Updated on June 14th, 2023 by Bob Ciura

Income investors tend to focus on stocks with the highest dividend yields. But dividend growth is also an important consideration when constructing an income portfolio.

While high-yield stocks are appealing for the income they provide in the short-term, the best dividend growth stocks are equally appealing due to the potential for even higher dividend income over the long run.

For example, the Dividend Aristocrats are among the best dividend growth stocks. The Dividend Aristocrats represent 68 companies in the S&P 500 Index, that have each raised their dividends for at least 25 consecutive years.

You can download an Excel spreadsheet of all 68 (with metrics that matter) by clicking the link below:

The Dividend Aristocrats are widely regarded as among the best dividend growth stocks. But they did not start out as Dividend Aristocrats.

It is also useful for investors to consider some of the best dividend growth stocks that may not have as long of a dividend history right now, but have the potential to become the next Dividend Aristocrats.

Investors should focus on high-quality companies with durable competitive advantages, consistent growth, and the ability to raise their dividends over the long term.

These best dividend growth stocks are not all on the list of Dividend Aristocrats. But in any case, they have the potential to raise their dividends at a high rate each year, and perhaps be among the future Dividend Aristocrats.

Table Of Contents

The top 12 best dividend growth stocks list is comprised of stocks with dividend yields at or above the S&P 500 average (currently 1.6%), as well as Dividend Risk scores of ‘C’ or better.

Finally, all 12 stocks have positive expected EPS growth of at least 10% per year, making them more likely to exhibit higher dividend growth rates.

The best dividend growth stocks are listed by 5-year expected total returns in the Sure Analysis Research Database, in order of lowest to highest.

You can instantly jump to a specific stock by clicking on the links below:

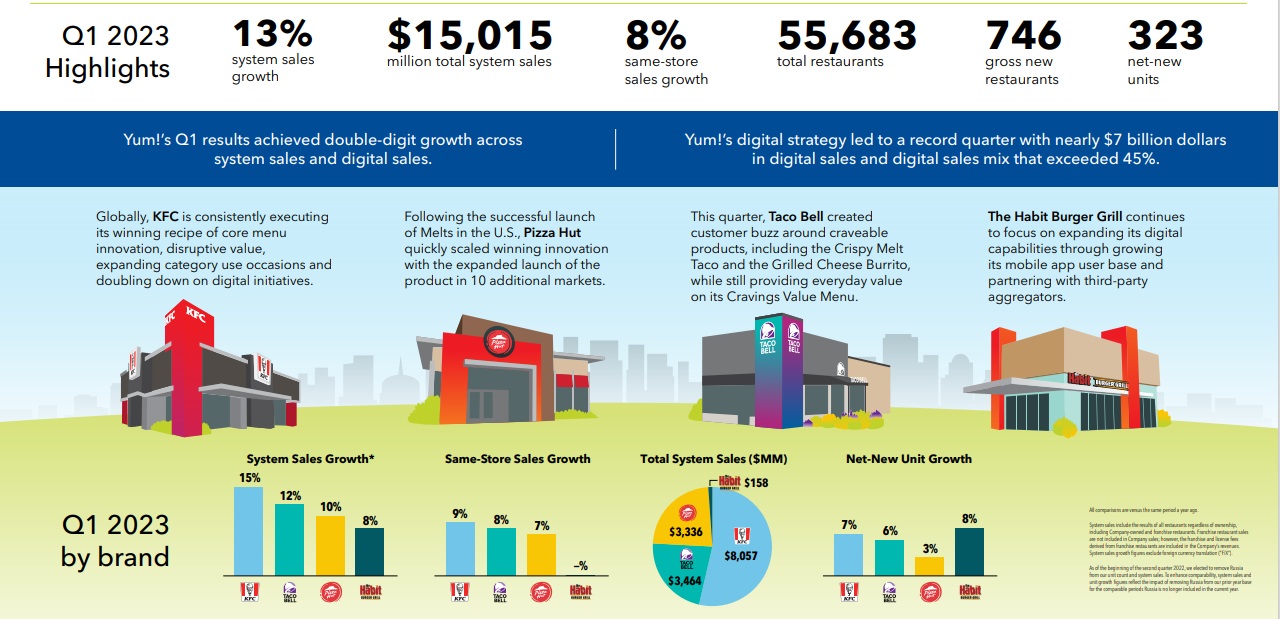

Dividend Growth Stock #12: Starbucks Corp. (SBUX)

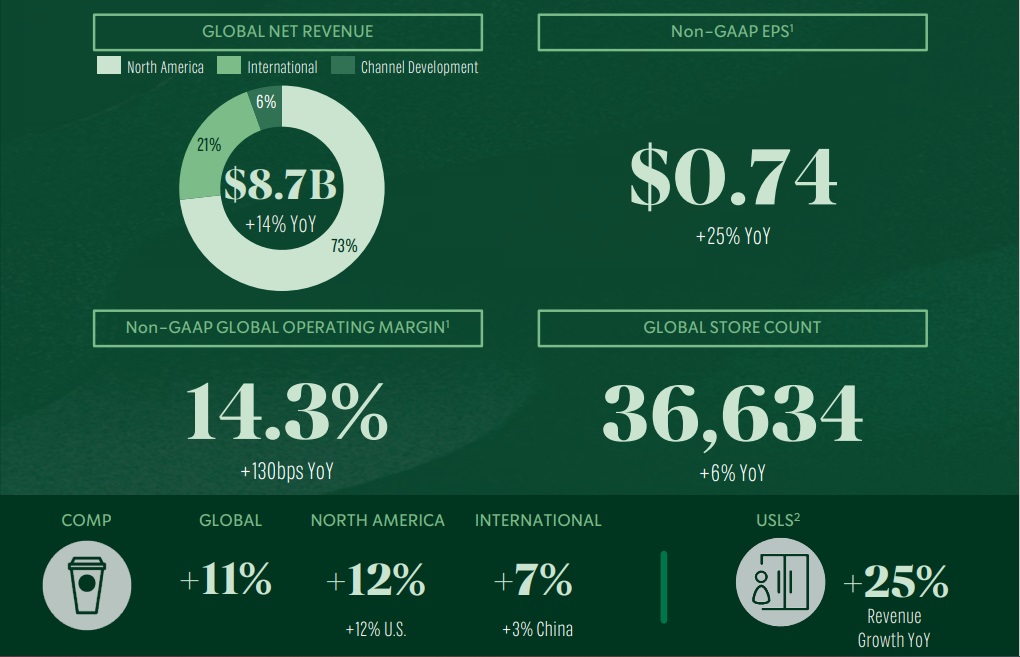

Starbucks has more than 36,000 stores worldwide. About half of the stores are in the U.S., and nearly 20% of the stores are in China. The company operates under the namesake Starbucks brand but also holds the Teavana, Evolution Fresh, and Ethos Water brands in its portfolio. The company generated $32 billion in annual revenue in fiscal 2022.

