Printed on Might 14th, 2025 by Bob Ciura

We’ve got just one promote rule within the Certain Passive Revenue E-newsletter.

That one rule is to promote when a inventory breaks its streak of consecutive annual dividend will increase. This happens when a inventory does any of the next:

- Fails to extend its dividend (flat year-over-year-dividends)

- Reduces its dividend (declining year-over-year dividends)

- Eliminates its dividend

This implies dividend coverage completely dictates once we promote.

The final word purpose of the Certain Passive Revenue E-newsletter, and dividend progress investing generally, is to comprehend dividend progress over time (because the title implies).

As long as dividends are rising, we need to purchase and maintain ceaselessly. Having extra promoting standards can intervene with the long-term dividend compounding of any earlier purchase.

For that reason, we advocate dividend progress buyers deal with shares with lengthy histories of accelerating dividends every year.

A main instance is the Dividend Aristocrats, a choose group of 69 S&P 500 shares with 25+ years of consecutive dividend will increase.

There are presently 69 Dividend Aristocrats. You possibly can obtain an Excel spreadsheet of all 69 Dividend Aristocrats (with metrics that matter similar to dividend yields and price-to-earnings ratios) by clicking the hyperlink beneath:

Disclaimer: Certain Dividend will not be affiliated with S&P World in any manner. S&P World owns and maintains The Dividend Aristocrats Index. The knowledge on this article and downloadable spreadsheet relies on Certain Dividend’s personal overview, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person buyers higher perceive this ETF and the index upon which it’s primarily based. Not one of the data on this article or spreadsheet is official information from S&P World. Seek the advice of S&P World for official data.

However when a inventory fails to generate dividend progress, it isn’t doing what we bought it for.

For a dividend progress investor, promoting a inventory that isn’t rising its dividend is lots like disposing of a fridge that doesn’t hold meals chilly – in both case, the explanation you got is now not legitimate.

This text will talk about 10 dividend shares that will have engaging yields, however shouldn’t have dividend progress–that means buyers targeted solely on rising revenue ought to take into account promoting.

The record is sorted by present yield, from lowest to highest.

Desk of Contents

You possibly can immediately bounce to any particular part of the article by utilizing the hyperlinks beneath:

Excessive Dividend Inventory To Contemplate Promoting #10: Oxford Sq. Capital (OXSQ)

