Up to date on June twenty first, 2022 by Bob Ciura

We firmly consider that buyers seeking to generate superior returns over the long-term, with out taking extreme dangers, ought to deal with high-quality dividend progress shares.

Because of this we deal with the Dividend Aristocrats.

The Dividend Aristocrats are a choose group of 65 S&P 500 shares with 25+ years of consecutive dividend will increase.

They’re the ‘better of the most effective’ dividend progress shares. The Dividend Aristocrats have a protracted historical past of outperforming the market.

The necessities to be a Dividend Aristocrat are:

- Be within the S&P 500

- Have 25+ consecutive years of dividend will increase

- Meet sure minimal dimension & liquidity necessities

There are presently 65 Dividend Aristocrats. You may obtain an Excel spreadsheet of all 65 (with metrics that matter corresponding to dividend yields and price-to-earnings ratios) by clicking the hyperlink beneath:

Traders can efficiently implement a dividend progress investing technique by discovering high quality dividend shares which can be additionally buying and selling at enticing valuations.

On this article, we current a technique for buyers to rapidly and successfully display screen for affordable dividend shares with a downloadable record.

We additionally present the highest 20 low-cost dividend shares to purchase now.

Hold studying this web page to find out about find out how to use a budget dividend shares record to seek out funding concepts.

Desk of Contents

You may skip to a selected part utilizing the desk of contents beneath:

Why Purchase Low-cost Shares?

There’s a important physique of empirical analysis to recommend that purchasing shares with low valuation multiples results in higher returns than shopping for shares with excessive valuation multiples.

This was very true from 1975-2010, when shares with low price-to-earnings ratios considerably outperformed shares with larger price-to-earnings ratios.

For instance of this pattern, contemplate analysis from Brandes Funding Companions which confirmed that the bottom decile of price-to-earnings ratio shares outperformed the very best decile of price-to-earnings ratio shares by 10.1% per 12 months between 1975 and 2010.

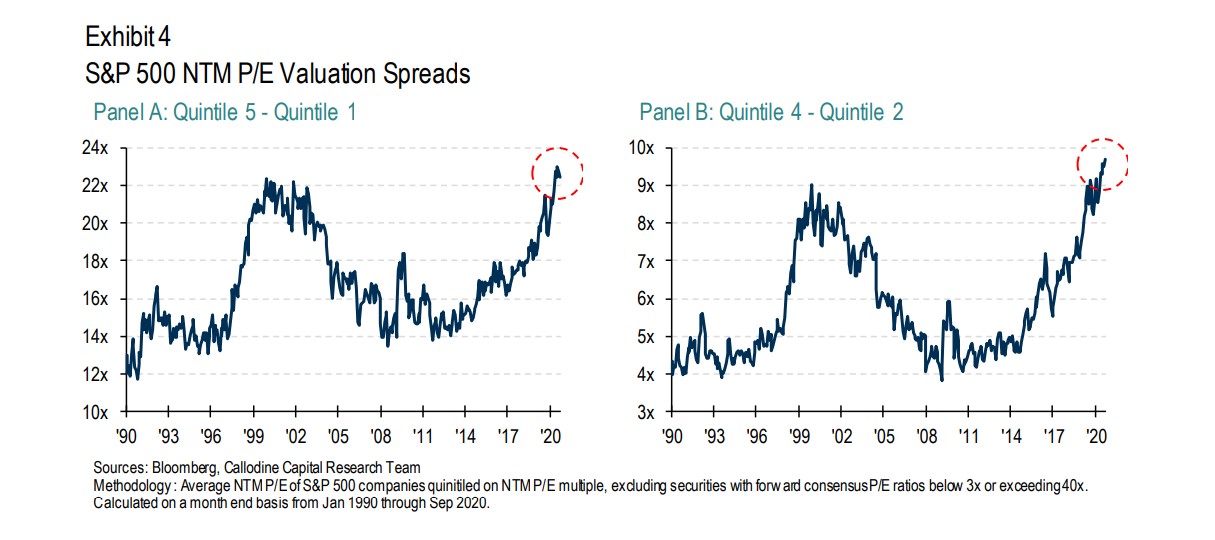

Nonetheless, this dynamic utterly modified within the decade after the Nice Recession ended. From 2010-2020, progress shares dominated worth shares. You may see this outperformance of progress shares relative to worth shares within the picture beneath:

Supply: The Case for Worth by Callodine Capital Analysis

Progress shares exhibited far stronger relative earnings-per-share progress and returns in contrast with worth shares. There have been a variety of causes for this, primarily the prolonged interval of low rates of interest and a macroeconomic backdrop of low financial progress.

Nonetheless, market cycles can reverse. As the next graph exhibits, when the S&P 500 is cut up up into quintiles, valuation spreads between larger P/E quintile and decrease P/E quintile are on the highest level for the reason that ’99-’00 tech bubble.

Supply: The Case for Worth by Callodine Capital Analysis

Individually, the sturdy outperformance of progress shares has brought on a shift in asset combine amongst institutional investor teams, leaving many comparatively under-invested in worth shares.

The general takeaway is that because the financial cycle matures, and with worth shares providing enticing price-to-earnings ratios and excessive dividend yields, worth may turn into a lovely technique as soon as once more.

Within the subsequent part of this text, we’ll talk about the deserves of investing in dividend shares and clarify why low-cost dividend shares are an particularly enticing mixture.

Why Purchase Dividend Shares?

The apparent good thing about investing in dividend shares is that they mean you can generate a passive revenue stream out of your funding portfolio.

Importantly, there are different advantages. Dividend shares have a protracted historical past of outperforming the broader inventory market.

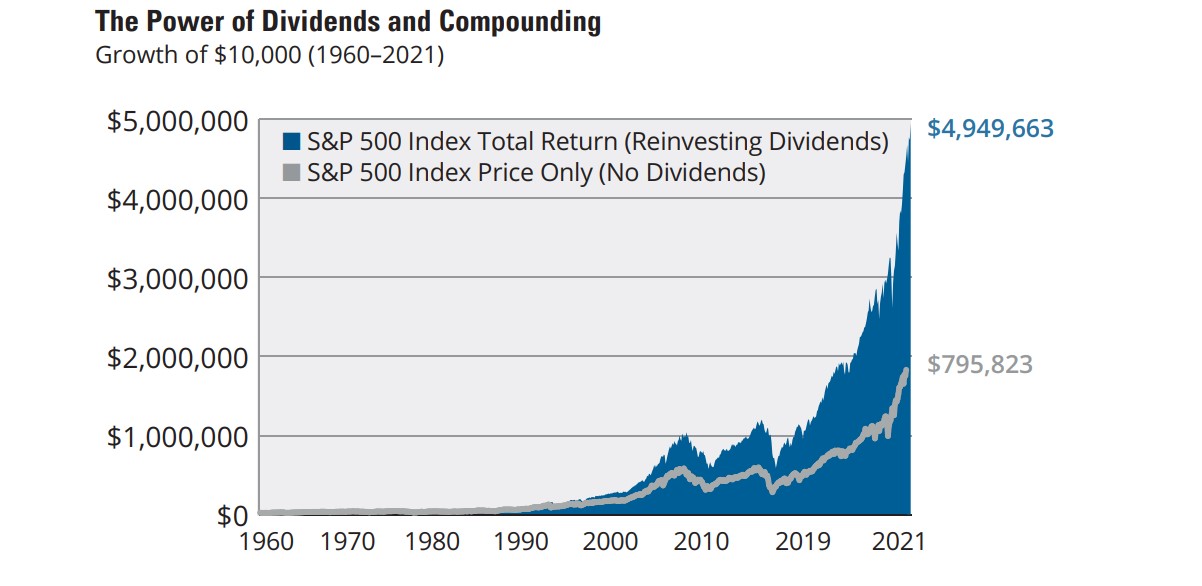

In accordance with a report from Hartford Funds, since 1960 roughly 84% of the whole return of the S&P 500 Index was resulting from reinvested dividends and compounding.

Supply: Hartford Funds

Combining worth investing and dividend investing to seek out low-cost dividend shares may be very highly effective as a result of it not solely combines two time-tested methods (worth and dividends), but it surely additionally permits buyers to have a better beginning yield for his or her funding portfolio.

Subsequently, buyers on the lookout for the very best return potential ought to take a more in-depth have a look at low-cost dividend shares.

The Prime 20 Low-cost Dividend Shares Now

The next 20 low-cost dividend shares characterize the very best 5-year anticipated annual returns amongst dividend shares which have P/E ratios beneath 15, in addition to Dividend Danger Scores of ‘C’ or higher.

Lastly, solely U.S. primarily based firms have been included within the low-cost dividend shares display screen, whereas REITs and MLPs have been excluded.

The highest 20 low-cost dividend shares are primarily based on 5 12 months ahead anticipated whole return estimates from the Certain Evaluation Analysis Database.

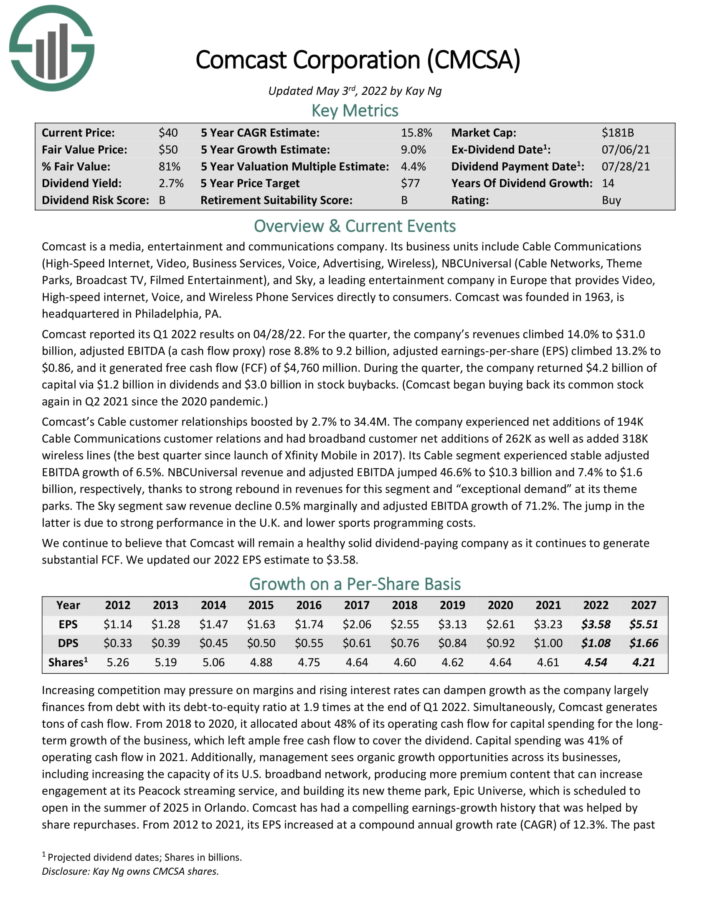

Low-cost Dividend Inventory #20: Comcast Company (CMCSA)

- P/E Ratio: 10.6

- 5-year Annual Anticipated Returns: 17.2%

Comcast is a media, leisure and communications firm. Its enterprise models embrace Cable Communications

(Excessive-Pace Web, Video, Enterprise Providers, Voice, Promoting, Wi-fi), NBCUniversal (Cable Networks, Theme Parks, Broadcast TV, Filmed Leisure), and Sky, a number one leisure firm in Europe that gives Video, Excessive-speed web, Voice, and Wi-fi Telephone Providers on to customers.