In early May, Starbucks reported (5/2/23) financial results for the second quarter of fiscal year 2023. The company enjoyed accelerated business momentum and grew its comparable store sales 11% thanks to 12% growth in the U.S. and 7% growth in international markets.

Source: Investor Presentation

Adjusted earnings-per-share grew 25%, from $0.59 in the prior year’s quarter to $0.74, and exceeded the analysts’ consensus by $0.09. The headwinds from the lockdowns in China and high inflation have subsided. Starbucks reiterated its positive guidance for 2023, expecting growth of earnings-per-share at the low end of its long-term guidance of 15%-20% growth.

Starbucks is among the best dividend growth stocks due to its world-class brand and long history of growth.

Click here to download our most recent Sure Analysis report on Starbucks Corporation (SBUX) (preview of page 1 of 3 shown below):

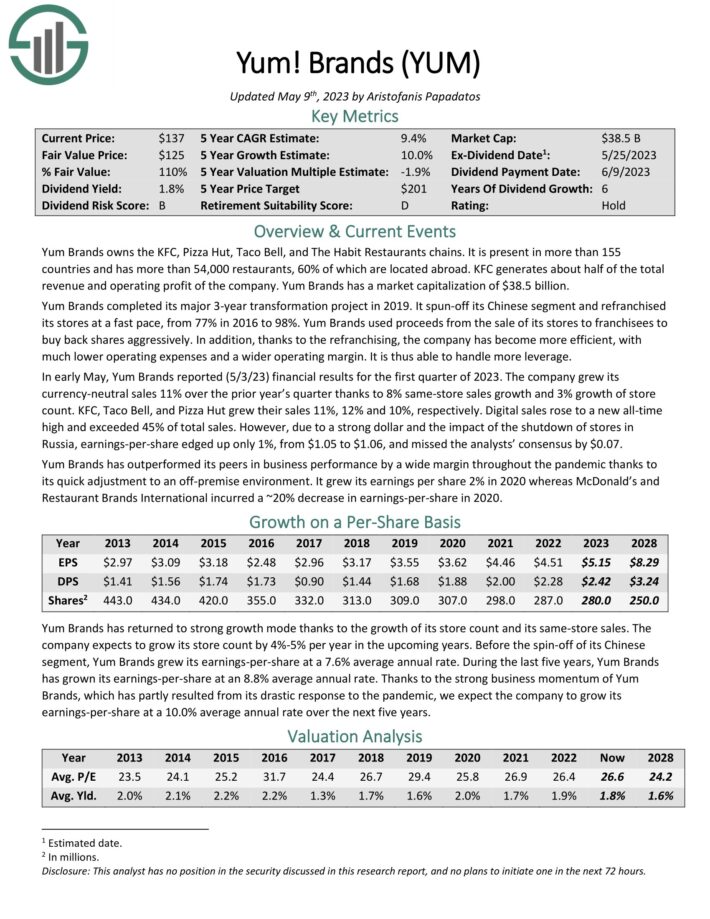

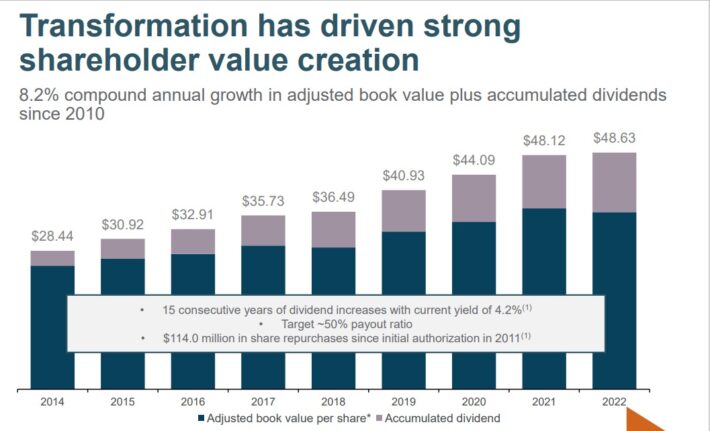

Dividend Growth Stock #11: Yum Brands (YUM)

