Printed on July nineteenth, 2022 by Bob Ciura

Spreadsheet information up to date day by day; Top 10 listing is up to date when the article is up to date

Return on invested capital, or ROIC, is a worthwhile monetary ratio that buyers can add to their analysis course of.

Understanding ROIC and utilizing it to display screen for prime ROIC shares is an efficient strategy to deal with the highest-quality companies.

With this in thoughts, we ran a inventory display screen to deal with the best ROIC shares within the S&P 500.

You possibly can obtain a free copy of the highest 100 shares with the best ROIC (together with necessary monetary metrics like dividend yields and price-to-earnings ratio) by clicking on the hyperlink under:

Utilizing ROIC permits buyers to filter out the highest-quality companies which might be successfully producing a return on capital.

This text will clarify ROIC and its usefulness for buyers. It is going to additionally listing the highest 10 highest ROIC shares proper now.

Desk Of Contents

You need to use the hyperlinks under to immediately leap to a person part of the article:

What Is ROIC?

Put merely, return on invested capital (ROIC) is a monetary ratio that reveals an organization’s capacity to allocate capital. The frequent formulation to calculate ROIC is to divide an organization’s after-tax web working revenue, by the sum of its debt and fairness capital.

As soon as the ROIC is calculated, it’s evaluated in opposition to an organization’s weighted common price of capital, generally known as WACC. If an organization’s WACC just isn’t instantly out there, it may be calculated by taking a weighted common of the price of an organization’s debt and fairness.

Value of debt is calculated by averaging the yield to maturity for an organization’s excellent debt. That is pretty simple to seek out, as a publicly-traded firm should report its debt obligations.

Value of fairness is usually calculated through the use of the capital asset pricing mannequin, in any other case referred to as CAPM.

As soon as the WACC is calculated, it may be in contrast with the ROIC. Traders wish to see an organization’s ROIC exceed its WACC. This means the underlying enterprise is efficiently investing its capital to generate a worthwhile return. On this manner, the corporate is creating financial worth.

Usually, shares producing the best ROIC are doing the perfect job of allocating their buyers’ capital. With this in thoughts, the next part ranks the ten shares with the best ROIC.

The Prime 10 Highest ROIC Shares

The next 10 shares have the best ROIC. Shares are listed so as from lowest to highest.

Excessive ROIC Inventory #10: Fortinet, Inc. (FTNT)

- Return on invested capital: 46.6%

Fortinet is a expertise firm that gives automated cybersecurity options worldwide. It affords FortiGate {hardware} and software program licenses that present numerous safety and networking features, together with firewall, intrusion prevention, anti-malware, digital non-public community, software management, net filtering, anti-spam, and extensive space community acceleration.

The corporate additionally offers the FortiSwitch product household that gives safe switching options. Fortinet inventory has a market capitalization of roughly $50 billion.

Excessive ROIC Inventory #9: Apple, Inc. (AAPL)

- Return on invested capital: 49.0%

Apple revolutionized private expertise with the introduction of the Macintosh in 1984. Right this moment the expertise firm designs, manufactures and sells merchandise equivalent to iPhones, iPads, Mac, Apple Watch and Apple TV. Apple additionally has a companies enterprise that sells music, apps, and subscriptions.

On April twenty eighth, 2022, Apple declared a $0.23 quarterly dividend, marking a 4.5% year-over-year enhance. Additionally on April twenty eighth, 2022, Apple reported Q2 fiscal yr 2022 outcomes for the interval ending March twenty sixth, 2022. (Apple’s fiscal yr ends the final Saturday in September).

For the quarter Apple generated income of $97.278 billion, an 8.6% enhance in comparison with Q2 2021. Product gross sales had been up 6.6%, led by a 5.5% enhance in iPhones (52% of complete gross sales). Service gross sales elevated 17.3% to $19.8 billion and made up 20% of all gross sales within the quarter. Internet revenue equaled $25.01 billion or $1.52 per share in comparison with $23.63 billion or $1.40 per share in Q2 2021.

