Updated on December 21st, 2023 by Bob Ciura

At Sure Dividend, we recommend investors focus on the best dividend stocks that can generate the highest returns over time.

When it comes to dividends, investors should also be focused on dividend safety. There have been many stocks with high dividend yields that eventually cut or eliminate their dividends when business conditions deteriorate.

Dividend cuts should be avoided whenever possible.

We have created a unique metric called Dividend Risk Score, which measures a stock’s ability to maintain its dividend during recessions, and increase the dividend over time.

With this in mind, we’ve compiled a free list of the 50 safest dividend stocks based on their payout ratios and Dividend Risk Score, which you can download below:

The best dividend growth stocks are high-quality businesses that can maintain their dividends, even during recessions. But investing in poor businesses that cut their dividends is a recipe for under-performance over time.

That’s why, in this article, we have analyzed the 10 safest dividend stocks from our Sure Analysis Research Database with the safest dividends based on our Dividend Risk Score rating system.

The stocks below all have Dividend Risk Scores of ‘A’, our top rating, and with the lowest payout ratios. The stocks also have dividend yields of at least 1%, to make them appealing for income investors.

Table of Contents

Why The Payout Ratio Matters

The dividend payout ratio is simply a company’s annual per-share dividend, divided by the company’s annual earnings-per-share. It is a measure of the level of earnings a company distributes to its shareholders via dividends.

The payout ratio is a valuable investing metric because it differentiates companies with low payout ratios that have lots of room for dividend growth, from companies with high payout ratios whose dividends may not be sustainable.

Indeed, research has shown that companies with higher dividend growth have outperformed companies with lower dividend growth or no dividend growth.

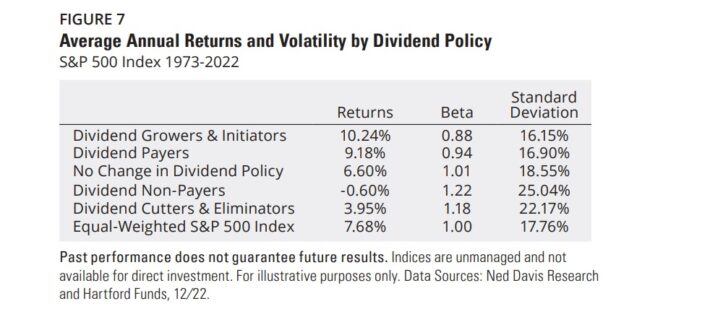

In research performed by Ned Davis and Hartford Funds, it was found that dividend growers and initiators delivered total returns of 10.24% per year from 1973 through 2022, better than the equal-weighted S&P 500’s performance of 7.68% per year.

Interestingly, the dividend growers and initiators analyzed in this study generated outperformance with less volatility – a rarity and a contradiction to what modern academic financial theory tells us.

A summary of this research can be found below.

Source: Hartford Funds – The Power Of Dividends

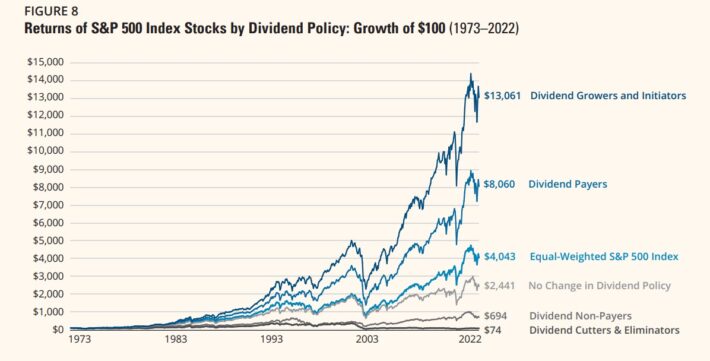

Outperformance of 2.56% annually might not seem like a game-changer, but it certainly is thanks to the wonder that is compound interest.

Using data from the same piece of research, investors who chose to invest exclusively in dividend growers and initiators were capable of turning $100 into $13,061. During the same time period, the S&P 500 index turned $100 into $4,043.

Source: Hartford Funds – The Power Of Dividends

Stocks that did not pay dividends could not match the performance of all types of dividend payers, turning $100 into $694 from 1973-2022. Dividend cutters and eliminators fared even worse, turning $100 into just $74–meaning these stocks actually lost money.

As a result, investors looking for stocks with better dividend growth (and long-term return potential) could consider these 10 dividend stocks with low payout ratios and Dividend Risk Scores of ‘A’.

