Up to date on June third, 2022 by Bob Ciura

Spreadsheet information up to date day by day

Actual property funding trusts – or REITs, for brief – might be improbable securities for producing significant portfolio earnings. REITs broadly supply greater dividend yields than the typical inventory.

Whereas the S&P 500 Index on common yields lower than 1.5% proper now, it’s comparatively simple to seek out REITs with dividend yields of 5% or greater.

The next downloadable REIT record accommodates a complete record of U.S. Actual Property Funding Trusts, together with metrics that matter together with:

- Inventory value

- Dividend yield

- Market capitalization

- 5-year beta

You may obtain your free 200+ REIT record (together with vital monetary metrics like dividend yields and payout ratios) by clicking on the hyperlink beneath:

Along with the downloadable Excel sheet of all REITs, this text discusses why earnings traders ought to pay significantly shut consideration to this asset class. And, we additionally embrace our prime 7 REITs right this moment based mostly on anticipated complete returns.

Desk Of Contents

Along with the complete downloadable Excel spreadsheet, this text covers our prime 7 REITs right this moment, as ranked utilizing anticipated complete returns from The Certain Evaluation Analysis Database.

The desk of contents beneath permits for straightforward navigation.

How To Use The REIT Listing To Discover Dividend Inventory Concepts

REITs give traders the flexibility to expertise the financial advantages related to actual property possession with out the effort of being a landlord within the conventional sense.

Due to the month-to-month rental cashflows generated by REITs, these securities are well-suited to traders that purpose to generate earnings from their funding portfolios. Accordingly, dividend yield would be the main metric of curiosity for a lot of REIT traders.

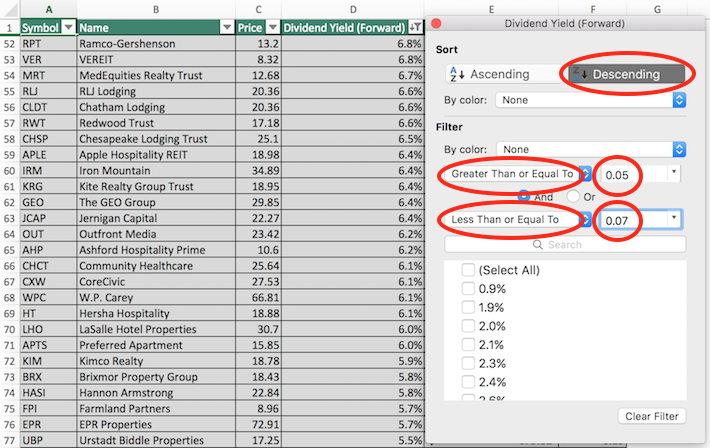

For these unfamiliar with Microsoft Excel, the next pictures present tips on how to filter for REITs with dividend yields between 5% and seven% utilizing the ‘filter’ perform of Excel.

Step 1: Obtain the Full REIT Excel Spreadsheet Listing on the hyperlink above.

Step 2: Click on on the filter icon on the prime of the ‘Dividend Yield’ column within the Full REIT Excel Spreadsheet Listing.

Step 3: Use the filter features ‘Higher Than or Equal To’ and ‘Much less Than or Equal To’ together with the numbers 0.05 advert 0.07 to show REITs with dividend yields between 5% and seven%.

This may assist to eradicate any REITs with exceptionally excessive (and maybe unsustainable) dividend yields.

Additionally, click on on ‘Descending’ on the prime of the filter window to record the REITs with the best dividend yields on the prime of the spreadsheet.

Now that you’ve the instruments to establish high-quality REITs, the subsequent part will present a number of the advantages of proudly owning this asset class in a diversified funding portfolio.

Why Put money into REITs?

REITs are, by design, a improbable asset class for traders trying to generate earnings.

Thus, one of many main advantages of investing in these securities is their excessive dividend yields.

The at the moment excessive dividend yields of REITs just isn’t an remoted prevalence. In reality, this asset class has traded at a better dividend yield than the S&P 500 for many years.

Associated: Dividend investing versus actual property investing.

The excessive dividend yields of REITs are because of the regulatory implications of doing enterprise as an actual property funding belief.

In alternate for itemizing as a REIT, these trusts should pay out a minimum of 90% of their web earnings as dividend funds to their unitholders (REITs commerce as models, not shares).

Typically you will notice a payout ratio of lower than 90% for a REIT, and that’s possible as a result of they’re utilizing funds from operations, not web earnings, within the denominator for REIT payout ratios (extra on that later).

REIT Monetary Metrics

REITs run distinctive enterprise fashions. Greater than the overwhelming majority of different enterprise varieties, they’re primarily concerned within the possession of long-lived property.

From an accounting perspective, which means that REITs incur important non-cash depreciation and amortization bills.

How does this have an effect on the underside line of REITs?

Depreciation and amortization bills cut back an organization’s web earnings, which implies that typically a REIT’s dividend will probably be greater than its web earnings, regardless that its dividends are protected based mostly on money circulation.

Associated: How To Worth REITs

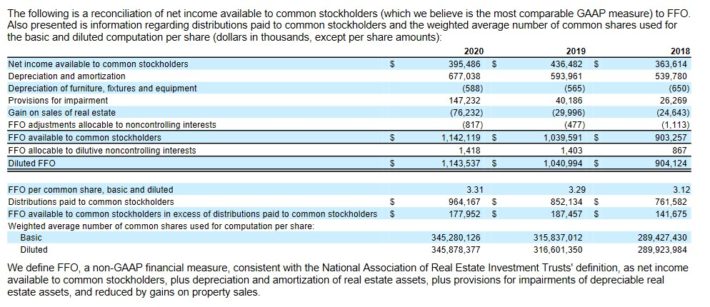

To offer a greater sense of economic efficiency and dividend security, REITs ultimately developed the monetary metric funds from operations, or FFO.

Identical to earnings, FFO might be reported on a per-unit foundation, giving FFO/unit – the tough equal of earnings-per-share for a REIT.

FFO is set by taking web earnings and including again varied non-cash fees which might be seen to artificially impair a REIT’s perceived skill to pay its dividend.

For an instance of how FFO is calculated, contemplate the next web income-to-FFO reconciliation from Realty Earnings (O), one of many largest and hottest REIT securities.

Supply: Realty Earnings Annual Report

In 2020, web earnings was $395 million whereas FFO out there to stockholders was above $1.1 billion, a large distinction between the 2 metrics. This exhibits the profound impact that depreciation and amortization can have on the GAAP monetary efficiency of actual property funding trusts.