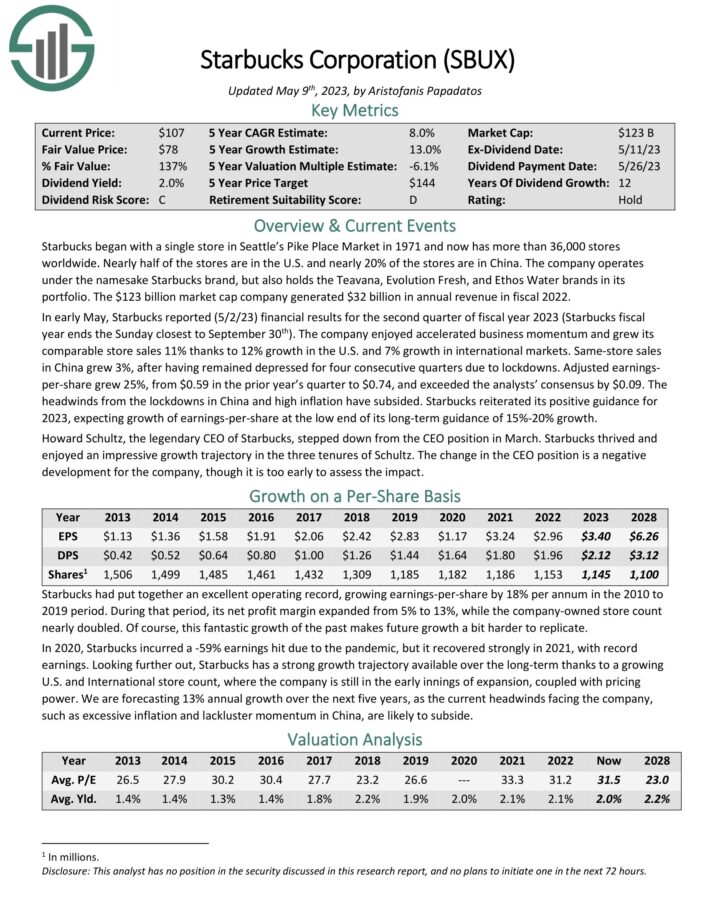

Yum Brands owns the KFC, Pizza Hut, Taco Bell, and The Habit Restaurants chains. It is present in more than 155 countries and has more than 54,000 restaurants, 60% of which are located abroad. KFC generates about half of the total revenue and operating profit of the company.

In early May, Yum Brands reported (5/3/23) financial results for the first quarter of 2023.

Source: Investor Presentation

The company grew its currency-neutral sales 11% over the prior year’s quarter thanks to 8% same-store sales growth and 3% growth of store count. KFC, Taco Bell, and Pizza Hut grew their sales 11%, 12% and 10%, respectively.

Click here to download our most recent Sure Analysis report on Yum Brands (preview of page 1 of 3 shown below):

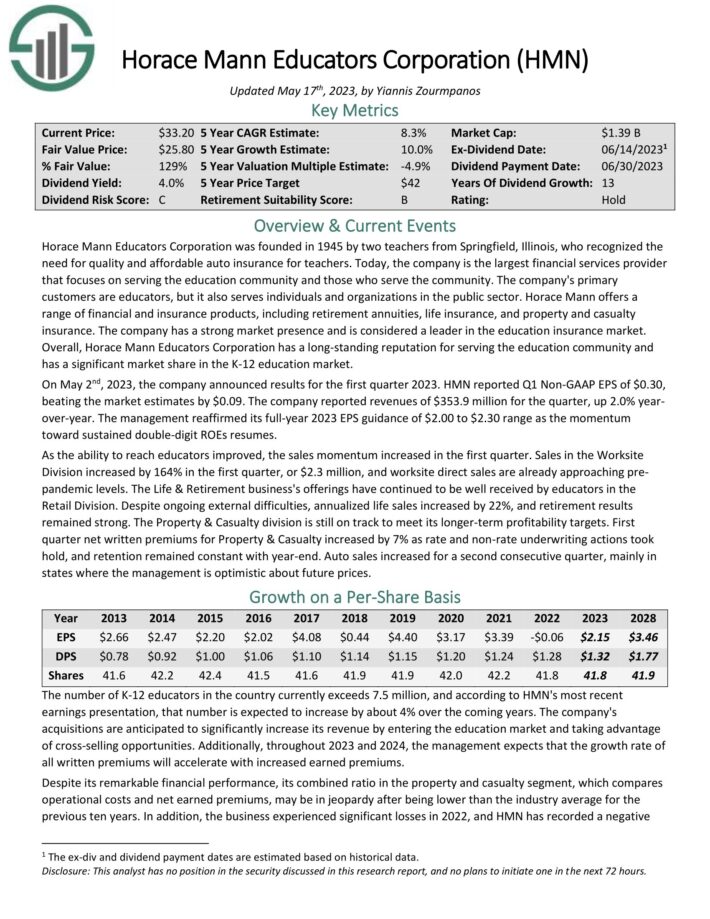

Dividend Growth Stock #10: Horace Mann Educators Corp. (HMN)

Horace Mann Educators Corporation was founded in 1945 by two teachers from Springfield, Illinois, who recognized the need for quality and affordable auto insurance for teachers. Today, the company is the largest financial services provider that focuses on serving the education community and those who serve the community. The company’s primary customers are educators, but it also serves individuals and organizations in the public sector.

Source: Investor Presentation

Horace Mann offers a range of financial and insurance products, including retirement annuities, life insurance, and property and casualty insurance. The company has a strong market presence and is considered a leader in the education insurance market. Overall, Horace Mann Educators Corporation has a long-standing reputation for serving the education community and has a significant market share in the K-12 education market.

Click here to download our most recent Sure Analysis report on HMN (preview of page 1 of 3 shown below):

