Printed on February seventh, 2025 by Bob Ciura

The common dividend yield within the S&P 500 Index stays low at simply 1.3%. Because of this, revenue buyers ought to give attention to higher-yielding securities, if they need further revenue from their inventory portfolios.

Even higher, buyers can purchase excessive dividend shares when they’re additionally undervalued, which might result in excessive complete returns within the coming years.

In spite of everything, the objective of rational buyers is to maximize complete return underneath a given set of constraints. Excessive dividend shares can contribute a good portion of a inventory’s complete return.

With this in thoughts, we compiled an inventory of excessive dividend shares with dividend yields above 5%. You possibly can obtain your free copy of the excessive dividend shares checklist by clicking on the hyperlink under:

Observe: The spreadsheet makes use of the Wilshire 5000 because the universe of securities from which to pick out, plus a number of further securities we display for with 5%+ dividend yields.

The free excessive dividend shares checklist spreadsheet has our full checklist of ~170 particular person securities (shares, REITs, MLPs, and so on.) with 5%+ dividend yields.

Curiously, all returns come from solely three sources:

- Dividends (or distributions, curiosity, and so on.)

- Development on a per share foundation (usually measured as earnings-per-share)

- Valuation a number of modifications (usually measured as a change within the price-to-earnings ratio)

Mixed, these three sources make up complete return.

Historic complete return, whereas attention-grabbing, is just not what issues in investing. It’s anticipated future returns that we care about.

And since complete returns can solely come from the three sources talked about above, you need to use the anticipated complete return framework to make clear your pondering on the place you count on complete returns to come back from.

The next checklist represents the ten most undervalued shares within the Positive Evaluation Analysis Database that even have yields above 5%.

The checklist excludes MLPs, BDCs, and REITs, and in addition excludes worldwide shares. The ten undervalued hidden gems under are sorted by anticipated return from valuation modifications, from lowest to highest.

Desk of Contents

You possibly can immediately leap to any particular part of the article by utilizing the hyperlinks under:

Undervalued Hidden Gem #10: Verizon Communications (VZ)

- Annual Valuation Return: 5.0%

- Dividend Yield: 6.8%

Verizon Communications was created by a merger between Bell Atlantic Corp and GTE Corp in June 2000. Verizon is among the largest wi-fi carriers within the nation.

Wi-fi contributes three-quarters of all revenues, and broadband and cable companies account for a couple of quarter of gross sales. The corporate’s community covers ~300 million folks and 98% of the U.S.

On January twenty fourth, 2025, Verizon introduced fourth quarter and full yr outcomes. For the quarter, income grew 1.7% to $35.7 billion, which beat estimates by $360 million.

Supply: Investor Presentation

Adjusted earnings-per-share of $1.10 in contrast favorably to $1.08 within the prior yr and was in-line with expectations. For the yr, grew 0.6% to $134.8 billion whereas adjusted earnings-per-share $4.59 in comparison with $4.71 in 2023.

For the quarter, Verizon had postpaid cellphone internet additions of 568K, which was higher than the 449K internet additions the corporate had in the identical interval final yr. Retail postpaid internet additions totaled 426K.

Wi-fi retail postpaid cellphone churn fee stays low at 0.89%. Wi-fi income grew 3.1% to $20.0 billion whereas the Shopper phase elevated 2.2% to $27.6 billion.

Click on right here to obtain our most up-to-date Positive Evaluation report on VZ (preview of web page 1 of three proven under):

