Up to date on July sixth, 2022 by Bob Ciura

Spreadsheet information up to date day by day

Month-to-month dividend shares are securities that pay a dividend each month as a substitute of quarterly or yearly. Extra frequent dividend funds imply a smoother revenue stream for buyers.

This text contains:

- A free spreadsheet on all 49 month-to-month dividend shares

- Hyperlinks to detailed stand-alone evaluation on all 49 month-to-month dividend shares

- A number of different sources that can assist you put money into month-to-month dividend securities for regular revenue

You’ll be able to obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter like dividend yield and payout ratio) by clicking on the hyperlink under:

The downloadable Month-to-month Dividend Shares Spreadsheet above comprises the next for every inventory that pays month-to-month dividends:

- Dividend yield

- Title and ticker

- Market cap

- Payout ratio

- Beta

Observe: We attempt to keep up an correct record of all month-to-month dividend payers. There’s no common supply we’re conscious of for month-to-month dividend shares; we curate this record manually. If you already know of any shares that pay month-to-month dividends that aren’t on our record, please electronic mail [email protected].

This text additionally contains our prime 5 ranked month-to-month dividend shares right this moment, in accordance with anticipated five-year annual returns.

We have now excluded oil and fuel royalty trusts resulting from their excessive dangers. These excessive dangers make them much less engaging for revenue buyers, in our view.

Desk of Contents

Having the record of month-to-month dividend shares together with metrics that matter is a good way to start making a month-to-month passive revenue stream.

Excessive-yielding month-to-month dividend payers have a singular mixture of traits that make them particularly appropriate for buyers in search of present revenue.

Preserve studying this text to be taught extra about investing in month-to-month dividend shares.

Easy methods to Use the Month-to-month Dividend Shares Sheet to Discover Dividend Funding Concepts

For buyers that use their dividend inventory portfolios to generate passive month-to-month revenue, one of many principal considerations is the sustainability of the corporate’s dividend.

A dividend minimize signifies one among two issues:

- The enterprise isn’t performing effectively sufficient to maintain a dividend

- Administration is not interested by rewarding shareholders with dividends

Both of those ought to be thought-about an computerized signal to promote a dividend inventory.

Of the 2 causes listed above, #1 is extra prone to occur. Thus, it is extremely necessary to repeatedly monitor the monetary feasibility of an organization’s dividend.

That is greatest evaluated by utilizing the payout ratio. The payout ratio is a mathematical expression that exhibits what proportion of an organization’s earnings is distributed to shareholders as dividend funds. A really excessive payout ratio may point out that an organization’s dividend is at risk of being decreased or eradicated utterly.

For readers unfamiliar with Microsoft Excel, this part will present you methods to record the shares within the spreadsheet so as of reducing payout ratio.

Step 1: Obtain the month-to-month dividend shares excel sheet on the hyperlink above.

Step 2: Spotlight columns A by means of H, and go to “Information”, then “Filter”.

Step 3: Click on on the ‘filter’ icon on the prime of the payout ratio column.

Step 4: Filter the excessive dividend shares spreadsheet in descending order by payout ratio. It will record the shares with decrease (safer) payout ratios on the prime.

The 5 Greatest Month-to-month Dividend Shares

The next firms characterize our prime 5 month-to-month dividend shares proper now. Shares have been chosen based mostly on their projected complete annual returns over the following 5 years.

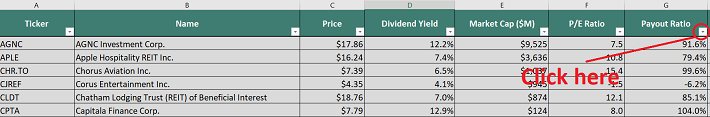

Month-to-month Dividend Inventory #5: Itau Unibanco (ITUB)

- 5-year anticipated annual returns: 14.5%

Itaú Unibanco Holding S.A. is headquartered in Sao Paulo, Brazil. The corporate trades on the New York Inventory Change with the ticker image ITUB. The corporate was shaped when Banco Itaú and Unibanco determined to merge in November 2008.

Since then, Itaú has been essentially the most distinguished monetary conglomerate within the Southern Hemisphere, the world’s tenth-largest financial institution by market worth, and the biggest Latin American financial institution by belongings and market capitalization. The financial institution has operations throughout South America and different locations like the USA, Portugal, Switzerland, China, Japan, and many others.

Itaú at the moment employs over 96,000 individuals worldwide and has a market capitalization of $48.8 billion. The corporate pays a dividend month-to-month however at totally different charges. Itaú Unibanco reviews its earnings in Brazilian Actual forex. This report will convert all monetary numbers into United States {Dollars}.

On Could ninth, 2022, Itaú Unibanco reported first-quarter outcomes for 2022. The corporate reported a rise in 0perating income from $6,251 million in 1Q2021 to $6,982 million for the quarter, growing 11.7% year-over-year. The recurring managerial return on fairness was 20.4%, whereas the return reached 21.0% in Brazil.

