Revealed on December thirty first, 2024 by Bob Ciura

Excessive yield securities are considered primarily as revenue mills. However much less consideration is paid to their capacity to compound revenue over time.

There are three drivers for compounding revenue from any funding:

- Reinvesting dividends

- Dividend development on a per share foundation

- The time over which the funding is held

Reinvesting dividends is particularly highly effective with high-yield securities. Increased yields imply which you could compound your revenue stream sooner by reinvesting dividends.

If all dividends from a 5.0% yielding inventory are reinvested, you’ll compound your revenue stream at roughly 5.0% yearly.

And since excessive yield shares, on common, don’t have notably excessive development charges, you possibly can “create” revenue development by reinvesting dividends till you want them for private finance causes.

We keep a listing of high-dividend shares with present yields above 5%. You’ll be able to obtain the excessive dividend shares checklist by clicking on the hyperlink under:

There are a lot of excessive yield securities on the market. But it surely’s non as widespread for a high-yield safety to pay rising dividends on a per share foundation over time.

When this occurs, your revenue compounds, even once you don’t reinvest dividends.

However in the event you do reinvest dividends, you get compounding advantages from each proudly owning extra shares (by way of reinvesting dividends), and receiving extra revenue from every share (from dividend development on a per share foundation).

Subsequently, discovering shares with a excessive present yield with dividend will increase, could be a highly effective mixture.

The next 10 excessive yield dividend compounders have present yields above 5%, and Dividend Danger Scores of ‘C’ or higher. The checklist additionally excludes REITs, BDCs, and MLPs.

Desk of Contents

The ten excessive yield dividend compounders are ranked by 5-year dividend development price, from lowest to highest.

Excessive Yield Dividend Compounder #10: Evergy Inc. (EVRG)