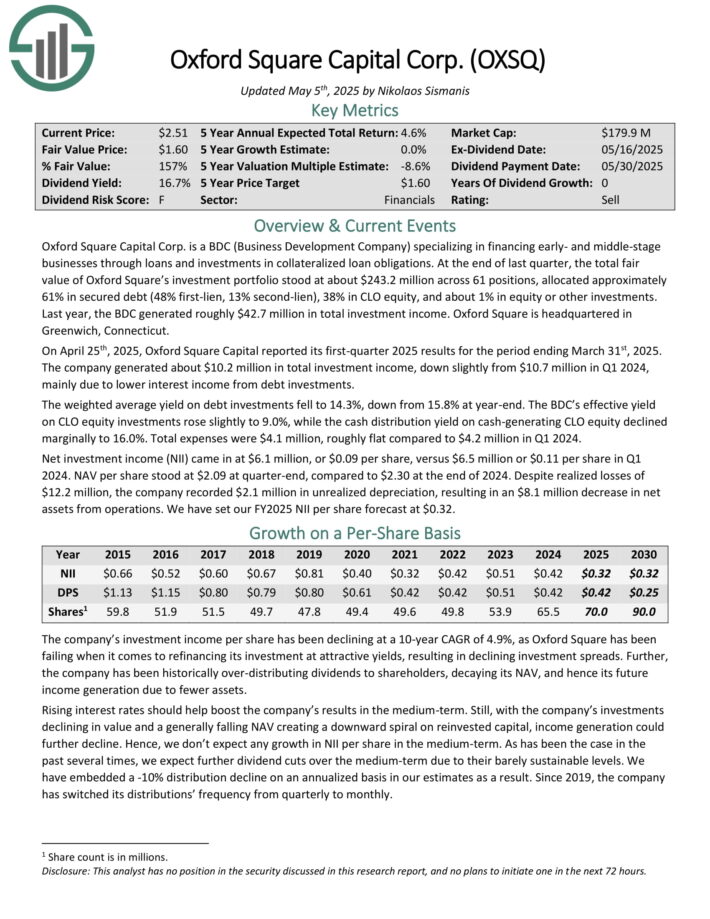

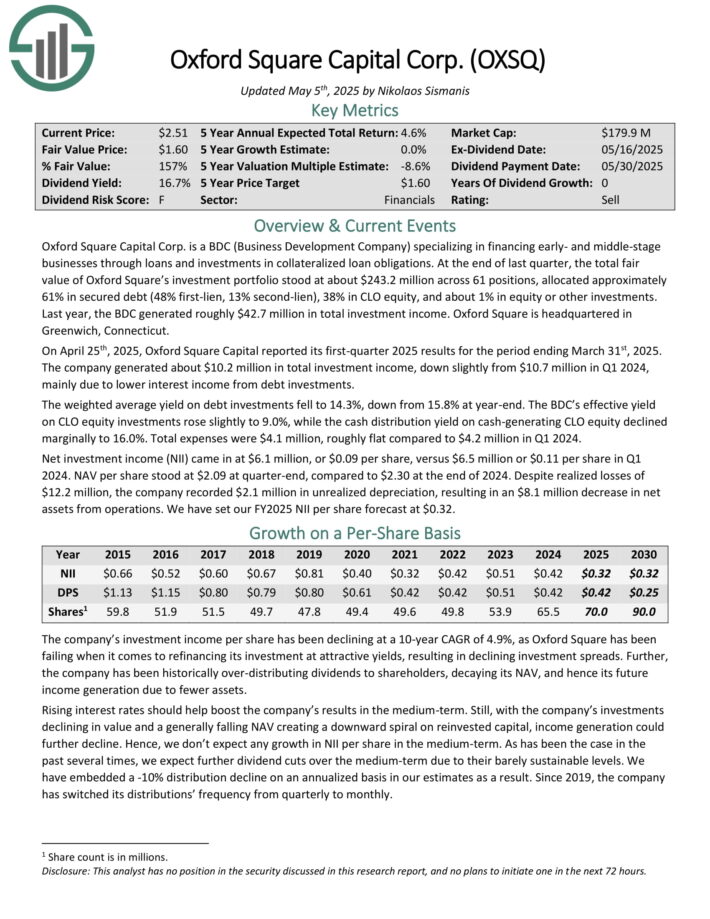

Oxford Sq. Capital Corp. is a BDC (Enterprise Growth Firm) specializing in financing early- and middle-stage companies by loans and investments in collateralized mortgage obligations.

On the finish of final quarter, the entire truthful worth of Oxford Sq.’s funding portfolio stood at about $243.2 million throughout 61 positions, allotted roughly 61% in secured debt (48% first-lien, 13% second-lien), 38% in CLO fairness, and about 1% in fairness or different investments. Final 12 months, the BDC generated roughly $42.7 million in complete funding revenue.

On April twenty fifth, 2025, Oxford Sq. Capital reported its first-quarter 2025 outcomes for the interval ending March thirty first, 2025. The corporate generated about $10.2 million in complete funding revenue, down barely from $10.7 million in Q1 2024, primarily attributable to decrease curiosity revenue from debt investments.

The weighted common yield on debt investments fell to 14.3%, down from 15.8% at year-end. The BDC’s efficient yield on CLO fairness investments rose barely to 9.0%, whereas the money distribution yield on cash-generating CLO fairness declined marginally to 16.0%. Complete bills have been $4.1 million, roughly flat in comparison with $4.2 million in Q1 2024.

Click on right here to obtain our most up-to-date Certain Evaluation report on OXSQ (preview of web page 1 of three proven beneath):

Excessive Dividend Inventory To Contemplate Promoting #9: Xerox Company (XRX)

Xerox Company traces its lineage again to 1906 when The Haloid Photographic Firm started manufacturing photographic paper and gear. Via a sequence of mergers and spinoffs, the Xerox we all know right this moment was fashioned.

Xerox spun off its enterprise processing unit in 2017 (now referred to as Conduent) and now focuses on design, improvement, and gross sales of doc administration techniques.

In February, the corporate minimize its quarterly dividend by 50%.

Xerox reported first quarter monetary outcomes on Might 1st. Quarterly income of $1.46 billion missed estimates by $60 million. Adjusted earnings-per-share of -$0.06 per share missed analyst estimates by $0.03 per share.