Apple is the #1 holding of Berkshire Hathaway (BRK.B), making the expertise big one of many high Warren Buffett shares.

Click on right here to obtain our most up-to-date Certain Evaluation report on AAPL (preview of web page 1 of three proven under):

Excessive ROIC Inventory #8: Moderna Inc. (MRNA)

- Return on invested capital: 49.1%

Moderna is a biotechnology firm. It develops therapeutics and vaccines primarily based on messenger RNA for the remedy of infectious ailments, immuno-oncology, uncommon ailments, cardiovascular ailments, and auto-immune ailments.

The corporate has over 40 growth packages, which incorporates 26 in medical trials throughout seven modalities comprising prophylactic vaccines, systemic secreted and cell floor therapeutics, most cancers vaccines, intratumoral immuno-oncology, localized regenerative therapeutics, systemic intracellular therapeutics, and inhaled pulmonary therapeutics.

Excessive ROIC Inventory #7: Superior Micro Units (AMD)

- Return on invested capital: 49.7%

Superior Micro Units was based in 1959 and within the many years since it has turn into a large participant within the chip market.

AMD is heavy in gaming chips, competing with others like NVIDIA for the profitable, however competitive market. It operates in two segments, Computing and Graphics; and Enterprise, Embedded and Semi-Customized. Its merchandise embody x86 microprocessors, chipsets, discrete and built-in graphics processing models (GPUs), and server and embedded processors. The corporate additionally offers processors for desktop and pocket book private computer systems.

As a risky tech inventory, AMD is among the excessive beta shares.

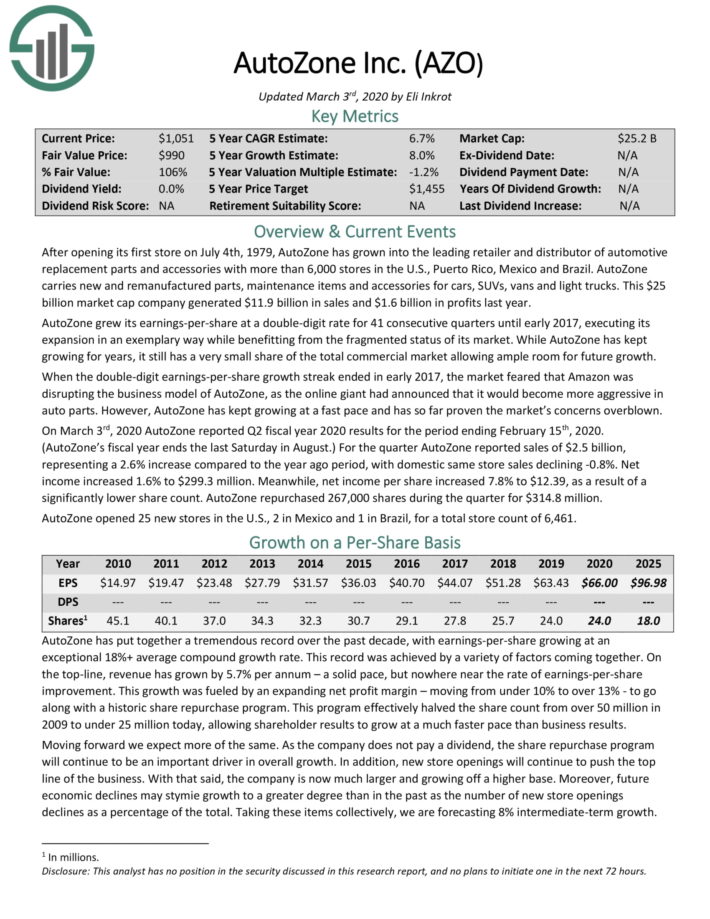

Excessive ROIC Inventory #6: AutoZone Inc. (AZO)

- Return on invested capital: 69.1%

After opening its first retailer on July 4th, 1979, AutoZone has grown into the main retailer and distributor of automotive substitute components and accessories with extra than 6,000 shops within the U.S., Puerto Rico, Mexico and Brazil. AutoZone carries new and re-manufactured components, upkeep objects and equipment for automobiles, SUVs, vans and lightweight vehicles.

