Up to date on June sixth, 2022 by Bob Ciura

Spreadsheet information up to date day by day

Grasp Restricted Partnerships – or MLPs, for brief – are a number of the most misunderstood funding autos within the public markets. And that’s a disgrace, as a result of the everyday MLP gives:

- Tax-advantaged revenue

- Excessive yields properly in extra of market averages

- The majority of company money flows returned to shareholders by way of distributions

An instance of a ‘regular’ MLP is a company concerned within the midstream power trade. Midstream power corporations are within the enterprise of transporting oil, primarily although pipelines. Pipeline corporations make up the overwhelming majority of MLPs.

Since MLPs broadly provide excessive yields, they’re naturally interesting for revenue traders. With this in thoughts, we created a full downloadable checklist of practically 100 MLPs in our protection universe.

You’ll be able to obtain the Excel spreadsheet (together with related monetary metrics like dividend yield and payout ratios) by clicking on the hyperlink under:

This complete article covers MLPs in depth, together with the historical past of MLPs, distinctive tax penalties and threat components of MLPs, in addition to our 7 top-ranked MLPs immediately.

The desk of contents under permits for straightforward navigation of the article:

Desk of Contents

The Historical past of Grasp Restricted Partnerships

MLPs have been created in 1981 to permit sure enterprise partnerships to challenge publicly traded possession pursuits.

The primary MLP was Apache Oil Firm, which was shortly adopted by different power MLPs, after which actual property MLPs.

The MLP area expanded quickly till an incredible many corporations from numerous industries operated as MLPs – together with the Boston Celtics basketball staff.

One essential pattern over time, is that power MLPs have grown from being roughly one-third of the whole MLP universe to containing the overwhelming majority of those securities.

Furthermore, the power MLP universe has developed to be centered on midstream power operations. Midstream partnerships have grown to be roughly half of the whole variety of power MLPs.

MLP Tax Penalties

Grasp restricted partnerships are tax-advantaged funding autos. They’re taxed in another way than companies. MLPs are pass-through entities. They aren’t taxed on the entity degree.

As an alternative, all cash distributed from the MLP to unit holders is taxed on the particular person degree.

Distributions are ‘handed by way of’ as a result of MLP traders are literally restricted companions within the MLP, not shareholders. Due to this, MLP traders are known as unit holders, not shareholders.

And, the cash MLPs pay out to unit holders known as a distribution (not a dividend).

The cash handed by way of from the MLP to unit holders is assessed as both:

MLPs are likely to have tons of depreciation and different non-cash fees. This implies they typically have revenue that’s far decrease than the amount of money they will truly distribute. The money distributed much less the MLPs revenue is a return of capital.

A return of capital just isn’t technically revenue, from an accounting and tax perspective. As an alternative, it’s thought-about because the MLP truly returning a portion of its property to unit holders.

Now right here’s the attention-grabbing half… Returns of capital scale back your price foundation. Meaning taxes for returns of capital are solely due while you promote your MLP items. Returns of capital are tax-deferred.

Be aware: Return of capital taxes are additionally due within the occasion that your price foundation is lower than $0. This solely occurs for very long-term holding, usually round 10 years or extra.

Every particular person MLP is completely different, however on common an MLPs distribution is normally round 80% to 90% a return of capital, and 10% to twenty% peculiar revenue.

This works out very properly from a tax perspective. The photographs under examine what occurs when an organization and an MLP every have the identical amount of money to ship to traders.

Be aware 1: Taxes are by no means easy. Some affordable assumptions needed to be made to simplify the desk above. These are listed under:

- Company federal revenue tax charge of 21%

- Company state revenue tax charge of 5%

- Certified dividend tax charge of 20%

- Distributable money is 80% a return of capital, 20% peculiar revenue

- Private federal tax charge of twenty-two% much less 20% for passive entity tax break

(19.6% whole as an alternative of twenty-two%) - Private state tax charge of 5% much less 20% for passive entity tax break

(4% whole as an alternative of 5%) - Lengthy-term capital positive aspects tax charge of 20% much less 20% for passive entity tax break

(16% whole as an alternative of 20%)

Be aware 2: The 20% passive revenue entity tax break will expire in 2025.

Be aware 3: Within the MLP instance, if the utmost private tax charge of 37% is used, the distribution in any case taxes is $8.05.

Be aware 4: Within the MLP instance, the accrued price foundation discount tax is due when the MLP is bought, not yearly come tax time.

Because the tables above present, MLPs are much more environment friendly autos for returning money to shareholders relative to companies. Moreover, within the instance above $9.57 out of $10.00 distribution could be stored by the MLP investor till they bought as a result of the majority of taxes are from returns of capital and never due till the MLP is bought.

Return of capital and different points mentioned above don’t matter when MLPs are held in a retirement account.

There’s a completely different challenge with holding MLPs in a retirement account, nonetheless. This consists of 401(ok), IRA, and Roth IRA accounts, amongst others.

When retirement plans conduct or put money into a enterprise exercise, they have to file separate tax varieties to report Unrelated Business Income (UBI) and should owe Unrelated Business Taxable Income (UBTI). UBTI tax brackets go as much as 37% (the highest private charge).

MLPs challenge Ok-1 varieties for tax reporting. Ok-1s report enterprise revenue, expense, and loss to house owners. Due to this fact, MLPs held in retirement accounts should qualify for taxes.

If UBI for all holdings in your retirement account is over $1,000, you need to have your retirement account supplier (usually, your brokerage) file Kind 990-T.

You’ll want to file kind 990-T as properly when you have a UBI loss to get a loss carryforward for subsequent tax years. Failure to file kind 990-T and pay UBIT can result in extreme penalties.

Happily, UBIs are sometimes destructive. It’s a pretty uncommon incidence to owe taxes on UBI.

The topic of MLP taxation may be sophisticated and complicated. Hiring a tax skilled to assist in making ready taxes is a viable choice for coping with the complexity.

The underside line is that this: MLPs are tax-advantaged autos which might be suited to traders on the lookout for present revenue. It’s positive to carry them in both taxable or non-taxable (retirement) accounts.

Since retirement accounts are already tax-deferred, holding MLPs in taxable accounts means that you can ‘get credit score’ for the total results of their distinctive construction.

4 Benefits & 6 Disadvantages of Investing in MLPs

MLPs are a singular asset class. Consequently, there are a number of benefits and downsides to investing in MLPs. Many of those benefits and downsides are distinctive particularly to MLPs.

