Up to date on March sixth, 2025 by Bob Ciura

“KISS” stands for Okayeep It Simple Stupid.

The “Silly” half isn’t meant to be an insult. It’s a reminder that good folks could make “silly” errors when issues are over-complicated.

“Simplicity is the last word sophistication”

– Attributed to Leonardo Da Vinci

Retirement investing ought to be saved easy as a way to decrease errors. At its core, retirement investing is all about creating passive earnings.

At Certain Dividend, we deal with dividend-paying shares to construct a rising passive earnings stream.

A technique for buyers to seek out nice dividend shares is to deal with these with the longest histories of elevating dividends.

With this in thoughts, we created a downloadable checklist of over 130 Dividend Champions, which have elevated their dividends for over 25 consecutive years.

You may obtain your free copy of the Dividend Champions checklist, together with related monetary metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the hyperlink beneath:

Traders are possible aware of the Dividend Aristocrats, a gaggle of 69 shares within the S&P 500 Index with 25+ consecutive years of dividend will increase.

In the meantime, buyers must also familiarize themselves with the Dividend Champions, which have additionally raised their dividends for a minimum of 25 years in a row.

Whereas their size of dividend will increase is identical, resulting in some overlap, there are additionally some vital variations between the Dividend Aristocrats and Dividend Champions.

In consequence, the Dividend Champions checklist is rather more expansive. There are numerous high-quality Dividend Champions that aren’t included on the Dividend Aristocrats checklist.

This text will talk about 10 Dividend Champions which might be best candidates for buyers trying to hold investing easy with high-quality dividend shares.

Desk of Contents

The ten shares beneath have all elevated their dividends for over 25 years, with Dividend Threat Scores of ‘C’ or increased. As well as, they’ve dividend payout ratios beneath 70% which signifies dividend sustainability.

Lastly, the ten shares have dividend development charges above 5%.

You may immediately soar to any particular part of the article by clicking on the hyperlinks beneath:

The ten KISS shares have been ranked by anticipated whole annual return over the following 5 years, from lowest to highest.

KISS Inventory #10: Tennant Co. (TNC)

- 5-year anticipated returns: 12.3%

Tennant Firm is a equipment firm that produces cleansing merchandise and that provides cleansing options to its clients.

Within the US, the corporate holds the market management place in its trade, however the firm additionally sells its merchandise in additional than 100 extra nations across the globe.

Supply: Investor Presentation

Tennant Firm reported its fourth quarter earnings outcomes on February 19. Revenues of $328 million throughout the quarter, which was 6% greater than the highest line quantity from the earlier 12 months’s quarter.

This was barely higher than the latest development, as income had grown much less on a year-over-year foundation throughout the earlier quarter.

Tennant Firm generated adjusted earnings-per-share of $1.52 throughout the fourth quarter, which was lower than what the analyst group had forecast, and which was down in comparison with the earlier 12 months.

Administration is forecasting that adjusted earnings-per-share will fall into a variety of $5.70 to $6.20 in 2025.

Click on right here to obtain our most up-to-date Certain Evaluation report on TNC (preview of web page 1 of three proven beneath):

