Spreadsheet & desk up to date each day

Up to date on Might twenty fourth, 2022 by Jonathan Weber

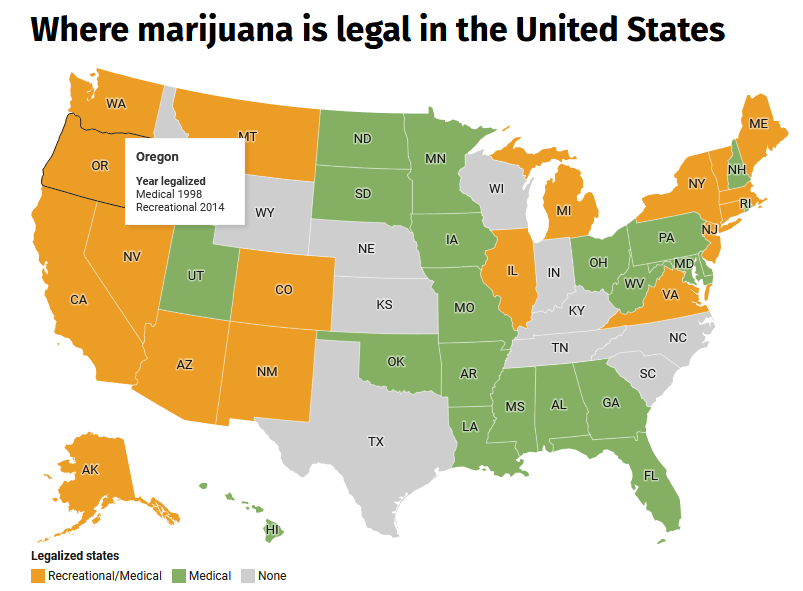

The marijuana {industry} continues to expertise lots of development. A number of nations around the globe have already moved to legalized leisure marijuana. Within the U.S., 18 states plus DC have legalized leisure marijuana already, with many extra having legalized medicinal use – 39 in complete. It’s probably that extra states will comply with swimsuit within the coming years, and ultimately, there may be federal legalization of marijuana within the US.

Whereas this naturally results in a doubtlessly vital funding alternative, buyers would do nicely to recollect a number of the {industry} bubbles of the previous. For instance, the tech bubble of the late 1990’s is a continuing reminder that speedy {industry} development alone doesn’t assure investing success. Selecting the highest-quality firms (or least dangerous shares) in a rising {industry} could make a world of distinction for returns.

This text takes a deep dive into the marijuana {industry}, in quest of the perfect marijuana shares at the moment. Surprisingly, there are over 100 to select from with full or partial publicity to the marijuana {industry}.

Click on the hyperlink beneath to obtain our free Excel spreadsheet of greater than 100 marijuana shares.

Desk of Contents

Trade Overview

The hashish plant could be divided into 2 broad classes primarily based on tetrahydrocannabinol [THC] content material:

- Excessive THC – what we frequently check with as marijuana

- Almost no THC – what we frequently check with as hemp

Marijuana has leisure and pharmaceutical makes use of whereas hemp has primarily industrial makes use of.

Curiously, THC is one in all greater than 480 recognized substances within the plant, with greater than 60 of these being cannabinoids.

Marijuana can be utilized both by smoking, by vaporizing, as content material in meals or drinks, or as an extract.

Marijuana Use & Legality Round The Globe

Over the past couple of years, marijuana legal guidelines across the globe have been relaxed in lots of circumstances, an growing variety of nations (and US states) have legalized the medical, and in some circumstances the leisure, use of marijuana. The drug has up to now not been legalized on the federal stage within the US, although. The picture beneath exhibits legalization by nation/state, blue nations and states permit leisure hashish use, whereas inexperienced nations and states permit the medical use of hashish.

Supply

Marijuana has been partially or absolutely legalized in round 50 nations as of Might 2022. Usually, medical marijuana has been legalized whereas the leisure use of marijuana has not (but) been legalized.

In Canada, marijuana was absolutely legalized on the federal stage in 2018. A number of different nations, equivalent to Germany and Mexico, have decriminalized the use and possession of small quantities of marijuana.

Within the majority of US states marijuana has been not less than partially legalized, and the variety of these states has grown steadily in recent times.

Supply

18 states, in addition to the District of Columbia, permit the leisure use of marijuana by adults, with age restrictions starting from 18 to 21.

