Up to date on June 2nd, 2022 by Bob Ciura

Spreadsheet information up to date every day

In poker, the blue chips have the best worth. We don’t like the concept of utilizing poker analogies for investing. Investing must be far faraway from playing. With that mentioned, the time period “blue-chip shares” has caught for a choose group of shares….

So, what are blue-chip shares?

Blue-chip shares are established, protected, dividend payers. They’re typically market leaders and have a tendency to have an extended historical past of paying rising dividends. Blue-chip shares have a tendency to stay worthwhile even throughout recessions.

Chances are you’ll be questioning “how do I discover blue-chip shares?”

You’ll find blue-chip dividend shares utilizing the lists and spreadsheet under.

At Positive Dividend, we qualify blue-chip shares as corporations which are members of 1 or extra of the next 3 lists:

You’ll be able to obtain the entire record of all 350+ blue-chip shares (plus vital monetary metrics akin to dividend yield, P/E ratios, and payout ratios) by clicking under:

Along with the Excel spreadsheet above, this text covers our prime 7 finest blue-chip inventory buys at this time as ranked utilizing anticipated complete returns from the Positive Evaluation Analysis Database.

Our prime 7 finest blue-chip inventory record excludes MLPs and REITs. The desk of contents under permits for straightforward navigation.

Desk of Contents

The spreadsheet above provides the complete record of blue chips. They’re a very good place to get concepts on your subsequent high-quality dividend progress inventory investments…

Our prime 7 favourite blue-chip shares are analyzed intimately under.

The 7 Finest Blue-Chip Buys Right this moment

The 7 finest blue-chip shares as ranked by 5-year anticipated annual returns from the Positive Evaluation Analysis Database (excluding REITs and MLPs) are analyzed intimately under.

On this part, shares have been additional screened for a passable Dividend Threat rating of ‘C’ or higher.

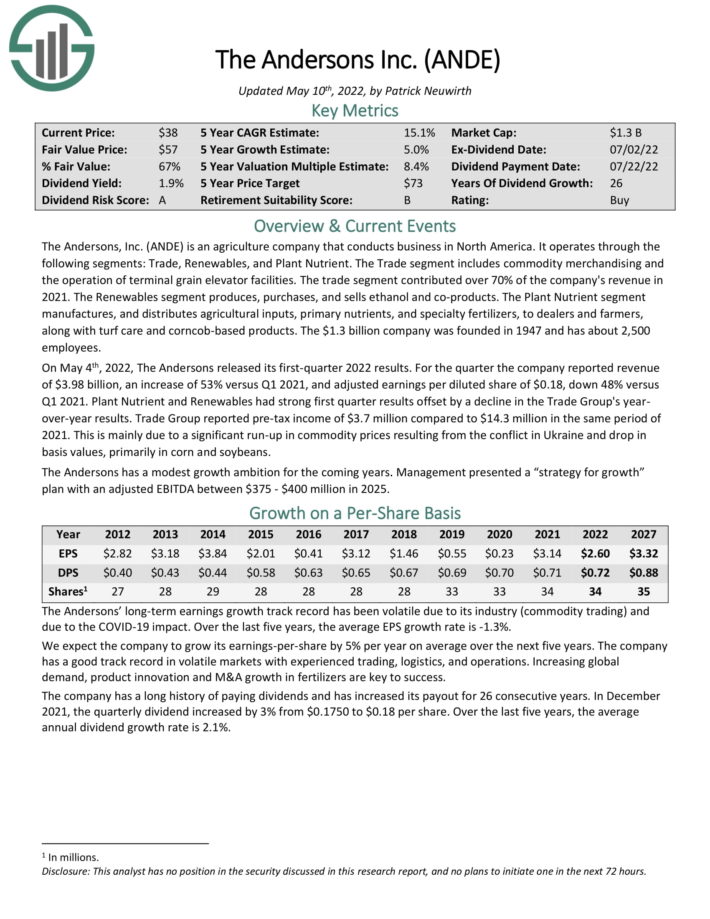

Blue-Chip Inventory #7: The Andersons Inc. (ANDE)

- Dividend Historical past: 26 years of consecutive will increase

- Dividend Yield: 1.9%

- Anticipated Whole Return: 15.5%

The Andersons, Inc. is an agriculture firm that conducts enterprise in North America. It operates by way of the next segments: Commerce, Renewables, and Plant Nutrient. The Commerce section contains commodity merchandising and the operation of terminal grain elevator amenities. The commerce section contributed over 70% of the corporate’s income in 2021.