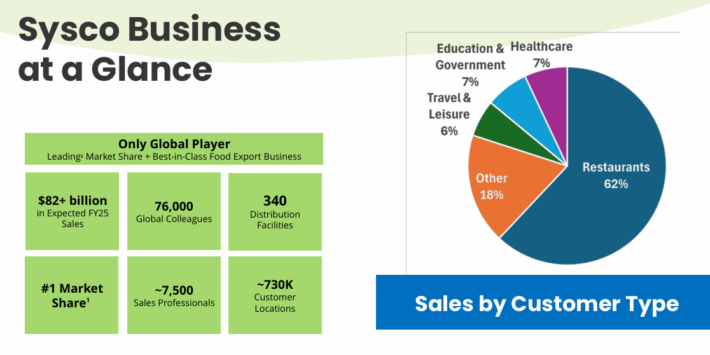

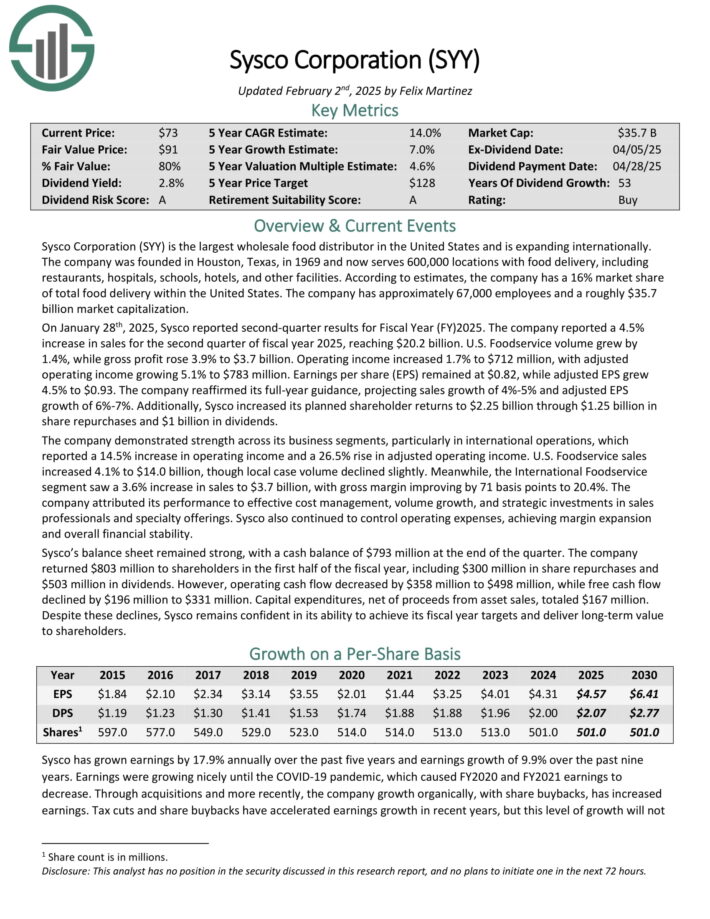

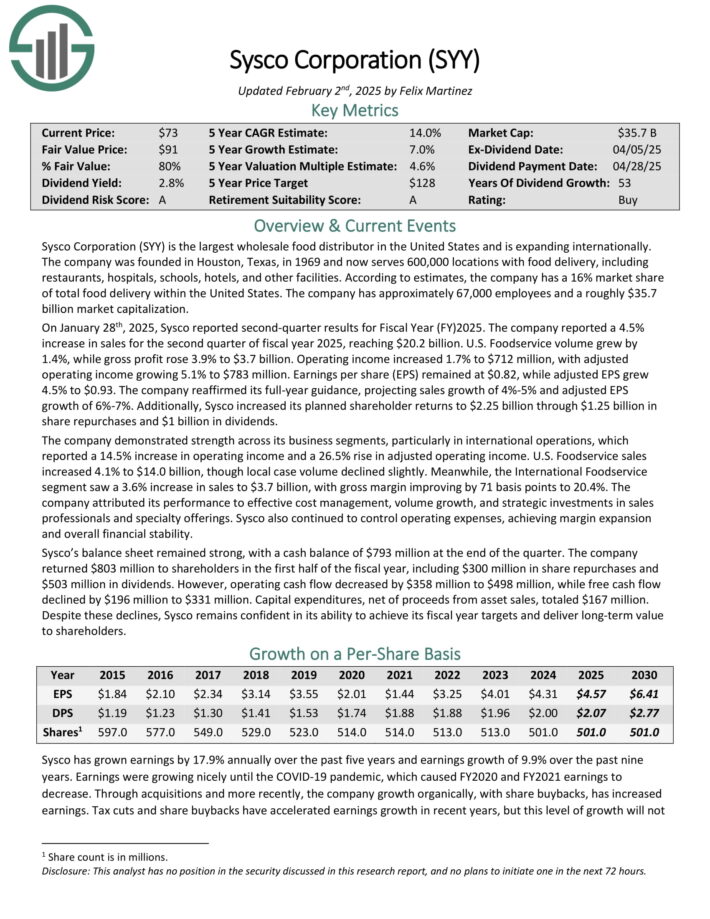

KISS Inventory #9: Sysco Corp. (SYY)

- 5-year anticipated returns: 13.5%

Sysco Company is the most important wholesale meals distributor in the US. The corporate serves 600,000 places with meals supply, together with eating places, hospitals, colleges, resorts, and different amenities.

Supply: Investor Presentation

On January twenty eighth, 2025, Sysco reported second-quarter outcomes for Fiscal 12 months (FY)2025. The corporate reported a 4.5% improve in gross sales for the second quarter of fiscal 12 months 2025, reaching $20.2 billion.

U.S. Foodservice quantity grew by 1.4%, whereas gross revenue rose 3.9% to $3.7 billion. Working earnings elevated 1.7% to $712 million, with adjusted working earnings rising 5.1% to $783 million. Earnings per share (EPS) remained at $0.82, whereas adjusted EPS grew 4.5% to $0.93.

The corporate reaffirmed its full-year steerage, projecting gross sales development of 4%-5% and adjusted EPS development of 6%-7%.

Click on right here to obtain our most up-to-date Certain Evaluation report on SYY (preview of web page 1 of three proven beneath):

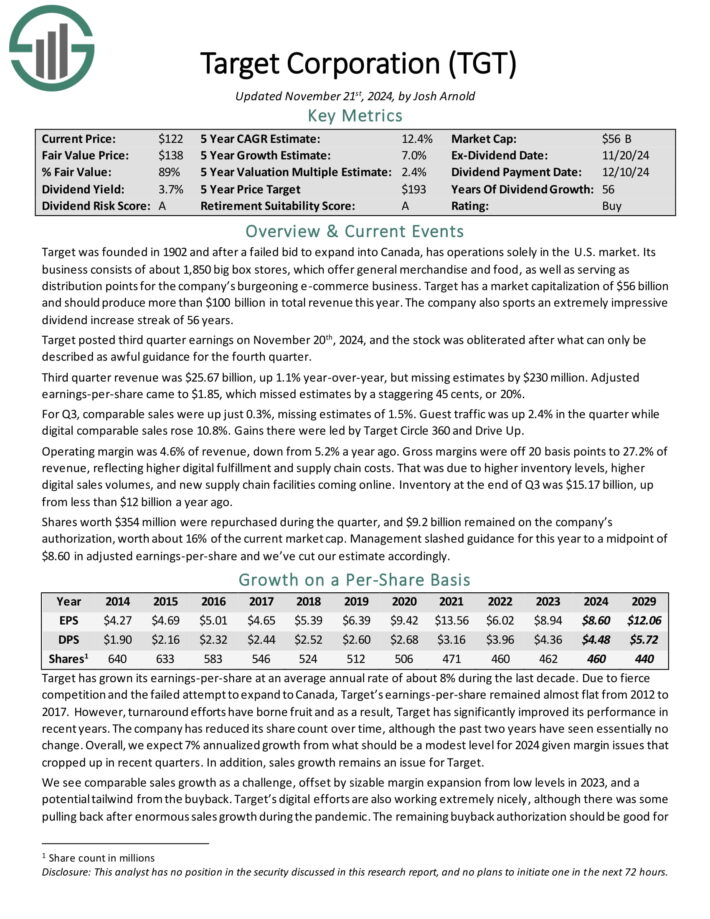

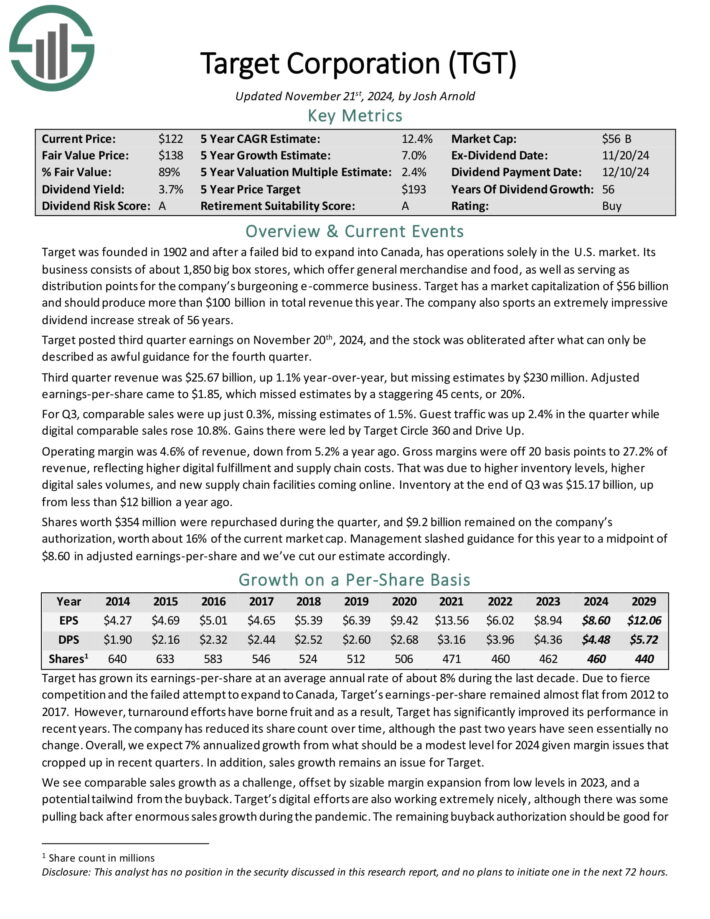

KISS Inventory #8: Goal Corp. (TGT)

- 5-year anticipated returns: 13.5%

Goal was based in 1902 and now operates about 1,850 massive field shops, which provide normal merchandise and meals, in addition to serving as distribution factors for the corporate’s e-commerce enterprise.

Goal posted third quarter earnings on November twentieth, 2024. Third quarter income was $25.67 billion, up 1.1% year-over-year, however lacking estimates by $230 million. Adjusted earnings-per-share got here to $1.85, which missed estimates by a staggering 45 cents, or 20%.