Benefits of MLPs

Benefit #1: Decrease taxes

MLPs are tax-advantaged securities, as mentioned within the “Tax Penalties” part above. Relying in your particular person tax bracket, MLPs are in a position to generate round 40% extra after-tax revenue for each pre-tax greenback they resolve to distribute, versus Firms.

Benefit #2: Tax-deferred revenue by way of returns of capital

Along with decrease taxes basically, 80% to 90% of the everyday MLPs distributions are labeled as returns of capital. Taxes are usually not 0wed (except price foundation falls under 0) on return of capital distributions till the MLP is bought.

This creates the favorable scenario of tax-deferred revenue.

Tax-deferred revenue is particularly useful for retirees as return on capital taxes might not must be paid all through retirement.

Benefit #3: Diversification from different asset courses

Investing in MLPs supplies added diversification in a balanced portfolio. Diversification may be measured by the correlation in return sequence between asset courses.

MLPs are wonderful diversifiers, having both a close to zero or destructive correlation to company bonds, authorities bonds, and gold.

Moreover, they’ve a correlation coefficient of lower than 0.5 to each REITs and the S&P 500. This makes MLPs a wonderful addition to a diversified portfolio.

Benefit #4: Sometimes very excessive yields

MLPs are likely to have excessive yields far in extra of the broader market. As of this writing, the S&P 500 yields ~2.1%, whereas the Alerian MLP ETF (AMLP) yields over 25%. Many particular person MLPs have yields above 10%.

Disadvantages of MLPs

Drawback #1: Sophisticated tax scenario

MLPs can create a headache come tax season. MLPs challenge Ok-1’s and are usually extra time-consuming and sophisticated to appropriately calculate taxes than ‘regular’ shares.

Drawback #2: Potential extra paperwork if held in a retirement account

As well as, MLPs create additional paperwork and problems when invested by way of a retirement account as a result of they probably create unrelated enterprise revenue (UBI). See the “Tax Penalties” part above for extra on this.

Drawback #3: Little diversification inside the MLP asset class

Whereas MLPs present important diversification versus different asset courses, there may be little diversification inside the MLP construction.

The overwhelming majority of publicly traded MLPs are oil and fuel pipeline companies. There are some exceptions, however basically MLP traders are investing in power pipelines and never a lot else.

Due to this, it might be unwise to allocate all or a majority of 1’s portfolio to this asset class.

Drawback #4: Incentive Distribution Rights (IDRs)

MLP traders are restricted companions within the partnership. The MLP kind additionally has a common accomplice.

The overall accomplice is normally the administration and possession group that controls the MLP, even when they personal a really small share of the particular MLP.

Incentive Distribution Rights, or IDRs, are used to ‘incentivize’ the final accomplice to develop the MLP.

IDRs usually allocate larger percentages of money flows to go to the final accomplice (and to not the restricted companions) because the MLP grows its money flows.

This reduces the MLPs skill to develop its distributions, placing a handicap on distribution will increase.

It needs to be famous that not all MLPs have IDRs, however the majority do.

Drawback #5: Elevated threat of distribution cuts resulting from excessive payout ratios

One of many large benefits of investing in MLPs is their excessive yields. Sadly, excessive yields fairly often include excessive payout ratios.

Most MLPs distribute practically all the money flows they make to unit holders. Basically, this can be a optimistic.

Nevertheless, it creates little or no room for error.

The pipeline enterprise is mostly steady, but when money flows decline unexpectedly, there may be nearly no margin of security at many MLPs. Even a short-term disturbance in enterprise outcomes can necessitate a discount within the distribution.

Drawback #6: Progress Via Debt & Share Issuances

Since MLPs usually distribute nearly all of their money flows as distributions, there may be little or no cash left over to really develop the partnership.

And most MLPs try to develop each the partnership, and distributions, over time. To do that, the MLP’s administration should faucet capital markets by both issuing new items or taking over extra debt.

When new items are issued, present unit holders are diluted; their share of possession within the MLP is lowered.

When new debt is issued, additional cash flows should be used to cowl curiosity funds as an alternative of going into the pockets of restricted companions by way of distributions.

If an MLPs administration staff begins tasks with decrease returns than the price of their debt or fairness capital, it destroys unit holder worth. It is a actual threat to contemplate when investing in MLPs.

The 7 Finest MLPs At present

The 7 finest MLPs are ranked and analyzed under utilizing anticipated whole returns from the Positive Evaluation Analysis Database. Anticipated whole returns consist of three parts:

- Return from change in valuation a number of

- Return from distribution yield

- Return from progress on a per-unit foundation

The highest MLPs checklist was screened additional on a qualitative evaluation of an organization’s dividend threat.

Particularly, MLPs with a Dividend Danger rating of ‘F’ or ‘D’ in response to the Positive Evaluation Analysis Database have been omitted from the checklist.

Moreover, MLPs with present distribution yields under 2% weren’t thought-about. This display screen makes the checklist extra enticing to revenue traders.

Proceed studying for detailed evaluation on every of our high MLPs, ranked in response to anticipated 5-year annual returns, but in addition ranked additional by debt ranges and energy of property.

MLP #7: MPLX LP (MPLX)

- 5-year anticipated annual returns: 8.6%

MPLX, LP is a Grasp Restricted Partnership that was fashioned by the Marathon Petroleum Company (MPC) in 2012.

The enterprise operates in two segments: Logistics and Storage – which pertains to crude oil and refined petroleum merchandise – and Gathering and Processing – which pertains to pure fuel and pure fuel liquids (NGLs). In 2019, MPLX acquired Andeavor Logistics LP.