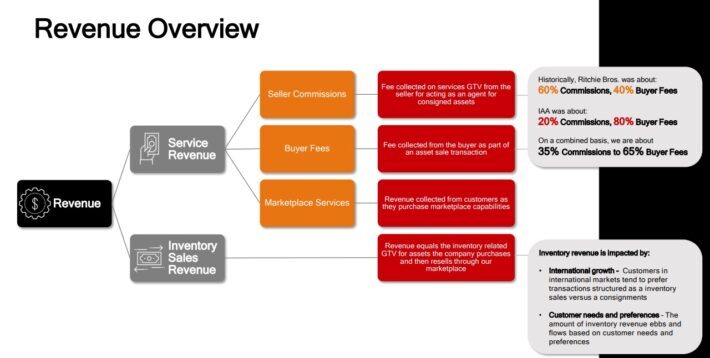

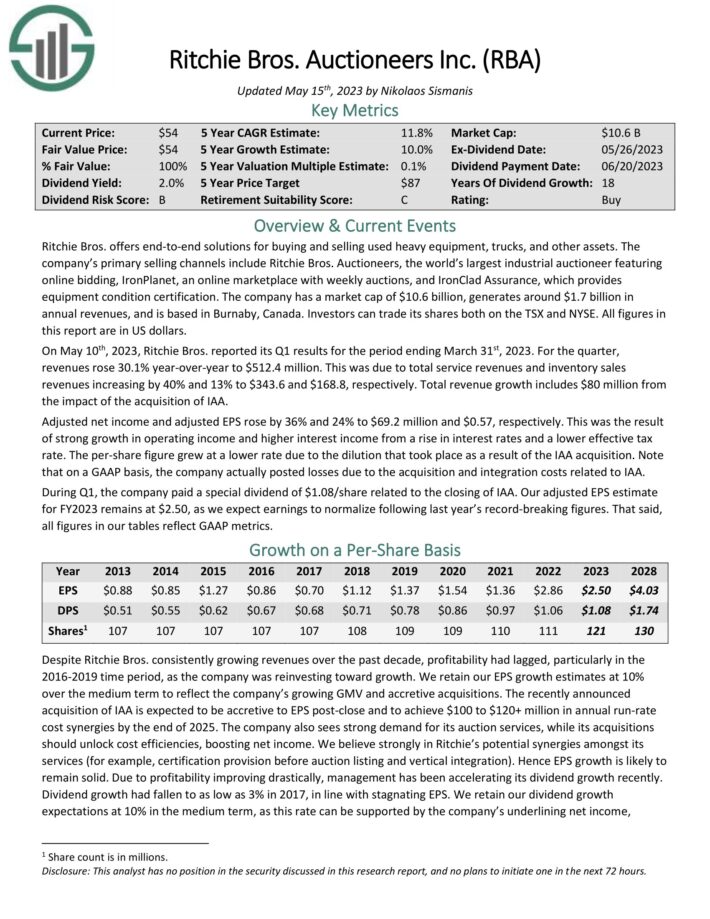

Dividend Growth Stock #9: RB Global (RBA)

Ritchie Bros. offers end-to-end solutions for buying and selling used heavy equipment, trucks, and other assets. The company’s primary selling channels include Ritchie Bros. Auctioneers, the world’s largest industrial auctioneer featuring online bidding, IronPlanet, an online marketplace with weekly auctions, and IronClad Assurance, which provides equipment condition certification. The company generates around $1.7 billion in annual revenues, and is based in Burnaby, Canada.

Source: Investor Presentation

On May 10th, 2023, Ritchie Bros. reported its Q1 results for the period ending March 31st, 2023. For the quarter, revenues rose 30.1% year-over-year to $512.4 million. This was due to total service revenues and inventory sales revenues increasing by 40% and 13% to $343.6 and $168.8, respectively. Total revenue growth includes $80 million from the impact of the acquisition of IAA.

Click here to download our most recent Sure Analysis report on RB Global (preview of page 1 of 3 shown below):

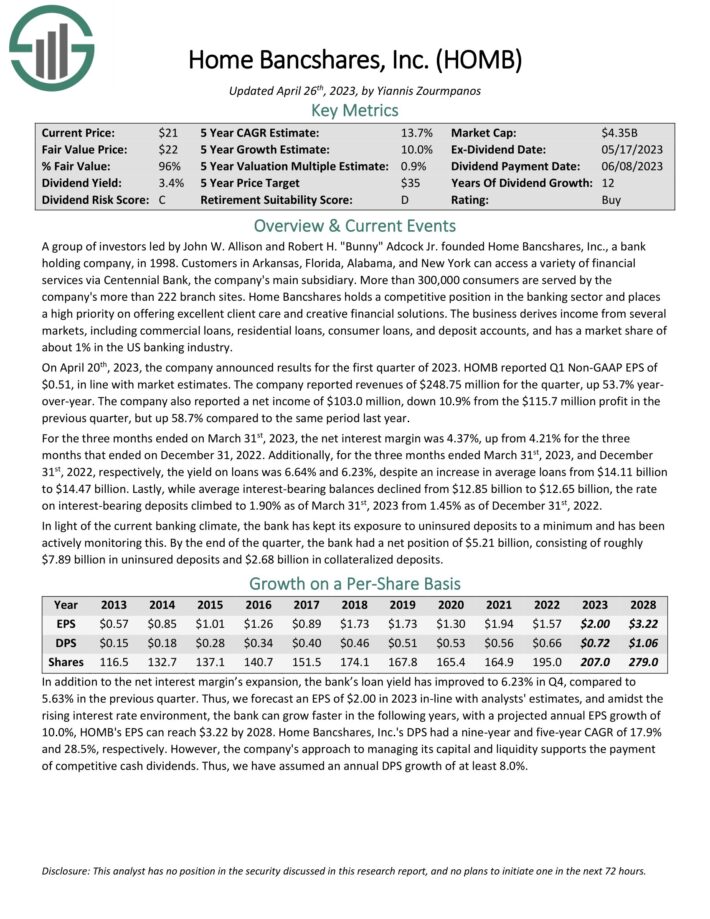

Dividend Growth Stock #8: Home Bancshares Inc. (HOMB)

Home Bancshares is a bank holding company. Customers in Arkansas, Florida, Alabama, and New York can access a variety of financial services via Centennial Bank, the company’s main subsidiary. More than 300,000 consumers are served by the company’s more than 222 branch sites.

Home Bancshares holds a competitive position in the banking sector and places a high priority on offering excellent client care and creative financial solutions. The business derives income from several markets, including commercial loans, residential loans, consumer loans, and deposit accounts, and has a market share of about 1% in the US banking industry.

