Published on January 8th, 2023 by Nikolaos Sismanis

Closed-end funds (CEFs) are a type of investment vehicle that can potentially serve income-oriented investors quite satisfactorily.

In this article, we will explore what CEFs are, how they work, and why they can be a good investment option for those looking to generate income.

With this in mind, we created a list of 117 closed-end funds. You can download your free copy of the closed-end funds list by clicking on the link below:

Table Of Contents

You can use the following table of contents to instantly jump to a specific section of the article:

What are Closed-End Funds (CEFs)?

Closed-end funds are similar to traditional mutual funds in that they both pool together money from multiple investors and use that money to invest in a diverse portfolio of assets.

However, unlike mutual funds, which can issue and redeem new shares as needed, CEFs have a fixed number of shares that are issued at the time of the fund’s initial public offering (IPO).

This means that the price of a CEF’s shares is determined by supply and demand on the stock exchange rather than the underlying value of the assets in the fund.

How are Closed-End Funds (CEFs) different from Exchange-Traded Funds (ETFs)?

What primarily differentiates CEFs and ETFs is the way in which they are structured and traded. CEFs have a fixed number of shares. These shares are traded on a stock exchange, just like ordinary stocks, but the fund itself does not issue new shares or buy back/redeem existing ones in response to investor demand.

This means that the price of a CEF share can contrast notably from its underlying net asset value (NAV), depending on the supply and demand of its shares in the market.

In contrast, ETFs are designed to track the performance of a particular index or basket of assets. Their prices tend to stay close to their NAV because they are constantly issuing and redeeming shares in response to investor demand.

Hence, an ETF will never trade at a premium/discount, and for this reason, ETFs are also way more liquid, in general.

ETFs are predominantly passively managed as they generally aim to track the performance of an index or benchmark as closely as possible rather than trying to outperform it.

In contrast, CEFs are typically actively managed, which means that fund managers pick the underlying securities and make decisions about when to buy and sell them based on their own research, analysis, and the fund’s targets. For this reason, CEFs often have significantly higher expense ratios than ETFs as well.

How do Closed-End Funds Work?

CEFs are generally managed by professional fund managers who use the pooled money from investors to buy a certain portfolio of assets. The specific assets that a CEF invests in are based on its investment objective and mandate.

For example, the fund managers of a CEF focused on income generation will likely invest in a mix of high-yield bonds, dividend-paying stocks, royalties, and other income-generating assets.

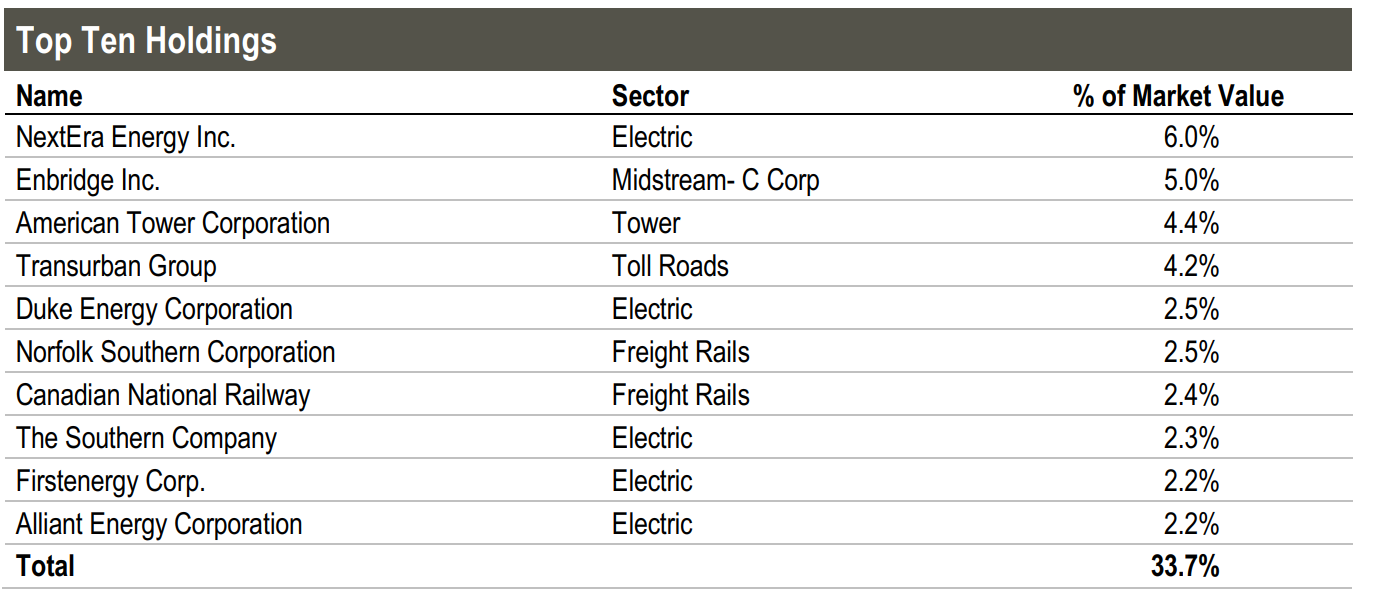

Each case is different. For instance, The Cohen & Steers Infrastructure Fund (UTF), as its name suggests, is focused on investing primarily in infrastructure assets. It holds stocks in companies that own electric transmission networks, toll roads, freight rails, pipelines, and cell towers, amongst other relevant assets.

