We all occasionally fall victim to fallacies—assumptions or beliefs that just aren’t true.

Consider a deceptively simple logic puzzle known as the Monty Hall problem: You’re presented with three doors, behind one of which is a prize, and you have to guess the door. Before revealing the answer, the game show host makes your life easier by eliminating one of the wrong answers and asks you if you want to change your guess. Should you change it?

Most people shrug and say, “At that point, it’s 50/50, so I’d just keep my guess the same.” This is the wrong answer: You should switch your guess because the other door has two-thirds odds of being correct.

To make the puzzle more intuitive, reframe it with a thousand doors and the host eliminating 998 wrong answers after your initial guess. They’ve basically identified the right door for you, and your original guess still only has a one-in-a-thousand chance of being correct.

If you still don’t believe me, look up mathematical explanations of the Monty Hall problem.

Returning to the point, we all believe in a few fallacies that hold us back, and when it comes to investing and real estate, those fallacies can cost us literal fortunes. Keeping an open mind, consider which of these money myths and fallacies you might secretly harbor.

Myth #1: Renting Is Throwing Money Away

I’ve been in real estate for over 20 years, and I own an interest in over 2,000 units. And I rent the apartment where I live.

Renting and owning a home each comes with trade-offs. After weighing them, each of us can and should decide for ourselves which option suits us better, but it’s not a foregone conclusion.

Renting offers flexibility. My wife and I live overseas, and we may well decide to move to a new country over the next year or two. We’re not chained to a single location.

Renters also outsource the headaches of managing and maintaining a building to someone else. You can think of it as paying a small premium to delegate the labor to someone else. I haven’t mown a lawn or repaired, well, anything in nearly nine years.

I made the case for renting a little while ago and won’t rehash all of what I said here, but don’t be so quick to assume that homeownership always makes financial sense.

Myth #2: You Can Time the Market

Professional economists and market analysts with access to the best data in the world can’t predict the market. And you’re going to sit in your armchair and tell me that you can?

Hubris, I say. Pure hubris.

No, really, it’s a fool’s errand to try to time the market. To begin with, you have to time it right twice: buying low and selling high. What are the odds of nailing that both times? And since that won’t dissuade you, consider that the next market low might still be higher than today’s pricing.

I don’t know which assets will outperform others in the coming years or when market highs or lows will come along. But I do know that if I invest in assets that cash flow well today, I’ll earn money while someone sitting on the sidelines hoping to time the market misses out.

Myth #3: Real Estate Investing Takes a Lot of Money

Back in the ‘90s, maybe. But today, you have plenty of options to invest small amounts of money in real estate.

I can buy fractional shares of rental properties for $20 to $100 apiece. I can put capital toward hard money loans at $10 per loan. Or I can buy plots of land for $2,000 to $5,000.

When I want to invest like the rich in private equity real estate for 15% to 25% returns, I invest $5,000 apiece in deals vetted together in SparkRental’s Co-Investing Club.

You don’t need tens of thousands of dollars to invest in real estate, and you certainly don’t need to invest that much in single assets. My money is diversified among many thousands of units across dozens of properties.

And specifically, because you can invest small amounts, it frees you up to practice dollar-cost averaging with your real estate investments—rather than trying to time the market.

Myth #4: Real Estate Investing Takes a Lot of Work and Skill

If you buy properties directly, it does take a ton of labor and skill. You have to find a good deal, arrange financing, negotiate with and manage contractors, navigate permits and inspectors, screen tenants, screen property managers, collect rents, and so on. The micro-skills required are endless.

I don’t do that anymore. I outsource all that to professional asset managers so I can go back to living my life. In fact, most of the members of our investment club don’t do heavy lifting due diligence for each deal. They simply participate in group vetting calls and decide whether they feel comfortable with the risk/reward ratio of any given deal.

Myth #5: Cash Flow Is “The Rent Minus the Mortgage”

Hopefully, no one reading this article actually still believes this. But it’s what the average person thinks and one more reason why some people love to hate landlords.

It shames me to admit that I didn’t understand how rental cash flow worked when I first started investing in rental properties. I didn’t know that you had to average out irregular but inevitable expenses like vacancy rate, repairs, and maintenance. And I didn’t know that you have to account for property management costs, even if you plan to manage the property yourself.