- Dividend Yield: 4.3%

- Dividend Development Charge: 5.0%

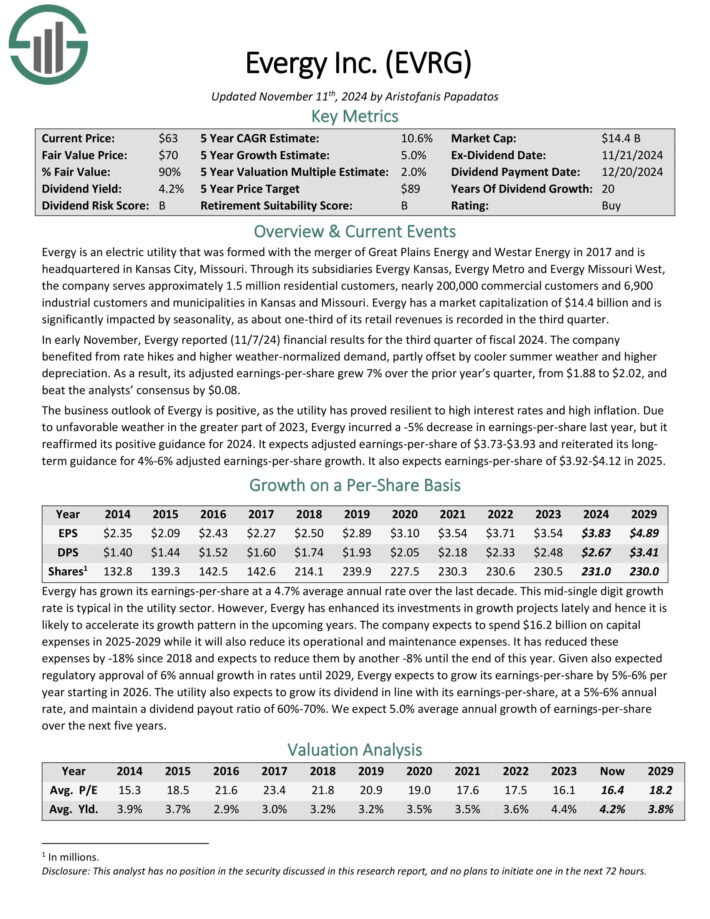

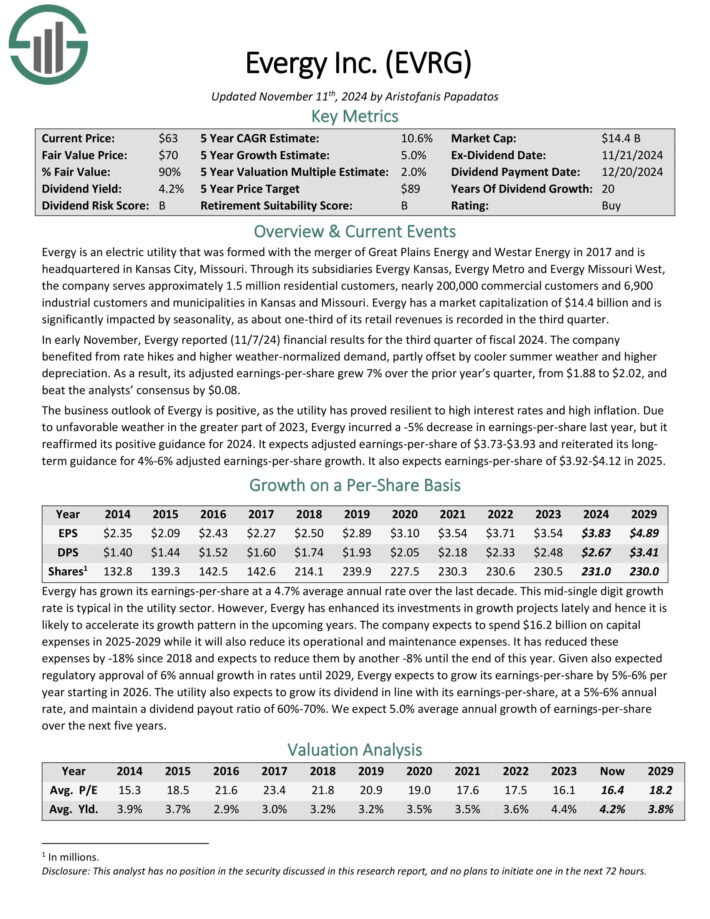

Evergy is an electrical utility holding firm included in 2017 and headquartered in Kansas Metropolis, Missouri.

By its subsidiaries Evergy Kansas, Evergy Metro and Evergy Missouri West, the corporate serves roughly 1.4 million residential clients, practically 200,000 business clients and 6,900 industrial clients and municipalities in Kansas and Missouri.

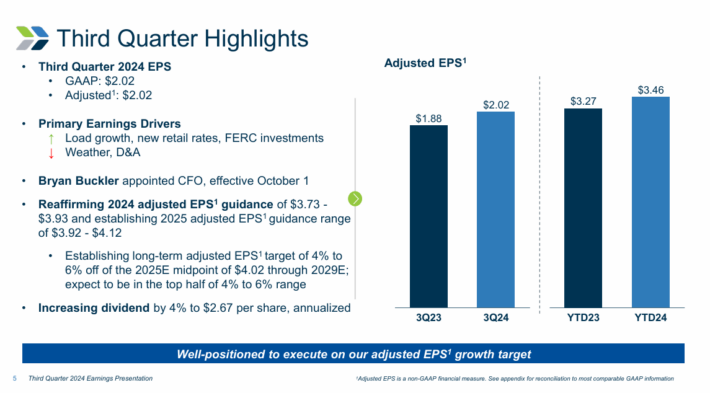

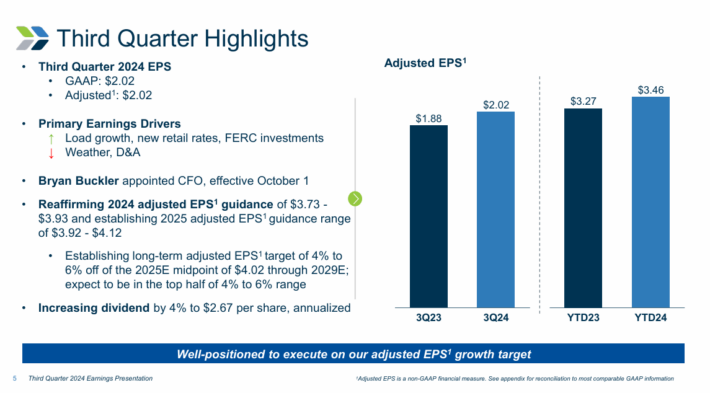

In early November, Evergy reported (11/7/24) monetary outcomes for the third quarter of fiscal 2024. The corporate benefited from price hikes and better weather-normalized demand, partly offset by cooler summer season climate and better depreciation.