Click here to download our most recent Sure Analysis report on Home Bancshares (HOMB) (preview of page 1 of 3 shown below):

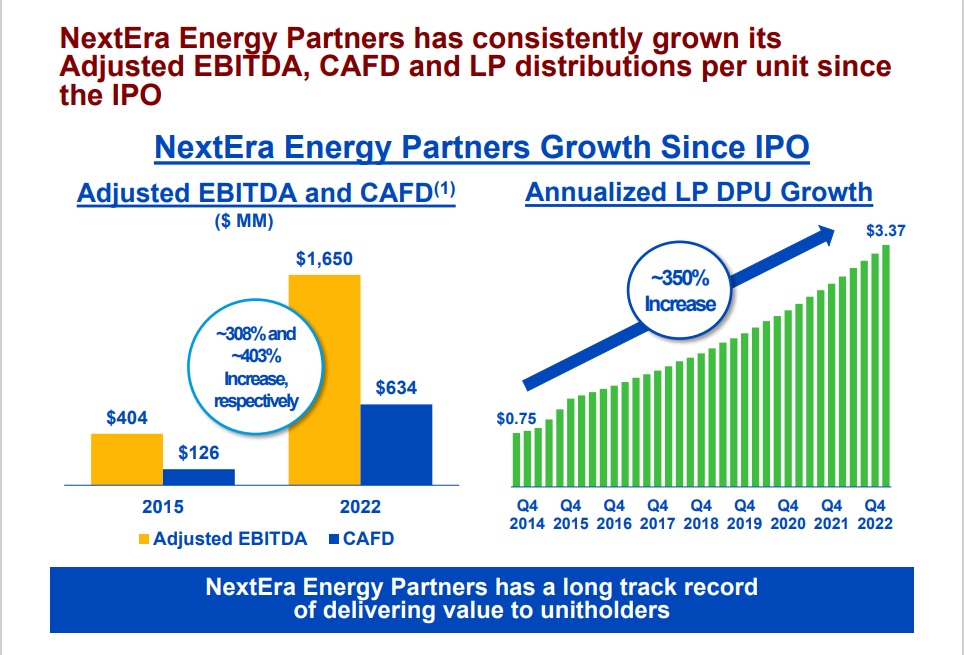

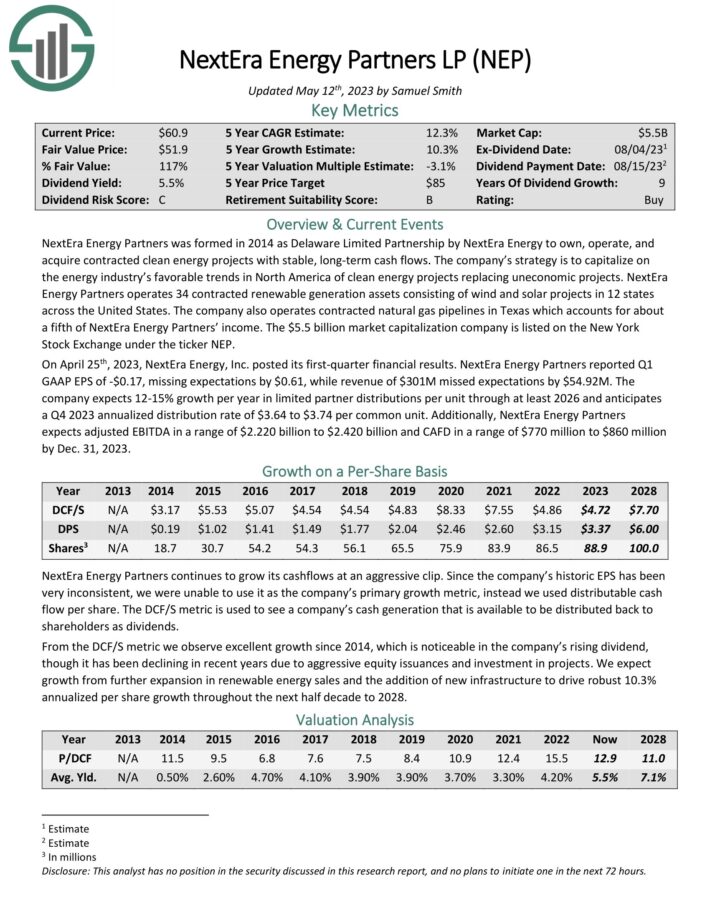

Dividend Growth Stock #7: NextEra Energy Partners (NEP)

NextEra Energy Partners was formed in 2014 as Delaware Limited Partnership by NextEra Energy to own, operate, and acquire contracted clean energy projects with stable, long-term cash flows. The company’s strategy is to capitalize on the energy industry’s favorable trends in North America of clean energy projects replacing uneconomic projects.

NextEra Energy Partners operates 34 contracted renewable generation assets consisting of wind and solar projects in 12 states across the United States. The company also operates contracted natural gas pipelines in Texas which accounts for about a fifth of NextEra Energy Partners’ income.

Source: Investor Presentation

On April 25th, 2023, NextEra Energy, Inc. posted its first-quarter financial results. NextEra Energy Partners reported Q1 GAAP EPS of -$0.17, missing expectations by $0.61, while revenue of $301M missed expectations by $54.92M. The company expects 12-15% growth per year in limited partner distributions per unit through at least 2026 and anticipates a Q4 2023 annualized distribution rate of $3.64 to $3.74 per common unit.

Click here to download our most recent Sure Analysis report on NextEra Partners (NEP) (preview of page 1 of 3 shown below):

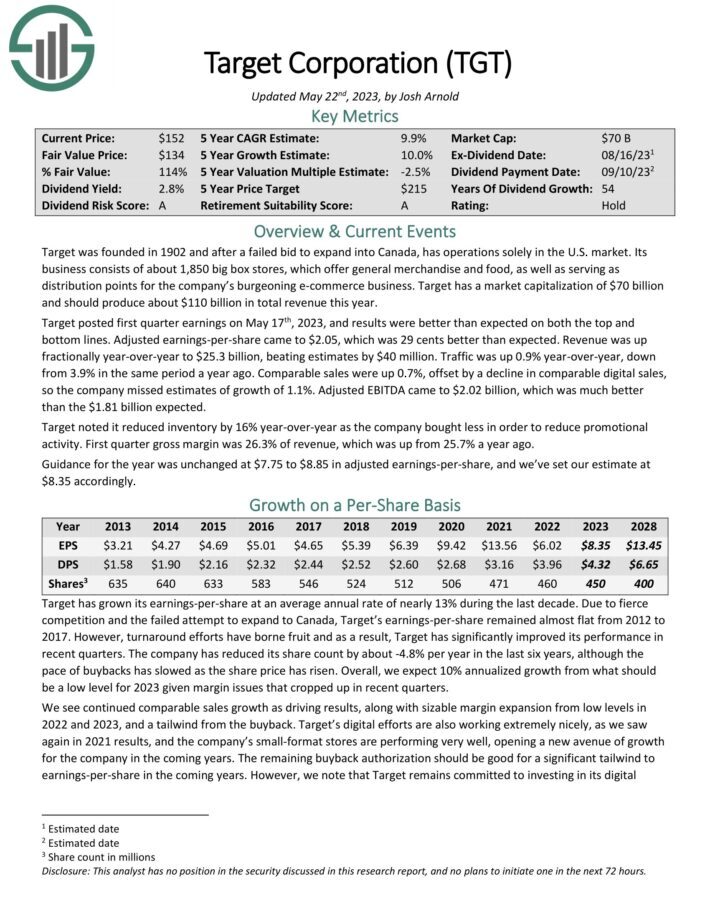

Dividend Growth Stock #6: Target Corp. (TGT)