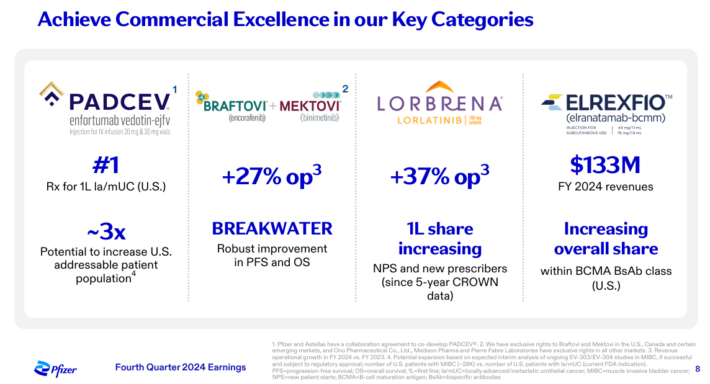

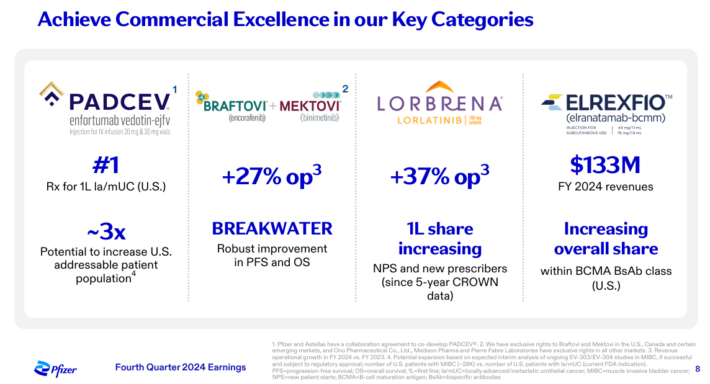

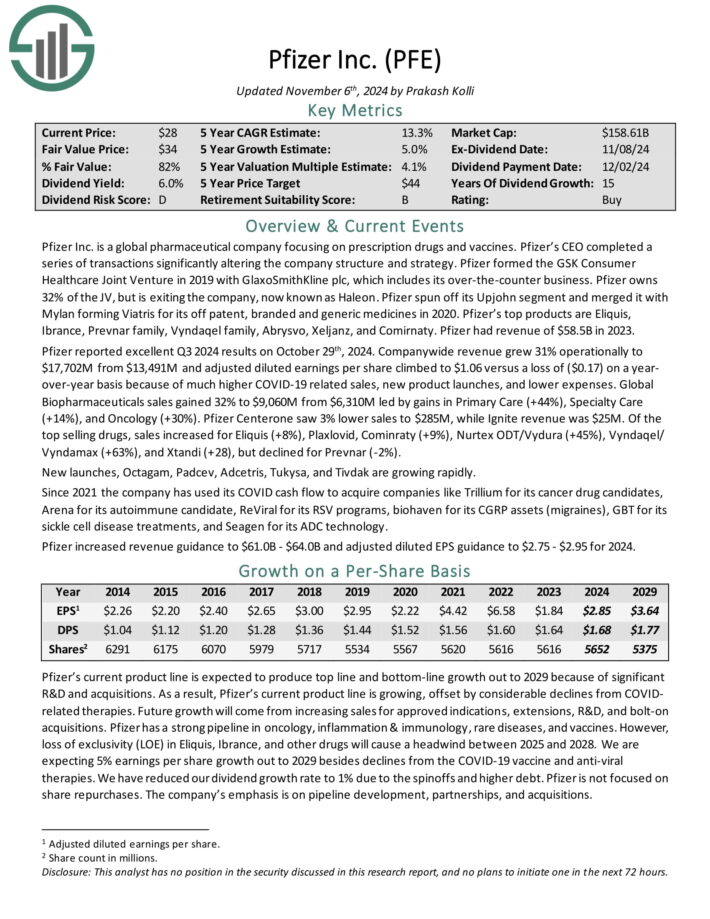

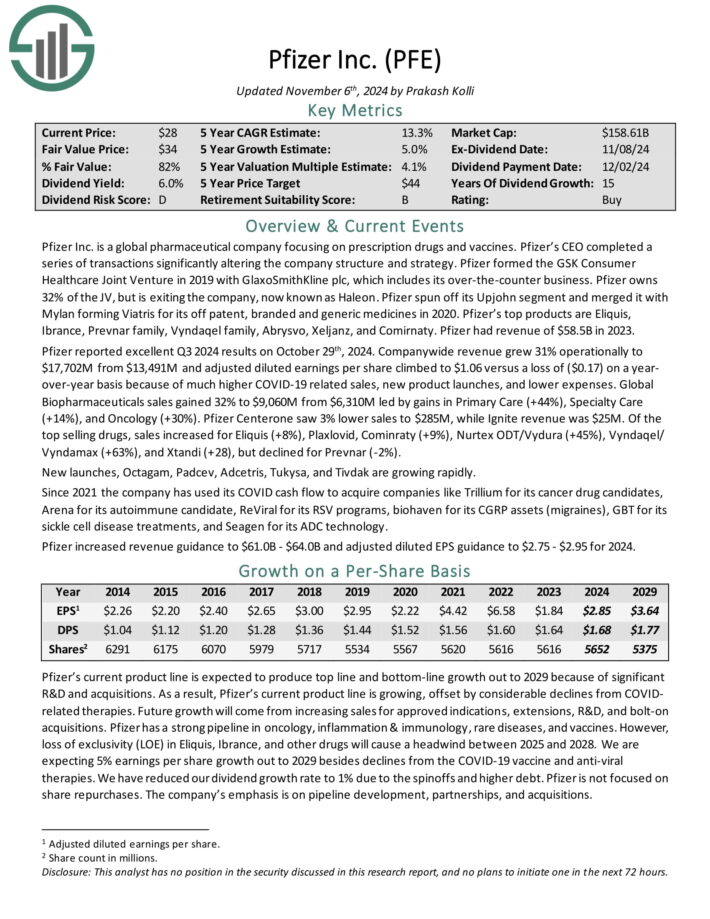

Undervalued Hidden Gem #9: Pfizer Inc. (PFE)

- Annual Valuation Return: 5.7%

- Dividend Yield: 6.7%

Pfizer Inc. is a worldwide pharmaceutical firm specializing in prescribed drugs and vaccines. Pfizer shaped the GSK Shopper Healthcare Joint Enterprise in 2019 with GlaxoSmithKline plc, which incorporates its over-the-counter enterprise.