Comcast reported its Q1 2022 outcomes on 04/28/22. For the quarter, the corporate’s revenues climbed 14.0% to $31.0 billion, adjusted EBITDA (a money circulation proxy) rose 8.8% to 9.2 billion, adjusted earnings-per-share (EPS) climbed 13.2% to $0.86, and it generated free money circulation (FCF) of $4,760 million.

Throughout the quarter, the corporate returned $4.2 billion of capital by way of $1.2 billion in dividends and $3.0 billion in inventory buybacks. (Comcast started shopping for again its frequent inventory once more in Q2 2021 for the reason that 2020 pandemic.) Comcast’s Cable buyer relationships boosted by 2.7% to 34.4M. The corporate skilled internet additions of 194K Cable Communications buyer relations and had broadband buyer internet additions of 262K in addition to added 318K wi-fi strains (the most effective quarter since launch of Xfinity Cell in 2017).

Its Cable section skilled secure adjusted EBITDA progress of 6.5%. NBCUniversal income and adjusted EBITDA jumped 46.6% to $10.3 billion and seven.4% to $1.6 billion, respectively, because of sturdy rebound in revenues for this section and “distinctive demand” at its theme parks.

The Sky section noticed income decline 0.5% marginally and adjusted EBITDA progress of 71.2%. The soar within the latter is because of sturdy efficiency within the U.Ok. and decrease sports activities programming prices. We proceed to consider that Comcast will stay a wholesome stable dividend-paying firm because it continues to generate substantial FCF.

Low-cost dividend shares like Comcast have enchantment as a result of it permits buyers to buy dividend progress shares at a reduction.

Click on right here to obtain our most up-to-date Certain Evaluation report on CMCSA (preview of web page 1 of three proven beneath):

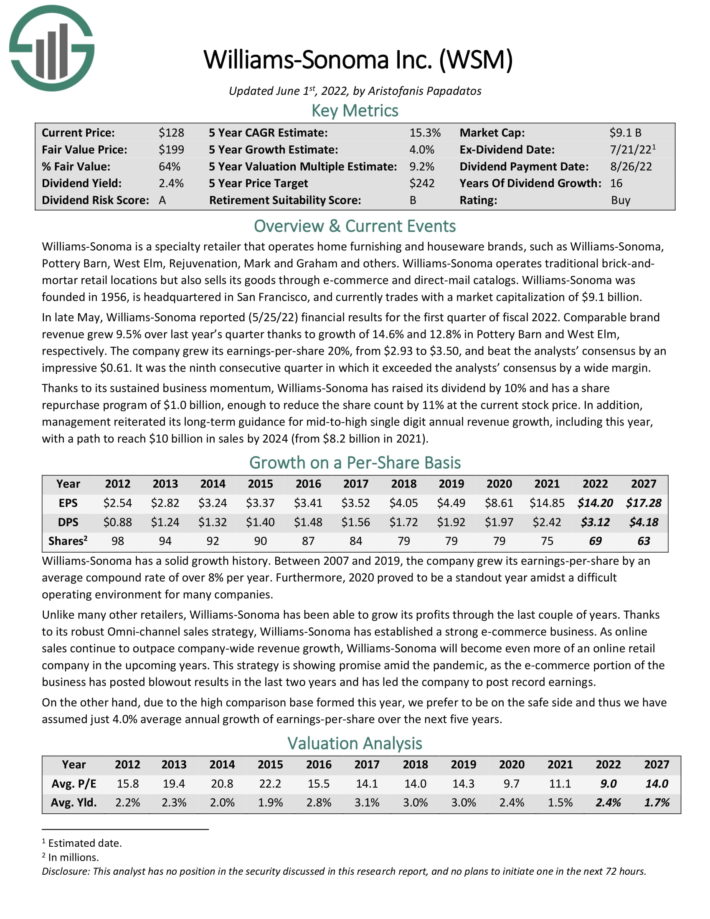

Low-cost Dividend Inventory #19: Williams-Sonoma (WSM)

- P/E Ratio: 8.1

- 5-year Annual Anticipated Returns: 17.7%

Williams-Sonoma is a specialty retailer that operates dwelling furnishing and houseware manufacturers, corresponding to Williams-Sonoma, Pottery Barn, West Elm, Rejuvenation, Mark and Graham and others.

Supply: Investor Presentation

In late Could, Williams-Sonoma reported (5/25/22) monetary outcomes for the primary quarter of fiscal 2022. Comparable model income grew 9.5% over final 12 months’s quarter because of progress of 14.6% and 12.8% in Pottery Barn and West Elm, respectively. The corporate grew its earnings-per-share 20%, from $2.93 to $3.50, and beat the analysts’ consensus by a powerful $0.61. It was the ninth consecutive quarter during which it exceeded the analysts’ consensus by a large margin.

Due to its sustained enterprise momentum, Williams-Sonoma has raised its dividend by 10% and has a share repurchase program of $1.0 billion, sufficient to scale back the share rely by 11% on the present inventory worth. As well as, administration reiterated its long-term steerage for mid-to-high single digit annual income progress, together with this 12 months, with a path to succeed in $10 billion in gross sales by 2024 (from $8.2 billion in 2021).

Due to its sustained enterprise momentum, Williams-Sonoma raised its dividend by 10%. We anticipate annual returns of 15.8% per 12 months, pushed by anticipated EPS progress of 4% per 12 months, the two.5% dividend yield, and a ~9.3% annual increase from an increasing P/E a number of.

Click on right here to obtain our most up-to-date Certain Evaluation report on Williams-Sonoma (preview of web page 1 of three proven beneath):

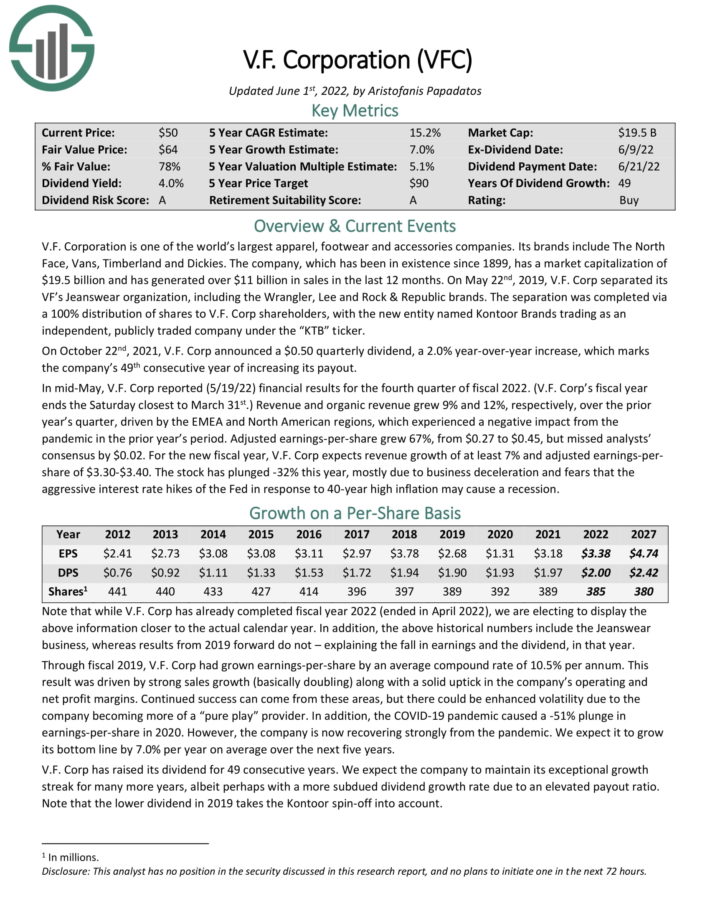

Low-cost Dividend Inventory #18: V.F. Corp. (VFC)

- P/E Ratio: 13.2

- 5-year Annual Anticipated Returns: 17.8%

V.F. Company is likely one of the world’s largest attire, footwear and equipment firms. The corporate’s manufacturers embrace The North Face, Vans, Timberland and Dickies. The corporate, which has been in existence since 1899, generated over $11 billion in gross sales within the final 12 months.

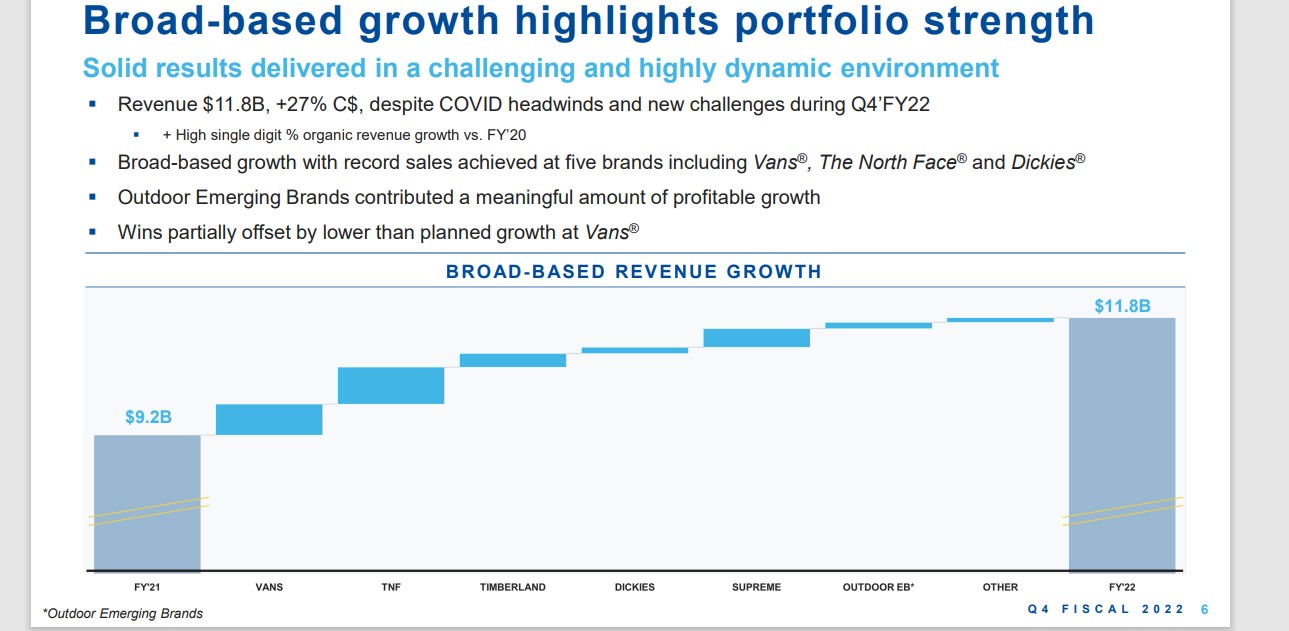

In mid-Could, V.F. Corp reported (5/19/22) monetary outcomes for the fourth quarter of fiscal 2022. Income and natural income grew 9% and 12%, respectively, over the prior 12 months’s quarter, pushed by the EMEA and North American areas, which skilled a damaging affect from the pandemic within the prior 12 months’s interval.

Supply: Investor Presentation

Adjusted earnings-per-share grew 67%, from $0.27 to $0.45, however missed analysts’ consensus by $0.02. For the brand new fiscal 12 months, V.F. Corp expects income progress of a minimum of 7% and adjusted earnings-per-share of $3.30 to $3.40.

Low-cost dividend shares like VF Corp are enticing as a result of the contraction of the share worth has resulted in a excessive dividend yield exceeding 4%.

