Updated on November 16th, 2022 by Bob Ciura

Business Development Companies, otherwise known as BDCs, are highly popular among income investors. BDCs widely have high dividend yields of 5% or higher.

This makes BDCs very appealing for income investors such as retirees. With this in mind, we’ve created a list of BDCs.

You can download your free copy of our BDC list, along with relevant financial metrics such as P/E ratios and dividend payout ratios, by clicking on the link below:

Of course, before investing in BDCs, investors should understand the unique characteristics of the sector.

This article will provide an overview of BDCs. It will also list our top 5 BDCs right now as ranked by expected total returns in The Sure Analysis Research Database.

Table Of Contents

The table of contents below provides for easy navigation of the article:

Overview of BDCs

Business Development Companies are closed-end investment firms. Their business model involves making debt and/or equity investments in other companies, typically small or mid-size businesses.

These target companies may not have access to traditional means of raising capital, which makes them suitable partners for a BDC. BDCs invest in a variety of companies, including turnarounds, developing, or distressed companies.

BDCs are registered under the Investment Company Act of 1940. As they are publicly-traded, BDCs must also be registered with the Securities and Exchange Commission.

To qualify as a BDC, the firm must invest at least 70% of its assets in private or publicly-held companies with market capitalizations of $250 million or below.

BDCs make money by investing with the goal of generating income, as well as capital gains on their investments if and when they are sold.

In this way, BDCs operate similar business models as a private equity firm or venture capital firm.

The major difference is that private equity and venture capital investment is typically restricted to accredited investors, while anyone can invest in publicly-traded BDCs.

Why Invest In BDCs?

The obvious appeal for BDCs is their high dividend yields. It is not uncommon to find BDCs with dividend yields above 5%. In some cases, certain BDCs provide 10%+ yields.

Of course, investors should conduct a thorough amount of due diligence, to make sure the underlying fundamentals support the dividend.

As always, investors should avoid dividend cuts whenever possible. Any stock that has an abnormally high yield is a potential danger.

Indeed, there are multiple risk factors that investors should know before they invest in BDCs. First and foremost, BDCs are often heavily indebted. This is commonplace across BDCs, as their business model involves borrowing to make investments in other companies. The end result is that BDCs are often significantly leveraged companies.

When the economy is strong and markets are rising, leverage can help amplify positive returns. However, the flip side is that leverage can accelerate losses as well, which can happen in bear markets or recessions.

Another risk to be aware of is interest rates. Since the BDC business model heavily utilizes debt, investors should understand the interest rate environment before investing. For example, rising interest rates can negatively affect BDCs if it causes a spike in borrowing costs.

That said, BDCs may benefit from falling interest rates. In the current climate of low interest rates, many BDCs could see a tailwind.

Lastly, credit risk is an additional consideration for investors. As previously mentioned, BDCs make investments in small to mid-size businesses.

Therefore, the quality of the BDC’s portfolio must be assessed, to make sure the BDC will not experience a high level of defaults within its investment portfolio. This would cause adverse results for the BDC itself, which could negatively impact its ability to maintain distributions to shareholders.

Another unique characteristic of BDCs that investors should know before buying is taxation. BDC dividends are typically not “qualified dividends” for tax purposes, which is generally a more favorable tax rate. Instead, BDC distributions are taxable at the investor’s ordinary income rates, while the BDC’s capital gains and qualified dividend income is taxed at capital gains rates.

After taking all of this into account, investors might decide that BDCs are a good fit for their portfolios. If that is the case, income investors might consider one of the following BDCs.

Tax Considerations Of BDCs

As always, investors should understand the tax implications of various securities before purchasing. Business Development Companies must pay out 90%+ of their income as distributions. In this way, BDCs are very similar to Real Estate Investment Trusts.

Another factor to keep in mind is that approximately 70% to 80% of BDC dividend income is typically derived from ordinary income. As a result, BDCs are widely considered to be good candidates for a tax-advantaged retirement account such as an IRA or 401k.