Pfizer owns 32% of the JV, however is exiting the corporate, now often called Haleon. Pfizer spun off its Upjohn phase and merged it with Mylan forming Viatris for its off patent, branded and generic medicines in 2020.

Pfizer’s high merchandise are Eliquis, Ibrance, Prevnar household, Vyndaqel household, Abrysvo, Xeljanz, and Comirnaty.

Supply: Investor Presentation

Pfizer’s present product line is predicted to supply high line and bottom-line development due to important R&D and acquisitions.

Because of this, Pfizer’s present product line is rising, offset by appreciable declines from COVID-related therapies. Future development will come from growing gross sales for permitted indications, extensions, R&D, and bolt-on acquisitions.

Pfizer is among the largest pharmaceutical firms on the planet. As such, it has scale in R&D, manufacturing, regulatory affairs, distribution, and advertising and marketing world wide.

This provides Pfizer the flexibility to deliver new therapies to market, associate with smaller firms, or purchase whole firms outright. The present pipeline is strong, and a few will seemingly be blockbuster medicine even after attrition.

Click on right here to obtain our most up-to-date Positive Evaluation report on PFE (preview of web page 1 of three proven under):

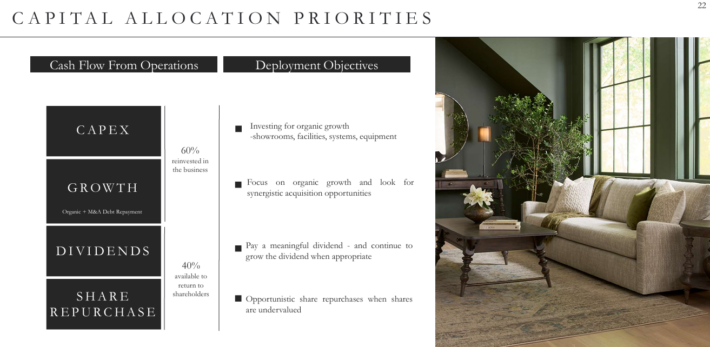

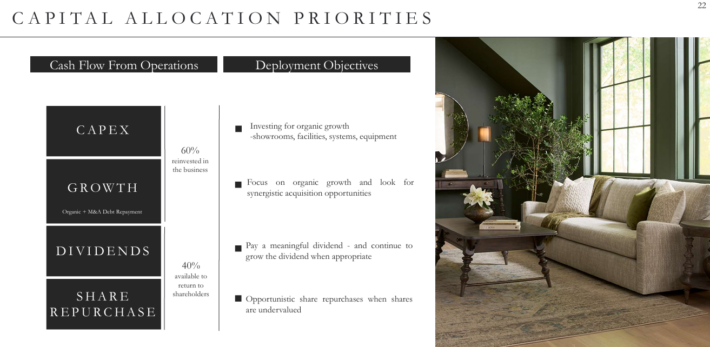

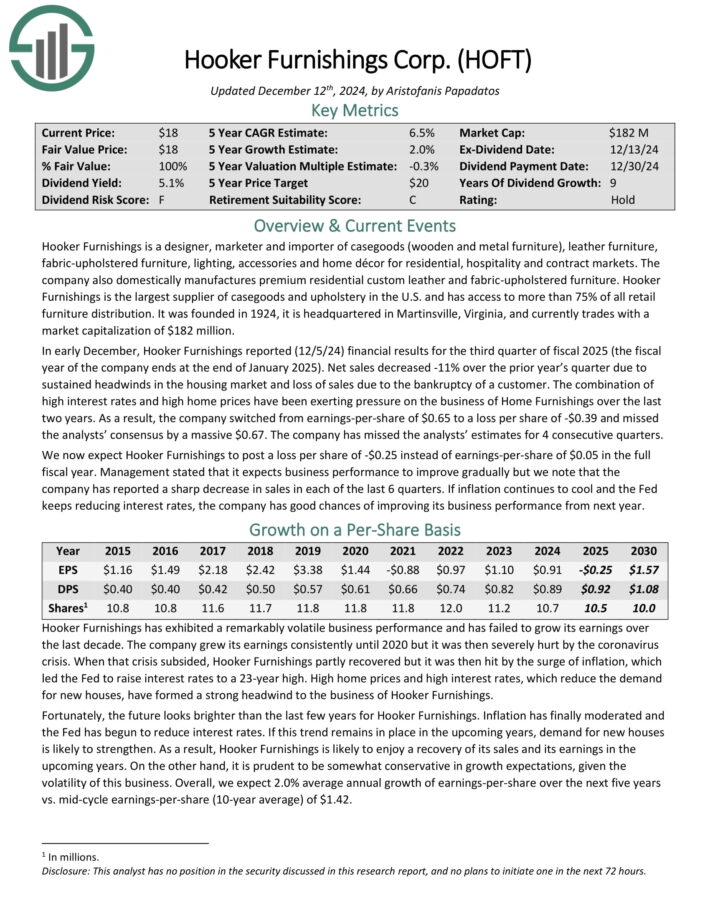

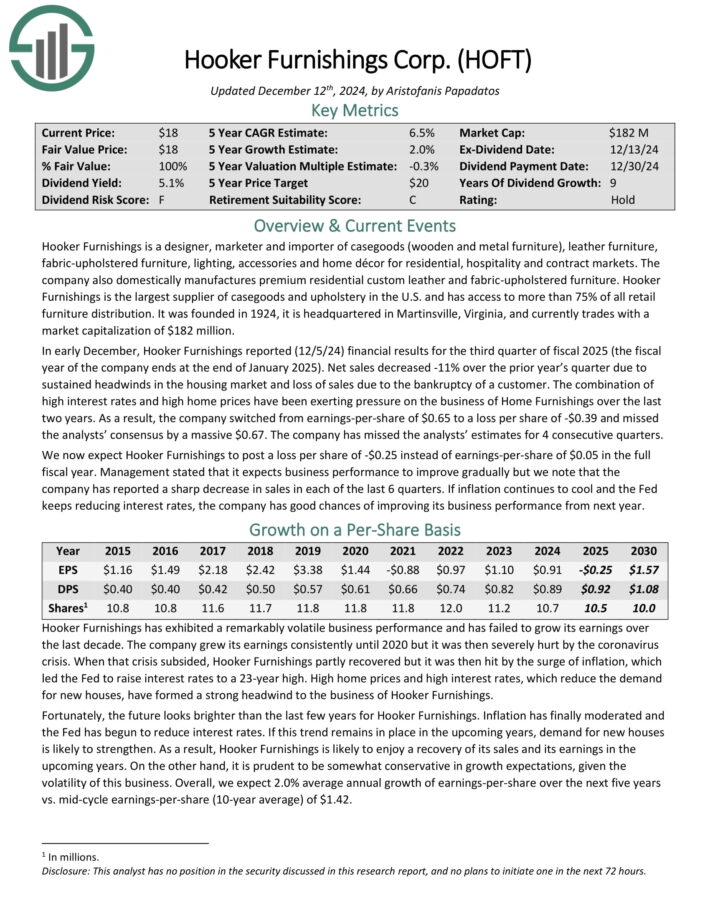

Undervalued Hidden Gem #8: Hooker Furnishings Firm (HOFT)

- Annual Valuation Return: 6.6%

- Dividend Yield: 7.0%