The Prime 7 REITs Immediately

Under we have now ranked our prime 7 REITs right this moment based mostly on anticipated complete returns.

Anticipated complete returns are in flip made up from dividend yield, anticipated progress on a per unit foundation, and valuation a number of modifications. Anticipated complete return investing takes into consideration earnings (dividend yield), progress, and worth.

Notice: The REITs beneath haven’t been vetted for security. These are excessive anticipated complete return securities, however they might include elevated dangers.

We encourage traders to completely contemplate the danger/reward profile of those investments.

For the Prime 10 REITs every month with 4%+ dividend yields, based mostly on anticipated complete returns and security, see our Prime 10 REITs service.

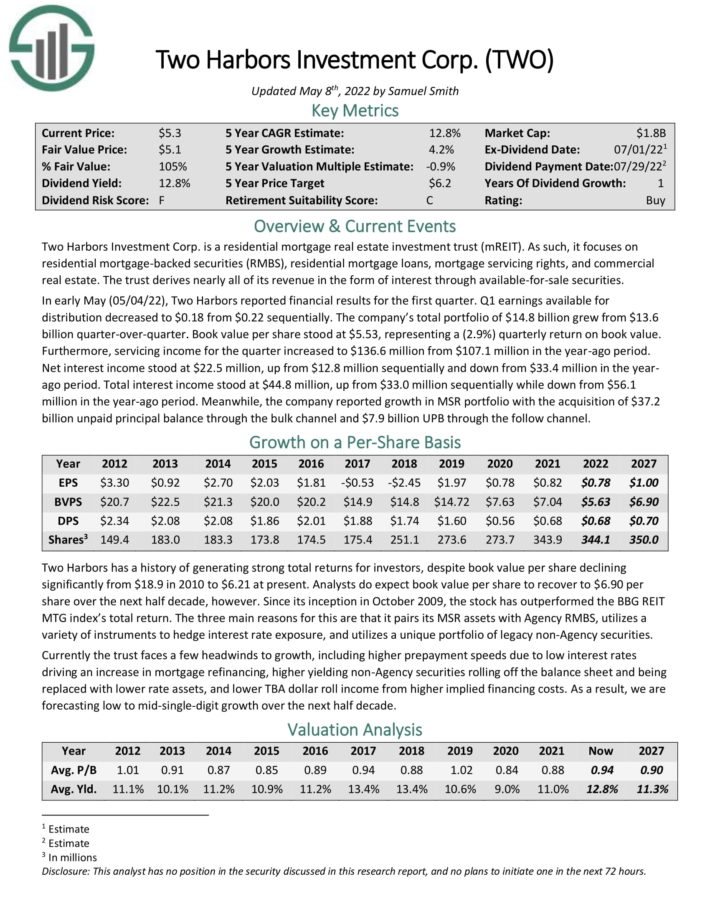

Prime REIT #7: Two Harbors Funding Corp. (TWO)

- Anticipated Whole Return: 15.0%

- Dividend Yield: 14.5%

Two Harbors Funding Corp. is a residential mortgage actual property funding belief (mREIT). As such, it focuses on residential mortgage–backed securities (RMBS), residential mortgage loans, mortgage servicing rights, and business actual property.

The belief derives practically all of its income within the type of curiosity by way of out there–for–sale securities.

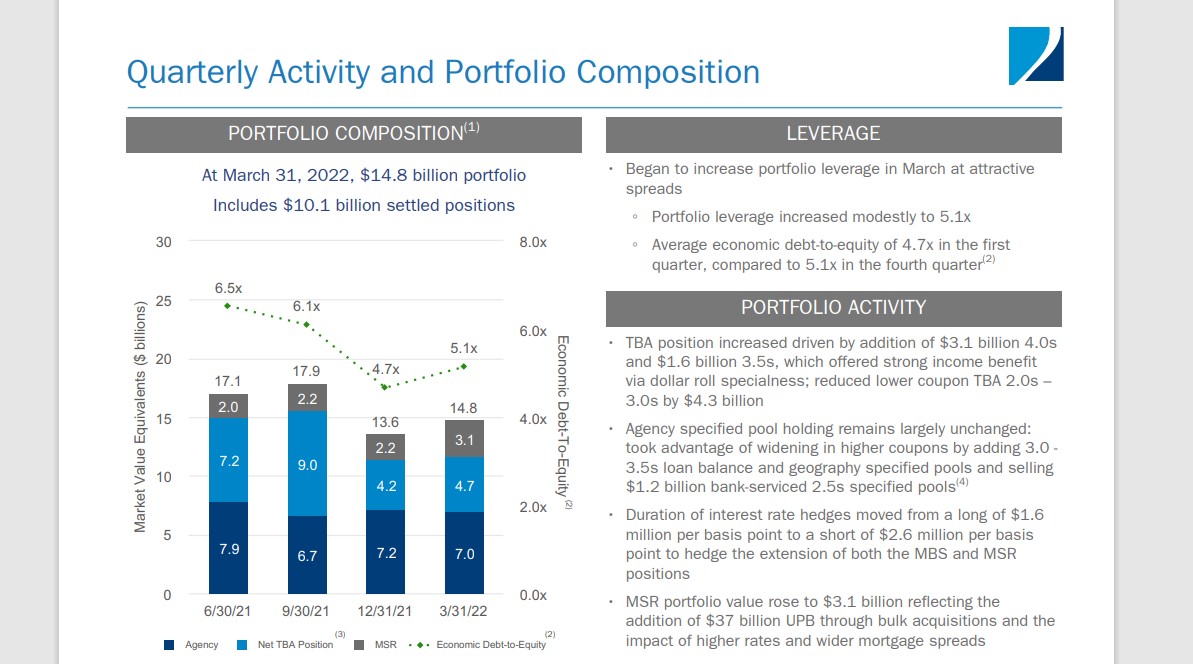

Supply: Investor Presentation

In early Could (05/04/22), Two Harbors reported monetary outcomes for the primary quarter. Q1 earnings out there for distribution decreased to $0.18 from $0.22 sequentially. The corporate’s complete portfolio of $14.8 billion grew from $13.6 billion quarter-over-quarter. Ebook worth per share stood at $5.53, representing a (2.9%) quarterly return on guide worth.

Moreover, servicing earnings for the quarter elevated to $136.6 million from $107.1 million within the year-ago interval. Web curiosity earnings stood at $22.5 million, up from $12.8 million sequentially and down from $33.4 million within the yearago interval. Whole curiosity earnings stood at $44.8 million, up from $33.0 million sequentially whereas down from $56.1 million within the year-ago interval.

