Updated on September 19th, 2022 by Bob Ciura

There are many was to measure the quality of a dividend stock. One way is the length of a company’s dividend history. In general, stocks that have raised their dividends for multiple years in a row have demonstrated that they are committed to rewarding investors with steadily rising dividends.

One lesser-known group of dividend growth stocks is the list of Dividend Challengers, which have raised their dividends for 5-9 years in a row.

While 5 years is not the longest history of dividend growth, it does demonstrate a history of returning cash to shareholders with dividends. It also represents a company with a profitable business model, durable competitive advantages, and a positive growth outlook.

With this in mind, we created a downloadable list of 270 Dividend Challengers.

You can download your free copy of the Dividend Challengers list, along with relevant financial metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the link below:

Investors are likely familiar with the Dividend Aristocrats, a group of 65 stocks in the S&P 500 Index with 25+ consecutive years of dividend increases. Dividend growth investors should also familiarize themselves with the Dividend Challengers, which could be Dividend Aristocrats in the making.

This article will discuss an overview of Dividend Challengers, and why investors should consider quality dividend growth stocks. Additional information regarding dividend stocks in our coverage universe can be found in the Sure Analysis Research Database.

Table of Contents

You can instantly jump to any specific section of the article by clicking on the links below:

Overview of Dividend Challengers

The requirement to become a Dividend Challenger is simple: 5-9 consecutive years of dividend growth. This is not exactly a high hurdle to clear, but it does separate dividend growth stocks from the companies that have held their dividends steady for many years. This is a subtle, but important, difference.

Companies that do not raise their dividends each year are often unable to do so because the underlying business is struggling.

While there are no proven precursors to a dividend cut, one potential red flag is when a stock freezes its dividend, particularly if that stock had previously held a long track record of hiking its dividend payout each year.

When business conditions deteriorate, companies often see their revenue and earnings-per-share decline. This could happen for a number of reasons, including a recession, escalating competition, or perhaps an unexpected event such as a geopolitical conflict or natural disaster. In any event, a company with falling revenue and earnings-per-share will likely not be able to raise its dividend.

Depending on how things go from there, the company in question might be able to return to dividend growth if its fundamentals improve.

On the other hand, if conditions worsen, the next step could be a dividend cut or suspension. A dividend freeze might be the first step in this process, which is why investors should pay attention if a dividend growth stock goes longer than a year without raising its payout.

Example Of A Dividend Challenger: Skyworks Solutions (SWKS)

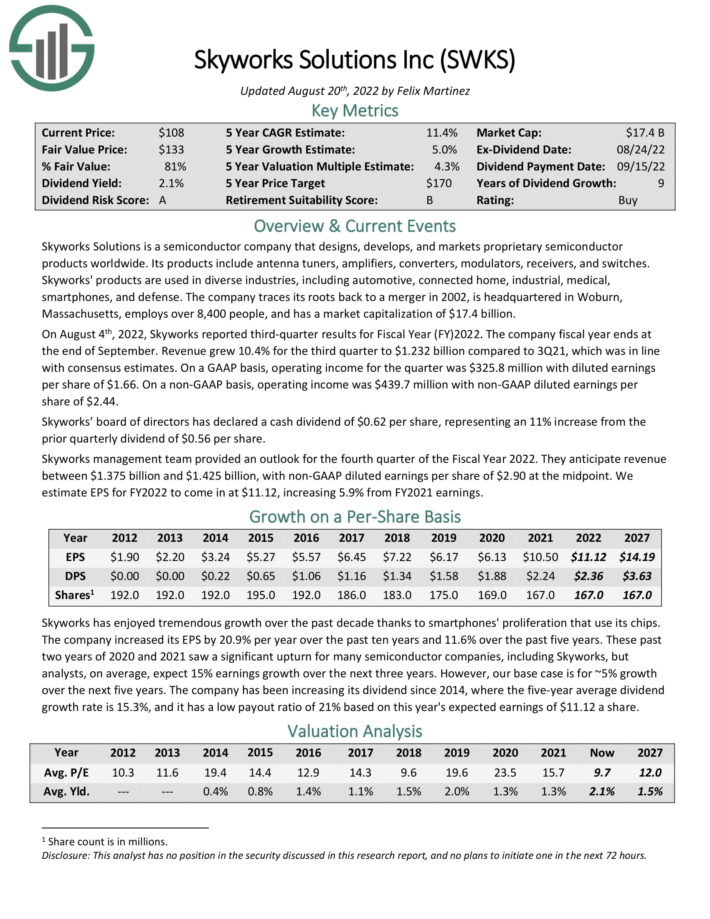

Skyworks Solutions is a semiconductor company that designs, develops, and markets proprietary semiconductor products used worldwide. Its products include antenna tuners, amplifiers, converters, modulators, receivers, and switches.

Source: Investor Presentation

The company has increased its dividend for 9 consecutive years. Shares currently yield 2.3%.

On August 4th, 2022, Skyworks reported third-quarter results for Fiscal Year (FY)2022. The company fiscal year ends at the end of September. Revenue grew 10.4% for the third quarter to $1.232 billion compared to 3Q21, which was in line with consensus estimates. On a non-GAAP basis, operating income was $439.7 million with non-GAAP diluted earnings per share of $2.44.

Skyworks’ board of directors has declared a cash dividend of $0.62 per share, representing an 11% increase from the prior quarterly dividend of $0.56 per share. Skyworks management team provided an outlook for the fourth quarter of the Fiscal Year 2022. They anticipate revenue between $1.375 billion and $1.425 billion, with non-GAAP diluted earnings per share of $2.90 at the midpoint. We estimate EPS for FY2022 to come in at $11.12, increasing 5.9% from FY2021 earnings.

The dividend is very well covered by earnings, and we consider it very safe. The company remained profitable during the previous recession.

Click here to download our most recent Sure Analysis report on SWKS (preview of page 1 of 3 shown below):

Final Thoughts

The various lists of stocks by length of dividend history are a good resource for investors who focus on high-quality dividend stocks. In order for a company to raise its dividend for at least 5 years, it must have durable competitive advantages, the ability to generate consistent profits even during recessions, and shareholder-friendly management that is dedicated to returning cash to investors.

They also have long-term growth potential and the apparent ability to raise their dividends in the future.

If you are interested in finding high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].