Article up to date on July 1st, 2022 by Bob Ciura

Spreadsheet knowledge up to date day by day

The Dividend Aristocrats are a choose group of 65 S&P 500 shares with 25+ years of consecutive dividend will increase.

They’re the ‘better of the most effective’ dividend development shares. The Dividend Aristocrats have an extended historical past of outperforming the market.

The necessities to be a Dividend Aristocrat are:

- Be within the S&P 500

- Have 25+ consecutive years of dividend will increase

- Meet sure minimal dimension & liquidity necessities

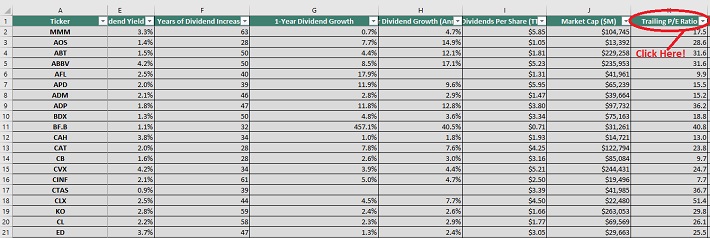

There are at the moment 65 Dividend Aristocrats. You possibly can obtain an Excel spreadsheet of all 65 (with metrics that matter resembling dividend yields and price-to-earnings ratios) by clicking the hyperlink under:

Word: On January twenty fourth, 2022 Brown & Brown (BRO) and Church & Dwight (CHD) have been added to the Dividend Aristocrats Index, whereas AT&T (T) was eliminated. Additionally, Individuals’s United (PBCT) was acquired, leaving 65 Dividend Aristocrats.

Supply: S&P Information Releases.

You possibly can see detailed evaluation on all 65 additional under on this article, in our Dividend Aristocrats In Focus Sequence. Evaluation consists of valuation, development, and aggressive benefit(s).

Desk of Contents

Tips on how to Use The Dividend Aristocrats Record To Discover Dividend Funding Concepts

The downloadable Dividend Aristocrats Excel Spreadsheet Record above incorporates the next for every inventory within the index:

- Worth-to-earnings ratio

- Dividend yield

- Market capitalization

All Dividend Aristocrats are high-quality companies primarily based on their lengthy dividend histories. An organization can’t pay rising dividends for 25+ years with out having a robust and sturdy aggressive benefit.

However not all Dividend Aristocrats make equally good investments at present. That’s the place the spreadsheet on this article comes into play. You should utilize the Dividend Aristocrats spreadsheet to rapidly discover high quality dividend funding concepts.

The record of all 65 Dividend Aristocrats is effective as a result of it offers you a concise record of all S&P 500 shares with 25+ consecutive years of dividend will increase (that additionally meet sure minimal dimension and liquidity necessities).

These are companies which have each the want and potential to pay shareholders rising dividends year-after-year. This can be a uncommon mixture.

Collectively, these two standards are highly effective – however they don’t seem to be sufficient. Worth should be thought of as properly.

The spreadsheet above permits you to type by trailing price-to-earnings ratio so you may rapidly discover undervalued, high-quality dividend shares.

Right here’s the best way to use the Dividend Aristocrats record to rapidly discover high-quality dividend development shares doubtlessly buying and selling at a reduction:

- Obtain the record

- Type by ‘Trailing PE Ratio,’ smallest to largest

- Analysis the highest shares additional

Right here’s how to do that rapidly within the spreadsheet:

Step 1: Obtain the record, and open it.

Step 2: Apply a filter perform to every column within the spreadsheet.

Step 3: Click on on the small grey down arrow subsequent to ‘Trailing P/E Ratio’, after which type smallest to largest.

Step 4: Overview the very best ranked Dividend Aristocrats earlier than investing. You possibly can see detailed evaluation on each Dividend Aristocrat discovered under on this article.

That’s it; you may comply with the identical process to type by every other metric within the spreadsheet.

This text examines the traits and efficiency of the Dividend Aristocrats intimately. Click on right here for a desk of contents for simple navigation of this text.

Efficiency By June 2022

In June 2022, the Dividend Aristocrats, as measured by the Dividend Aristocrats ETF (NOBL), registered a damaging 6.7% return. It outperformed the SPDR S&P 500 ETF (SPY) for the month.

- NOBL generated complete returns of -6.7% in June 2022

- SPY generated complete returns of -8.2% in June 2022

Quick-term efficiency is generally noise. Efficiency needs to be measured over a minimal of three years, and ideally longer durations of time.

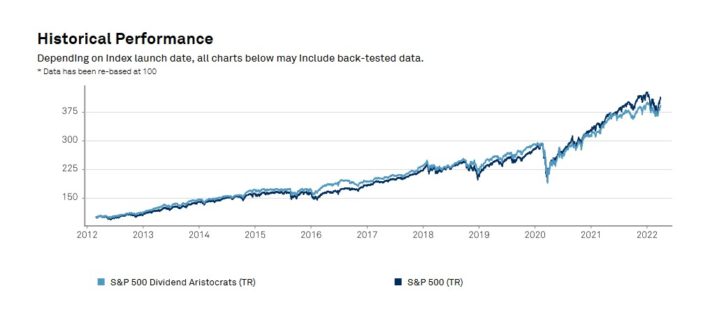

The Dividend Aristocrats Index has almost matched the efficiency of the broader market index during the last decade, with a 12.95% complete annual return for the Dividend Aristocrats versus 12.96% for the S&P 500 Index.

The Dividend Aristocrats have exhibited decrease danger than the benchmark, as measured by commonplace deviation.

Supply: S&P Truth Sheet

Greater complete returns with decrease volatility is the ‘holy grail’ of investing. It’s value exploring the traits of the Dividend Aristocrats intimately to find out why they’ve carried out so properly.