Hooker Furnishings is a designer, marketer and importer of casegoods (wood and metallic furnishings), leather-based furnishings, fabric-upholstered furnishings, lighting, equipment and residential décor for residential, hospitality and contract markets.

The corporate additionally domestically manufactures premium residential customized leather-based and fabric-upholstered furnishings.

Hooker Furnishings is the biggest provider of casegoods and fabric within the U.S. and has entry to greater than 75% of all retail furnishings distribution.

Supply: Investor Presentation

In early December, Hooker Furnishings reported (12/5/24) monetary outcomes for the third quarter of fiscal 2025. Internet gross sales decreased -11% over the prior yr’s quarter because of sustained headwinds within the housing market and lack of gross sales because of the chapter of a buyer.

The mix of excessive rates of interest and excessive dwelling costs have been exerting strain on the enterprise of Dwelling Furnishings during the last two years.

Because of this, the corporate switched from earnings-per-share of $0.65 to a loss per share of -$0.39 and missed the analysts’ consensus by an enormous $0.67.

Click on right here to obtain our most up-to-date Positive Evaluation report on HOFT (preview of web page 1 of three proven under):

Undervalued Hidden Gem #7: Kraft Heinz Co. (KHC)

- Annual Valuation Return: 6.6%

- Dividend Yield: 7.0%

Kraft-Heinz is a processed meals and drinks firm which owns a product portfolio that features meals merchandise comparable to condiments, sauces, cheese & dairy, frozen & chilled meals, and toddler eating regimen & vitamin.

The corporate was created in 2015 in a merger between Kraft Meals Group and H. J. Heinz Firm, orchestrated by Warren Buffett’s Berkshire Hathaway and 3G Capital.

