Printed on January sixteenth, 2025 by Bob Ciura

The best retirement funding shares present:

- Excessive yields

- Rising revenue

- Passive revenue

In different phrases, the perfect retirement funding offers you excessive (and rising) passive revenue.

1. Excessive Yields

The necessity for prime yields is clear. The upper the yield, the extra revenue you obtain for each greenback invested. It doesn’t take a genius to say that extra revenue is an effective factor.

2. Rising Revenue

Your excessive yield revenue stream must develop to assist offset inflation. The fact of inflation signifies that a static revenue stream will see its buying energy erode over time.

3. Passive Revenue

And at last, your rising excessive yield revenue stream must be passive for it to be really helpful for retirement. You shouldn’t must do a lot work to maintain the revenue coming in.

With all three targets in thoughts, we advocate buyers contemplate the Dividend Champions, a bunch of over 130 shares which have elevated their dividends for over 25 consecutive years.

You possibly can obtain your free copy of the Dividend Champions record, together with related monetary metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the hyperlink beneath:

Retirees are usually involved with producing excessive revenue, rising that revenue, and reaching as a lot revenue security as doable.

The next 10 very best retirement funding shares symbolize the highest-yielding Dividend Champions with Dividend Threat Scores of ‘A’ or ‘B’ within the Positive Evaluation Analysis Database, and at the very least 25 years of consecutive dividend will increase.

All 10 very best retirement funding shares shares are based mostly in the USA. The ten very best retirement funding shares are ranked by dividend yield, from lowest to highest.

Desk of Contents

You possibly can immediately leap to any particular part of the article by clicking on the hyperlinks beneath:

Ideally suited Retirement Funding Inventory: Polaris Inc. (PII)

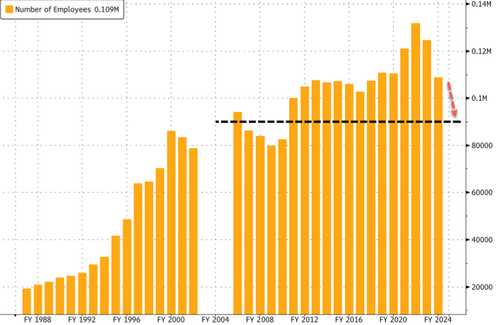

Polaris designs, engineers, and manufactures snowmobiles, all-terrain automobiles (ATVs) and bikes. As well as, associated equipment and substitute components are offered with these automobiles by way of sellers positioned all through the U.S.

The corporate operates beneath 30+ manufacturers together with Polaris, Ranger, RZR, Sportsman, Indian Motorbike, Slingshot and Transamerican Auto Components. The worldwide powersports maker, serving over 100 international locations, generated $8.9 billion in gross sales in 2023.

On February 1st, 2024, Polaris raised its quarterly dividend 1.5% to $0.66.

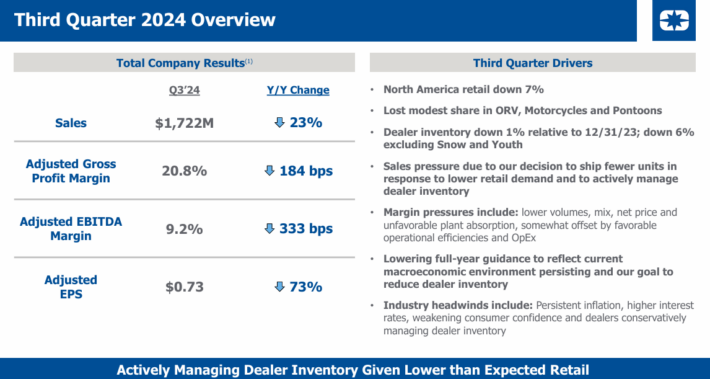

On October twenty second, 2024, Polaris reported third quarter outcomes for the interval ending September thirtieth, 2024. For the quarter, income decreased 23.6% to $1.72 billion, which missed estimates by $50 million.

Supply: Investor Presentation

Adjusted earnings-per-share of $0.73 in contrast very unfavorably to $2.72 within the prior 12 months and was $0.18 lower than anticipated.

For the quarter, Marine gross sales have been down 36%, On-Highway fell 13%, and Off-Highway, the most important element of the corporate, declined 24%. Decreases in all three companies have been largely as a result of decrease volumes.

Off-Highway was negatively impacted by increased promotional spend and product combine. On-Highway and Marine each suffered from weaker product combine. Gross margin contracted 204 foundation factors to twenty.6%.

Click on right here to obtain our most up-to-date Positive Evaluation report on PII (preview of web page 1 of three proven beneath):