In the meantime, the corporate reported progress in MSR portfolio with the acquisition of $37.2 billion unpaid principal stability by way of the majority channel and $7.9 billion UPB by way of the observe channel.

Click on right here to obtain our most up-to-date Certain Evaluation report on Two Harbors (TWO) (preview of web page 1 of three proven beneath):

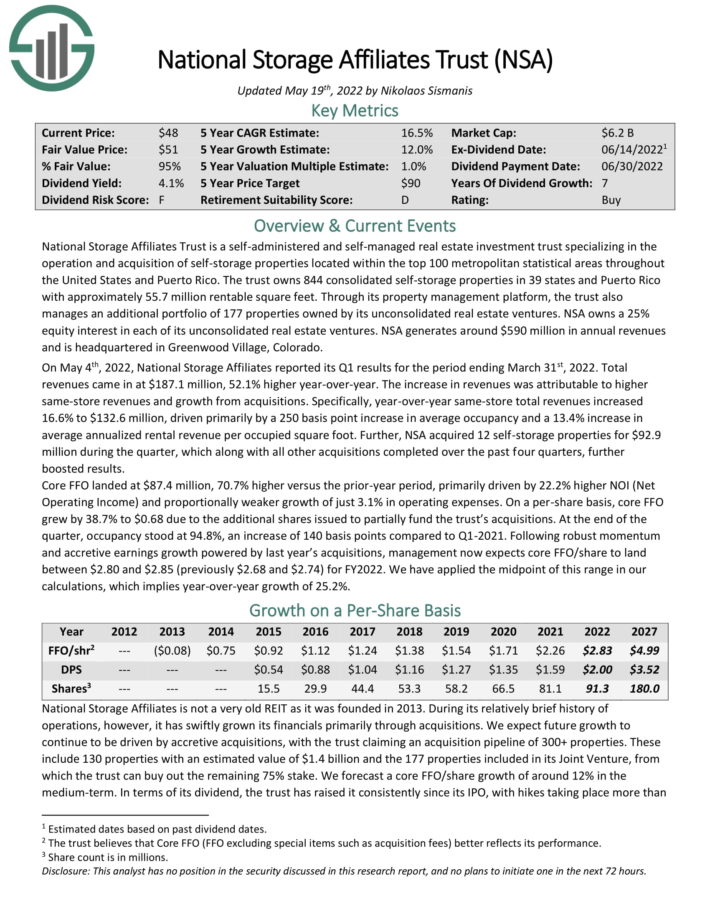

Prime REIT #6: Nationwide Storage Associates Belief (NSA)

- Anticipated Whole Return: 15.0%

- Dividend Yield: 4.2%

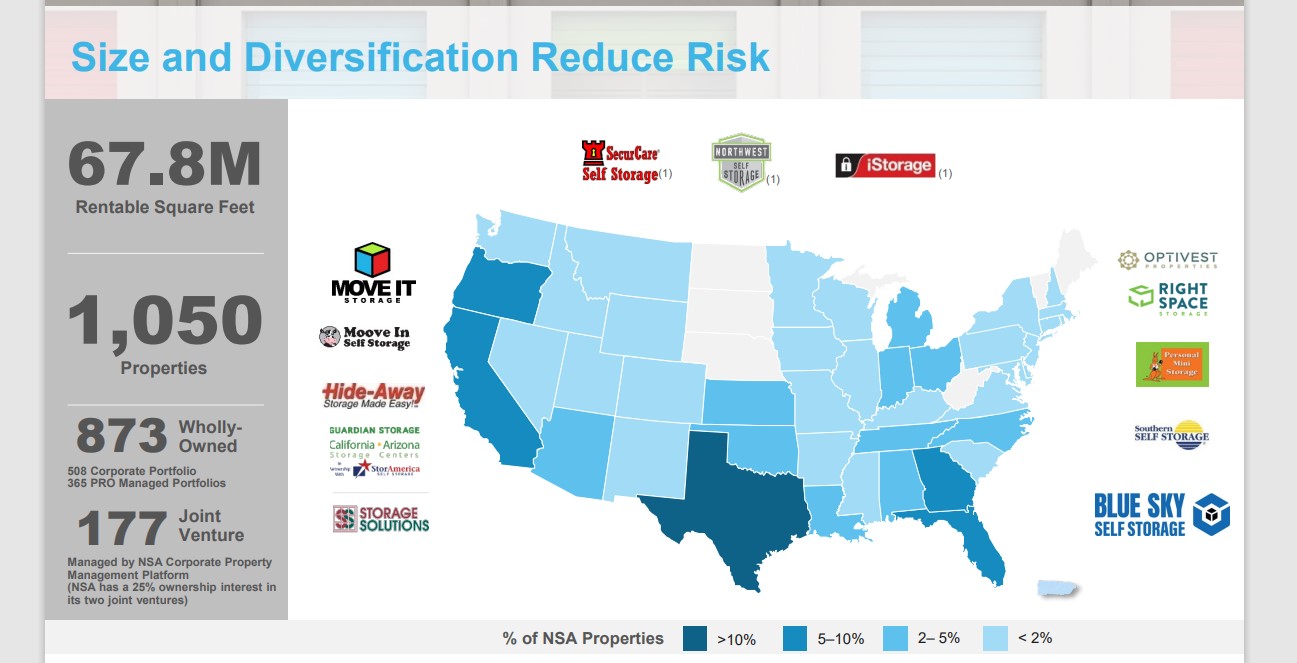

Nationwide Storage Associates Belief is a self–administered and self–managed actual property funding belief specializing within the operation and acquisition of self–storage properties situated throughout the prime 100 metropolitan statistical areas all through the USA and Puerto Rico.

The belief owns 873 consolidated self–storage properties in 39 states and Puerto Rico with roughly 55.1 million rentable sq. toes. Via its property administration platform, the belief additionally manages an extra portfolio of 177 properties owned by its unconsolidated actual property ventures. NSA owns a 25% fairness curiosity in every of its unconsolidated actual property ventures. NSA generates around $585 million in annual revenues.

Supply: Investor Presentation

On Could 4th, 2022, Nationwide Storage Associates reported its Q1 outcomes. Whole revenues got here in at $187.1 million, 52.1% greater year-over-year. The rise in revenues was attributable to greater same-store revenues and progress from acquisitions. Similar-store complete revenues elevated 16.6% to $132.6 million, pushed primarily by a 250 foundation level improve in common occupancy and a 13.4% improve in common annualized rental income per occupied sq. foot. Additional, NSA acquired 12 self-storage properties for $92.9 million in the course of the quarter.

