My mid-week morning practice reads:

• Inside Chernobyl, 200 Exhausted Workers Toil Around the Clock at Russian Gunpoint Trapped since their shift 3 weeks in the past, the Ukrainians protecting the deserted nuclear plant secure from meltdown are ill-fed, confused and determined for aid (Wall Road Journal)

• Powell Admires Paul Volcker. He Could Should Act Like Him. The Federal Reserve is dealing with the quickest inflation most People have ever seen. Its chair says policymakers will do what it takes to tame costs. (New York Instances)

• How Kyiv’s outgunned defenders have saved Russian forces from capturing the capital “The Russians weren’t prepared for unconventional warfare,” mentioned Rob Lee, senior fellow on the International Coverage Analysis Institute and an professional on Russian protection coverage. “They weren’t prepared for unconventional ways. They don’t seem to be certain how you can cope with this insurgency, guerilla-warfare-type state of affairs.” (Washington Publish) see additionally Stingers, rifles and ‘St. Javelin’: The worldwide race to arm Ukraine The U.S. and NATO are main a multibillion-dollar effort to ship high-end weaponry to Ukraine. Will it change the course of the warfare? (Grid)

• Predicting the Subsequent Recession The Fed can’t ease pandemic associated provide constraints (besides by curbing demand), and the Fed can’t cease the warfare. So, there’s a chance that the Fed will tighten an excessive amount of and that can result in a “laborious touchdown” (aka recession). (Calculated Threat)

• Buyers Haven’t Confronted a Market Like This in Many years. Right here’s How They’re Coping. Inflation and geopolitical danger are “again with a vengeance” simply as volatility is spiking. (Institutional Investor)

• Russia Is Spiraling Towards a $150 Billion Default Nightmare What occurs with bond funds due Wednesday may kickstart Russia’s first foreign-currency default because the 1917 revolution. (Bloomberg)

• How a wrinkle within the oil futures market has clogged America’s oil pump Huge deal, you could say. Merchants are speculating. That’s simply what they do. But it surely’s not simply merchants who watch the futures market. Oil corporations watch the market carefully, too, as do the traders who spend money on them, to find out whether or not it’s worthwhile placing cash within the floor. (NPR)

• Main breakthrough on nuclear fusion vitality: European scientists say they’ve made a serious breakthrough of their quest to develop sensible nuclear fusion – the vitality course of that powers the celebs. (BBC)

• In case your hospital all of the sudden feels extra like an Apple retailer or greenhouse, biophilic design is why Healthcare areas are more and more utilizing nature as a method to make their buildings higher for sufferers. (Quick Firm)

• The Senate simply voted to make daylight saving time everlasting. Good. The case in opposition to altering clocks is much less about extending sunsets later all 12 months and extra about staying constant. (Vox)

You’ll want to try our Masters in Enterprise interview this weekend with Michelle Seitz, Chairman and Chief Government Officer of Russell Investments, the sixth largest supervisor on this planet. The agency manages over $331. billion in belongings and advises on one other $2.8 trillion.

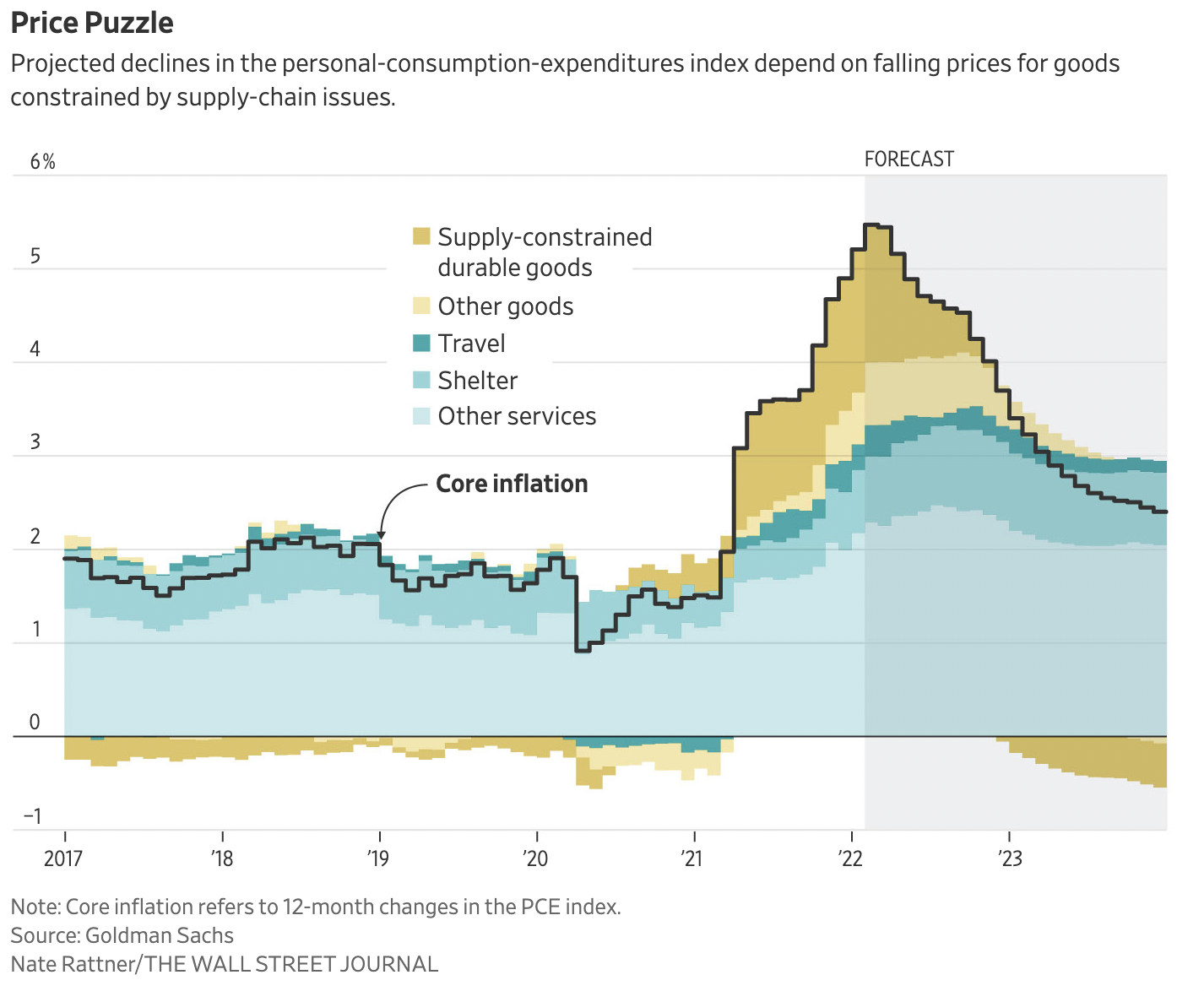

The Inflation Hits Simply Maintain Coming, Elevating Stakes for the Fed

Supply: Wall Road Journal

Join our reads-only mailing listing right here.