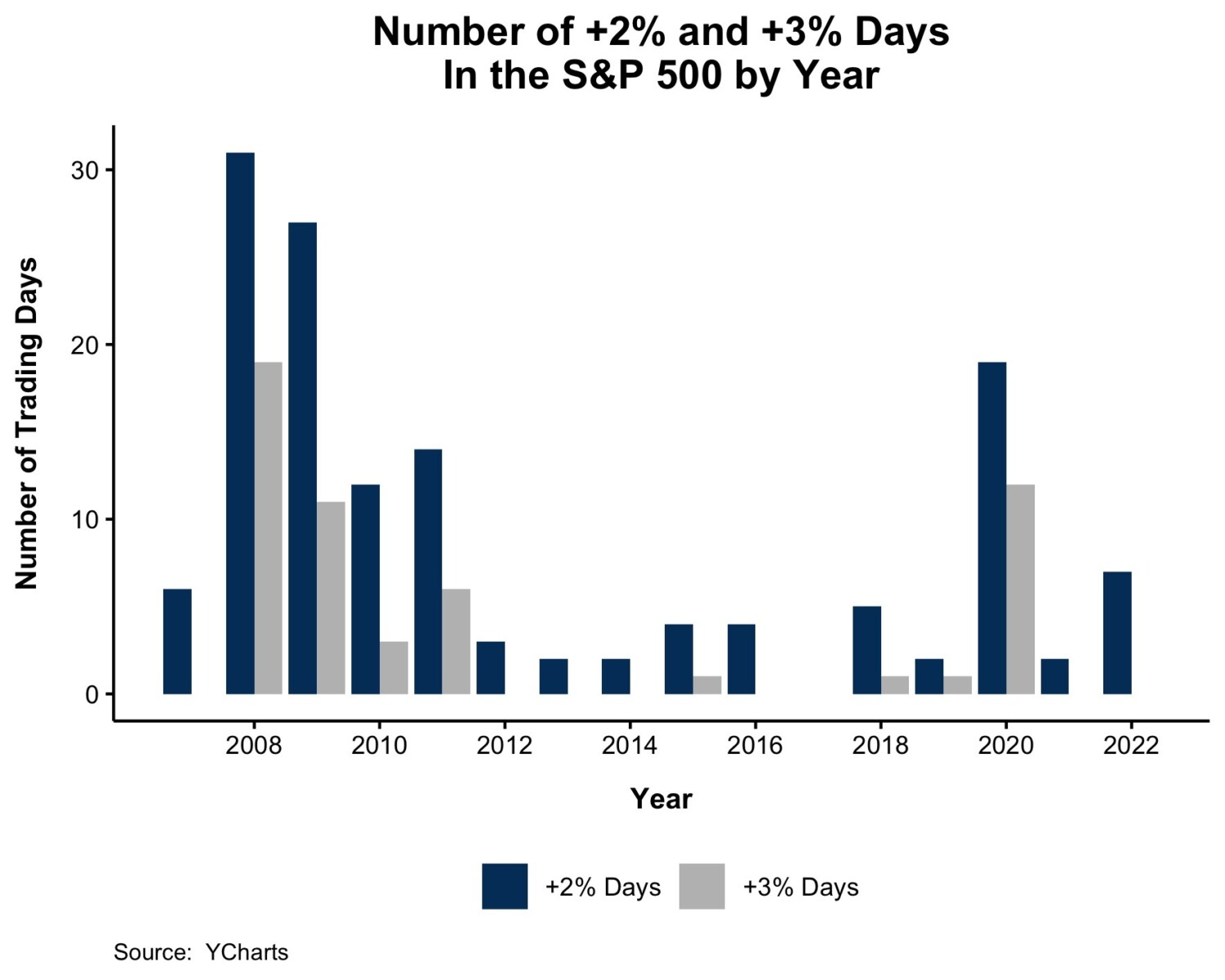

Word {that a} good portion of the outperformance relative to the S&P 500 comes throughout recessions (2000 – 2002, 2008). Dividend Aristocrats have traditionally seen smaller drawdowns throughout recessions versus the S&P 500. This makes holding via recessions that a lot simpler. Case-in-point: In 2008 the Dividend Aristocrats Index declined 22%. That very same 12 months, the S&P 500 declined 38%.

Nice companies with sturdy aggressive benefits have a tendency to have the ability to generate stronger money flows throughout recessions. This enables them to realize market share whereas weaker companies struggle to remain alive.

The Dividend Aristocrats Index has overwhelmed the market during the last 28 years…

We consider dividend paying shares outperform non-dividend paying shares for 3 causes:

- An organization that pays dividends is prone to be producing earnings or money flows in order that it may pay dividends to shareholders. This excludes ‘pre-earnings’ start-ups and failing companies. Briefly, it excludes the riskiest shares.

- A enterprise that pays constant dividends should be extra selective with the expansion initiatives it takes on as a result of a portion of its money flows are being paid out as dividends. Scrutinizing over capital allocation choices probably provides to shareholder worth.

- Shares that pay dividends are prepared to reward shareholders with money funds. This can be a signal that administration is shareholder pleasant.

In our view, Dividend Aristocrats have traditionally outperformed the market and different dividend paying shares as a result of they’re, on common, higher-quality companies.

A high-quality enterprise ought to outperform a mediocre enterprise over an extended time frame, all different issues being equal.

For a enterprise to extend its dividends for 25+ consecutive years, it should have or not less than had within the very latest previous a robust aggressive benefit.

Sector Overview

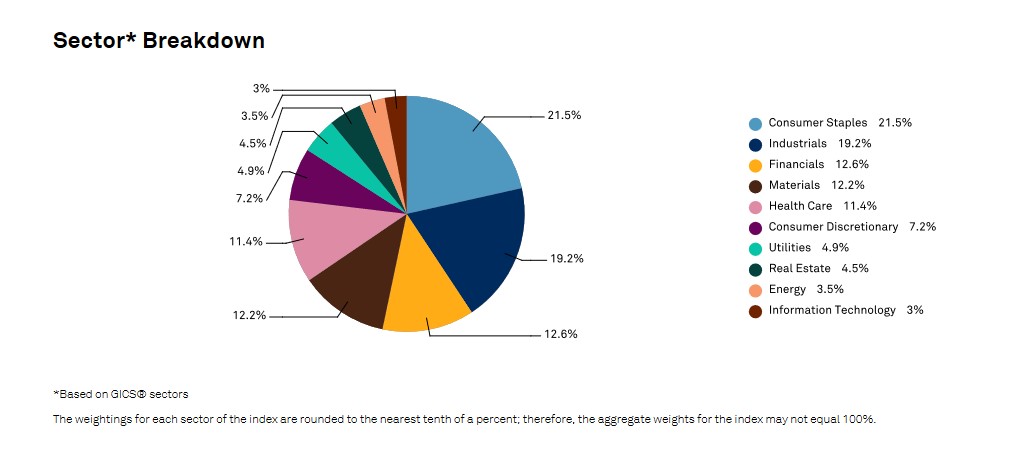

A sector breakdown of the Dividend Aristocrats Index is proven under:

The highest 2 sectors by weight within the Dividend Aristocrats are Industrials and Shopper Staples. The Dividend Aristocrats Index is tilted towards Shopper Staples and Industrials relative to the S&P 500.