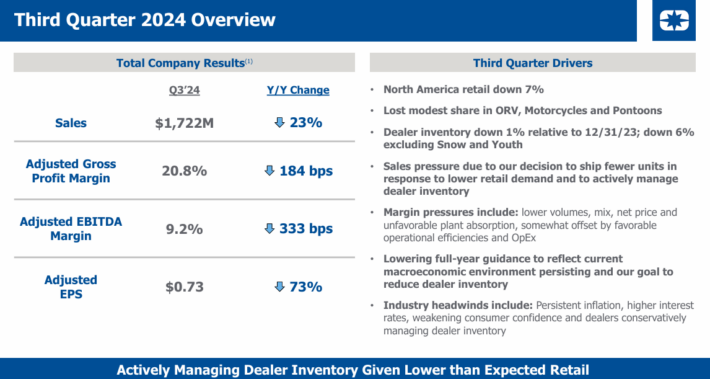

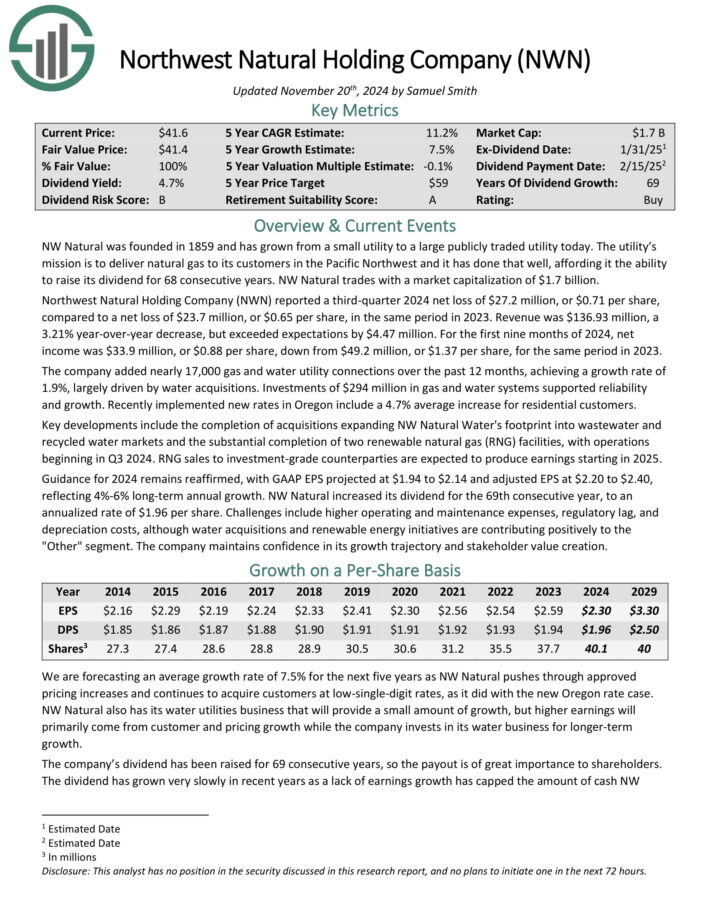

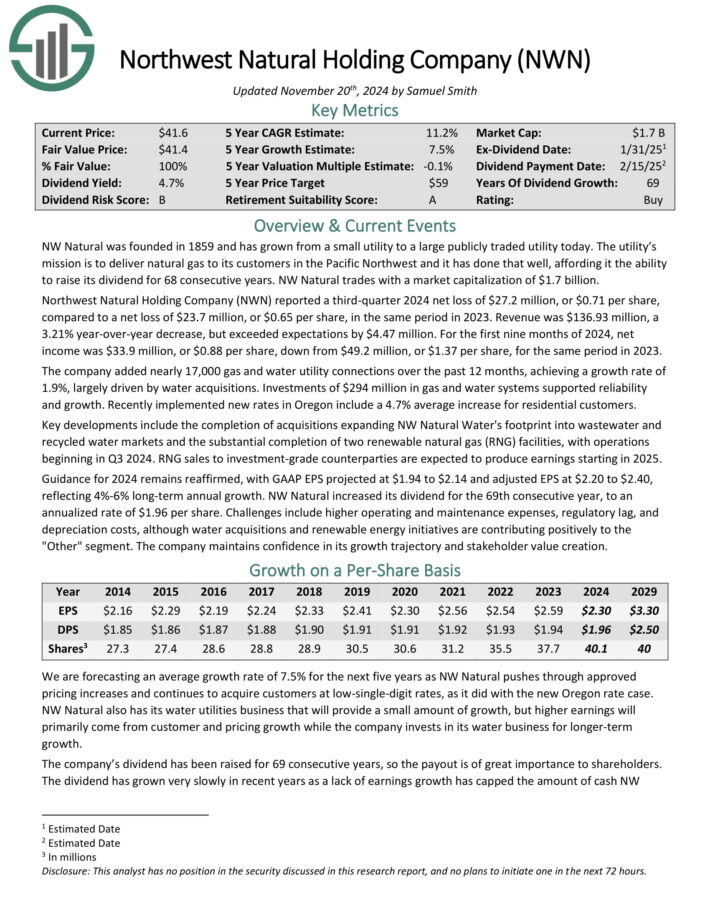

Ideally suited Retirement Funding Inventory: Northwest Pure Holding (NWN)

Northwest was based over 160 years in the past as a pure gasoline utility in Portland, Oregon.

It has grown from a really small, native utility that offered gasoline service to a handful of consumers to a really profitable regional utility with pursuits that now embrace water and wastewater, which have been bought in current acquisitions.

The corporate’s places served are proven within the picture beneath.

Supply: Investor Presentation

Northwest supplies gasoline service to 2.5 million prospects in ~140 communities in Oregon and Washington, serving greater than 795,000 connections. It additionally owns and operates ~35 billion cubic ft of underground gasoline storage capability.

Northwest Pure Holding Firm reported a third-quarter 2024 internet lack of $27.2 million, or $0.71 per share, in comparison with a internet lack of $23.7 million, or $0.65 per share, in the identical interval in 2023. Income was $136.93 million, a 3.21% year-over-year lower, however exceeded expectations by $4.47 million.

For the primary 9 months of 2024, internet revenue was $33.9 million, or $0.88 per share, down from $49.2 million, or $1.37 per share, for a similar interval in 2023.

Click on right here to obtain our most up-to-date Positive Evaluation report on NWN (preview of web page 1 of three proven beneath):

Ideally suited Retirement Funding Inventory: Eversource Vitality (ES)

Eversource Vitality is a diversified holding firm with subsidiaries that present regulated electrical, gasoline, and water distribution service within the Northeast U.S.

The corporate’s utilities serve greater than 4 million prospects after buying NStar’s Massachusetts utilities in 2012, Aquarion in 2017, and Columbia Fuel in 2020.

Eversource has delivered regular development to shareholders for a few years.

Supply: Investor Presentation

On November 4th, 2024, Eversource Vitality launched its third-quarter 2024 outcomes for the interval ending September thirtieth, 2024.

For the quarter, the corporate reported a internet lack of $(118.1) million, a pointy decline from earnings of $339.7 million in the identical quarter of final 12 months, which displays the influence of the corporate’s exit from offshore wind investments.

The corporate reported a loss per share of $(0.33), in contrast with earnings-per-share of $0.97 within the prior 12 months.

Earnings from the Electrical Transmission phase elevated to $174.9 million, up from $160.3 million within the prior 12 months, primarily as a result of a better stage of funding in Eversource’s electrical transmission system.

Click on right here to obtain our most up-to-date Positive Evaluation report on ES (preview of web page 1 of three proven beneath):

Ideally suited Retirement Funding Inventory: UGI Corp. (UGI)

UGI Company is a gasoline and electrical utility that operates in Pennsylvania, along with a big vitality distribution enterprise that serves all the US and different components of the world.

It was based in 1882 and has paid consecutive dividends since 1885. Its market capitalization is $6.2 billion. The corporate operates in 4 reporting segments: AmeriGas, UGI Worldwide, Midstream & Advertising, and UGI Utilities.