For Q3, comparable gross sales have been up simply 0.3%, lacking estimates of 1.5%. Visitor visitors was up 2.4% within the quarter whereas digital comparable gross sales rose 10.8%. Beneficial properties there have been led by Goal Circle 360 and Drive Up.

Working margin was 4.6% of income, down from 5.2% a 12 months in the past. Gross margins have been off 20 foundation factors to 27.2% of income, reflecting increased digital achievement and provide chain prices.

Click on right here to obtain our most up-to-date Certain Evaluation report on TGT (preview of web page 1 of three proven beneath):

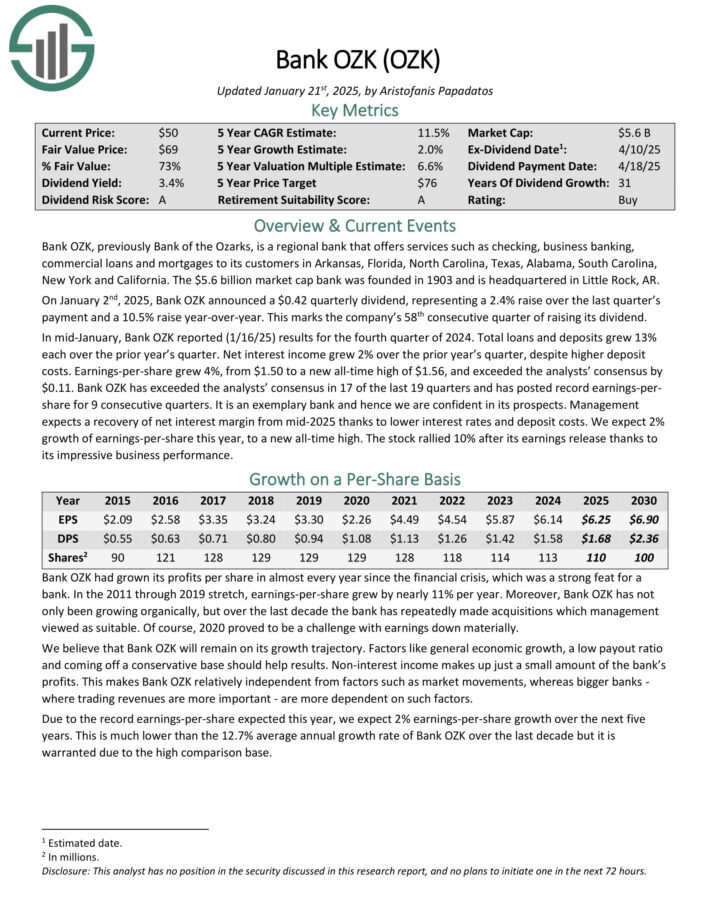

KISS Inventory #7: Financial institution OZK (OZK)

- 5-year anticipated returns: 13.8%

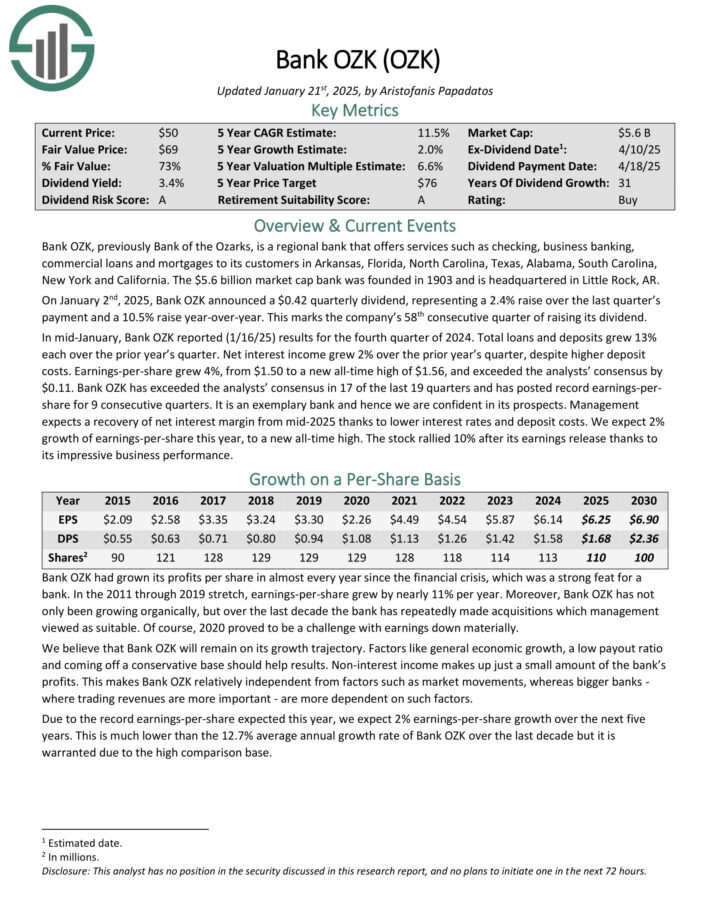

Financial institution OZK is a regional financial institution that provides companies resembling checking, enterprise banking, business loans and mortgages to its clients in Arkansas, Florida, North Carolina, Texas, Alabama, South Carolina, New York and California.

On January 2nd, 2025, Financial institution OZK introduced a $0.42 quarterly dividend, representing a 2.4% increase during the last quarter’s cost and a ten.5% increase year-over-year. This marked the corporate’s 58th consecutive quarter of elevating its dividend.

In mid-January, Financial institution OZK reported (1/16/25) outcomes for the fourth quarter of 2024. Whole loans and deposits grew 13% every over the prior 12 months’s quarter. Web curiosity earnings grew 2% over the prior 12 months’s quarter, regardless of increased deposit prices.

Earnings-per-share grew 4%, from $1.50 to a brand new all-time excessive of $1.56, and exceeded the analysts’ consensus by $0.11. Financial institution OZK has exceeded the analysts’ consensus in 17 of the final 19 quarters and has posted file earnings-per-share for 9 consecutive quarters.

Administration expects a restoration of internet curiosity margin from mid-2025 due to decrease rates of interest and deposit prices.

Click on right here to obtain our most up-to-date Certain Evaluation report on OZK (preview of web page 1 of three proven beneath):

