xijian/iStock through Getty Photographs

This text first appeared on Pattern Investing on Could 20, 2022 when the TAN ETF was at US$66.72, however has been up to date for this text.

2022 Bear Market Bargains Collection – Invesco Photo voltaic ETF (NYSEARCA:TAN) (“TAN”)

Because the 2022 U.S fairness bear market continues (S&P 500 index is now at 3,674, down 22.90% YTD, PE is now 18.37), we check out the Invesco Photo voltaic ETF (TAN) (“TAN”).

For a background on the TAN ETF you may learn our previous articles:

Invesco Photo voltaic ETF

Invesco Photo voltaic ETF (“TAN”) – Worth = USD 70.13

Yahoo Finance

The renewable vitality sector (photo voltaic, wind, hydro, geothermal and many others.,) appears to be like set to be a winner because the world accelerates its shift away from fossil fuels. Simply final month the European Union (“EU”) unveiled a “multi-billion Euro plan to chop crimson tape for photo voltaic and wind farms” to assist cut back dependence on Russian fossil fuels. The Monetary Instances reported “EU drive for brand new clear vitality may see photo voltaic panels on all new buildings.”

The Invesco Photo voltaic ETF (to be known as “TAN”) is a broad strategy to play the photo voltaic vitality sector. The ETF is at present comprised of 51 world corporations. The expense ratio is 0.66percentpa.

Invesco defines their TAN fund stating:

The Invesco Photo voltaic ETF [FUND] is predicated on the MAC International Photo voltaic Vitality Index [INDEX]. The Fund will make investments not less than 90% of its whole property within the securities, American depositary receipts [ADRS] and world depositary receipts [GDRs] that comprise the Index. The Index is comprised of corporations within the photo voltaic vitality trade. The index is computed utilizing the web return, which withholds relevant taxes for non-resident buyers. The Fund and the Index are rebalanced quarterly.

Be aware: You’ll be able to learn extra on the MAC International Photo voltaic Vitality Inventory Index (SUNDIX) right here.

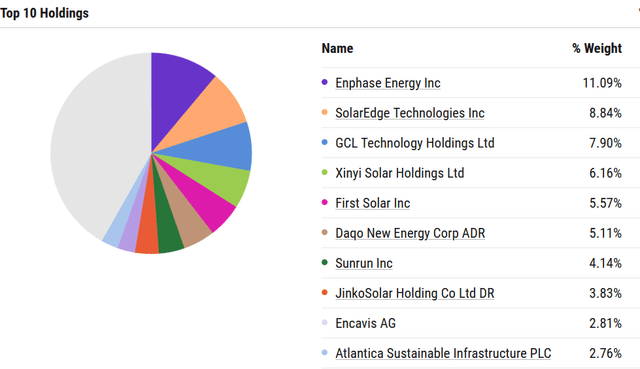

As proven beneath within the high ten holdings, photo voltaic inverter corporations Enphase Vitality (ENPH) (11.09%) and SolarEdge Applied sciences (SEDG) (8.84%) maintain the highest two positions within the fund. GCL Know-how Holdings Restricted [HK:3800] (previously GCL-Poly Vitality Holdings Ltd) (7.90%) produces polysilicon merchandise and operates as a globally main developer and producer of excessive effectivity photovoltaic (“PV’) supplies. Xinyi Photo voltaic Holdings [HK:0968] (6.16%) is a producer and vendor of photo voltaic glass. First Photo voltaic Inc. (FSLR) (5.57%) is an American producer of photo voltaic panels and a supplier of utility-scale PV energy crops and supporting providers.

Nearly all of the stability of holdings are largely photo voltaic panel producers or photo voltaic supplies and components suppliers.

Prime ten holdings of the TAN ETF

YCharts

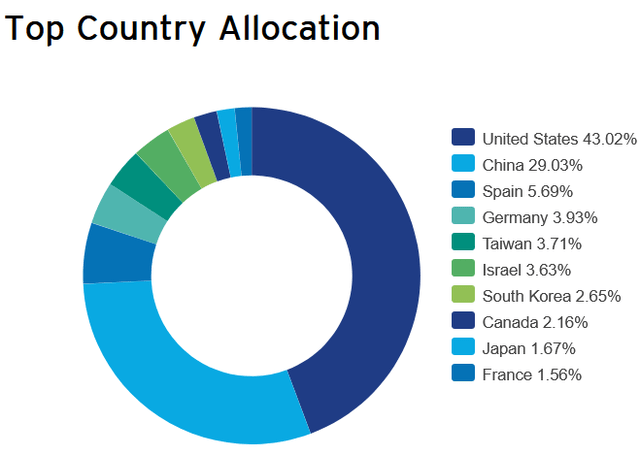

Nation allocation (firm headquarters) is dominated by USA (43.02%) and China (29.03%).