Click on right here to obtain our most up-to-date Certain Evaluation report on XRX (preview of web page 1 of three proven beneath):

Excessive Dividend Inventory To Contemplate Promoting #8: BCE Inc. (BCE)

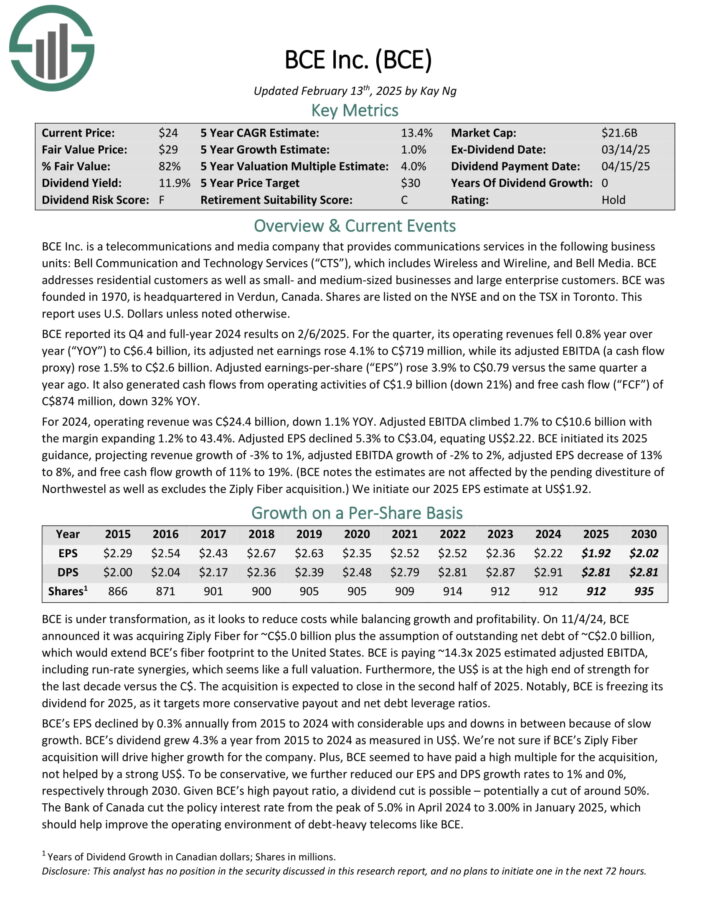

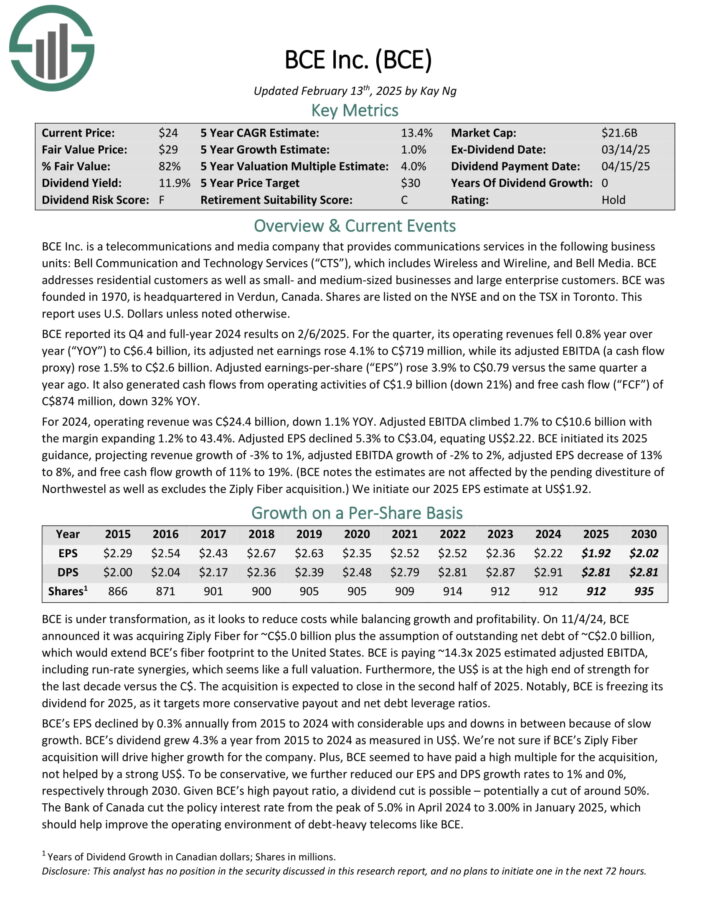

BCE Inc. is a telecommunications and media firm that gives communications providers within the following enterprise models: Bell Communication and Know-how Companies (“CTS”), which incorporates Wi-fi and Wireline, and Bell Media.

BCE addresses residential prospects in addition to small- and medium-sized companies and enormous enterprise prospects. BCE was based in 1970, is headquartered in Verdun, Canada. Shares are listed on the NYSE and on the TSX in Toronto.