On Could 4th, 2022, The Andersons launched its first-quarter 2022 outcomes. For the quarter the corporate reported income of $3.98 billion, a rise of 53% versus Q1 2021, and adjusted earnings per diluted share of $0.18, down 48% versus Q1 2021.

Supply: Investor Presentation

Plant Nutrient and Renewables had robust first quarter outcomes offset by a decline within the Commerce Group’s year-over-year outcomes. Commerce Group reported pre-tax earnings of $3.7 million in comparison with $14.3 million in the identical interval of 2021. That is primarily as a result of a big run-up in commodity costs ensuing from the battle in Ukraine and drop in foundation values, primarily in corn and soybeans.

The Andersons has a modest progress ambition for the approaching years. Administration offered a “technique for progress” plan with an adjusted EBITDA between $375 – $400 million in 2025.

The corporate has an extended historical past of paying dividends and has elevated its payout for 26 consecutive years. Shares presently yield 1.9%. Whole returns are estimated at 15.5% per 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on ANDE (preview of web page 1 of three proven under):

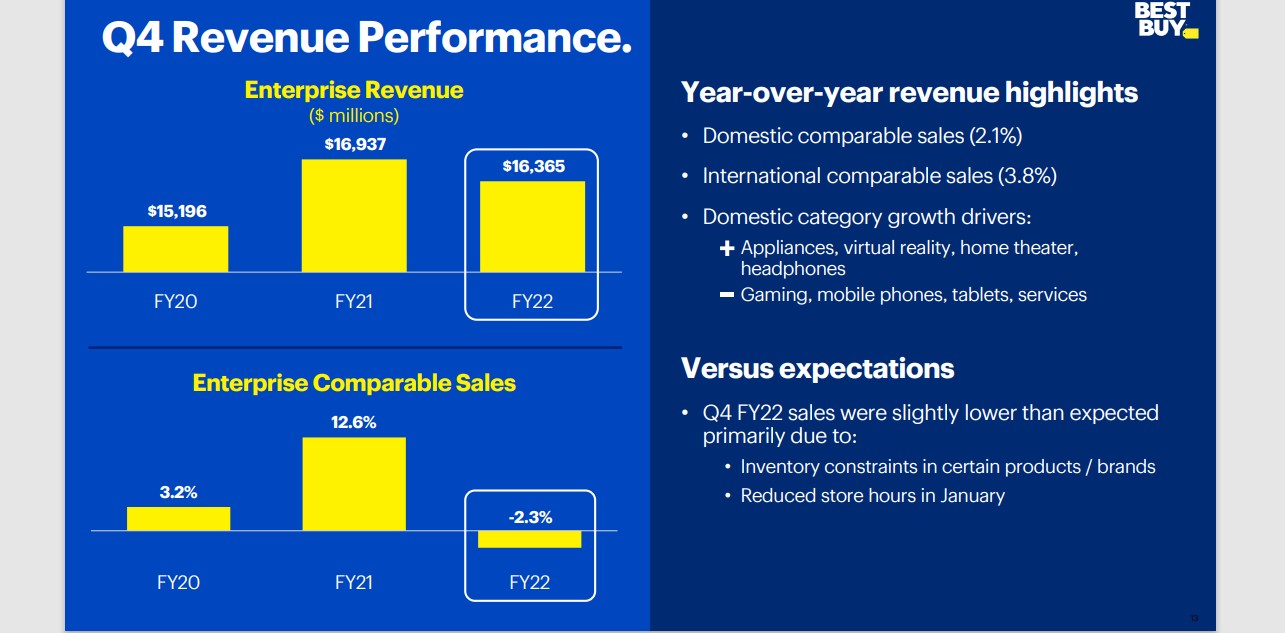

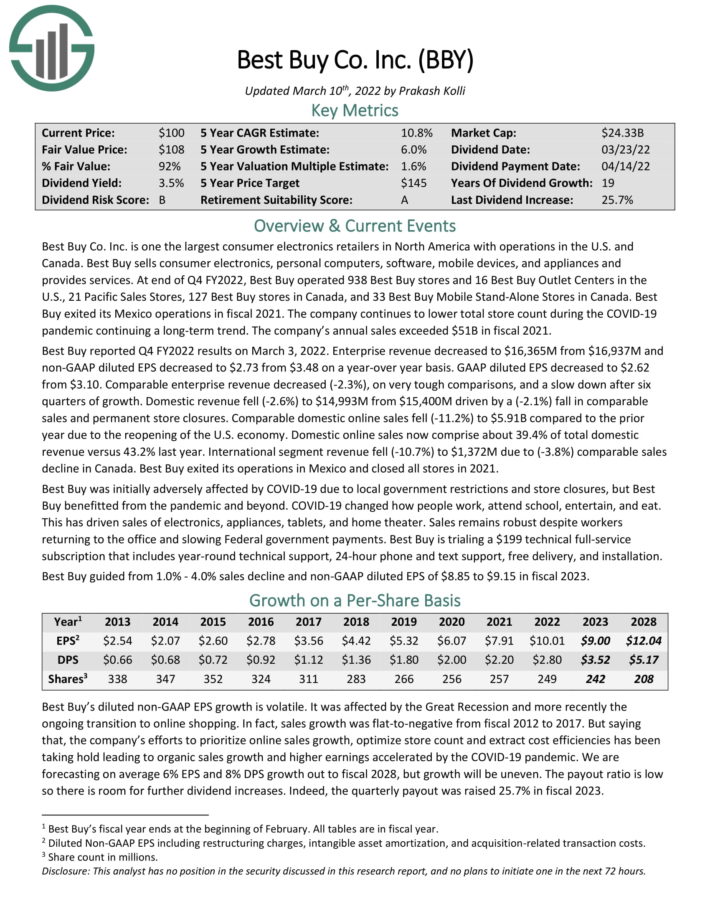

Blue-Chip Inventory #6: Finest Purchase (BBY)

- Dividend Historical past: 19 years of consecutive will increase

- Dividend Yield: 4.4%

- Anticipated Whole Return: 15.8%