Mortgage operations continued to develop, and the corporate mortgage portfolio was up 3.4% in Brazil and 0.5% consolidated. The person mortgage portfolio was up 0.5% within the quarter. Additionally, the bank card portfolio elevated 4.4%, with seasonality pushing it greater on the finish of the yr.

The financial institution continues to make important headway on the digital entrance. Within the fourth quarter, 66.1% of merchandise bought by people have been made digitally. Recurring managerial outcomes there up 2.8% for the quarter in comparison with the primary quarter of 2021. Internet revenue for the quarter was up 24.5% versus the primary quarter of FY2021. The corporate had a historic file with the issuance of 4.8 million playing cards.

Private loans grew 7.5%, with important will increase in credit score traces with higher spreads, akin to overdraft and shopper credit score. Mortgage loans grew 5.4% this quarter, with a excessive manufacturing stage.

We anticipate annual returns of 14.5%, pushed by the two.1% dividend yield, 5% EPS progress, and a ~7.4% constructive influence from an increasing valuation a number of.

Click on right here to obtain our most up-to-date Positive Evaluation report on ITUB (preview of web page 1 of three proven under):

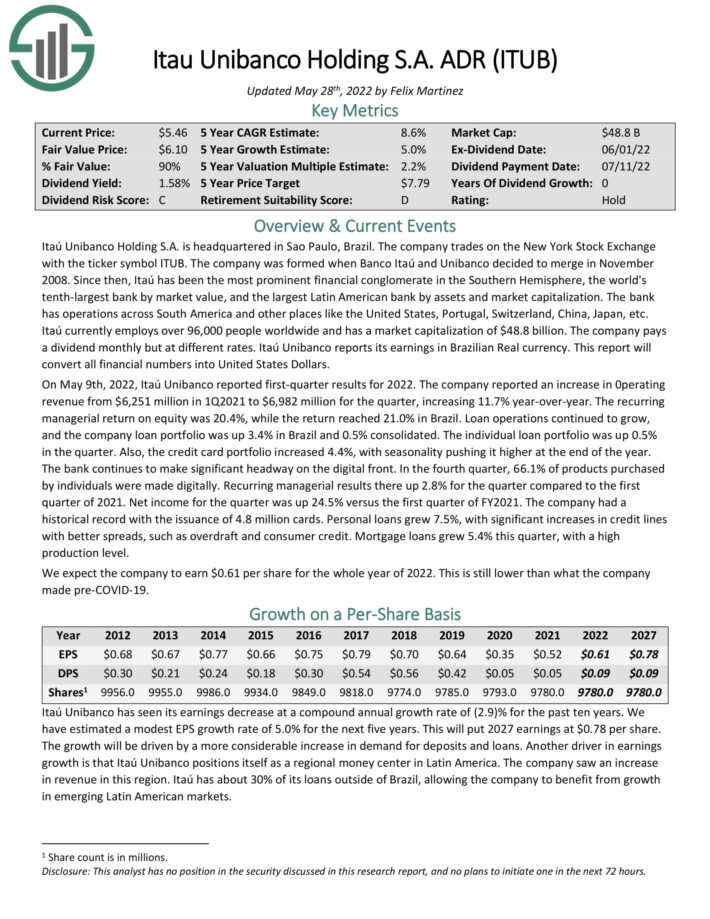

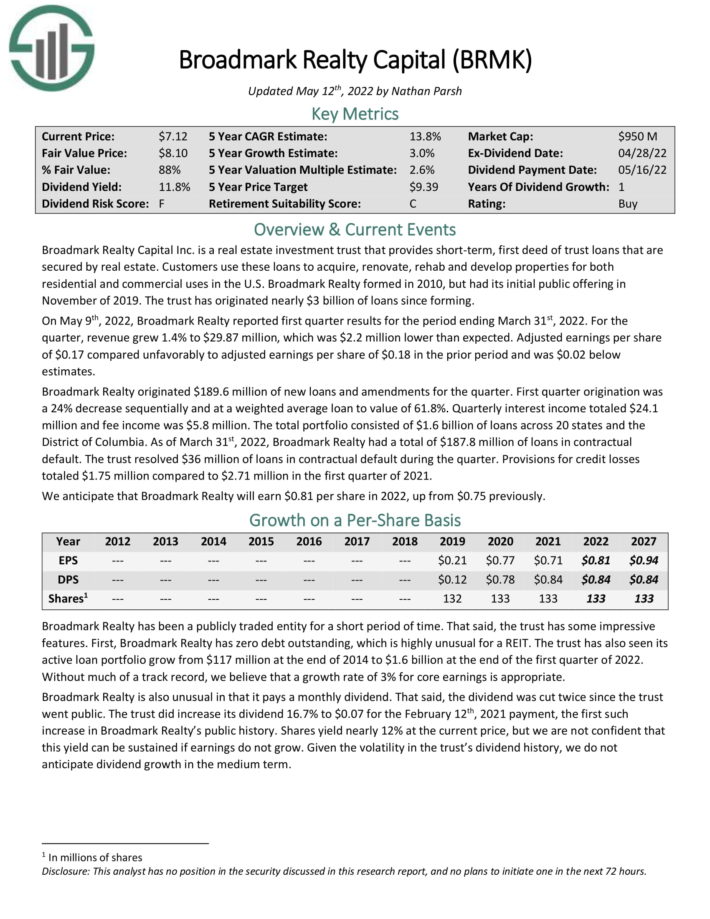

Month-to-month Dividend Inventory #4: Broadmark Realty Capital (BRMK)

- 5-year anticipated annual returns: 14.7%

Broadmark Realty Capital Inc. is an actual property funding belief that gives short-term, first deed of belief loans which might be secured by actual property. Prospects use these loans to accumulate, renovate, rehab and develop properties for each residential and business makes use of within the U.S. Broadmark Realty shaped in 2010, however had its preliminary public providing in November 2019.