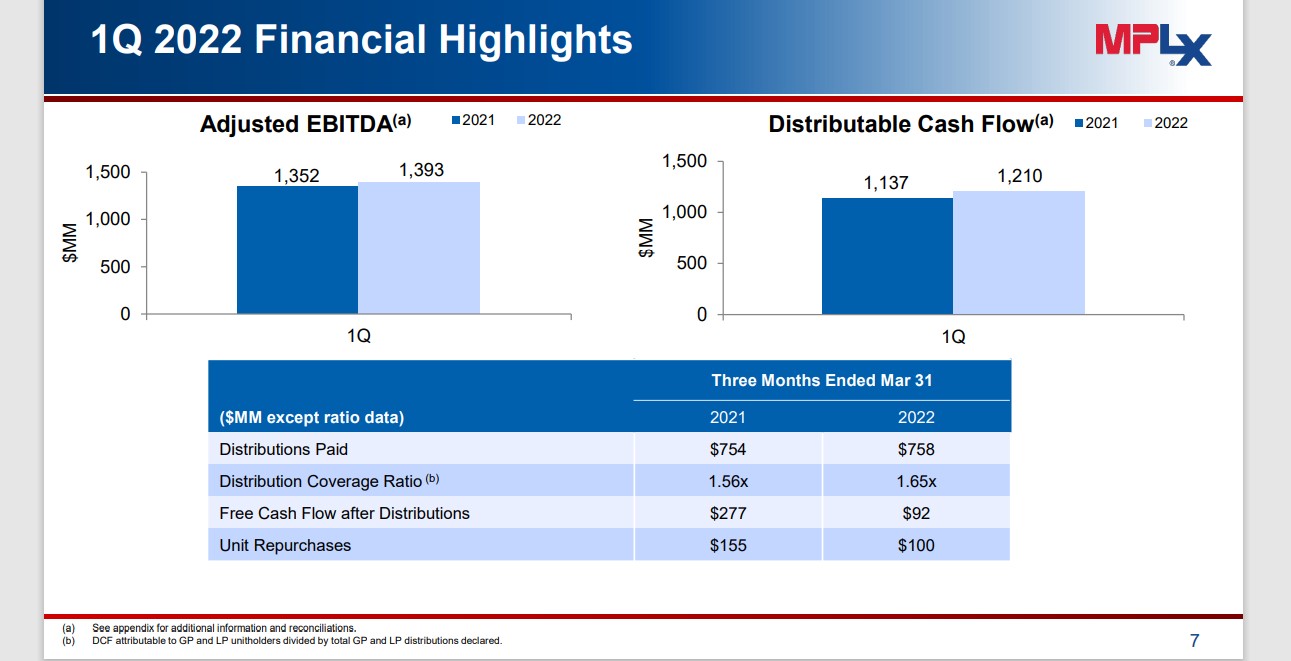

You’ll be able to see highlights of the corporate’s first-quarter report within the picture under:

Supply: Investor Presentation

Web revenue and distributable money move (DCF) per share grew 12% and eight%, respectively, over the prior 12 months’s quarter. The robust efficiency resulted from 4% quantity progress in Logistics & Storage, greater NGL costs and better volumes in Gathering & Processing.

MPLX maintained a wholesome consolidated debt to adjusted EBITDA ratio of three.7x and a stable distribution protection ratio of 1.65.

Click on right here to obtain our most up-to-date Positive Evaluation report on MPLX (preview of web page 1 of three proven under):

MLP #6: Suburban Propane Companions (SPH)

- 5-year anticipated annual returns: 11.6%

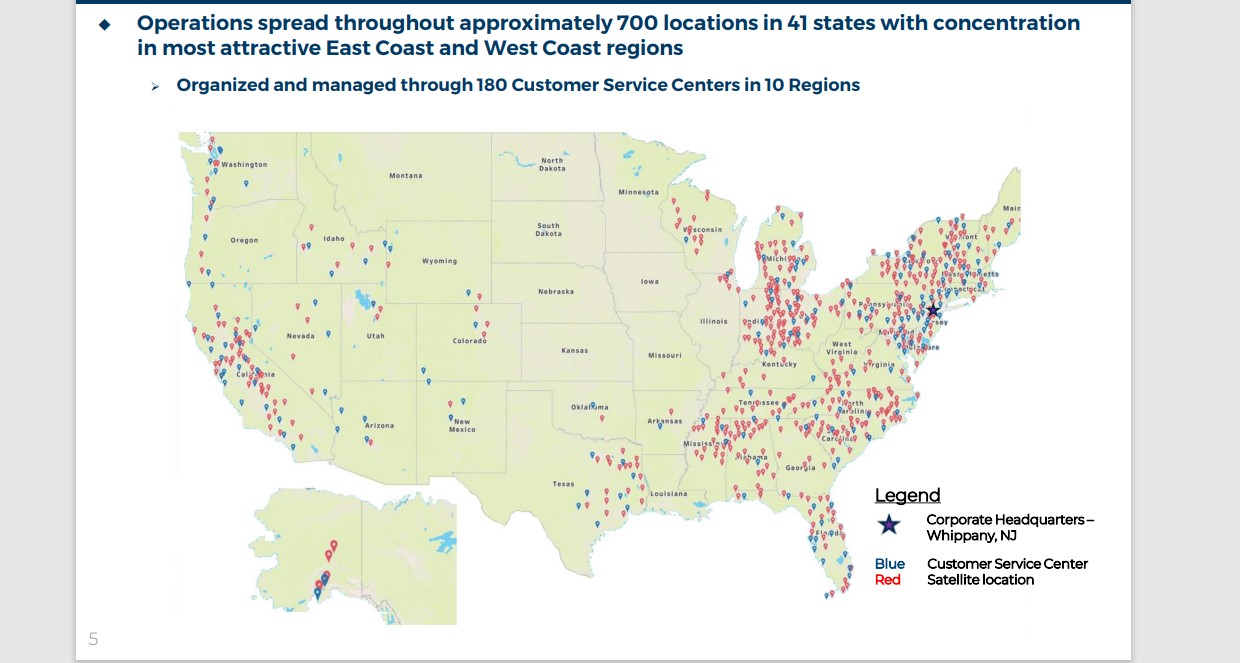

Suburban Propane has been in operation since 1928 and have become a Grasp Restricted Partnership in 1996. The partnership companies a lot of the U.S. with propane and different power sources, with propane making up round 90% of whole income. It ought to generate about $1.3 billion in income this 12 months. The partnership has about 3,200 full-time workers in 41 states, serving roughly 1 million prospects.

Supply: Investor Presentation

Suburban reported second quarter earnings on Might fifth, 2022, and outcomes have been higher than anticipated on each income and income. Earnings-per-share got here to $2.74, which was 70 cents higher than anticipated. That was up from $2.03 within the year-ago interval. Adjusted EBITDA, which is our most well-liked earnings measurement for Suburban, was up 0.3% to $173 million.

Income was up 9.5% to $588 million, which was attributable to a small decline in quantity greater than offset by a large improve in pricing. Retail propane gallons sod have been 159 million, down 5.8% year-over-year, primarily resulting from file heat temperatures in December.

As well as, Suburban cited unseasonably heat and inconsistent temperatures all through the quarter, in addition to buyer conservation resulting from excessive commodity costs. Temperatures have been 7% hotter than regular throughout the quarter in Suburban’s service areas

We anticipate 11.6% annual returns for EPD, based mostly on ~1% annual DCF-per-unit progress, the 7.5% yield, and a ~3.1% annual enhance from an increasing valuation a number of.