Click on right here to obtain our most up-to-date Certain Evaluation report on V.F. Corp. (preview of web page 1 of three proven beneath):

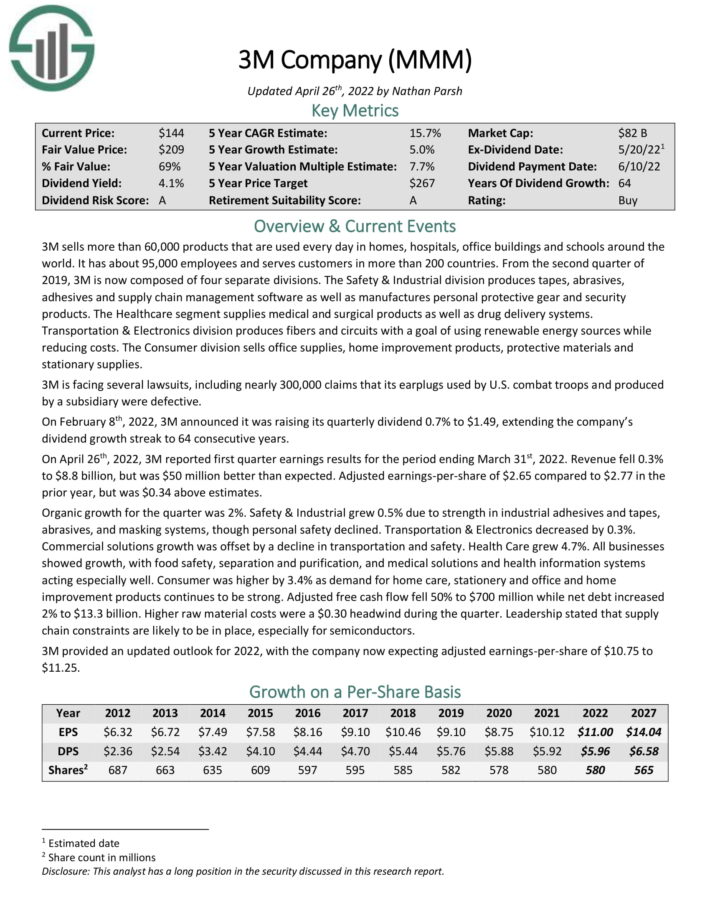

Low-cost Dividend Inventory #17: 3M Firm (MMM)

- P/E Ratio: 11.9

- 5-year Annual Anticipated Returns: 17.9%

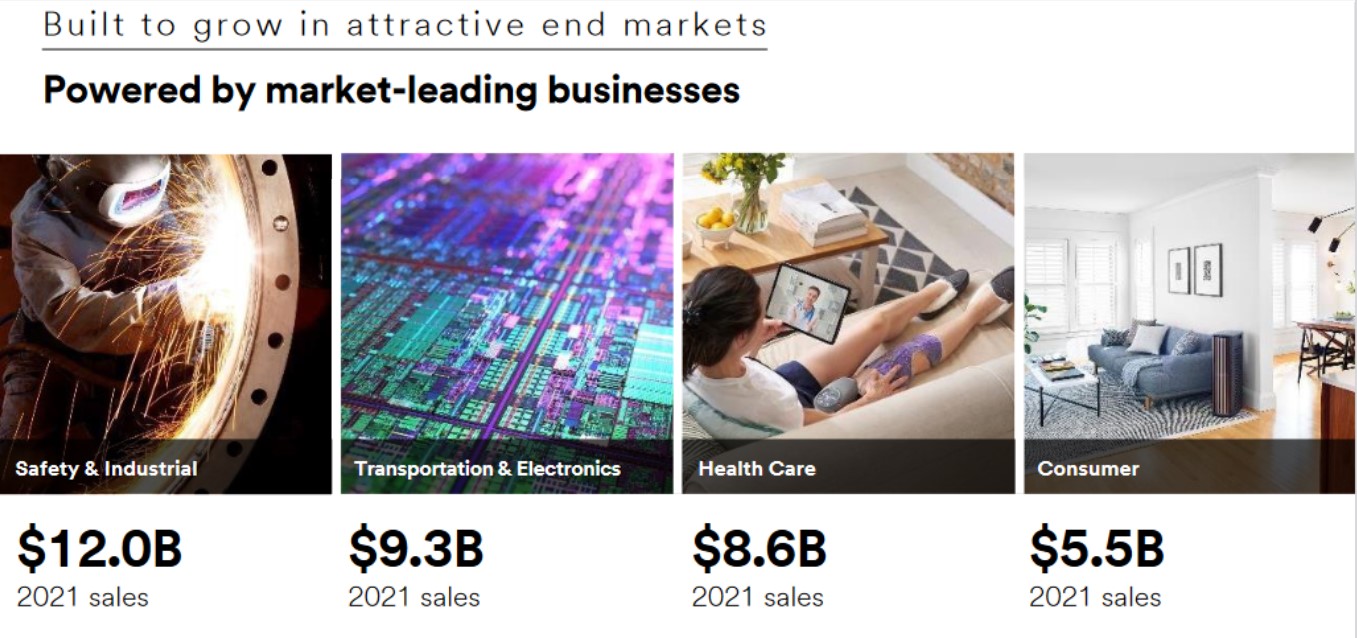

3M sells greater than 60,000 merchandise which can be used each day in houses, hospitals, workplace buildings and colleges across the world. It has about 95,000 workers and serves prospects in additional than 200 international locations.

Supply: Investor Presentation

3M is now composed of 4 separate divisions. The Security & Industrial division produces tapes, abrasives, adhesives and provide chain administration software program in addition to manufactures private protecting gear and safety merchandise.

The Healthcare section provides medical and surgical merchandise in addition to drug supply techniques. Transportation & Digitals division produces fibers and circuits with a purpose of utilizing renewable vitality sources whereas decreasing prices. The Client division sells workplace provides, dwelling enchancment merchandise, protecting supplies and stationary provides.

On April twenty sixth, 2022, 3M reported first quarter earnings outcomes for the interval ending March thirty first, 2022. Income fell 0.3% to $8.8 billion, however was $50 million higher than anticipated. Adjusted earnings-per-share of $2.65 in comparison with $2.77 within the prior 12 months, however was $0.34 above estimates. Natural progress for the quarter was 2%.

Security & Industrial grew 0.5% resulting from power in industrial adhesives and tapes, abrasives, and masking techniques, although private security declined. Transportation & Electronics decreased by 0.3%. Industrial options progress was offset by a decline in transportation and security. Well being Care grew 4.7%. Client was larger by 3.4% as demand for dwelling care, stationery and workplace and residential enchancment merchandise continues to be sturdy.

3M supplied an up to date outlook for 2022, with the corporate now anticipating adjusted earnings-per-share of $10.75 to $11.25. Low-cost dividend shares like 3M are legendary for his or her lengthy histories of progress and dividends.

Click on right here to obtain our most up-to-date Certain Evaluation report on 3M (preview of web page 1 of three proven beneath):

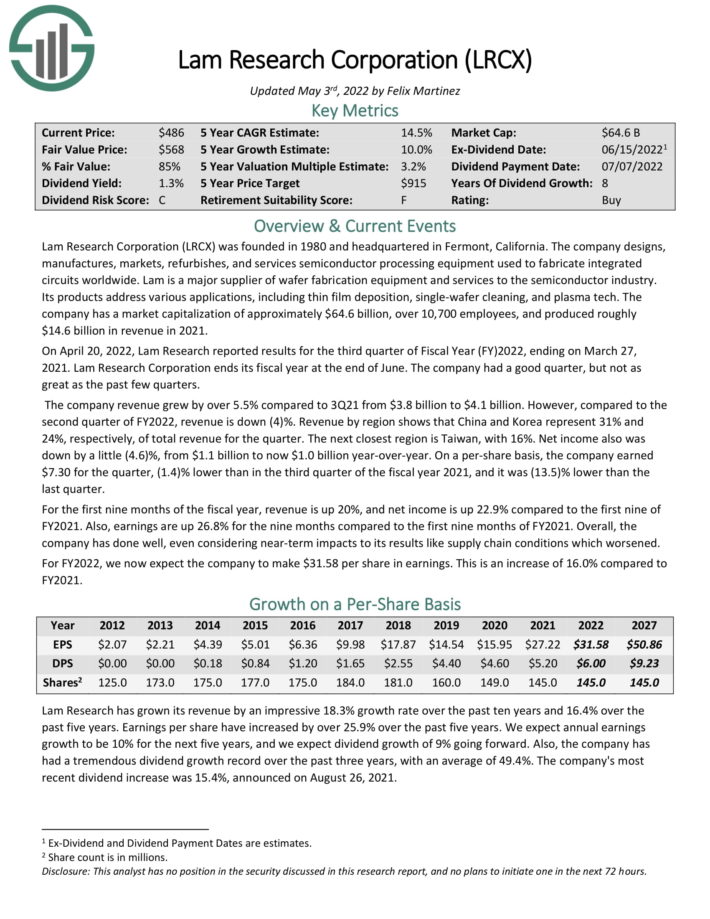

Low-cost Dividend Inventory #16: Lam Analysis (LRCX)

- P/E Ratio: 13.2

- 5-year Annual Anticipated Returns: 17.9%

Lam Analysis Company designs, manufactures, markets, refurbishes, and companies semiconductor processing gear used to manufacture built-in circuits worldwide. Lam is a significant provider of wafer fabrication gear and companies to the semiconductor business. Its merchandise handle varied functions, together with skinny movie deposition, single-wafer cleansing, and plasma tech.

On April 20, 2022, Lam Analysis reported outcomes for the third quarter of Fiscal 12 months (FY)2022, ending on March 27, 2021. Lam Analysis Company ends its fiscal 12 months on the finish of June. Income grew by over 5.5% in comparison with 3Q21 from $3.8 billion to $4.1 billion. Nonetheless, in comparison with the second quarter of FY2022, income is down (4)%.

Internet revenue additionally was down by 4.6% to $1.0 billion. On a per-share foundation, the corporate earned $7.30 for the quarter, (1.4)% decrease than within the third quarter of the fiscal 12 months 2021, and it was (13.5)% decrease than the final quarter. For the primary 9 months of the fiscal 12 months, income is up 20%, and internet revenue is up 22.9% in comparison with the primary 9 of FY2021. Additionally, earnings are up 26.8% for the 9 months in comparison with the primary 9 months of FY2021.

Click on right here to obtain our most up-to-date Certain Evaluation report on LRCX (preview of web page 1 of three proven beneath):

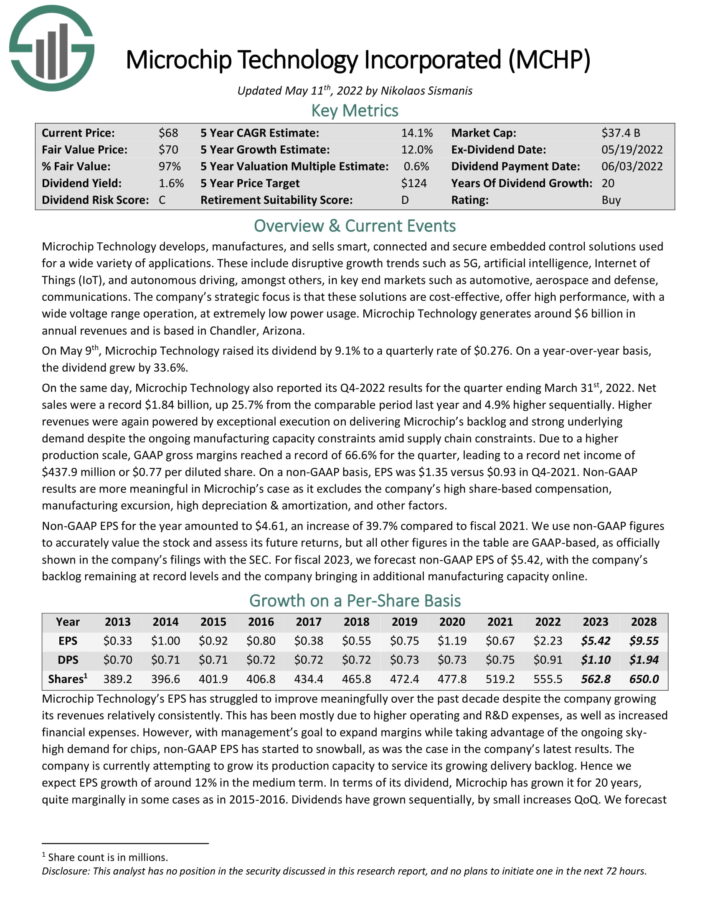

Low-cost Dividend Inventory #15: Microchip Know-how (MCHP)

- P/E Ratio: 10.5

- 5-year Annual Anticipated Returns: 18.1%

Microchip Know-how develops, manufactures, and sells sensible, linked and safe embedded management options used for all kinds of functions. These embrace disruptive progress traits corresponding to 5G, synthetic intelligence, Web of Issues (IoT), and autonomous driving, amongst others, in key finish markets corresponding to automotive, aerospace and protection, communications.