Finest Purchase Co. Inc. is one the biggest client electronics retailers in North America with operations within the U.S. and Canada. Finest Purchase sells client electronics, private computer systems, software program, cell gadgets, and home equipment and supplies companies. At finish of This fall FY2022, Finest Purchase operated 938 Finest Purchase shops and 16 Finest Purchase Outlet Facilities within the U.S., 21 Pacific Gross sales Shops, 127 Finest Purchase shops in Canada, and 33 Finest Purchase Cellular Stand-Alone Shops in Canada. The corporate’s annual gross sales exceeded $51B in fiscal 2021.

Finest Purchase reported This fall FY2022 outcomes on March third, 2022. Enterprise income decreased to $16.365 billion from $16.937 billion. Non-GAAP diluted EPS decreased to $2.73 from $3.48 on a year-over 12 months foundation. Comparable enterprise income decreased (-2.3%), on very powerful comparisons, and a decelerate after six quarters of progress.

Supply: Investor Presentation

Comparable home on-line gross sales fell (-11.2%) to $5.91B in comparison with the prior 12 months because of the reopening of the U.S. financial system. Home on-line gross sales now comprise about 39.4% of complete home income versus 43.2% final 12 months.

Finest Purchase guided from 1.0% – 4.0% gross sales decline and non-GAAP diluted EPS of $8.85 to $9.15 in fiscal 2023.

We anticipate annual returns of 15.8% over the following 5 years for Finest Purchase inventory. Shares presently yield 4.4%, whereas we anticipate 6% annual EPS progress. Growth of the P/E a number of might increase returns by 5.4% per 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on Finest Purchase (preview of web page 1 of three proven under):