Core FFO landed at $87.4 million, 70.7% greater versus the prior-year interval, primarily pushed by 22.2% greater NOI (Web Working Earnings) and proportionally weaker progress of simply 3.1% in working bills. On a per-share foundation, core FFO grew by 38.7% to $0.68 because of the extra shares issued to partially fund the belief’s acquisitions. On the finish of the quarter, occupancy stood at 94.8%, a rise of 140 foundation factors in comparison with Q1-2021.

Administration now expects core FFO/share to land between $2.80 and $2.85 (beforehand $2.68 and $2.74) for FY2022. The midpoint of this vary implies year-over-year progress of 25.2%.

Click on right here to obtain our most up-to-date Certain Evaluation report on NSA (preview of web page 1 of three proven beneath):

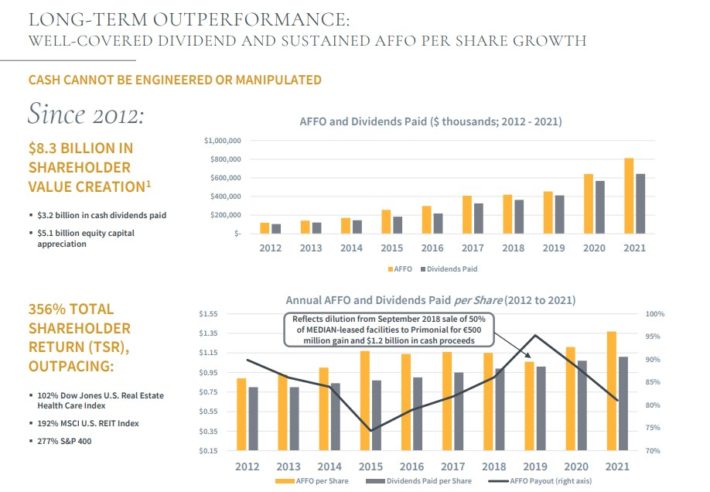

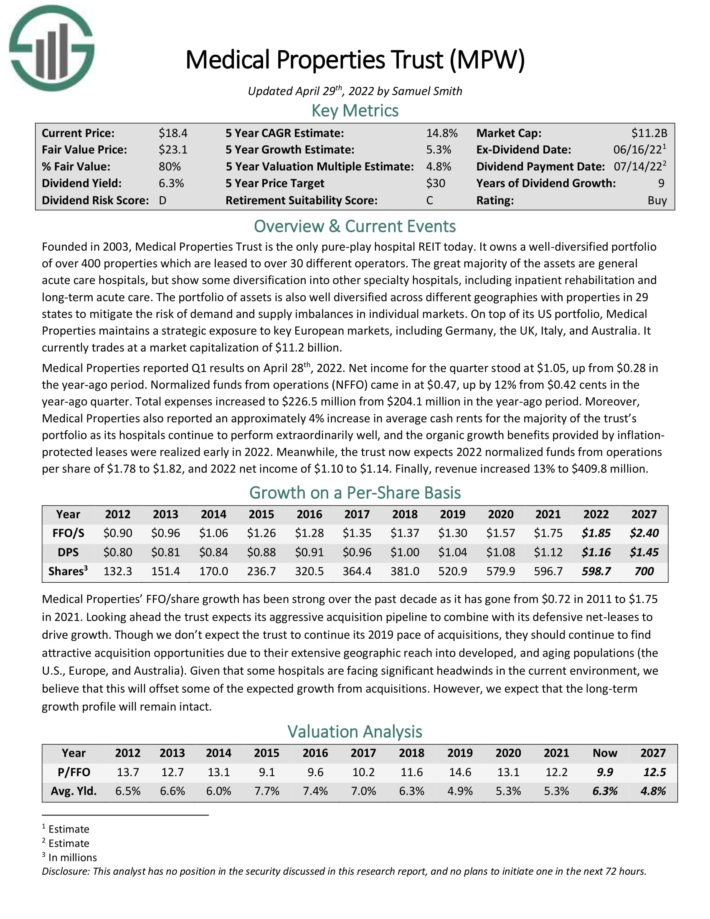

Prime REIT #5: Medical Properties Belief (MPW)

- Anticipated Whole Return: 15.2%

- Dividend Yield: 6.4

Medical Properties Belief is the one pure-play hospital REIT right this moment. It owns a diversified portfolio of over 400 properties that are leased to over 30 completely different operators. The good majority of the property are normal acute care hospitals, however present some diversification into different specialty hospitals, together with inpatient rehabilitation and long-term acute care.

The portfolio of property can be diversified throughout completely different geographies with properties in 29 states to mitigate the danger of demand and provide imbalances in particular person markets.

Supply: Investor Presentation

On prime of its US portfolio, Medical Properties maintains a strategic publicity to key European markets, together with Germany, the UK, Italy, and Australia.

Medical Properties reported Q1 outcomes on April twenty eighth, 2022. Web earnings for the quarter stood at $1.05, up from $0.28 within the year-ago interval. Normalized funds from operations (NFFO) got here in at $0.47, up by 12% from $0.42 cents within the year-ago quarter. Whole bills elevated to $226.5 million from $204.1 million within the year-ago interval.

Furthermore, Medical Properties additionally reported an roughly 4% improve in common money rents for almost all of the belief’s portfolio as its hospitals proceed to carry out terribly nicely, and the natural progress advantages offered by inflationprotected leases have been realized early in 2022. The belief now expects 2022 normalized funds from operations per share of $1.78 to $1.82, and 2022 web earnings of $1.10 to $1.14. Lastly, income elevated 13% to $409.8 million.