These 2 sectors make up over 40% of the Dividend Aristocrats Index, however lower than 20% of the S&P 500.

The Dividend Aristocrats Index can also be considerably underweight the Data Know-how sector, with a 3% allocation in contrast with over 20% allocation throughout the S&P 500.

The Dividend Aristocrat Index is crammed with steady ‘previous economic system’ blue chip client merchandise companies and producers; the 3M’s (MMM), Coca-Cola’s (KO), and Johnson & Johnson’s (JNJ) of the investing world.

These ‘boring’ companies aren’t prone to generate 20%+ earnings-per-share development, however in addition they are impossible to see giant earnings drawdowns as properly.

The High 7 Dividend Aristocrats Now

Evaluation on our prime 7 Dividend Aristocrats is under. These rankings are primarily based on 5 12 months ahead anticipated complete return estimates from the Positive Evaluation Analysis Database.

Trying to transcend the Dividend Aristocrats?

There are ~140 securities with 25+ years of rising dividends, greater than double the variety of Dividend Aristocrats. That’s as a result of the Dividend Aristocrats record excludes securities that aren’t within the S&P 500 and/or that don’t meet sure dimension and liquidity necessities.

Every month we rank shares with 25+ years of rising dividends primarily based on a mixture of anticipated complete returns and Dividend Threat Scores in our High 10 Dividend Elite Service.

A particular report of our prime 10 is revealed on the first Sunday of every month.

Click on right here to begin your free trial of this service and get your particular report on our prime 10 dividend inventory picks with 25+ years of rising dividends.

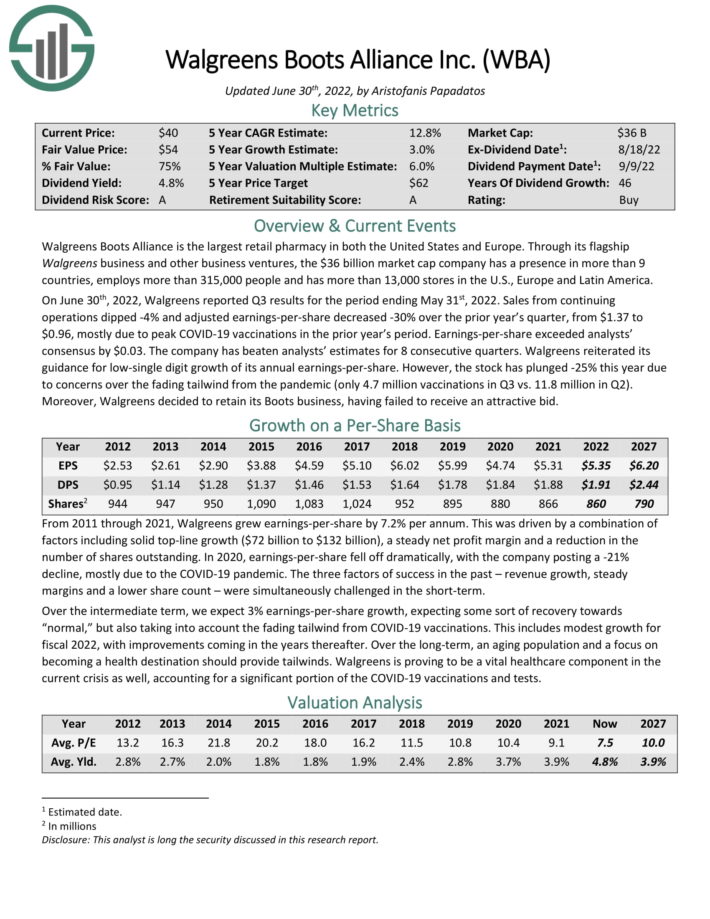

Dividend Aristocrat #7: Walgreens Boots Alliance (WBA)

- 5-year Anticipated Annual Returns: 14.2%

Walgreens Boots Alliance is the biggest retail pharmacy in each the USA and Europe. By its flagship Walgreens enterprise and different business ventures, the firm employs extra than 325,000 folks and has greater than 13,000 shops.

On June thirtieth, 2022, Walgreens reported Q3 outcomes for the interval ending Could thirty first, 2022. Gross sales from persevering with operations dipped -4% and adjusted earnings-per-share decreased -30% over the prior 12 months’s quarter, from $1.37 to $0.96, largely as a result of peak COVID-19 vaccinations within the prior 12 months’s interval. Earnings-per-share exceeded analysts’ consensus by $0.03. The corporate has overwhelmed analysts’ estimates for 8 consecutive quarters.

Walgreens reiterated its steerage for low-single digit development of its annual earnings-per-share.

We anticipate 5% annual EPS development over the subsequent 5 years. As well as, the inventory has a 5.0% dividend yield. We additionally view the inventory as undervalued, resulting in complete anticipated returns of 14.2% per 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on Walgreens (preview of web page 1 of three proven under):