In these nations and US states the place marijuana has not been legalized, marijuana continues to be used frequently. It’s the mostly used unlawful drug in each the world, in addition to in america, the place a 2021 examine discovered that 49% of People had used the drug not less than as soon as. Globally, round 190 million individuals use marijuana for leisure functions yearly, in accordance with UN estimates.

Medical Use Of Marijuana

Medical marijuana, additionally referred to as medical hashish, refers to marijuana that has been prescribed by docs to their sufferers as a type of remedy for a wide range of signs. Proof means that the consumption of marijuana (or marijuana-based merchandise) can have optimistic impacts on sufferers with sure situations that aren’t defined by the placebo impact.

The use circumstances for medical marijuana embody:

- The remedy of nausea and vomiting for sufferers present process chemotherapy

- Rising urge for food for sufferers with an HIV/AIDS an infection

- The remedy of persistent ache (e.g. brought on by peripheral neuropathy) and muscle spasms

- The remedy of neurological points, equivalent to a number of sclerosis (MS), epilepsy, and motion issues.

- Sleep enchancment

- the discount of tics for sufferers with Tourette syndrome

- the remedy of post-traumatic stress dysfunction

In these nations the place medical marijuana has been legalized, it oftentimes has solely been allowed for a few years. The medical marijuana market thus continues to be in a comparatively early part of development.

Potential development catalysts for the {industry} embody:

- Rising utilization in nations which have legalized using hashish

- Extra nations legalizing using hashish

A examine from 2022 counsel that the US authorized marijuana market (medical and leisure) will develop to as a lot as $80 billion by 2030. The report that was revealed by Grand View Analysis sees an annual market development price in extra of 25% in that time-frame.

For docs to more and more prescribe medical marijuana as an alternative of opioid narcotics (which may trigger habit and severe unwanted effects and are thus not essentially innocent) is seen as one other long-term development driver for using medical marijuana as a type of ache aid.

An important geographic markets will probably be these the place healthcare budgets are significant and the place marijuana has been (partially) legalized. This consists of america (states the place using medical marijuana has been legalized), Canada, Israel, Australia, components of Europe (Germany, Italy, France, The Netherlands), and components of South America (Chile, Argentina).

Leisure Use Of Marijuana

Marijuana, the world’s mostly used unlawful drug, has a doubtlessly very vast (and rising) authorized leisure market.

Within the US, the leisure hashish market is forecasted to develop to $25 billion by 2025, though development is forecasted to decelerate meaningfully over time – to only 5%-10% a yr by the center of the present decade.

In keeping with this 2022 report, the leisure hashish market in Canada is producing gross sales of $11 billion a yr, whereas additionally sustaining greater than 90,000 jobs throughout manufacturing, retail, and so forth. Extra Canadians have began utilizing the drug in recent times because it has been legalized, whereas some customers who consumed illicit marijuana have shifted in direction of consuming regulated, authorized hashish as an alternative.

Despite the fact that marijuana has not been legalized in america on a federal stage, the US nonetheless has turn out to be an important marketplace for leisure marijuana over time. Within the 18 states the place marijuana has been legalized, a quantity that can probably proceed to develop over the approaching years, leisure marijuana gross sales outpaced medical marijuana gross sales.

Forbes has forecasted that medical marijuana will make up simply 35% of world authorized marijuana gross sales in 2022, down from nearly 100% one decade earlier. We do consider that it’s probably that leisure marijuana might proceed to achieve market share versus medical marijuana, particularly if leisure marijuana will get legalized in further nations and states.

The worldwide peer market is projected to be price $685 billion by 2025. The worldwide tobacco market, for reference, is price about $700 billion yearly, with a low-single-digit development price. In comparison with these two markets, the leisure marijuana market nonetheless is slightly small, which might point out lots of future upside. However, buyers ought to contemplate that beer and tobacco are authorized in additional markets around the globe in comparison with marijuana, which continues to be restricted in lots of components of the world.

Analysts have been projecting vital market development for the worldwide marijuana markets for years. In recent times, the market has certainly grown meaningfully. But when the present development projections for 2025-2030 don’t materialize, e.g. because of legalization modifications or shifts in client conduct, or as a result of these projections had been flawed within the first place, these market dimension estimates might change into manner too optimistic, thus buyers ought to take these projections with a grain of salt.