Click on right here to obtain our most up-to-date Certain Evaluation report on MPW (preview of web page 1 of three proven beneath):

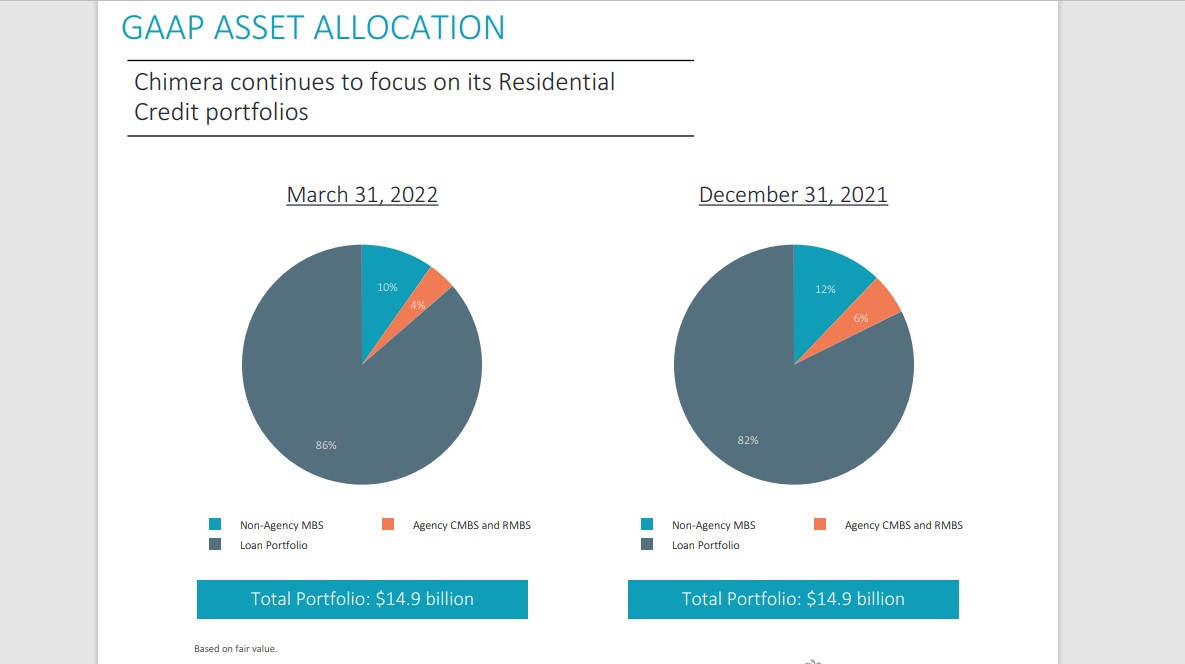

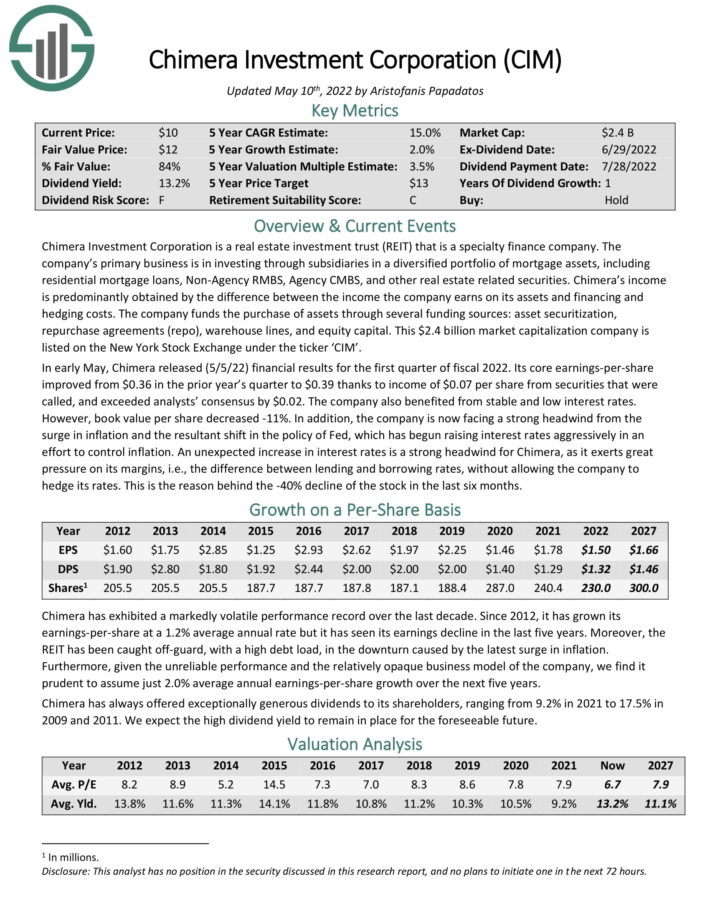

Prime REIT #4: Chimera Inv. Corp. (CIM)

- Anticipated Whole Return: 15.2%

- Dividend Yield: 13.2%

Chimera Funding Company’s main enterprise is in investing by way of subsidiaries in a diversified portfolio of mortgage property, together with residential mortgage loans, Non-Company RMBS, Company CMBS, and different actual property associated securities.

Supply: Investor Presentation

Chimera’s earnings is predominantly obtained by the distinction between the earnings the corporate earns on its property and financing and hedging prices. The corporate funds the acquisition of property by way of a number of funding sources: asset securitization, repurchase agreements (repo), warehouse traces, and fairness capital.

In early Could, Chimera launched (5/5/22) monetary outcomes for the primary quarter of fiscal 2022. Its core earnings-per-share improved from $0.36 within the prior 12 months’s quarter to $0.39 because of earnings of $0.07 per share from securities that have been referred to as, and exceeded analysts’ consensus by $0.02. The corporate additionally benefited from steady and low rates of interest. Nonetheless, guide worth per share decreased -11%.

As well as, the corporate is now going through a powerful headwind from the surge in inflation and the resultant shift within the coverage of Fed, which has begun elevating rates of interest aggressively in an effort to manage inflation.

Click on right here to obtain our most up-to-date Certain Evaluation report on CIM (preview of web page 1 of three proven beneath):