The corporate’s strategic focus is that these options are cost-effective, supply excessive efficiency, with a large voltage vary operation, at extraordinarily low energy utilization. Microchip Know-how generates round $6 billion in annual revenues.

On Could ninth, Microchip Know-how raised its dividend by 9.1% to a quarterly fee of $0.276. On a year-over-year foundation, the dividend grew by 33.6%.

On the identical day, Microchip Know-how additionally reported its This autumn-2022 outcomes for the quarter ending March thirty first, 2022. Internet gross sales have been a file $1.84 billion, up 25.7% from the comparable interval final 12 months and 4.9% larger sequentially. Larger revenues have been once more powered by distinctive execution on delivering Microchip’s backlog and robust underlying demand regardless of the continuing manufacturing capability constraints amid provide chain constraints.

On a non-GAAP foundation, EPS was $1.35 versus $0.93 in This autumn-2021. Non-GAAP outcomes are extra significant in Microchip’s case because it excludes the corporate’s excessive share-based compensation, manufacturing tour, excessive depreciation & amortization, and different components. Non-GAAP EPS for the 12 months amounted to $4.61, a rise of 39.7% in comparison with fiscal 2021.

Click on right here to obtain our most up-to-date Certain Evaluation report on MCHP (preview of web page 1 of three proven beneath):

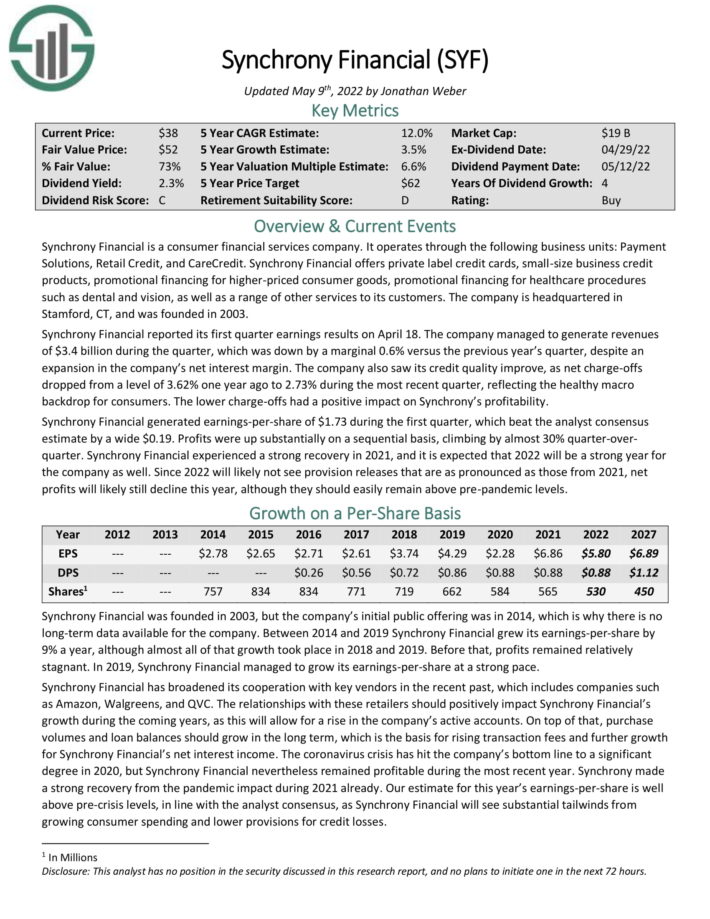

Low-cost Dividend Inventory #14: Synchrony Monetary (SYF)

- P/E Ratio: 5.0

- 5-year Annual Anticipated Returns: 18.2%

Synchrony Monetary is a shopper monetary companies firm. It operates by the next enterprise models: Fee Options, Retail Credit score, and CareCredit. Synchrony Monetary presents personal label bank cards, small-size enterprise credit score merchandise, promotional financing for higher-priced shopper items, promotional financing for healthcare procedures corresponding to dental and imaginative and prescient, in addition to a variety of different companies to its prospects.

Synchrony Monetary reported its first quarter earnings outcomes on April 18. The corporate managed to generate revenues of $3.4 billion throughout the quarter, which was down by a marginal 0.6% versus the earlier 12 months’s quarter, regardless of an growth within the firm’s internet curiosity margin.

The corporate additionally noticed its credit score high quality enhance, as internet charge-offs dropped from a degree of three.62% one 12 months in the past to 2.73% throughout the latest quarter, reflecting the wholesome macro backdrop for customers. The decrease charge-offs had a constructive affect on Synchrony’s profitability.

Synchrony Monetary generated earnings-per-share of $1.73 throughout the first quarter, which beat the analyst consensus estimate by a large $0.19. Earnings have been up considerably on a sequential foundation, climbing by virtually 30% quarter-overquarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on SYF (preview of web page 1 of three proven beneath):

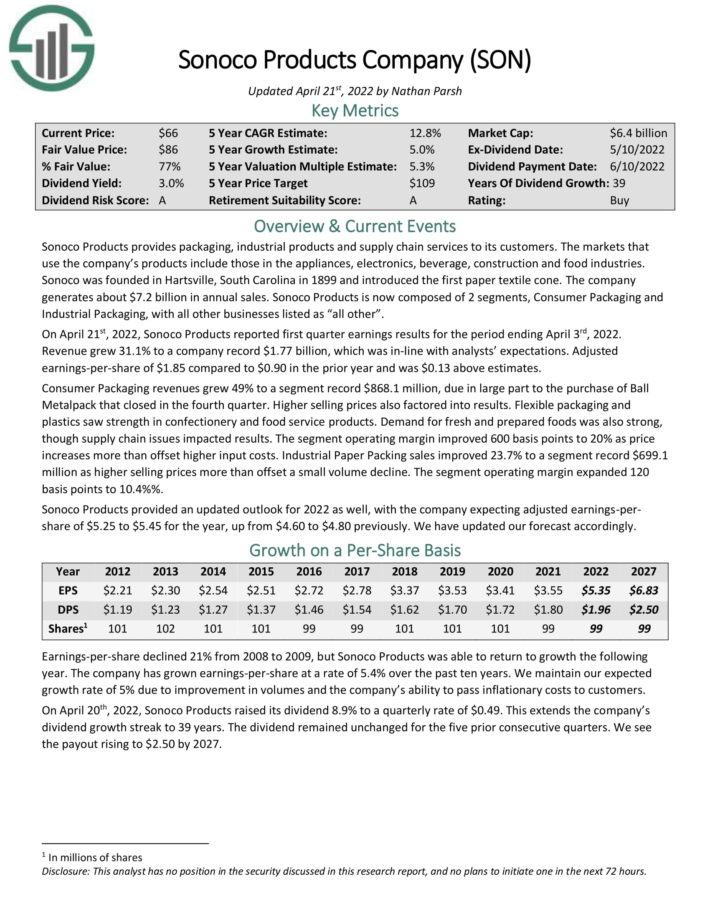

Low-cost Dividend Inventory #13: Sonoco Merchandise Firm (SON)

- P/E Ratio: 9.7

- 5-year Annual Anticipated Returns: 18.6%

Sonoco Merchandise offers packaging, industrial merchandise and provide chain companies to its prospects. The markets that use the corporate’s merchandise embrace these within the home equipment, electronics, beverage, building and meals industries. Sonoco was based in Hartsville, South Carolina in 1899 and launched the primary paper textile cone. The corporate generates about $7.2 billion in annual gross sales. Sonoco Merchandise is now composed of two segments, Client Packaging and Industrial Packaging, with all different companies listed as “all different”.

On April twenty first, 2022, Sonoco Merchandise reported first quarter earnings outcomes for the interval ending April third, 2022. Income grew 31.1% to an organization file $1.77 billion, which was in-line with analysts’ expectations. Adjusted earnings-per-share of $1.85 in comparison with $0.90 within the prior 12 months and was $0.13 above estimates.

Client Packaging revenues grew 49% to a section file $868.1 million, due largely to the acquisition of Ball Metalpack that closed within the fourth quarter. Larger promoting costs additionally factored into outcomes. Versatile packaging and plastics noticed power in confectionery and meals service merchandise.

Demand for recent and ready meals was additionally sturdy, although provide chain points impacted outcomes. The section working margin improved 600 foundation factors to twenty% as worth will increase greater than offset larger enter prices. Industrial Paper Packing gross sales improved 23.7% to a section file $699.1 million as larger promoting costs greater than offset a small quantity decline. The section working margin expanded 120 foundation factors to 10.4%.

Sonoco Merchandise supplied an up to date outlook for 2022 as effectively, with the corporate anticipating adjusted earnings-pershare of $5.25 to $5.45 for the 12 months, up from $4.60 to $4.80 beforehand.

Click on right here to obtain our most up-to-date Certain Evaluation report on SON (preview of web page 1 of three proven beneath):

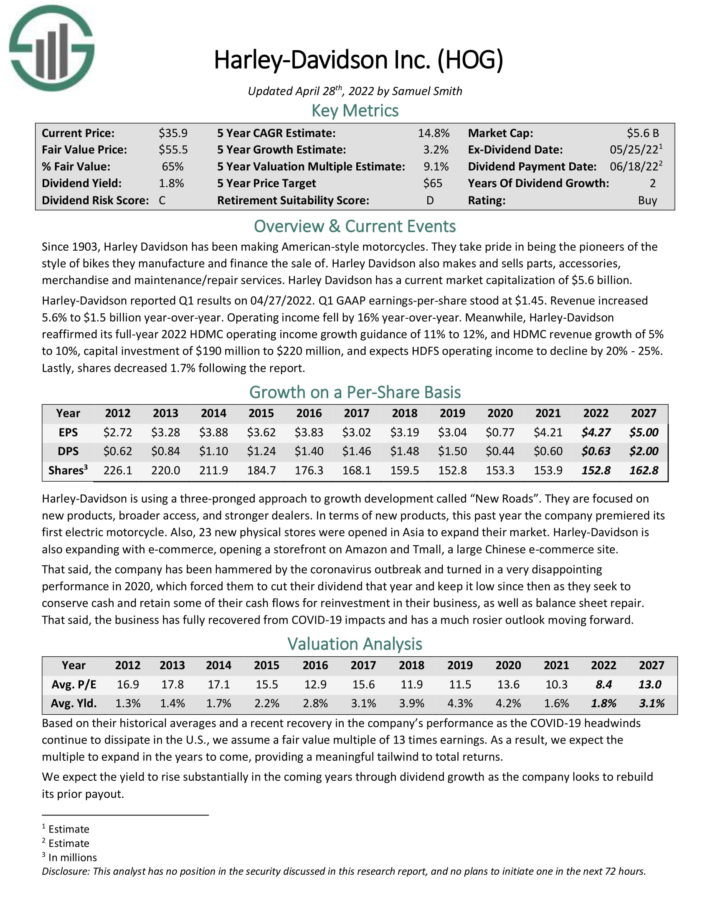

Low-cost Dividend Inventory #12: Harley-Davidson, Inc. (HOG)

- P/E Ratio: 7.1

- 5-year Annual Anticipated Returns: 18.8%

Since 1903, Harley Davidson has been making American-style bikes. They take pleasure in being the pioneers of the fashion of bikes they manufacture and finance the sale of. Harley Davidson additionally makes and sells components, equipment,

merchandise and upkeep/restore companies.