BCE reported its This fall and full-year 2024 outcomes on 2/6/2025. For the quarter, its working revenues fell 0.8% 12 months over 12 months (“YOY”) to C$6.4 billion, its adjusted internet earnings rose 4.1% to C$719 million, whereas its adjusted EBITDA (a money stream proxy) rose 1.5% to C$2.6 billion.

Adjusted earnings-per-share (“EPS”) rose 3.9% to C$0.79 versus the identical quarter a 12 months in the past. It additionally generated money flows from working actions of C$1.9 billion (down 21%) and free money stream (“FCF”) of C$874 million, down 32% YOY.

For 2024, working income was C$24.4 billion, down 1.1% YOY. Adjusted EBITDA climbed 1.7% to C$10.6 billion with the margin increasing 1.2% to 43.4%. Adjusted EPS declined 5.3%.

In Might, BCE minimize its dividend by 56%.

Click on right here to obtain our most up-to-date Certain Evaluation report on BCE (preview of web page 1 of three proven beneath):

Excessive Dividend Inventory To Contemplate Promoting #7: Prospect Capital (PSEC)

Prospect Capital Company is a Enterprise Growth Firm, or BDC, that gives personal debt and personal fairness to center–market corporations within the U.S.

The corporate focuses on direct lending to proprietor–operated corporations, in addition to sponsor–backed transactions. Prospect invests primarily in first and second lien senior loans and mezzanine debt, with occasional fairness investments.

Prospect posted second quarter earnings on February tenth, 2025, and outcomes have been considerably weak. Internet funding revenue per-share acme to twenty cents, whereas complete funding revenue fell from $211 million to $185 million year-over-year.

NII per-share fell from 21 cents in Q1, and 24 cents from the year-ago interval. Complete curiosity revenue was $169 million for the quarter, down from $185 million within the prior quarter, and $195 million a 12 months in the past. It additionally missed estimates by about $2 million.

Complete originations have been $135 million, down sharply from $291 million within the earlier quarter. Complete funds and gross sales have been $383 million, up from $282 million in Q1.

Click on right here to obtain our most up-to-date Certain Evaluation report on PSEC (preview of web page 1 of three proven beneath):

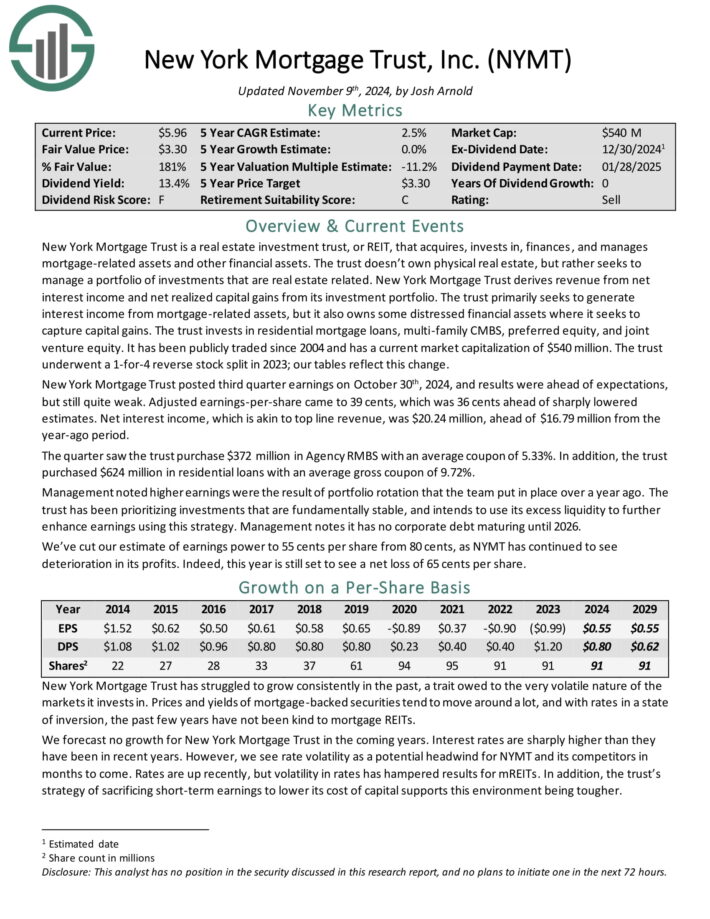

Excessive Dividend Inventory To Contemplate Promoting #6: New York Mortgage Belief (NYMT)

New York Mortgage Belief acquires, invests in, funds, and manages mortgage-related belongings and different monetary belongings. The belief doesn’t personal bodily actual property, however slightly seeks to handle a portfolio of investments which are actual property associated.