Nation weightings (as of June 17, 2022)

Invesco

Supply: Invesco

Valuation

TAN’s present PE is nineteen.43. Dividend yield is 0%. The fund is buying and selling on a 0.09% NTA premium.

The TAN ETF is buying and selling at US$70.13 with its 52 week low at US$55.60 and effectively off its 52 week excessive of US$101.58.

Our view is that the valuation is sort of enticing given the very robust progress outlook for the photo voltaic vitality sector this decade.

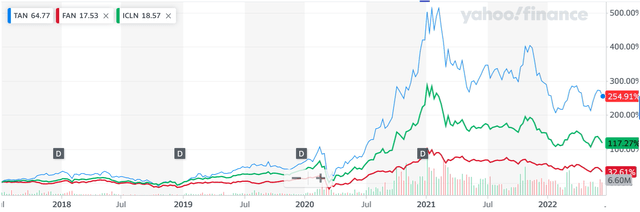

Peer comparability

Wanting on the desk beneath TAN has a barely decrease PE than another renewable vitality funds such because the First Belief International Wind Vitality ETF (FAN) and the iShares International Clear Vitality ETF (ICLN). It must be famous, nonetheless, the TAN ETF has a decrease dividend yield.

| Present PE | Dividend yield | |

| TAN | 19.43 | 0% |

| FAN | 20.13 | 2.01% |

| ICLN | 22.86 | 1.43% |

Comparability of previous 5 12 months inventory worth good points for TAN [blue], FAN [red], and ICLN [green]

Yahoo Finance

Supply: Yahoo Finance

Feedback on the TAN ETF and the photo voltaic sector

The TAN ETF presents a easy and simple strategy to get broad publicity to the vast majority of the bigger listed world photo voltaic vitality sector corporations. It does imply taking some China publicity with the TAN fund’s China allocation at present at 29.03%, lots of that are Chinese language American Depository Receipts [ADRs] which have their very own dangers (see dangers part).