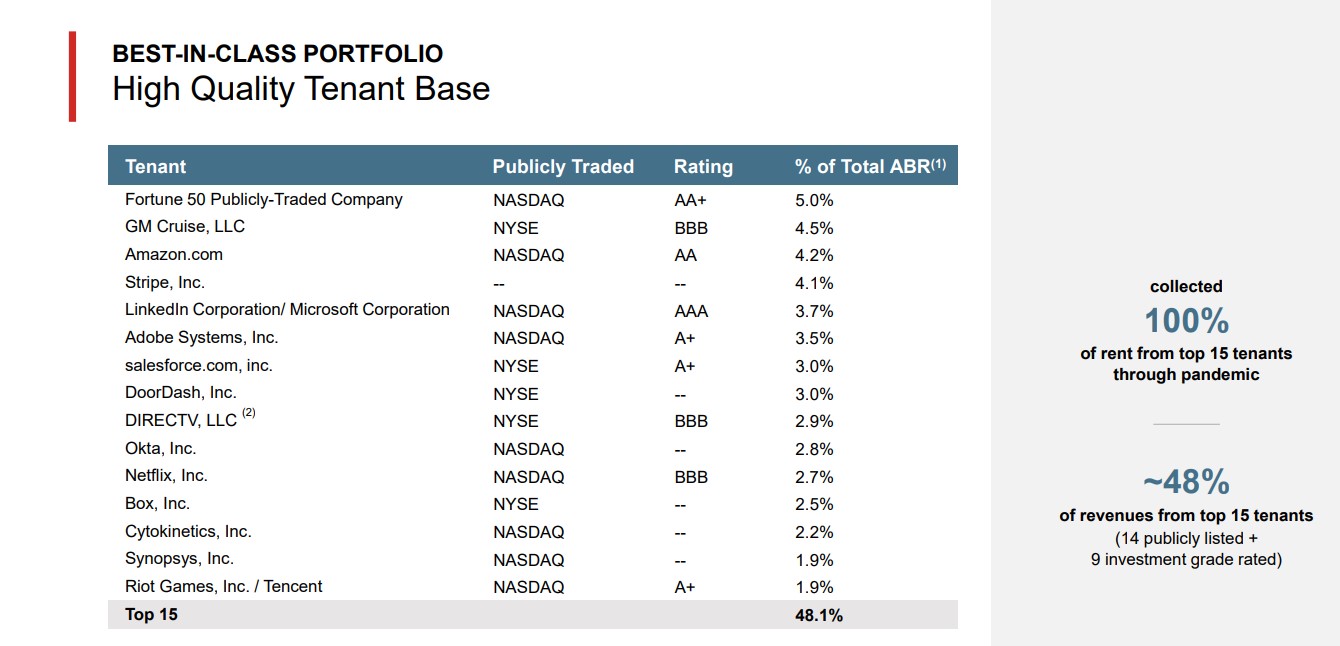

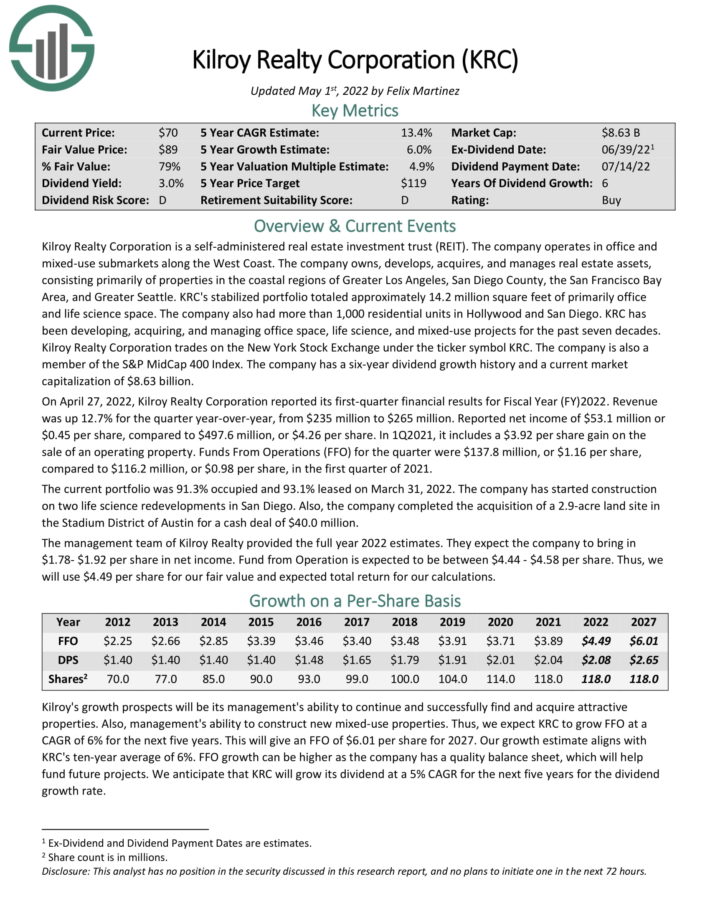

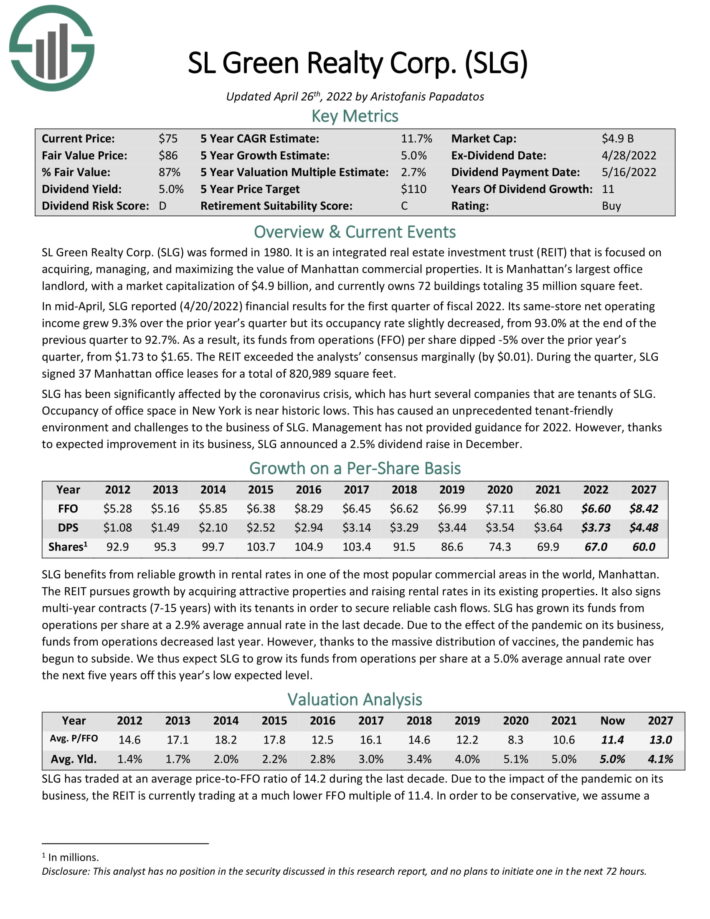

Prime REIT #3: Kilroy Realty (KRC)

- Anticipated Whole Return: 16.7%

- Dividend Yield: 3.4%

Kilroy Realty Company operates in workplace and mixed-use submarkets alongside the West Coast. The corporate owns, develops, acquires, and manages actual property property, consisting primarily of properties within the coastal areas of Higher Los Angeles, San Diego County, the San Francisco Bay Space, and Higher Seattle.