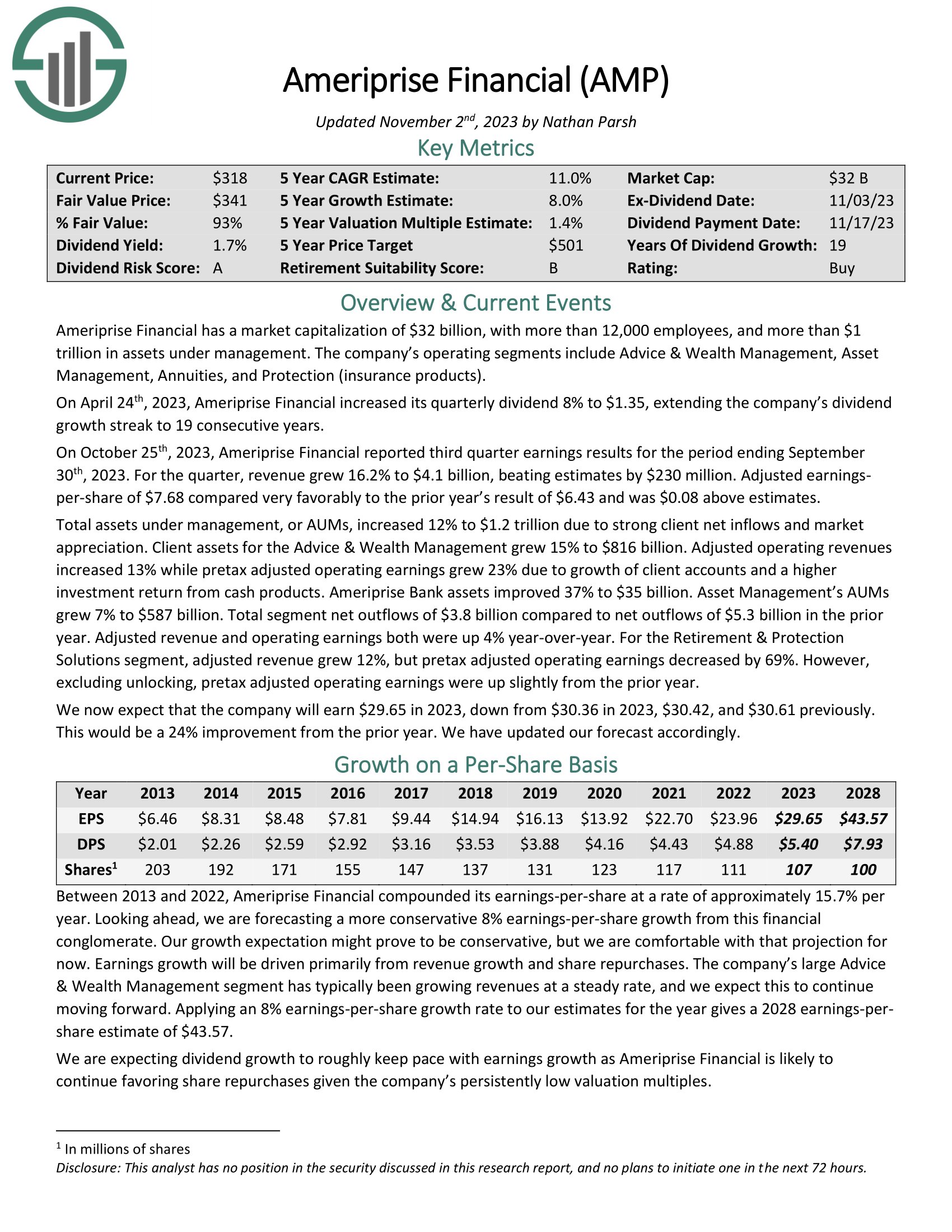

Safest Dividend Stock #10: Ameriprise Financial (AMP)

Ameriprise Financial has a market capitalization of $32 billion, with more than 12,000 employees, and more than $1 trillion in assets under management. The company’s operating segments include Advice & Wealth Management, Asset Management, Annuities, and Protection (insurance products).

On April 24th, 2023, Ameriprise Financial increased its quarterly dividend 8% to $1.35, extending the company’s dividend growth streak to 19 consecutive years.

On October 25th, 2023, Ameriprise Financial reported third quarter earnings results for the period ending September

30th, 2023. For the quarter, revenue grew 16.2% to $4.1 billion, beating estimates by $230 million. Adjusted earnings-per-share of $7.68 compared very favorably to the prior year’s result of $6.43 and was $0.08 above estimates. Total assets under management, or AUMs, increased 12% to $1.2 trillion due to strong client net inflows and market appreciation.

Click here to download our most recent Sure Analysis report on AMP (preview of page 1 of 3 shown below):

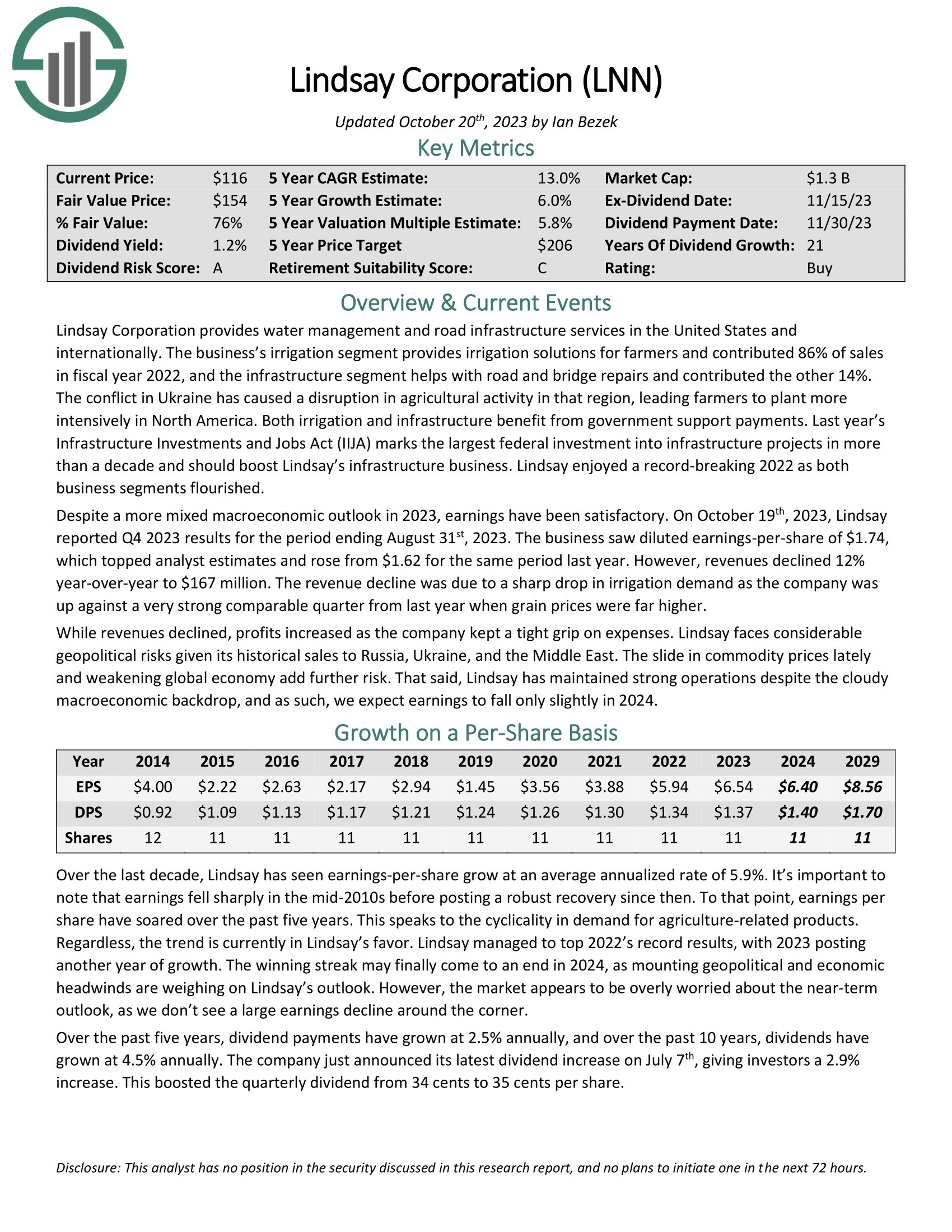

Safest Dividend Stock #9: Lindsay Corporation (LNN)

Lindsay Corporation provides water management and road infrastructure services in the United States and internationally. The business’s irrigation segment provides irrigation solutions for farmers and contributed 86% of sales in fiscal year 2022, and the infrastructure segment helps with road and bridge repairs and contributed the other 14%.

Lindsay is one of the top water stocks.