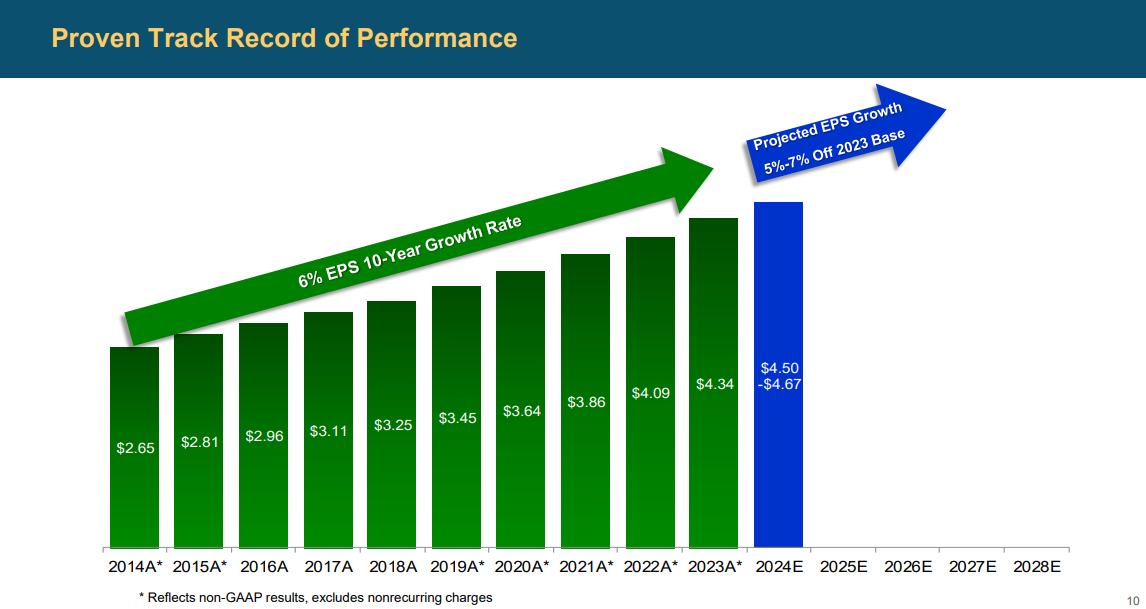

On November 22, 2024, UGI Company reported file outcomes for fiscal 2024, reaching an all-time excessive adjusted diluted EPS of $3.06, pushed by sturdy execution of strategic priorities and effectivity enhancements.

The corporate realized a $75 million discount in working bills forward of schedule, reaching everlasting value financial savings focused for fiscal 2025.

UGI additionally returned $320 million to shareholders by way of dividends, persevering with a 140-year streak of consecutive dividend funds and demonstrating a five-year EPS CAGR of 6%.

Key accomplishments included important investments in infrastructure, with $500 million allotted to utility enhancements and the completion of the Moody RNG venture, anticipated to provide 300 MMCF yearly.

Click on right here to obtain our most up-to-date Positive Evaluation report on UGI (preview of web page 1 of three proven beneath):

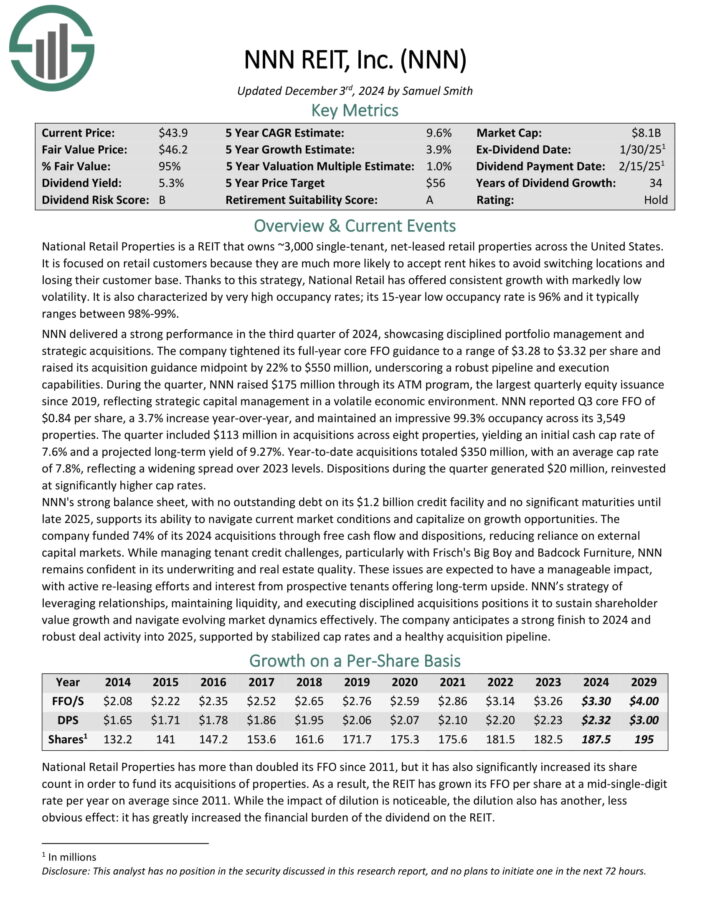

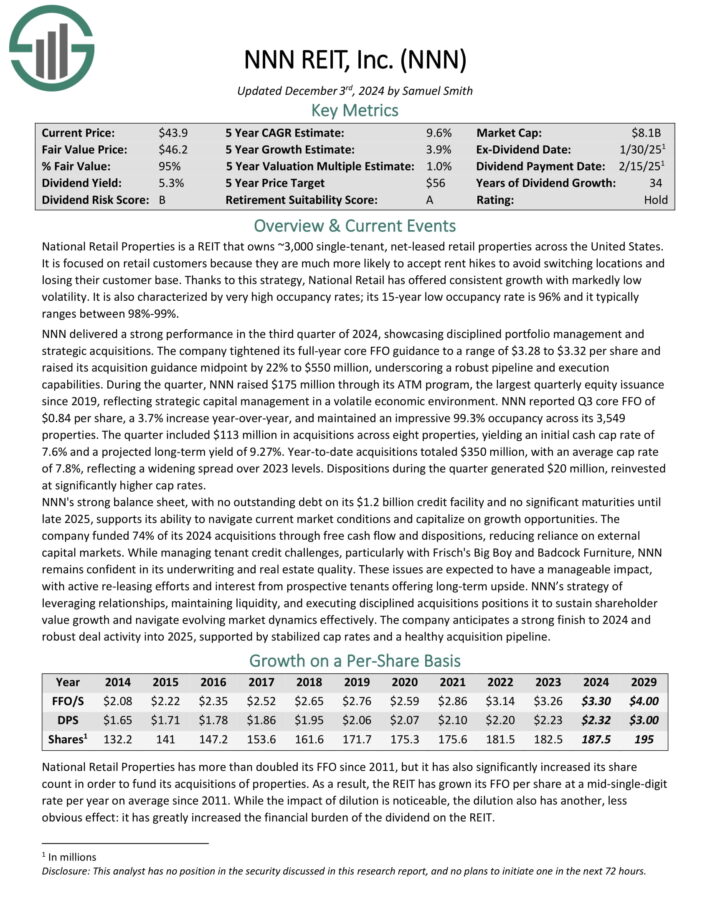

Ideally suited Retirement Funding Inventory: NNN REIT (NNN)

Nationwide Retail Properties is a REIT that owns ~3,000 single-tenant, net-leased retail properties throughout the USA.