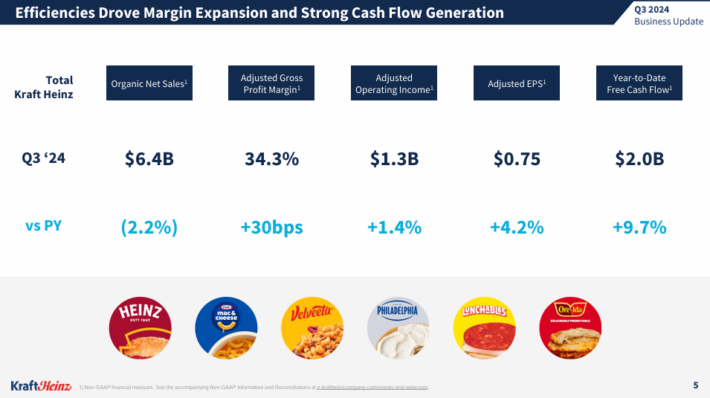

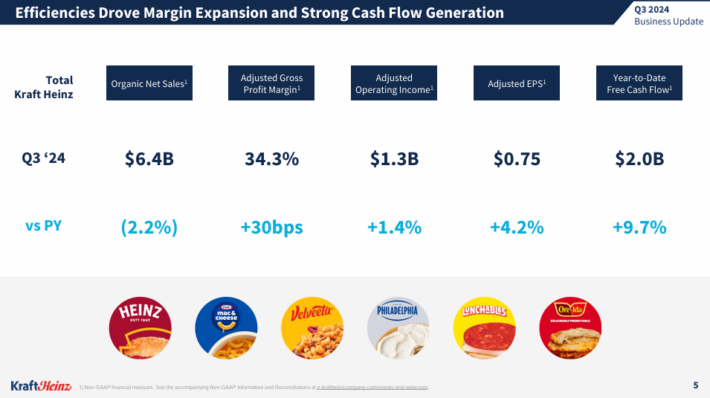

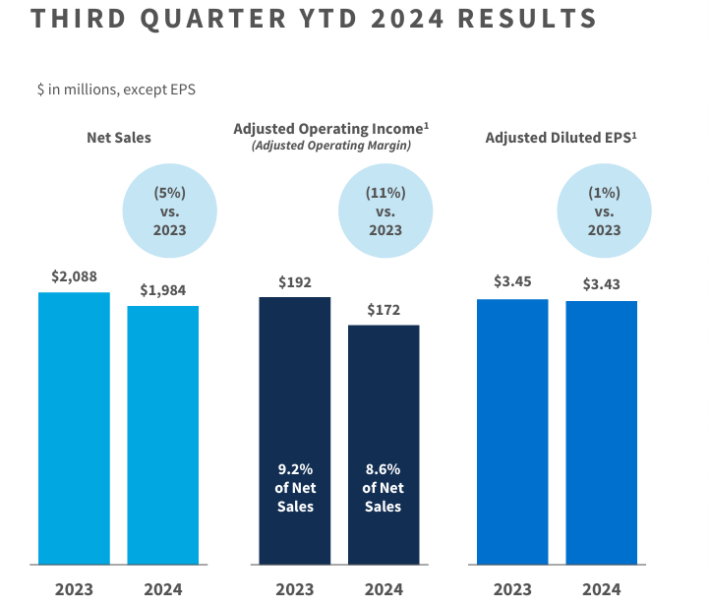

The Kraft-Heinz Firm reported its third quarter earnings outcomes on October 30. The corporate reported that its revenues totaled $6.38 billion through the quarter, which was down 2.9% year-over-year.

Supply: Investor Presentation

Natural gross sales have been down by 2.2%. This was a weaker efficiency in comparison with the earlier quarter, when natural gross sales had declined by simply 0.5%.

Kraft-Heinz generated earnings-per-share of $0.75 through the third quarter, which was above the consensus estimate. Earnings-per-share have been up 4% versus the earlier yr’s quarter.

Administration said that they see natural internet gross sales declining by round 2% in 2024, whereas administration is forecasting earnings-per-share to come back in between $3.01 and $3.07 for the present yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on KHC (preview of web page 1 of three proven under):

Undervalued Hidden Gem #6: FMC Corp. (FMC)

- Annual Valuation Return: 6.6%

- Dividend Yield: 7.0%

FMC Company is an agricultural sciences firm that gives crop safety, plant well being, {and professional} pest and turf administration merchandise. By way of acquisitions, FMC is now one of many 5 largest patented crop chemical firms.

The corporate markets its merchandise by means of its personal gross sales group and thru alliance companions, unbiased distributors, and gross sales representatives. It operates in North America, Latin America, Europe, the Center East, Africa, and Asia.

The corporate stays effectively positioned in its markets and was in a position to enhance costs in all areas. We count on rising demand from agricultural markets that can drive robust gross sales of fertilizer within the years forward. Development from rising markets also needs to be robust.

Pricing good points together with robust quantity development of higher-margin merchandise have supported FMC’s revenues and earnings. The corporate’s sturdy analysis and growth pipeline will help steady development within the years to come back.