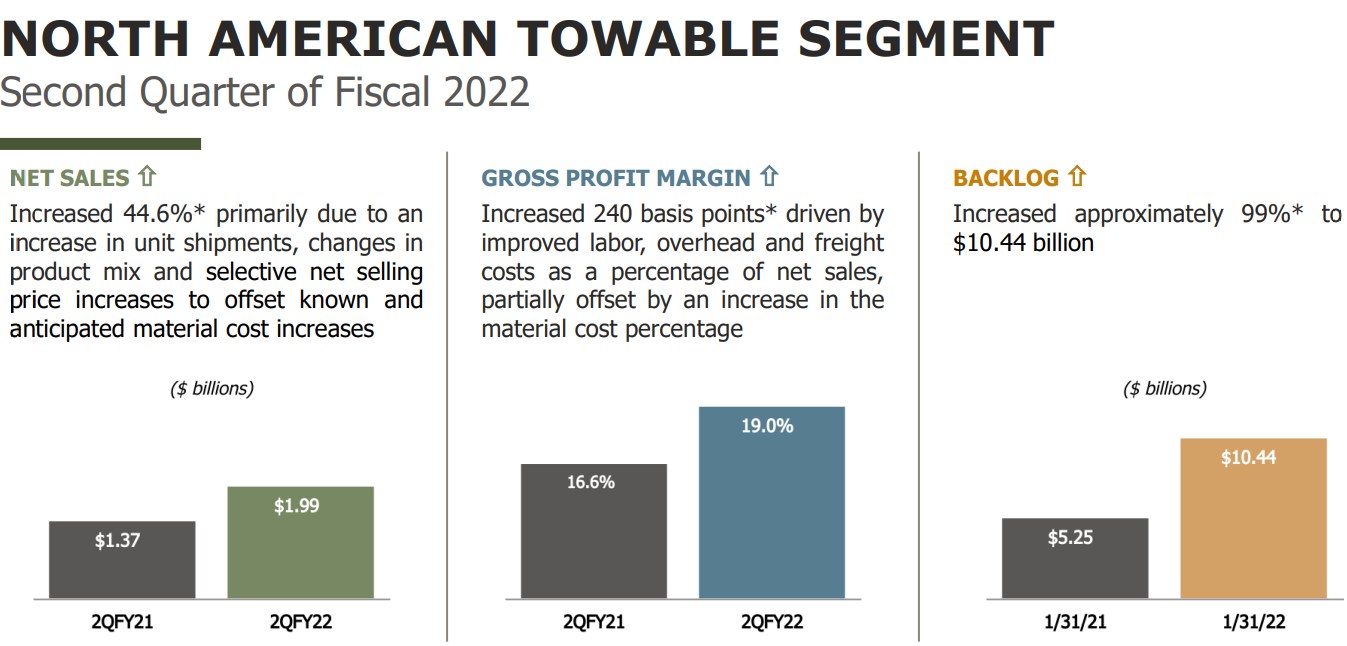

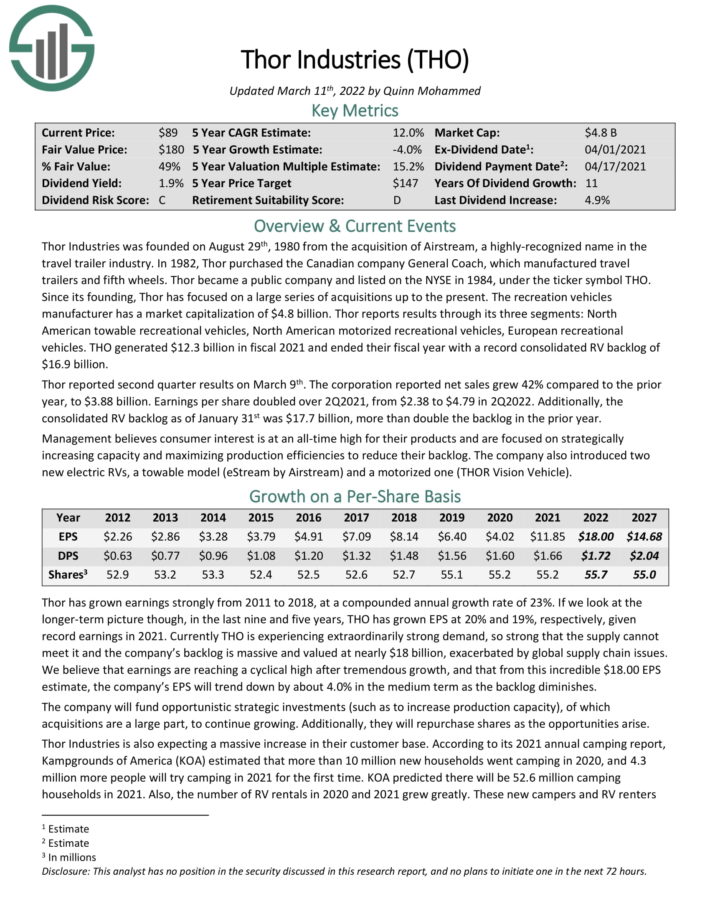

Blue-Chip Inventory #5: Thor Industries (THO)

- Dividend Historical past: 11 years of consecutive will increase

- Dividend Yield: 2.3%

- Anticipated Whole Return: 15.8%

Thor Industries was based on August twenty ninth, 1980 from the acquisition of Airstream, a highly-recognized title within the journey trailer trade. In 1982, Thor bought the Canadian firm Common Coach, which manufactured journey trailers and fifth wheels.

Since its founding, Thor has targeted on a big collection of acquisitions as much as the current. The recreation autos producer has a market capitalization of $4.8 billion. Thor studies outcomes by way of its three segments: North American towable leisure autos, North American motorized leisure autos, European leisure autos. THO generated $12.3 billion in fiscal 2021 and ended their fiscal 12 months with a report consolidated RV backlog of $16.9 billion.

Thor reported second quarter outcomes on March ninth. The company reported web gross sales grew 42% in comparison with the prior 12 months, to $3.88 billion.

The towable section led the best way final quarter.