It’s targeted on retail prospects as a result of they’re much extra prone to settle for hire hikes to keep away from switching places and shedding their buyer base. Its 15-year low occupancy fee is 96% and it usually ranges between 98%-99%.

NNN delivered a powerful efficiency within the third quarter of 2024, showcasing disciplined portfolio administration and strategic acquisitions.

The corporate tightened its full-year core FFO steering to a variety of $3.28 to $3.32 per share and raised its acquisition steering midpoint by 22% to $550 million, underscoring a strong pipeline and execution capabilities.

NNN reported Q3 core FFO of $0.84 per share, a 3.7% improve year-over-year, and maintained a formidable 99.3% occupancy throughout its 3,549 properties.

Click on right here to obtain our most up-to-date Positive Evaluation report on NNN (preview of web page 1 of three proven beneath):

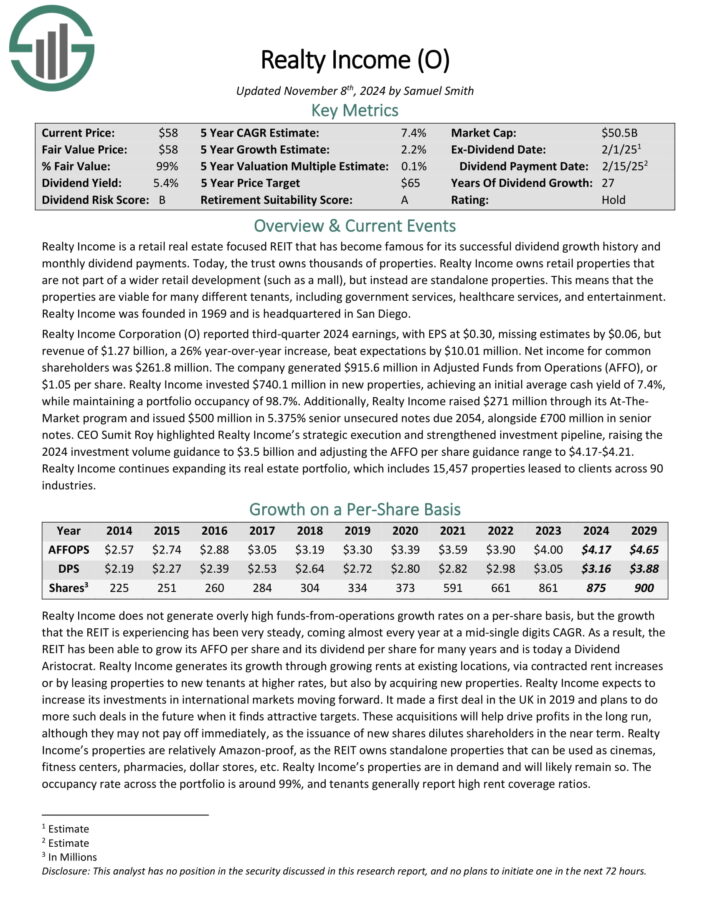

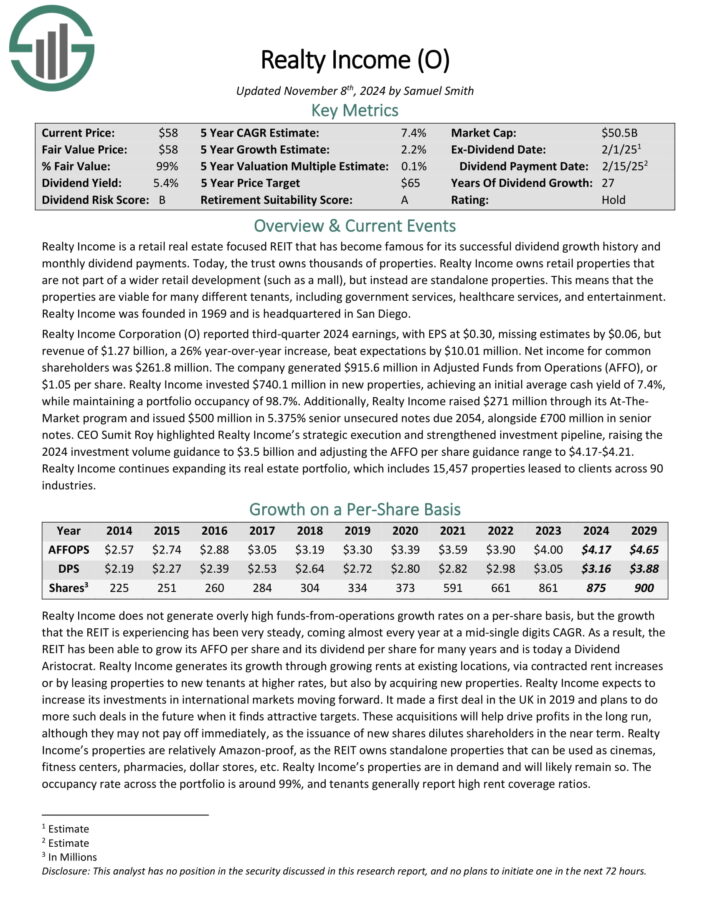

Ideally suited Retirement Funding Inventory: Realty Revenue Corp. (O)

Realty Revenue is a retail actual property targeted REIT that has turn out to be well-known for its profitable dividend development historical past and month-to-month dividend funds.

Realty Revenue owns retail properties that aren’t a part of a wider retail improvement (akin to a mall), however as a substitute are standalone properties. Which means the properties are viable for a lot of totally different tenants, together with authorities providers, healthcare providers, and leisure.

Realty Revenue reported third-quarter 2024 earnings, with EPS at $0.30, lacking estimates by $0.06, however income of $1.27 billion, a 26% year-over-year improve, beat expectations by $10.01 million. Internet revenue for frequent shareholders was $261.8 million.

The corporate generated $915.6 million in Adjusted Funds from Operations (AFFO), or $1.05 per share. Realty Revenue invested $740.1 million in new properties, reaching an preliminary common money yield of seven.4%, whereas sustaining a portfolio occupancy of 98.7%.