Click on right here to obtain our most up-to-date Positive Evaluation report on SPH (preview of web page 1 of three proven under):

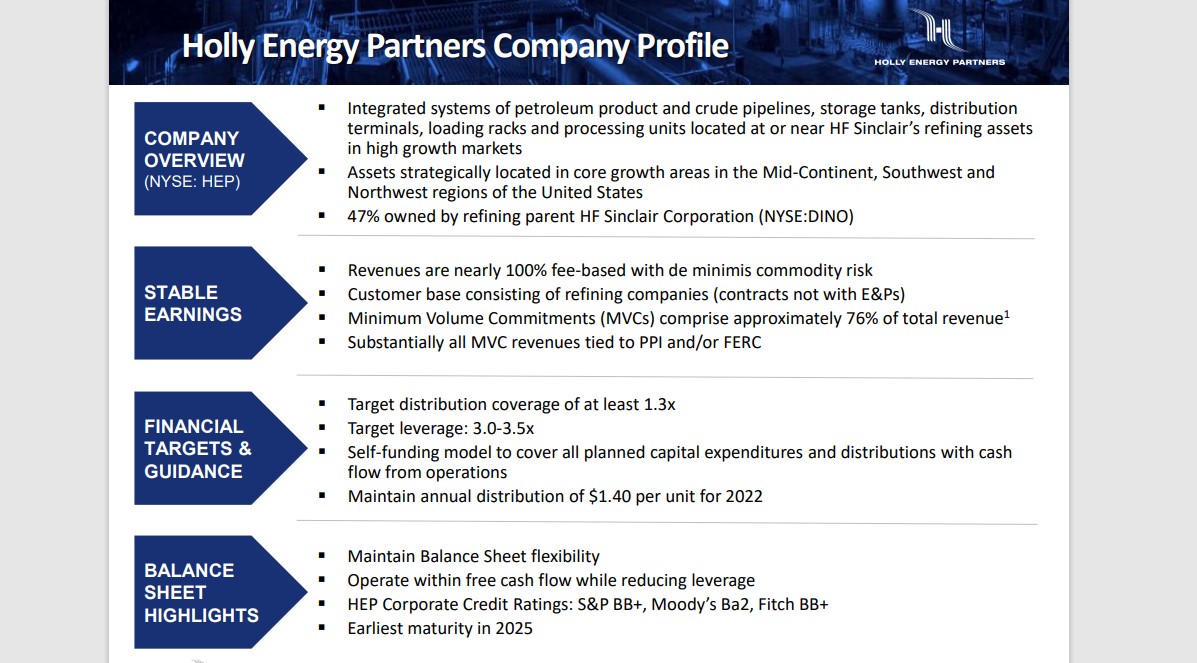

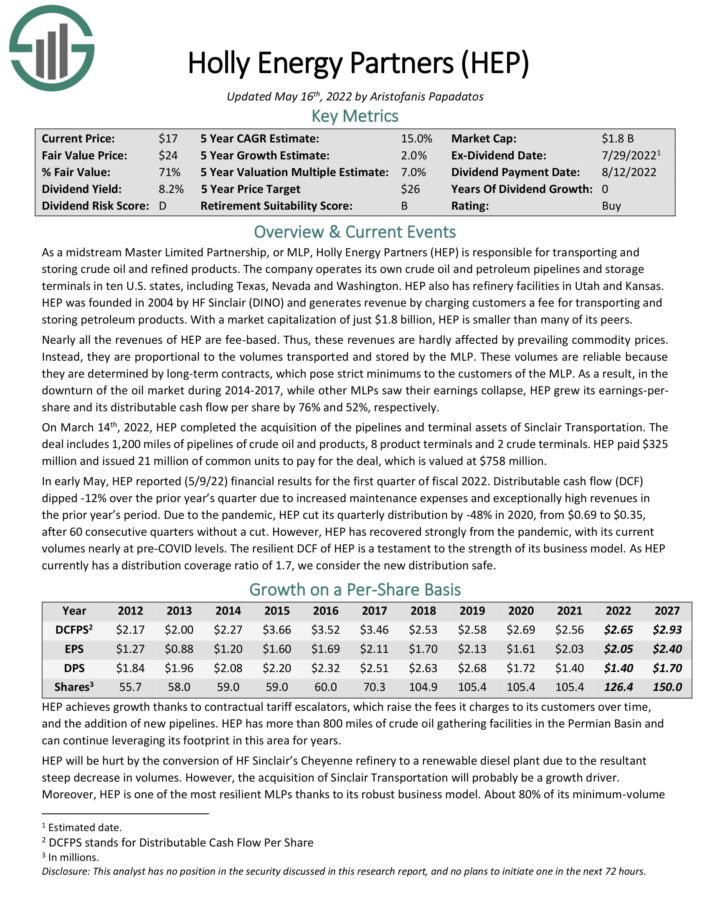

MLP #5: Holly Power Companions (HEP)

- 5-year anticipated annual returns: 11.7%

Holly Power Companions is liable for transporting and storing crude oil and refined merchandise. The corporate operates its personal crude oil and petroleum pipelines and storage terminals in ten U.S. states, together with Texas, Nevada and Washington. HEP additionally has refinery services in Utah and Kansas.

Almost all of the revenues of HEP are fee-based. Thus, these revenues are hardly affected by prevailing commodity costs. As an alternative, they’re proportional to the volumes transported and saved by the MLP. These volumes are dependable as a result of they’re decided by long-term contracts, which pose strict minimums to the shoppers of the MLP. Consequently, within the downturn of the oil market throughout 2014-2017, whereas different MLPs noticed their earnings collapse, HEP grew its earnings-pershare and its distributable money move per share by 76% and 52%, respectively.

On March 14th, 2022, HEP accomplished the acquisition of the pipelines and terminal property of Sinclair Transportation. The deal consists of 1,200 miles of pipelines of crude oil and merchandise, 8 product terminals and a pair of crude terminals. HEP paid $325 million and issued 21 million of frequent items to pay for the deal, which is valued at $758 million.

Supply: Investor Presentation

In early Might, HEP reported (5/9/22) monetary outcomes for the primary quarter of fiscal 2022. Distributable money move dipped -12% over the prior 12 months’s quarter resulting from elevated upkeep bills and exceptionally excessive revenues within the prior 12 months’s interval.

