The political winds are pushing the energy industry ever further toward the green, promoting renewable power sources and electrification over fossil fuels. The irony in this is that certain rare metals, essential to a green energy economy, have taken on a new importance. In a sense, lithium is the new coal.

This point was driven home just this month, when the Chinese battery maker CATL, a leader in the global market for electric vehicle battery packs, announced a changing to its pricing strategy. The short version is, the company will be subsidizing lithium to reduce the cost of its batteries, accepting a hit to margins and profits in an effort to maximize market share. The effects of this decision have been overwhelming, and lithium miners have been among the first to feel it.

As a group, major lithium mining companies saw their shares fall on fears that CATL’s price manipulations may distort demand and pricing throughout the lithium production and supply chains. But at least some Wall Street analysts are saying that now is the time to get into lithium, trusting the underlying strength of the industry going forward and using current pricing to ‘buy the dip.’

We’ve used the TipRanks database to look up the details on two lithium miners that have recently gotten the nod from the Street.

Sociedad Quimica Y Minera de Chile (SQM)

First up is the Chilean firm of Sociedad Quimica Y Minera, SQM. This company has its hands in a range of chemical and mineral production sectors, from iodine and potassium to industrial chemicals and plant fertilizers – and it is the world’s largest single producer of lithium. Increased demand for lithium, powered by the EV market’s never-ending appetite for lithium-ion battery packs, has been supportive of SQM, which has seen rising revenues, earnings, and share prices over the last year.

On the financial side, SQM won’t report 4Q and full year 2022 results until next week, but according to the 3Q22 results, the company had a bottom line of $2.75 billion for the nine months ending on September 30, 2022. This was almost 10x more than the $263.9 million reported in the same period of 2021, and reflects both the global economic reopening post-COVID as well as increasing demand for lithium on the global markets. EPS for the nine-month period was $9.65, compared to just $0.92 in the prior year time-frame. At the top line, 9-month revenues came to $7.57 billion.

Of that 9-month revenue total, $5.62 billion came from lithium and lithium derivatives, showing just how dominant lithium is in SQM’s business. SQM’s lithium-related revenue grew by 1,161% year-over-year in 3Q22 alone, to reach $2.33 billion.

With the lithium sector powering that kind of revenue and earnings growth, SQM should be able to weather any storm. J.P. Morgan analyst Lucas Ferreira would agree. Looking at the disruptions in the lithium markets this week, he writes, “While noisy, we think this should not become an industry-wide practice, and lithium prices should ultimately be a function of Li SxD dynamics, which we still see in a deficit for the next three years….”

“We think CATL’s lithium subsidies should generate a battery price war, which is not healthy for the value chain. Nonetheless, the company cannot solve the lithium deficit by itself as this is a function of the unbalanced SxD JPM forecasts to remain in place for the next 3 years. That said, we believe CATL’s actions should have limited impact on pricing of other suppliers [like SQM] in the near term,” the analyst added.

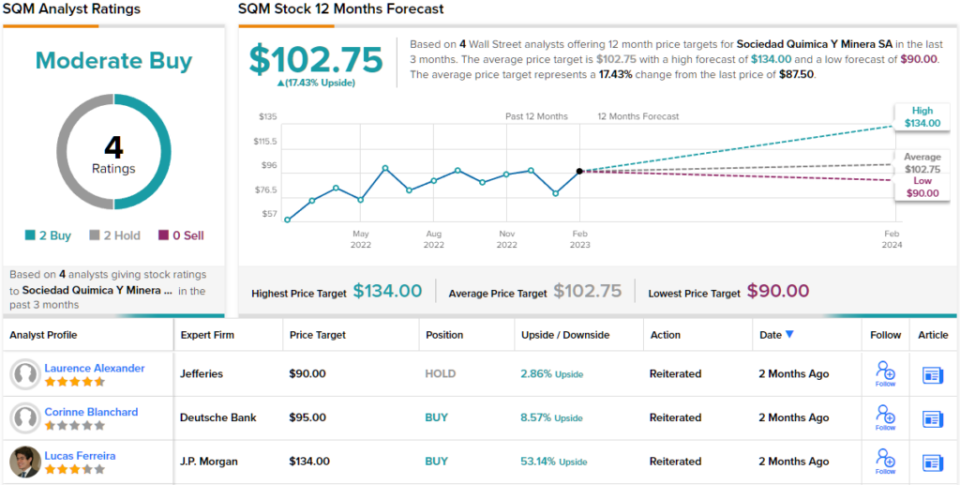

Ferreira backs his bullish view with an Overweight (i.e. Buy) rating on SQM, and price target of $134 that indicates his own confidence in a 53% upside by the end of this year. (To watch Ferreira’s track record, click here)