Supply: Investor Presentation

On Could ninth, 2022, Broadmark Realty reported first quarter outcomes for the interval ending March thirty first, 2022. For the quarter, income grew 1.4% to $29.87 million, which was $2.2 million decrease than anticipated. Adjusted earnings per share of $0.17 in contrast unfavorably to adjusted earnings per share of $0.18 within the prior interval and was $0.02 under estimates.

Broadmark Realty originated $189.6 million of recent loans and amendments for the quarter. First quarter origination was a 24% lower sequentially and at a weighted common mortgage to worth of 61.8%. Quarterly curiosity revenue totaled $24.1 million and payment revenue was $5.8 million. The full portfolio consisted of $1.6 billion of loans throughout 20 states and the District of Columbia.

As of March thirty first, 2022, Broadmark Realty had a complete of $187.8 million of loans in contractual default. The belief resolved $36 million of loans in contractual default throughout the quarter. Provisions for credit score losses totaled $1.75 million in comparison with $2.71 million within the first quarter of 2021.

We anticipate 14.7% annual returns for Broadmark inventory, representing 3% anticipated EPS progress, the 12.3% dividend yield, and a ~0.6% discount from a declining valuation a number of.

Click on right here to obtain our most up-to-date Positive Evaluation report on BRMK (preview of web page 1 of three proven under):

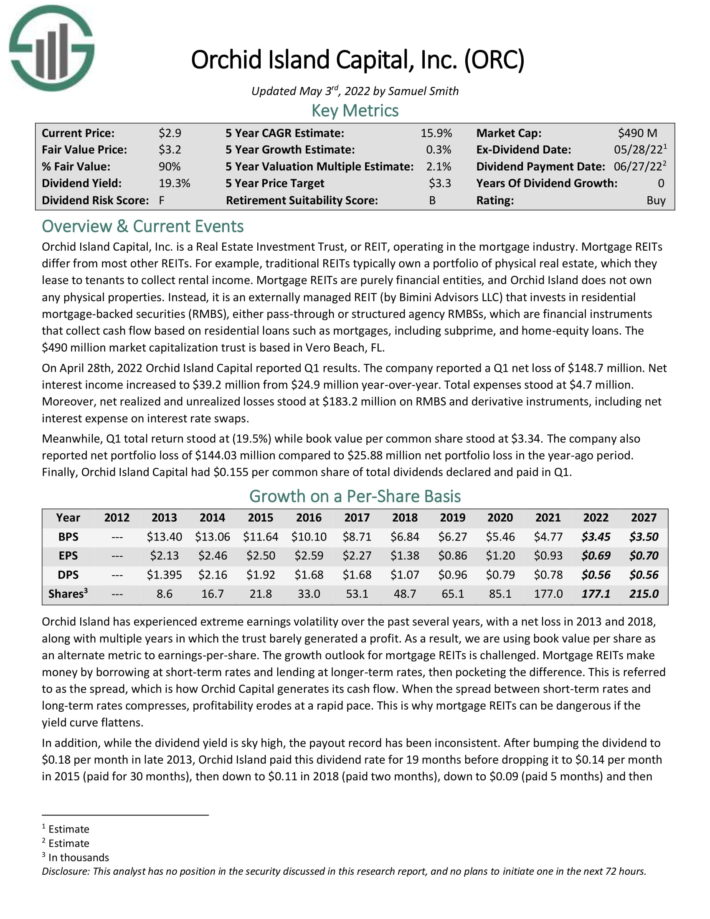

Month-to-month Dividend Inventory #3: Orchid Island Capital (ORC)

- 5-year anticipated annual returns: 15.5%

Orchid Island Capital, Inc. is a REIT working within the mortgage industry. Mortgage REITs differ from most different REITs.