On October 19th, 2023, Lindsay reported Q4 2023 results for the period ending August 31st, 2023. The business saw diluted earnings-per-share of $1.74, which topped analyst estimates and rose from $1.62 for the same period last year. However, revenues declined 12% year-over-year to $167 million. The revenue decline was due to a sharp drop in irrigation demand as the company was up against a very strong comparable quarter from last year when grain prices were far higher.

Click here to download our most recent Sure Analysis report on Lindsay (preview of page 1 of 3 shown below):

Safest Dividend Stock #8: Raymond James Financial (RJF)

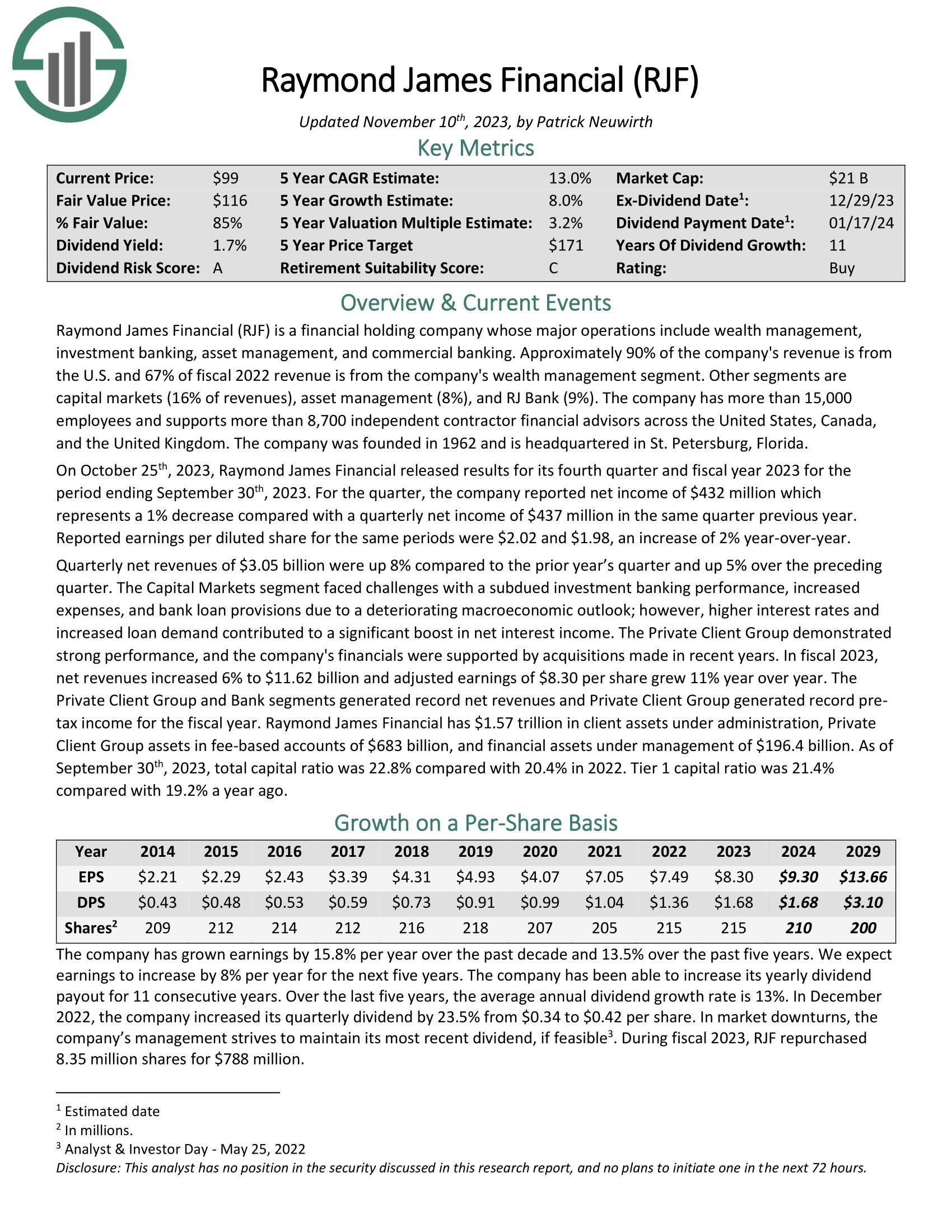

Raymond James Financial (RJF) is a financial holding company whose major operations include wealth management, investment banking, asset management, and commercial banking. Approximately 90% of the company’s revenue is from the U.S. and 67% of fiscal 2022 revenue is from the company’s wealth management segment. Other segments are

capital markets (16% of revenues), asset management (8%), and RJ Bank (9%). The company has more than 15,000 employees and supports more than 8,700 independent contractor financial advisors across the United States, Canada, and the United Kingdom.

On October 25th, 2023, Raymond James Financial released results for its fourth quarter and fiscal year 2023 for the period ending September 30th, 2023. For the quarter, the company reported net income of $432 million which represents a 1% decrease compared with a quarterly net income of $437 million in the same quarter previous year. Reported earnings per diluted share for the same periods were $2.02 and $1.98, an increase of 2% year-over-year.

Click here to download our most recent Sure Analysis report on RJF (preview of page 1 of 3 shown below):

Safest Dividend Stock #7: Tennant Co. (TNC)