Supply: Investor Presentation

Earnings per share doubled over 2Q2021, from $2.38 to $4.79 in 2Q2022. Moreover, the consolidated RV backlog as of January thirty first was $17.7 billion, greater than double the backlog within the prior 12 months.

Administration believes client curiosity is at an all-time excessive for his or her merchandise and are targeted on strategically rising capability and maximizing manufacturing efficiencies to scale back their backlog. The corporate additionally launched two new electrical RVs, a towable mannequin (eStream by Airstream) and a motorized one (THOR Imaginative and prescient Car).

We anticipate 15.8% returns yearly, comprised of -4% EPS progress, the two.3% dividend yield, and a ~17.5% annual increase from an increasing P/E a number of.

Click on right here to obtain our most up-to-date Positive Evaluation report on Thor (preview of web page 1 of three proven under):

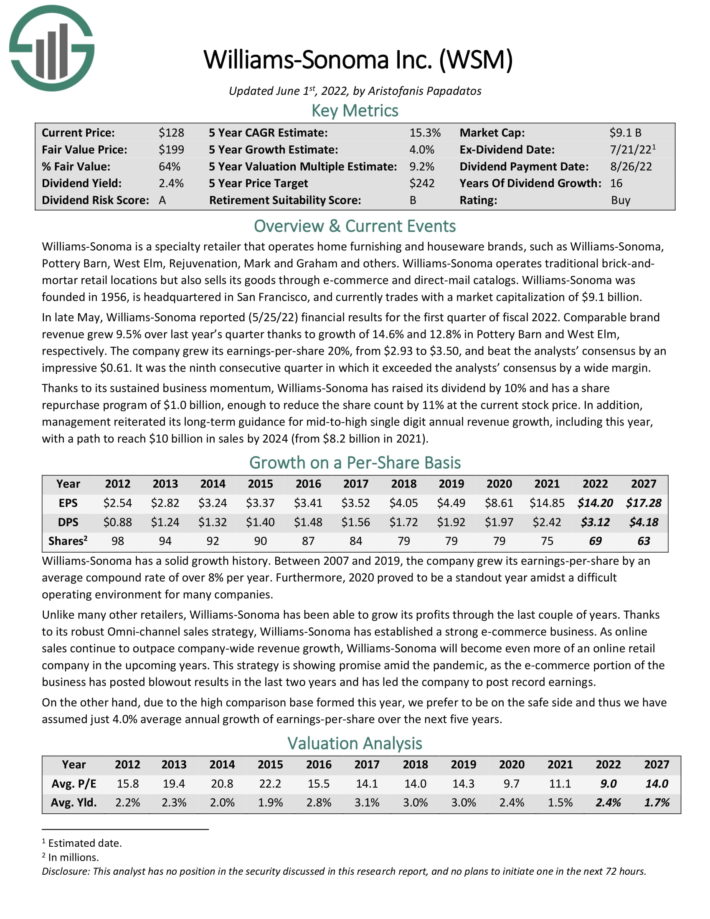

Blue-Chip Inventory #4: Williams-Sonoma (WSM)

- Dividend Historical past: 16 years of consecutive will increase

- Dividend Yield: 2.5%

- Anticipated Whole Return: 15.8%

Williams-Sonoma is a specialty retailer that operates dwelling furnishing and houseware manufacturers, akin to Williams-Sonoma, Pottery Barn, West Elm, Rejuvenation, Mark and Graham and others.

Supply: Investor Presentation

In late Could, Williams-Sonoma reported (5/25/22) monetary outcomes for the primary quarter of fiscal 2022. Comparable model income grew 9.5% over final 12 months’s quarter due to progress of 14.6% and 12.8% in Pottery Barn and West Elm, respectively. The corporate grew its earnings-per-share 20%, from $2.93 to $3.50, and beat the analysts’ consensus by a powerful $0.61. It was the ninth consecutive quarter during which it exceeded the analysts’ consensus by a large margin.

Because of its sustained enterprise momentum, Williams-Sonoma has raised its dividend by 10% and has a share repurchase program of $1.0 billion, sufficient to scale back the share depend by 11% on the present inventory value. As well as, administration reiterated its long-term steerage for mid-to-high single digit annual income progress, together with this 12 months, with a path to succeed in $10 billion in gross sales by 2024 (from $8.2 billion in 2021).

Because of its sustained enterprise momentum, Williams-Sonoma raised its dividend by 10%. We anticipate annual returns of 15.8% per 12 months, pushed by anticipated EPS progress of 4% per 12 months, the two.5% dividend yield, and a ~9.3% annual increase from an increasing P/E a number of.