AutoZone has confirmed to be recession–resistant because of the character of its enterprise. Throughout tough financial intervals, the gross sales of recent automobiles fall considerably, inflicting the common age of automobiles to extend. This favors AutoZone’s enterprise. In the Nice Recession, when most corporations noticed their earnings plunge, AutoZone grew its EPS by 18% in 2008 and one other 17% in 2009.

Resulting from its spectacular development, AutoZone is among the high automotive half shares.

Click on right here to obtain our most up-to-date Certain Evaluation report on AZO (preview of web page 1 of three proven under):

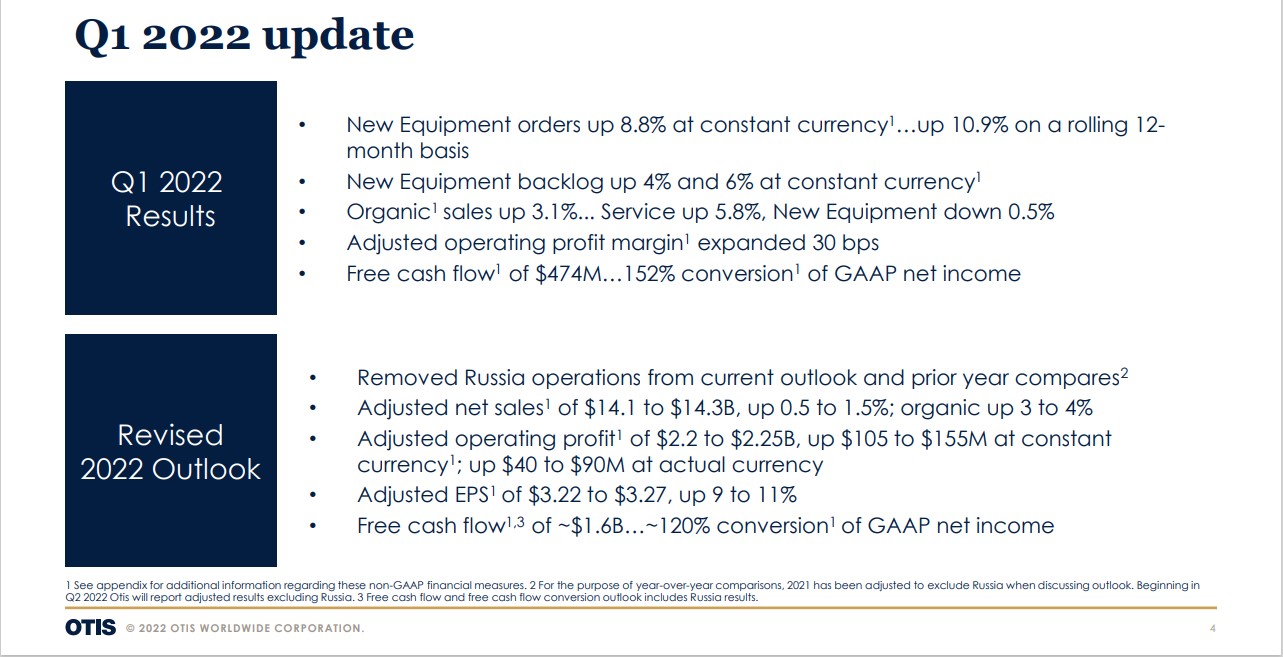

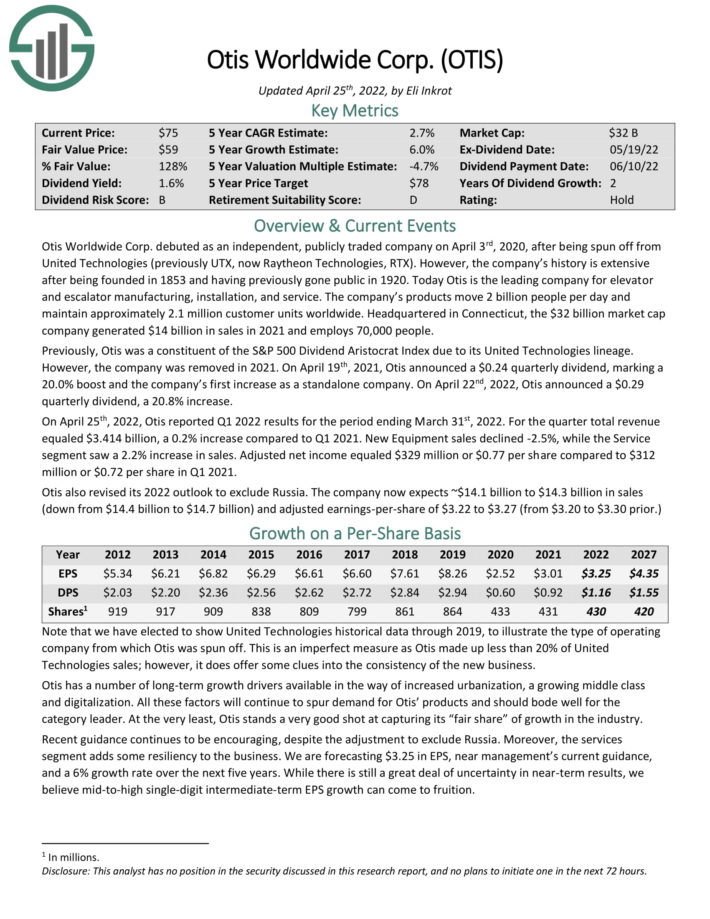

Excessive ROIC Inventory #5: Otis Worldwide (OTIS)

- Return on invested capital: 89.5%

Otis Worldwide Corp. debuted as an impartial, publicly traded firm on April third, 2020, after being spun off from United Applied sciences (beforehand UTX, now Raytheon Applied sciences, RTX). Nevertheless, the corporate’s historical past is intensive after being based in 1853 and having beforehand gone public in 1920.

Right this moment Otis is the main firm for elevator and escalator manufacturing, set up, and repair. The corporate’s merchandise transfer 2 billion individuals per day and keep roughly 2.1 million buyer models worldwide.

On April twenty second, 2022, Otis introduced a $0.29 quarterly dividend, a 20.8% enhance. On April twenty fifth, 2022, Otis reported Q1 2022 outcomes for the interval ending March thirty first, 2022.

Supply: Investor Presentation

For the quarter complete income equaled $3.414 billion, a 0.2% enhance in comparison with Q1 2021. New Tools gross sales declined -2.5%, whereas the Service section noticed a 2.2% enhance in gross sales. Adjusted web revenue equaled $329 million or $0.77 per share in comparison with $312 million or $0.72 per share in Q1 2021.

Otis additionally revised its 2022 outlook to exclude Russia. The corporate now expects ~$14.1 billion to $14.3 billion in gross sales (down from $14.4 billion to $14.7 billion) and adjusted earnings-per-share of $3.22 to $3.27 (from $3.20 to $3.30 prior.)

Click on right here to obtain our most up-to-date Certain Evaluation report on OTIS (preview of web page 1 of three proven under):