Harley-Davidson reported Q1 outcomes on 04/27/2022. Q1 GAAP earnings-per-share stood at $1.45. Income elevated 5.6% to $1.5 billion year-over-year. Working revenue fell by 16% year-over-year. In the meantime, Harley-Davidson reaffirmed its full-year 2022 HDMC working revenue progress steerage of 11% to 12%, and HDMC income progress of 5% to 10%, capital funding of $190 million to $220 million, and expects HDFS working revenue to say no by 20% – 25%.

Harley-Davidson has a aggressive benefit with its historical past, distinctive fashion and title model recognition. HarleyDavidson has crafted their picture by cautious advertising corresponding to licensing offers with TV exhibits corresponding to ‘Sons of

Anarchy’ that convey the model’s picture.

The corporate’s dividend historical past has been good apart from the final recession, when the dividend was lower from $1.29 in 2008 to $0.40 in 2009. This transformation got here as their earnings per share fell from $3.77 in 2008 to $1.11 in 2009. As their bikes are primarily luxurious gadgets, Harley Davidson’s gross sales are considerably impacted by financial downturns. Throughout the Nice Recession, Harley-Davidson was hit exhausting, shedding 86% of its market capitalization. Earnings per share additionally dropped to $0.06 in 2009.

Click on right here to obtain our most up-to-date Certain Evaluation report on HOG (preview of web page 1 of three proven beneath):

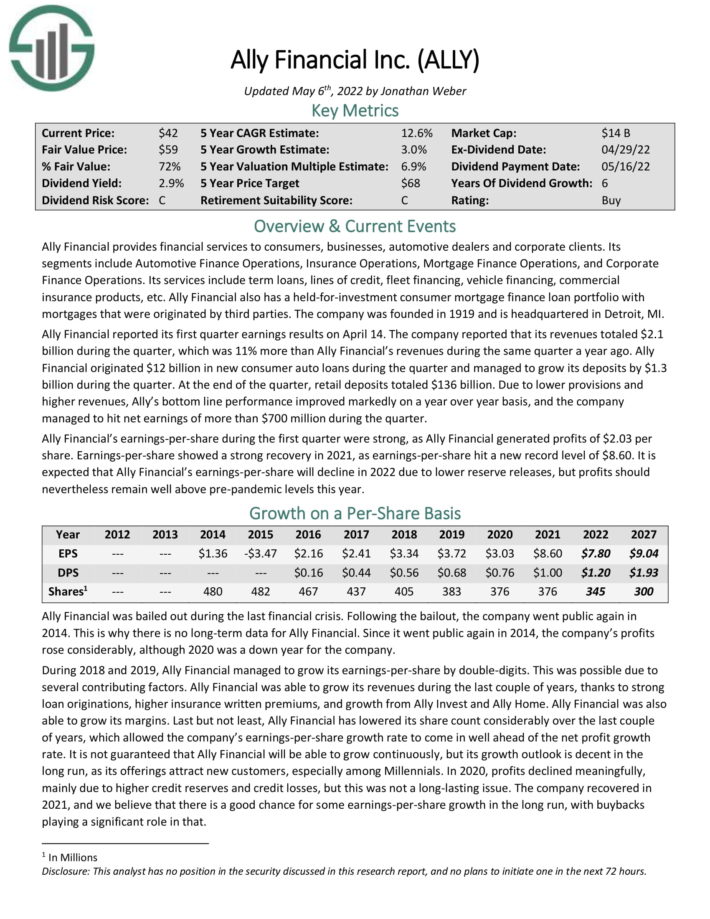

Low-cost Dividend Inventory #11: Ally Monetary (ALLY)

- P/E Ratio: 4.1

- 5-year Annual Anticipated Returns: 18.8%

Ally Monetary offers monetary companies to customers, companies, automotive sellers and company shoppers. Its

segments embrace Automotive Finance Operations, Insurance coverage Operations, Mortgage Finance Operations, and Company Finance Operations. Its companies embrace time period loans, strains of credit score, fleet financing, car financing, business insurance coverage merchandise, and so forth.

Ally Monetary additionally has a held-for-investment shopper mortgage finance mortgage portfolio with mortgages that have been originated by third events.

Ally Monetary reported its first quarter earnings outcomes on April 14. The corporate reported that its revenues totaled $2.1 billion throughout the quarter, which was 11% greater than Ally Monetary’s revenues throughout the identical quarter a 12 months in the past. Ally originated $12 billion in new shopper auto loans throughout the quarter and managed to develop its deposits by $1.3 billion throughout the quarter.

On the finish of the quarter, retail deposits totaled $136 billion. As a consequence of decrease provisions and better revenues, Ally’s backside line efficiency improved markedly on a 12 months over 12 months foundation, and the corporate

managed to hit internet earnings of greater than $700 million throughout the quarter.

Ally Monetary’s earnings-per-share throughout the first quarter have been sturdy, because it generated income of $2.03 per share. Earnings-per-share confirmed a powerful restoration in 2021, as earnings-per-share hit a brand new file degree of $8.60.

It’s anticipated that Ally Monetary’s earnings-per-share will decline in 2022 resulting from decrease reserve releases, however income ought to however stay effectively above pre-pandemic ranges this 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on ALLY (preview of web page 1 of three proven beneath):

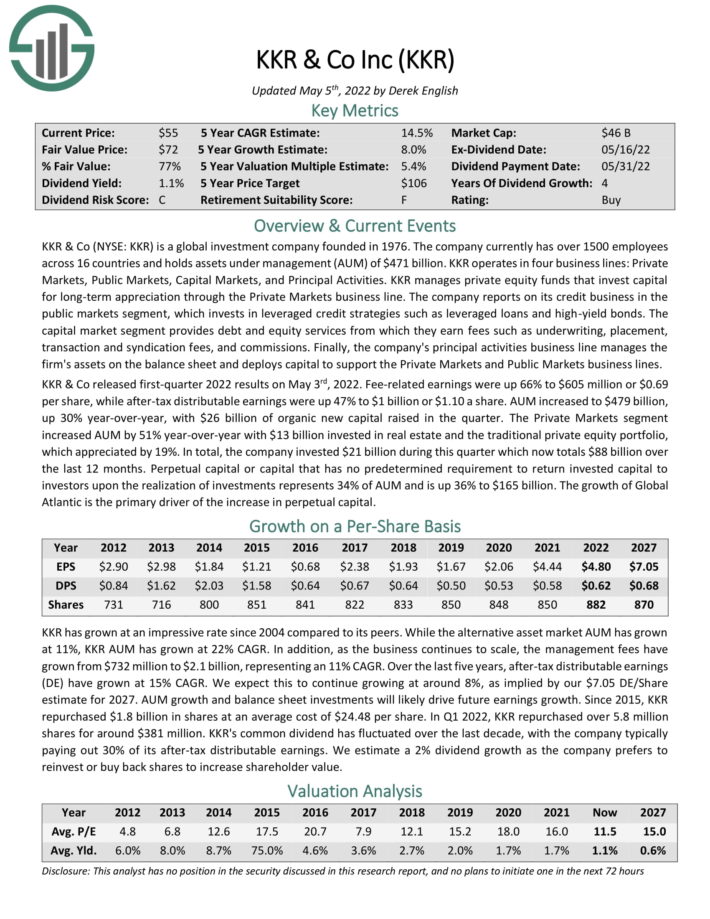

Low-cost Dividend Inventory #10: KKR & Firm Inc. (KKR)

- P/E Ratio: 9.4

- 5-year Annual Anticipated Returns: 19.3%

KKR & Co is a world funding firm based in 1976. The corporate presently has over 1500 workers throughout 16 international locations and holds belongings below administration (AUM) of $471 billion. KKR operates in 4 enterprise strains: Non-public Markets, Public Markets, Capital Markets, and Principal Actions.

KKR manages personal fairness funds that make investments capital for long-term appreciation by the Non-public Markets enterprise line. The corporate reviews on its credit score enterprise within the public markets section, which invests in leveraged credit score methods corresponding to leveraged loans and high-yield bonds.

The capital market section offers debt and fairness companies from which they earn charges corresponding to underwriting, placement, transaction and syndication charges, and commissions. Lastly, the corporate’s principal actions enterprise line manages the agency’s belongings on the stability sheet and deploys capital to assist the Non-public Markets and Public Markets enterprise strains.

KKR & Co launched first-quarter 2022 outcomes on Could third, 2022. Charge-related earnings have been up 66% to $605 million or $0.69 per share, whereas after-tax distributable earnings have been up 47% to $1 billion or $1.10 a share. AUM elevated to $479 billion, up 30% year-over-year, with $26 billion of natural new capital raised within the quarter.

The Non-public Markets section elevated AUM by 51% year-over-year with $13 billion invested in actual property and the normal personal fairness portfolio, which appreciated by 19%. In whole, the corporate invested $21 billion throughout this quarter which now totals $88 billion during the last 12 months.

Perpetual capital or capital that has no predetermined requirement to return invested capital to buyers upon the belief of investments represents 34% of AUM and is up 36% to $165 billion. The expansion of International Atlantic is the first driver of the rise in perpetual capital.

Click on right here to obtain our most up-to-date Certain Evaluation report on KKR (preview of web page 1 of three proven beneath):

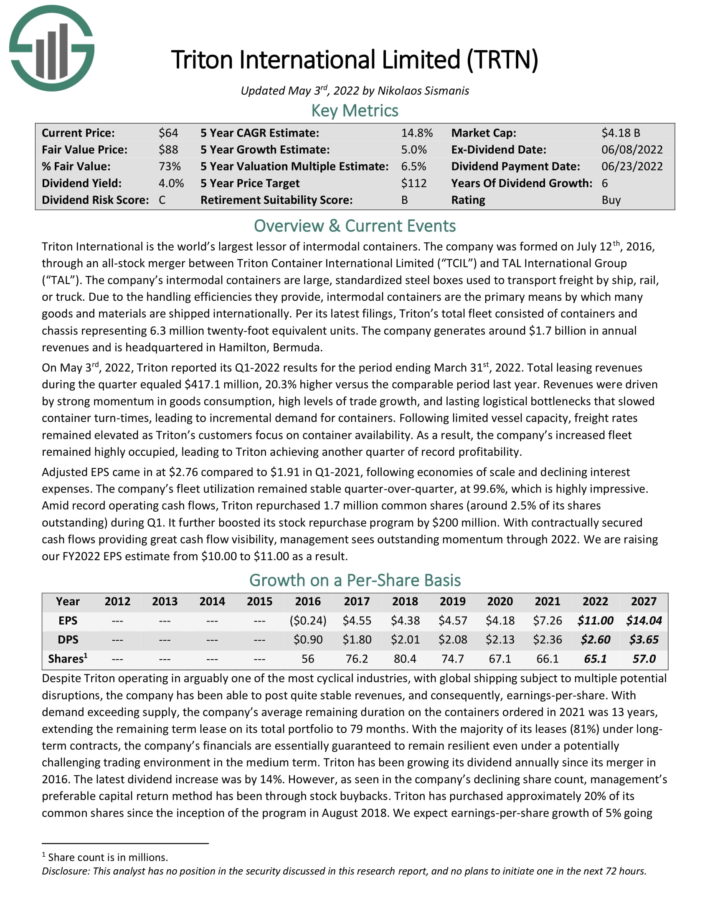

Low-cost Dividend Inventory #9: Triton Worldwide (TRTN)

- P/E Ratio: 4.8

- 5-year Annual Anticipated Returns: 19.4%

Triton Worldwide is the world’s largest lessor of intermodal containers. The corporate’s intermodal containers are giant, standardized metal containers used to move freight by ship, rail, or truck. As a result of dealing with efficiencies they supply, intermodal containers are the first means by which many items and supplies are shipped internationally. Per its newest filings, Triton’s whole fleet consisted of containers and chassis representing 6.3 million twenty-foot equal models. The corporate generates round $1.7 billion in annual revenues.