Traders also needs to hold the next assertion by Benjamin Graham in thoughts:

“Apparent prospects for bodily development in a enterprise don’t translate into apparent income for buyers.”

Market development charges don’t essentially go hand in hand with excessive income for the firms which might be lively on this respective market, and so they particularly don’t go hand in hand with significant shareholder payouts.

Development shares which might be priced for perfection can disappoint buyers and produce underwhelming complete returns, even when the unique thesis about sturdy underlying development charges for the {industry} proves true.

There are credible arguments to be made towards high-profit margins within the marijuana {industry}. These embody the truth that market entry boundaries will not be overly excessive — there aren’t any substantial community results, entry prices will not be overly massive, and there aren’t any massive technological benefits — and the truth that marijuana is an agricultural good.

Margins within the agricultural {industry} are notoriously low. Half of all agricultural companies generate working revenue margins (earlier than curiosity bills and earlier than taxes) of lower than 5%. It’s under no circumstances assured that the identical will apply to the marijuana market, however it’s attainable that industry-wide income within the marijuana {industry} could possibly be comparatively meager, regardless of a big market dimension.

In recent times, we now have already seen this play out to a point. Regardless of additional legalization of marijuana in further nations and states, the shares of many hashish firms have underwhelmed, as revenue margins are slim for a lot of of those firms, and since valuations had been too excessive, which triggered a number of compression headwinds over time.

Investing In The Marijuana Trade

There are numerous publicly traded marijuana firms, with the most important ones being positioned in Canada, which isn’t shocking, as Canada is without doubt one of the largest markets the place marijuana has been absolutely legalized. Corporations on this phase have totally different methods, equivalent to specializing in the medical marijuana market, or sure geographic markets.

There are a number of ETFs which buyers can select if they’re bullish on the {industry} as an entire and if they don’t wish to select amongst single firms. The biggest one in all these ETFs is the Horizons Marijuana Life Sciences Index ETF (HMLSF), which has a present internet asset worth of CAD4.45 per share (Might 2022).

The Horizons Marijuana Life Sciences Index ETF has moved down since our final replace. Share value declines in a variety of hashish shares have triggered its internet asset worth to say no, and rising rates of interest and excessive inflation result in decrease curiosity from buyers with regards to investing in oftentimes barely worthwhile development shares.

This ETF made two distributions in 2021, in accordance with its reality sheet, however its estimated annualized yield of 0.81% just isn’t engaging for revenue buyers and doesn’t add meaningfully to the ETF’s complete return potential. The Horizons Marijuana Life Science ETF has a comparatively excessive expense ratio of 0.86% yearly.

‘Pure Play’ Marijuana Shares

Traders who’re on this area can select from a big record of publicly traded firms with direct publicity to the marijuana market, i.e. marijuana pure performs. These are firms which derive all, or a overwhelming majority of, their revenues from the sale of marijuana and marijuana merchandise, for medical use and/or for leisure use.

Many massive gamers on this phase are Canada-based, however US-based firms with significant market capitalizations exist as nicely. Outdoors of North America, there aren’t any massive gamers on this area, since different nations the place (medical) marijuana has been legalized do oftentimes import marijuana from North American firms as an alternative of manufacturing marijuana “at dwelling”.

Most marijuana firms do not need an extended historical past of revenues or earnings as a result of the authorized marijuana {industry} continues to be comparatively younger. It appears probably that these marijuana firms with the very best gross sales base and the biggest manufacturing capability have the best probability of producing above-average margins sooner or later. Causes for this embody economics of scale, working leverage, and the truth that these with probably the most expertise are probably the perfect at bringing down prices of manufacturing.

However, buyers ought to be cautious to not overpay for shares – which is why the value for a inventory ought to at all times be checked out relative to metrics such because the earnings or the money flows that the corporate generates (on a per-share foundation).