BDCs pay their distributions as a mix of ordinary income and non-qualified dividends, qualified dividends, return of capital, and capital gains.

Returns of capital reduce your tax basis. Qualified dividends and long-term capital gains are taxed at lower rates, while ordinary income and non-qualified dividends are taxed at your personal income tax bracket rate.

The Top 5 BDCs Today

With all this in mind, here are our top 5 BDCs today, ranked according to their expected annual returns over the next five years.

BDC #5: Main Street Capital (MAIN)

- 5-year expected annual return: 11.4%

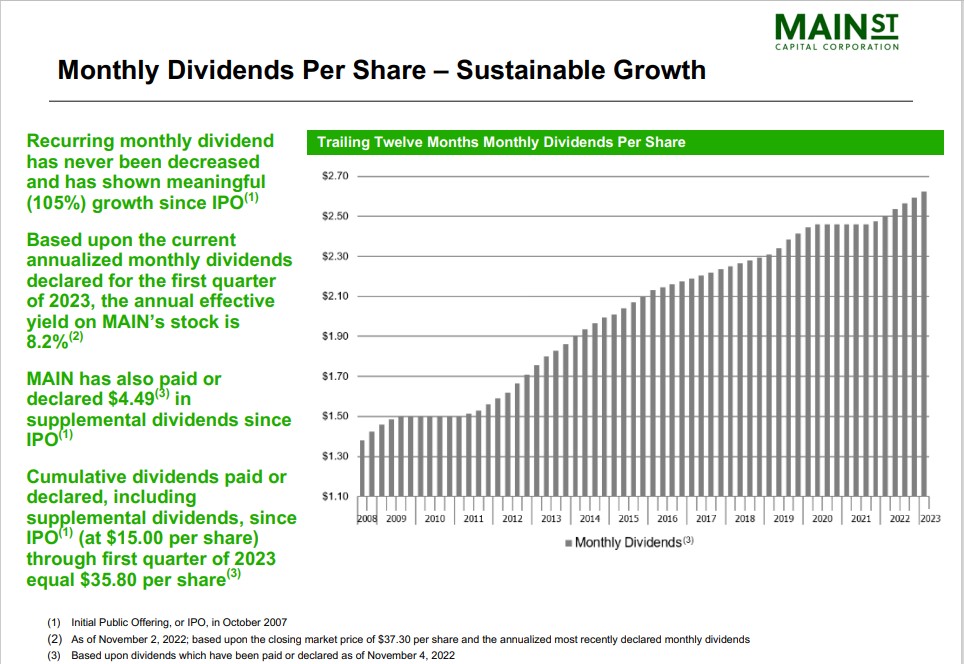

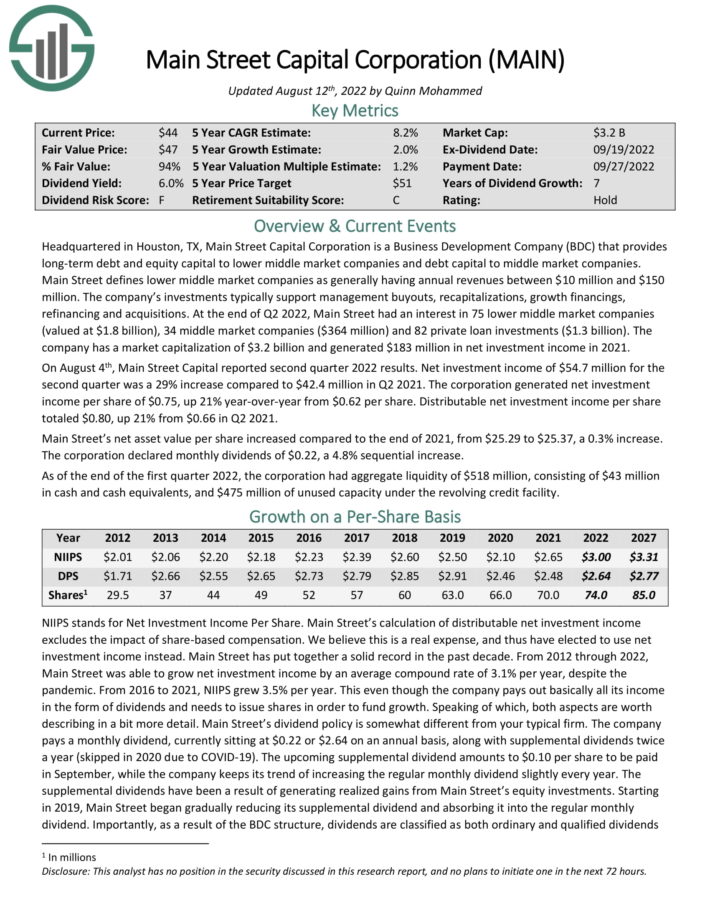

Main Street Capital Corporation provides long-term debt and equity capital to lower middle market companies and debt capital to middle market companies. Main Street defines lower middle market companies as generally having annual revenues between $10 million and $150 million. The company’s investments typically support management buyouts, recapitalizations, growth financings, refinancing and acquisitions.