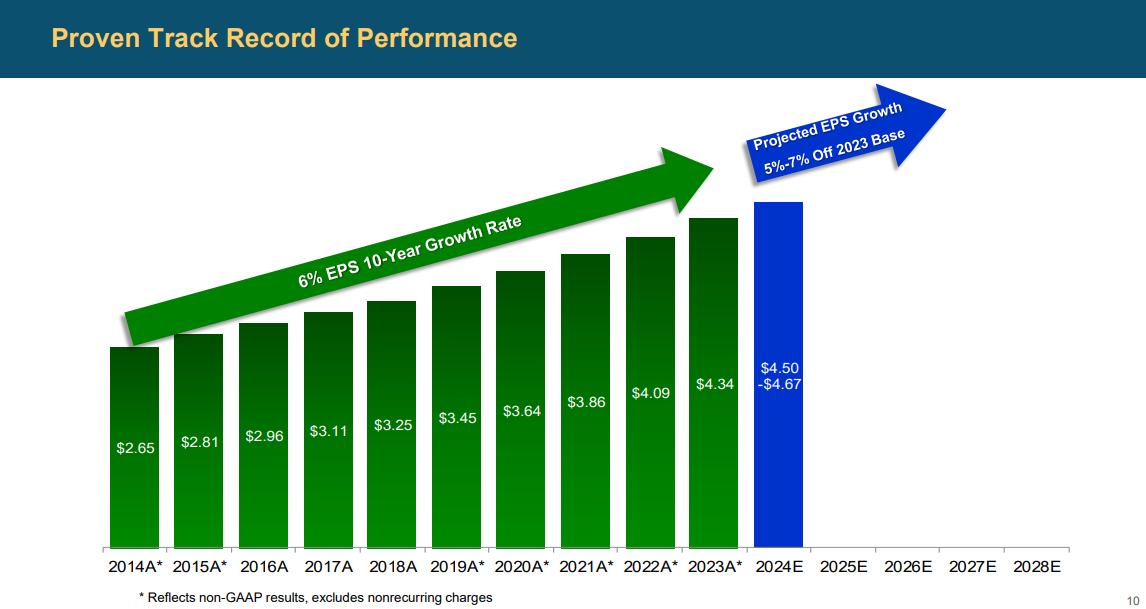

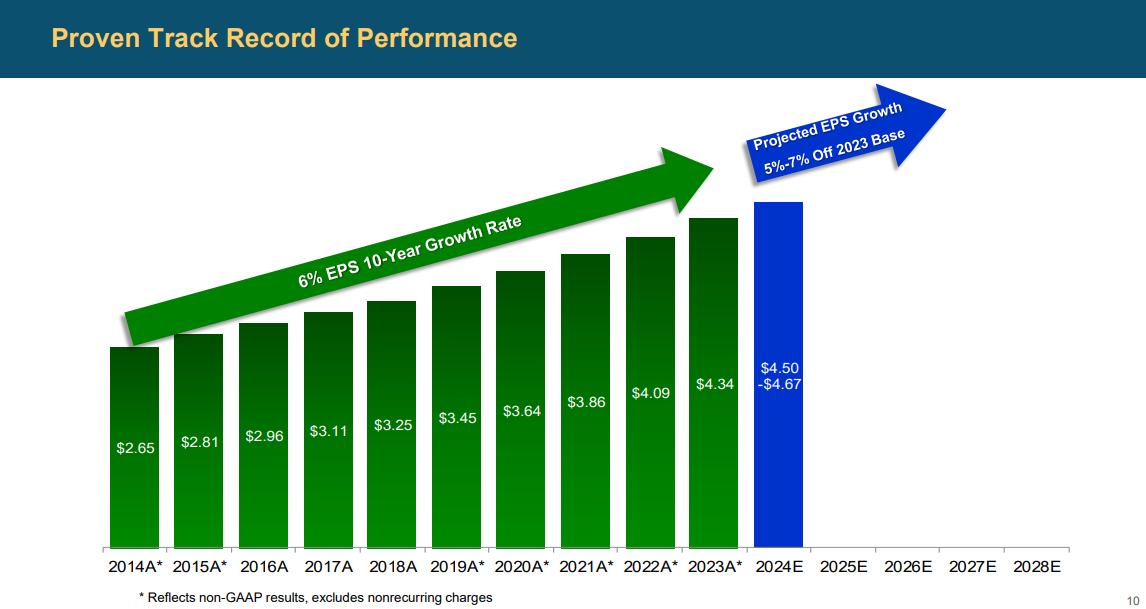

Supply: Investor Presentation

Adjusted earnings-per-share grew 7% year-over-year. Evergy reaffirmed its constructive steerage for 2024. It expects adjusted earnings-per-share of $3.73-$3.93 and reiterated its long-term steerage for 4%-6% adjusted earnings-per-share development.

It additionally expects earnings-per-share of $3.92-$4.12 in 2025.

Click on right here to obtain our most up-to-date Positive Evaluation report on Evergy Inc. (preview of web page 1 of three proven under):

Excessive Yield Dividend Compounder #9: Spire Inc. (SR)

- Dividend Yield: 6.2%

- Dividend Danger Rating: B

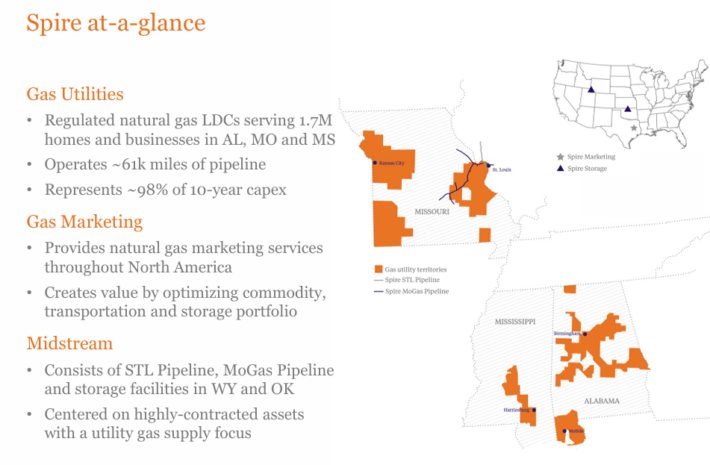

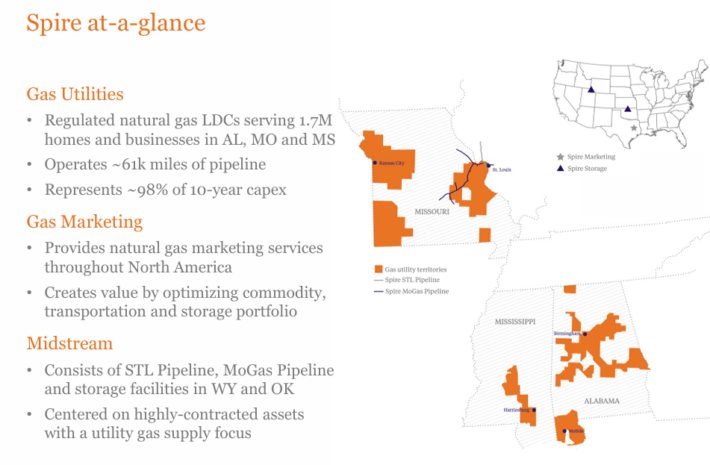

Spire Inc. is a public utility holding firm primarily based in St. Louis, Missouri. The corporate gives pure fuel service by way of its regulated core utility operations whereas participating in non-regulated actions that present enterprise alternatives.