That is the record of 10 of the biggest pureplay marijuana firms by income technology:

- Aurora Hashish (ACB)

- Cover Development (CGC)

- Tilray (TLRY)

- Cronos (CRON)

- Organigram (OGRMF)

- Cresco Labs (CRLBF)

- Curaleaf Holdings (CURLF)

- Inexperienced Thumb Industries (GTBIF)

- Trulieve Hashish (TCNNF)

- Columbia Care (CCHWF)

Aphria, which was one of many largest marijuana firms initially, bought taken over by Tilray since our final replace. Of those, our high three picks are the next ones:

Marijuana Pure Play Inventory: Trulieve Hashish Corp

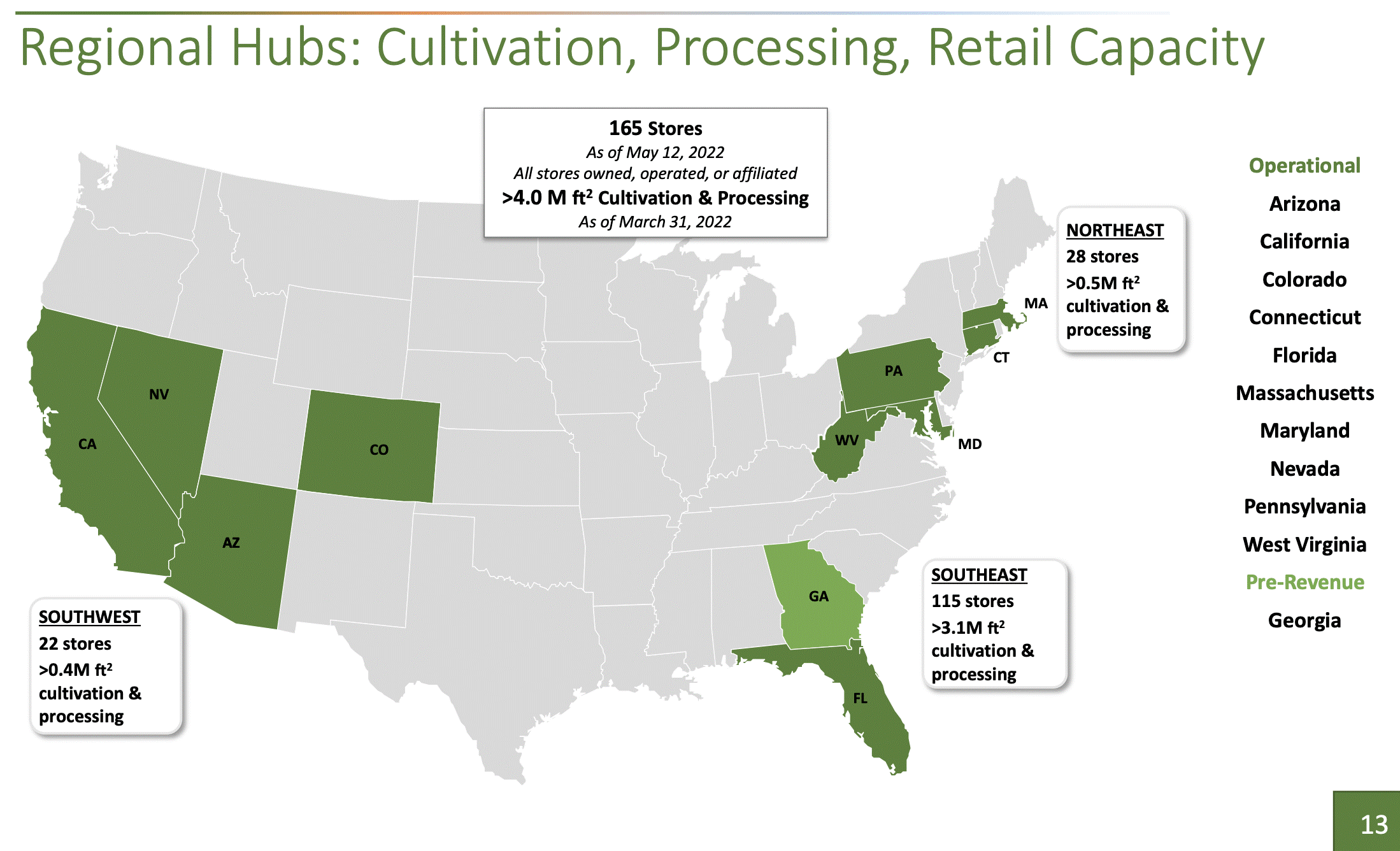

Trulieve Hashish Corp isn’t the biggest marijuana pureplay firm by far. However its profitability is, in comparison with most of its friends, excellent, which makes it attention-grabbing for buyers. Trulieve Hashish operates as a medical hashish firm that cultivates, produces, and distributes its merchandise itself, by dispensaries in its dwelling market Florida, however over time, Trulieve Hashish has additionally ventured into different markets, together with California, Arizona, Nevada, and a pair extra.