Main Street is a monthly dividend stock.

Source: Investor Presentation

At the end of Q2 2022, Main Street had an interest in 75 lower middle market companies (valued at $1.8 billion), 34 middle market companies ($364 million) and 82 private loan investments ($1.3 billion).

On August 4th, Main Street Capital reported second quarter 2022 results. Net investment income of $54.7 million for the second quarter was a 29% increase compared to $42.4 million in Q2 2021. The corporation generated net investment income per share of $0.75, up 21% year-over-year from $0.62 per share. Distributable net investment income per share totaled $0.80, up 21% from $0.66 in Q2 2021.

Main Street’s net asset value per share increased compared to the end of 2021, from $25.29 to $25.37, a 0.3% increase. The corporation declared monthly dividends of $0.22, a 4.8% sequential increase.

Click here to download our most recent Sure Analysis report on Main Street (preview of page 1 of 3 shown below):

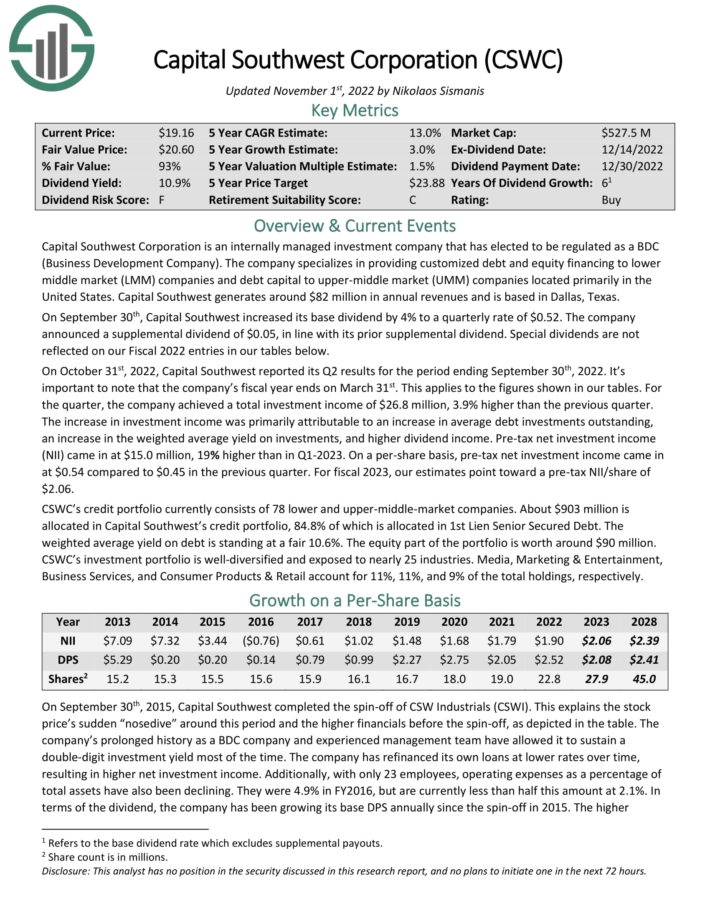

BDC #4: Capital Southwest Corp. (CSWC)