As a result of pandemic, HEP minimize its quarterly distribution by -48% in 2020, from $0.69 to $0.35, after 60 consecutive quarters with out a minimize. Nevertheless, HEP has recovered strongly from the pandemic, with its present volumes practically at pre-COVID ranges. The resilient DCF of HEP is a testomony to the energy of its enterprise mannequin. As HEP presently has a distribution protection ratio of 1.7, we contemplate the brand new distribution secure.

Click on right here to obtain our most up-to-date Positive Evaluation report on HEP (preview of web page 1 of three proven under):

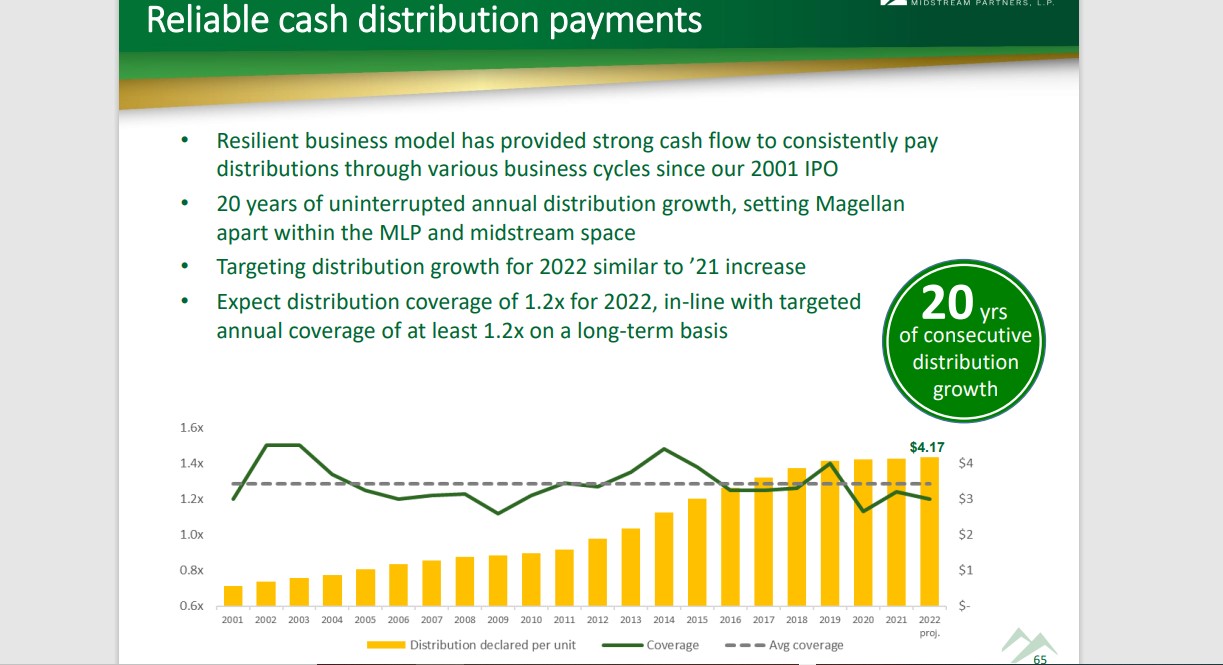

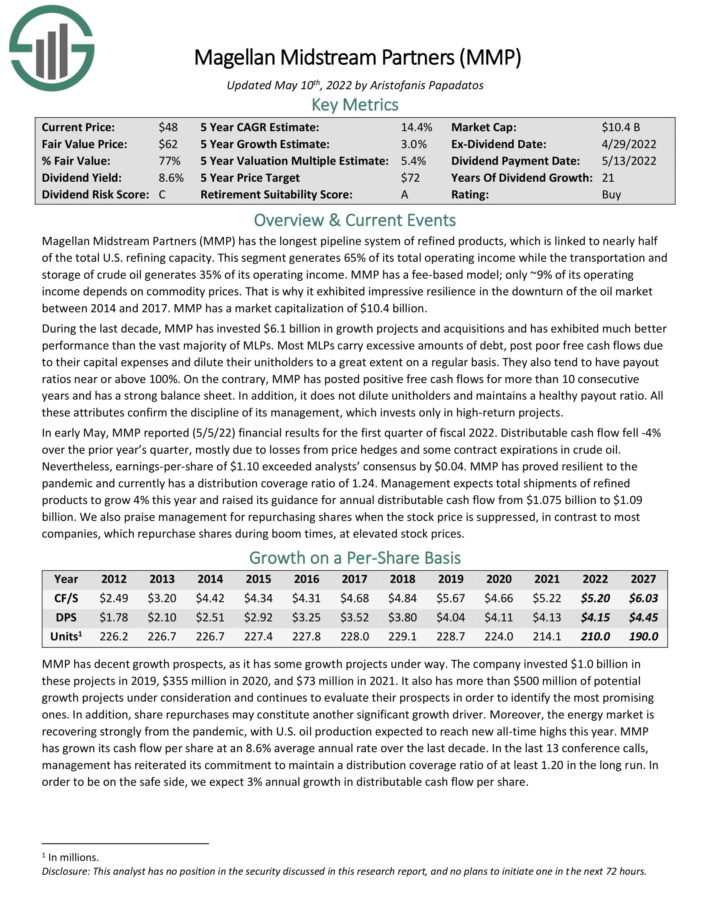

MLP #4: Magellan Midstream Companions LP (MMP)

- 5-year anticipated annual returns: 12.3%

Magellan has the longest pipeline system of refined merchandise, which is linked to just about half of the whole U.S. refining capability.

This section generates ~65% of its whole working revenue whereas the transportation and storage of crude oil generates ~35% of its working revenue. MMP has a fee-based mannequin; solely ~10% of its working revenue is dependent upon commodity costs.

MMP has a protracted historical past of regular distributions:

Supply: Investor Presentation

In early Might, MMP reported (5/5/22) monetary outcomes for the primary quarter of fiscal 2022. Distributable money move fell -4% over the prior 12 months’s quarter, largely resulting from losses from worth hedges and a few contract expirations in crude oil. Nonetheless, earnings-per-share of $1.10 exceeded analysts’ consensus by $0.04. MMP has proved resilient to the pandemic and presently has a distribution protection ratio of 1.24.

Administration expects whole shipments of refined merchandise to develop 4% this 12 months and raised its steering for annual distributable money move from $1.075 billion to $1.09 billion.