Click on right here to obtain our most up-to-date Positive Evaluation report on FMC (preview of web page 1 of three proven under):

Undervalued Hidden Gem #5: Western Union Firm (WU)

- Annual Valuation Return: 6.6%

- Dividend Yield: 7.0%

The Western Union Firm is the world chief within the enterprise of home and worldwide cash transfers. The corporate has a community of roughly 550,000 brokers globally and operates in additional than 200 international locations.

About 90% of brokers are outdoors of the US. Western Union operates two enterprise segments, Shopper-to-Shopper (C2C) and Different (invoice funds within the US and Argentina).

Western Union reported Q3 2024 outcomes on October twenty third, 2024. Firm-wide income decreased 6% and diluted GAAP earnings per share elevated 70% to $0.78 within the quarter in comparison with $0.46 within the prior yr.

Supply: Investor Presentation

Income fell on challenges in Iraq regardless of increased retail, branded digital transactions, and Shopper Providers volumes. Volumes are typically increased, however income is flat to declining in most geographies.

CMT income fell 9% on a year-over-year foundation even with 3% increased transaction volumes. Branded Digital Cash Switch CMT revenues elevated 9% as volumes rose 15%.

Click on right here to obtain our most up-to-date Positive Evaluation report on WU (preview of web page 1 of three proven under):

Undervalued Hidden Gem #4: Wendy’s Co. (WEN)

- Annual Valuation Return: 9.1%

- Dividend Yield: 5.1%

Wendy’s is the second largest hamburger quick-service restaurant chain within the U.S. (up from #3 previous to 2020), with over 7,000 restaurant areas globally. The corporate was based in 1969 in Columbus, Ohio. Greater than 90% of the corporate’s areas are in america.

On October thirty first, 2024, Wendy’s reported third quarter 2024 outcomes for the interval ending September twenty ninth, 2024. The corporate’s international system-wide gross sales development equaled 1.8% in comparison with development of 4.8% in third quarter 2023.

International same-restaurant gross sales development of 0.2% in contrast unfavorably to 2.8% in the identical prior yr interval. System-wide gross sales of $3.64 billion in comparison with $3.58 billion earned in Q3 2023.

Out of the 64 complete new restaurant openings within the third quarter, the corporate had 31 internet new eating places, which compares unfavorably to final yr’s 51 internet new eating places on 72 complete new eating places.

The U.S. noticed 2 internet new eating places closed, whereas 33 internet new eating places openings have been worldwide. The worldwide re-imaging of Wendy’s was reported to be 89% full as of 3Q 2024 in comparison with 83% one yr in the past.

Click on right here to obtain our most up-to-date Positive Evaluation report on WEN (preview of web page 1 of three proven under):

Undervalued Hidden Gem #3: Eversource Power (ES)

- Annual Valuation Return: 6.6%

- Dividend Yield: 7.0%

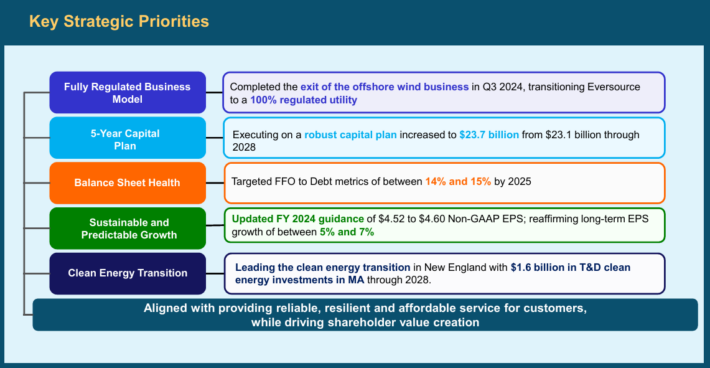

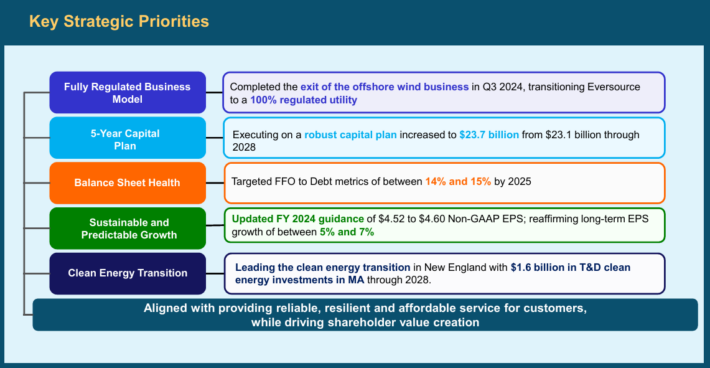

Eversource Power is a diversified holding firm with subsidiaries that present regulated electrical, gasoline, and water distribution service within the Northeast U.S.