The corporate has 5 fuel utilities, serving 1.7 million properties and companies throughout Alabama, Mississippi, and Missouri. This makes Spire the fifth largest publicly traded pure fuel firm within the nation.

Supply: Investor Presentation

The corporate generated $2.6 billion in gross sales in Fiscal 12 months (FY)2024. Spire has been rising its dividends for 22 straight years.

On November twentieth., 2024, the corporate reported its FY2024 fourth quarter outcomes. The corporate reported a web revenue of $250.9 million ($4.19 per share), up from $217.5 million ($3.85 per share) in fiscal 2023.

Adjusted earnings reached $247.4 million ($4.13 per share), enhancing from $228.1 million ($4.05 per share) the earlier 12 months.

The corporate reaffirmed its long-term adjusted earnings development goal of 5–7% and supplied fiscal 2025 earnings steerage of $4.40 to $4.60 per share.

Click on right here to obtain our most up-to-date Positive Evaluation report on SR (preview of web page 1 of three proven under):

Excessive Yield Dividend Compounder #8: Flowers Meals, Inc. (FLO)

- Dividend Yield: 4.7%

- Dividend Development Charge: 5.1%

Flowers Meals opened its first bakery in 1919 and has since turn into one of many largest producers of packaged bakery meals in the US, working 46 bakeries in 18 states.

Its well-known manufacturers embrace Marvel Bread, Residence Pleasure, Nature’s Personal, Dave’s Killer Bread, Tastykake and Canyon Bakehouse.

The corporate operates in two segments: Direct Retailer-Supply (DSD) and Warehouse Supply, with ~85% of the corporate’s product being delivered on to shops.

Supply: Investor Presentation

Contemporary breads, buns, rolls, and tortillas make up a few three-fourths of the enterprise, with gross sales channels for the corporate cut up between Supermarkets, Mass Merchandisers, Foodservice, and Comfort Retailer.

On Could twenty third, 2024, Flower Meals elevated its quarterly dividend 4.3% to $0.24, extending the corporate’s dividend development streak to 22 consecutive years.

On November eighth, 2024, Flowers Meals reported third quarter outcomes for the interval ending October fifth, 2024. For the quarter, income of $1.19 billion was down 0.8% from the prior 12 months. Adjusted earnings-per-share equaled $0.33, up from $0.29 in the identical quarter final 12 months.

Flowers Meals supplied an up to date outlook for 2024 as properly. For the 12 months, income is predicted in a spread of $5.116 billion to $5.147 billion. Adjusted earnings-per-share are anticipated to be in a spread of $1.24 to $1.28.

Click on right here to obtain our most up-to-date Positive Evaluation report on FLO (preview of web page 1 of three proven under):

Excessive Yield Dividend Compounder #7: RGC Sources, Inc. (RGCO)

- Dividend Yield: 4.2%

- Dividend Development Charge: 5.2%

RGC Sources, Inc. operates as a distributor and vendor of pure fuel to industrial, business, and residential clients by way of its subsidiaries: Roanoke Fuel, Midstream, and Diversified Vitality.

Residential clients are the corporate’s largest buyer phase, accounting for ~58% of the full revenues, adopted by business clients at 34%.

The corporate operates in three segments: Fuel Utility, the important thing income generator; Funding in Associates; and Mum or dad & Different. The corporate was based in 1883 and generates slightly below $100 million in annual income.

On November 14th, 2024, RGC Sources introduced its This fall 2024 outcomes. The corporate posted non-GAAP EPS of $0.01, beating the market’s estimate by $0.02, and whole revenues of $13.10 million, which had been up 5.11% 12 months over 12 months.

The earnings development was pushed by greater contributions from the Mountain Valley Pipeline (MVP), primarily from Allowance for Funds Used Throughout Development (AFUDC) earlier than the pipeline commenced operations in June 2024.