The belief invests in residential mortgage loans, multi household CMBS, most popular fairness, and three way partnership fairness.

New York Mortgage Belief posted third quarter earnings on October thirtieth, 2024, and outcomes have been forward of expectations, however nonetheless fairly weak.

Adjusted earnings-per-share got here to 39 cents, which was 36 cents forward of sharply lowered estimates. Internet curiosity revenue, which is akin to high line income, was $20.24 million, forward of $16.79 million from the year-ago interval.

The quarter noticed the belief buy $372 million in Company RMBS with a median coupon of 5.33%. As well as, the belief bought $624 million in residential loans with a median gross coupon of 9.72%.

Click on right here to obtain our most up-to-date Certain Evaluation report on NYMT (preview of web page 1 of three proven beneath):

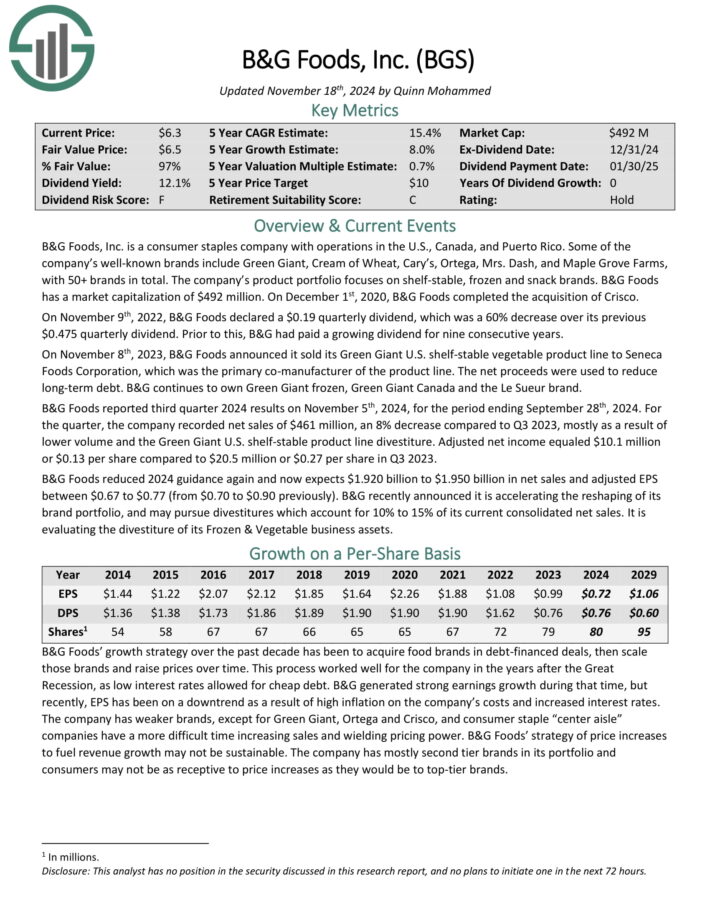

Excessive Dividend Inventory To Contemplate Promoting #5: B&G Meals, Inc. (BGS)

B&G Meals, Inc. is a shopper staples firm with operations within the U.S., Canada, and Puerto Rico. A number of the firm’s well-known manufacturers embody Inexperienced Big, Cream of Wheat, Cary’s, Ortega, Mrs. Sprint, and Maple Grove Farms, with 50+ manufacturers in complete.

It product portfolio focuses on shelf-stable, frozen and snack manufacturers. On December 1st, 2020, B&G Meals accomplished the acquisition of Crisco.

B&G Meals reported first-quarter monetary outcomes on Might seventh. For the quarter, the corporate recorded internet gross sales of $425 million, which missed analyst estimates by $10.4 million. Adjusted earnings-per-share of $0.04 missed estimates, which referred to as for $0.08 per share.

The corporate revised full-year steerage, now anticipating 2025 income of $1.86 billion to $1.91 billion.

Click on right here to obtain our most up-to-date Certain Evaluation report on BGS (preview of web page 1 of three proven beneath):

Excessive Dividend Inventory To Contemplate Promoting #4: ARMOUR Residential REIT (ARR)

ARMOUR Residential invests in residential mortgage-backed securities that embody U.S. Authorities-sponsored entities (GSE) similar to Fannie Mae and Freddie Mac.

It additionally consists of Ginnie Mae, the Authorities Nationwide Mortgage Administration’s issued or assured securities backed by fixed-rate, hybrid adjustable-rate, and adjustable-rate house loans.