Supply

In keeping with its personal knowledge, Trulieve sells roughly half of the medical marijuana that’s offered in Florida, regardless of working solely one-fourth of the dispensaries within the state. Its scale and huge market share, particularly in its most vital market, permits Trulieve Hashish to function with margins which might be stronger than what we see from most of its friends.

For the present fiscal yr, 2022, Trulieve Hashish is forecasting income of $1.3 billion to $1.4 billion, and adjusted EBITDA of $450 to $500 million. This doesn’t solely level to a reasonably strong EBITDA margin within the 30% vary, however the $450+ million EBITDA technology that’s anticipated for the present yr additionally leads to a valuation that doesn’t appear excessive in any respect. The corporate’s market capitalization stands at $2.7 billion, which signifies that it’s valued at round 6x this yr’s anticipated adjusted EBITDA. After all, internet income are significantly smaller because of depreciation, taxes, and many others. However nonetheless, Trulieve Hashish is without doubt one of the extra worthwhile hashish firms, and surprisingly cheap on the similar time.

Marijuana Pure Play Inventory: Cover Development

Cover Development is, by market capitalization, one of many largest hashish firms in Canada. One of many poster youngsters of the hashish investing increase (or bubble) a few years in the past, its value and market capitalization have pulled again significantly over the past couple of years. That has made its valuation enhance, which is why it looks as if a considerably higher funding at the moment.

Cover Development isn’t worthwhile, not like Trulieve, however is producing strong income of round $400 to $500 million per yr, and the corporate has not too long ago introduced new cost-cutting measures. Mixed with some natural income development, that ought to enhance profitability over time, all else equal.

Cover Development has additionally been shifting its product portfolio in direction of branded client items equivalent to its sports activities diet merchandise below the BioSteel label:

Supply

BioSteel and a few of Cover Development’s different branded merchandise had a file quarter in Q1, which signifies that its shift in direction of this merchandise might assist enhance Cover’s enterprise development over time. This technique might assist differentiate Cover Development from its friends over time, and so long as its manufacturers are engaging, they may additionally assist Cover Development generate bettering margins over time, in comparison with the comparatively commoditized pure hashish manufacturing enterprise.