Click on right here to obtain our most up-to-date Positive Evaluation report on RGCO (preview of web page 1 of three proven under):

Excessive Yield Dividend Compounder #6: CVS Well being Corp. (CVS)

- Dividend Yield: 6.1%

- Dividend Development Charge: 6.0%

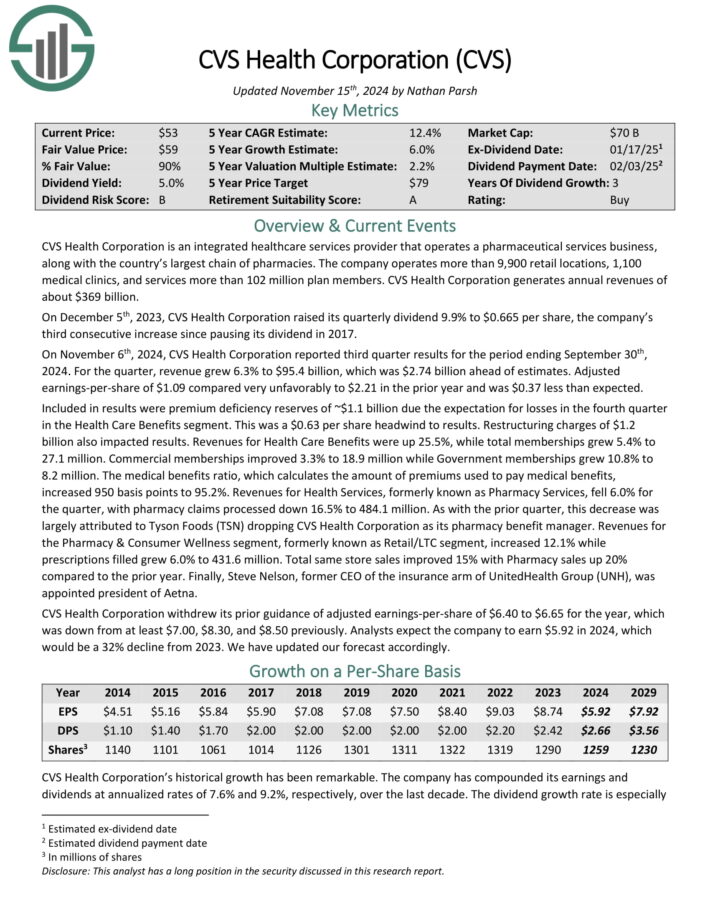

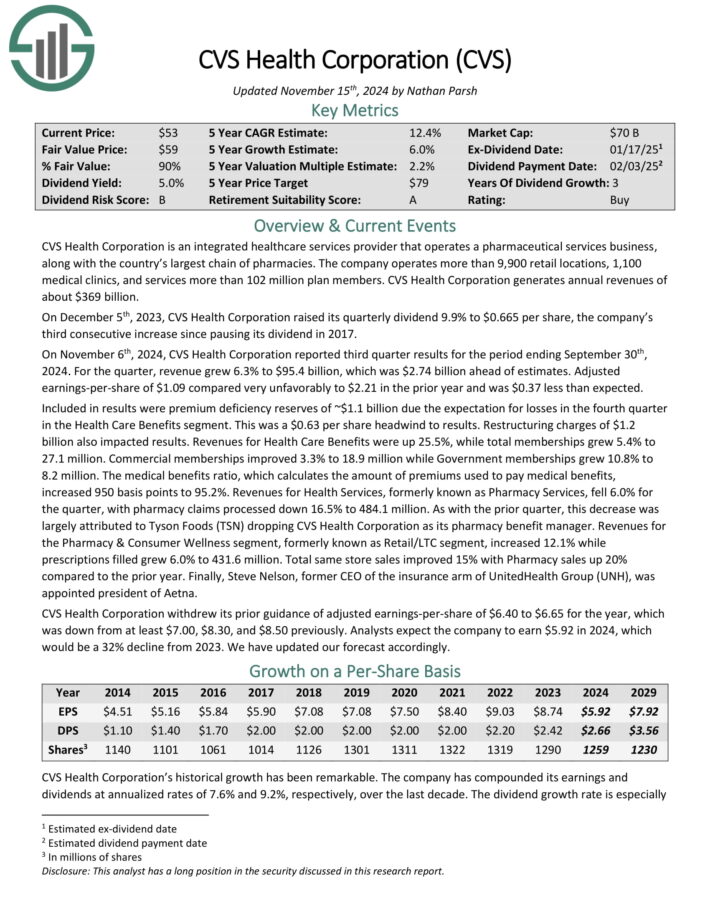

CVS Well being Company is an built-in healthcare companies supplier that operates a pharmaceutical companies enterprise, together with the nation’s largest chain of pharmacies.

The corporate operates greater than 9,900 retail areas, 1,100 medical clinics, and companies greater than 102 million plan members. CVS Well being Company generates annual revenues of about $369 billion.

On November sixth, 2024, CVS Well being Company reported third quarter outcomes for the interval ending September thirtieth, 2024. For the quarter, income grew 6.3% to $95.4 billion, which was $2.74 billion forward of estimates. Adjusted earnings-per-share of $1.09 in contrast very unfavorably to $2.21 within the prior 12 months and was $0.37 lower than anticipated.

Included in outcomes had been premium deficiency reserves of ~$1.1 billion due the expectation for losses within the fourth quarter within the Well being Care Advantages phase.

This was a $0.63 per share headwind to outcomes. Restructuring fees of $1.2 billion additionally impacted outcomes. Revenues for Well being Care Advantages had been up 25.5%, whereas whole memberships grew 5.4% to 27.1 million.

Click on right here to obtain our most up-to-date Positive Evaluation report on CVS (preview of web page 1 of three proven under):

Excessive Yield Dividend Compounder #5: Eversource Vitality (ES)

- Dividend Yield: 5.0%

- Dividend Development Charge: 6.0%

Eversource Vitality is a diversified holding firm with subsidiaries that present regulated electrical, fuel, and water distribution service within the Northeast U.S.