Click on right here to obtain our most up-to-date Positive Evaluation report on Williams-Sonoma (preview of web page 1 of three proven under):

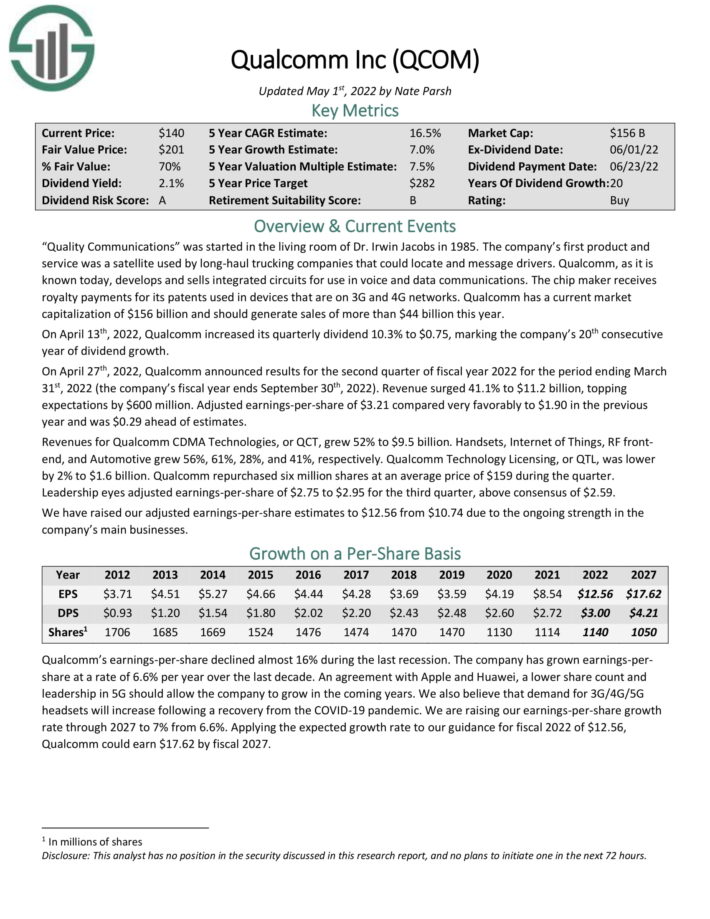

Blue-Chip Inventory #3: Qualcomm Inc. (QCOM)

- Dividend Historical past: 20 years of consecutive will increase

- Dividend Yield: 2.1%

- Anticipated Whole Return: 16.5%

Qualcomm, as it’s recognized at this time, develops and sells built-in circuits to be used in voice and information communications. The chip maker receives royalty funds for its patents utilized in gadgets which are on 3G and 4G networks.

On April twenty seventh, 2022, Qualcomm introduced outcomes for the second quarter of fiscal 12 months 2022 for the interval ending March thirty first, 2022 (the corporate’s fiscal 12 months ends September thirtieth, 2022). Income surged 41.1% to $11.2 billion, topping expectations by $600 million. Adjusted earnings-per-share of $3.21 in contrast very favorably to $1.90 within the earlier 12 months and was $0.29 forward of estimates.

Qualcomm just lately elevated its dividend by 10%, and the inventory now yields 2.1%. The corporate has elevated its dividend for 20 consecutive years. We anticipate 7% annual EPS progress by way of 2027, resulting in 16.5% anticipated annual returns.

Click on right here to obtain our most up-to-date Positive Evaluation report on Qualcomm (preview of web page 1 of three proven under):