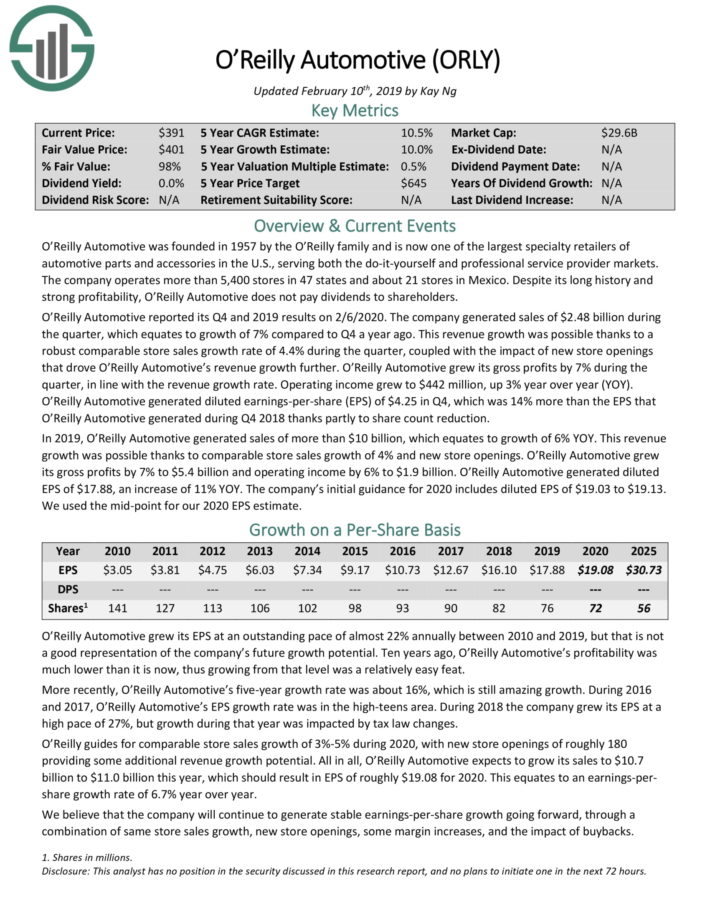

Excessive ROIC Inventory #4: O’Reilly Automotive (ORLY)

- Return on invested capital: 90.4%

O’Reilly Automotive was based in 1957 by the O’Reilly household and is now one of many largest specialty retailers of automotive components and equipment in the U.S., serving each the do–it–your self {and professional} service professionalvider markets. The corporate operates greater than 5,400 shops in 47 states and about 21 shops in Mexico.

Click on right here to obtain our most up-to-date Certain Evaluation report on ORLY (preview of web page 1 of three proven under):

Excessive ROIC Inventory #3: Starbucks Corp. (SBUX)