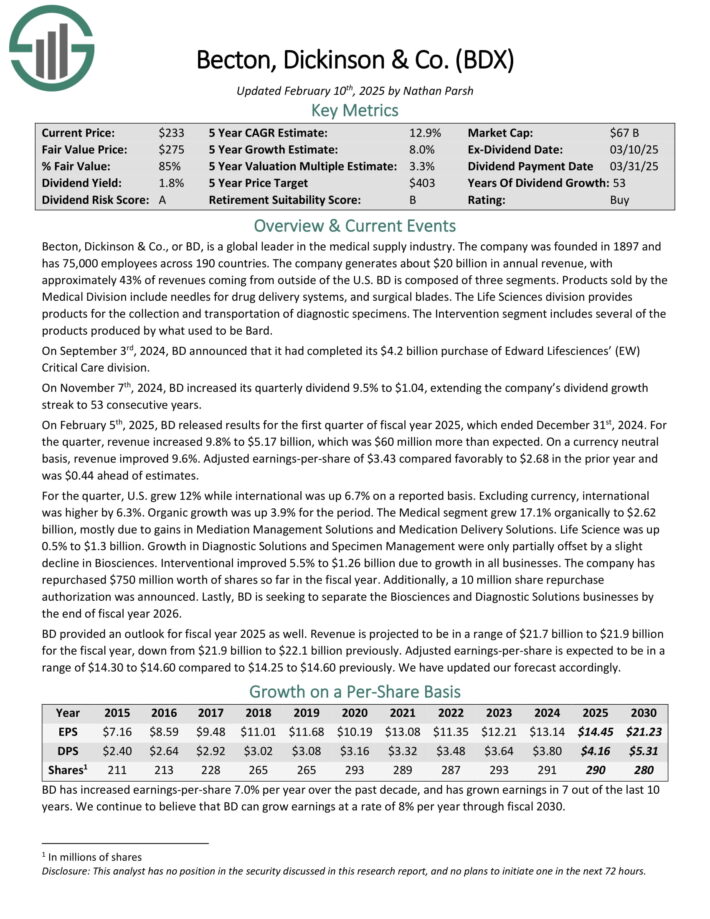

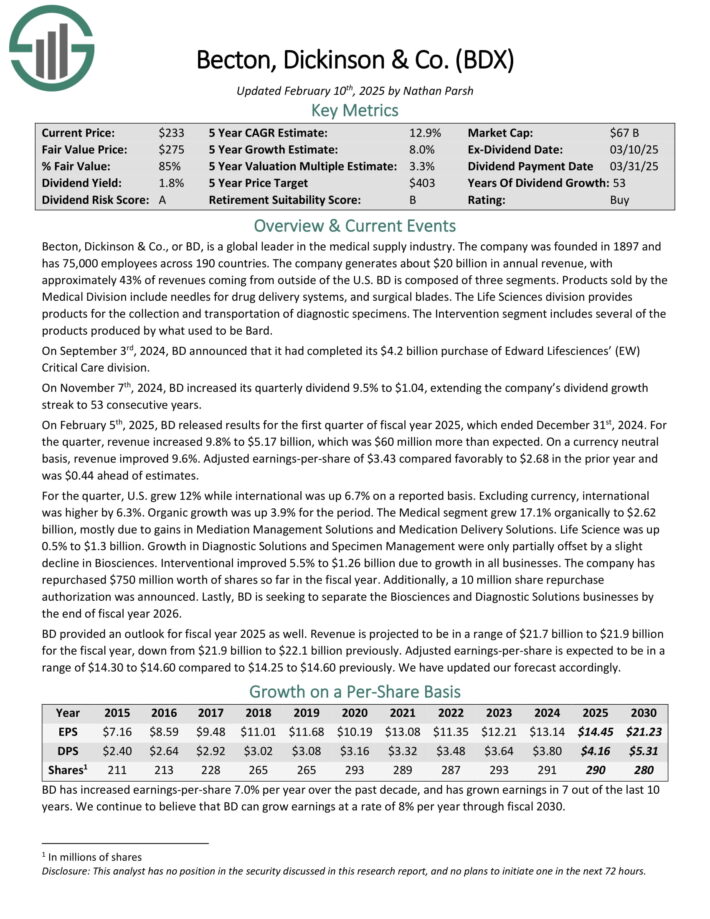

KISS Inventory #6: Becton Dickinson & Co. (BDX)

- 5-year anticipated returns: 13.8%

Becton, Dickinson & Co. is a world chief within the medical provide trade. The corporate was based in 1897 and has 75,000 staff throughout 190 nations.

The corporate generates about $20 billion in annual income, with roughly 43% of revenues coming from outdoors of the U.S.

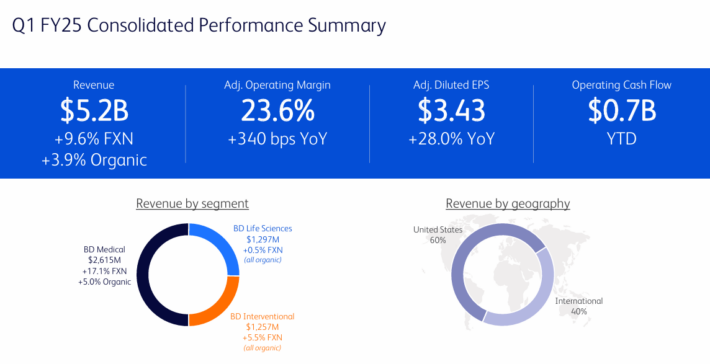

On February fifth, 2025, BD launched outcomes for the primary quarter of fiscal 12 months 2025, which ended December thirty first, 2024. For the quarter, income elevated 9.8% to $5.17 billion, which was $60 million greater than anticipated.

Supply: Investor Presentation

On a foreign money impartial foundation, income improved 9.6%. Adjusted earnings-per-share of $3.43 in contrast favorably to $2.68 within the prior 12 months and was $0.44 forward of estimates.

For the quarter, U.S. grew 12% whereas worldwide was up 6.7% on a reported foundation. Excluding foreign money, worldwide was increased by 6.3%. Natural development was up 3.9% for the interval.

The Medical phase grew 17.1% organically to $2.62 billion, principally because of beneficial properties in Mediation Administration Options and Medicine Supply Options. Life Science was up 0.5% to $1.3 billion.

Click on right here to obtain our most up-to-date Certain Evaluation report on BDX (preview of web page 1 of three proven beneath):

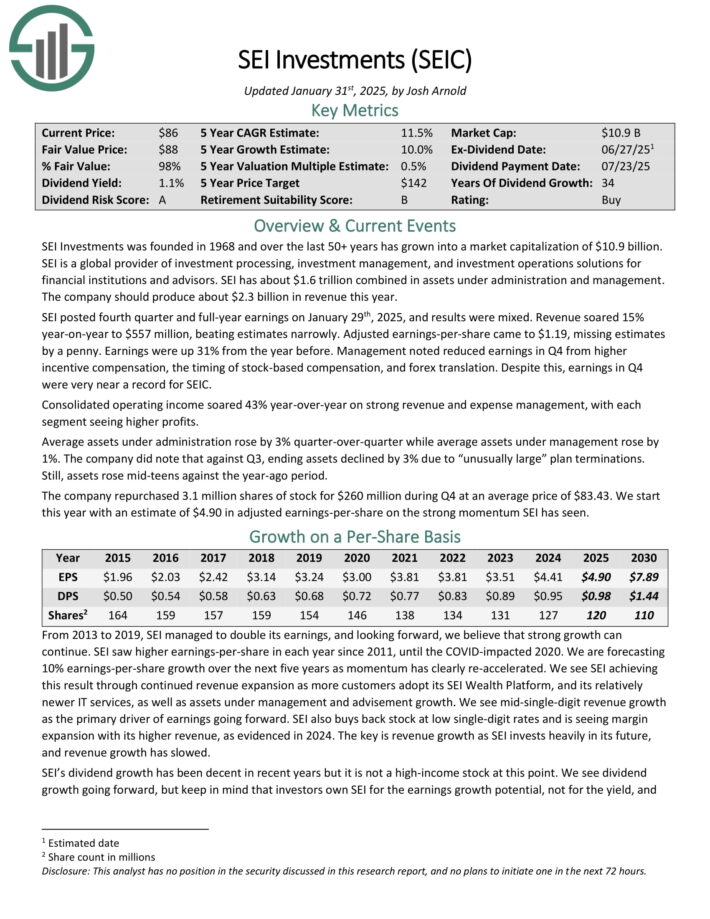

KISS Inventory #5: SEI Investments Co. (SEIC)

- 5-year anticipated returns: 13.9%

SEI Investments was based in 1968 and during the last 50+ years has grown into a world supplier of funding processing, funding administration, and funding operations options for monetary establishments and advisors.