The corporate’s utilities serve greater than 4 million clients after buying NStar’s Massachusetts utilities in 2012, Aquarion in 2017, and Columbia Fuel in 2020.

Eversource has delivered regular development to shareholders for a few years.

Supply: Investor Presentation

On November 4th, 2024, Eversource Power launched its third-quarter 2024 outcomes for the interval ending September thirtieth, 2024.

For the quarter, the corporate reported a internet lack of $(118.1) million, a pointy decline from earnings of $339.7 million in the identical quarter of final yr, which displays the affect of the corporate’s exit from offshore wind investments.

The corporate reported a loss per share of $(0.33), in contrast with earnings-per-share of $0.97 within the prior yr. Earnings from the Electrical Transmission phase elevated to $174.9 million, up from $160.3 million within the prior yr, primarily because of the next degree of funding in Eversource’s electrical transmission system.

Click on right here to obtain our most up-to-date Positive Evaluation report on ES (preview of web page 1 of three proven under):

Undervalued Hidden Gem #2: Carters Inc. (CRI)

- Annual Valuation Return: 9.1%

- Dividend Yield: 6.3%

Carter’s, Inc. is the biggest branded retailer of attire solely for infants and younger kids in North America. It was based in 1865 by William Carter. The corporate owns the Carter’s and OshKosh B’gosh manufacturers, two of essentially the most identified manufacturers within the kids’s attire house.

Carter’s acquired competitor OshKosh B’gosh for $312 million in 2005. Now, these manufacturers are bought in main department shops, nationwide chains, and specialty retailers domestically and internationally.

On October twenty sixth, 2024, the corporate reported third-quarter outcomes for Fiscal Yr (FY)2024. The corporate reported a decline in third-quarter fiscal 2024 outcomes, with internet gross sales down 4.2% to $758 million in comparison with the earlier yr’s $792 million.

Supply: Investor Presentation

The corporate’s working margin decreased to 10.2% from 11.8%, attributed to increased investments in pricing and advertising and marketing, regardless of a decrease price of products.

Earnings per diluted share (EPS) dropped to $1.62 from $1.78, reflecting softer demand in key segments.

Click on right here to obtain our most up-to-date Positive Evaluation report on CRI (preview of web page 1 of three proven under):