On Could third, 2022, Triton reported its Q1-2022 outcomes for the interval ending March thirty first, 2022. Whole leasing revenues throughout the quarter equaled $417.1 million, 20.3% larger versus the comparable interval final 12 months. Revenues have been pushed by sturdy momentum in items consumption, excessive ranges of commerce progress, and lasting logistical bottlenecks that slowed container turn-times, resulting in incremental demand for containers.

Following restricted vessel capability, freight charges remained elevated as Triton’s prospects deal with container availability. Consequently, the corporate’s elevated fleet remained extremely occupied, resulting in Triton attaining one other quarter of file profitability.

Adjusted EPS got here in at $2.76 in comparison with $1.91 in Q1-2021, following economies of scale and declining curiosity bills. The corporate’s fleet utilization remained secure quarter-over-quarter, at 99.6%, which is extremely spectacular. Amid file working money flows, Triton repurchased 1.7 million frequent shares (round 2.5% of its shares excellent) throughout Q1. It additional boosted its inventory repurchase program by $200 million.

Click on right here to obtain our most up-to-date Certain Evaluation report on TRTN (preview of web page 1 of three proven beneath):

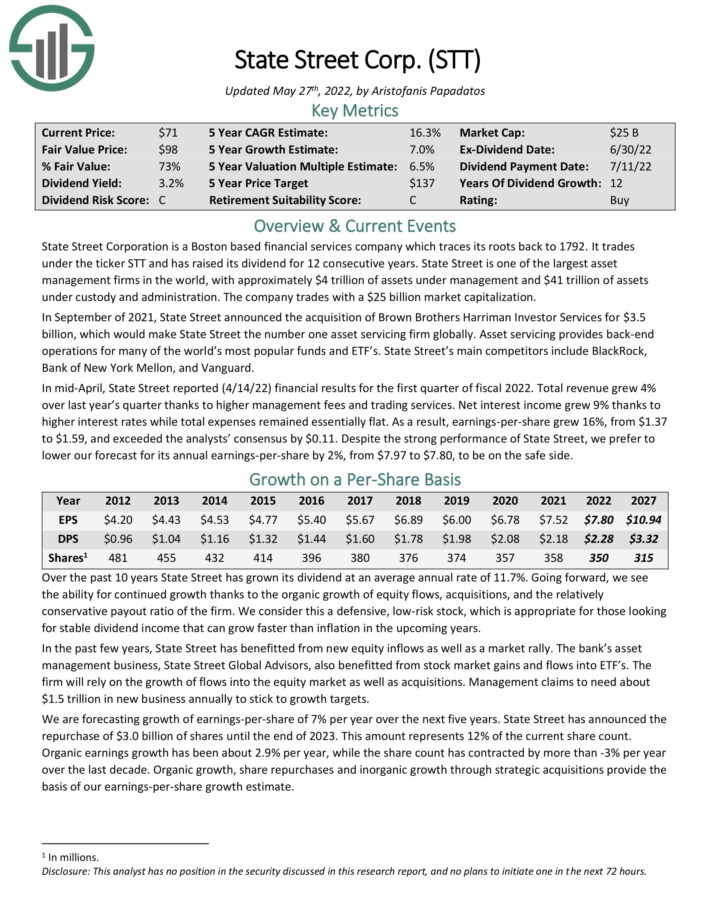

Low-cost Dividend Inventory #8: State Road (STT)

- P/E Ratio: 8.0

- 5-year Annual Anticipated Returns: 19.5%

State Road Company is a Boston primarily based monetary companies firm which traces its roots again to 1792. State Road trades below the ticker STT and has elevated its dividend for 12 consecutive years. State Road is likely one of the largest asset administration corporations on this planet with roughly $4 trillion of belongings below administration and $44 trillion of belongings below custody and administration.

In September of 2021, State Road introduced the acquisition of Brown Brothers Harriman Investor Providers for $3.5 billion, which might make State Road the primary asset servicing agency globally. Asset servicing offers back-end operations for most of the world’s hottest funds and ETF’s. State Road’s primary rivals embrace BlackRock, Financial institution of New York Mellon, and Vanguard.

You may see an outline of State Road’s first-quarter highlights within the picture beneath:

Supply: Investor Presentation

We anticipate annual returns of 16.8% per 12 months for State Road. This will likely be pushed by 7% anticipated EPS progress, plus the three.3% dividend yield and a large increase from an increasing P/E a number of.

Click on right here to obtain our most up-to-date Certain Evaluation report on State Road (preview of web page 1 of three proven beneath):

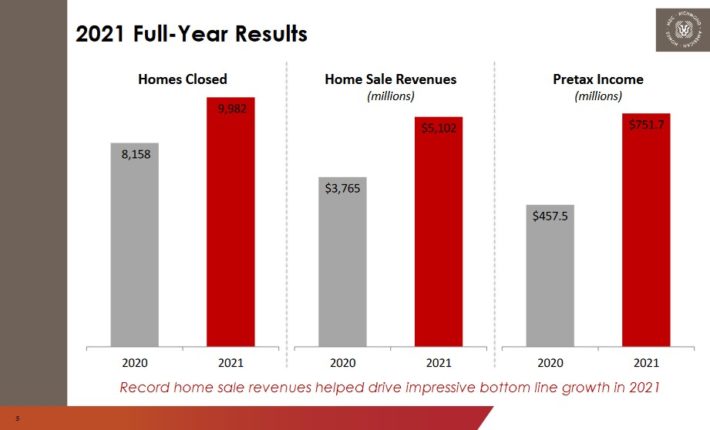

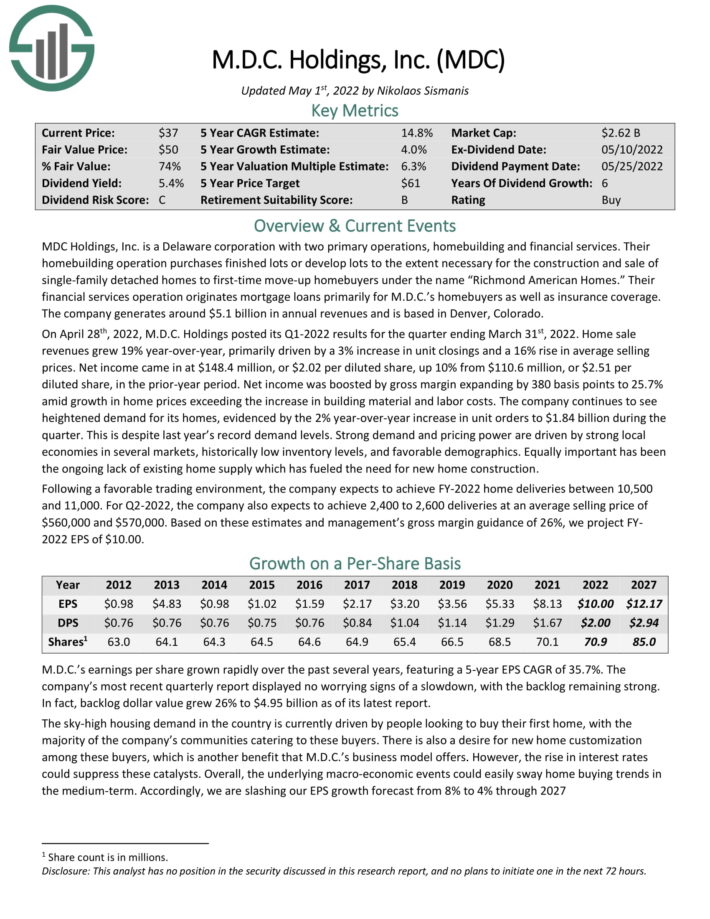

Low-cost Dividend Inventory #7: MDC Holdings (MDC)

- P/E Ratio: 3.0

- 5-year Annual Anticipated Returns: 19.9%

M.D.C. Holdings has two main operations, dwelling constructing and monetary companies. Its dwelling constructing operation purchases completed heaps or develops heaps to the extent crucial for the development and sale of single-family indifferent houses to dwelling patrons below the title “Richmond American Houses.” Its monetary companies operation points mortgage loans primarily for the house patrons of the corporate whereas it additionally sells insurance coverage protection.

As a result of nature of its enterprise, M.D.C. Holdings has at all times been extremely weak to recessions, as demand for brand new houses plunges throughout tough financial intervals. Within the Nice Recession, the quarterly gross sales of M.D.C. Holdings plunged 99% inside just some quarters and the corporate incurred hefty losses.

Nonetheless, M.D.C. Holdings has proved markedly resilient all through the coronavirus disaster. Regardless of the fierce recession attributable to the unprecedented lockdowns imposed in 2020, the house builder grew its earnings per share 50% in that 12 months, from $3.56 to $5.33.

Even higher, because of the extreme fiscal stimulus packages provided by the federal government and robust pent-up demand, M.D.C. Holdings posted blowout leads to 2021.

Supply: Investor Presentation

The corporate grew its dwelling sale models by 22%, from 8,158 to a file 9,982, and its earnings per share by 53%, from $5.33 to a brand new all-time excessive of $8.13.

Even higher, the enterprise momentum stays sturdy. Within the fourth quarter, the corporate grew its dwelling sale revenues 22% over the prior 12 months’s quarter because of a 4% enhance in new models and a 17% enhance in common promoting costs. Consequently, it grew its earnings per share 10%.

Click on right here to obtain our most up-to-date Certain Evaluation report on MDC (preview of web page 1 of three proven beneath):

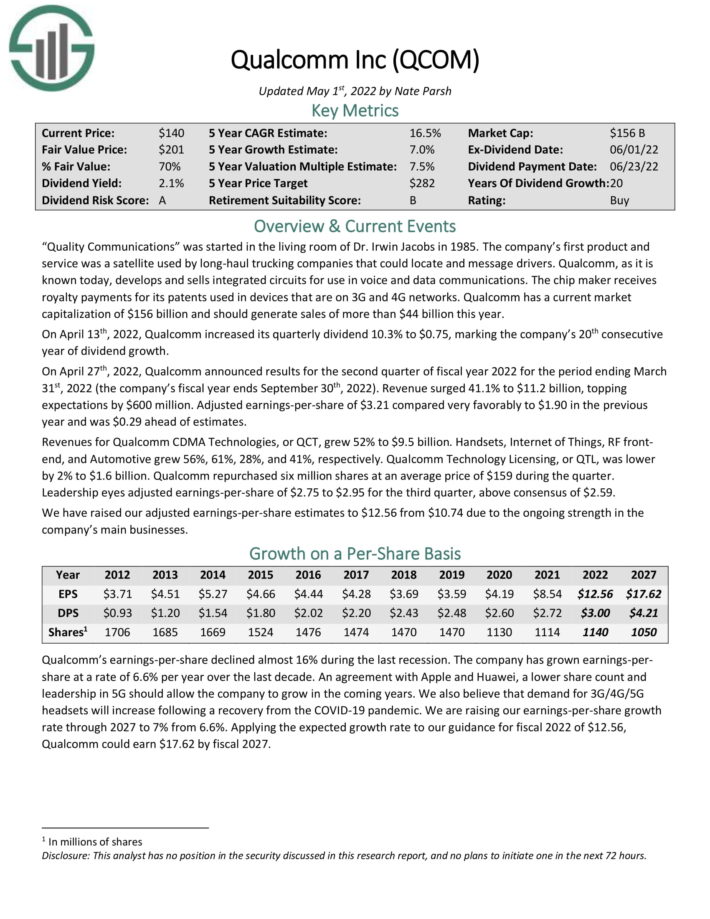

Low-cost Dividend Inventory #6: Qualcomm Inc. (QCOM)

- P/E Ratio: 9.6

- 5-year Annual Anticipated Returns: 20.0%

Qualcomm, as it’s identified immediately, develops and sells built-in circuits to be used in voice and information communications. The chip maker receives royalty funds for its patents utilized in units which can be on 3G and 4G networks.