For instance, conventional REITs usually personal a portfolio of bodily actual property, which they lease to tenants to gather rental revenue. Mortgage REITs are purely monetary entities, and Orchid Island does not personal any bodily properties.

As an alternative, it’s an externally managed REIT (by Bimini Advisors LLC) that invests in residential mortgage–backed securities (RMBS), both pass-by means of or structured company RMBSs, that are monetary devices that gather cash circulation based mostly on residential loans akin to mortgages, together with subprime, and home-fairness loans.

ORC not too long ago minimize its dividend by 18%. We anticipate annual returns of 15.5% for ORC inventory, pushed by the 19% dividend yield partially offset by a declining valuation a number of.

Click on right here to obtain our most up-to-date Positive Evaluation report on ORC (preview of web page 1 of three proven under):

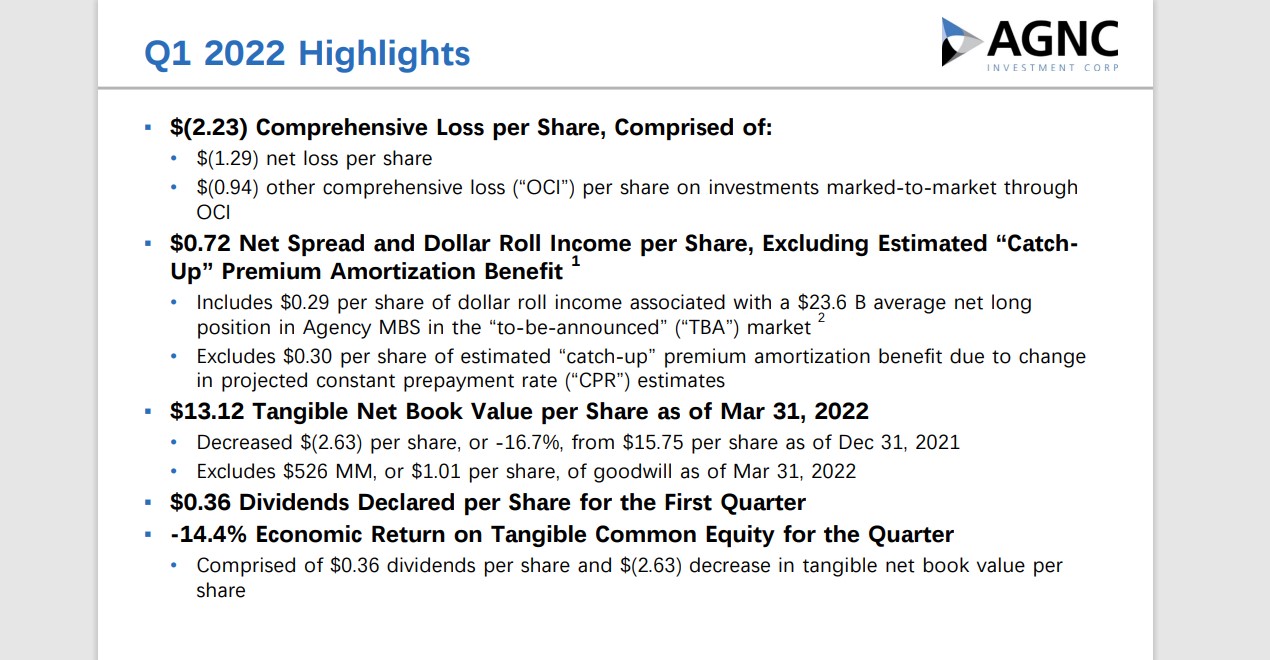

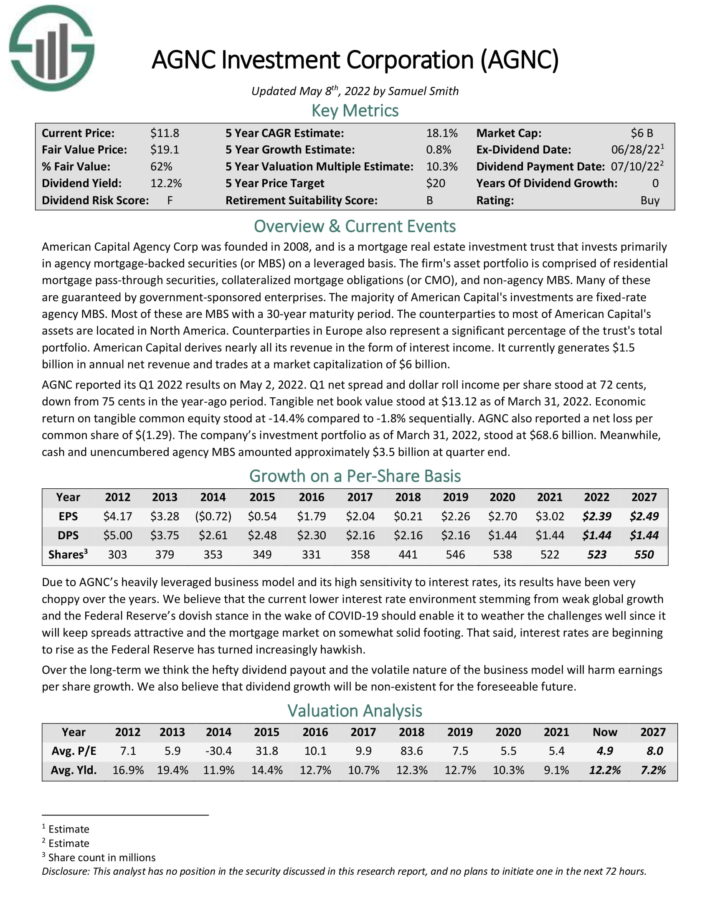

Month-to-month Dividend Inventory #2: AGNC Funding Company (AGNC)

- 5-year anticipated annual returns: 18.5%