So, that’s J.P. Morgan’s view, let’s turn our attention now to rest of the Street: SQM 2 Buys and 2 Holds coalesce into a Moderate Buy rating. There’s a double-digit upside – 17.43% to be exact – should the $102.75 average price target be met in the next 12 months. (See SQM stock forecast)

Albemarle Corporation (ALB)

The second lithium stock we’ll look at is North Carolina-based Albemarle, a specialty chemical company with a focus on lithium and bromine refining. The company is a major name in the market for battery-grade lithium products, and holds a leading market share in the EV battery segment. The company boasts a global reach, and sources its lithium from three major production sites, in Nevada, Chile, and Australia.

As with SQM above, Albemarle has benefited from rising lithium prices over the past year. For the full year 2022, Albemarle’s revenues came to more than $7.3 billion. The company saw its top line rise sequentially in each quarter of 2022, culminating in Q4’s year-over-year increase of 163% to $2.6 billion. At the bottom line, Albemarle saw a quarterly net income of $1.1 billion, or an adjusted diluted EPS of $8.62 – a figure that was up a whopping 753% y/y.

Lithium was the driver of the company’s strong results, with the Q4 net sales coming in at $2.06 billion. This was a 410% increase from the prior-year quarter.

Looking ahead, Albemarle is guiding toward full-year 2023 revenues of $11.3 billion to $12.9 billion, and predicts an adjusted income for this year in the range of $4.2 billion to $5.1 billion. Achieving the midpoint of the revenue guidance will translate to a 65% year-over-year top line gain.

5-star analyst Colin Rusch, from Oppenheimer, gives an encouraging outlook on Albemarle’s prospects, writing, “We view the incremental information on spot pricing, seasonality, and overall production levels for China EVs as comforting for bulls. ALB is assuming 40% Y/Y growth in EV production in China, which we believe could prove conservative given historical patterns and scale benefits to OEM cost structure likely will help drive higher volumes… We continue to believe ALB’s technology position in lithium extraction and processing is underappreciated by investors…”

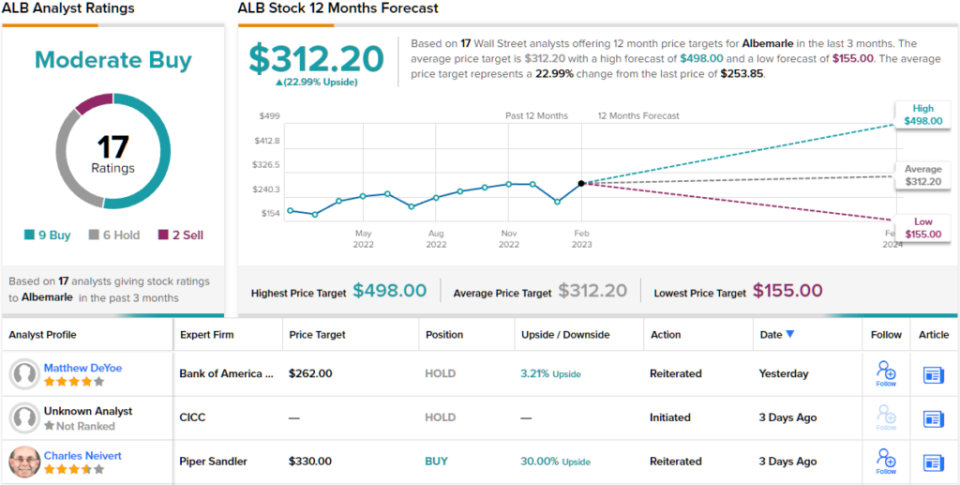

Taking this line forward, Rusch gives ALB an Outperform (i.e. Buy) rating, with a $498 price target to suggest an impressive one-year upside potential of 96%. (To watch Rusch’s track record, click here)

Overall, ALB has 17 recent analyst reviews on record, and they include 9 buys, 6 Holds, and 2 Sells – for a Moderate Buy consensus rating. The shares are selling for $253.85 and their average price target of $312.20 points toward a gain of 23% in the months ahead. (See ALB stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.