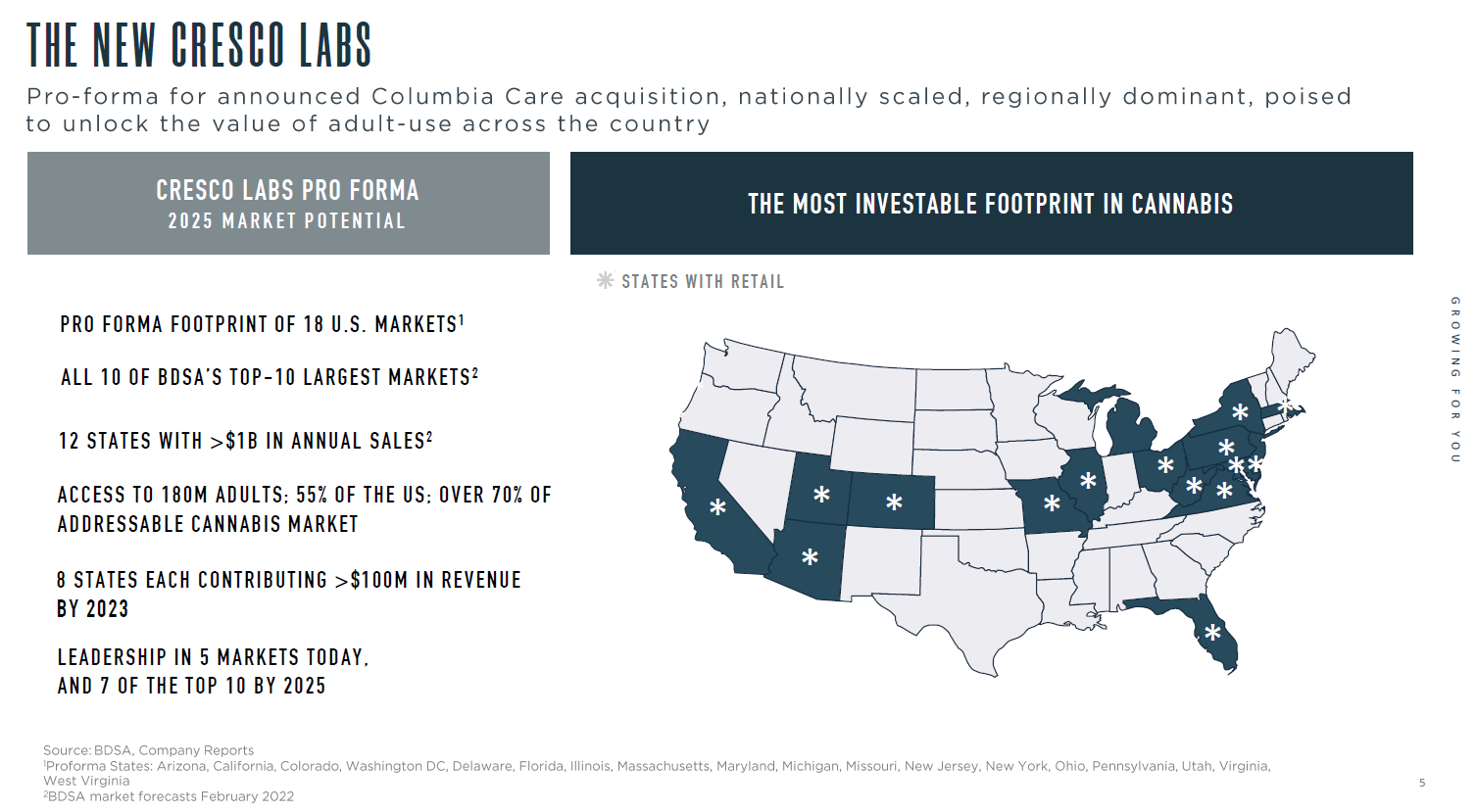

Marijuana Pure Play Inventory: Cresco Labs

Cresco Labs Inc. cultivates, manufactures, and sells each medical and retail hashish merchandise in US states the place it’s allowed to take action. Its merchandise embody flowers, vape pens, extracts, concentrates, but additionally shakes and popcorn. Not surprisingly, the corporate is lively in a variety of US markets, together with in vital ones equivalent to Florida or California:

Supply

The corporate generates compelling enterprise development, as its income rose by 20% throughout the latest quarter. EBITDA, in the meantime, was up by 45% yr over yr, climbing to $51 million. That makes for a 24% EBITDA margin, which is rather less than that of Trulieve, however which continues to be removed from dangerous.

Primarily based on its present EBITDA run price, Cresco Labs is valued at round 6x EBITDA, which is kind of consistent with Trulieve’s valuation. It ought to be famous that Cresco Labs just isn’t anticipated to be worthwhile on a GAAP internet revenue foundation this yr, because of depreciation, taxes, curiosity bills, and many others. That’s to be anticipated and holds true for nearly all hashish firms, nevertheless. Due to its encouraging development and strong EBITDA margins, Cresco Labs ought to have the ability to attain GAAP profitability within the not too distant future, we consider.

Oblique-Publicity Marijuana Shares

Marijuana pure play shares have the issue that their valuations will not be low in any respect, and that almost all of those firms will not be worthwhile but. It’s also not assured that they are going to (all) turn out to be worthwhile (because of attainable margin pressures for the {industry}). Final however not least buyers don’t get any significant dividend yields from marijuana pure play shares.

For buyers that don’t wish to put money into marijuana pure play shares as a result of causes outlined above, and that search publicity to the rising marijuana {industry} nonetheless, one chance is to put money into shares that aren’t marijuana pure performs, however which have some publicity to the {industry} nonetheless.

This primarily consists of client items firms (beverage shares, tobacco shares) which have ventured into the marijuana area, however that proceed to generate nearly all of their revenues and earnings in one other {industry}. Our high 5 picks amongst these firms are analyzed beneath.

Oblique Marijuana Publicity Inventory: AbbVie

AbbVie (ABBV) is a biotech firm that’s lively in oncology and immunology primarily. AbbVie generates revenues of greater than $50 billion yearly and is very worthwhile, with its greatest drug Humira enjoying an vital function in each income and earnings technology.

AbbVie is seen by some as one of many first medical marijuana firms, as its drug Marinol was the primary FDA-approved hashish drug. Marinol is used for the remedy of nausea and vomiting in sufferers enduring chemotherapy. Marinol can also be used for growing urge for food in sufferers with HIV/AIDS or sure cancers.