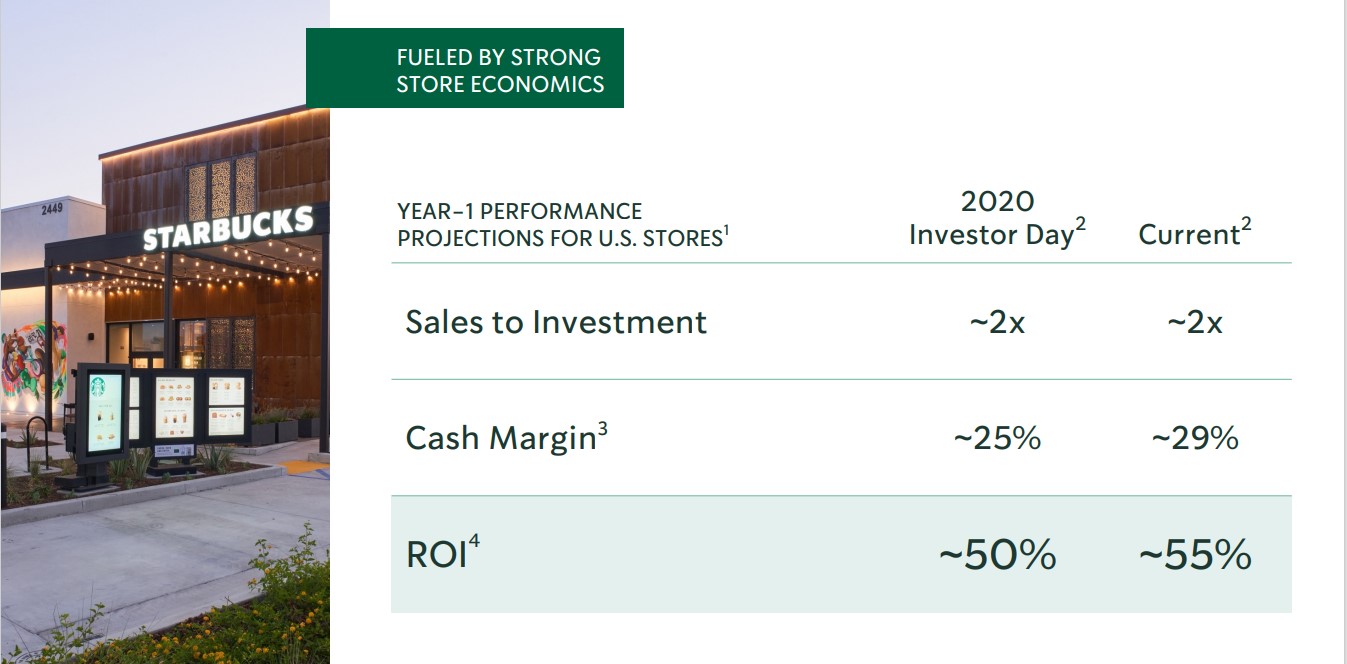

- Return on invested capital: 141.0%

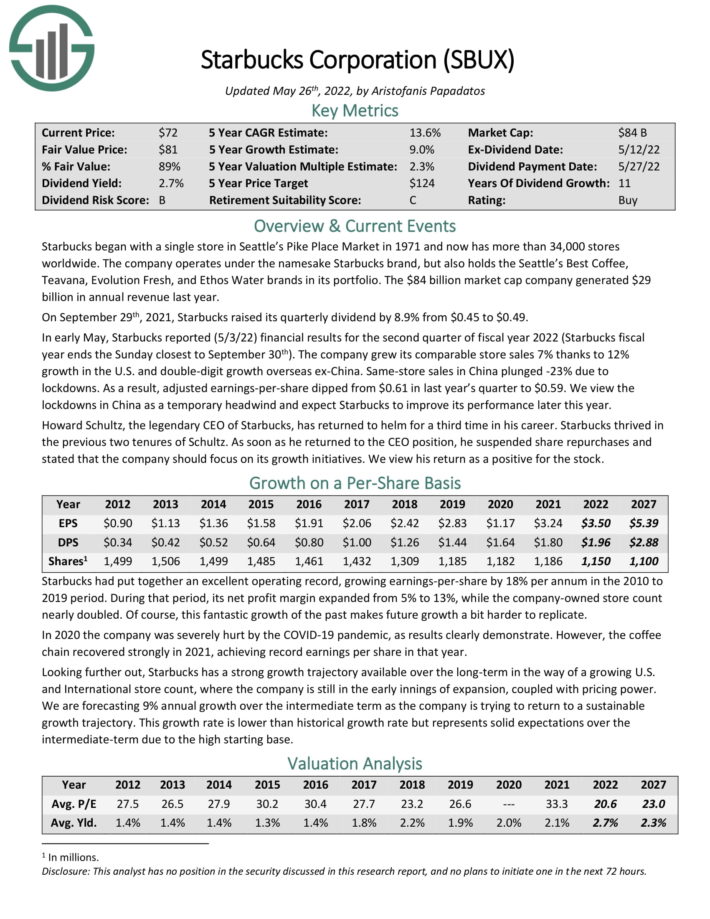

Starbucks has greater than 34,000 shops worldwide. The corporate operates below the namesake Starbucks model, but in addition holds the Seattle’s Greatest Espresso, Teavana, Evolution Recent, and Ethos Water manufacturers in its portfolio. The firm generated $29 billion in annual income final yr.

Starbucks is among the excessive ROIC shares, due largely to its favorable retailer economics.

Supply: Investor Presentation

In early Could, Starbucks reported (5/3/22) monetary outcomes for the second quarter of fiscal yr 2022 (Starbucks fiscal yr ends the Sunday closest to September thirtieth). The corporate grew its comparable retailer gross sales 7% because of 12% development within the U.S. and double-digit development abroad ex-China. Identical-store gross sales in China plunged -23% attributable to lockdowns.