SEI has about $1.6 trillion mixed in belongings underneath administration and administration. The corporate ought to produce about $2.3 billion in income this 12 months.

SEI posted fourth quarter and full-year earnings on January twenty ninth, 2025, and outcomes have been blended. Income soared 15% year-on-year to $557 million, beating estimates narrowly.

Adjusted earnings-per-share got here to $1.19, lacking estimates by a penny. Earnings have been up 31% from the 12 months earlier than.

Administration famous diminished earnings in This autumn from increased incentive compensation, the timing of stock-based compensation, and foreign exchange translation. Regardless of this, earnings in This autumn have been very close to a file for SEIC.

Consolidated working earnings soared 43% year-over-year on sturdy income and expense administration, with every phase seeing increased earnings.

Click on right here to obtain our most up-to-date Certain Evaluation report on SEIC (preview of web page 1 of three proven beneath):

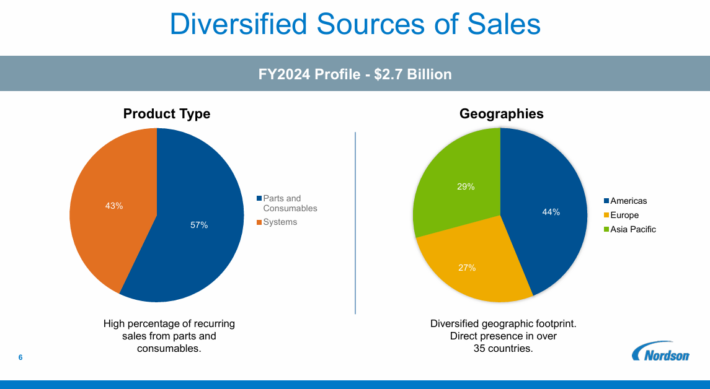

KISS Inventory #4: Nordson Corp. (NDSN)

- 5-year anticipated returns: 14.1%

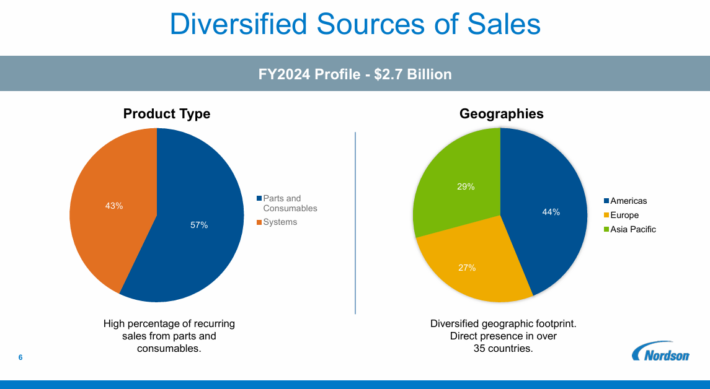

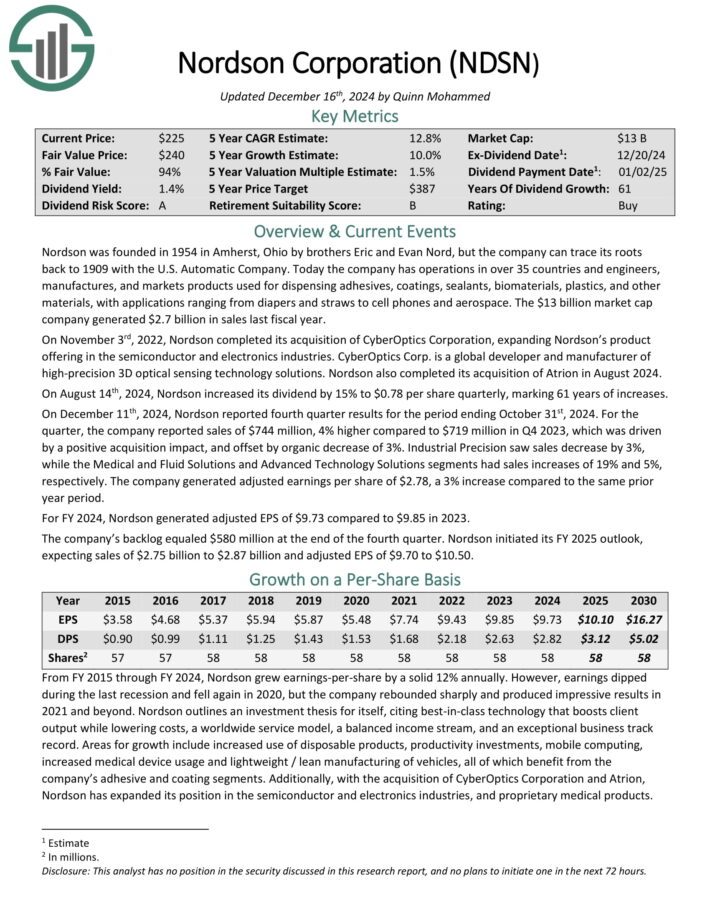

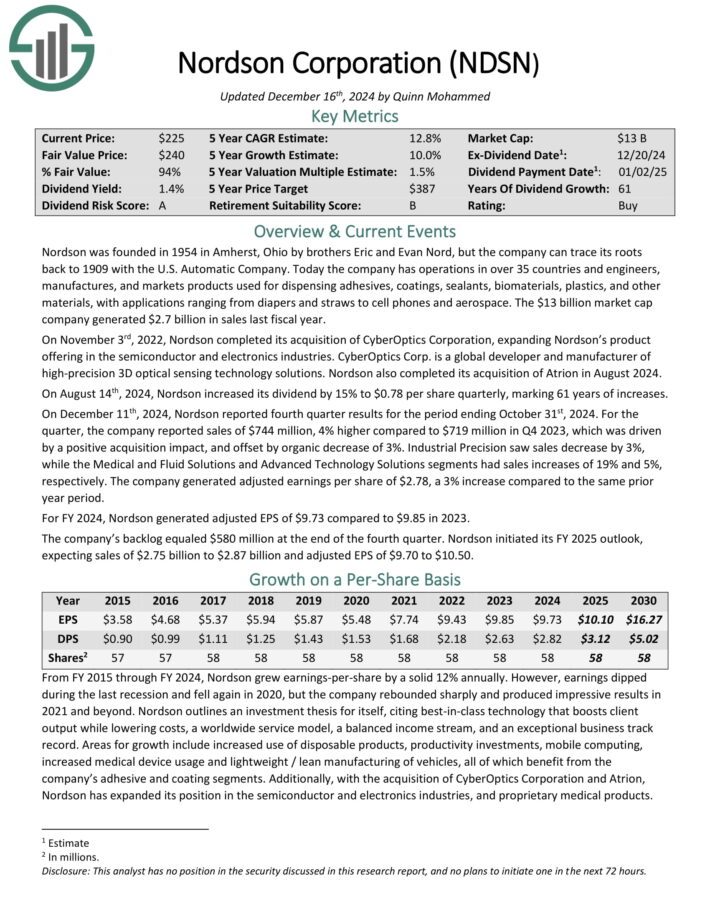

Nordson was based in 1954 in Amherst, Ohio by brothers Eric and Evan Nord, however the firm can hint its roots again to 1909 with the U.S. Computerized Firm.