- 5-year expected annual return: 13.8%

Capital Southwest Corporation is an internally managed BDC. The company specializes in providing customized debt and equity financing to lower middle market (LMM) companies and debt capital to upper-middle market (UMM) companies located primarily in the United States. Capital Southwest generates around $68 million in annual revenues.

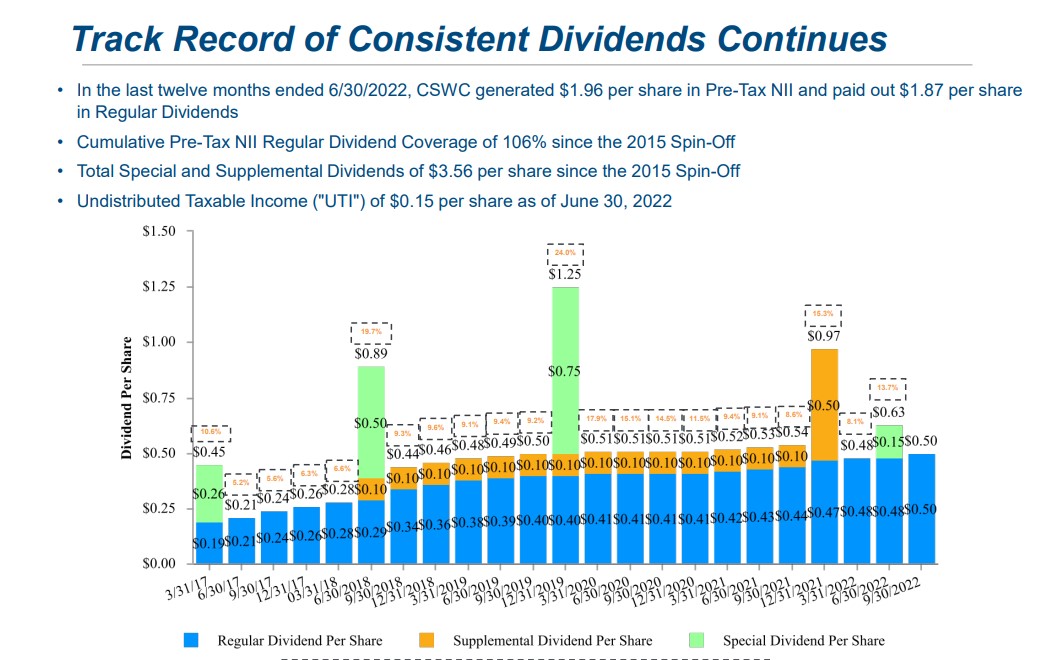

The company has a long history of paying out regular and supplemental dividends.

Source: Investor Presentation

On August 1st, 2022, Capital Southwest reported its Q1 results for the period ending June 30th, 2022. For the quarter, the company achieved a total investment income of $22.5 million, 7.1% higher than the previous quarter.

The increase in investment income was primarily attributable to an increase in average debt investments outstanding and an increase in prepayment fees received from portfolio companies. Pre-tax net investment income (NII) came in at $12.6 million, 5% higher versus Q4-2022. However, due to a higher share count, pre-tax EPS came in at $0.50, stable quarter-overquarter.

Along with its results, management announced a 4.2% increase in the regular dividend to a quarterly rate of $0.50. The company also paid a $0.15 special dividend per share during the quarter, which is not reflected in our tables and total returns estimates.