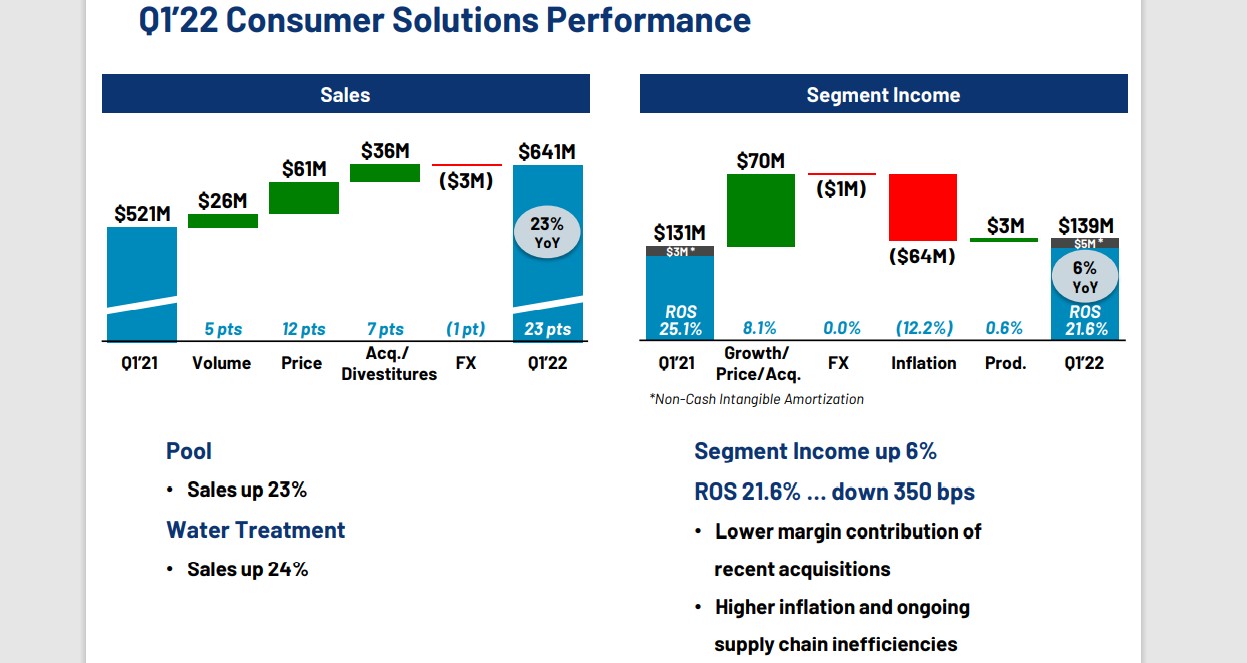

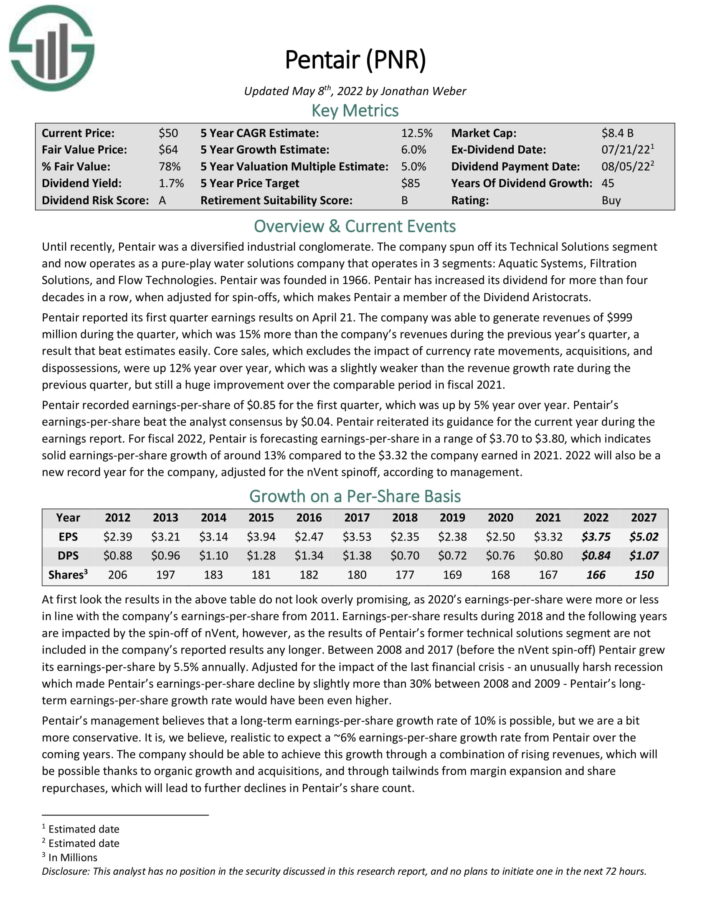

Dividend Aristocrat #6: Pentair (PNR)

- 5-year Anticipated Annual Returns: 14.6%

Pentair operates as a pure–play water options firm with 3 segments: Aquatic Programs, Filtration Options, and Circulate Applied sciences. Pentair was based in 1966. Pentair has elevated its dividend for greater than 4 a long time in a row, when adjusted for spin–offs.

Pentair reported its first-quarter earnings outcomes on April 21. Revenues of $999 million rose 15% year-over-year, and beat estimates simply. Core gross sales, which excludes the impression of foreign money price actions, acquisitions, and dispossessions, have been up 12% 12 months over 12 months.

Supply: Investor Presentation

Pentair recorded earnings-per-share of $0.85 for the primary quarter, which was up by 5% 12 months over 12 months. Pentair’s earnings-per-share beat the analyst consensus by $0.04.

Pentair reiterated its steerage for the present 12 months throughout the earnings report. For fiscal 2022, Pentair is forecasting earnings-per-share in a spread of $3.70 to $3.80, which signifies stable earnings-per-share development of round 13% in comparison with the $3.32 the corporate earned in 2021. 2022 may even be a brand new document 12 months for the corporate, adjusted for the nVent spinoff, in response to administration.

Complete returns are anticipated to succeed in 14.6% over the subsequent 5 years.

Click on right here to obtain our most up-to-date Positive Evaluation report on Pentair (preview of web page 1 of three proven under):

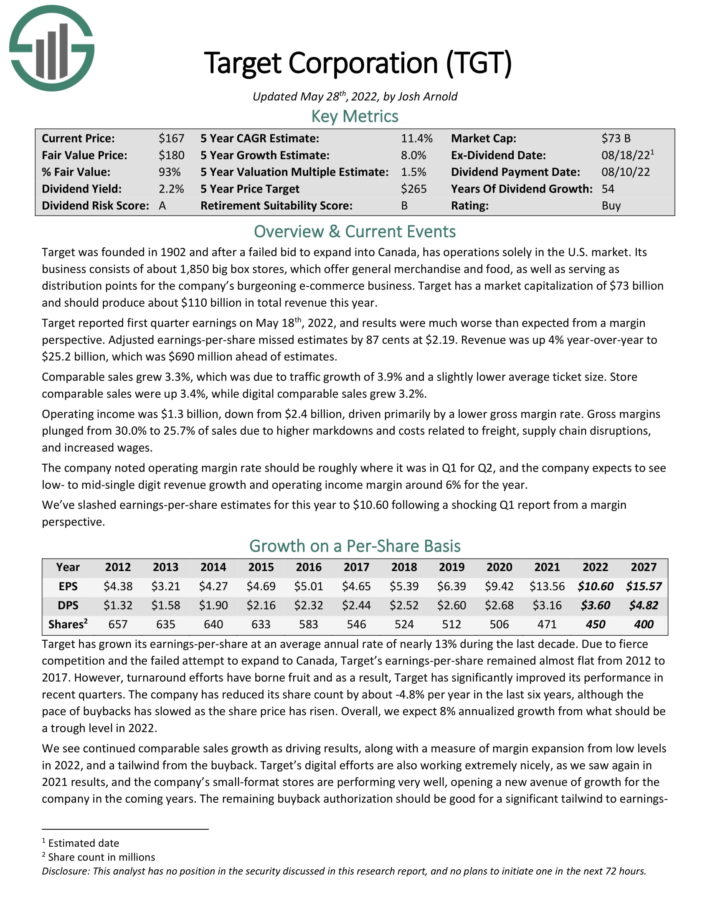

Dividend Aristocrat #5: Goal Company (TGT)

- 5-year Anticipated Annual Returns: 15.3%

Goal was based in 1902 and after a failed bid to increase into Canada, has operations solely within the U.S. market. Its enterprise consists of about 1,850 large field shops, which supply common merchandise and meals, in addition to serving as distribution factors for the corporate’s burgeoning e-commerce enterprise.