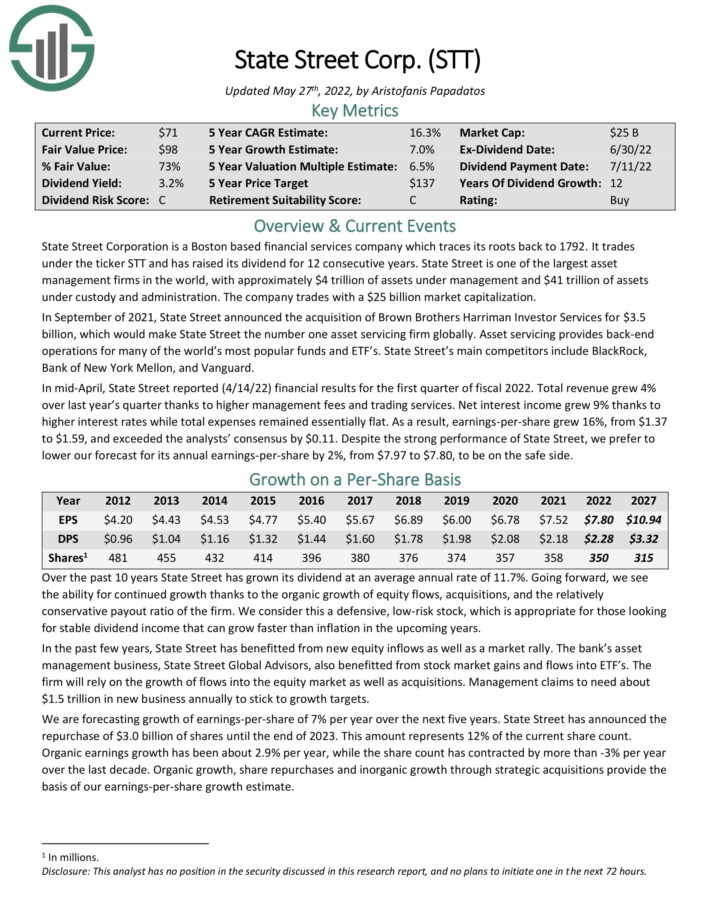

Blue-Chip Inventory #2: State Road (STT)

- Dividend Historical past: 12 years of consecutive will increase

- Dividend Yield: 3.3%

- Anticipated Whole Return: 17.2%

State Road Company is a Boston based mostly monetary companies firm which traces its roots again to 1792. State Road trades beneath the ticker STT and has elevated its dividend for 12 consecutive years. State Road is likely one of the largest asset administration companies on the planet with roughly $4 trillion of property beneath administration and $44 trillion of property beneath custody and administration.

In September of 2021, State Road introduced the acquisition of Brown Brothers Harriman Investor Providers for $3.5 billion, which might make State Road the primary asset servicing agency globally. Asset servicing supplies back-end operations for lots of the world’s hottest funds and ETF’s. State Road’s fundamental opponents embody BlackRock, Financial institution of New York Mellon, and Vanguard.

You’ll be able to see an summary of State Road’s first-quarter highlights within the picture under:

Supply: Investor Presentation

We anticipate annual returns of 16.8% per 12 months for State Road. This will probably be pushed by 7% anticipated EPS progress, plus the three.3% dividend yield and a large increase from an increasing P/E a number of.

Click on right here to obtain our most up-to-date Positive Evaluation report on State Road (preview of web page 1 of three proven under):

Blue-Chip Inventory #1: Stanley Black & Decker (SWK)

- Dividend Historical past: 54 years of consecutive will increase

- Dividend Yield: 2.8%

- Anticipated Whole Return: 18.0%

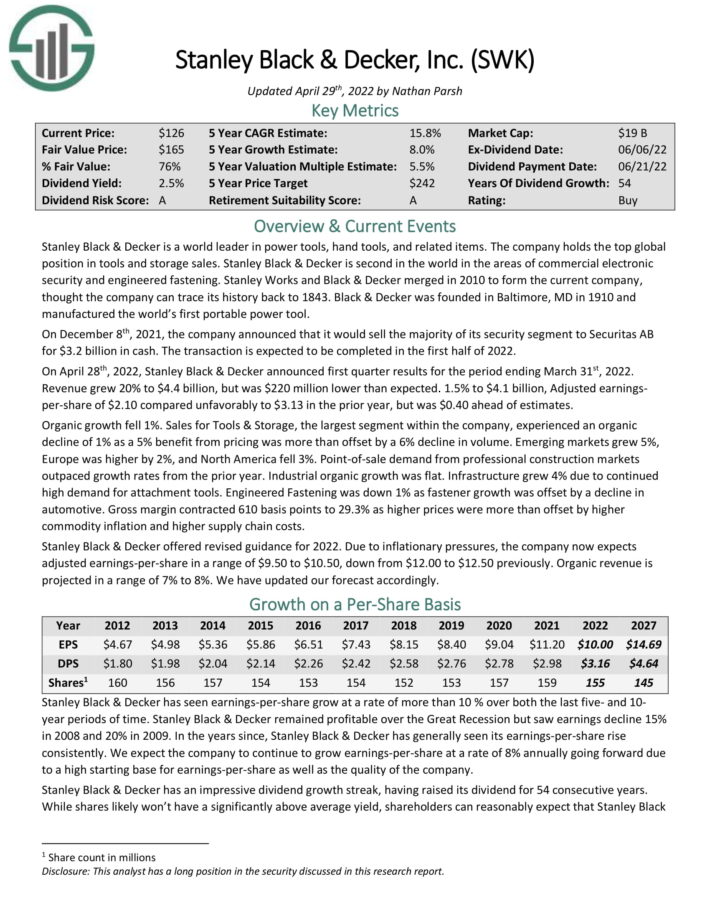

Stanley Black & Decker is a world chief in energy instruments, hand instruments, and associated gadgets. The corporate holds the highest international place in instruments and storage gross sales. Stanley Black & Decker is second in the world within the areas of business digital safety and engineered fastening.