On April twenty seventh, 2022, Qualcomm introduced outcomes for the second quarter of fiscal 12 months 2022 for the interval ending March thirty first, 2022 (the corporate’s fiscal 12 months ends September thirtieth, 2022). Income surged 41.1% to $11.2 billion, topping expectations by $600 million. Adjusted earnings-per-share of $3.21 in contrast very favorably to $1.90 within the earlier 12 months and was $0.29 forward of estimates.

Qualcomm not too long ago elevated its dividend by 10%, and the inventory now yields 2.1%. The corporate has elevated its dividend for 20 consecutive years. We anticipate 7% annual EPS progress by 2027, resulting in 16.5% anticipated annual returns.

Click on right here to obtain our most up-to-date Certain Evaluation report on Qualcomm (preview of web page 1 of three proven beneath):

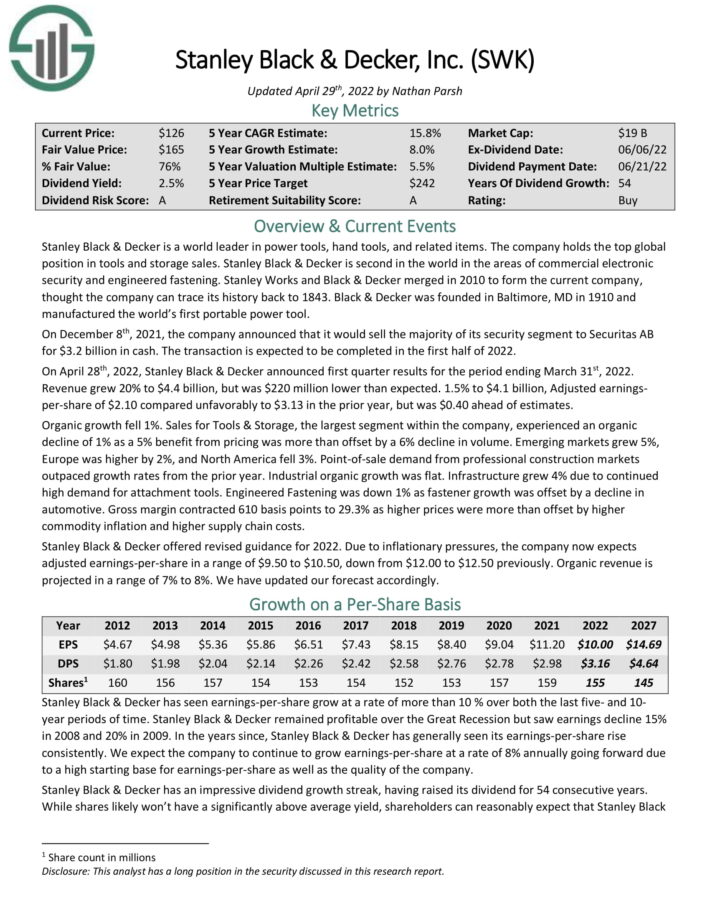

Low-cost Dividend Inventory #5: Stanley Black & Decker (SWK)

- P/E Ratio: 10.2

- 5-year Annual Anticipated Returns: 20.9%

Stanley Black & Decker is a world chief in energy instruments, hand instruments, and associated gadgets. The corporate holds the highest international place in instruments and storage gross sales. Stanley Black & Decker is second in the world within the areas of business digital safety and engineered fastening.

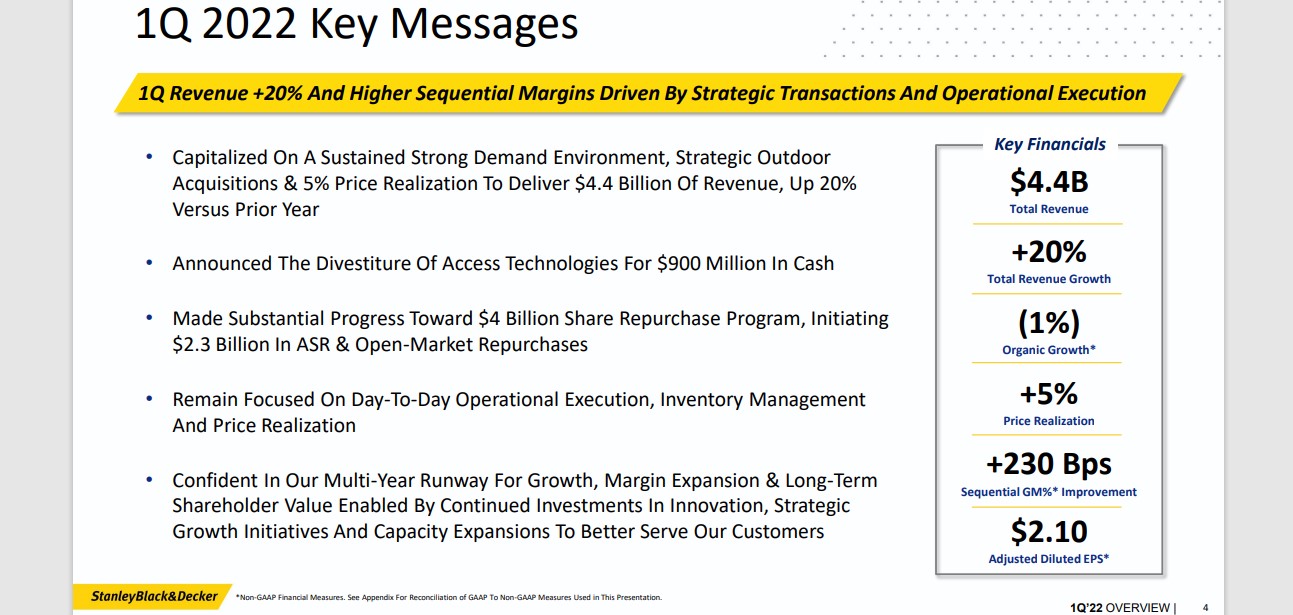

You may see an outline of the corporate’s 2022 first-quarter efficiency within the picture beneath:

Supply: Investor Presentation

On April twenty eighth, 2022, Stanley Black & Decker introduced first quarter outcomes. Income grew 20% to $4.4 billion, however was $220 million decrease than anticipated. Adjusted earnings-per-share of $2.10 in contrast unfavorably to $3.13 within the prior 12 months, however was $0.40 forward of estimates. Natural progress fell 1%.

Stanley Black & Decker provided revised steerage for 2022. As a consequence of inflationary pressures, the corporate now expects adjusted earnings-per-share in a variety of $9.50 to $10.50, down from $12.00 to $12.50 beforehand. Natural income is projected in a variety of seven% to eight%.

The inventory has a 2.7% dividend yield, and we anticipate 8% annual EPS progress. With a ~6.5% annual increase from an increasing P/E a number of, whole returns are anticipated to succeed in 17.2% per 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on SWK (preview of web page 1 of three proven beneath):

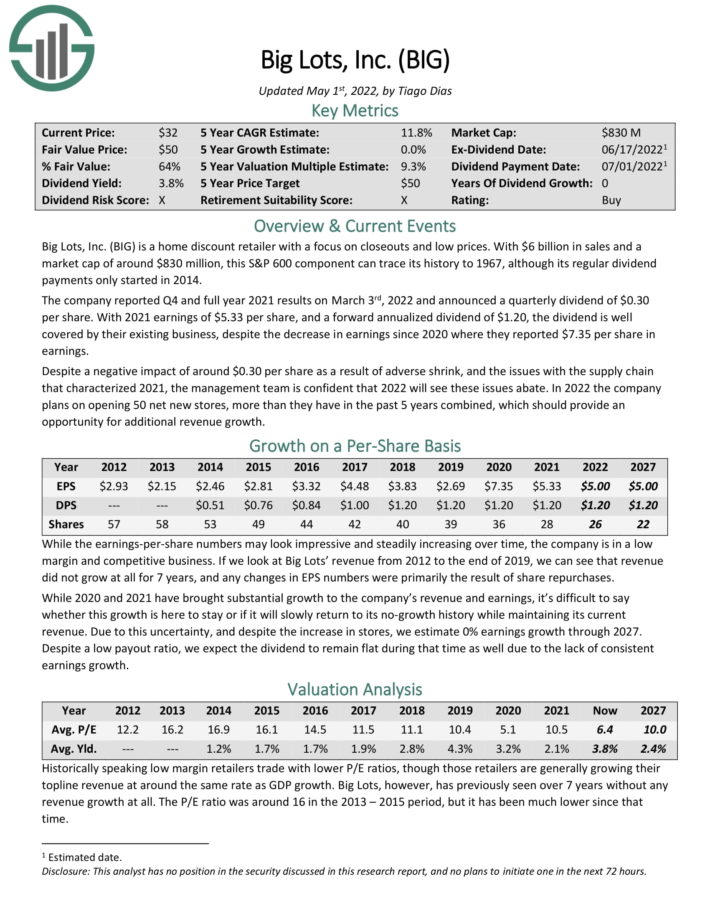

Low-cost Dividend Inventory #4: Massive Tons (BIG)

- P/E Ratio: 4.3

- 5-year Annual Anticipated Returns: 21.0%

Massive Tons is a house low cost retailer with a deal with closeouts and low costs. With $6 billion in gross sales and a market cap of round $930 million, this S&P 600 part can hint its historical past to 1967.

Supply: Investor Presentation

The corporate reported This autumn and full 12 months 2021 outcomes on March third, 2022 and introduced a quarterly dividend of $0.30 per share. With 2021 earnings of $5.33 per share, and a ahead annualized dividend of $1.20, the dividend is effectively coated by their current enterprise, regardless of the lower in earnings since 2020 the place they reported $7.35 per share in earnings.

Regardless of a damaging affect of round $0.30 per share because of opposed shrink, and the problems with the provision chain that characterised 2021, the administration group is assured that 2022 will see these points abate. In 2022 the corporate plans on opening 50 internet new shops, greater than they’ve previously 5 years mixed, which ought to present a possibility for added income progress.

Massive Tons inventory has a P/E beneath 5, making it a deep-value inventory. Shares even have a dividend yield of 4.1%, whereas we anticipate no EPS progress. Whole returns are estimated at 14.1% over the subsequent 5 years.