Goal reported first-quarter outcomes on Could 18th. Quarterly income of $25.17 billion beat analyst estimates by $688 million, however earnings-per-share of $2.19 missed estimates by $0.87. Price inflation led to the disappointing EPS determine.

We see continued comparable gross sales development as driving outcomes, together with a small measure of margin growth, and a tailwind from the buyback. Goal’s digital efforts are additionally working extraordinarily properly, and the corporate’s small-format shops are performing very properly, opening a brand new avenue of development for the corporate within the coming years. The remaining buyback authorization needs to be good for a major tailwind to earnings-per-share within the coming years.

We anticipate 8% annual EPS development via 2027. As well as, the inventory has a present dividend yield of three.1%. Lastly, the inventory has a 2022 P/E of 13.3, under our truthful worth P/E of 17. Complete returns are estimated at 15.3% per 12 months over the subsequent 5 years.

Click on right here to obtain our most up-to-date Positive Evaluation report on Goal (preview of web page 1 of three proven under):

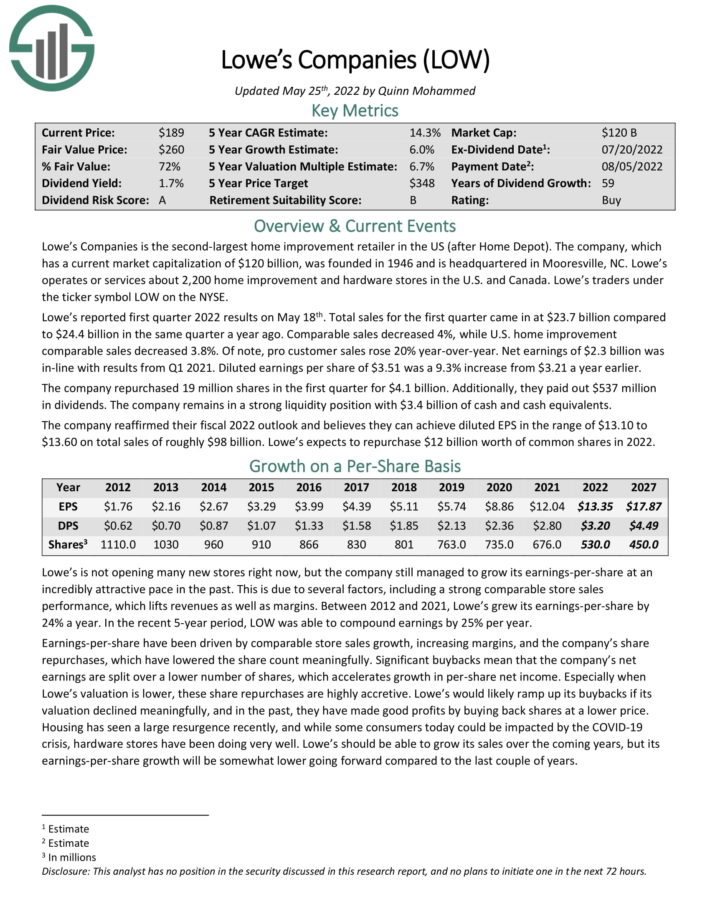

Dividend Aristocrat #4: Lowe’s Corporations (LOW)

- 5-year Anticipated Annual Returns: 16.2%

Lowe’s Corporations is the second-largest house enchancment retailer within the US (after Dwelling Depot). Lowe’s operates or services greater than 2,200 house enchancment and {hardware} shops within the U.S. and Canada.

Lowe’s reported first quarter 2022 outcomes on Could 18th. Complete gross sales for the primary quarter got here in at $23.7 billion in comparison with $24.4 billion in the identical quarter a 12 months in the past. Comparable gross sales decreased 4%, whereas U.S. house enchancment comparable gross sales decreased 3.8%.

Of notice, professional buyer gross sales rose 20% year-over-year. Internet earnings of $2.3 billion was in-line with outcomes from Q1 2021. Diluted earnings per share of $3.51 was a 9.3% enhance from $3.21 a 12 months earlier.

The corporate repurchased 19 million shares within the first quarter for $4.1 billion. Moreover, they paid out $537 million in dividends. The corporate stays in a robust liquidity place with $3.4 billion of money and money equivalents.

The corporate offered a fiscal 2022 outlook and believes they will obtain diluted EPS within the vary of $13.10 to $13.60 on complete gross sales of roughly $98 billion. Lowe’s expects to repurchase $12 billion value of frequent shares in 2022.

The mix of a number of growth, 6% anticipated EPS development and the two.4% dividend yield result in complete anticipated returns of 16.2% per 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on Lowe’s (preview of web page 1 of three proven under):

