Data updated daily

Constituents updated annually

The financial sector is an interesting field to search for compelling investing ideas.

However, thorough due diligence is required. The Great Recession showed us how dangerous investing in poorly-managed financial companies can be.

With that in mind, we’ve compiled a list of more than 200 financial stocks, along with important investing metrics. The database is available for download below:

The stocks for this list were derived from some of the major ETFs that track the financial sector:

- Financial Select Sector SPDR ETF (XLF)

- iShares U.S. Insurance ETF (IAK)

- SPDR S&P Regional Banking ETF (KRE)

Keep reading this article to learn more about the merits of investing in financial stocks.

How To Use The Financials Stocks List To Find Compelling Investing Ideas

Having an Excel database of all financial sector stocks is extremely useful.

This resource becomes even more valuable when combined with a working knowledge of Microsoft Excel.

With that in mind, this section will show you how to implement two actionable investing screens to the Financials Stocks List. The first filter we’ll implement is for stocks trading at low valuation multiples as measured by the price-to-earnings ratio.

Screen 1: Low Price-to-Earnings Ratios

Step 1: Download the Financial Sector Stocks List at the link above.

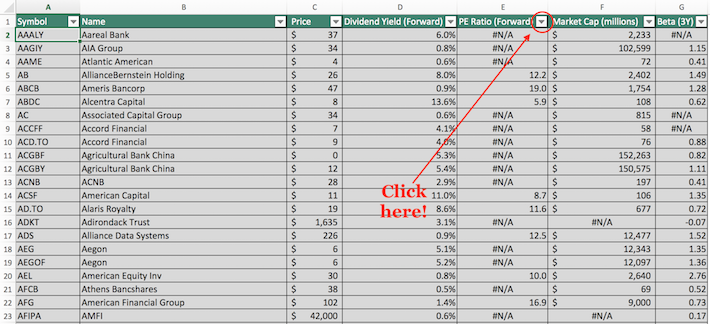

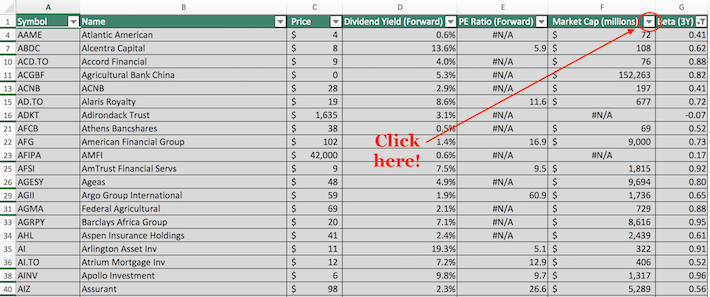

Step 2: Click on the filter icon at the top of the price-to-earnings ratio, as shown below.

Step 3: Change the filter setting to “Less Than” and input an appropriate P/E cutoff into the field beside it. Keep in mind that financial stocks tend to trade at discounts to the broader market when measured by the price-to-earnings ratio, so a multiple of 20 (which would make sense for, say, consumer staples stocks) is not prudent here.

The following image shows how to implement a screen for price-to-earnings ratios less than 15.

The remaining stocks within this spreadsheet are financial stocks with price-to-earnings ratios below 15.

The next filter that we’ll implement is a two-factor screen for stocks with market capitalizations above $10 billion and betas below 1.0.

Screen 2: Low Volatility, Large Market Capitalization

Step 1: Download the Financial Sector Stocks List at the link above.

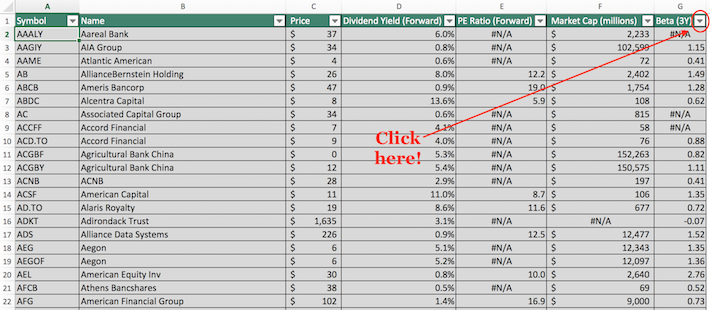

Step 2: Click on the filter icon at the top of the Beta column, as shown below.