Click here to download our most recent Sure Analysis report on CSWC (preview of page 1 of 3 shown below):

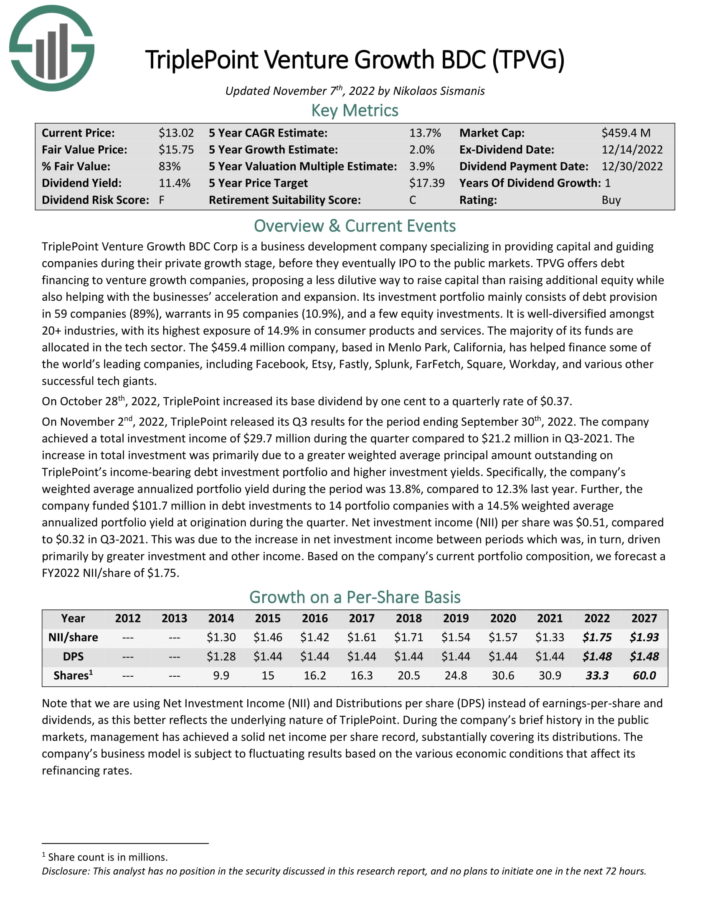

BDC #3: TriplePoint Venture Growth BDC (TPVG)

- 5-year expected annual return: 13.9%

TriplePoint Venture Growth BDC Corp specializes in providing capital and guiding companies during their private growth stage, before they eventually IPO to the public markets.

TPVG offers debt financing to venture growth companies, proposing a less dilutive way to raise capital than raising additional equity while also helping with the businesses’ acceleration and expansion.

Source: Investor Presentation

Its investment portfolio consists of debt provision in 48 companies (86.3%), warrants in 86 companies (3.2%), and equity in just 42 companies (7.1%). It is well-diversified amongst 20+ industries, with its highest exposure of 14.9% in e-commerce clothing & accessories. The majority of its funds are allocated in the tech sector.

On October 28th, 2022, TriplePoint increased its base dividend by one cent to a quarterly rate of $0.37. On November 2nd, 2022, TriplePoint released its Q3 results for the period ending September 30th, 2022. The company achieved a total investment income of $29.7 million during the quarter compared to $21.2 million in Q3-2021. The increase in total investment was primarily due to a greater weighted average principal amount outstanding on TriplePoint’s income-bearing debt investment portfolio and higher investment yields.

Specifically, the company’s weighted average annualized portfolio yield during the period was 13.8%, compared to 12.3% last year. Further, the company funded $101.7 million in debt investments to 14 portfolio companies with a 14.5% weighted average annualized portfolio yield at origination during the quarter. Net investment income (NII) per share was $0.51, compared to $0.32 in Q3-2021.