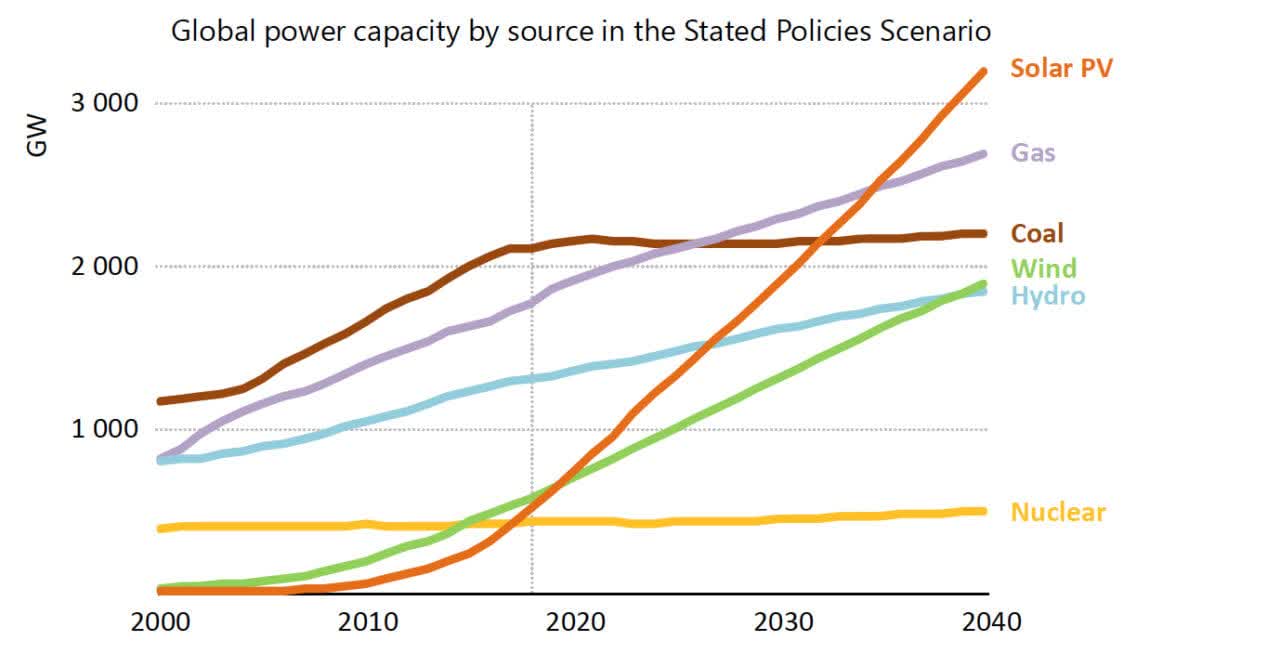

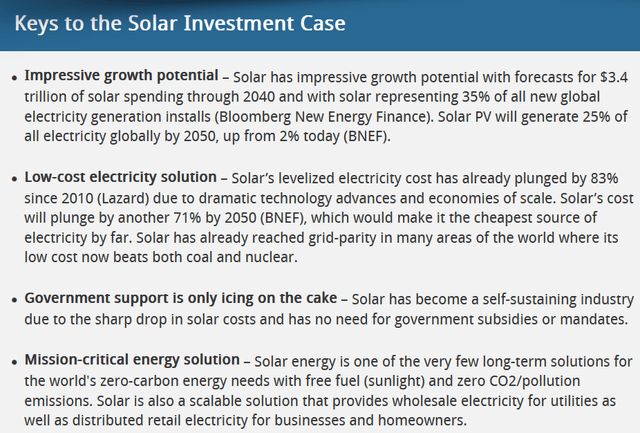

Photo voltaic vitality is, in lots of areas, now one of many most cost-effective types of vitality manufacturing and one of many quickest rising sectors of recent vitality manufacturing globally. As proven beneath the IEA forecasts photo voltaic to be by far the quickest rising vitality sector from now to 2040.

IEA forecasts world renewables to surge led by photo voltaic & wind

IEA

Supply: PowerMag courtesy IEA

MAC International Photo voltaic Vitality Inventory Index web site

Dangers

- A slowdown within the photo voltaic sector.

- Extra competitors (Tesla (TSLA) has mentioned it would make photo voltaic inverters they usually already make photo voltaic roofs), provide chain dangers (semiconductor chip shortages, polysilicon provide and many others), know-how change (new photo voltaic cells and many others could threaten the present leaders). A number of photo voltaic panels and photo voltaic supplies are made in China the place competitors is intense.

- Authorities laws – Photo voltaic subsidies could possibly be diminished.

- ETF dangers – Invesco administration of the fund. The TAN ETF may commerce beneath its web tangible property (“NTA”) worth. Extra particulars particular to the TAN ETF’s dangers are right here.

- Sovereign threat – Usually low to reasonable for the TAN fund. Threat largely resulting from its China publicity (29.03%).

- Inventory market dangers – Market sentiment. Liquidity appears to be like to be okay. There was previous speak of Chinese language ADRs being de-listed by 2024. Latest information linked beneath provides some hope for an answer.

- China’s plan to save lots of US-listed corporations from delisting

- China and U.S. Negotiate On-Website Audit Checks as Delistings Loom

Be aware: Usually, the chance of shopping for right into a diversified fund is way decrease than shopping for right into a single inventory. There’s nonetheless nonetheless the chance that the entire sector (photo voltaic vitality) does poorly, or the entire inventory market does poorly.

Additional studying

- Could 19, 2021 – “Photo voltaic, clear vitality shares surge once more on Europe’s deliberate inexperienced push. Photo voltaic shares are scorching in Thursday’s buying and selling, rallying for a second straight session after the European Union unveiled a plan to chop crimson tape for photo voltaic and winds installations in an effort to scale back reliance on Russian fossil fuels.”

- Invesco Photo voltaic web site

- TAN Factsheet – March 31, 2022

- Invesco Semi-Annual Report back to Shareholders – Feb. 2022

Conclusion

The shift in direction of renewable vitality resembling photo voltaic and wind is a robust development this decade and past. The renewable vitality sector has been considerably out of favor in current months as many nations continued to decide on the simple choice of their current vitality sources, together with coal and fuel. Nevertheless the Russia-Ukraine struggle is main the EU and others to speed up a transfer in direction of renewable vitality and away from Russian oil and fuel. Final month’s announcement {that a} “EU drive for brand new clear vitality may see photo voltaic panels on all new buildings” is probably an enormous constructive for the sector if put into laws.

Valuation appears to be like fairly enticing on a present PE of 19.43, given the sector’s very robust progress outlook this decade.

Dangers revolve largely across the photo voltaic sector performing poorly. Additionally some provide chain and China dangers, together with potential China ADR de-listings in 2024. Please learn the dangers part.

We view TAN as a purchase, appropriate for a 5 12 months plus time-frame, particularly in case you are constructive on the outlook for photo voltaic vitality progress this decade. Safer to purchase in phases in case we see additional falls because of the present very poor market sentiment.

As traditional, all feedback are welcome.