Click on right here to obtain our most up-to-date Positive Evaluation report on Realty Revenue (preview of web page 1 of three proven beneath):

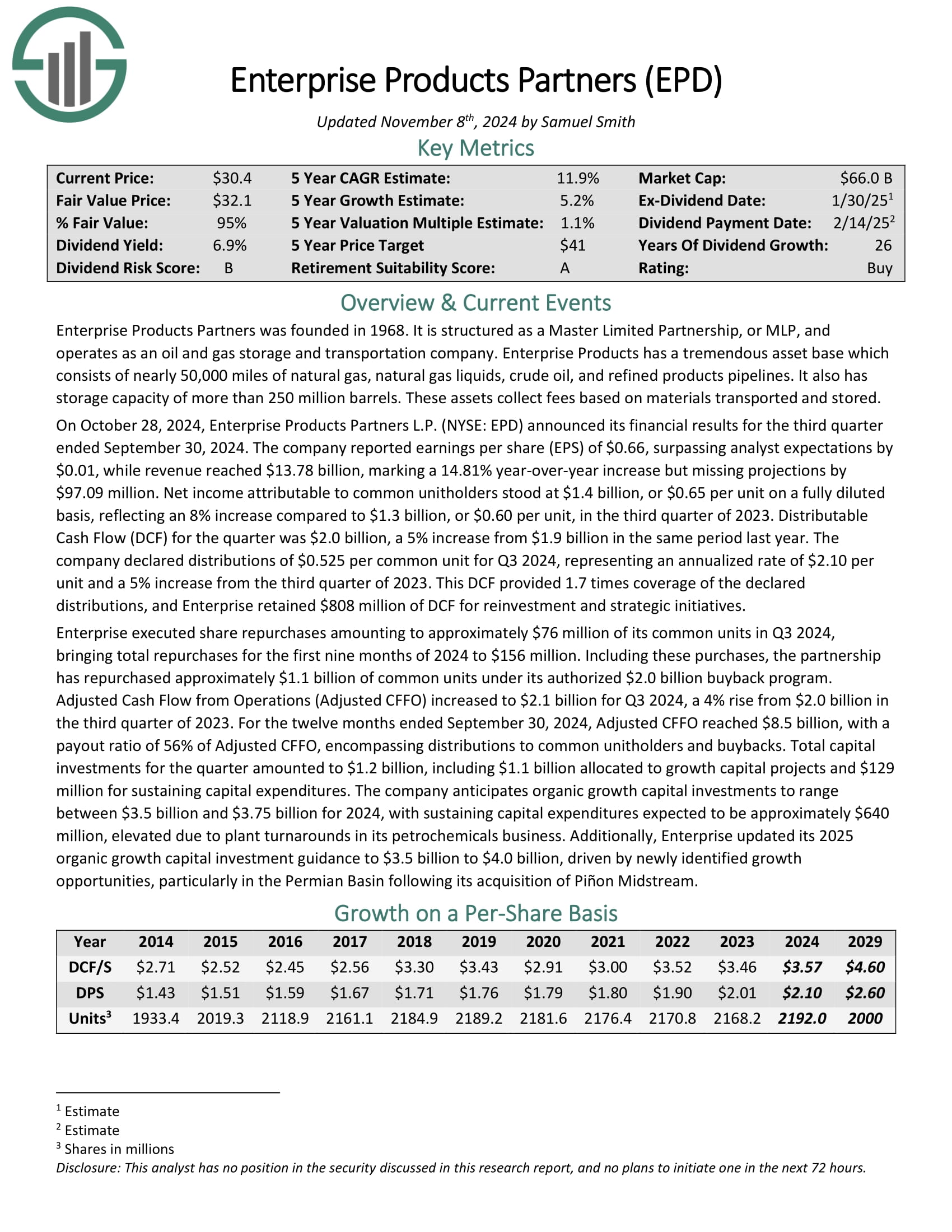

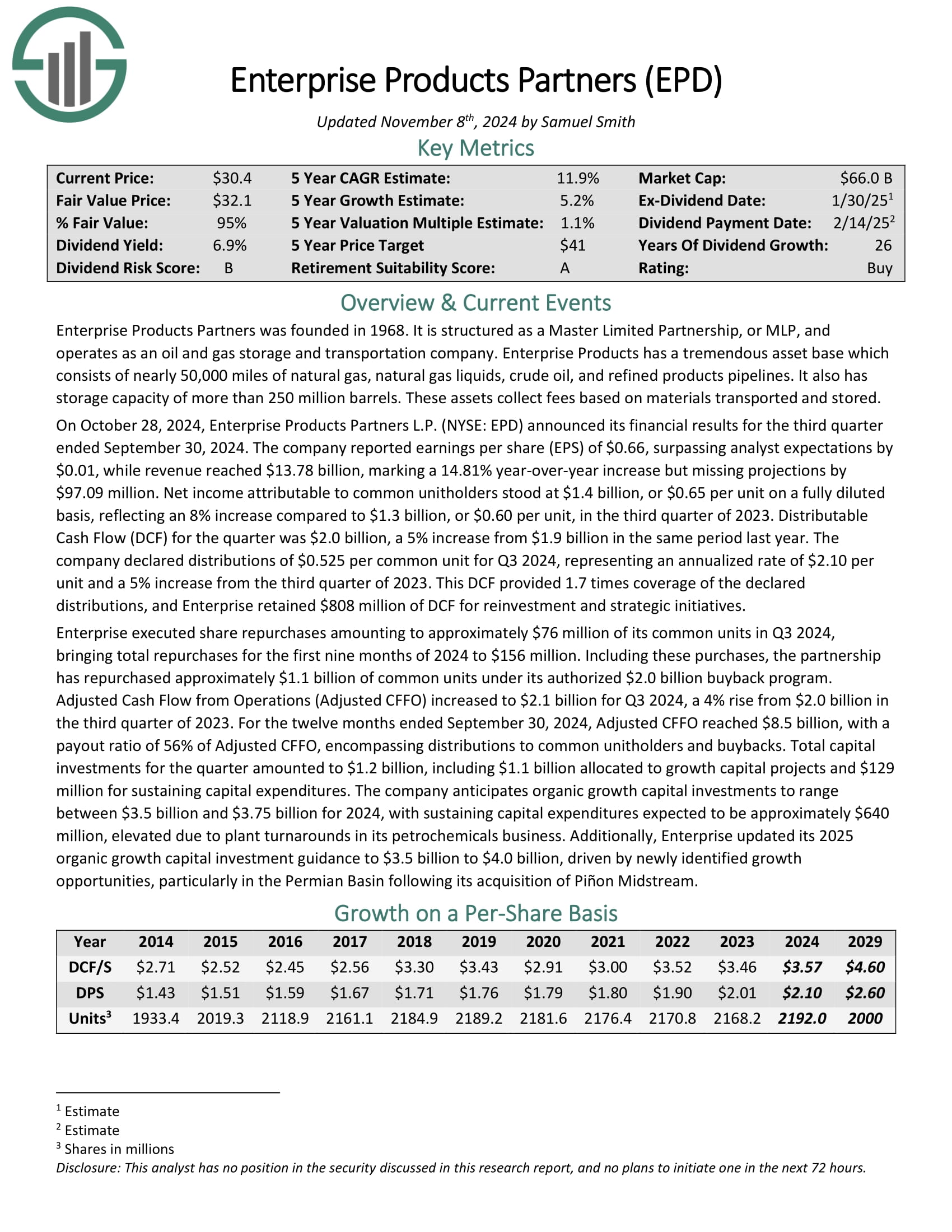

Ideally suited Retirement Funding Inventory: Enterprise Merchandise Companions LP (EPD)

Enterprise Merchandise Companions was based in 1968. It’s structured as a Grasp Restricted Partnership, or MLP, and operates as an oil and gasoline storage and transportation firm.

Enterprise Merchandise has a big asset base which consists of almost 50,000 miles of pure gasoline, pure gasoline liquids, crude oil, and refined merchandise pipelines.

It additionally has storage capability of greater than 250 million barrels. These property accumulate charges based mostly on volumes of supplies transported and saved.

Supply: Investor Presentation