Source: Cohen & Steers Infrastructure Fund Fact Sheet

It’s also worth noting that since CEFs are regulated as investment companies under the Investment Company Act of 1940, they are required to distribute at least 90% of their income to shareholders on a regular basis (typically quarterly or semi-annually).

This condition helps to ensure that CEFs do not accumulate growing amounts of income and retain it for the benefit of the fund manager or other insiders. Instead, the income must be passed along to the fund’s shareholders, who are actually the owners of the fund.

Why are Closed-End Funds a Good Choice for Income-Oriented Investors?

CEFs have historically been fine investment vehicles for investors in terms of generating a consistent stream of income. We have tried to dissect the qualities of CEFs in order to create a list of the different reasons income-oriented investors are likely to find CEFs fitting investments for their portfolio and why you may want to consider investing in CEFs.

Potential for Consistent Income Generation

As mentioned, because CEFs are required to distribute a cut of their income to shareholders, you can be sure that as long as the CEFs underlying holdings generate cash flow, the majority of it will be paid out.

This can be particularly appealing for investors who are relying on their investments to generate a reliable source of income (e.g., if dividends are utilized for one’s everyday expenses).

Active Management Comes With Benefits (and risks)

We previously differentiated CEFs from ETFs in that they are predominantly actively managed by professional fund managers who are appointed to select and manage the assets in the fund.

This can be beneficial for income-oriented investors who may not have the time or expertise to manage their own portfolio of income-generating assets.

Higly-skilled professionals who stay on top of the market are more likely to constantly optimize the holdings of a CEF in order to meet its mandate, which in this case would be to generate sustainable/growing income.

While this is a great advantage, and active management can also lead to outperformance against, say, an equivalent ETF holding dividend-paying stocks, it also imposes a risk. Fund managers could make poor investment decisions or fail to meet the fund’s investment strategy, harming shareholders’ capital.

Diversification / Flexibility

Another reason CEFs could be ideal investment vehicles for income-oriented investors is that, by nature, they are diversified and provide shareholders with flexibility.

Regarding diversification, the portfolios of CEFs are typically exposed across a wide range of assets, which can help to reduce risk and enhance the stability of the fund’s income stream.

As far as providing flexibility goes, CEFs come in a variety of types, such as those focused on income generation, growth, or a combination of the two.

Thus, income-oriented investors choose between high-yield CEFs, dividend-growth CEFs, or anything else that aligns with their investment goals and risk tolerance.

Other individual characteristics can also provide further flexibility in order to meet one’s investment goals.

For instance, income-oriented investors who require a very frequent stream of income can invest in monthly-paying CEFs, such as the BlackRock Science and Technology Trust (BST).

The diversification and flexibility of CEFs can make them an excellent choice for investors who are looking to build a well-rounded portfolio that meets their specific investment needs.

Buying CEFs Below Their NAV Can Be Quite Appealing – Here’s Why

As we mentioned earlier, in contrast to ETFs, which are designed to track the performance of a particular index or basket of assets, the share price of CEFs does not automatically adjust to the underlying value of its holdings.

Instead, the share price is determined solely by investors’ underlying demand for its shares. This can result in CEFs trading below or above their actual NAV.

Obviously, buying a CEF above its NAV is not something you should want to do. However, buying a CEF below its underlying NAV can be quite beneficial.

We have bundled these benefits into three reasons which explain why buying CEFs below their NAV can be quite appealing.

Arbitrage Amid a Possible Convergence to NAV

The most apparent advantage of buying CEFs below their NAV is the opportunity that comes from the discount eventually narrowing or closing over time. Sooner or later, investors will tend to price shares equally to their NAV.

If this wasn’t the case, a big arbitrage opportunity would arise. In that regard, buying CEFs below their NAV can lead to relatively low-risk gains, all other factors equal.