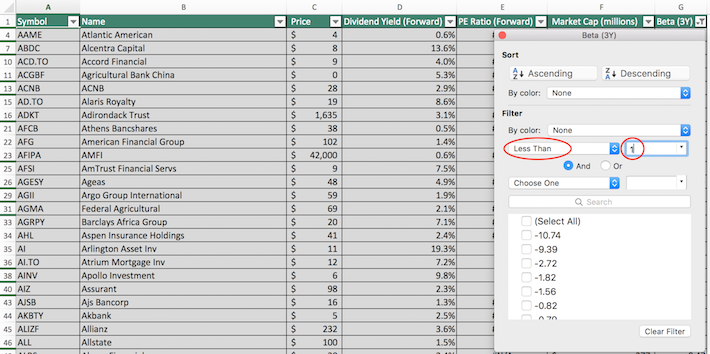

Step 3: Change the filter setting to “Less Than”, and input “1” into the field beside it, as shown below.

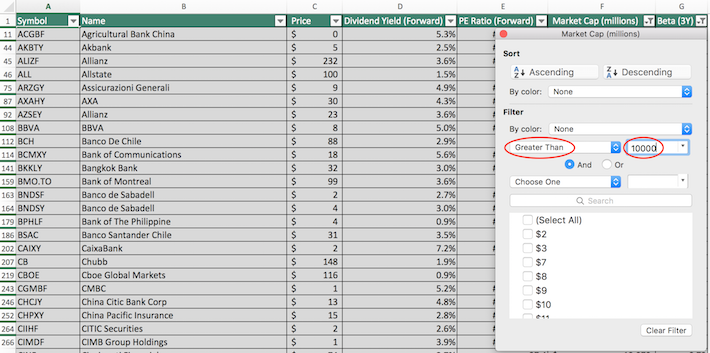

Step 4: Close out of the filter window (using the exit button, not the “Clear Filter” button). Then, click on the filter icon at the top of the Market Capitalization column, as shown below.

Step 5: Change the filter setting to “Greater Than” and input 10000 into the field beside it. Note that since market capitalization is measured in millions of dollars in this spreadsheet, inputting “$10,000 million” is equivalent to $10 billion.

The remaining stocks in this list are dividend-paying financial sector stocks with market capitalizations above $10 billion and betas below 1. These are large companies with low volatility, which will appeal to conservative dividend investors.

You now have a working knowledge of how to maximize the utility of the Financial Stocks List. The next section will discuss the merits of investing in financial stocks as well as why these stocks need to use leverage to generate adequate returns.

Why Invest In The Financials Sector

The Great Recession showed us the perils associated with investing in financial stocks with poor risk management practices. Banks and other financial institutions over-extended themselves, leaving the sector as the worst-performing S&P 500 component during the 2008 economic downturn.

With that said, financial stocks still have some endearing characteristics.

The most notable is that they tend to trade at price-to-earnings ratios well below the average earnings multiple of the broader stock market. The low valuation multiples of financial sector stocks are primarily due to the leverage employed by these companies.

In fact, financial companies – by definition – need to use leverage to generate adequate returns on equity. Some basic math can help us to understand why.

Imagine that you’re analyzing two nearly-identical companies. Let’s call them Company A and Company B. Both operate within the financial sector and neither has a significantly different business model than the other.

The two companies both have a similar amount of assets – say, $10 billion – and identical earnings of $1 billion. The only discernable difference between the companies is the nature of their balance sheet.

Company A employs no leverage. In other words, their balance sheet is 100% equity.

Conversely, Company B operates with a debt-to-equity ratio of 1.0x, meaning its balance sheet is 50% debt and 50% equity.

What does this mean from the perspective of the security analyst?

Well, although the companies each have the same 10% return on assets ($1 billion of earnings generated from $10 billion of assets) – Company B’s return on equity will be twice as high because it has been able to successfully employ leverage without experiencing any diminishing returns.

This concept – that leverage can boost returns on equity – is particularly important for financial sector stocks because they generally have very low return on assets.

The rock-bottom returns on assets exhibited by this sector is due to the business model of lenders – which comprise the vast majority of financial stocks. These companies take a small spread on the interest rates between borrowers and depositors.

In order for this business model to make sense, it needs to be done on a vast scale – hence the leverage.

The financial sector is also interesting in that it has a wide variety of industries within the sector. Financial sector industries include banks, insurance stocks, asset managers, ratings agencies, and payment processors, among others.

Final Thoughts

The Financials Stocks List is a useful tool for finding high-quality investment opportunities.

With that said, it is not the only place where great investments can be found.

If you’re willing to consider investments outside of the financial sector, the following databases contain information on some of the strongest dividend stocks around:

If you’re looking for other sector-specific dividend stocks, the following Sure Dividend databases will be useful:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].