Click here to download our most recent Sure Analysis report on TPVG (preview of page 1 of 3 shown below):

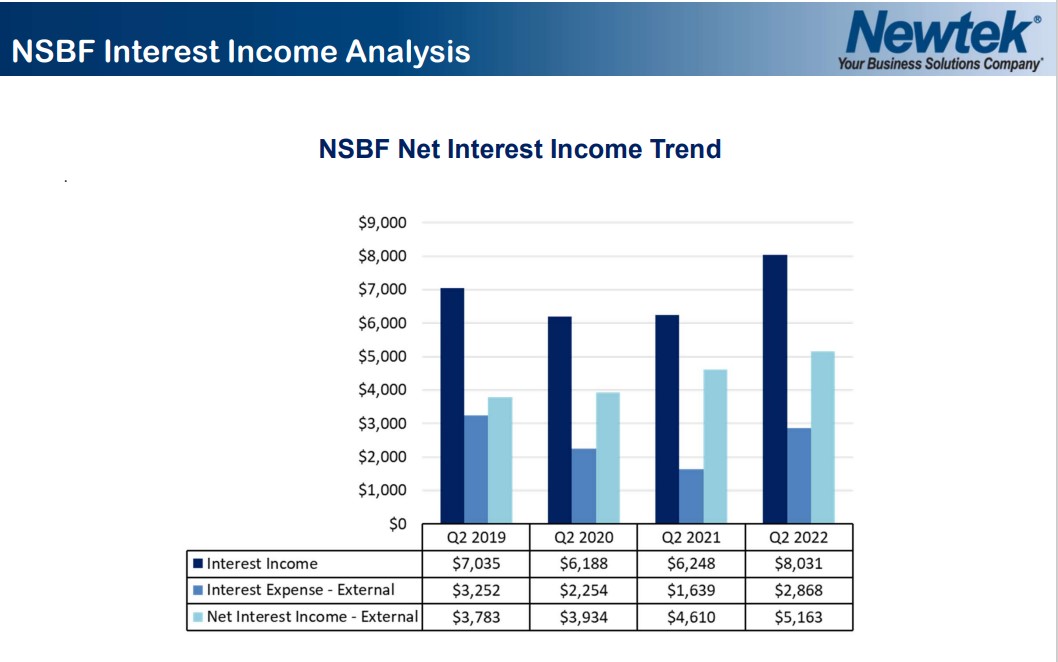

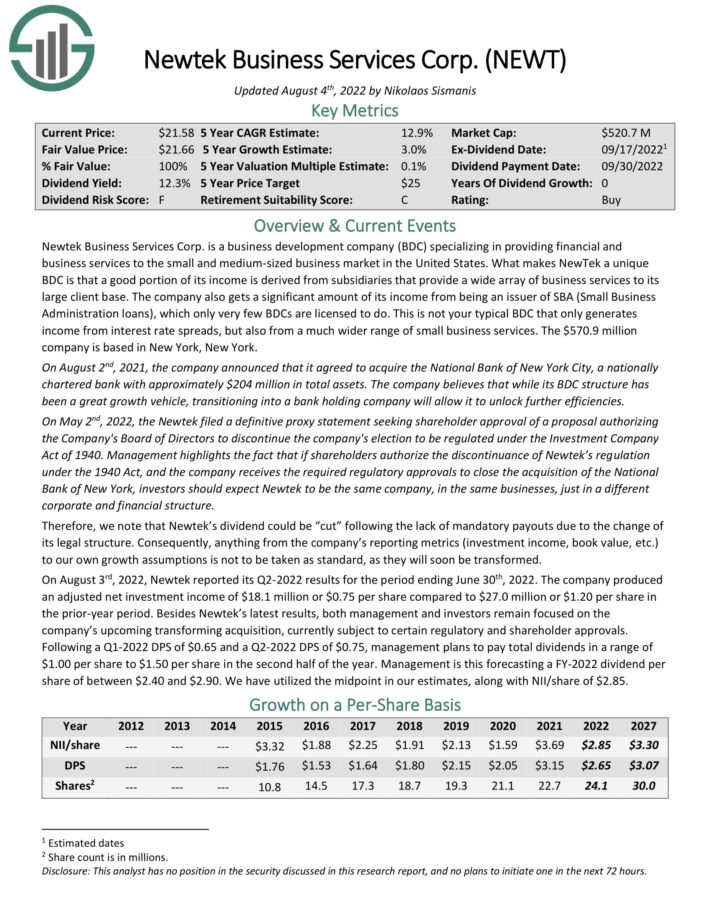

BDC #2: Newtek Business Services (NEWT)

- 5-year expected annual return: 20.4%

Newtek Business Services Corp. specializes in providing financial and business services to the small and medium–sized business market in the United States. What makes NewTek a unique BDC is that a good portion of its income is derived from subsidiaries that provide a wide array of business services to its large client base.