On October 28, 2024, Enterprise Merchandise Companions introduced its monetary outcomes for the third quarter ended September 30, 2024. Income reached $13.78 billion, marking a 14.81% year-over-year improve.

Distributable Money Move (DCF) for the quarter was $2.0 billion, a 5% improve from $1.9 billion in the identical interval final 12 months.

The corporate declared distributions of $0.525 per frequent unit for Q3 2024, representing an annualized fee of $2.10 per unit and a 5% improve from the third quarter of 2023.

DCF offered 1.7 occasions protection of the declared distributions.

Click on right here to obtain our most up-to-date Positive Evaluation report on EPD (preview of web page 1 of three proven beneath):

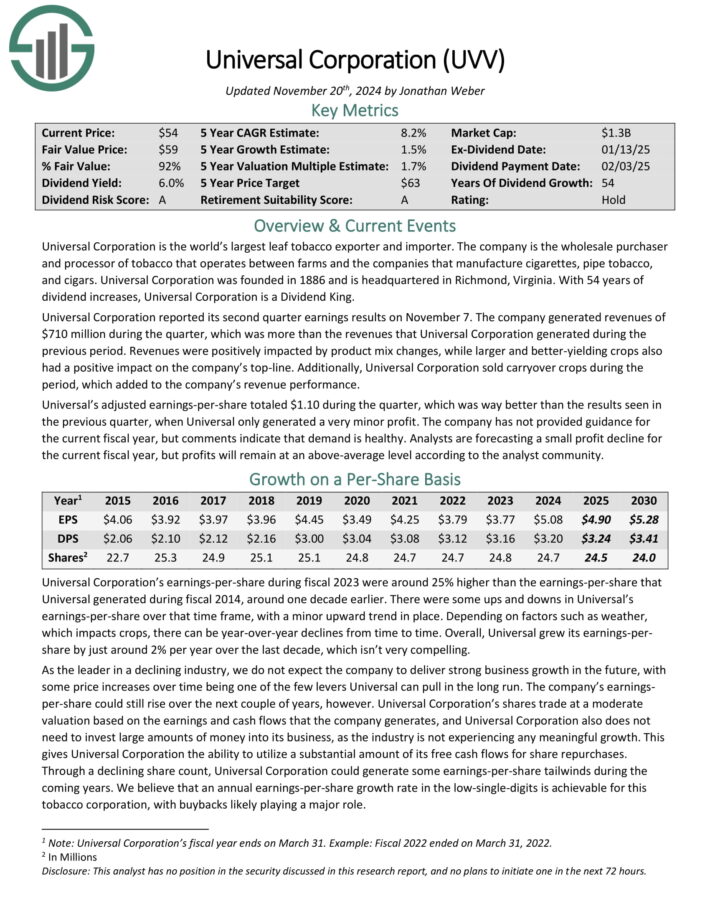

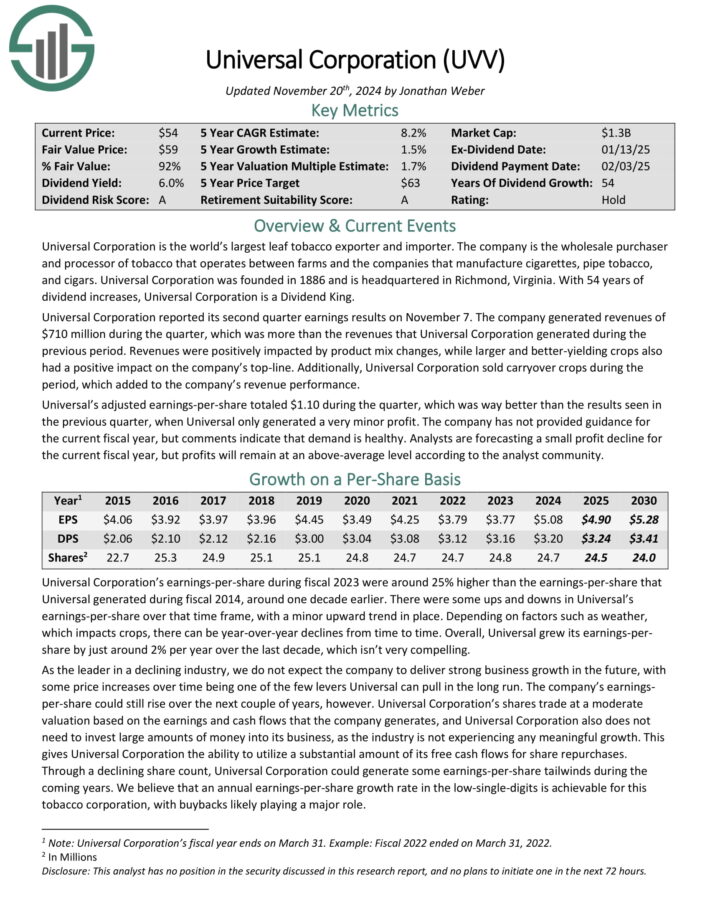

Ideally suited Retirement Funding Inventory: Common Corp. (UVV)