Click on right here to obtain our most up-to-date Positive Evaluation report on MMP (preview of web page 1 of three proven under):

MLP #3: Icahn Enterprises LP (IEP)

- 5-year anticipated annual returns: 12.9%

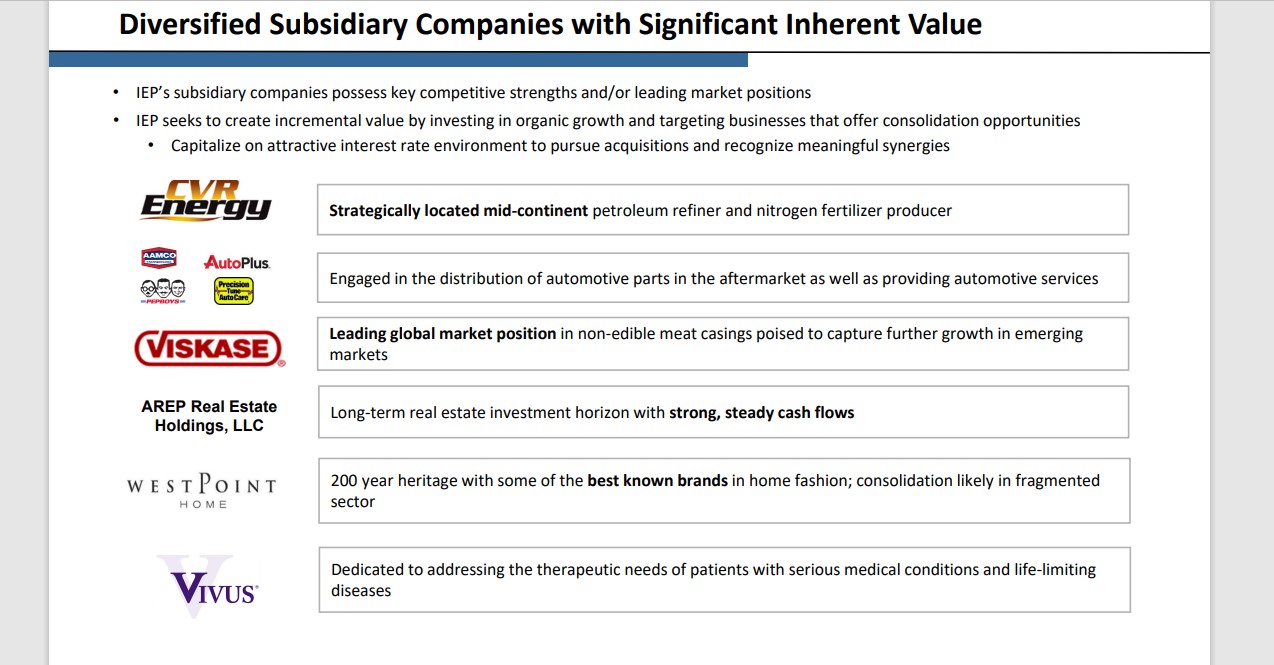

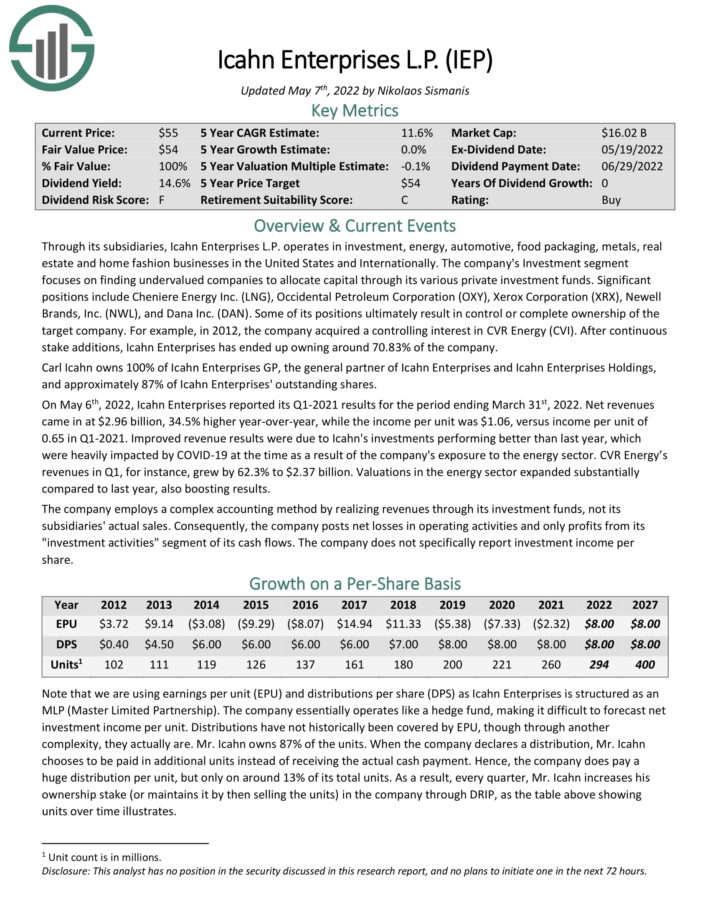

Icahn Enterprises L.P. operates in funding, power, automotive, meals packaging, metals, actual property and residential style companies in the USA and Internationally. The corporate’s Funding section focuses on discovering undervalued corporations to allocate capital by way of its varied non-public funding funds.

A few of its positions finally end in management or full possession of the goal firm. For instance, in 2012, the corporate acquired a controlling curiosity in CVR Power (CVI).

After steady stake additions, Icahn Enterprises has ended up proudly owning round 70.83% of the corporate. Carl Icahn owns 100% of Icahn Enterprises GP, the final accomplice of Icahn Enterprises and Icahn Enterprises Holdings, and roughly 87% of Icahn Enterprises’ excellent shares.

Supply: Investor Presentation

On Might sixth, 2022, Icahn Enterprises reported its Q1-2021 outcomes for the interval ending March thirty first, 2022. Web revenues got here in at $2.96 billion, 34.5% greater year-over-year, whereas the revenue per unit was $1.06, versus revenue per unit of 0.65 in Q1-2021.

Improved income outcomes have been resulting from Icahn’s investments performing higher than final 12 months, which have been closely impacted by COVID-19 on the time on account of the corporate’s publicity to the power sector. CVR Power’s revenues in Q1, for example, grew by 62.3% to $2.37 billion. Valuations within the power sector expanded considerably in comparison with final 12 months, additionally boosting outcomes.