American Capital Company Corp was based in 2008, and is a mortgage actual property funding belief that invests primarily in company mortgage-backed securities (or MBS) on a leveraged foundation.

The agency’s asset portfolio is comprised of residential mortgage pass-through securities, collateralized mortgage obligations (or CMO), and non-agency MBS. Many of those are assured by authorities sponsored enterprises.

The vast majority of American Capital’s investments are fastened price company MBS. Most of those are MBS with a 30-year maturity interval. AGNC derives almost all its income within the type of curiosity revenue. It at the moment generates $1.2 billion in annual web income.

You’ll be able to see an outline of the corporate’s first-quarter report within the picture under:

Supply: Investor Presentation

We anticipate 18.5% annual returns for AGNC, made up of the 12.4% dividend yield, no progress, and a ~6.1% enhance from a rising P/FFO a number of.

Click on right here to obtain our most up-to-date Positive Evaluation report on AGNC (preview of web page 1 of three proven under):

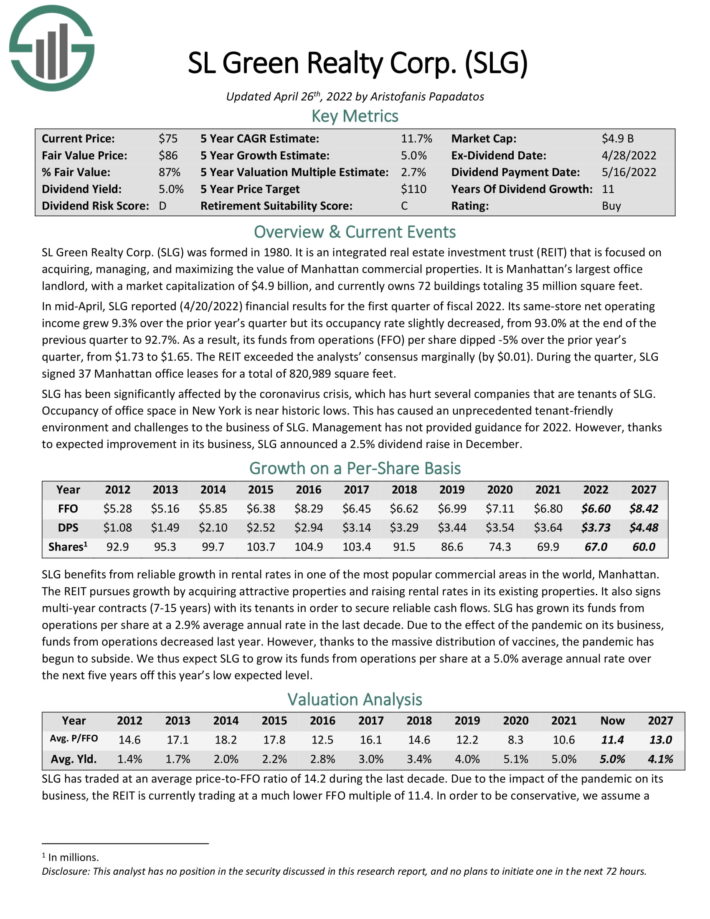

Month-to-month Dividend Inventory #1: SL Inexperienced Realty (SLG)