Supply: Investor Presentation

KRC’s stabilized portfolio totaled roughly 14.2 million sq. toes of primarily workplace and life science area. The corporate additionally had greater than 1,000 residential models in Hollywood and San Diego. KRC has been growing, buying, and managing workplace area, life science, and mixed-use tasks for the previous seven a long time.

On April 27, 2022, Kilroy Realty Company reported its first-quarter monetary outcomes. Income was up 12.7% for the quarter year-over-year, from $235 million to $265 million. Funds From Operations (FFO) for the quarter have been $137.8 million, or $1.16 per share, in comparison with $116.2 million, or $0.98 per share, within the first quarter of 2021.

The present portfolio was 91.3% occupied and 93.1% leased on March 31, 2022. The corporate has began development on two life science redevelopments in San Diego. Additionally, the corporate accomplished the acquisition of a 2.9-acre land website within the Stadium District of Austin for a money deal of $40.0 million.

Click on right here to obtain our most up-to-date Certain Evaluation report on KRC (preview of web page 1 of three proven beneath):

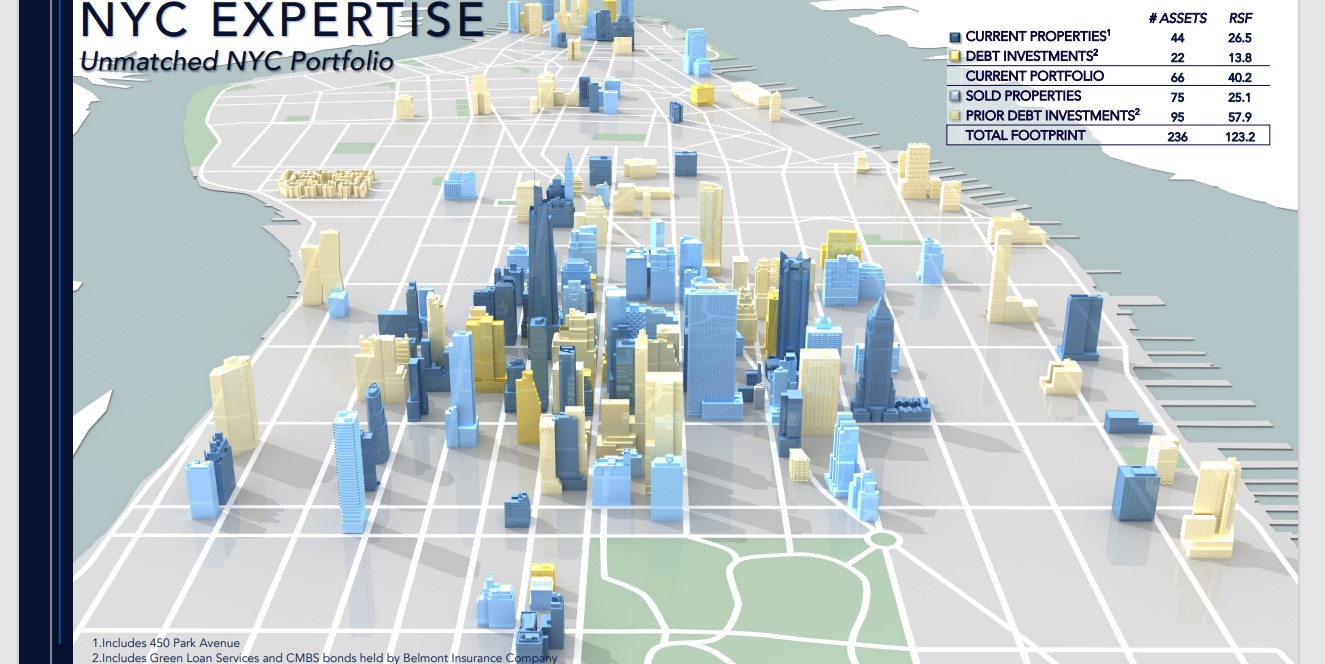

Prime REIT #2: SL Inexperienced Realty (SLG)

- Anticipated Whole Return: 16.8%

- Dividend Yield: 6.2%

SL Inexperienced Realty Corp was fashioned in 1980. It’s an built-in actual property funding belief (REIT) that’s targeted on buying, managing, and maximizing the worth of Manhattan business properties. It’s Manhattan’s largest workplace landlord, and at the moment owns 73 buildings totaling 35 million sq. toes.

Supply: Investor Presentation

In mid-April, SLG reported (4/20/2022) monetary outcomes for the primary quarter of fiscal 2022. Its same-store web working earnings grew 9.3% over the prior 12 months’s quarter however its occupancy charge barely decreased, from 93.0% on the finish of the earlier quarter to 92.7%.

In consequence, its funds from operations (FFO) per share dipped -5% over the prior 12 months’s quarter, from $1.73 to $1.65. The REIT exceeded the analysts’ consensus marginally (by $0.01). In the course of the quarter, SLG signed 37 Manhattan workplace leases for a complete of 820,989 sq. toes.

We forecast FFO-per-share of $6.60 in 2022. Due to this fact, the inventory at the moment trades for a P/FFO ratio of 9.0.

We anticipate annual returns of 16.8% going ahead, comprised of 5% anticipated earnings progress, the 6.2% dividend yield, and a ~5.6% annual increase from an increasing P/FFO a number of.

Click on right here to obtain our most up-to-date Certain Evaluation report on SLG (preview of web page 1 of three proven beneath):

