Guest Contribution by Tom Hutchinson, Chief Analyst, Cabot Dividend Investor

Predicting the future is a dicey business. Most didn’t expect the economy to remain so resilient, or inflation to fall so fast, or the huge impact of artificial intelligence (AI) in 2023. But here we are. Now it’s time to take a stab at 2024. What can we expect from the current vantage point?

Things look good. The main reason for optimism is that inflation has fallen far, and interest rates have likely peaked. Inflation and rising interest rates have hindered the market for the past two years. The removal of that negative catalyst should be very positive going forward. The economy remains strong. It looks like we might get through this Fed rate hiking cycle without much economic pain.

At the same time, many stocks are still cheap. For this reason, Sure Dividend recommends investors focus on high quality dividend stocks that have increased their payouts for at least 10 years.

Blue-chip stocks are established, financially strong, and consistently profitable publicly traded companies.

Their strength makes them appealing investments for comparatively safe, reliable dividends and capital appreciation versus less established stocks.

This research report has the following resources to help you invest in blue chip stocks:

Technology drove the market indexes higher in 2023, while most other stock sectors continued to languish. Defensive sectors including utilities and REITs were driven lower by rising interest rates and several of the best stocks in those sectors hit multi-year lows. Those stocks come into 2024 with dirt-cheap valuations, no longer rising interest rates, and a likely slowing economy, which is a time of relative market outperformance.

Technology stocks had a blowout 2023 with that sector up over 50% for the year. But much of the move is a rebound from an awful 2022. And AI provides another strong catalyst for growth going forward. Technology isn’t done and the rally should broaden out in 2024.

Of course, you never know. Inflation could reignite and rates could continue to rise after all. The geopolitical situation could turn ugly and trump everything else. It’s also a big election year. The recession that never happened could be just a little further down the road. The consumer has shown distinct signs of rolling over, and consumption accounts for 70% of GDP. Most pundits are predicting a slowing economy and possible mild recession. But it could be worse.

Anything is possible in 2024. But the risks seem more toward a slowing economy and recession rather than still-rising inflation and interest rates. That sets up well for the beleaguered defensive stocks. At the same time, AI isn’t going anywhere. Companies will continue to spend big on the technology regardless of the economy, the Fed, or who is President.

Looking ahead to 2024, I like a battered defensive stock that has recent momentum off a multi-year low as well as a technology stock that has not yet benefited from the AI craze but should in the next year.

Qualcomm Incorporated (QCOM)

Qualcomm (QCOM) is the world’s largest supplier of chips for mobile devices. It also holds the patents for the key technology systems that are the backbone of all 3G and 4G networks. Chips account for roughly 75% of revenues while licensing from patents accounts for 25%, although the smaller area is more profitable and better insulated from competition.

Qualcomm is the undisputed king of smartphone chips and Analysts estimate that the 5G chipset market will grow from $2.1 billion in 2020 to over $23 billion by 2026. And another huge growth catalyst is emerging, artificial intelligence (AI). It’s a technological game-changer that companies can’t afford to miss.

The AI market in the U.S. is expected to grow from $86.9 billion in 2022 to $407 billion by 2030. Global estimates for the industry have it around $500 billion in 2022 growing to over $2 trillion by 2030. Another study estimates that the AI industry’s value will grow by 13 times over the next seven years. Qualcomm describes itself as the “on-device AI leader,” referring to mobile devices.

But this hasn’t been a good year for QCOM despite the AI boost and tech sector dominance this year. QCOM is up about 30% YTD after the recent rally in the sector, but the overall technology sector is up 50% this year. QCOM has been a laggard. The stock currently trades more than 25% below the all-time high made at the beginning of 2022.

The issue is that device sales are cyclical and this year smartphone sales have been down in a slower global economy. Qualcomm’s revenues are down more than 20% from last year. Semiconductors are a cyclical industry subsector as well. Technology market research outfit Gartner estimates that industry semiconductor revenues will fall about 11% in 2023.

But things appear to have bottomed out. Qualcomm soundly beat expectations in the last earnings quarter and revised forward guidance higher as it sees business picking up in 2024. Smartphone sales are accelerating. Gartner estimates semiconductor revenues will grow by about 17% in 2024. Meanwhile, Qualcomm is introducing new AI-enabled chips for smartphones and personal computers (PCs) as well, a new market for the company.

The biggest beneficiaries of the initial AI boost were the companies that benefit from the technology more immediately. But as AI continues to proliferate it will certainly find its way to mobile devices, and Qualcomm will be a primary beneficiary.

NextEra Energy, Inc. (NEE)

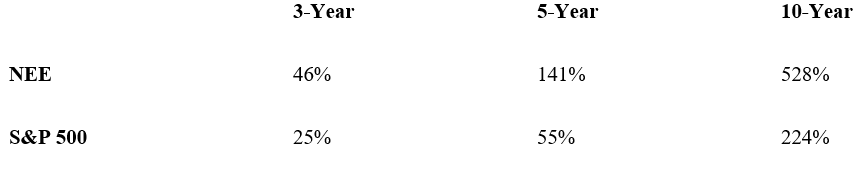

NEE isn’t just some boring, stodgy utility stock with the possible benefit of good timing. It has a long track record of not only vastly outperforming the utility sector, but the overall market as well. Prior to this year, here’s how NEE’s total returns compared to those of the S&P 500:

How could a utility stock more than double the returns of the market over five- and ten-year periods? It’s not an ordinary utility.

NextEra Energy provides all the advantages of a defensive utility plus exposure to the fast-growing and highly sought-after alternative energy market. It’s the world’s largest utility. It’s a monster with about $21 billion in annual revenue and a $125 billion market capitalization. Earnings growth and stock returns have well exceeded what is normally expected of a utility.

NEE is two companies in one. It owns Florida Power and Light Company, which is one of the very best regulated utilities in the country, accounting for about 55% of revenues. It also owns NextEra Energy Resources, the world’s largest generator of renewable energy from wind and solar and a world leader in battery storage.

There is also a huge runway for growth projects. NextEra has deployed $50 to $55 billion in the last few years on growth expansions and acquisitions. It also has a large project backlog.

But NEE is down 27% YTD and recently traded near the lowest price in three years. Yet, everything that propelled the stock higher in the past is still firmly in place. In fact, things might be better in the future than they were in the past.

Further Reading

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].