The corporate’s utilities serve greater than 4 million clients after buying NStar’s Massachusetts utilities in 2012, Aquarion in 2017, and Columbia Fuel in 2020.

Eversource has delivered regular development to shareholders for a few years.

Supply: Investor Presentation

On November 4th, 2024, Eversource Vitality launched its third-quarter 2024 outcomes for the interval ending September thirtieth, 2024.

For the quarter, the corporate reported a web lack of $(118.1) million, a pointy decline from earnings of $339.7 million in the identical quarter of final 12 months, which displays the affect of the corporate’s exit from offshore wind investments.

The corporate reported a loss per share of $(0.33), in contrast with earnings-per-share of $0.97 within the prior 12 months. Earnings from the Electrical Transmission phase elevated to $174.9 million, up from $160.3 million within the prior 12 months, primarily resulting from a better degree of funding in Eversource’s electrical transmission system.

Click on right here to obtain our most up-to-date Positive Evaluation report on ES (preview of web page 1 of three proven under):

Excessive Yield Dividend Compounder #4: Portland Normal Electrical (POR)

- Dividend Yield: 4.6%

- Dividend Development Charge: 6.0%

Portland Normal Electrical is an electrical utility primarily based in Portland, Oregon, offering electrical energy to greater than 930,000 clients in 51 cities. The corporate owns or contracts greater than 3.5 gigawatts of vitality era, between fuel, coal, wind & photo voltaic, and hydro.

On April nineteenth, 2024, Portland Normal Electrical introduced a 5% enhance within the quarterly dividend to $0.50 per share.

Portland Normal reported third quarter 2024 outcomes on October twenty fifth, 2024. The corporate reported web revenue of $94 million for the quarter, equal to $0.90 per diluted share on a GAAP foundation, in comparison with $0.46 in Q3 2023.

Retail vitality deliveries rose 0.3% year-to-date in comparison with the identical prior 12 months interval, however wholesale vitality deliveries soared 45%. Consequently, whole vitality deliveries rose 11%.

Management narrowed its 2024 full 12 months steerage for adjusted earnings per share to $3.13 on the midpoint primarily based on a collection of assumptions, most notably a 2.5% enhance in annual vitality deliveries.

Click on right here to obtain our most up-to-date Positive Evaluation report on Portland Normal Electrical Firm (preview of web page 1 of three proven under):