- 5-year anticipated annual returns: 22.3%

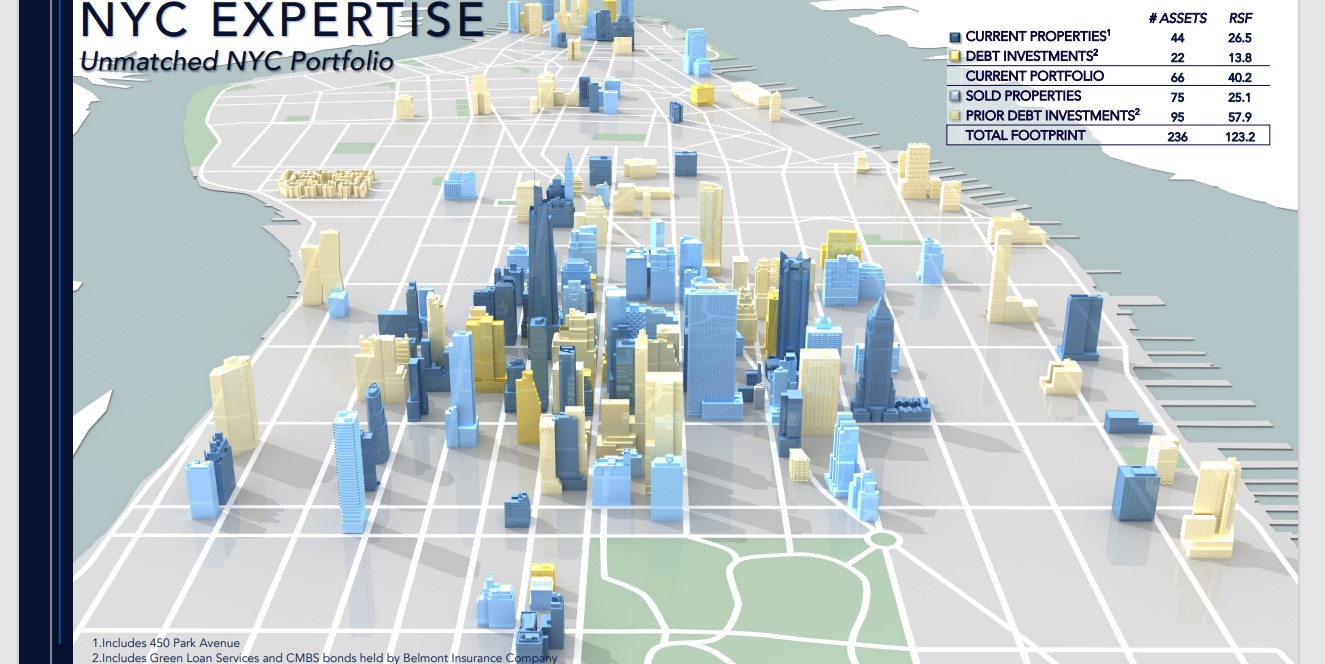

SL Inexperienced Realty Corp was shaped in 1980. It’s an built-in actual property funding belief (REIT) that’s centered on buying, managing, and maximizing the worth of Manhattan business properties. It’s Manhattan’s largest workplace landlord, and at the moment owns 73 buildings totaling 35 million sq. toes.

Supply: Investor Presentation

In mid-April, SLG reported (4/20/2022) monetary outcomes for the primary quarter of fiscal 2022. Its same-store web working revenue grew 9.3% over the prior yr’s quarter however its occupancy price barely decreased, from 93.0% on the finish of the earlier quarter to 92.7%.

Consequently, its funds from operations (FFO) per share dipped -5% over the prior yr’s quarter, from $1.73 to $1.65. The REIT exceeded the analysts’ consensus marginally (by $0.01). In the course of the quarter, SLG signed 37 Manhattan workplace leases for a complete of 820,989 sq. toes.

We forecast FFO-per-share of $6.60 in 2022. Subsequently, the inventory at the moment trades for a P/FFO ratio of 9.0.

We anticipate annual returns of twenty-two.3% going ahead, comprised of 5% anticipated earnings progress, the 7.9% dividend yield, and a ~9.4% annual enhance from an increasing P/FFO a number of.

Click on right here to obtain our most up-to-date Positive Evaluation report on SLG (preview of web page 1 of three proven under):

Detailed Evaluation On All of The Month-to-month Dividend Shares

You’ll be able to see detailed evaluation on month-to-month dividend securities we cowl by clicking the hyperlinks under. We’ve included our most up-to-date Positive Evaluation Analysis Database report replace in brackets as effectively, the place relevant.

- Agree Realty (ADC) | [See Newest Sure Analysis Report]

- AGNC Funding (AGNC) | [See Newest Sure Analysis Report]

- Apple Hospitality REIT, Inc. (APLE) | See Latest Positive Evaluation Report

- ARMOUR Residential REIT (ARR) | [See Newest Sure Analysis Report]

- Banco Bradesco S.A. (BBD) | [See Newest Sure Analysis Report]

- Broadmark Realty Capital (BRMK) | [See Newest Sure Analysis Report]

- Chatham Lodging (CLDT)* | [See Newest Sure Analysis Report]

- Selection Properties REIT (PPRQF) | [See Newest Sure Analysis Report]

- Cross Timbers Royalty Belief (CRT) | [See Newest Sure Analysis Report]

- Dream Industrial REIT (DREUF) | [See Newest Sure Analysis Report]

- Dream Workplace REIT (DRETF) | [See Newest Sure Analysis Report]

- Dynex Capital (DX) | [See Newest Sure Analysis Report]