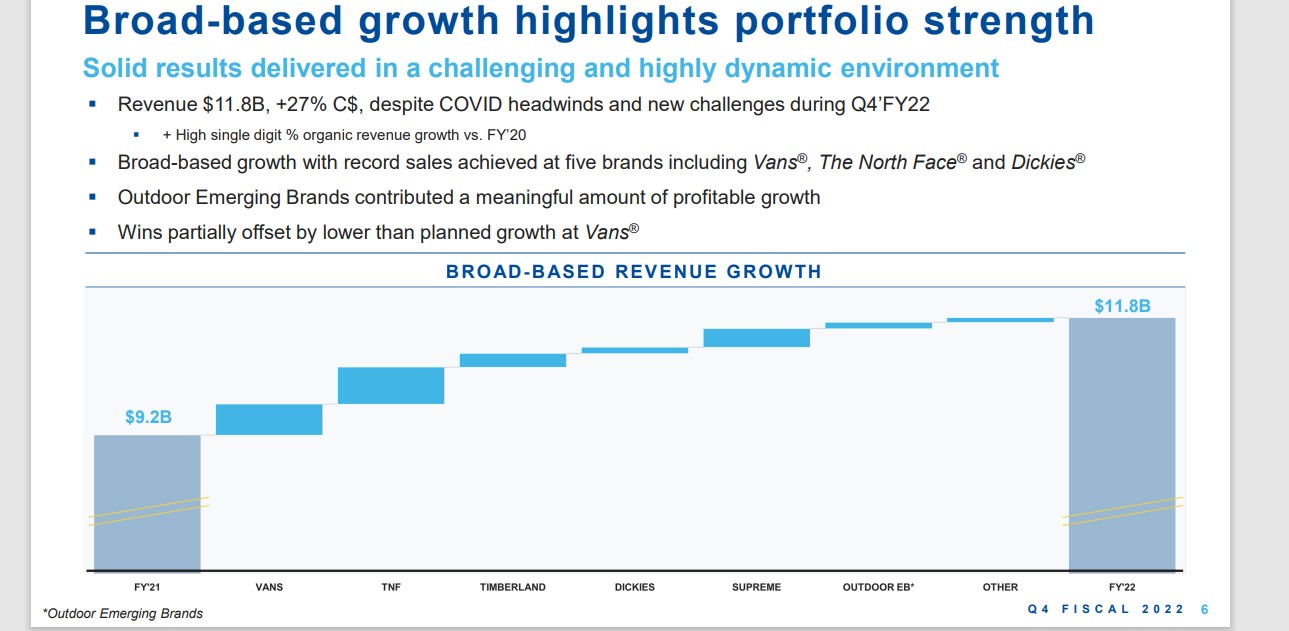

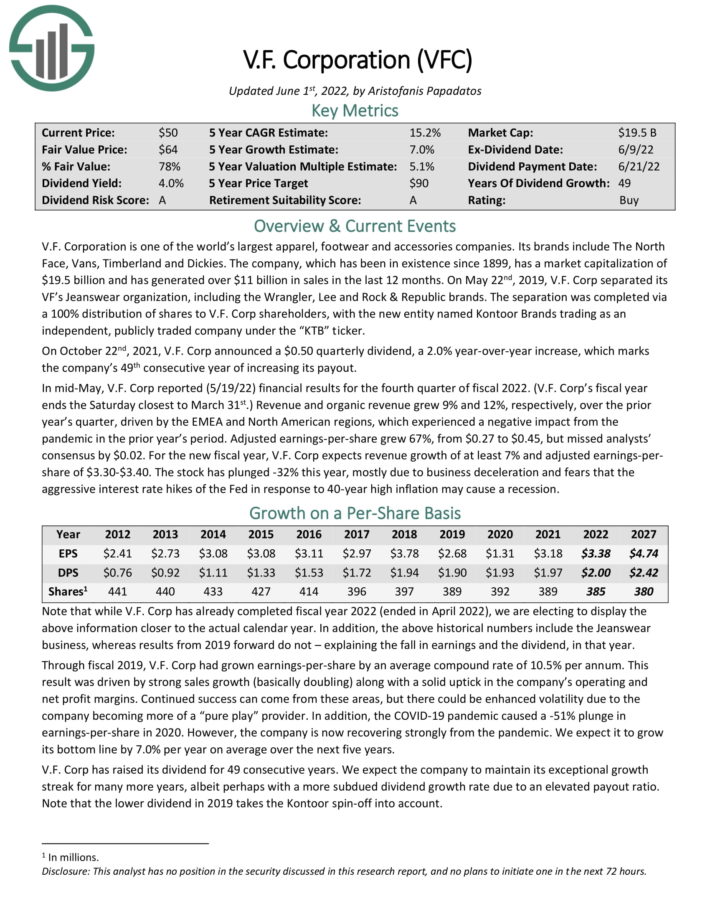

Dividend Aristocrat #3: V.F. Company (VFC)

- 5-year Anticipated Annual Returns: 18.0%

V.F. Company is likely one of the world’s largest attire, footwear and equipment firms. The corporate’s manufacturers embody The North Face, Vans, Timberland and Dickies. The corporate, which has been in existence since 1899, generated over $11 billion in gross sales within the final 12 months.

In mid-Could, V.F. Corp reported (5/19/22) monetary outcomes for the fourth quarter of fiscal 2022. Income and natural income grew 9% and 12%, respectively, over the prior 12 months’s quarter, pushed by the EMEA and North American areas, which skilled a damaging impression from the pandemic within the prior 12 months’s interval.

Supply: Investor Presentation

Adjusted earnings-per-share grew 67%, from $0.27 to $0.45, however missed analysts’ consensus by $0.02. For the brand new fiscal 12 months, V.F. Corp expects income development of not less than 7% and adjusted earnings-per-share of $3.30 to $3.40.

We anticipate 7% annual EPS development over the subsequent 5 years. VFC inventory additionally has a dividend yield of 4.5%. Annual returns from an increasing P/E a number of are estimated at 6.5%, equaling complete anticipated annual returns of 18.0% via 2027.

Click on right here to obtain our most up-to-date Positive Evaluation report on V.F. Corp. (preview of web page 1 of three proven under):