We anticipate no progress, whereas the MLP additionally gives a 15.6% yield. Nevertheless, items seem considerably overvalued proper now. Whole returns are estimated at 12.9% per 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on IEP (preview of web page 1 of three proven under):

MLP #2: Plains All American Pipeline LP (PAA)

- 5-year anticipated annual returns: 13.1%

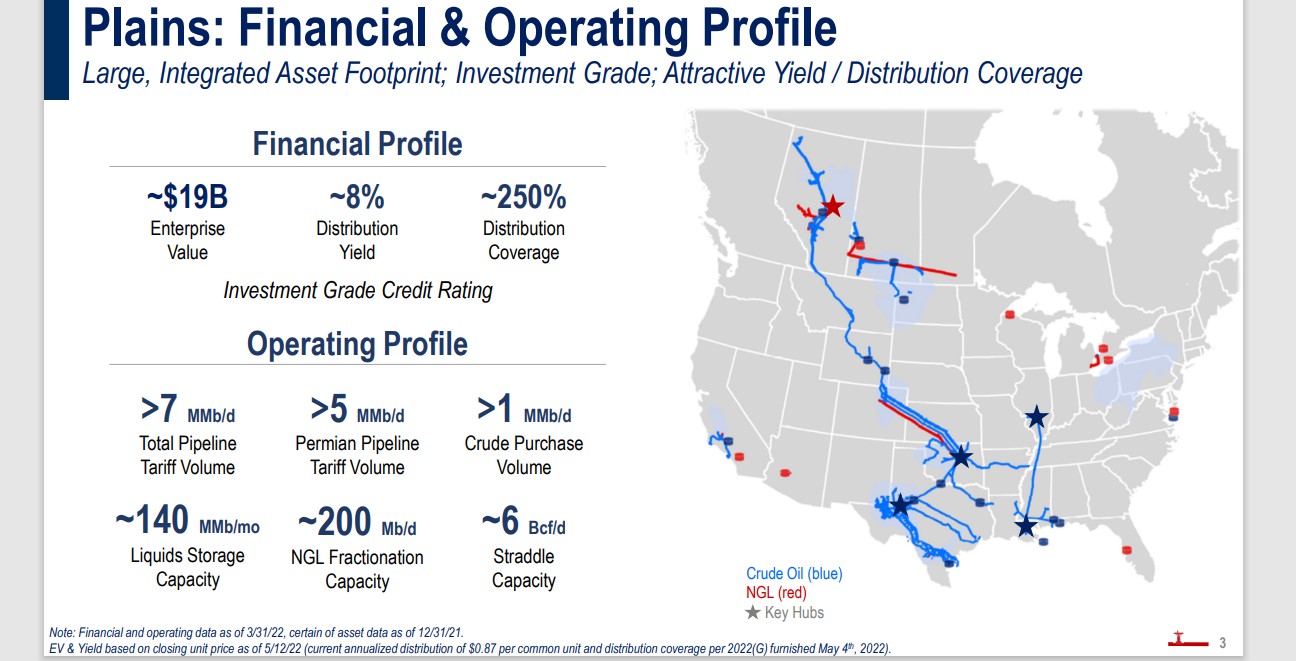

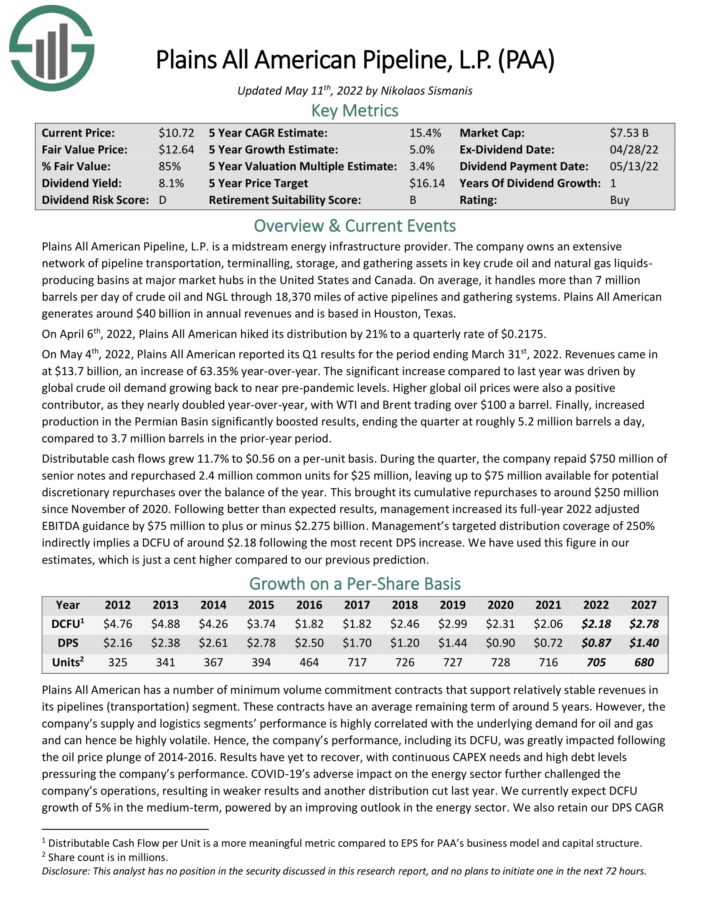

Plains All American Pipeline is a midstream power infrastructure supplier. The corporate owns an intensive community of pipeline transportation, terminalling, storage, and gathering property in key crude oil and pure fuel liquids producing basins at main market hubs in the USA and Canada. On common, it handles greater than 7 million barrels per day of crude oil and NGL by way of 18,370 miles of energetic pipelines and gathering programs. Plains All American generates round $40 billion in annual revenues and is predicated in Houston, Texas.

Supply: Investor Presentation

On April sixth, 2022, Plains All American hiked its distribution by 21% to a quarterly charge of $0.2175. On Might 4th, 2022, Plains All American reported its Q1 outcomes. Revenues got here in at $13.7 billion, a rise of 63.35% year-over-year. The numerous improve in comparison with final 12 months was pushed by international crude oil demand rising again to close pre-pandemic ranges. Greater international oil costs have been additionally a optimistic contributor, as they practically doubled year-over-year, with WTI and Brent buying and selling over $100 a barrel.

Lastly, elevated manufacturing within the Permian Basin considerably boosted outcomes, ending the quarter at roughly 5.2 million barrels a day, in comparison with 3.7 million barrels within the prior-year interval. Distributable money flows grew 11.7% to $0.56 on a per-unit foundation.

