Parradee Kietsirikul

On Tuesday, I posted an article around three biotech/biopharma mid-cap concerns that make logical buyout targets for larger players in the pharma space. As noted in the previous article, there are many reasons to believe the M&A will remain active in this sector. Among these are the huge amounts of cash on the balance sheets of major drug firms, some key patent expirations over the next few years, and dramatically dropping revenue from Covid-related products like vaccines and therapeutics.

Healthpopuli.com

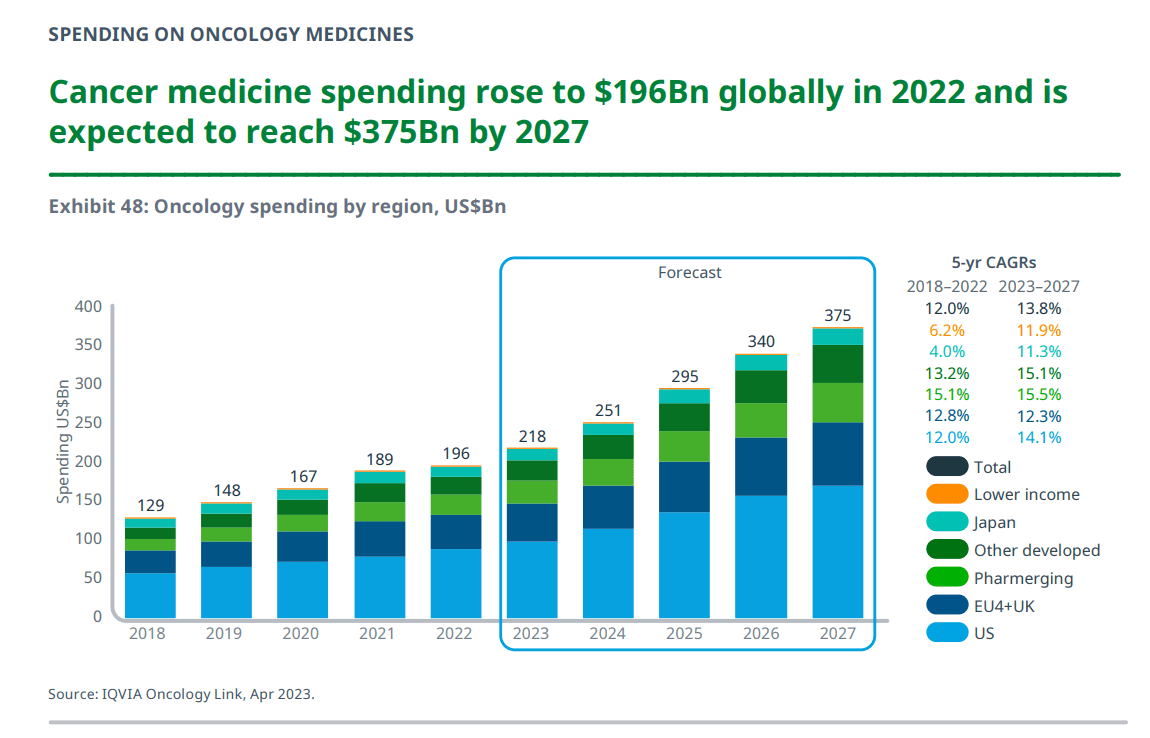

That article focused on companies targeting areas outside of oncology. This article will highlight two logical buyout targets in the oncology space. This has been one of the hottest areas for deal volume for years given its huge and still growing global market. Oncology produced $196 billion worth of sales globally in 2022 and this is projected to grow to $375 billion by 2027.

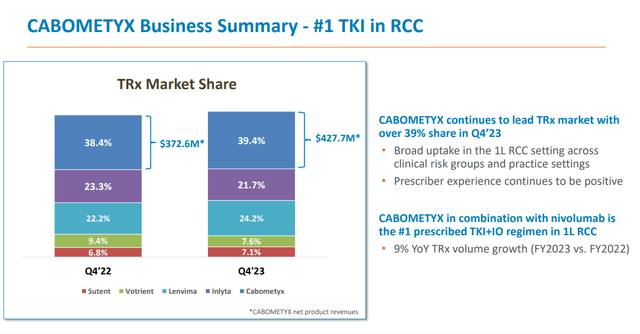

Let’s start with Exelixis (EXEL). This midcap oncology concern has an approximate market capitalization of $7.2 billion. The company has a couple of products approved and on the market. But its core franchise is all around a compound called Cabometyx, which is also known as cabozantinib. This drug is the leading Tyrosine Kinase Inhibitors or TKI for RCC (Renal Cell Carcinoma) in both first line I-O TKI market and the second line monotherapy segment. The compound continues to take market share in this indication.