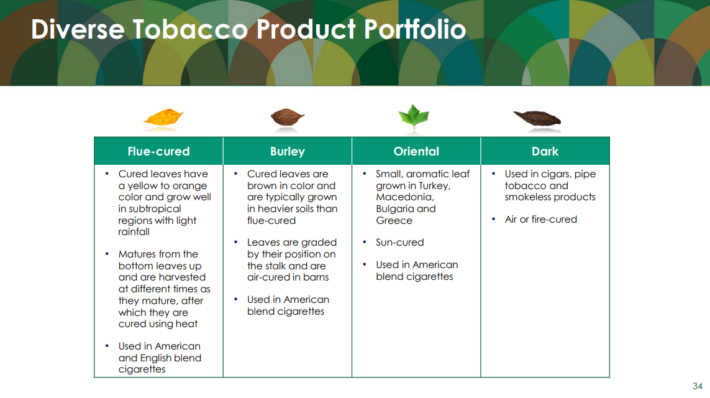

Common Company is a market chief in supplying leaf tobacco and different plant-based inputs to shopper product producers.

The Tobacco Operations phase buys and sells tobacco used to make cigarettes, cigars, pipe tobacco, and smokeless merchandise.

Common buys tobacco from its suppliers, processes it, and sells it to giant tobacco corporations within the US and internationally.

Supply: Investor Presentation

The Ingredient Operations deal primarily with greens and fruits however is considerably smaller than the tobacco operations. Common has been rising this enterprise by way of acquisitions beginning in 2020.

Common Company reported its second quarter earnings outcomes on November 7. The corporate generated revenues of $710 million through the quarter.

Moreover, Common Company offered carryover crops through the interval, which added to the corporate’s income efficiency.

Click on right here to obtain our most up-to-date Positive Evaluation report on Common (preview of web page 1 of three proven beneath):

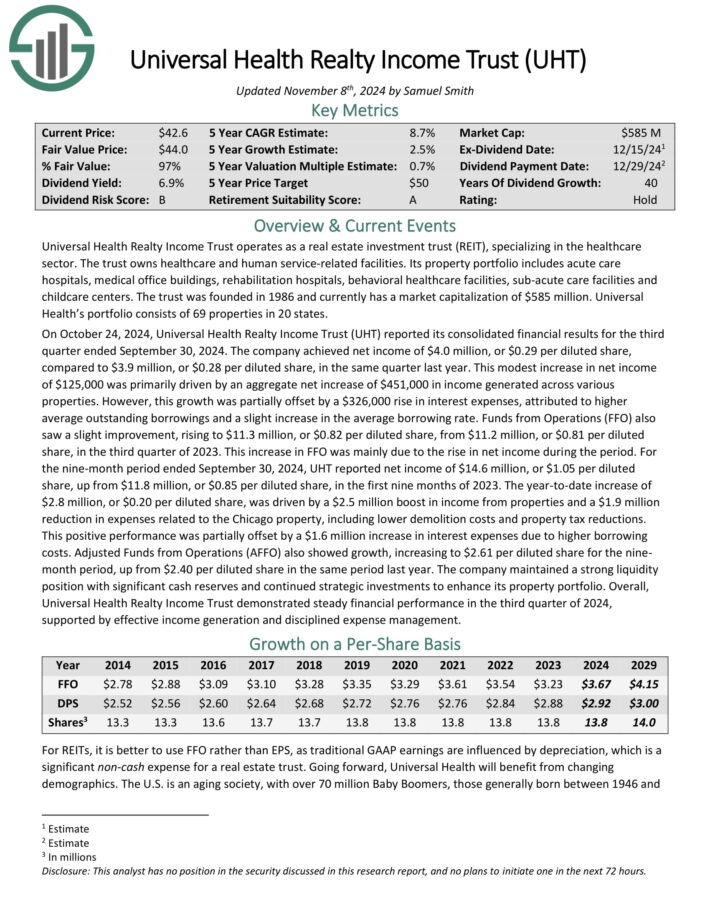

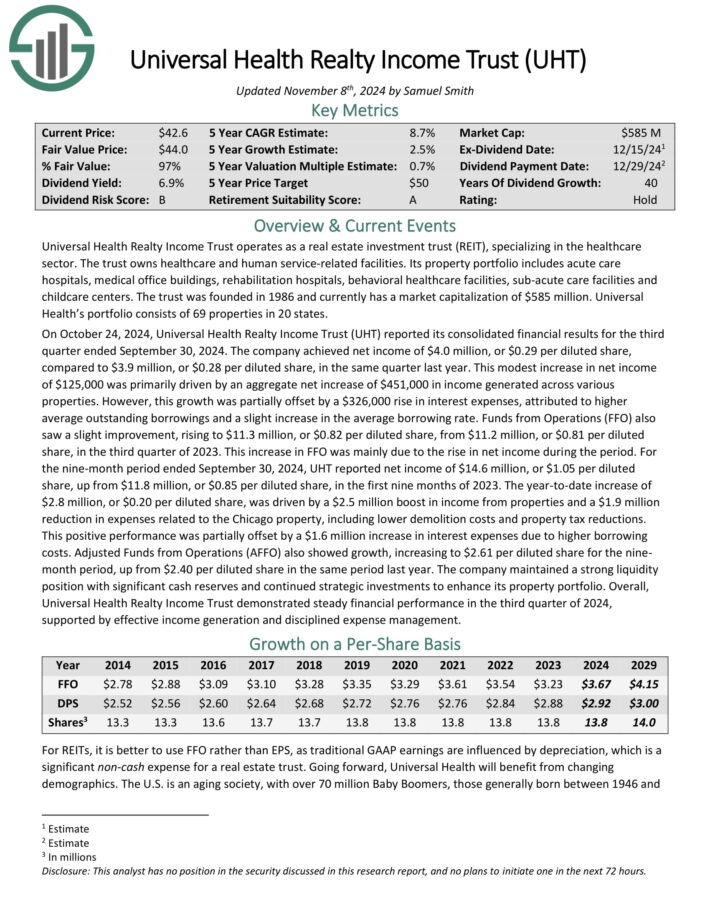

Ideally suited Retirement Funding Inventory: Common Well being Realty Revenue Belief (UHT)

Common Well being Realty Revenue Belief operates as an actual property funding belief (REIT), specializing within the healthcare sector. The belief owns healthcare and human service-related amenities.