Following higher than anticipated outcomes, administration elevated its full-year 2022 adjusted EBITDA steering by $75 million to plus or minus $2.275 billion. Administration’s focused distribution protection of 250% not directly implies a DCFU of round $2.18 following the newest DPS improve.

We anticipate 13.1% annual returns for PAA, pushed by the 7.3% yield, in addition to 5% annual DCF-per-unit progress and a ~0.8% enhance from an increasing valuation a number of.

Click on right here to obtain our most up-to-date Positive Evaluation report on PAA (preview of web page 1 of three proven under):

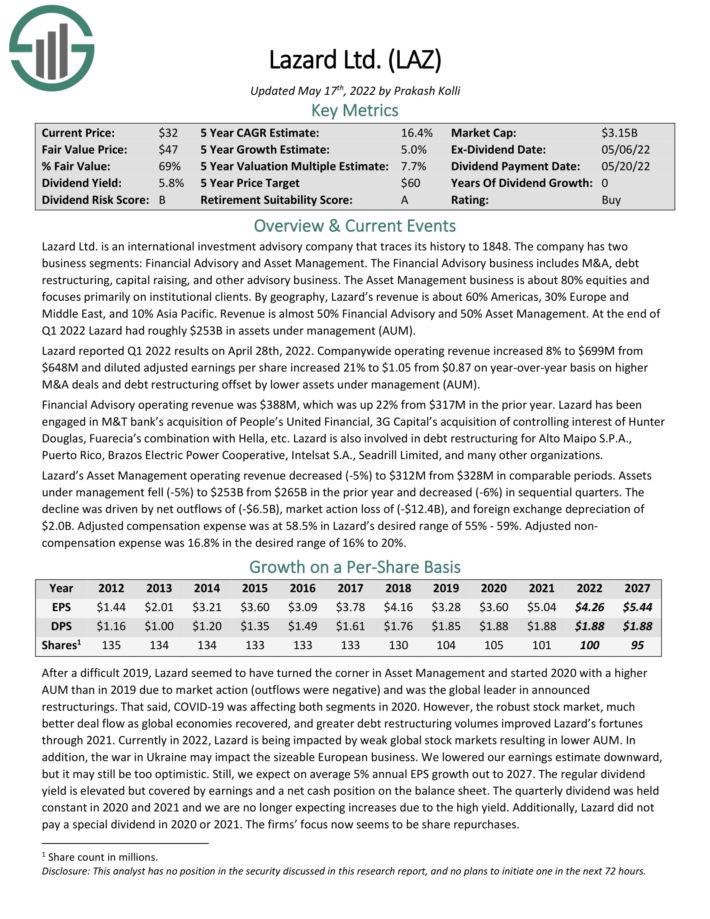

MLP #1: Lazard Ltd. (LAZ)

- 5-year anticipated annual returns: 14.5%

Lazard is likely one of the few MLPs that doesn’t function within the power sector. As an alternative, is a world funding advisory firm that traces its historical past to 1848.

The corporate has two enterprise segments which might be Financial Advisory and Asset Management. The Financial Advisory enterprise consists of M&A, debt restructuring, capital elevating, and different advisory enterprise. The Asset Administration enterprise is about 80% equities and focuses totally on institutional purchasers.

You’ll be able to see the highlights of the corporate’s first-quarter efficiency within the picture under:

Supply: Investor Presentation

Lazard’s aggressive benefit is derived from its popularity for excellence and integrity, worldwide attain, range in asset administration, long-term relationships, and talent to advise on advanced transactions. The corporate is usually the go to agency for advanced international M&A transactions and restructuring. The corporate’s popularity additionally permits it to draw high expertise, which is essential within the advisory enterprise. Notably its managing administrators have on common over 25 years of expertise.

Lazard’s high and backside strains and thus inventory worth is delicate to the financial cycle and markets. Lazard is a comparatively small participant within the asset administration enterprise, which is present process consolidation. Scale is essential in asset administration for profitability. Earnings per share declined considerably over the last recession however quickly recovered.

We anticipate annual returns of 14.5% per 12 months for Lazard, resulting from a mix of 5% EPS progress, the 5.5% yield, and a ~6.1% enhance from an increasing valuation a number of.

Click on right here to obtain our most up-to-date Positive Evaluation report on Lazard (preview of web page 1 of three proven under):

MLP ETFs, ETNs, & Mutual Funds

There are 3 main methods to put money into MLPs:

- By investing in items of particular person publicly traded MLPs

- By investing in a MLP ETF or mutual fund

- By investing in a MLP ETN

Be aware: ETN stands for ‘alternate traded notice’

The distinction between investing immediately in an organization (regular inventory investing) versus investing in a mutual fund or ETF may be very clear. It’s merely investing in a single safety versus a bunch of securities.

ETNs are completely different. Not like mutual funds or ETFs, ETNs don’t truly personal any underlying shares or items of actual companies. As an alternative, ETNs are monetary devices backed by the monetary establishment (usually a big financial institution) that issued them. They completely monitor the worth of an index. The drawback to ETNs is that they expose traders to the potential for a complete loss if the backing establishment have been to go bankrupt.

The benefit to investing in a MLP ETN is that distribution revenue is tracked, however paid through a 1099. This eliminates the tax disadvantages of MLPs (no Ok-1s, UBTI, and so forth.). This distinctive characteristic might attraction to traders who don’t need to problem with a extra sophisticated tax scenario. The J.P. Morgan Alerian MLP ETN makes a good selection on this case.

Buying particular person securities is preferable for a lot of, because it permits traders to focus on their finest concepts. However ETFs have their place as properly, particularly for traders on the lookout for diversification advantages.

Ultimate Ideas

Grasp Restricted Partnerships are a misunderstood asset class. They provide diversification, tax-advantaged and tax-deferred revenue, excessive yields, and have traditionally generated wonderful whole returns. You’ll be able to obtain your free copy of all MLPs by clicking on the hyperlink under:

The asset class is probably going under-appreciated due to its extra sophisticated tax standing.

MLPs are usually enticing for revenue traders, resulting from their excessive yields.

As at all times, traders have to conduct their very own due diligence relating to the distinctive tax results and threat components earlier than buying MLPs.

The MLPs on this checklist might be a superb place to seek out long-term shopping for alternatives among the many beaten-down MLPs. To see the highest-yielding MLPs, click on right here.

Moreover, MLPs are usually not the one option to discover excessive ranges of revenue. The next lists comprise many extra shares that often pay rising dividends.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].