- Ellington Residential Mortgage REIT (EARN) | [See Newest Sure Analysis Report]

- Ellington Monetary (EFC) | [See Newest Sure Analysis Report]

- EPR Properties (EPR) | [See Newest Sure Analysis Report]

- Change Earnings Company (EIFZF) | [See Newest Sure Analysis Report]

- Fortitude Gold (FTCO) | [See Newest Sure Analysis Report]

- Technology Earnings Properties (GIPR) | [See Newest Sure Analysis Report]

- Gladstone Capital Company (GLAD) | [See Newest Sure Analysis Report]

- Gladstone Business Company (GOOD) | [See Newest Sure Analysis Report]

- Gladstone Funding Company (GAIN) | [See Newest Sure Analysis Report]

- Gladstone Land Company (LAND) | [See Newest Sure Analysis Report]

- International Water Sources (GWRS) | [See Newest Sure Analysis Report]

- Granite Actual Property Funding Belief (GRP.U)** | [Historical Reports]

- Horizon Expertise Finance (HRZN) | [See Newest Sure Analysis Report]

- Itaú Unibanco (ITUB) | [See Newest Sure Analysis Report]

- LTC Properties (LTC) | [See Newest Sure Analysis Report]

- Important Road Capital (MAIN) | [See Newest Sure Analysis Report]

- Orchid Island Capital (ORC) | [See Newest Sure Analysis Report]

- Oxford Sq. Capital (OXSQ) | [See Newest Sure Analysis Report]

- Pembina Pipeline (PBA) | [See Newest Sure Analysis Report]

- Permian Basin Royalty Belief (PBT) | [See Newest Sure Analysis Report]

- Phillips Edison & Firm (PECO) | [See Newest Sure Analysis Report]

- Pennant Park Floating Price (PFLT) | [See Newest Sure Analysis Report]

- PermRock Royalty Belief (PRT) | [See Newest Sure Analysis Report]

- Prospect Capital Company (PSEC) | [See Newest Sure Analysis Report]

- Permianville Royalty Belief (PVL)

- Realty Earnings (O) | [See Newest Sure Analysis Report]

- Sabine Royalty Belief (SBR) | [See Newest Sure Analysis Report]

- Stellus Capital Funding Corp. (SCM) | [See Newest Sure Analysis Report]

- San Juan Basin Royalty Belief (SJT)

- Shaw Communications (SJR) | [See Newest Sure Analysis Report]

- SL Inexperienced Realty Corp. (SLG) | [See Newest Sure Analysis Report]

- SLR Funding Corp. (SLRC) | [See Newest Sure Analysis Report]

- Stag Industrial (STAG) | [See Newest Sure Analysis Report]

- Superior Plus (SUUIF) | [See Newest Sure Analysis Report]

- TransAlta Renewables (TRSWF) | [See Newest Sure Analysis Report]

- U.S. International Traders (GROW) | [See Newest Sure Analysis Report]

- Whitestone REIT (WSR) | [See Newest Sure Analysis Report]

Observe 1: The asterisk (*) denotes a inventory that has suspended its dividend. Consequently, we have now not included the inventory in our annual Month-to-month Dividend Inventory In Focus Sequence. We’ll resume protection when and if the corporate in query resumes paying dividends.

Observe 2: The double asterisk (**) denotes a safety that isn’t included by our information supplier and is subsequently excluded from our Positive Evaluation analysis database regardless of being a month-to-month paying dividend inventory.

As we don’t have protection of each month-to-month dividend inventory, they don’t seem to be all included within the record above. Observe that the majority of those companies are both small or mid-cap firms.

You’ll not see any S&P 500 shares on this record – it’s predominantly populated by members of the Russell 2000 Index or numerous worldwide inventory market indices.

Primarily based on the record above, the majority of month-to-month dividend paying securities are REITs and BDCs.

Efficiency By means of June 2022

In June 2022, a basket of the 49 month-to-month dividend shares above (excluding SJT) generated adverse complete returns of 8.8%. For comparability, the Russell 2000 ETF (IWM) generated adverse complete returns of 9.1% for the month.

Notes: Information for efficiency is from Ycharts. Canadian firm efficiency could also be within the firm’s dwelling forex. 12 months-to-date efficiency does have survivorship bias as some securities have been excluded as they eradicated their dividends. International Internet Lease (GNL) was additionally eradicated because it modified its dividend to quarterly funds.

Month-to-month dividend shares outperformed in June. We’ll replace our efficiency part month-to-month to trace future month-to-month dividend inventory returns.

In June 2022, the three best-performing month-to-month dividend shares (together with dividends) have been:

- Eagle Level Earnings Co. (EIC), up 4.5%

- Shaw Communications (SJR), up 4.4%

- Agree Realty (ADC), up 4.0%

The three worst-performing month-to-month dividend shares (together with dividends) in June have been:

- Permianville Royalty Belief (PVL), down 29.8%

- SL Inexperienced Realty (SLG), down 24.8%

- Financial institution Bradesco SA (BBD), down 22.4%

Why Month-to-month Dividends Matter

Month-to-month dividend funds are useful for one group of buyers specifically – retirees who depend on dividend shares for revenue.