Unsecured notes and bonds issued by the GSE and the US Treasury, cash market devices, and non-GSE or authorities agency-backed securities are examples of different kinds of investments.

Within the fourth quarter of 2024, ARMOUR Residential REIT, Inc. reported a GAAP internet lack of $49.4 million, or $0.83 per frequent share. Regardless of this, the corporate achieved distributable earnings of $46.5 million, equating to $0.78 per frequent share, which fell in need of the anticipated $0.97. Internet curiosity revenue for the quarter was $12.7 million.

Throughout this era, ARMOUR raised roughly $136.2 million by the issuance of about 7.2 million shares by way of an on the market providing program. The corporate maintained its month-to-month frequent inventory dividend at $0.24 per share, totaling $0.72 for the quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on ARMOUR Residential REIT Inc (ARR) (preview of web page 1 of three proven beneath):

Excessive Dividend Inventory To Contemplate Promoting #3: Kohl’s Company (KSS)

Kohl’s traces its roots again to a single retailer: Kohl’s Division Retailer in 1962. Since then, it has grown into a pacesetter within the area – providing ladies’s, males’s and kids’s attire, housewares, equipment, and footwear in additional than 1,100 shops in 49 states. The corporate ought to generate roughly $16 billion in gross sales this 12 months.

From 2007 by 2018, Kohl’s was capable of develop earnings-per-share by about 4.7% yearly. Nonetheless, it ought to be famous that this was pushed by the corporate’s in depth share repurchase program. Over that interval the share depend was almost halved, a discount charge of -5.6% per 12 months.

With the share repurchase program having been paused, we don’t see that as a tailwind in the interim. Fears of struggling margins have confirmed to be proper, because the previous few years have seen declining profitability. We observe that 2021’s earnings has the potential to be the highest for a while.

In March, Kohl’s minimize its quarterly dividend by 75%.

Click on right here to obtain our most up-to-date Certain Evaluation report on KSS (preview of web page 1 of three proven beneath):

Excessive Dividend Inventory To Contemplate Promoting #2: Orchid Island Capital (ORC)