Click on right here to obtain our most up-to-date Certain Evaluation report on Massive Tons (preview of web page 1 of three proven beneath):

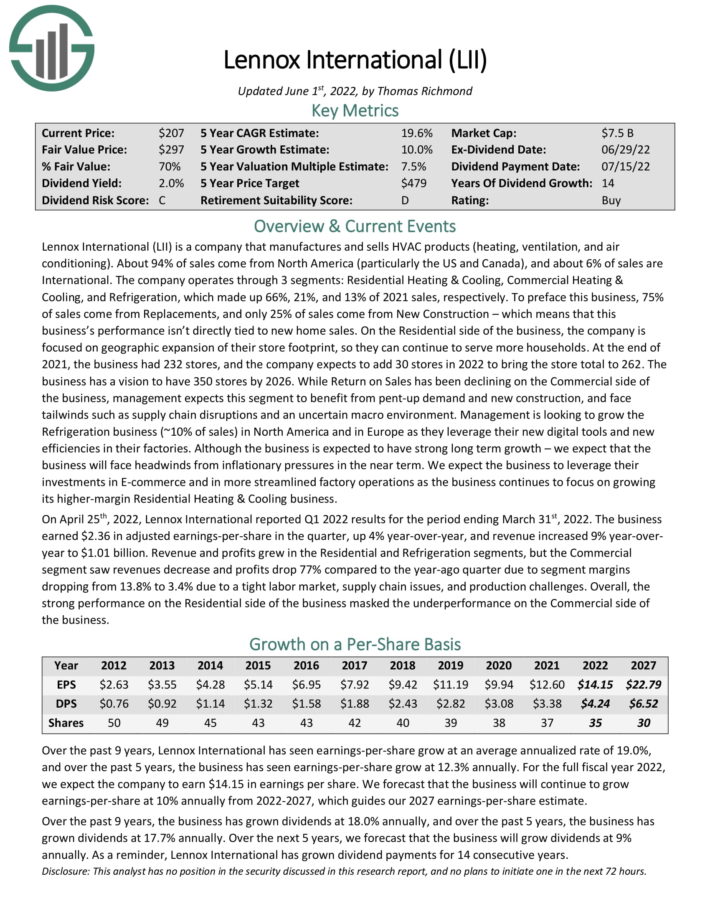

Low-cost Dividend Inventory #3: Lennox Worldwide (LII)

- P/E Ratio: 13.2

- 5-year Annual Anticipated Returns: 22.1%

Lennox Worldwide (LII) is an organization that manufactures and sells HVAC merchandise (heating, air flow, and air

conditioning). About 94% of gross sales come from North America (notably the US and Canada), and about 6% of gross sales are Worldwide.

The corporate operates by 3 segments: Residential Heating & Cooling, Industrial Heating & Cooling, and Refrigeration, which made up 66%, 21%, and 13% of 2021 gross sales, respectively. To preface this enterprise, 75% of gross sales come from Replacements, and solely 25% of gross sales come from New Building – which implies that this enterprise’s efficiency isn’t instantly tied to new dwelling gross sales.

On the Residential aspect of the enterprise, the corporate is concentrated on geographic growth of their retailer footprint, to allow them to proceed to serve extra households. On the finish of 2021, the enterprise had 232 shops, and the corporate expects so as to add 30 shops in 2022 to deliver the shop whole to 262. The enterprise has a imaginative and prescient to have 350 shops by 2026.

On April twenty fifth, 2022, Lennox Worldwide reported Q1 2022 outcomes for the interval ending March thirty first, 2022. The enterprise earned $2.36 in adjusted earnings-per-share within the quarter, up 4% year-over-year, and income elevated 9% year-overyear to $1.01 billion.

Click on right here to obtain our most up-to-date Certain Evaluation report on LII (preview of web page 1 of three proven beneath):

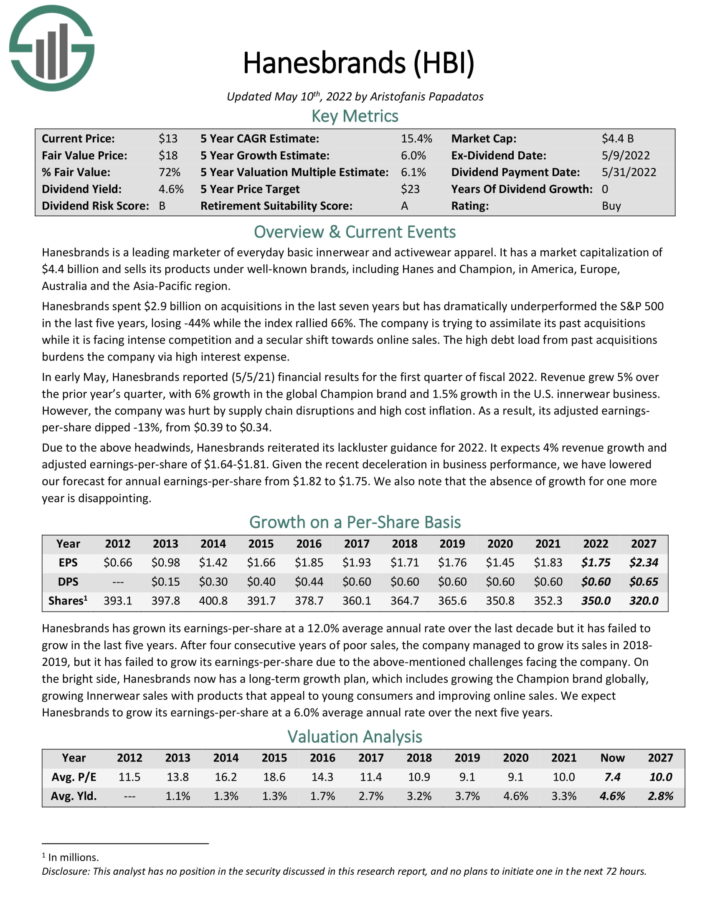

Low-cost Dividend Inventory #2: Hanesbrands (HBI)

- P/E Ratio: 5.6

- 5-year Annual Anticipated Returns: 22.8%

Hanesbrands is a number one marketer of on a regular basis fundamental innerwear and activewear attire. It sells its merchandise below well-known manufacturers, together with Hanes and Champion, in America, Europe, Australia and the Asia-Pacific area.

Hanesbrands spent $2.9 billion on acquisitions within the final seven years however has dramatically underperformed the S&P 500 within the final 5 years, shedding -44% whereas the index rallied 66%.

The corporate is making an attempt to assimilate its previous acquisitions whereas it’s going through intense competitors and a secular shift in the direction of on-line gross sales. The excessive debt load from previous acquisitions burdens the corporate by way of excessive curiosity expense.

In early Could, Hanesbrands reported (5/5/21) monetary outcomes for the primary quarter of fiscal 2022. Income grew 5% over the prior 12 months’s quarter, with 6% progress within the international Champion model and 1.5% progress within the U.S. innerwear enterprise.

Nonetheless, the corporate was damage by provide chain disruptions and excessive price inflation. Consequently, its adjusted earningsper-share dipped 13%, from $0.39 to $0.34. Hanesbrands expects 4% income progress and adjusted earnings-per-share of $1.64-$1.81.

Click on right here to obtain our most up-to-date Certain Evaluation report on HBI (preview of web page 1 of three proven beneath):

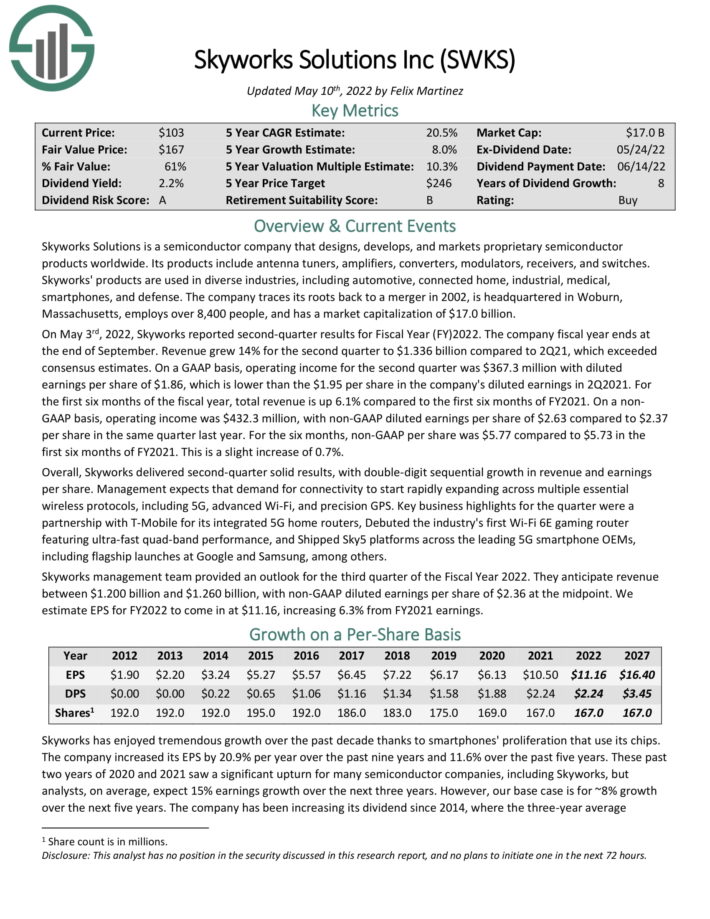

Low-cost Dividend Inventory #1: Skyworks Options (SWKS)

- P/E Ratio: 8.0

- 5-year Annual Anticipated Returns: 23.7%

Skyworks Options is a semiconductor firm that designs, develops, and markets proprietary semiconductor merchandise used worldwide. Its merchandise embrace antenna tuners, amplifiers, converters, modulators, receivers, and switches.

In the latest quarter, income grew 15% year-over-year. Adjusted diluted earnings per share of $3.14 in comparison with $3.36 per share in the identical quarter final 12 months. Total, Skyworks delivered first-quarter stable outcomes, with double-digit sequential progress in each income and earnings per share.

Skyworks has a powerful stability sheet with over $1 billion in money and money equivalents and no debt. This provides the corporate great flexibility and resiliency to offset a few of its concentrated buyer base dangers and transfer ahead with its progress plans. The dividend may be very effectively coated by earnings, and we contemplate it very secure. The corporate remained worthwhile throughout the earlier recession.

Low-cost dividend shares like Skyworks are a major instance of the whole return potential of shopping for undervalued dividend progress shares.

Click on right here to obtain our most up-to-date Certain Evaluation report on SWKS (preview of web page 1 of three proven beneath):

Last Ideas and Different Investing Assets

Low-cost dividend shares are interesting for long-term buyers, as they might generate excessive returns by EPS progress, dividends, and an increasing P/E ratio.

Having an Excel doc with the names, tickers, and monetary data of all low-cost dividend shares with price-to-earnings ratios beneath 15 may be very helpful. Nonetheless, it might not have fulfilled your wants for investing due diligence.

You probably have perused our record of low-cost dividend shares and are nonetheless on the lookout for your subsequent funding concept, take coronary heart. Certain Dividend has loads of different free dividend investing sources accessible to assist. Particularly, you could be involved in trying by our lists of dividend shares ranked by dividend historical past:

- The Dividend Aristocrats: S&P 500 dividend shares with 25+ years of consecutive dividend will increase.

- The Dividend Achievers: dividend shares with 10+ years of consecutive dividend will increase.

- The Dividend Kings: thought of to be the best-of-the-best with regards to dividend historical past, the Dividend Kings are a bunch of dividend shares with 50+ years of consecutive dividend will increase.

One other technique to display screen the investable universe is by on the lookout for dividend shares with specific yield or payout traits. With that in thoughts, Certain Dividend maintains the next inventory market databases:

Looking out throughout the main inventory market indices may also be fruitful. You may obtain Excel paperwork of the constituents of every main inventory market index beneath:

Alternatively, you might be involved in looking the inventory market by sector. Sector-specific inventory market databases can be found for obtain beneath:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].