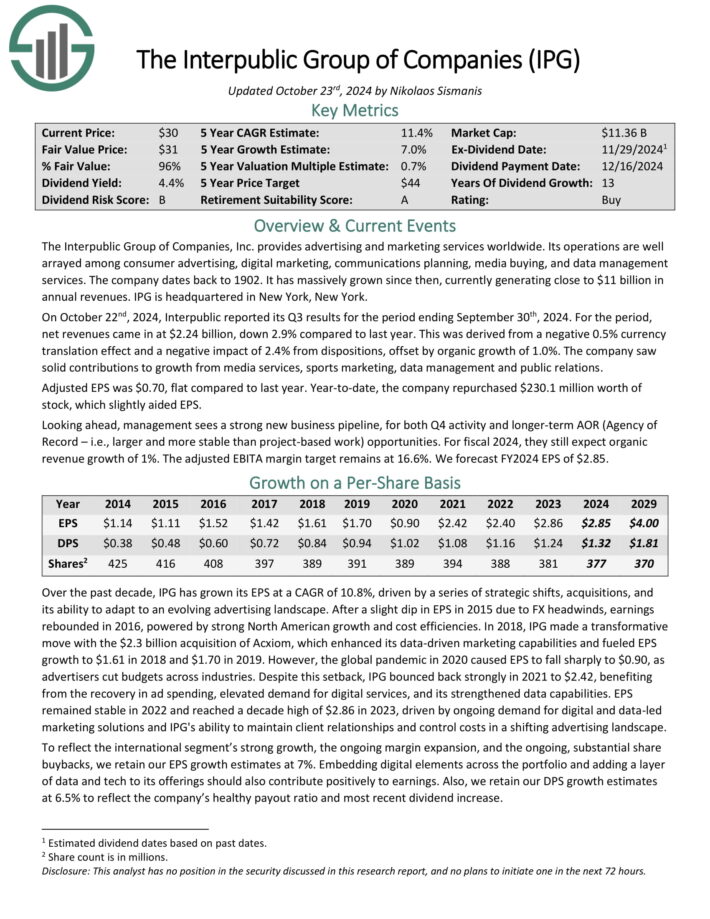

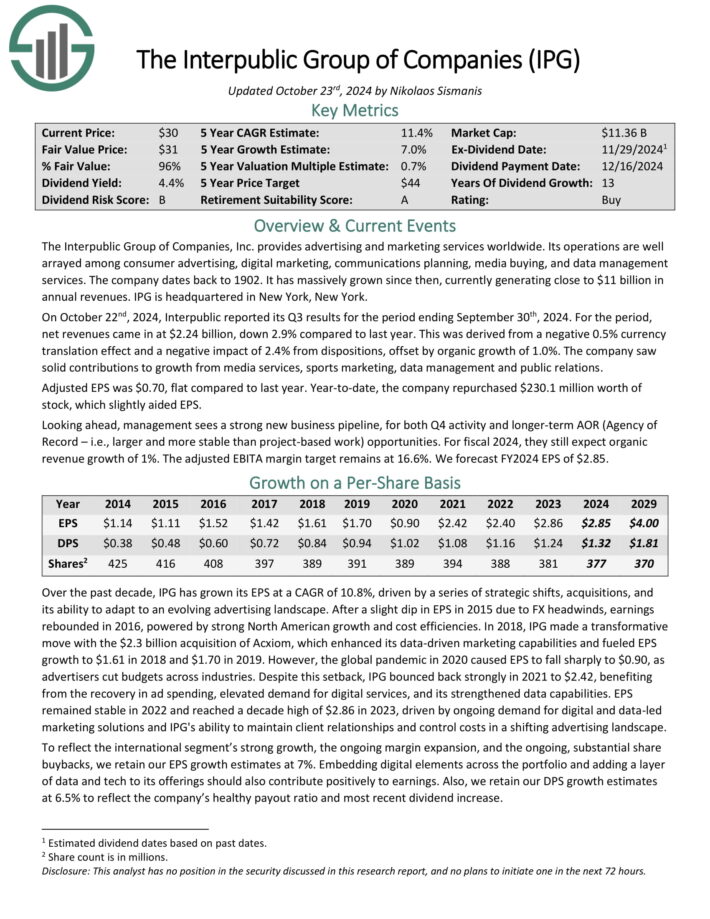

Excessive Yield Dividend Compounder #3: Interpublic Group of Cos. (IPG)

- Dividend Yield: 4.7%

- Dividend Development Charge: 6.5%

The Interpublic Group of Firms, Inc. gives promoting and advertising and marketing companies worldwide. Its operations are properly arrayed amongst client promoting, digital advertising and marketing, communications planning, media shopping for, and knowledge administration companies.

On October twenty second, 2024, Interpublic reported its Q3 outcomes for the interval ending September thirtieth, 2024. For the interval, web revenues got here in at $2.24 billion, down 2.9% in comparison with final 12 months.

This was derived from a adverse 0.5% foreign money translation impact and a adverse affect of two.4% from tendencies, offset by natural development of 1.0%.

The corporate noticed strong contributions to development from media companies, sports activities advertising and marketing, knowledge administration and public relations.

Adjusted EPS was $0.70, flat in comparison with final 12 months. 12 months-to-date, the corporate repurchased $230.1 million price of inventory, which barely aided EPS.

Click on right here to obtain our most up-to-date Positive Evaluation report on IPG (preview of web page 1 of three proven under):

Excessive Yield Dividend Compounder #2: FMC Corp. (FMC)

- Dividend Yield: 4.8%

- Dividend Development Charge: 7.0%

FMC Company is an agricultural sciences firm that gives crop safety, plant well being, {and professional} pest and turf administration merchandise. By acquisitions, FMC is now one of many 5 largest patented crop chemical corporations.

The corporate markets its merchandise by way of its personal gross sales group and thru alliance companions, impartial distributors, and gross sales representatives. It operates in North America, Latin America, Europe, the Center East, Africa, and Asia.

On October twenty ninth, 2024, FMC Company launched its third quarter outcomes for the interval ending September thirtieth, 2024.

For the quarter, the corporate reported income of $1.07 billion, up 9% versus the third quarter of 2023, and adjusted earnings per diluted share of $0.69, up 57% versus the identical quarter of the earlier 12 months.

Quarterly income development was primarily pushed by a 17% enhance in quantity, notably robust in North America and Latin America, regardless of dealing with a 5% decline from worth decreases resulting from difficult market circumstances and a 3% international trade headwind.

Click on right here to obtain our most up-to-date Positive Evaluation report on FMC (preview of web page 1 of three proven under):

Excessive Yield Dividend Compounder #1: HA Sustainable Infrastructure Capital (HASI)