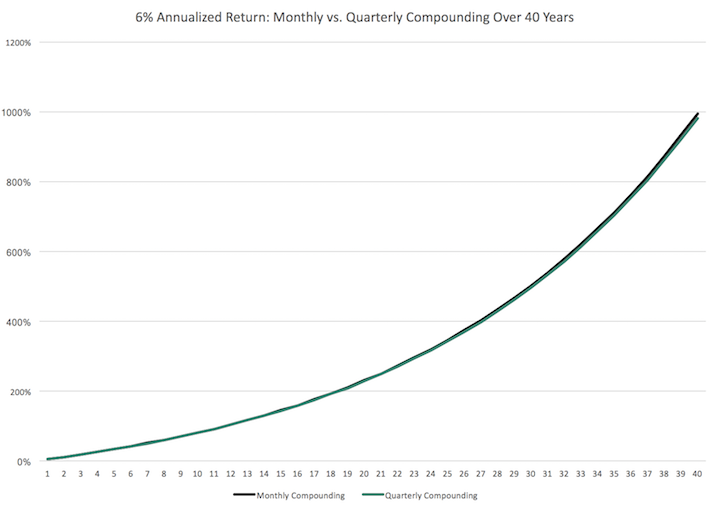

With that mentioned, month-to-month dividend shares are higher beneath all circumstances (every little thing else being equal), as a result of they permit for returns to be compounded on a extra frequent foundation. Extra frequent compounding ends in higher complete returns, significantly over lengthy intervals of time.

Think about the next efficiency comparability:

Over the long term, month-to-month compounding generates barely greater returns over quarterly compounding. Each little bit helps.

With that mentioned, it may not be sensible to manually re-invest dividend funds on a month-to-month foundation. It’s extra possible to mix month-to-month dividend shares with a dividend reinvestment plan to greenback value common into your favourite dividend shares.

The final advantage of month-to-month dividend shares is that they permit buyers to have – on common – additional cash available to make opportunistic purchases. A month-to-month dividend fee is extra prone to put money in your account once you want it versus a quarterly dividend.

Case-in-point: Traders who purchased a broad basket of shares on the backside of the 2008-2009 monetary disaster are doubtless sitting on triple-digit complete returns from these purchases right this moment.

The Risks of Investing In Month-to-month Dividend Shares

Month-to-month dividend shares have traits that make them interesting to do-it-yourself buyers on the lookout for a gentle stream of revenue. Usually, these are retirees and other people planning for retirement.

Traders ought to notice many month-to-month dividend shares are extremely speculative. On common, month-to-month dividend shares are likely to have elevated payout ratios. An elevated payout ratio means there’s much less margin for error to proceed paying the dividend if enterprise outcomes undergo a brief (or everlasting) decline.

Consequently, we have now actual considerations that many month-to-month dividend payers won’t be able to proceed paying rising dividends within the occasion of a recession.

Moreover, a excessive payout ratio signifies that an organization is retaining little cash to take a position for future progress. This will lead administration groups to aggressively leverage their steadiness sheet, fueling progress with debt. Excessive debt and a excessive payout ratio is maybe essentially the most harmful mixture round for a possible future dividend discount.

With that mentioned, there are a handful of high-quality month-to-month dividend payers round. Chief amongst them is Realty Earnings (O). Realty Earnings has paid growing dividends (on an annual foundation) yearly since 1994.

The Realty Earnings instance exhibits that there are high-quality month-to-month dividend payers round, however they’re the exception relatively than the norm. We recommend buyers do ample due diligence earlier than shopping for into any month-to-month dividend payer.

Ultimate Ideas

Monetary freedom is achieved when your passive funding revenue exceeds your bills. However the sequence and timing of your passive revenue funding funds can matter.

Month-to-month funds make matching portfolio revenue with bills simpler. Most private bills recur month-to-month whereas most dividend shares pay quarterly. Investing in month-to-month dividend shares matches the frequency of portfolio revenue funds with the conventional frequency of private bills.

Moreover, many month-to-month dividend payers supply buyers excessive yields. The mixture of a month-to-month dividend fee and a excessive yield ought to be particularly interesting to revenue buyers.

However not all month-to-month dividend payers supply the security that revenue buyers want. A month-to-month dividend is best than a quarterly dividend, however not if that month-to-month dividend is decreased quickly after you make investments. The excessive payout ratios and shorter histories of most month-to-month dividend securities imply they have an inclination to have elevated danger ranges.

Due to this, we advise buyers to search for high-quality month-to-month dividend payers with cheap payout ratios, buying and selling at honest or higher costs.

In case you are interested by discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Positive Dividend databases might be helpful:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].