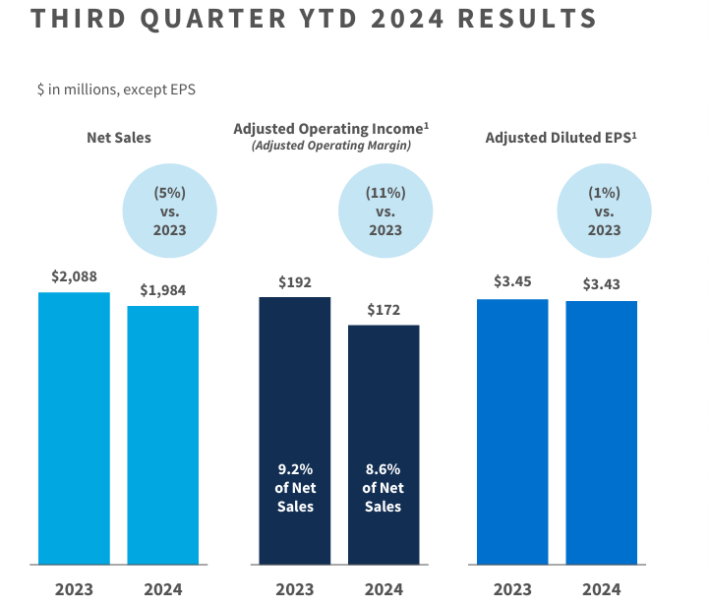

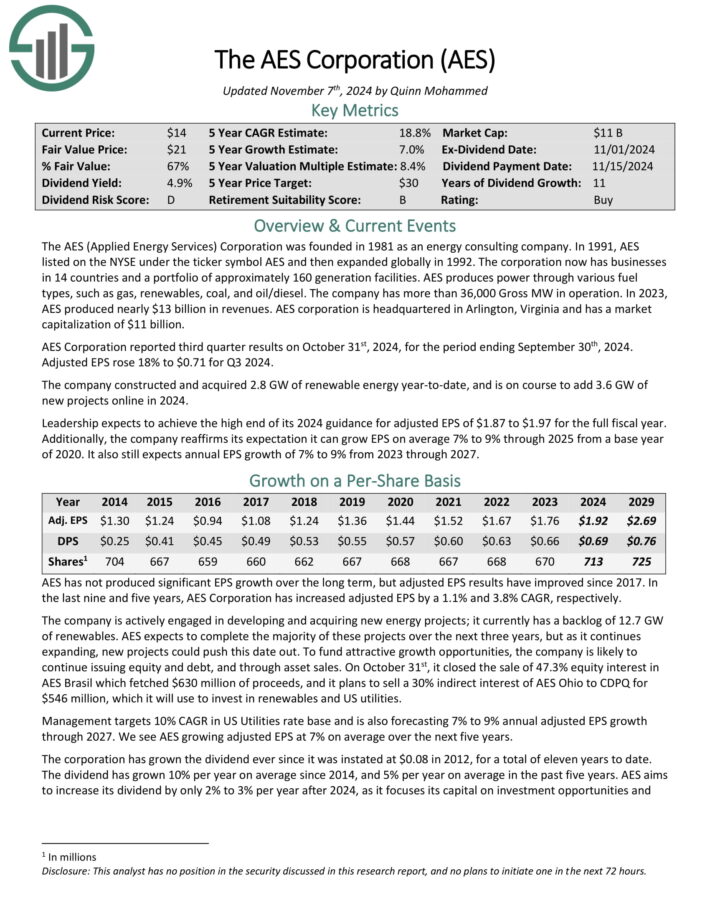

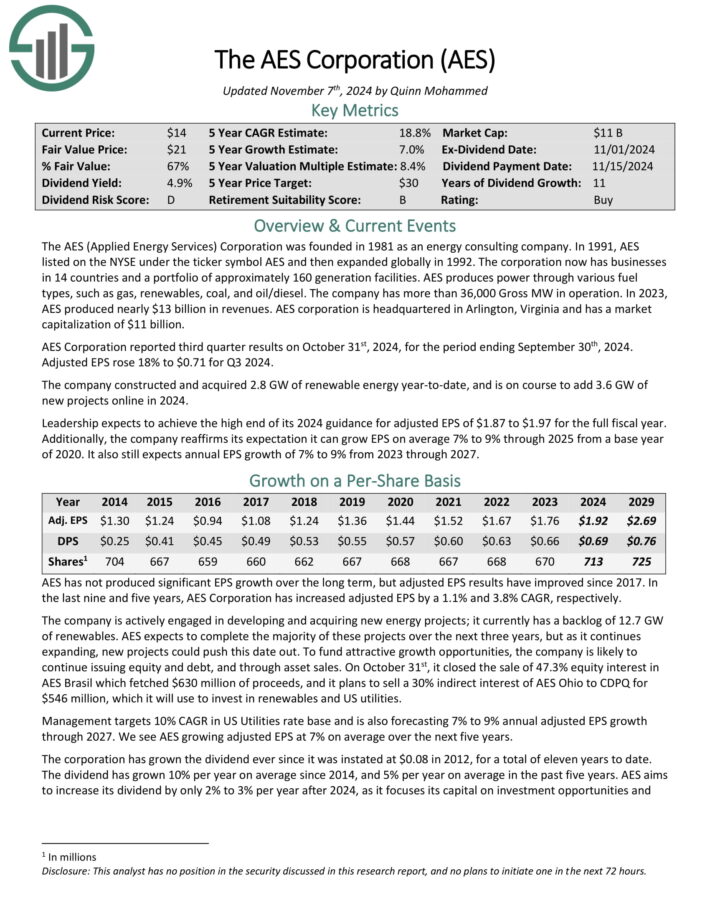

Undervalued Hidden Gem #1: AES Corp. (AES)

- Annual Valuation Return: 14.2%

- Dividend Yield: 6.5%

The AES (Utilized Power Providers) Company was based in 1981 as an power consulting firm. It now has companies in 14 international locations and a portfolio of roughly 160 era amenities.

AES produces energy by means of varied gasoline varieties, comparable to gasoline, renewables, coal, and oil/diesel. The corporate has greater than 36,000 Gross MW in operation.

AES Company reported third quarter outcomes on October thirty first, 2024, for the interval ending September thirtieth, 2024. Adjusted EPS rose 18% to $0.71 for Q3 2024.

The corporate constructed and bought 2.8 GW of renewable power year-to-date, and is on the right track so as to add 3.6 GW of recent initiatives on-line in 2024.

Supply: Investor Presentation

Management expects to attain the excessive finish of its 2024 steerage for adjusted EPS of $1.87 to $1.97 for the complete fiscal yr. Moreover, the corporate reaffirms it additionally nonetheless expects annual EPS development of seven% to 9% from 2023 by means of 2027.

The corporate is actively engaged in creating and buying new power initiatives.

It at present has a backlog of 12.7 GW of renewables. AES expects to finish nearly all of these initiatives by means of 2027.

Click on right here to obtain our most up-to-date Positive Evaluation report on AES (preview of web page 1 of three proven under):

Closing Ideas & Extra Studying

In case you are desirous about discovering high-quality dividend development shares and/or different high-yield securities and revenue securities, the next Positive Dividend assets will likely be helpful:

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].