Right now the corporate has operations in over 35 nations and engineers, manufactures, and markets merchandise used for shelling out adhesives, coatings, sealants, biomaterials, plastics, and different supplies, with functions starting from diapers and straws to cell telephones and aerospace.

Supply: Investor Presentation

On December eleventh, 2024, Nordson reported fourth quarter outcomes for the interval ending October thirty first, 2024. For the quarter, the corporate reported gross sales of $744 million, 4% increased in comparison with $719 million in This autumn 2023, which was pushed by a constructive acquisition influence, and offset by natural lower of three%.

Industrial Precision noticed gross sales lower by 3%, whereas the Medical and Fluid Options and Superior Expertise Options segments had gross sales will increase of 19% and 5%, respectively.

The corporate generated adjusted earnings per share of $2.78, a 3% improve in comparison with the identical prior 12 months interval.

Click on right here to obtain our most up-to-date Certain Evaluation report on NDSN (preview of web page 1 of three proven beneath):

KISS Inventory #3: PPG Industries (PPG)

- 5-year anticipated returns: 14.8%

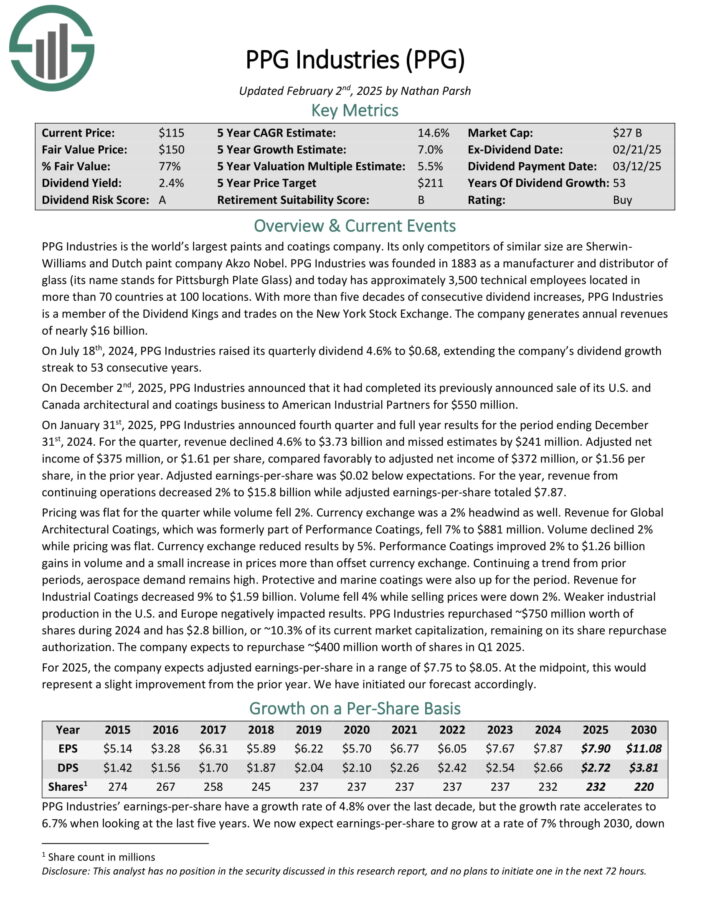

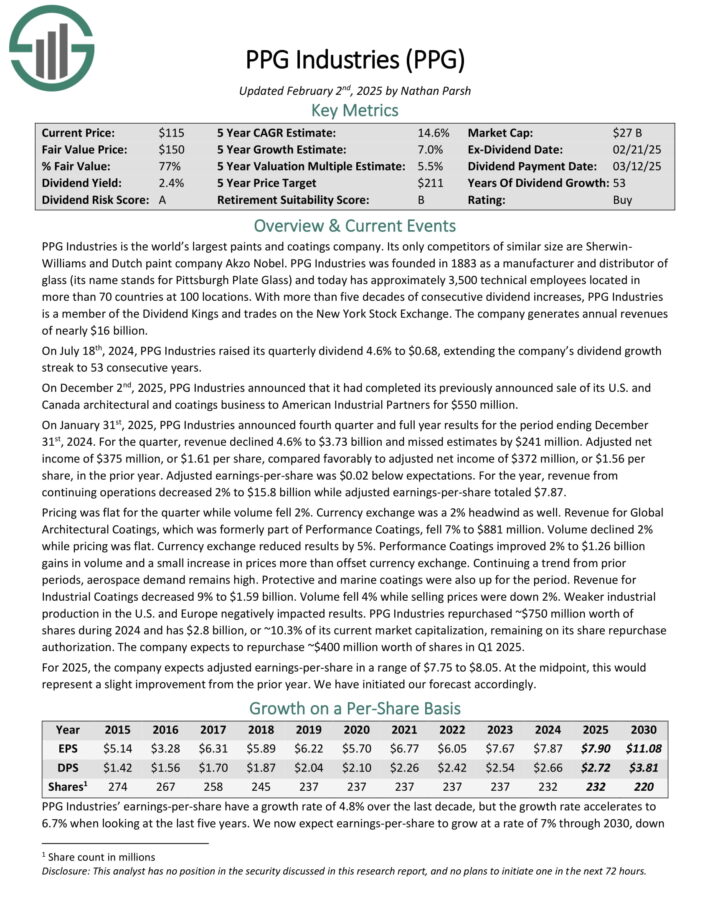

PPG Industries is the world’s largest paints and coatings firm. Its solely rivals of comparable dimension are Sherwin-Williams and Dutch paint firm Akzo Nobel.

PPG Industries was based in 1883 as a producer and distributor of glass (its title stands for Pittsburgh Plate Glass) and at present has roughly 3,500 technical staff situated in additional than 70 nations at 100 places.