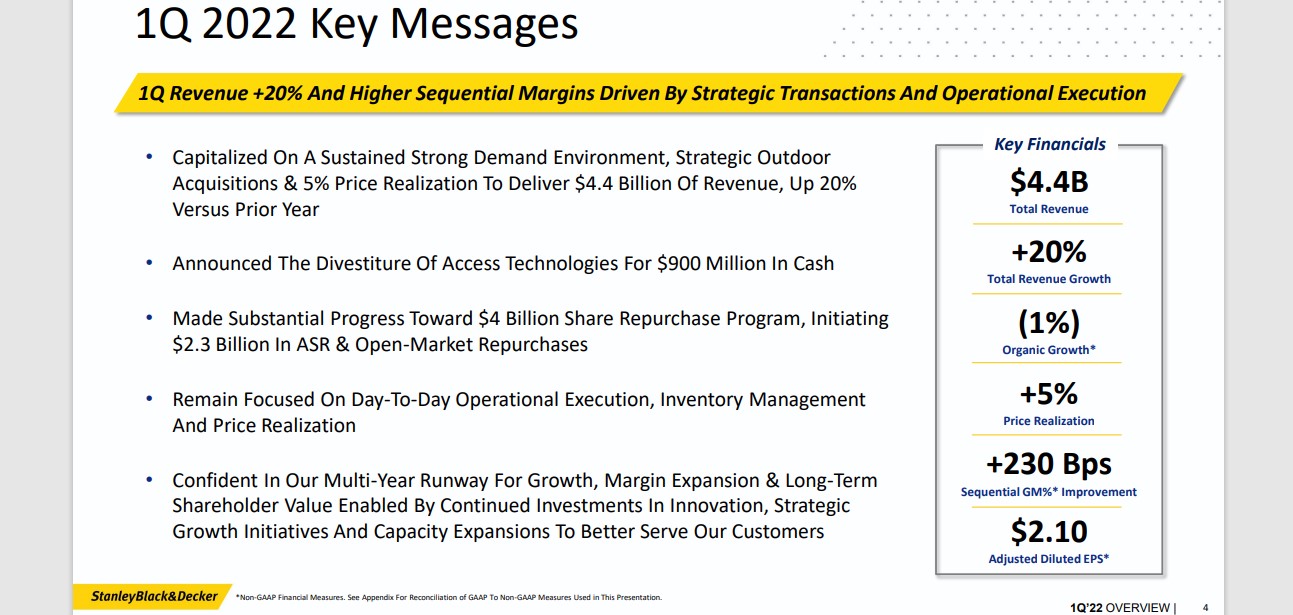

You’ll be able to see an summary of the corporate’s 2022 first-quarter efficiency within the picture under:

Supply: Investor Presentation

On April twenty eighth, 2022, Stanley Black & Decker introduced first quarter outcomes. Income grew 20% to $4.4 billion, however was $220 million decrease than anticipated. Adjusted earnings-per-share of $2.10 in contrast unfavorably to $3.13 within the prior 12 months, however was $0.40 forward of estimates. Natural progress fell 1%.

Stanley Black & Decker supplied revised steerage for 2022. On account of inflationary pressures, the corporate now expects adjusted earnings-per-share in a variety of $9.50 to $10.50, down from $12.00 to $12.50 beforehand. Natural income is projected in a variety of seven% to eight%.

The inventory has a 2.7% dividend yield, and we anticipate 8% annual EPS progress. With a ~7.3% annual increase from an increasing P/E a number of, complete returns are anticipated to succeed in 18.0% per 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on SWK (preview of web page 1 of three proven under):

Closing Ideas

Shares with lengthy histories of accelerating dividends are sometimes the very best shares to purchase for long-term dividend progress and excessive complete returns.

However simply because an organization has maintained an extended monitor report of dividend will increase, doesn’t essentially imply it can proceed to take action sooner or later.

Buyers have to individually assess an organization’s fundamentals, significantly in instances of financial misery.

These 7 blue-chip shares have engaging dividend yields, and lengthy histories of elevating their dividends annually. In addition they have compelling valuations that make them engaging picks for buyers keen on complete returns.

The Blue Chips record is just not the one method to shortly display screen for shares that commonly pay rising dividends.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].