Consequently, adjusted earnings-per-share dipped from $0.61 in final yr’s quarter to $0.59. We view the lockdowns in China as a short lived headwind and count on Starbucks to enhance its efficiency later this yr.

Howard Schultz, the legendary CEO of Starbucks, has returned to helm for a 3rd time in his profession. Starbucks thrived within the earlier two tenures of Schultz. As quickly as he returned to the CEO place, he suspended share repurchases and said that the corporate ought to deal with its development initiatives.

Click on right here to obtain our most up-to-date Certain Evaluation report on SBUX (preview of web page 1 of three proven under):

Excessive ROIC Inventory #2: NortonLifeLock Inc. (NLOK)

- Return on invested capital: 170.5%

NortonLifeLock is a expertise firm that gives safety options for customers around the globe. It affords Norton 360, an built-in platform offering safety with a subscription mannequin for private computer systems and cellular gadgets.

It additionally affords Norton and LifeLock id theft safety answer that gives monitoring, alerts, and restoration companies to its clients. The corporate additionally offers Norton Safe VPN options.

NLOK inventory has a market capitalization above $13 billion. Shares have a present dividend yield of two.1%.

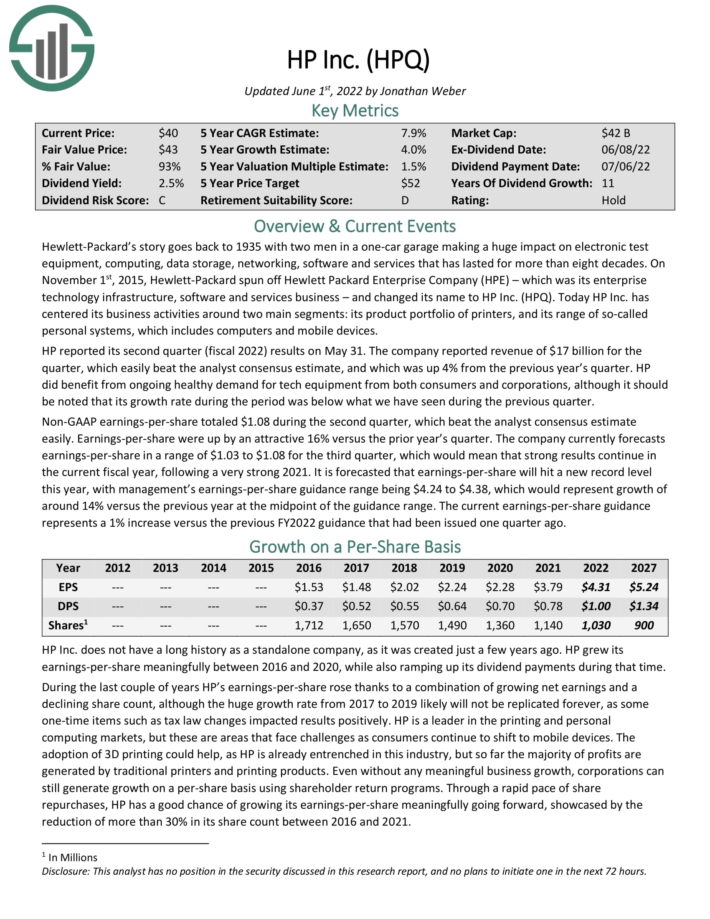

Excessive ROIC Inventory #1: HP Inc. (HPQ)