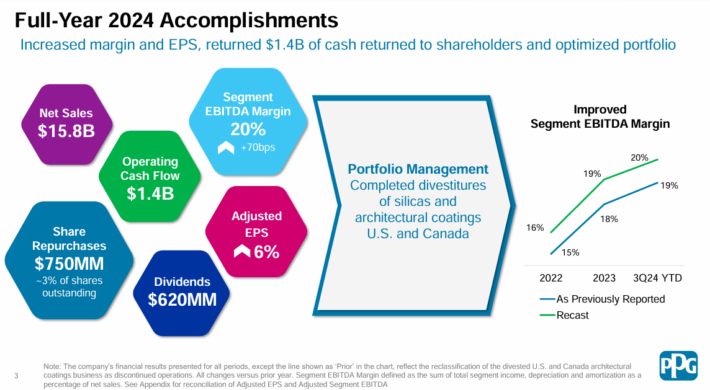

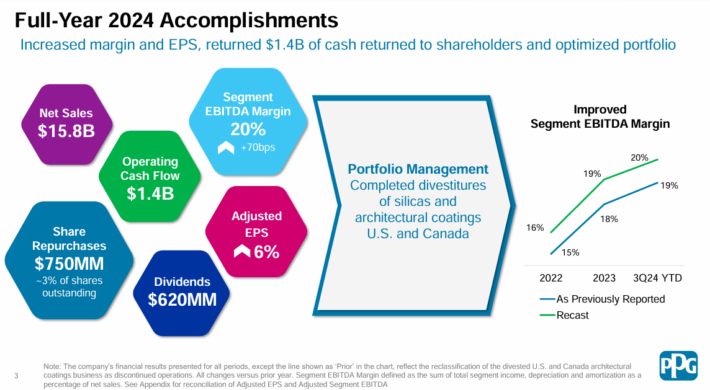

On January thirty first, 2025, PPG Industries introduced fourth quarter and full 12 months outcomes for the interval ending December thirty first, 2024. For the quarter, income declined 4.6% to $3.73 billion and missed estimates by $241 million.

Adjusted internet earnings of $375 million, or $1.61 per share, in contrast favorably to adjusted internet earnings of $372 million, or $1.56 per share, within the prior 12 months. Adjusted earnings-per-share was $0.02 beneath expectations.

Supply: Investor Presentation

For the 12 months, income from persevering with operations decreased 2% to $15.8 billion whereas adjusted earnings-per-share totaled $7.87.

PPG Industries repurchased ~$750 million price of shares throughout 2024 and has $2.8 billion, or ~10.3% of its present market capitalization, remaining on its share repurchase authorization. The corporate expects to repurchase ~$400 million price of shares in Q1 2025.

For 2025, the corporate expects adjusted earnings-per-share in a variety of $7.75 to $8.05.

Click on right here to obtain our most up-to-date Certain Evaluation report on PPG (preview of web page 1 of three proven beneath):

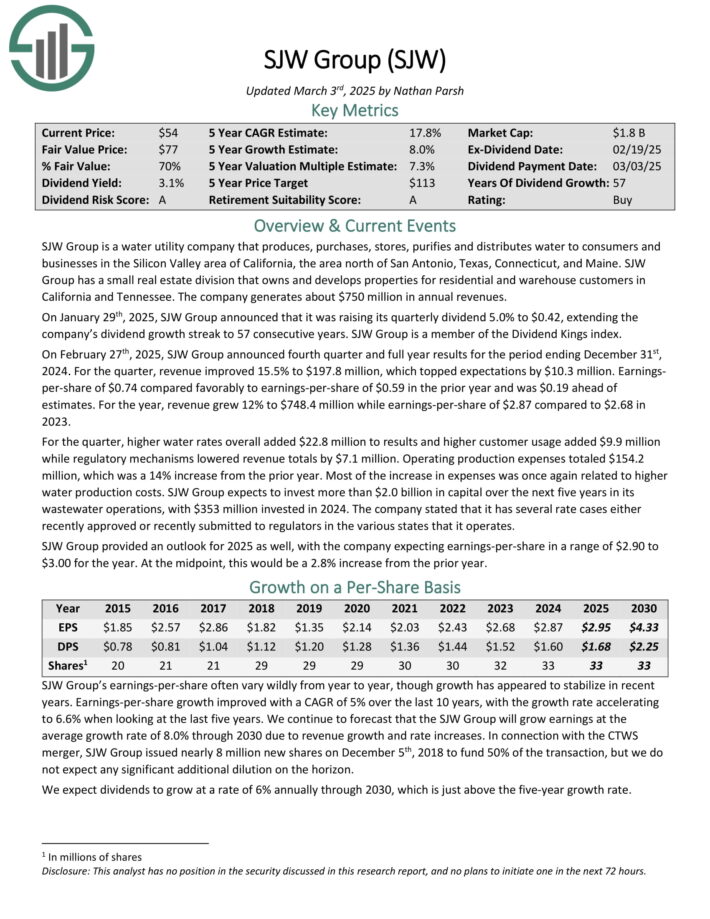

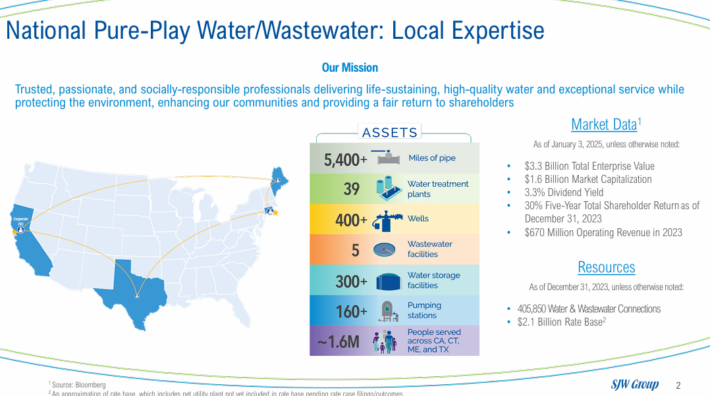

KISS Inventory #2: SJW Group (SJW)

- 5-year anticipated returns: 17.8%

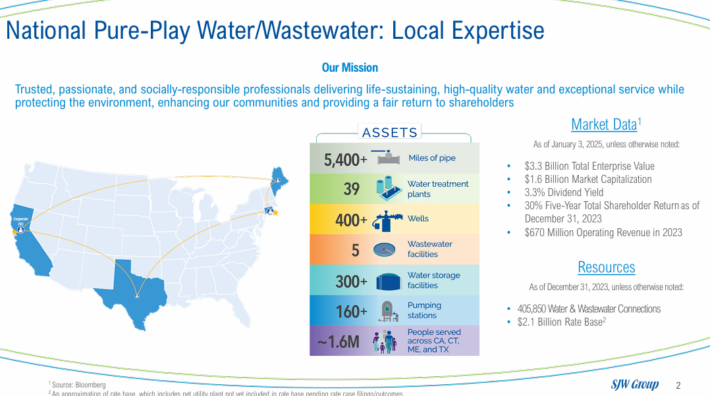

SJW Group is a water utility firm that produces, purchases, shops, purifies and distributes water to customers and companies within the Silicon Valley space of California, the realm north of San Antonio, Texas, Connecticut, and Maine.

SJW Group has a small actual property division that owns and develops properties for residential and warehouse clients in California and Tennessee. The corporate generates about $750 million in annual revenues.

Supply: Investor Presentation

On February twenty seventh, 2025, SJW Group introduced fourth quarter and full 12 months outcomes for the interval ending December thirty first, 2024. For the quarter, income improved 15.5% to $197.8 million, which topped expectations by $10.3 million.