Target is a giant discount retailer. Its business consists of about 1,850 big box stores, which offer general merchandise and food, as well as serving as distribution points for the company’s burgeoning e-commerce business. Target should produce about $110 billion in total revenue this year.

Target posted first quarter earnings on May 17th, 2023, and results were better than expected on both the top and

bottom lines. Adjusted earnings-per-share came to $2.05, which was 29 cents better than expected. Revenue was up

fractionally year-over-year to $25.3 billion, beating estimates by $40 million.

Click here to download our most recent Sure Analysis report on Target (TGT) (preview of page 1 of 3 shown below):

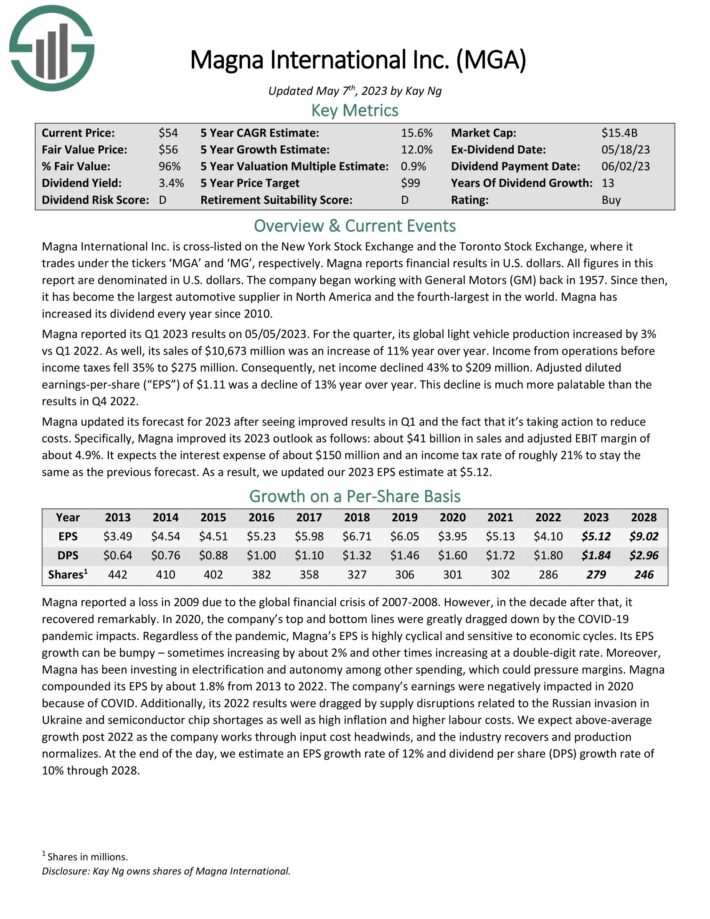

Dividend Growth Stock #5: Magna International Inc. (MGA)

Magna International is the largest automotive supplier in North America and the fourth-largest in the world. Magna has increased its dividend every year since 2010.

Magna reported its Q1 2023 results on 05/05/2023. For the quarter, its global light vehicle production increased by 3% vs Q1 2022. As well, its sales of $10,673 million was an increase of 11% year over year. Income from operations before income taxes fell 35% to $275 million. Consequently, net income declined 43% to $209 million.

Adjusted diluted earnings-per-share (“EPS”) of $1.11 was a decline of 13% year over year. This decline is much more palatable than the results in Q4 2022.

Click here to download our most recent Sure Analysis report on Magna International (MGA) (preview of page 1 of 3 shown below):

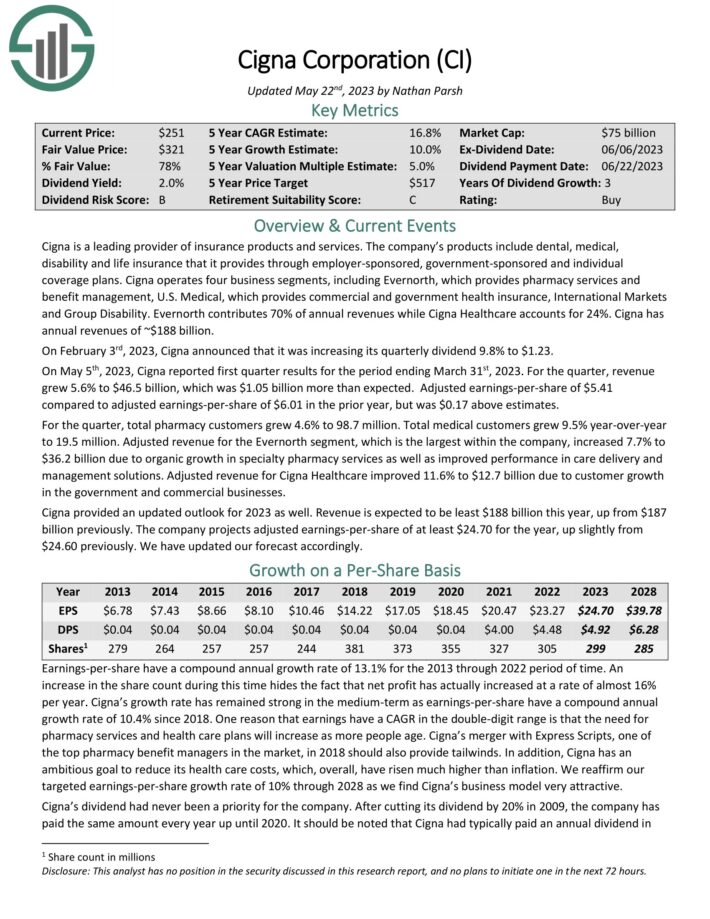

Dividend Growth Stock #4: Cigna Group (CI)

Cigna is a leading provider of insurance products and services. The company’s products include dental, medical, disability and life insurance that it provides through employer-sponsored, government-sponsored and individual coverage plans.