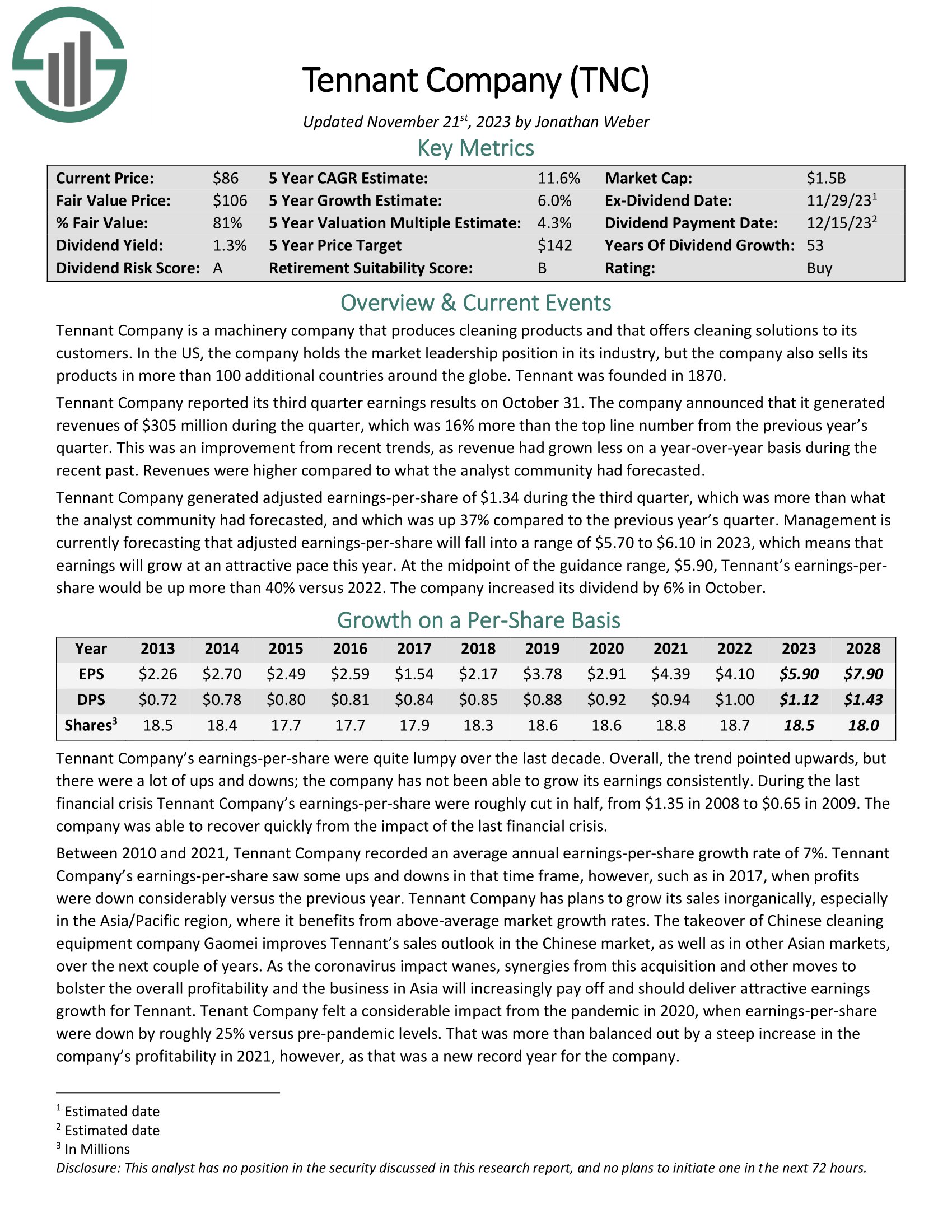

Tennant Company is a machinery company that produces cleaning products and that offers cleaning solutions to its customers. In the US, the company holds the market leadership position in its industry, but the company also sells its products in more than 100 additional countries around the globe. Tennant was founded in 1870.

Tennant Company reported its third quarter earnings results on October 31. The company announced that it generated revenues of $305 million during the quarter, which was 16% more than the top line number from the previous year’s quarter. This was an improvement from recent trends, as revenue had grown less on a year-over-year basis during the recent past. Revenues were higher compared to what the analyst community had forecasted.

Tennant Company generated adjusted earnings-per-share of $1.34 during the third quarter, which was more than what the analyst community had forecasted, and which was up 37% compared to the previous year’s quarter.

Click here to download our most recent Sure Analysis report on TNC (preview of page 1 of 3 shown below):

Safest Dividend Stock #6: Westlake Corporation (WLK)

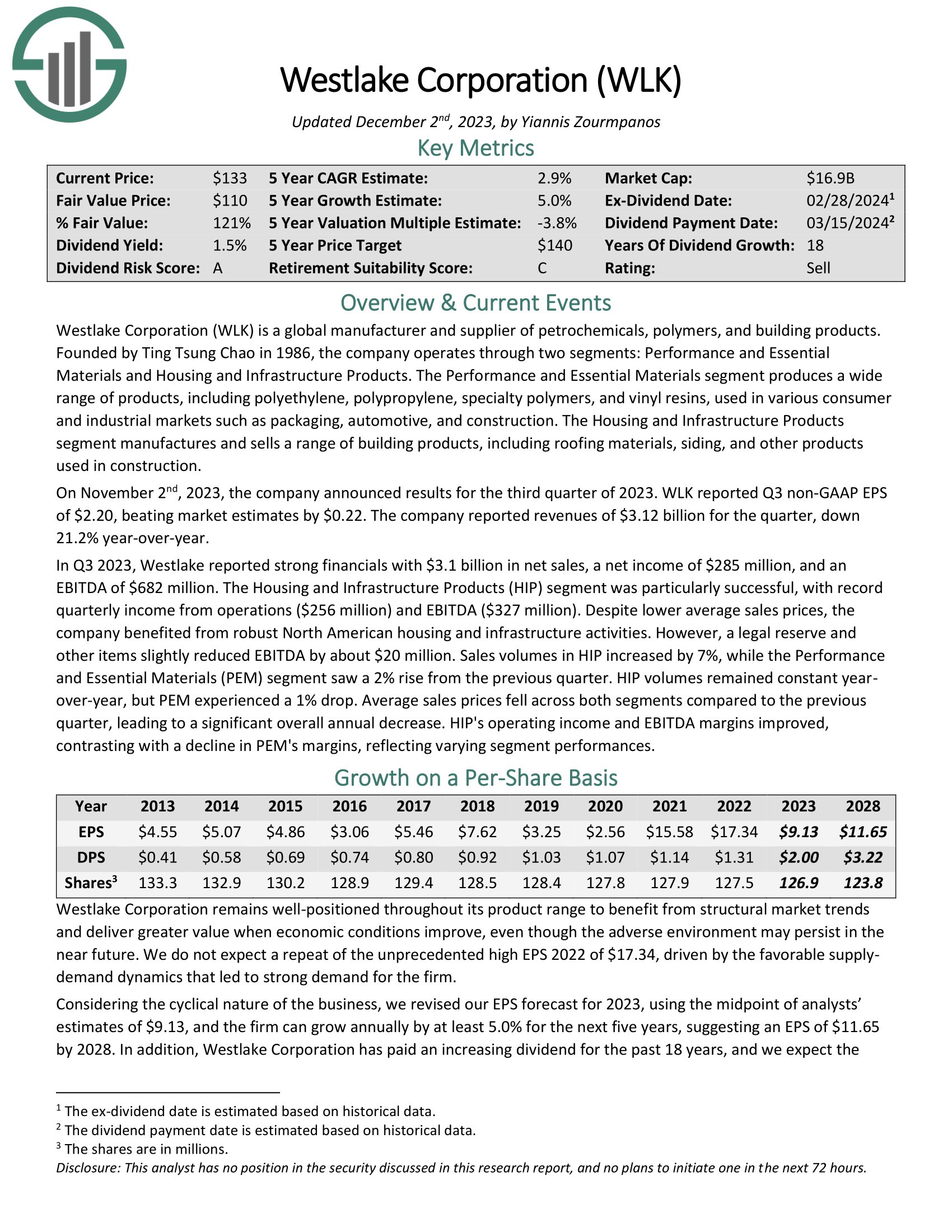

Westlake Corporation is a global manufacturer and supplier of petrochemicals, polymers, and building products. Founded by Ting Tsung Chao in 1986, the company operates through two segments: Performance and Essential Materials and Housing and Infrastructure Products.

