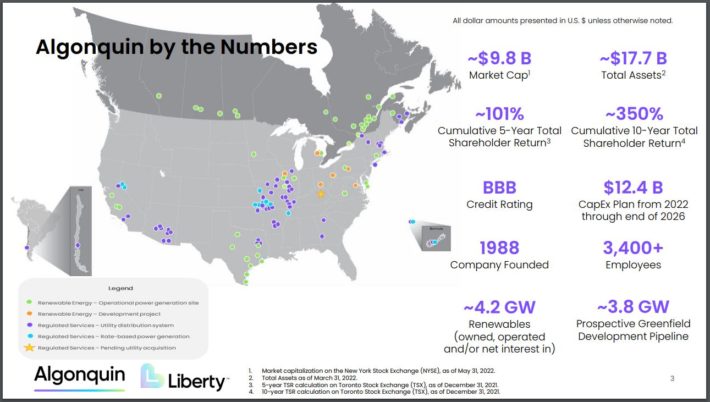

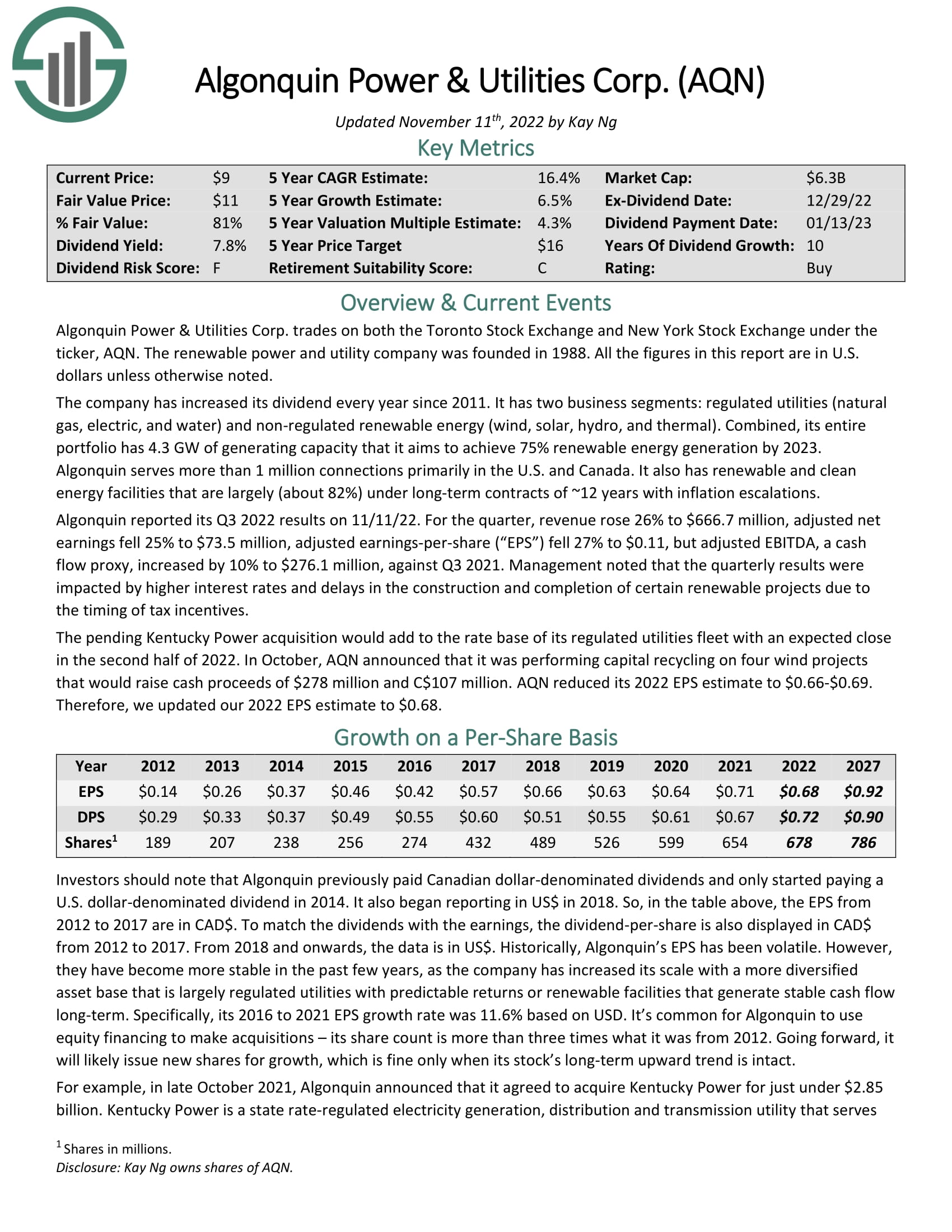

Algonquin Power & Utilities Corp. trades on both the Toronto Stock Exchange and New York Stock Exchange under the ticker, AQN. The renewable power and utility company was founded in 1988.

Source: Investor Presentation

The company has increased its dividend every year since 2011. It has two business segments: regulated utilities (natural gas, electric, and water) and non-regulated renewable energy (wind, solar, hydro, and thermal). Combined, its entire portfolio has 4.3 GW of generating capacity that it aims to achieve 75% renewable energy generation by 2023.

Algonquin serves more than 1 million connections primarily in the U.S. and Canada. It also has renewable and clean energy facilities that are largely (about 82%) under long-term contracts of ~12 years with inflation escalations.

We expect annual returns of 23.2% per year, due to 6.5% expected EPS growth, the 10.7% dividend yield and a 10.2% boost from an expanding P/E multiple.

Click here to download our most recent Sure Analysis report on Algonquin Power & Utilities (preview of page 1 of 3 shown below):

Final Thoughts

The utility sector is a great place to find high-quality dividend stocks suitable for long-term investment.

It is not, however, the only place to find attractive investments.

If you’re willing to venture outside of the utility industry for investment opportunities, the following Sure Dividend databases are very useful:

If you’re looking for other sector-specific dividend stocks, the following Sure Dividend databases will be useful:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].