The company also gets a significant amount of its income from being an issuer of SBA (Small Business Administration loans), which very few BDCs are licensed to do. This is not your typical BDC that only generates income from interest rate spreads, but also from a much wider range of small business services.

Source: Investor Presentation

On August 3rd, 2022, Newtek reported its Q2-2022 results for the period ending June 30th, 2022. The company produced an adjusted net investment income of $18.1 million or $0.75 per share compared to $27.0 million or $1.20 per share in the prior-year period.

Click here to download our most recent Sure Analysis report on NEWT (preview of page 1 of 3 shown below):

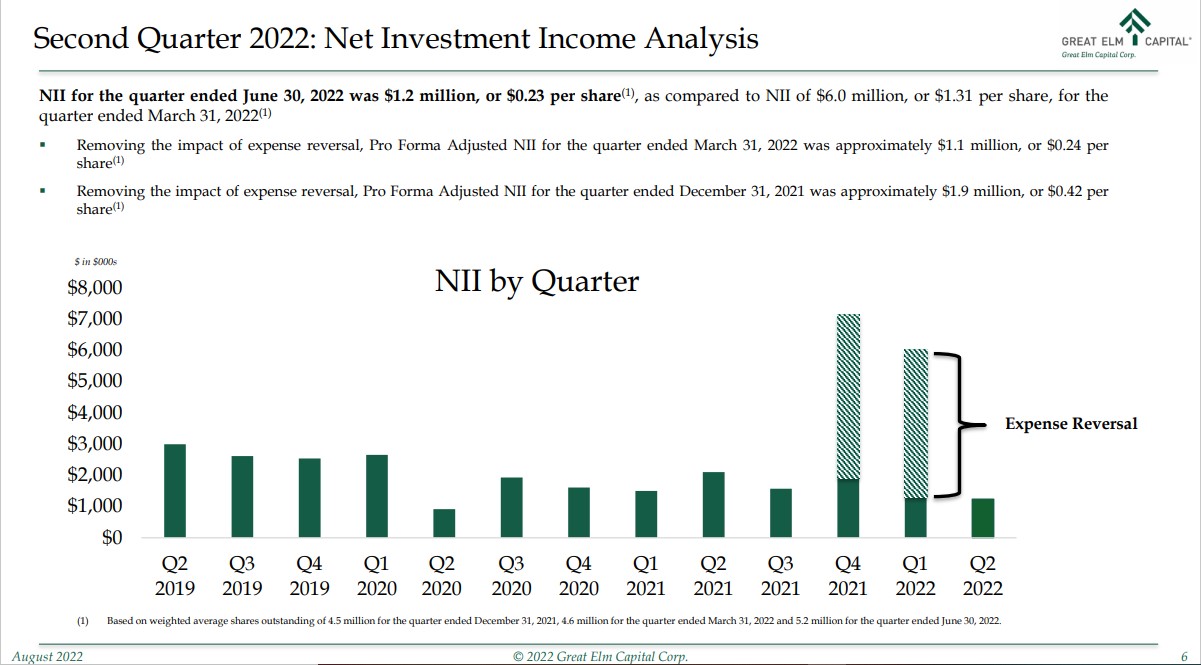

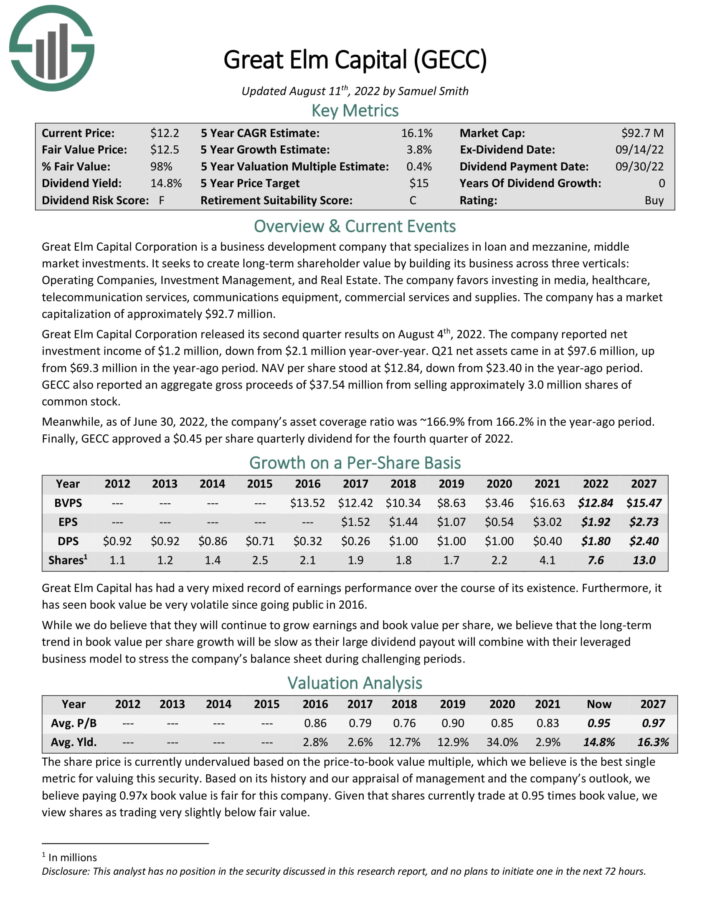

BDC #1: Great Elm Capital Corp. (GECC)

- 5-year expected annual return: 20.7%

Great Elm Capital Corporation is a business development company that specializes in loan and mezzanine, middle market investments. It seeks to create long–term shareholder value by building its business across three verticals: Operating Companies, Investment Management, and Real Estate.

The company favors investing in media, healthcare, telecommunication services, communications equipment, commercial services and supplies.

Great Elm Capital Corporation released its second quarter results on August 4th, 2022. The company reported net investment income of $1.2 million, down from $2.1 million year-over-year. Q21 net assets came in at $97.6 million, up from $69.3 million in the year-ago period.

Source: Investor Presentation