The Performance and Essential Materials segment produces a wide range of products, including polyethylene, polypropylene, specialty polymers, and vinyl resins, used in various consumer and industrial markets such as packaging, automotive, and construction. The Housing and Infrastructure Products segment manufactures and sells a range of building products, including roofing materials, siding, and other products used in construction.

On November 2nd, 2023, the company announced results for the third quarter of 2023. WLK reported Q3 non-GAAP EPS of $2.20, beating market estimates by $0.22. The company reported revenues of $3.12 billion for the quarter, down 21.2% year-over-year.

Click here to download our most recent Sure Analysis report on WLK (preview of page 1 of 3 shown below):

Safest Dividend Stock #5: Primerica Inc. (PRI)

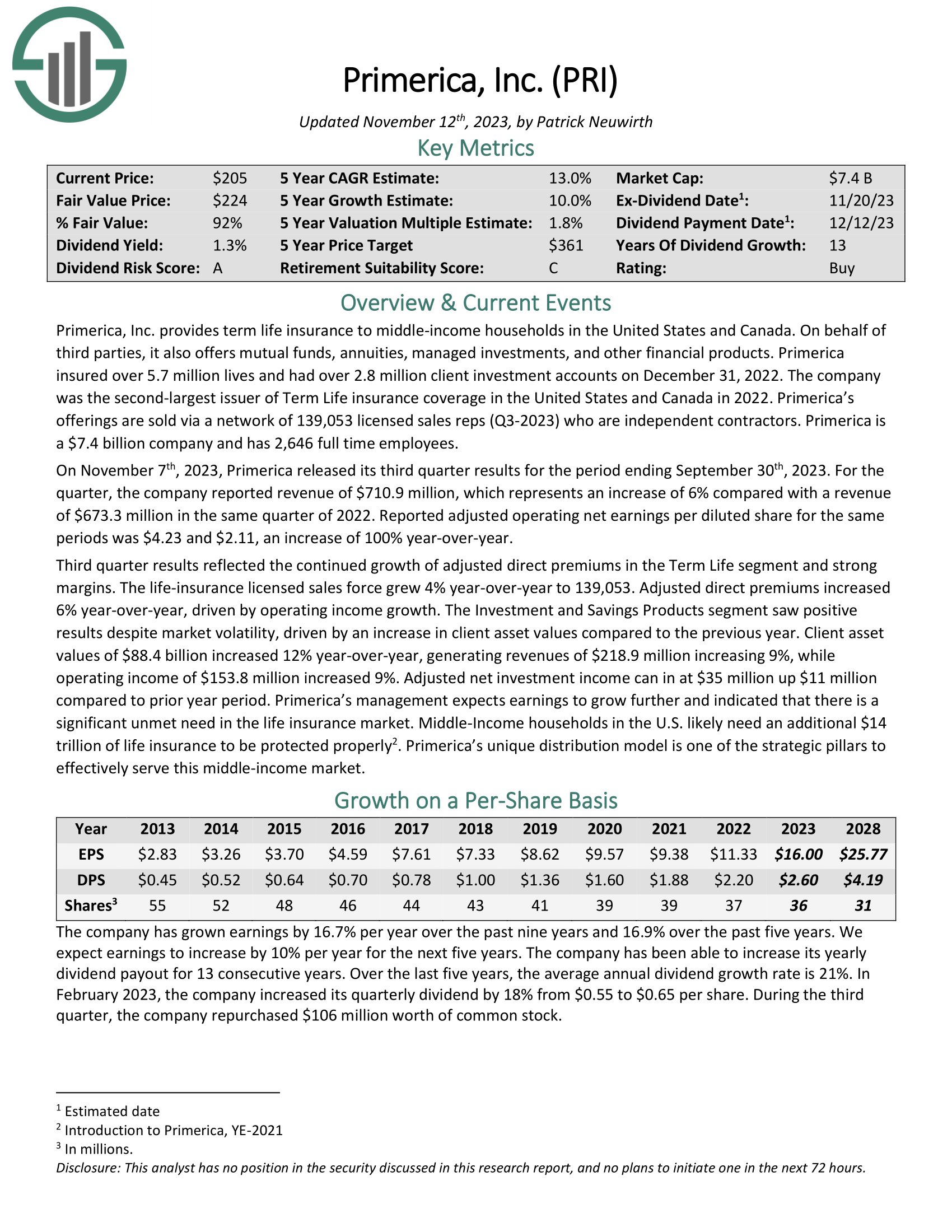

Primerica, Inc. provides term life insurance to middle-income households in the United States and Canada. On behalf of third parties, it also offers mutual funds, annuities, managed investments, and other financial products. Primerica insured over 5.7 million lives and had over 2.8 million client investment accounts on December 31, 2022. The company was the second-largest issuer of Term Life insurance coverage in the United States and Canada in 2022. Primerica’s offerings are sold via a network of 139,053 licensed sales reps (Q3-2023) who are independent contractors.

On November 7th, 2023, Primerica released its third quarter results for the period ending September 30th, 2023. For the quarter, the company reported revenue of $710.9 million, which represents an increase of 6% compared with a revenue of $673.3 million in the same quarter of 2022. Reported adjusted operating net earnings per diluted share for the same periods was $4.23 and $2.11, an increase of 100% year-over-year.

Click here to download our most recent Sure Analysis report on PRI (preview of page 1 of 3 shown below):

Safest Dividend Stock #4: Deere & Co. (DE)