Marinol was not a big income driver for AbbVie prior to now, as different medicine had been bigger by way of their addressable market and with regards to the costs the corporate might demand for them. AbbVie additionally offered Marinol to Alkem Labs some time in the past. One can argue whether or not AbbVie ought to be seen as a marijuana inventory, however the firm has been within the area and had FDA-approved merchandise available on the market. It appears attainable that AbbVie develops new merchandise that make the most of marijuana sooner or later, though there is no such thing as a assure of that.

Traders don’t have the excessive dangers which might be related to an funding right into a marijuana pure play, however may nonetheless profit from development of the medical marijuana {industry}. AbbVie trades at a reasonable valuation of simply 11 instances 2022’s income proper now. AbbVie additionally affords a sizeable dividend yield of three.7% proper right here. Because of its yield, its low valuation, and its share value upside potential AbbVie is one in all our favourite Dividend Aristocrat buys at the moment.

Oblique Marijuana Publicity Inventory: Altria

Altria (MO) is without doubt one of the largest tobacco firms on the earth. Altria produces and sells cigarettes below the Marlboro model within the US. The corporate additionally sells a number of different cigarette manufacturers, cigar manufacturers, and non-smokeable tobacco merchandise to spherical out the corporate’s product portfolio. As well as, Altria owns a ten% stake in Anheuser-Busch InBev (BUD), which is without doubt one of the world’s largest beer firms.

As a tobacco firm Altria is primed for an enlargement into the marijuana area, which is why the corporate has taken a stake in Canadian marijuana firm Cronos. In December 2018 Altria agreed to pay $1.8 billion for a forty five% stake in Cronos. Moreover Altria has an possibility to amass one other 10% at a set value. Since then, there was hypothesis that Altria may make a bid to take over Cronos fully, with these rumors boiling up once more in 2021. To this point, no deal to amass all of Cronos has been introduced, nevertheless, and it’s removed from sure that such a deal will probably be crafted sooner or later.

In comparison with Altria’s market capitalization of $96 billion its Cronos stake just isn’t overly massive, however it offers an entry into this doubtlessly massive market. In case marijuana will get legalized within the US on a federal stage, Altria might probably broaden into this area very quick due to the know-how that the corporate acquires by its stake in Cronos and thru Altria’s established (tobacco) gross sales channels throughout all the United States.

Altria is very worthwhile, trades at simply 11 instances 2022’s earnings, and affords a hefty dividend yield of seven.1% which makes it a excessive dividend inventory. We consider that Altria is a compelling decide for buyers that search an revenue funding with some potential upside by a side-venture within the marijuana area.

Oblique Marijuana Publicity Inventory: Related British Meals

Related British Meals (ASBFY) is a London, UK, primarily based firm that’s lively in a number of industries. The corporate operates within the sugar manufacturing and agricultural industries, however it additionally produces drinks, cereals, and different meals merchandise. Final however not least, Related British Meals has established itself as a low-cost attire retailer with its Primark model.

Related British Meals has ventured into the marijuana {industry} by changing into a marijuana cultivator and provider to the medical {industry}. Not like many marijuana pure performs, Related British Meals is very worthwhile and produces sizeable money flows due to its different companies, which signifies that it is a lower-risk inventory, that would doubtlessly develop its marijuana enterprise at a quick tempo by natural investments due to its money technology from different enterprise models.

As Related British Meals is skilled in rising farm merchandise and producing snacks and drinks, which supplies the corporate the potential to introduce marijuana-containing merchandise snacks and drinks, the enlargement into the marijuana {industry} looks as if an inexpensive transfer.

Related British Meals, which is valued at $16 billion at the moment, trades at 13 instances this yr’s earnings, which isn’t a excessive valuation in any respect. Related British Meals affords a dividend yielding 2.7%, which is greater than what buyers can get from the broad market. The corporate has raised its dividend frequently and at an ample tempo prior to now.

Oblique Marijuana Publicity Inventory: Constellation Manufacturers

Constellation Manufacturers (STZ) is without doubt one of the largest alcoholic drinks firms on the earth. Constellation Manufacturers is targeted on the wine and spirits markets, however it owns a small beer phase as nicely.

Constellation Manufacturers made information when the corporate introduced a $4 billion funding in Canadian marijuana firm Cover Development. This deal diluted Cover Development’s present shareholders, however it gave Constellation Manufacturers a considerable place within the marijuana {industry}.