Its property portfolio consists of acute care hospitals, medical workplace buildings, rehabilitation hospitals, behavioral healthcare amenities, sub-acute care amenities and childcare facilities. Common Well being’s portfolio consists of 69 properties in 20 states.

On October 24, 2024, UHT reported its third quarter outcomes. Funds from Operations (FFO) noticed a slight enchancment, rising to $11.3 million, or $0.82 per diluted share, from $11.2 million, or $0.81 per diluted share, within the third quarter of 2023. This improve in FFO was primarily as a result of rise in internet revenue through the interval.

The corporate maintained a powerful liquidity place with important money reserves and continued strategic investments to reinforce its property portfolio.

Click on right here to obtain our most up-to-date Positive Evaluation report on UHT (preview of web page 1 of three proven beneath):

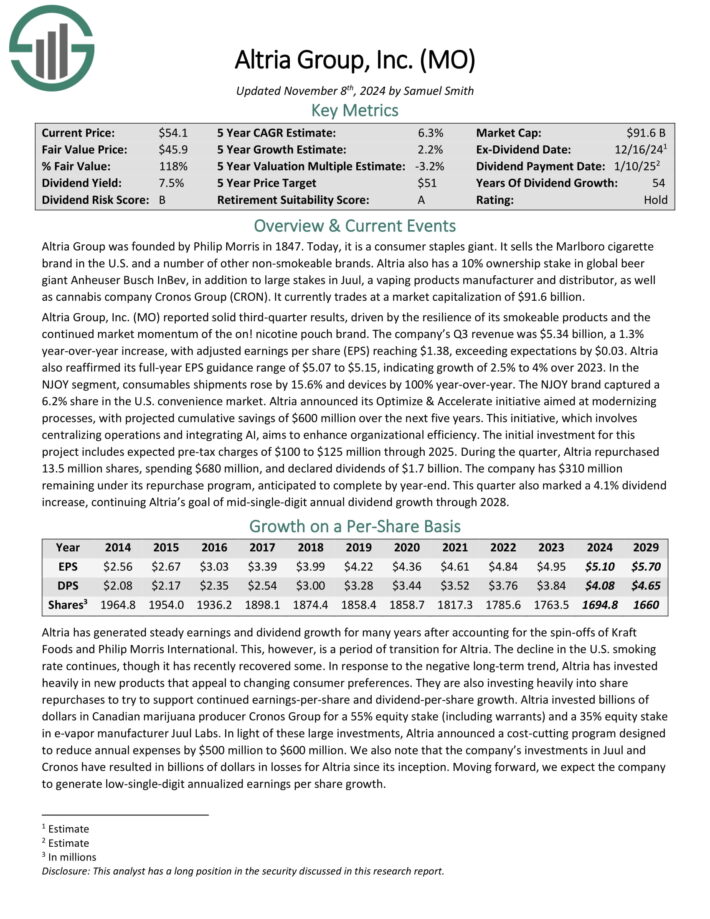

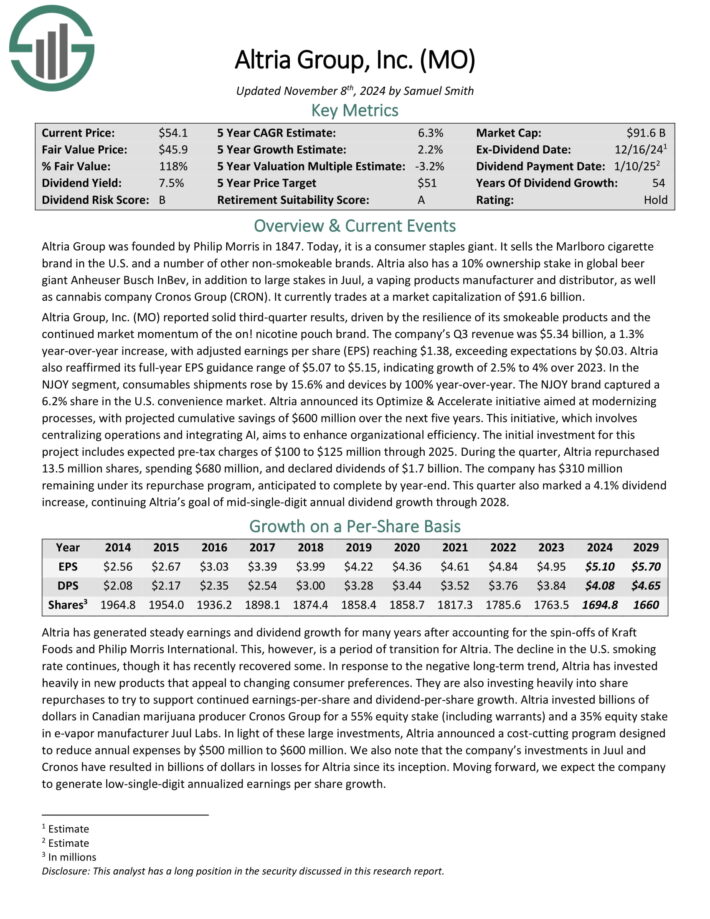

Ideally suited Retirement Funding Inventory: Altria Group (MO)

Altria is a tobacco inventory that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and extra beneath quite a lot of manufacturers, together with Marlboro, Skoal, and Copenhagen, amongst others.

The corporate additionally has a 35% funding stake in e-cigarette maker JUUL, and a forty five% stake within the hashish firm Cronos Group (CRON).

Altria reported strong third-quarter outcomes, pushed by the resilience of its smokeable merchandise and the continued market momentum of the on! nicotine pouch model.

Supply: Investor Presentation

The corporate’s Q3 income was $5.34 billion, a 1.3% year-over-year improve, with adjusted earnings per share (EPS) reaching $1.38, exceeding expectations by $0.03.

Altria additionally reaffirmed its full-year EPS steering vary of $5.07 to $5.15, indicating development of two.5% to 4% over 2023.

In the course of the quarter, Altria repurchased 13.5 million shares, spending $680 million, and declared dividends of $1.7 billion. The corporate has $310 million remaining beneath its repurchase program, anticipated to finish by year-end.

Click on right here to obtain our most up-to-date Positive Evaluation report on Altria (preview of web page 1 of three proven beneath):

Extra Studying

Ideally suited retirement funding shares present sustainable and rising dividend revenue, with market-beating yields. The Dividend Champions are an incredible place to begin searching for very best retirement funding shares.

The Dividend Champions record is just not the one approach to shortly display screen for shares that frequently pay rising dividends:

The key home inventory market indices are one other strong useful resource for locating very best retirement funding shares. Positive Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].