Earnings-per-share of $0.74 in contrast favorably to earnings-per-share of $0.59 within the prior 12 months and was $0.19 forward of estimates. For the 12 months, income grew 12% to $748.4 million whereas earnings-per-share of $2.87 in comparison with $2.68 in 2023.

Click on right here to obtain our most up-to-date Certain Evaluation report on SJW (preview of web page 1 of three proven beneath):

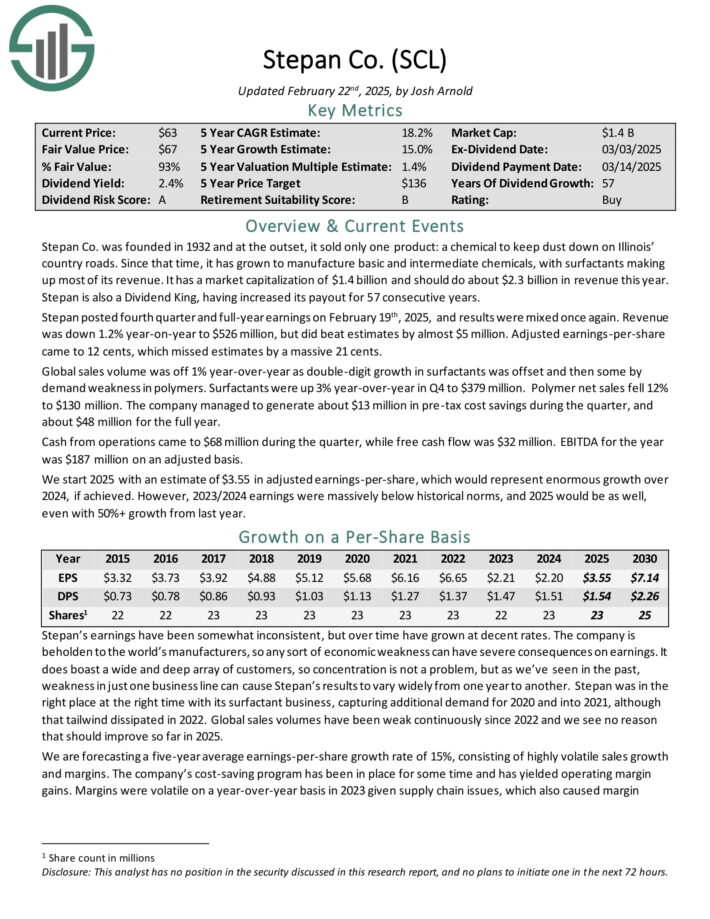

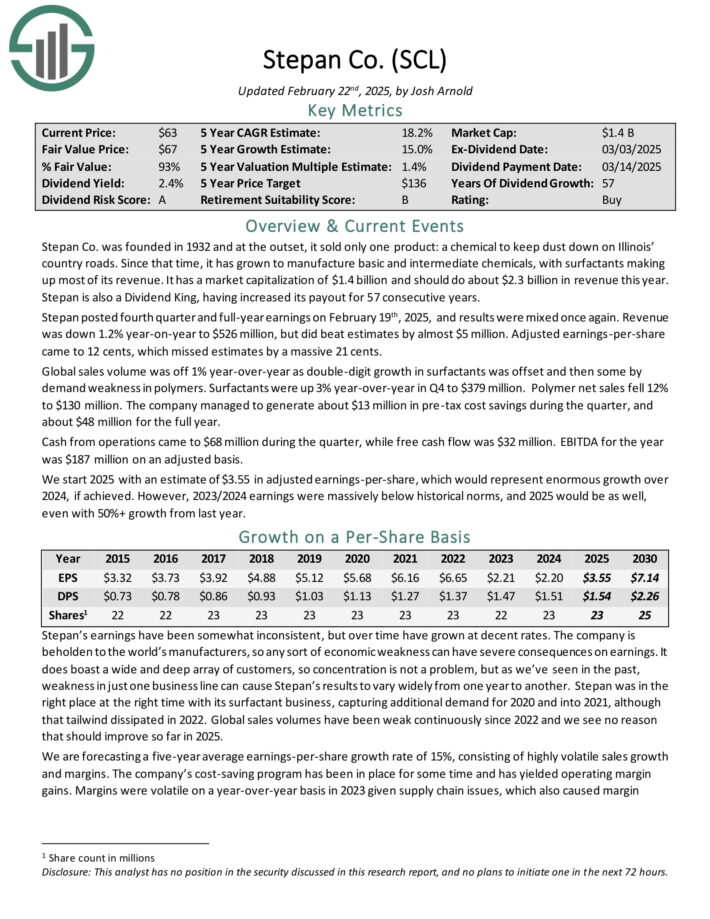

KISS Inventory #1: Stepan Co. (SCL)

- 5-year anticipated returns: 19.9%

Stepan manufactures primary and intermediate chemical substances, together with surfactants, specialty merchandise, germicidal and material softening quaternaries, phthalic anhydride, polyurethane polyols and particular substances for the meals, complement, and pharmaceutical markets.

It’s organized into three distinct enterprise traces: surfactants, polymers, and specialty merchandise. These companies serve all kinds of finish markets, that means that Stepan isn’t beholden to only a handful of industries.

Supply: Investor presentation

The surfactants enterprise is Stepan’s largest by income, accounting for ~68% of whole gross sales in the latest quarter. A surfactant is an natural compound that comprises each water-soluble and water-insoluble parts.

Stepan posted fourth quarter and full-year earnings on February nineteenth, 2025, and outcomes have been blended as soon as once more. Income was down 1.2% year-on-year to $526 million, however did beat estimates by nearly $5 million. Adjusted earnings-per-share got here to 12 cents, which missed estimates by 21 cents.

International gross sales quantity was off 1% year-over-year as double-digit development in surfactants was offset after which some by demand weak point in polymers. Surfactants have been up 3% year-over-year in This autumn to $379 million. Polymer internet gross sales fell 12% to $130 million.

The corporate managed to generate about $13 million in pre-tax price financial savings throughout the quarter, and about $48 million for the complete 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on SCL (preview of web page 1 of three proven beneath):

Remaining Ideas

To ensure that an organization to boost its dividend for a minimum of 25 years, it will need to have sturdy aggressive benefits, extremely worthwhile companies, and management positions of their respective industries.

Because of this the Dividend Champions are engaging for long-term buyers.

Plus, high quality dividend development shares permit buyers to easily their investing course of, with a buy-and-hold strategy that may create wealth over the long-run.

Further Studying

The Dividend Champions checklist isn’t the one approach to shortly display screen for shares that often pay rising dividends.

- The Dividend Kings Checklist is much more unique than the Dividend Aristocrats. It’s comprised of 54 shares with 50+ years of consecutive dividend will increase.

- The Excessive Dividend Shares Checklist: shares that enchantment to buyers within the highest yields of 5% or extra.

- The Month-to-month Dividend Shares Checklist: shares that pay dividends each month, for 12 dividend funds per 12 months.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].