Source: Investor Presentation

On May 5th, 2023, Cigna reported first quarter results for the period ending March 31st, 2023. For the quarter, revenue grew 5.6% to $46.5 billion, which was $1.05 billion more than expected. Adjusted earnings-per-share of $5.41 compared to adjusted earnings-per-share of $6.01 in the prior year, but was $0.17 above estimates.

Click here to download our most recent Sure Analysis report on Cigna (preview of page 1 of 3 shown below):

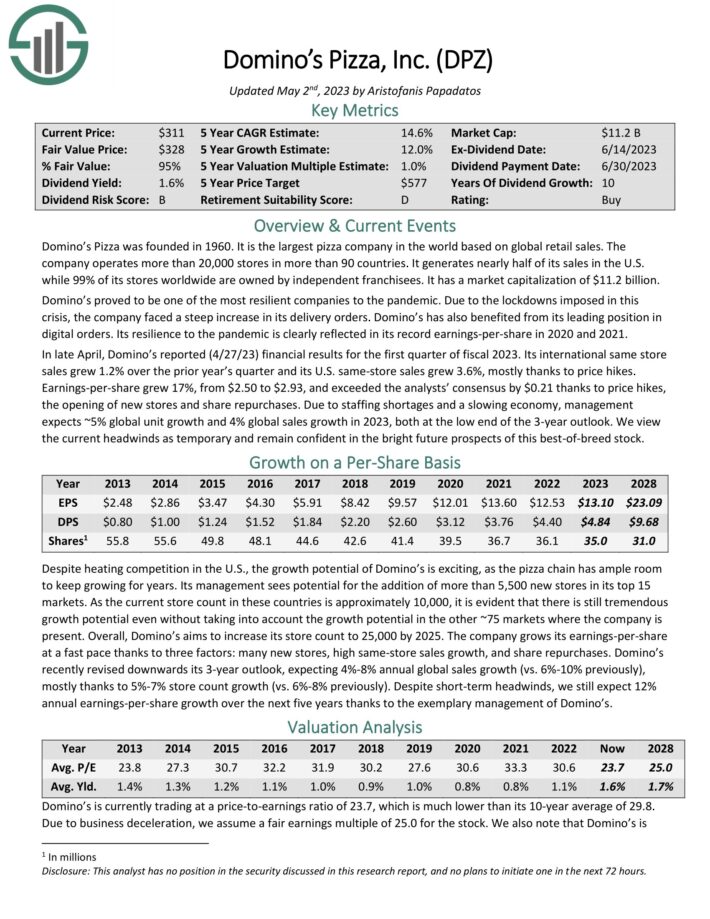

Dividend Growth Stock #3: Dominos Pizza (DPZ)

Domino’s Pizza is the largest pizza company in the world based on global retail sales. The company operates more than 20,000 stores in more than 90 countries. It generates nearly half of its sales in the U.S. while 99% of its stores worldwide are owned by independent franchisees.

In late April, Domino’s reported (4/27/23) financial results for the first quarter of fiscal 2023. Its international same store sales grew 1.2% over the prior year’s quarter and its U.S. same-store sales grew 3.6%, mostly thanks to price hikes. Earnings-per-share grew 17%, from $2.50 to $2.93, and exceeded the analysts’ consensus by $0.21 thanks to price hikes, the opening of new stores and share repurchases.

Click here to download our most recent Sure Analysis report on Dominos Pizza (DPZ) (preview of page 1 of 3 shown below):