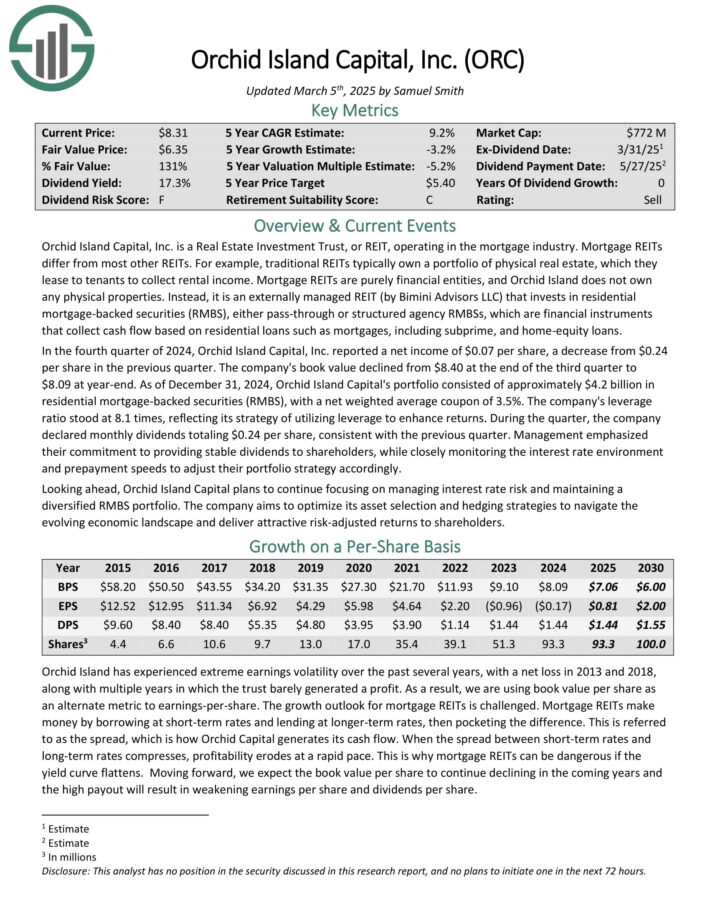

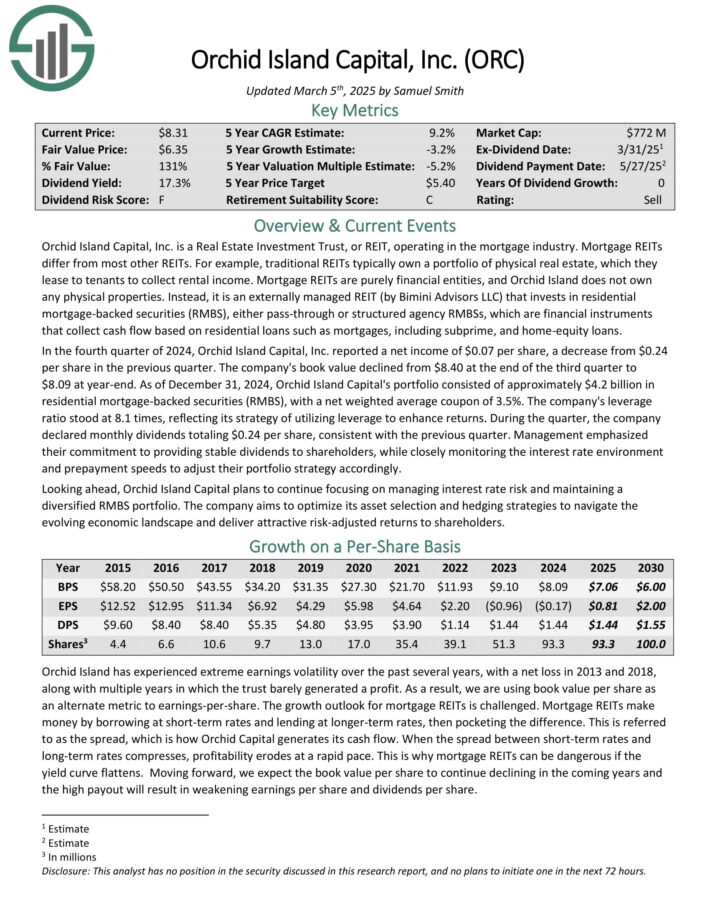

Orchid Island Capital is a mortgage REIT that’s externally managed by Bimini Advisors LLC and focuses on investing in residential mortgage-backed securities (RMBS), together with pass-through and structured company RMBSs.

These monetary devices generate money stream primarily based on residential loans similar to mortgages, subprime, and home-equity loans.

Within the fourth quarter of 2024, Orchid Island Capital, Inc. reported a internet revenue of $0.07 per share, a lower from $0.24 per share within the earlier quarter. The corporate’s ebook worth declined from $8.40 on the finish of the third quarter to $8.09 at year-end.

As of December 31, 2024, Orchid Island Capital’s portfolio consisted of roughly $4.2 billion in residential mortgage-backed securities (RMBS), with a internet weighted common coupon of three.5%. The corporate’s leverage ratio stood at 8.1 instances, reflecting its technique of using leverage to reinforce returns.

Click on right here to obtain our most up-to-date Certain Evaluation report on Orchid Island Capital, Inc. (ORC) (preview of web page 1 of three proven beneath):

Excessive Dividend Inventory To Contemplate Promoting #1: Icahn Enterprises LP (IEP)