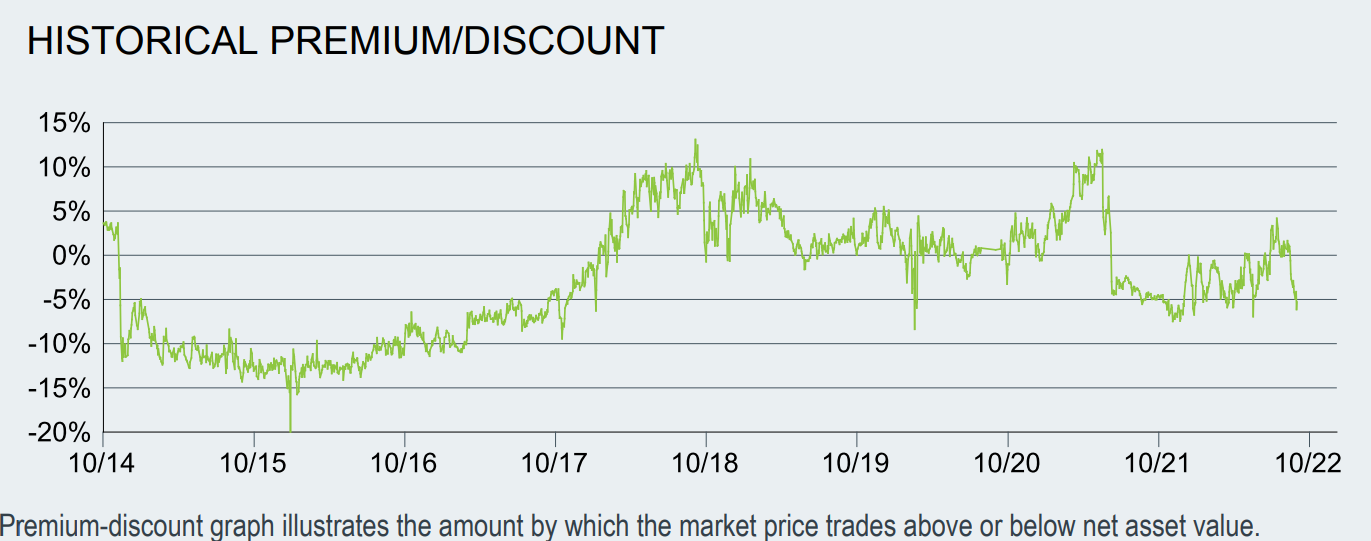

We previously cited BlackRock’s Science and Technology Trust (BST). Here is a graph displaying the discount/premium the fund was trading at during different periods.

Source: BlackRock Science and Technology Trust Factsheet

Investors could have exploited the periods the fund was trading at a discount for additional capital gains as the fund was converging toward its NAV or, even better, dump the fund’s shares when they were trading at a hefty premium.

The only example in which a discount could be long-sustained is if the CEF is holding assets that are expected to keep deteriorating or that are poorly managed, and investors want to pull their money regardless of what the CEF’s NAV is at the present moment.

That’s why you should avoid poorly-managed CEFs with ambiguous portfolios and unclear strategies in the first place.

It’s also worth noting that the opposite is also possible. For example, if investors highly appreciate a manager’s skills and believe that the manager could outperform the market moving forward, a CEF may trade at a premium over an extended period of time.

Still, we would suggest avoiding buying CEFs above their NAV.

Prospects for Higher Yields

Because CEFs are required to distribute a portion of their income to shareholders, buying CEFs below their NAV can result in a higher yield for investors.

Here is an example to illustrate how this could work:

- Let’s say that a CEF has a NAV/share of $10 and a dividend yield of 5% at that share price.

- This means that if you were to go and exactly replicate the CEF’s portfolio (same holdings/weights), your portfolio would also yield 5%.

- If the CEF is trading at a 10% discount to its NAV, however, the market price of the CEF’s shares would be $9.

- In this case, the dividend yield of the CEF trading at $9/share would be 5.55%, even though replicating the portfolio would yield less.

Therefore, by buying a CEF below its NAV, you can potentially extract higher yields compared to constructing such a portfolio manually.

A Higher Margin of Safety

Buying a CEF below its NAV can sometimes provide investors with a higher margin of safety, which refers to the difference between the market price of an investment and its intrinsic value.

This can shield investors from potential downside in the future, as the fund’s convergence to NAV could offset a potential decline in NAV.

Suppose you buy a CEF at a 10% discount to NAV. If the NAV of the fund were to decline by a further 10% because the values of its holdings were to slip further, but the share price of the CEF gradually corrects upwards toward its actual NAV during the same period, the two forces would somewhat cancel each other out.

This point is also combined with our previous regarding a higher yield, as capturing a higher yield during a period of discounted trading can result in higher tangible returns, which could offset future NAV declines and overall smooth investors’ future total return prospects.

Final Thoughts

CEFs can be useful investment vehicles for income-oriented investors due to their unique qualities, which can help generate more predictable income, lead to outperformance, and overall cater to each investor’s individual goals amid the numerous types of such funds.

The fact that CEFs can sometimes be exploited due to their deviation from NAV makes things all much more exciting if trading decisions are executed correctly (i.e., buying below NAV or selling above NAV).

That said, CEFs come with their own set of risks, including depending on the fund manager’s skills to produce returns, the potential lack of adequate liquidity, and the mandatory distribution requirements, which could limit the manager’s ability to make adjustable decisions based on the underlying market conditions.

The divergence from NAV, while it can be exploited favorably, is also a risk. Imagine you want to exit the fund, but it is currently trading at a discount even though its underlying holdings have held up strong. In that case, it would be much better to hold each stock individually and sell them all at market prices.

Finally, make sure you understand each CEFs fee structure, which can notably affect the fund’s future total return prospects.

Thus, make sure you weigh the pros and cons of CEFs well enough before allocating capital to these securities and that each CEF’s mandate adequately matches your investment objectives.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].