Glassnode, an on-chain analytics platform, not too long ago highlighted a pointy rise within the whole variety of Bitcoin whale addresses. 149,127 BTC addresses now maintain at the very least 10 Bitcoin, the very best stage since August 2021.

The earlier 11-month excessive of 149,120 was noticed yesterday. Since March 2022, the general variety of Bitcoin whales has jumped considerably. Glassnode’s knowledge reveals that roughly 145,500 Bitcoin addresses held at the very least 10 BTC in March 2022.

Yesterday, a big BTC whale motion was highlighted by Whale Alert. In line with the main points shared by the blockchain monitoring agency, somebody moved 3,492 BTC price greater than $75 million from Coinbase to an unknown pockets. The talked about switch was executed at round 00:51 UTC.

The most recent rise within the whole variety of BTC whale addresses signifies the buildup development of main crypto accounts within the bearish market. The crypto market cap is down by practically 70% since November 2021. Nonetheless, the final seven days witnessed a good restoration throughout the digital asset market as BTC climbed by 12% and Ethereum noticed a worth soar of roughly 16%.

Bitcoin Restoration

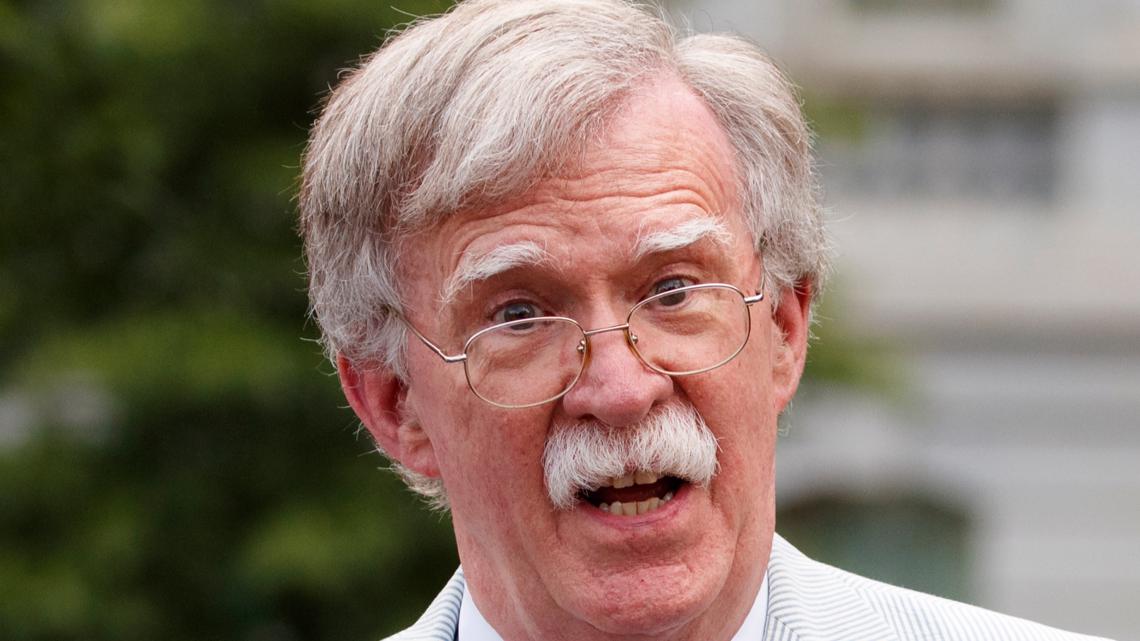

Commenting on the latest soar in BTC and the potential affect of the macroeconomic state of affairs on the crypto market, Marcus Sotiriou, Analyst at GlobalBlock, stated: “Bitcoin lastly noticed some aid yesterday, topping out at round $22,500, because the S&P 500 climbed 1.5%. There may be some renewed optimism that the worst of the liquidity disaster could also be behind us after SBF’s re-assurance on Wednesday.”

“The one Bitcoin backside sign for me is persistent knowledge exhibiting us that inflation is convincingly inflecting down. This could end result within the Federal Reserve turning into much less aggressive with their financial coverage, and due to this fact present confidence that the liquidity disaster within the crypto market is over,” Sotiriou added in a latest analysis observe.

Glassnode, an on-chain analytics platform, not too long ago highlighted a pointy rise within the whole variety of Bitcoin whale addresses. 149,127 BTC addresses now maintain at the very least 10 Bitcoin, the very best stage since August 2021.

The earlier 11-month excessive of 149,120 was noticed yesterday. Since March 2022, the general variety of Bitcoin whales has jumped considerably. Glassnode’s knowledge reveals that roughly 145,500 Bitcoin addresses held at the very least 10 BTC in March 2022.

Yesterday, a big BTC whale motion was highlighted by Whale Alert. In line with the main points shared by the blockchain monitoring agency, somebody moved 3,492 BTC price greater than $75 million from Coinbase to an unknown pockets. The talked about switch was executed at round 00:51 UTC.

The most recent rise within the whole variety of BTC whale addresses signifies the buildup development of main crypto accounts within the bearish market. The crypto market cap is down by practically 70% since November 2021. Nonetheless, the final seven days witnessed a good restoration throughout the digital asset market as BTC climbed by 12% and Ethereum noticed a worth soar of roughly 16%.

Bitcoin Restoration

Commenting on the latest soar in BTC and the potential affect of the macroeconomic state of affairs on the crypto market, Marcus Sotiriou, Analyst at GlobalBlock, stated: “Bitcoin lastly noticed some aid yesterday, topping out at round $22,500, because the S&P 500 climbed 1.5%. There may be some renewed optimism that the worst of the liquidity disaster could also be behind us after SBF’s re-assurance on Wednesday.”

“The one Bitcoin backside sign for me is persistent knowledge exhibiting us that inflation is convincingly inflecting down. This could end result within the Federal Reserve turning into much less aggressive with their financial coverage, and due to this fact present confidence that the liquidity disaster within the crypto market is over,” Sotiriou added in a latest analysis observe.