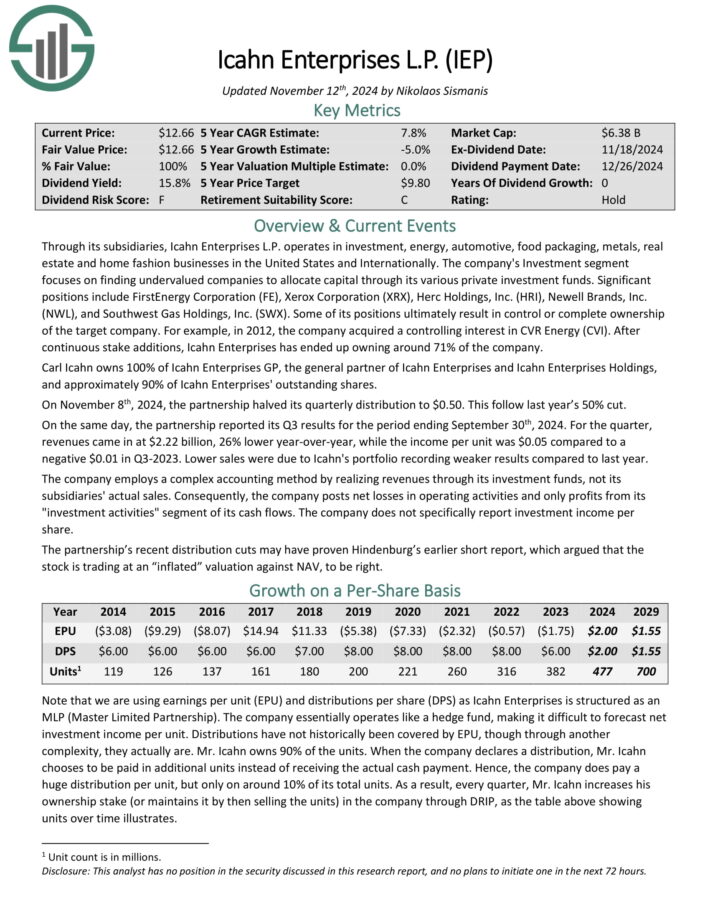

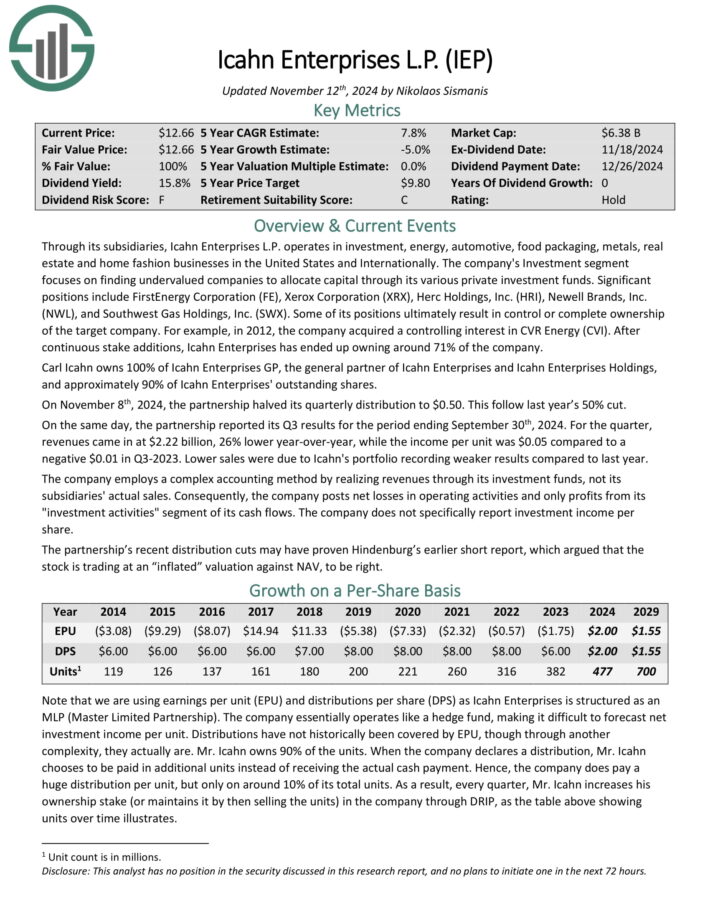

Via its subsidiaries, Icahn Enterprises L.P. operates in funding, power, automotive, meals packaging, metals, actual property and residential style companies in america and Internationally.

The corporate’s Funding phase focuses on discovering undervalued corporations to allocate capital by its varied personal funding funds.

Vital positions embody FirstEnergy Company (FE), Xerox Company (XRX), Herc Holdings, Inc. (HRI), Newell Manufacturers, Inc. (NWL), and Southwest Fuel Holdings, Inc. (SWX).

On November eighth, 2024, the partnership halved its quarterly distribution to $0.50. This observe final 12 months’s 50% minimize. On the identical day, the partnership reported its Q3 outcomes for the interval ending September thirtieth, 2024.

For the quarter, revenues got here in at $2.22 billion, 26% decrease year-over-year, whereas the revenue per unit was $0.05 in comparison with a damaging $0.01 in Q3-2023. Decrease gross sales have been attributable to Icahn’s portfolio recording weaker outcomes in comparison with final 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on IEP (preview of web page 1 of three proven beneath):

Closing Ideas & Extra Studying

Excessive dividend shares are naturally interesting on the floor, attributable to their excessive dividend yields.

However revenue buyers want to verify they don’t fall right into a dividend ‘lure’, that means buying a inventory solely attributable to its excessive yield, solely to see the corporate minimize or remove the dividend payout.

Revenue buyers in search of progress ought to take into account promoting the ten dividend shares on this article, as a result of they haven’t displayed any dividend progress. In lots of circumstances, these shares have already minimize their dividends, violating one of many three guidelines of the Certain Passive Revenue publication.

In case you are enthusiastic about discovering high-quality dividend progress shares and/or different high-yield securities and revenue securities, the next Certain Dividend sources might be helpful:

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].