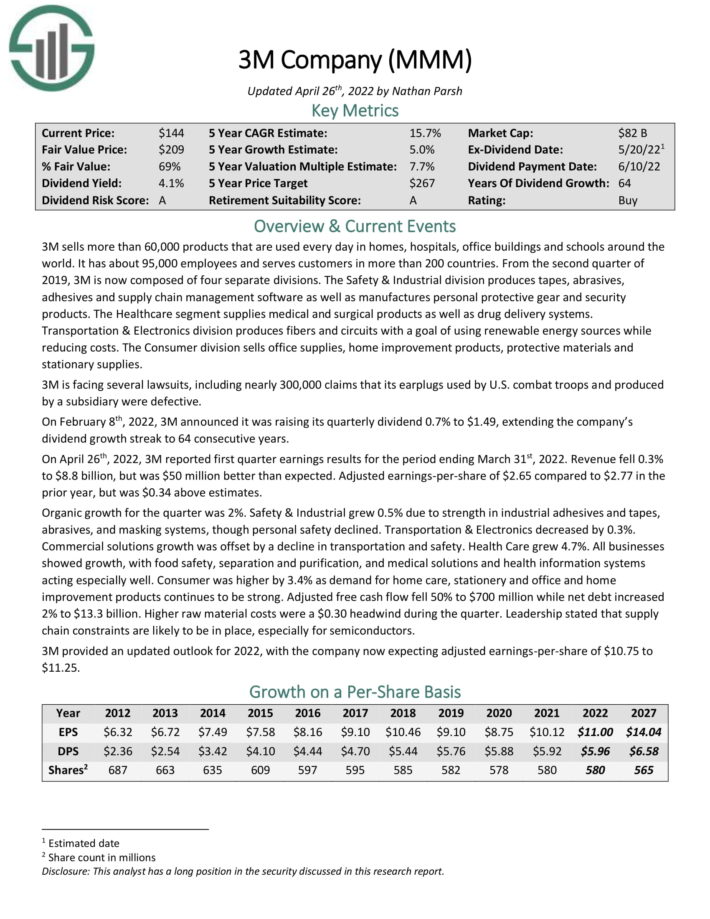

Dividend Aristocrat #2: 3M Firm (MMM)

- 5-year Anticipated Annual Returns: 18.2%

3M sells greater than 60,000 merchandise which are used each day in properties, hospitals, workplace buildings and faculties across the world. It has about 95,000 staff and serves clients in additional than 200 international locations.

3M is now composed of 4 separate divisions. The Security & Industrial division produces tapes, abrasives, adhesives and provide chain administration software program in addition to manufactures private protecting gear and safety merchandise.

The Healthcare phase provides medical and surgical merchandise in addition to drug supply methods. Transportation & Digitals division produces fibers and circuits with a aim of utilizing renewable power sources whereas decreasing prices. The Shopper division sells workplace provides, house enchancment merchandise, protecting supplies and stationary provides.

On April twenty sixth, 2022, 3M reported first quarter earnings outcomes for the interval ending March thirty first, 2022. Income fell 0.3% to $8.8 billion, however was $50 million higher than anticipated. Adjusted earnings-per-share of $2.65 in comparison with $2.77 within the prior 12 months, however was $0.34 above estimates. Natural development for the quarter was 2%.

Supply: Investor Presentation

Security & Industrial grew 0.5% as a result of energy in industrial adhesives and tapes, abrasives, and masking methods, although private security declined. Transportation & Electronics decreased by 0.3%. Industrial options development was offset by a decline in transportation and security. Well being Care grew 4.7%. Shopper was larger by 3.4% as demand for house care, stationery and workplace and residential enchancment merchandise continues to be sturdy.

3M offered an up to date outlook for 2022, with the corporate now anticipating adjusted earnings-per-share of $10.75 to $11.25. Complete returns are anticipated to succeed in 18.2% per 12 months over the subsequent 5 years.

Click on right here to obtain our most up-to-date Positive Evaluation report on 3M (preview of web page 1 of three proven under):

Dividend Aristocrat #1: Stanley Black & Decker (SWK)

- 5-year Anticipated Annual Returns: 20.1%

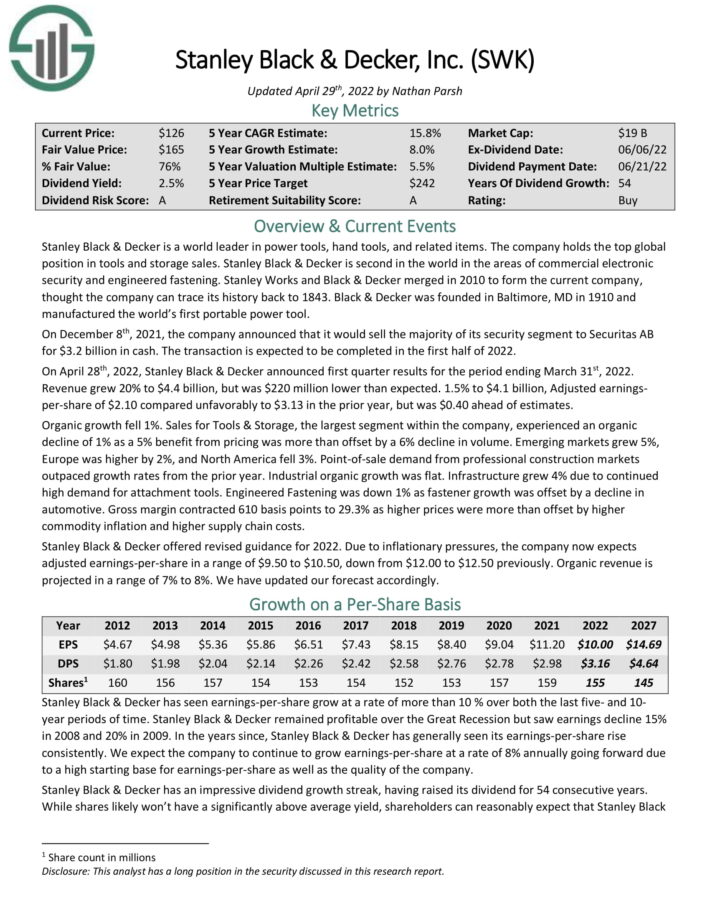

Stanley Black & Decker is a world chief in energy instruments, hand instruments, and associated objects. The corporate holds the highest world place in instruments and storage gross sales. Stanley Black & Decker is second in the world within the areas of business digital safety and engineered fastening.