February 2024 Company Presentation

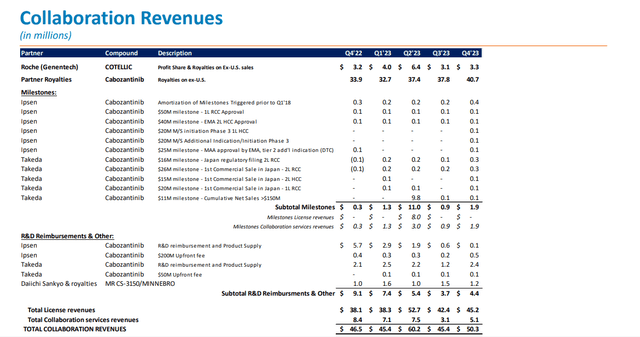

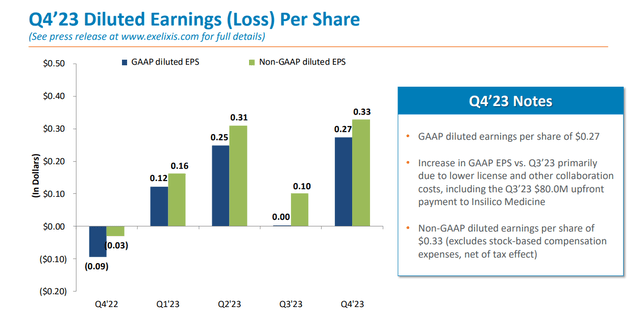

Cabometyx is a blockbuster drug and Exelixis posted revenues of nearly $1.63 billion in FY2023. Collaboration, milestones, royalties and licensing revenue made up just a tad over $200 million. These were primarily from the company’s partners overseas for Cabometyx, Ipsen Pharma SAS (OTCPK:IPSEY) and Takeda Pharmaceutical Company Limited (TAK).

February 2024 Company Presentation

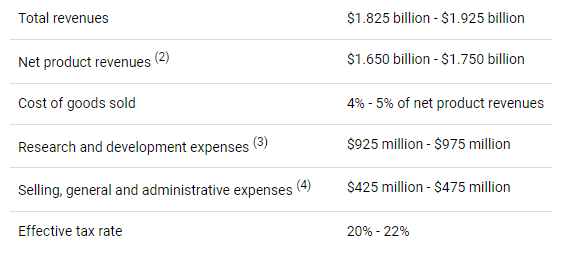

Almost all the rest came from net product revenues of Cabometyx. This was up from just over $1.4 billion, where licensing and other non-direct product revenue was $210 million. Management recently provided the following initial guidance for FY2024.

EXEL Press Release via Seeking Alpha

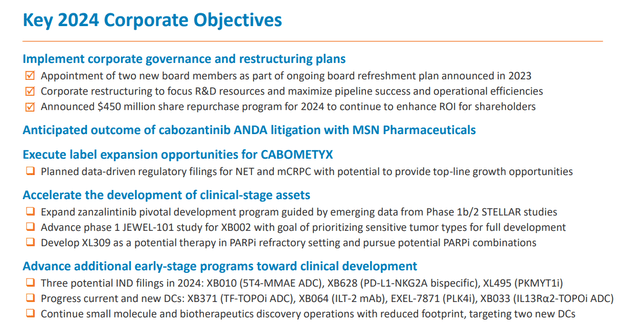

Cabometyx is being evaluated for other indications in the hopes of expanding its potential target market. Exelixis plans to file marketing applications for Cabometyx to treat net and metastatic CRPC (mCRPC) at some point in 2024. The company also has a mid/late stage pipeline asset called Zanzalintinib, which is its next-generation multi-targeted TKI. Late last year, the company initiated a phase 2/3 pivotal study called STELLAR-305. This trial will evaluate Zanzalintinib as part of a combination therapy with pembrolizumab (KEYTRUDA) from Merck (MRK)) versus pembrolizumab alone in patients with previously untreated PD-L1-positive recurrent or metastatic squamous cell carcinoma of the head and neck (SCCHN). The company also has several pre-clinical compounds in development. Management has guided it plans to file three IND (Investigational New Drug) applications in 2024.

February 2024 Company Presentation

The company also ended FY2023 with just over $1.7 billion of cash and marketable securities on its balance sheet, according to its 10-K filed for the fiscal year. The firm listed no long-term debt. Exelixis bought back approximately $550 million worth of stock in FY2023. It has a stock buyback authorization to buy back an additional $450 million worth of its own shares in FY2024.

February 2024 Company Presentation

Exelixis is nicely profitable as a standalone entity but would be quite accretive to a larger concern in the low to mid $30s. Most of the approximate $450 million (midpoint of guidance) of 2024 SG&A costs would go away once folded into a larger established sales force as would a decent amount of R&D costs. This potential acquisition becomes more likely once Exelixis gets a favorable litigation trial ruling around Cabometyx that should come out by the close of the first half of 2024. Management seems quite confident the outcome will go their way as does Jefferies, which will keep patent protection around Cabometyx until 2030/2032.