NAV per share stood at $12.84, down from $23.40 in the year-ago period. GECC also reported an aggregate gross proceeds of $37.54 million from selling approximately 3.0 million shares of common stock.

Meanwhile, as of June 30, 2022, the company’s asset coverage ratio was ~166.9% from 166.2% in the year-ago period. Finally, GECC approved a $0.45 per share quarterly dividend for the fourth quarter of 2022.

Click here to download our most recent Sure Analysis report on GECC (preview of page 1 of 3 shown below):

Final Thoughts

Business Development Companies allow everyday retail investors the opportunity to invest indirectly in small and mid-size businesses. Previously, investment in early-stage or developing companies was restricted to accredited investors, through venture capital.

And, BDCs have obvious appeal for income investors. BDCs widely have high dividend yields above 5%, and many BDCs pay dividends every month instead of the more typical quarterly payment schedule.

Of course, investors should consider all of the unique characteristics, including but not limited to the tax implications of BDCs. Investors should also be aware of the risk factors associated with investing in BDCs, such as the use of leverage, interest rate risk, and default risk.

If investors understand the various implications and make the decision to invest in BDCs, the 5 individual stocks on this list could provide attractive total returns and dividends over the next several years.

At Sure Dividend, we often advocate for investing in companies with a high probability of increasing their dividends each and every year.

If that strategy appeals to you, it may be useful to browse through the following databases of dividend growth stocks:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].