Constellation Manufacturers sees vital potential for marijuana-infused drinks, and because of its expertise within the drinks {industry} and its present gross sales networks Constellation Manufacturers will probably turn out to be one of many greatest gamers on this (doubtlessly massive) market.

Even when this enterprise doesn’t work out, Constellation Manufacturers would stay a worthwhile firm, and buyers would probably not endure an excessive amount of from a failure on this area. As we speak, Constellation Manufacturers trades at 21 instances this yr’s earnings, which isn’t low cost, however which additionally isn’t particularly costly in comparison with what number of different alcoholic drinks firms are valued.

Traders get a dividend that yields 1.4% from Constellation Manufacturers, which isn’t actually so much, however higher than what one receives from pure-play hashish shares, as these usually make no dividend funds in any respect. On the similar time, the stake in Cover Development permits for substantial upside potential in case issues go nicely.

Oblique Marijuana Publicity Inventory: Molson Coors

Molson Coors (TAP) is a beverage firm as nicely, however not like Constellation Manufacturers, it’s targeted on the worldwide beer market. Molson Coors, which relies in Denver, CO, has moved into the marijuana {industry} by a three way partnership with Hydropothecary, a Canada-based marijuana producer. The three way partnership focuses on producing marijuana-containing, however alcohol-free drinks.

The be part of enterprise first moved into the Canadian market when it was authorized to take action, however worldwide enlargement was solely pure, and extra market ought to get added over time as hashish will get legalized in an increasing number of nations and states. Because of Molson Coors’ present world gross sales networks it’s probably that the enterprise between Molson Coors and Hydropothecary would have the ability to seize vital market share in abroad markets if the chance arises, e.g. when further nations in Europe or South America legalize marijuana/marijuana merchandise.

Molson Coors is buying and selling at a comparatively cheap valuation of simply 13 instances 2022’s earnings, and buyers receives a commission a dividend yield of two.1% at present costs.

The Finest Marijuana Shares

The marijuana {industry} continues to be younger, which signifies that each dangers and potential rewards are elevated.

Within the pure play area, Trulieve Hashish seems to be cheap relative to different marijuana pure performs, whereas on the similar time, it’s working with above-average profitability, which reduces monetary dangers to a point. Authorized and regulatory dangers stay, in fact.

Marijuana pure play firms are principally not worthwhile and don’t pay dividends. Extra risk-averse buyers with a objective of regular revenue technology ought to slightly have a look at firms with some oblique marijuana publicity.

This record consists of established firms with lengthy and regular dividend development information that will probably be extra appropriate for a lot of buyers in comparison with the higher-risk pure performs.

Amongst these shares with oblique publicity, there are a number of ones which might be moderately to attractively priced and that provide an above-average dividend yield on high of that. These firms give buyers the power to learn from future development alternatives within the marijuana {industry} with out taking up lots of danger.

Of those, Altria is our favourite oblique publicity marijuana inventory in Might 2022, due to its low valuation and powerful complete return outlook, pushed by its excellent dividend yield of greater than 7%. Its marijuana publicity just isn’t as massive as that of pureplays, in fact, however in case marijuana will get legalized on a federal stage within the US, Altria nonetheless could possibly be a significant beneficiary. The truth that it’s a Dividend Aristocrats that has raised the dividend like clockwork for a number of a long time can also be a extremely engaging trait for a lot of revenue buyers.

Closing Ideas

In relation to marijuana, there’s a clear development of decriminalization and outright legalization, for each medicinal and leisure functions, within the U.S. and throughout the globe. Because of this the potential marketplace for authorized marijuana continues to develop.

That mentioned, buyers shouldn’t blindly soar into this {industry} primarily based solely available on the market potential. Most of the firms on this {industry} will not be worthwhile, and should by no means attain profitability. In consequence, investing in marijuana shares is fraught with danger. It isn’t assured that each one main marijuana firms (a few of that are valued at a number of billion {dollars}) will develop into their valuations in an inexpensive period of time.

Traders ought to take an in depth have a look at all related knowledge factors earlier than making any choices, particularly in a higher-risk atmosphere such because the marijuana {industry}. Selecting lower-risk shares which permit for some oblique publicity to the {industry} could possibly be an opportune transfer for buyers, particularly for people who want common and dependable dividend revenue from their inventory holdings.

Additional Studying

The next lists include many extra high-quality dividend shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].