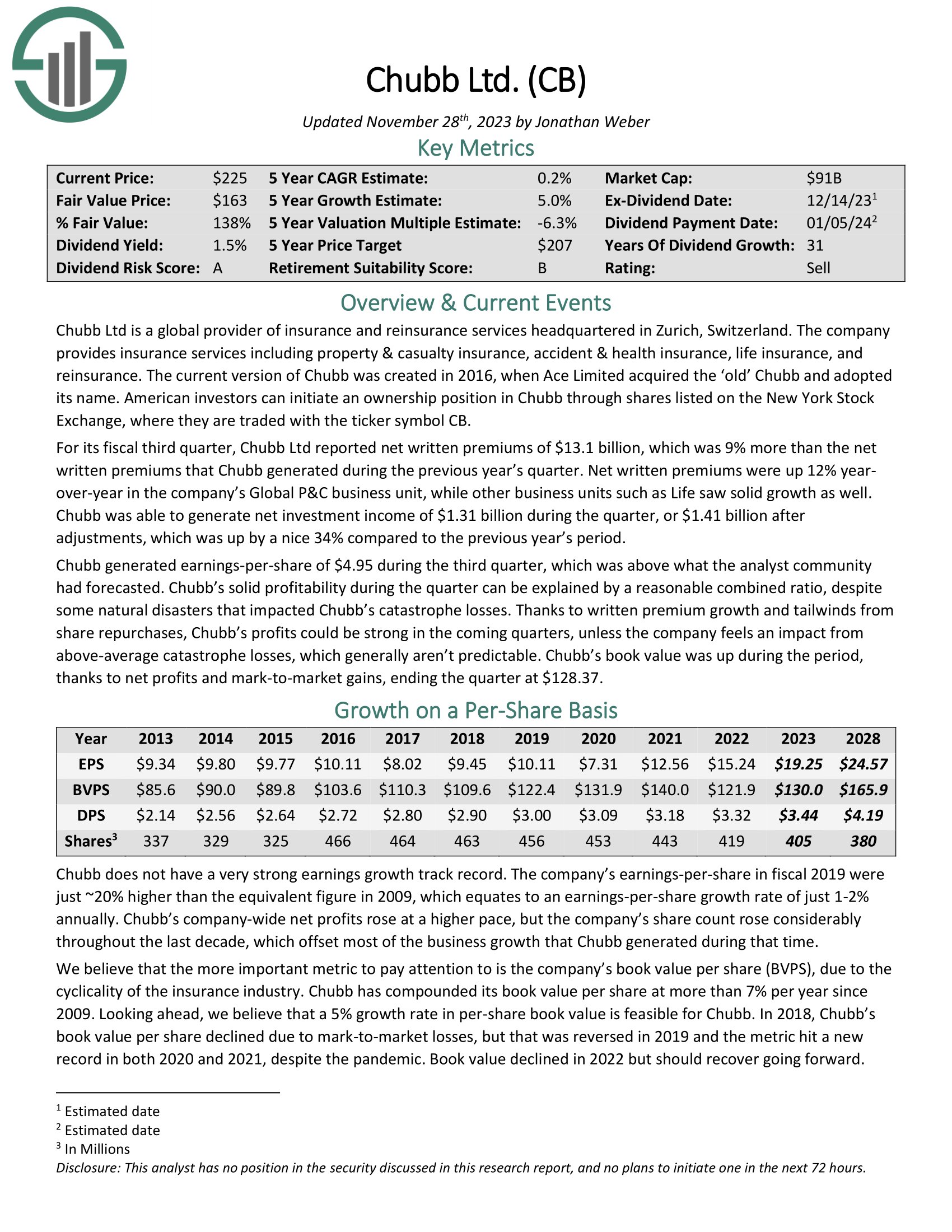

Chubb Ltd is a global provider of insurance and reinsurance services headquartered in Zurich, Switzerland. The company provides insurance services including property & casualty insurance, accident & health insurance, life insurance, and reinsurance.

For its fiscal third quarter, Chubb Ltd reported net written premiums of $13.1 billion, which was 9% more than the net written premiums that Chubb generated during the previous year’s quarter. Net written premiums were up 12% year over-year in the company’s Global P&C business unit, while other business units such as Life saw solid growth as well.

Chubb was able to generate net investment income of $1.31 billion during the quarter, or $1.41 billion after adjustments, which was up by a nice 34% compared to the previous year’s period.

Click here to download our most recent Sure Analysis report on Chubb (preview of page 1 of 3 shown below):

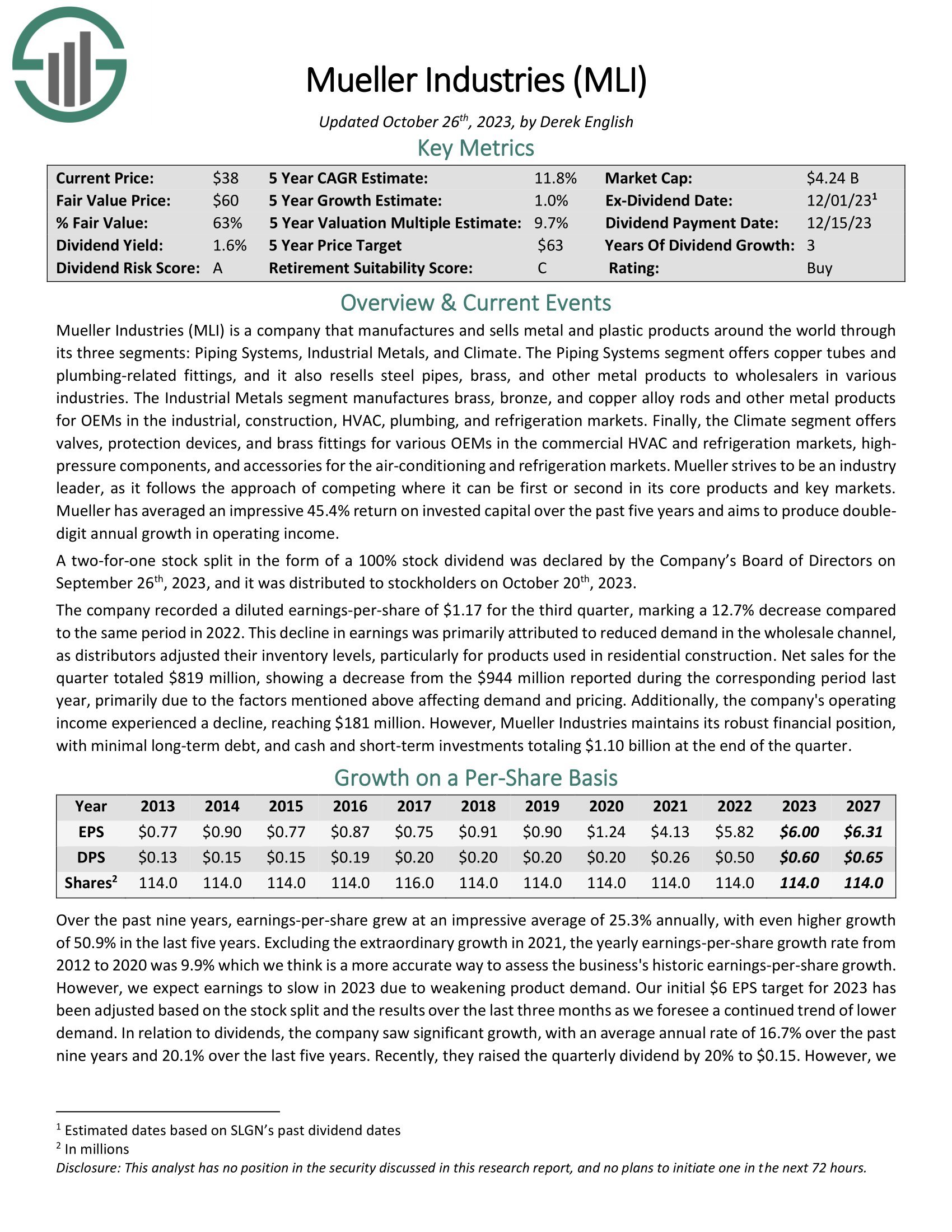

Safest Dividend Stock #3: Mueller Industries (MLI)