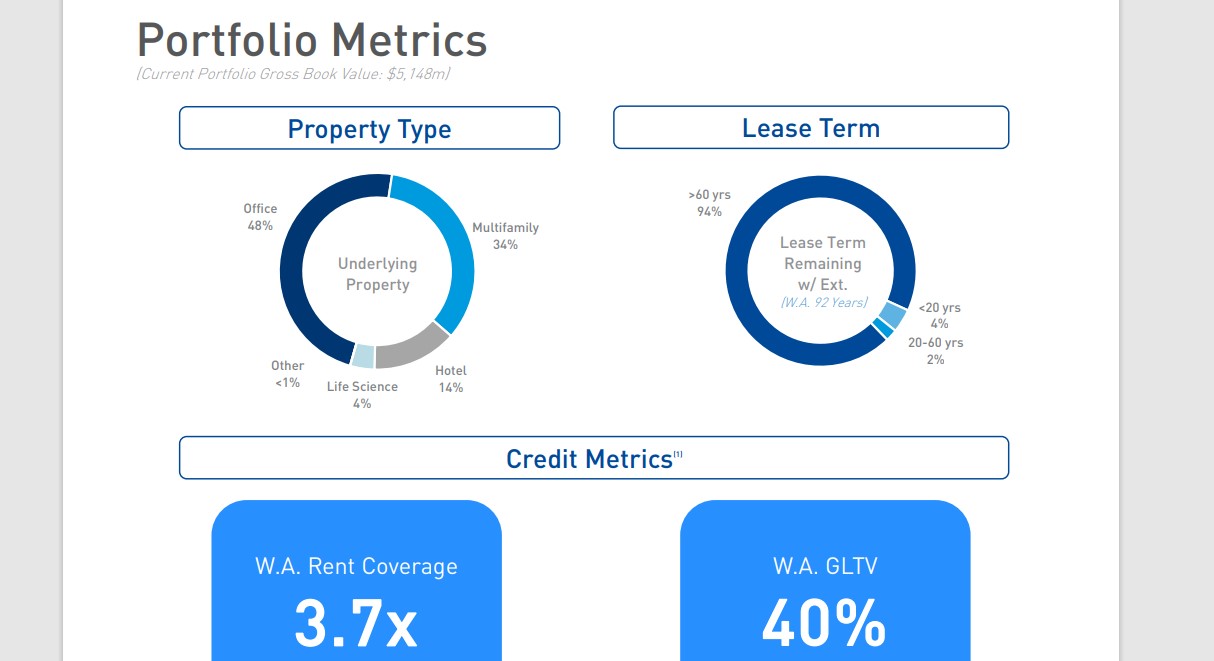

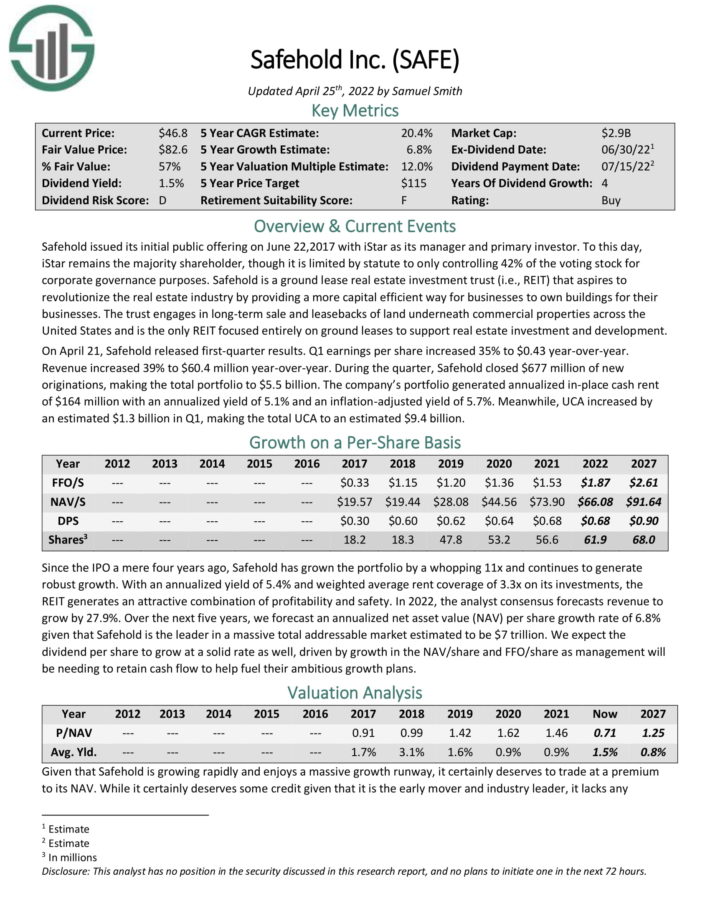

Prime REIT #1: Safehold Inc. (SAFE)

- Anticipated Whole Return: 20.8%

- Dividend Yield: 1.5%

Safehold is a floor lease REIT that aspires to revolutionize the true property business by offering a extra capital efficient means for companies to personal buildings for his or her companies.

The belief engages in lengthy–time period sale and leasebacks of land beneath business properties throughout the United States and is the one REIT targeted completely on floor leases to help actual estate funding and improvement.

Supply: Investor Presentation

On April 21, Safehold launched first-quarter outcomes. Q1 earnings per share elevated 35% to $0.43 year-over-year. Income elevated 39% to $60.4 million year-over-year. In the course of the quarter, Safehold closed $677 million of recent originations, making the entire portfolio to $5.5 billion.

The corporate’s portfolio generated annualized in-place money hire of $164 million with an annualized yield of 5.1% and an inflation-adjusted yield of 5.7%. In the meantime, UCA elevated by an estimated $1.3 billion in Q1, making the entire UCA to an estimated $9.4 billion.

Safehold is a low-yielding REIT with a dividend yield of 1.5%, however we anticipate a excessive progress charge of 6.8% per 12 months. The inventory additionally seems undervalued, resulting in anticipated annual returns above 20% per 12 months over the subsequent 5 years.

Click on right here to obtain our most up-to-date Certain Evaluation report on SAFE (preview of web page 1 of three proven beneath).

Last Ideas

The REIT Spreadsheet record on this article accommodates a listing of publicly-traded Actual Property Funding Trusts.

Nonetheless, this database is definitely not the one place to seek out high-quality dividend shares buying and selling at truthful or higher costs.

In reality, probably the greatest strategies to seek out high-quality dividend shares is in search of shares with lengthy histories of steadily rising dividend funds. Firms which have elevated their payouts by way of many market cycles are extremely prone to proceed doing so for a very long time to come back.

You may see extra high-quality dividend shares within the following Certain Dividend databases, every based mostly on lengthy streaks of steadily rising dividend funds:

Alternatively, one other great spot to search for high-quality enterprise is contained in the portfolios of extremely profitable traders. By analyzing the portfolios of legendary traders working multi-billion greenback funding portfolios, we’re in a position to not directly profit from their million-dollar analysis budgets and private investing experience.

To that finish, Certain Dividend has created the next two articles:

You may additionally be trying to create a extremely personalized dividend earnings stream to pay for all times’s bills.

The next lists present helpful info on excessive dividend shares and shares that pay month-to-month dividends:

Bonus: Take heed to our interview with Brad Thomas on The Certain Investing Podcast about clever REIT investing within the beneath video.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].