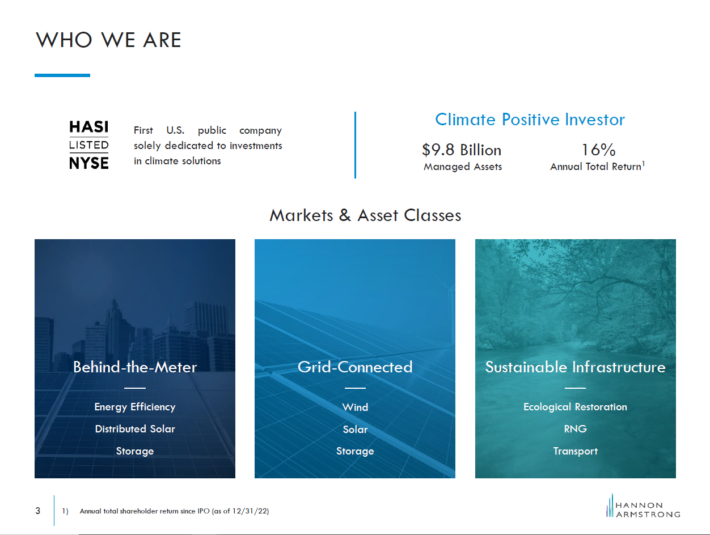

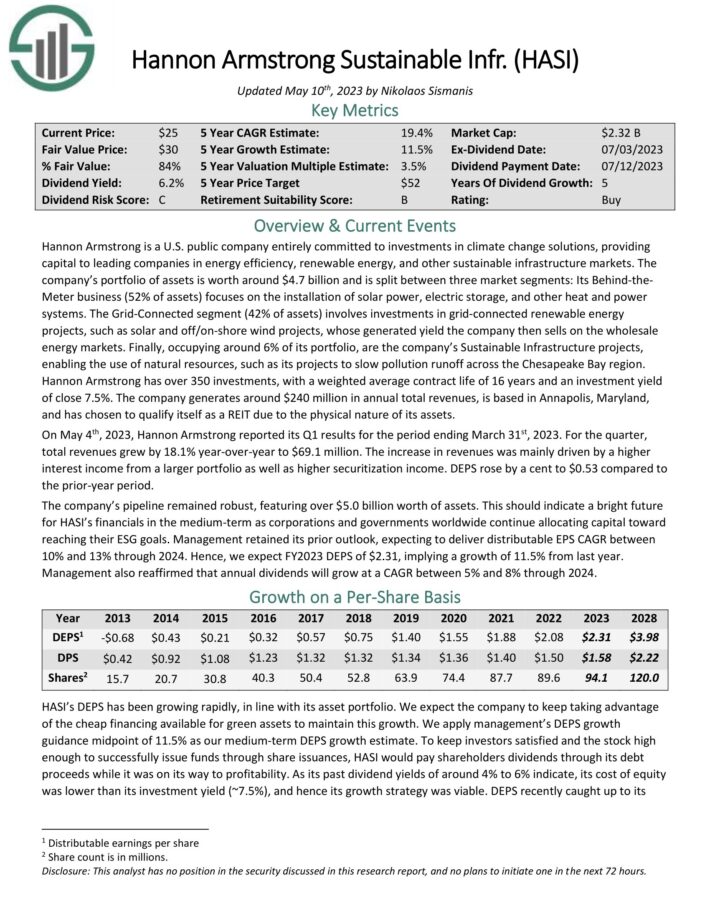

Dividend Growth Stock #2: Hannon Armstrong Sustainable Infrastructure (HASI)

Hannon Armstrong Sustainable Infrastructure Capital, Inc. is a company that is focused on providing capital for businesses in the energy efficiency, renewable energy, and sustainable infrastructure industries.

Source. Hannon Armstrong Sustainable Infrastructure Capital presentation

The industries Hannon Armstrong provides capital for are growing, in part due to massive public investments and incentives by governments and regulators. There thus is ample market growth for Hannon Armstrong to target. We believe that Hannon Armstrong will grow its profits at a low double-digit pace over the coming five years, which is a strong growth rate for an income stock.

Between its solid dividend yield and high earnings growth, Hannon Armstrong should deliver compelling total returns over the coming years, making the company one of the best dividend growth stocks.

Click here to download our most recent Sure Analysis report on Hannon Armstrong (HASI) (preview of page 1 of 3 shown below):

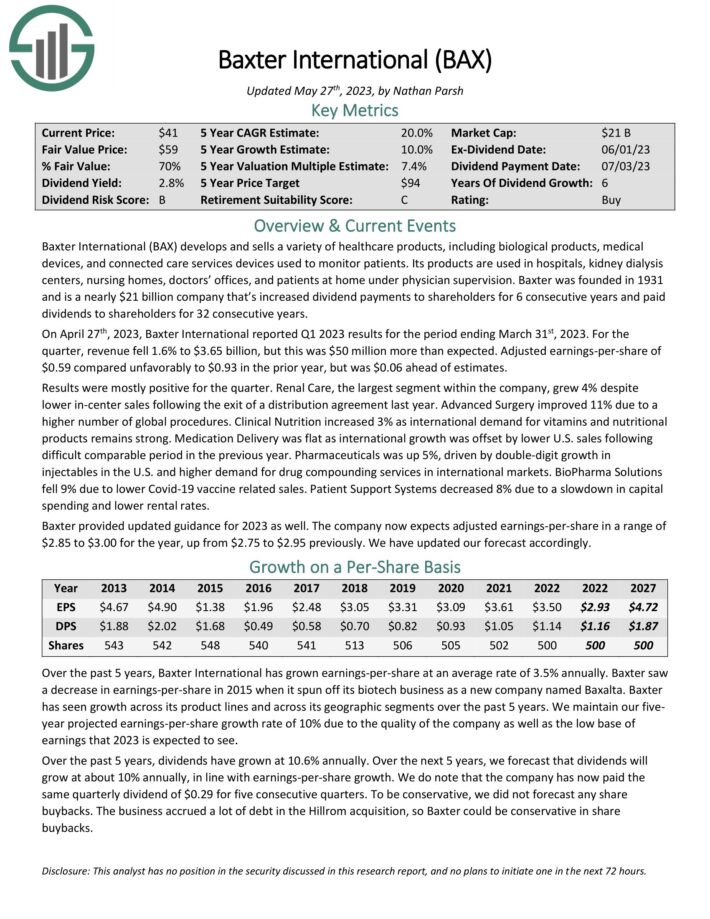

Dividend Growth Stock #1: Baxter International (BAX)

Baxter International develops and sells a variety of healthcare products, including biological products, medical devices, and connected care services devices used to monitor patients. Its products are used in hospitals, kidney dialysis centers, nursing homes, doctors’ offices, and patients at home under physician supervision. Baxter has paid dividends to shareholders for 32 consecutive years.

On April 27th, 2023, Baxter International reported Q1 2023 results for the period ending March 31st, 2023. For the quarter, revenue fell 1.6% to $3.65 billion, but this was $50 million more than expected. Adjusted earnings-per-share of $0.59 compared unfavorably to $0.93 in the prior year, but was $0.06 ahead of estimates.

Baxter takes the top spot among the best dividend growth stocks due to its expected earnings and dividend growth, and attractive expected returns.

Click here to download our most recent Sure Analysis report on Baxter (BAX) (preview of page 1 of 3 shown below):

Final Thoughts

Investors should not ignore the best dividend growth stocks simply because many have low current dividend yields. Companies with strong business models, competitive advantages, and growth potential are attractive regardless of their starting yields.

The best dividend growth stocks unleash the power of compounding. There are many cases in which the best dividend growth stocks could produce a higher yield on cost over time than a stock with a higher current yield but little or no dividend growth.

These 12 of the best dividend growth stocks have the potential to raise their dividends by 10% per year or more for the foreseeable future, which makes them an attractive combination of dividend growth and total returns.

Other Dividend Lists

The Dividend Aristocrats list is not the only way to quickly screen for the best dividend growth stocks. If you are interested in finding more of the best dividend growth stocks, the following Sure Dividend resources will be of interest to you.

Blue Chip Stock Investing

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].