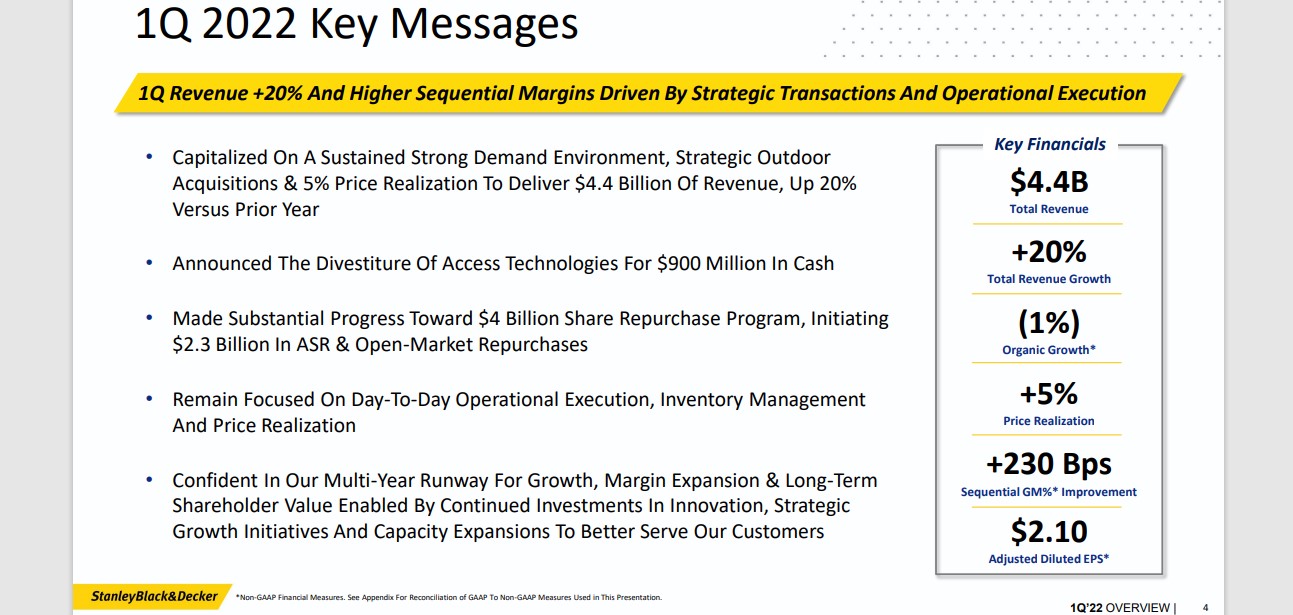

You possibly can see an outline of the corporate’s 2022 first-quarter efficiency within the picture under:

Supply: Investor Presentation

Income grew 20% to $4.4 billion, however was $220 million decrease than anticipated. Adjusted earnings-per-share of $2.10 in contrast unfavorably to $3.13 within the prior 12 months, however was $0.40 forward of estimates. Natural development fell 1%.

Stanley Black & Decker provided revised steerage for 2022. Resulting from inflationary pressures, the corporate now expects adjusted earnings-per-share in a spread of $9.50 to $10.50, down from $12.00 to $12.50 beforehand. Natural income is projected in a spread of seven% to eight%.

The inventory has a 3.0% dividend yield, and we anticipate 8% annual EPS development. With a ~9.1% annual increase from an increasing P/E a number of, complete returns are anticipated to succeed in 20.1% per 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on SWK (preview of web page 1 of three proven under):

The Dividend Aristocrats In Focus Evaluation Sequence

You possibly can see evaluation on each single Dividend Aristocrat under. Every is sorted by GICS sectors and listed in alphabetical order by title. The most recent Positive Evaluation Analysis Database report for every safety is included as properly.

Shopper Staples

Industrials

Well being Care

Shopper Discretionary

Financials

Supplies

Vitality

Data Know-how

Actual Property

Utilities

In search of no-fee DRIP Dividend Aristocrats? Click on right here to learn an article analyzing all 15 no-fee DRIP Dividend Aristocrats intimately.

Historic Dividend Aristocrats Record

(1989 – 2022)

The picture under reveals the historical past of the Dividend Aristocrats Index from 1989 via 2022:

Word: CL, GPC, and NUE have been all eliminated and re-added to the Dividend Aristocrats Index via the historic interval analyzed above. We’re not sure as to why. Corporations created through a spin-off (like AbbVie) may be Dividend Aristocrats with lower than 25 years of rising dividends if the mother or father firm was a Dividend Aristocrat.

This info was compiled from the next sources:

Continuously Requested Questions

This part will tackle a few of commonest questions traders have relating to the Dividend Aristocrats.

1. What’s the highest-paying Dividend Aristocrat?

Reply: Leggett & Platt at the moment yields 5.1%.

2. What’s the distinction between the Dividend Aristocrats and the Dividend Kings?

Reply: The Dividend Aristocrats should be constituents of the S&P 500 Index, have raised their dividends for not less than 25 consecutive years, and fulfill plenty of liquidity necessities. The Dividend Kings solely have to have raised their dividends for not less than 50 consecutive years.

3. Is there an ETF that tracks the Dividend Aristocrats?

Reply: Sure, the Dividend Aristocrats ETF (NOBL) is an exchange-traded fund that particularly holds the Dividend Aristocrats. For a extra detailed evaluation of dividend ETFs, click on right here.

4. What’s the distinction between the Dividend Aristocrats and the Dividend Champions?

Reply: The Dividend Aristocrats and Dividend Champions share one requirement, which is that an organization should have raised its dividend for not less than 25 consecutive years.

However just like the Dividend Kings, the Dividend Champions don’t have to be within the S&P 500 Index, nor fulfill the assorted liquidity necessities.

5. Which Dividend Aristocrat has the longest lively streak of annual dividend will increase?

Presently, there are 3 Dividend Aristocrats tied at 66 years: Real Components, 3M Firm, and Dover Company.

6. What’s the common dividend yield of the Dividend Aristocrats?

Proper now, the common dividend yield of the 65 Dividend Aristocrats is 2.6%.

7. Are the Dividend Aristocrats secure investments?

Whereas there are by no means any ensures relating to the inventory market, we consider the Dividend Aristocrats are among the many most secure dividend shares relating to the sustainability of their dividend payouts.

The Dividend Aristocrats have sturdy aggressive benefits that enable them to lift their dividends annually, even throughout a recession.

Different Dividend Lists & Closing Ideas

The Dividend Aristocrats record will not be the one solution to rapidly display for shares that repeatedly pay rising dividends.

There’s nothing magical in regards to the Dividend Aristocrats. They’re ‘simply’ a group of high-quality shareholder pleasant shares which have sturdy aggressive benefits.

Buying a majority of these shares at truthful or higher costs and holding for the long-run will probably end in favorable long-term efficiency.

You may have a selection in what sort of enterprise you purchase into. You should purchase into the mediocre, or the superb.

Usually, wonderful companies aren’t dearer (primarily based on their price-to-earnings ratio) than mediocre companies.

“After we personal parts of excellent companies with excellent managements, our favourite holding interval is ceaselessly.”

– Warren Buffett

Disclaimer: Positive Dividend will not be affiliated with S&P International in any method. S&P International owns and maintains The Dividend Aristocrats Index. The data on this article and downloadable spreadsheet relies on Positive Dividend’s personal assessment, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person traders higher perceive this ETF and the index upon which it’s primarily based. Not one of the info on this article or spreadsheet is official knowledge from S&P International. Seek the advice of S&P International for official info.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].