Mueller Industries is a company that manufactures and sells metal and plastic products around the world through its three segments: Piping Systems, Industrial Metals, and Climate. The Piping Systems segment offers copper tubes and plumbing-related fittings, and it also resells steel pipes, brass, and other metal products to wholesalers in various industries.

The Industrial Metals segment manufactures brass, bronze, and copper alloy rods and other metal products for OEMs in the industrial, construction, HVAC, plumbing, and refrigeration markets. Finally, the Climate segment offers valves, protection devices, and brass fittings for various OEMs.

Click here to download our most recent Sure Analysis report on MLI (preview of page 1 of 3 shown below):

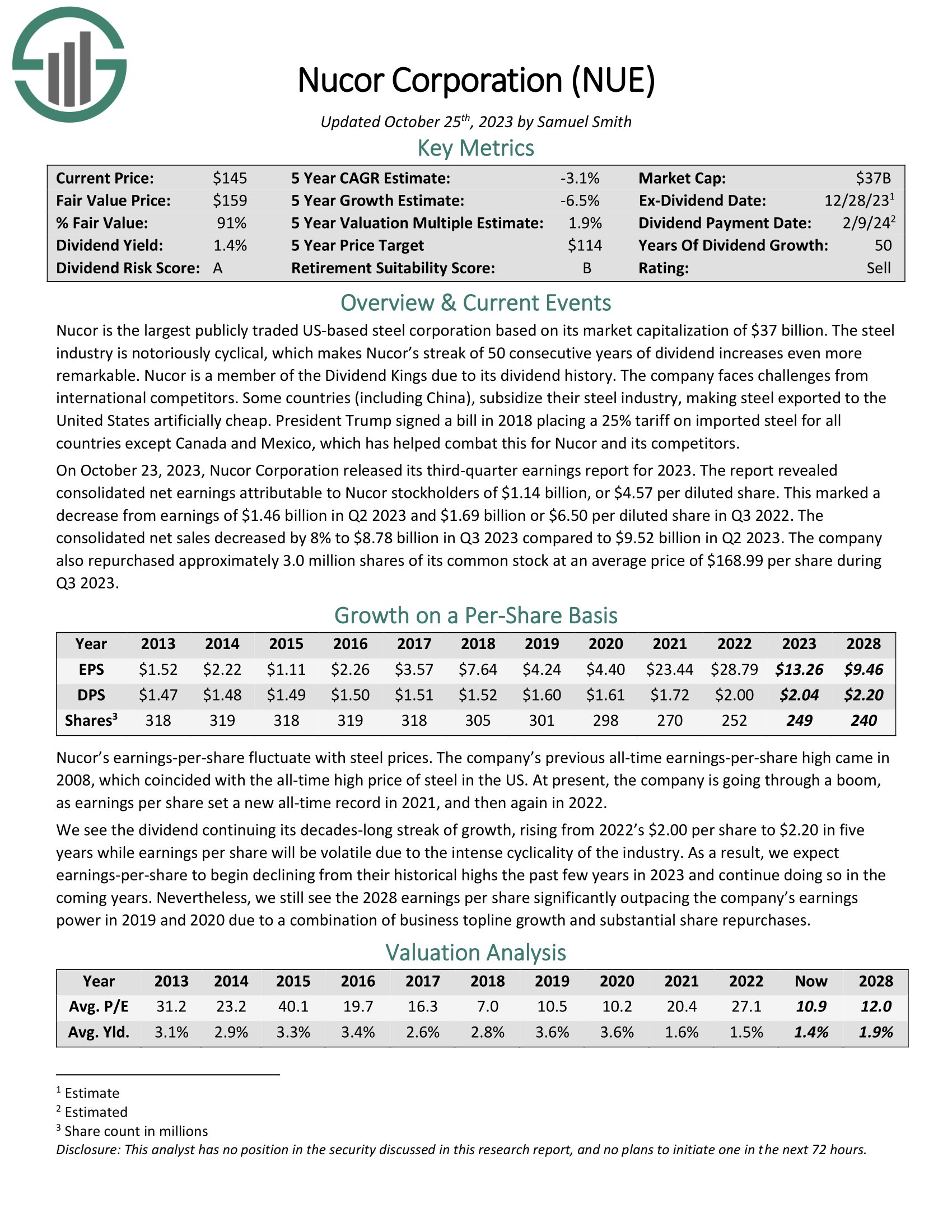

Safest Dividend Stock #2: Nucor Corp. (NUE)

Nucor is the largest publicly traded US-based steel corporation. The steel industry is notoriously cyclical, which makes Nucor’s streak of 50 consecutive years of dividend increases even more remarkable.

On October 23, 2023, Nucor Corporation released its third-quarter earnings report for 2023. The report revealed consolidated net earnings attributable to Nucor stockholders of $1.14 billion, or $4.57 per diluted share. This marked a decrease from earnings of $1.46 billion in Q2 2023 and $1.69 billion or $6.50 per diluted share in Q3 2022. Consolidated net sales decreased by 8% to $8.78 billion.

The company also repurchased approximately 3.0 million shares of its common stock at an average price of $168.99 per share during Q3 2023.