- Dividend Yield: 6.2%

- Dividend Development Charge: 7.0%

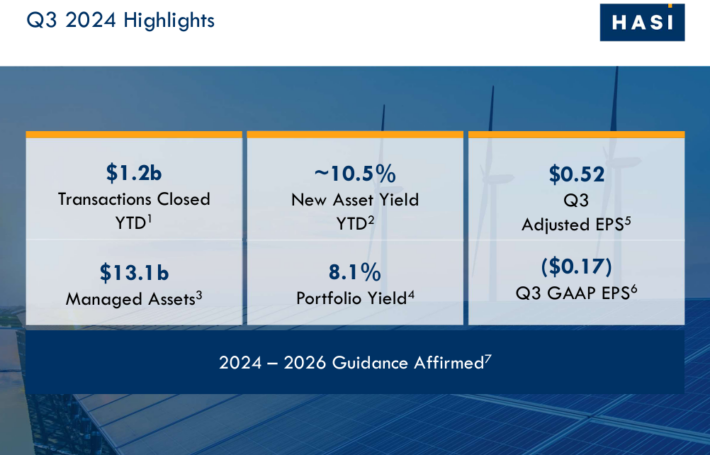

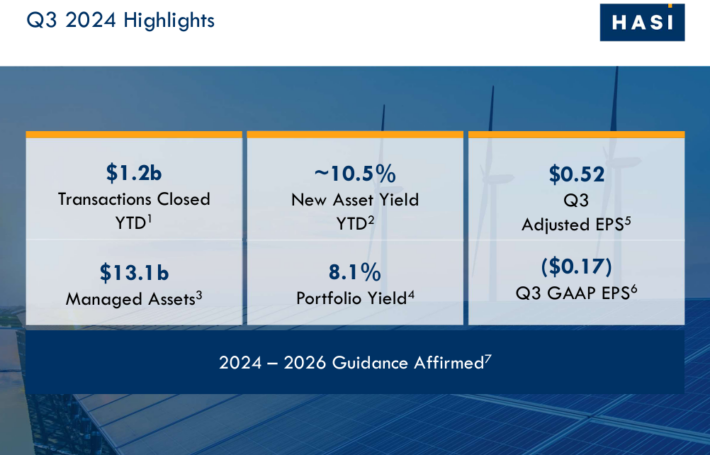

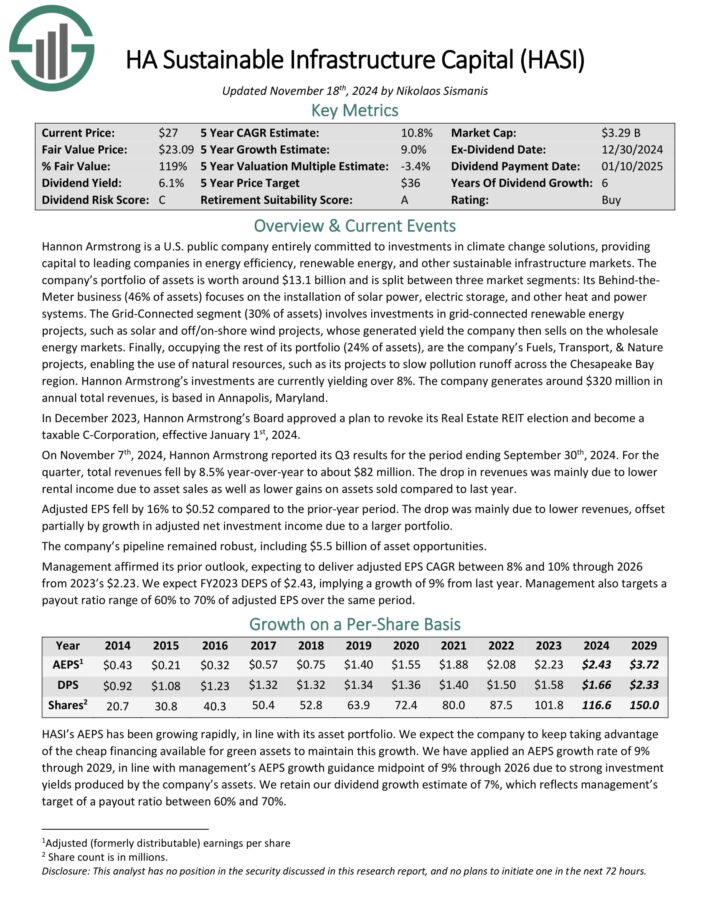

Hannon Armstrong is a U.S. public firm that invests in local weather change options, offering capital to main corporations in vitality effectivity, renewable vitality, and different sustainable infrastructure markets.

The corporate’s portfolio of belongings is price round $13.1 billion and is cut up between three market segments: Its Behind the Meter enterprise (46% of belongings) focuses on the set up of solar energy, electrical storage, and different warmth and energy programs.

The Grid-Related phase (30% of belongings) includes investments in grid-connected renewable vitality tasks, equivalent to photo voltaic and off/on-shore wind tasks, whose generated yield the corporate then sells on the wholesale vitality markets.

Lastly, occupying the remainder of its portfolio (24% of belongings), are the corporate’s Fuels, Transport, & Nature tasks, enabling using pure assets, equivalent to its tasks to gradual air pollution runoff throughout the Chesapeake Bay area.

Supply: Investor Presentation

On November seventh, 2024, Hannon Armstrong reported its Q3 outcomes for the interval ending September thirtieth, 2024. For the quarter, whole revenues fell by 8.5% year-over-year to about $82 million.

The drop in revenues was primarily resulting from decrease rental revenue resulting from asset gross sales in addition to decrease beneficial properties on belongings offered in comparison with final 12 months.

Adjusted EPS fell by 16% to $0.52 in comparison with the prior-year interval. The drop was primarily resulting from decrease revenues, offset partially by development in adjusted web funding revenue resulting from a bigger portfolio.

The corporate’s pipeline remained strong, together with $5.5 billion of asset alternatives. Administration affirmed its prior outlook, anticipating to ship adjusted EPS CAGR between 8% and 10% by way of 2026.

Click on right here to obtain our most up-to-date Positive Evaluation report on HASI (preview of web page 1 of three proven under):

Further Studying

Buyers ought to proceed to observe every inventory to ensure their fundamentals and development stay on observe, notably amongst shares with extraordinarily excessive dividend yields.

See the assets under to generate extra compelling funding concepts for dividend development shares and/or high-yield funding securities.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].