- Return on invested capital: 168%

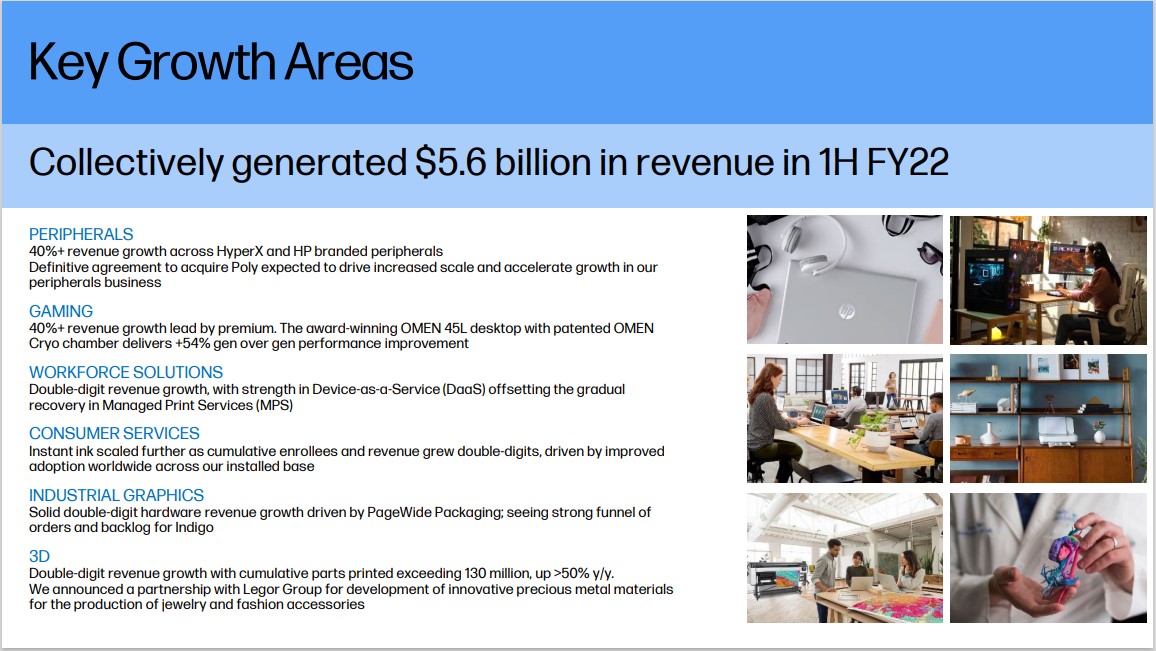

HP Inc. has centered its enterprise actions round two foremost segments: its product portfolio of printers, and its vary of so–known as private techniques, which incorporates computers and cellular gadgets.

HP reported its second quarter (fiscal 2022) outcomes on Could 31. The corporate reported income of $17 billion for the quarter, which simply beat the analyst consensus estimate, and which was up 4% from the earlier yr’s quarter. HP benefited from ongoing wholesome demand for tech tools from each customers and firms.

Non-GAAP earnings-per-share totaled $1.08 in the course of the second quarter, which beat the analyst consensus estimate simply. Earnings-per-share had been up by 16% versus the prior yr’s quarter.

Supply: Investor Presentation

The corporate at present forecasts earnings-per-share in a spread of $1.03 to $1.08 for the third quarter, which might imply that robust outcomes proceed within the present fiscal yr, following a really robust 2021. It’s forecasted that earnings-per-share will hit a brand new report stage this yr, with administration’s earnings-per-share steerage vary being $4.24 to $4.38, which might characterize development of round 14% versus the earlier yr on the midpoint.

The present earnings-per-share steerage represents a 1% enhance versus the earlier FY2022 steerage that had been issued one quarter in the past.

Click on right here to obtain our most up-to-date Certain Evaluation report on HPQ (preview of web page 1 of three proven under):

Remaining Ideas

There are various other ways for buyers to worth shares. One in style valuation methodology is to calculate an organization’s return on invested capital. By doing so, buyers can get a greater gauge of corporations that do the perfect job investing their capital.

ROIC is under no circumstances the one metric that buyers ought to use to purchase shares. There are various different worthwhile valuation strategies that buyers ought to take into account. That mentioned, the highest 10 ROIC shares on this listing have confirmed the flexibility to create financial worth for shareholders.

Additional Studying

If you’re occupied with discovering high-quality dividend development shares appropriate for long-term funding, the next Certain Dividend databases will likely be helpful:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].