Click here to download our most recent Sure Analysis report on NUE (preview of page 1 of 3 shown below):

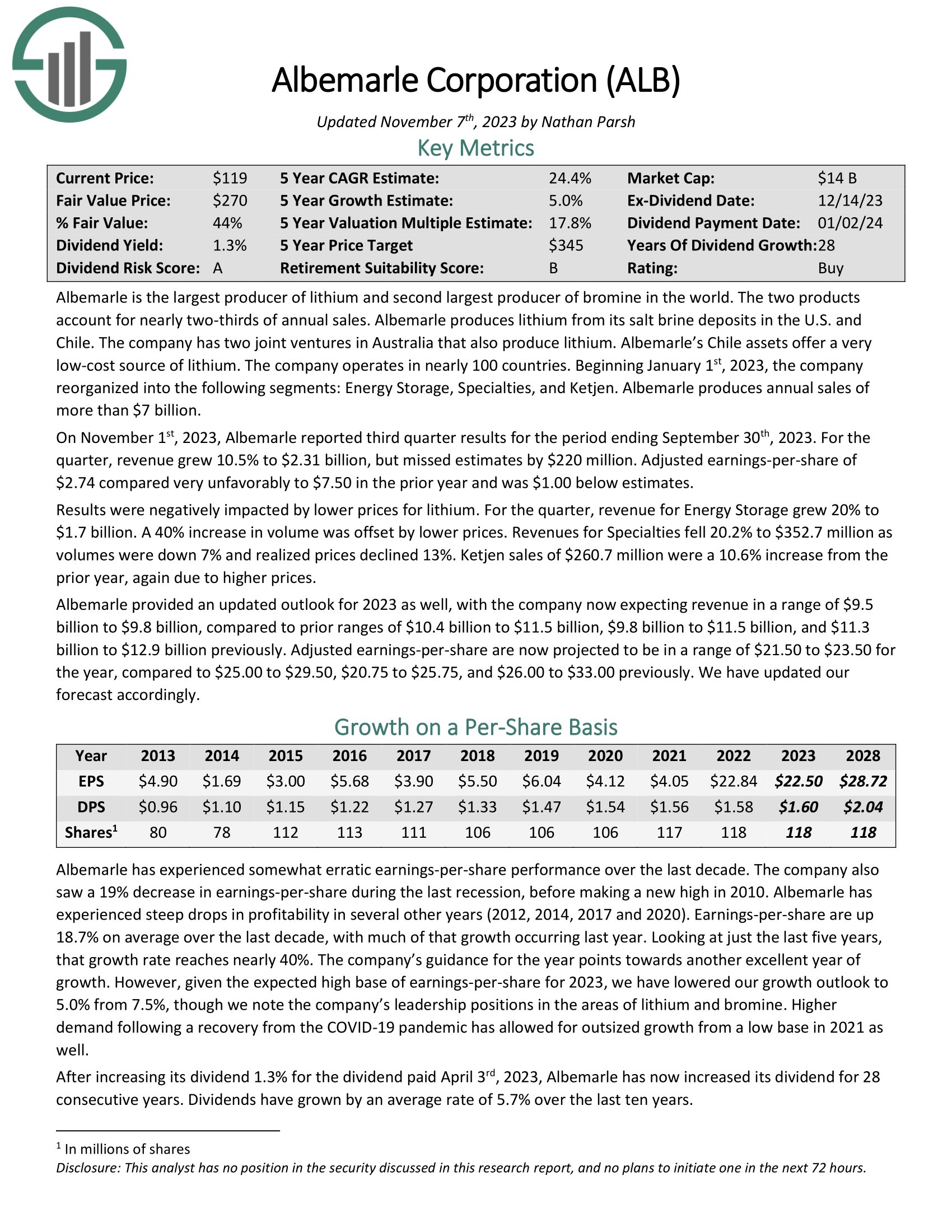

Safest Dividend Stock #1: Albemarle Corp. (ALB)

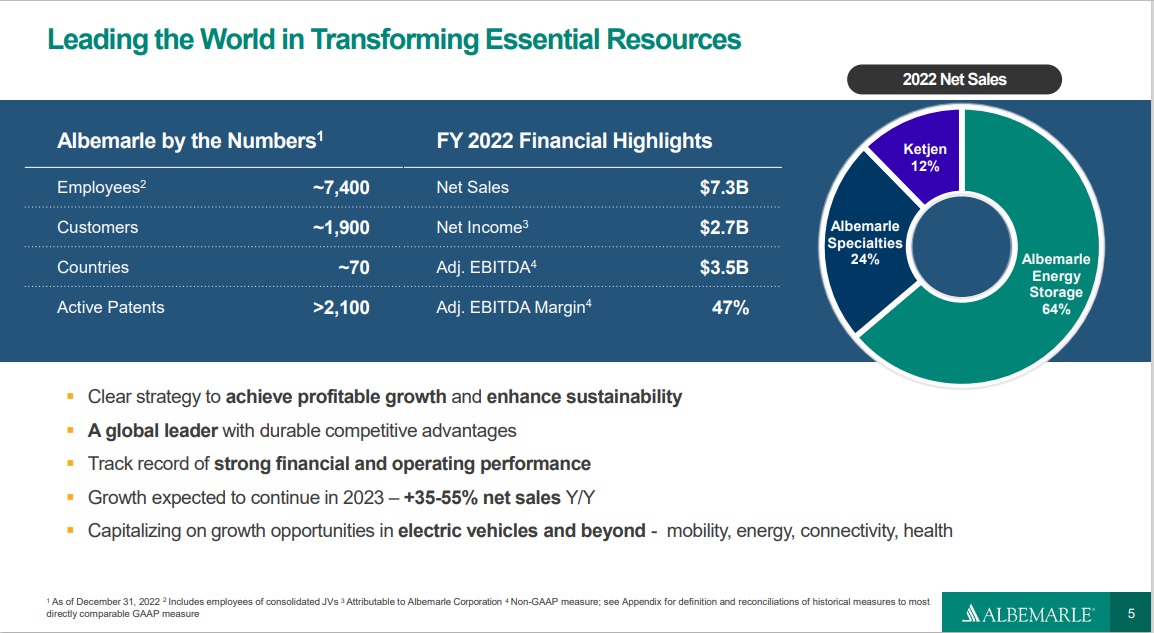

Albemarle is the largest producer of lithium and second largest producer of bromine in the world. The two products account for nearly two-thirds of annual sales. Albemarle produces lithium from its salt brine deposits in the U.S. and Chile. The company has two joint ventures in Australia that also produce lithium.

Related: 2023 Lithium Stocks List

Source: Investor Presentation

On November 1st, 2023, Albemarle reported third quarter results for the period ending September 30th, 2023. For the quarter, revenue grew 10.5% to $2.31 billion, but missed estimates by $220 million. Adjusted earnings-per-share of $2.74 compared very unfavorably to $7.50 in the prior year and was $1.00 below estimates.

Results were negatively impacted by lower prices for lithium. For the quarter, revenue for Energy Storage grew 20% to $1.7 billion. A 40% increase in volume was offset by lower prices. Revenues for Specialties fell 20.2% to $352.7 million as volumes were down 7% and realized prices declined 13%. Ketjen sales of $260.7 million were a 10.6% increase from the prior year, again due to higher prices.

Click here to download our most recent Sure Analysis report on Albemarle (preview of page 1 of 3 shown below):

Additional Reading

Investors looking for additional dividend stock ideas can find additional reading below:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].