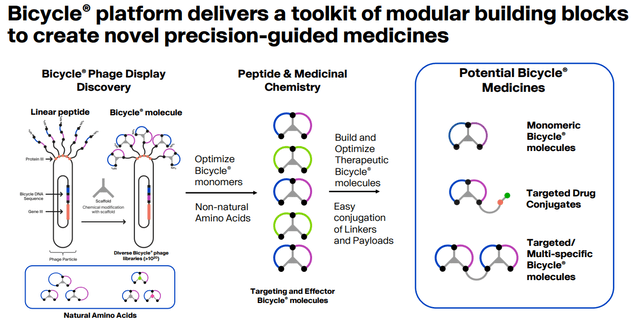

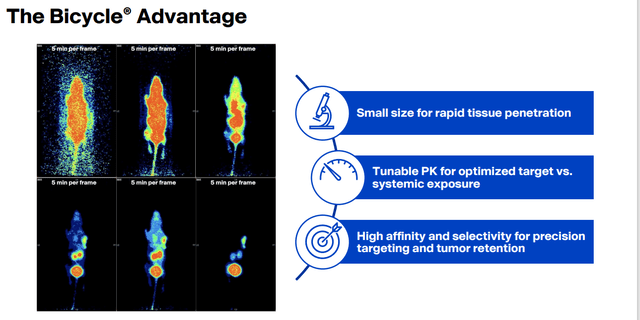

Next up is Bicycle Therapeutics (BCYC). The company made the oncology focused list this month from Cantor Fitzgerald about logical buyout targets. Recently, AstraZeneca (AZN) purchased Fusion Pharma (FUSN) with an approximate 100% buyout premium. The larger drug maker had been partnered with Fusion since 2020 around co-developing radiopharmaceutical candidates. The radiopharmaceutical space is projected to be a $14 billion market by 2032. Late last year, both Eli Lilly (LLY) and Bristol Myers (BMY) made similar acquisitions.

In 2023, Bicycle entered into a collaboration deal with Bayer (OTCPK:BAYRY) to develop Bicycle/s radioconjugates (BRCs) for multiple cancer targets. This quickly followed a similar arrangement with drug giant Novartis (NVS) around a different set of BRCs.

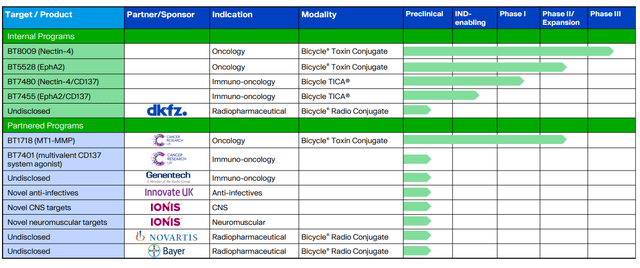

February Company Presentation

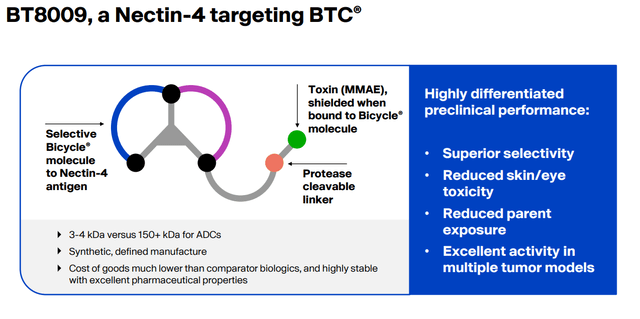

The company has other wholly owned candidates as well as other partnered compounds in development as well. The most advanced of which is BT8009. This is a second-generation bicycle toxin conjugate or BTC targeting Nectin-4. The FDA signed off on Bicycle’s Phase II/III registrational study for BT8009 evaluating the treatment for metastatic urothelial cancer or MUC. The candidate has Fast Track designation for this indication and this trial is currently actively recruiting individuals to participate in this study.

February 2024 Company Presentation

Bicycle Therapeutics has a market cap of approximately $1.1 billion and ended FY2023 with just over $525 million of cash and marketable securities on its balance sheet. It would seem a bite size acquisition for larger concern that wants to expand/establish a position in the growing radiopharmaceutical space while picking up a potentially valuable asset (BT8009), other earlier stage wholly owned/partnered clinical stage candidates and Bicycle’s underlying development platform. Bayer and Novartis would make logical acquirers given their existing partnerships with Bicycle. The two other and unknown pharma concerns that reportedly bid on RayzeBio before it was acquired by Bristol Myers would also be logical suitors for Bicycle.

February 2024 Company Presentation February 2024 Company Presentation

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.