Myth #6: It Takes Decades to Become a Millionaire

As of now, there are over 59.4 million millionaires around the world. And you absolutely, positively can become one of them.

Don’t get me wrong—you don’t get rich overnight. It takes years of disciplined savings and investing. But the more you’re willing to slash your spending and invest aggressively, the quicker you’ll join the two-comma club.

And hey, it helps to earn high returns. The long-term average returns on U.S. stocks exceed 10%, and I target 15% to 25% on my real estate investments.

Check out the math to become a millionaire in 10 years to see it for yourself.

Myth #7: I’m Too Old/Young/Single/Married/Whatever to Reach Financial Independence

I’ve heard every excuse for why other people can reach financial independence, but you can’t. Or to invest in real estate. Or to achieve whatever other goal.

Too old, too young. Only single people can do it. Only married couples can do it. Only 34-year-old white males working in tech with hipster glasses and shaggy haircuts can do it.

Being single or married each has pros and cons for building wealth. Sure, married couples can split some expenses—but many are also financially rowing in opposite directions.

And so it goes with every other characteristic that people use to explain away why they aren’t living the lifestyle they want. Stop making excuses, and start taking accountability for every single outcome in your life.

Myth #8: Cash Is Safer Than Any Investment

Sure, investments sometimes lose money. But cash always loses money.

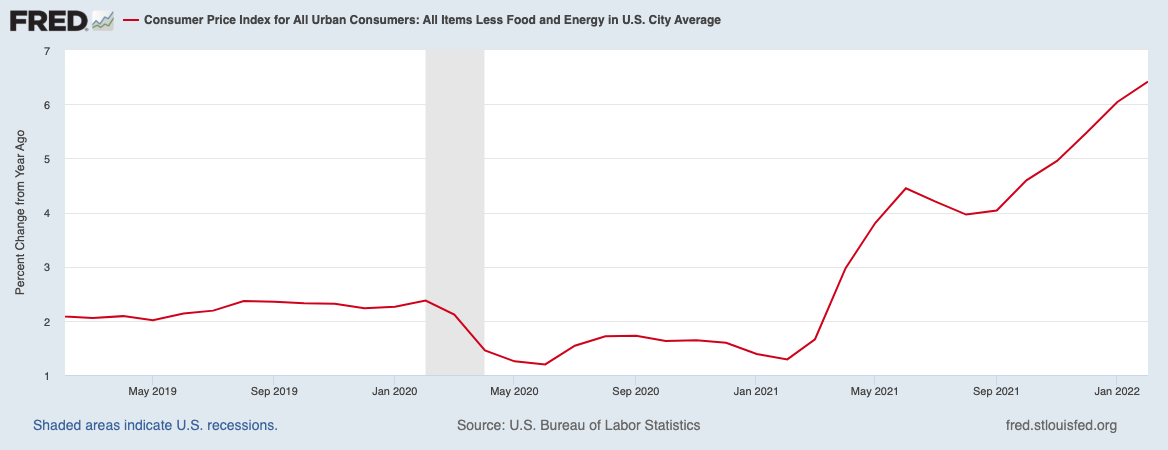

It may be a little, such as the annual 2% inflation rate that the Fed targets. Or it may be a lot, such as the 9.1% inflation rate we saw in 2022.

And that says nothing about the risks to your physical cash in your possession—risks like theft, loss, or simply forgetting where you put it. It makes me froth at the mouth when I see all the crumpled-up bills in the bottom of my wife’s purse, which are just as likely to disappear unspent as they are to wind up in her wallet.

Myth #9: You Should Avoid Risk in Investments

Wealthy people understand that everything in life comes with risk. Your mission isn’t to avoid risk—it’s to manage it. Take calculated risks in your investments by measuring the risk against the potential returns.

When I invest for double-digit returns, I spread that risk out over many investments. I don’t invest $100,000 in a single real estate investment targeting 20% returns but rather spread that out over 15 to 20 investments. The result will look like a bell curve, with some investments underperforming, some overperforming, and others falling in the middle.

Embrace risk —as long as you can assess it and it fits within your broader investing strategy.

Myth #10: Risk Always Determines Return on Investment

The average person hears 15% to 25% targeted returns, and they assume equivalently high risk.

Don’t get me wrong—private equity real estate does come with risk. But I would argue that the risk is no higher than, say, the stock market and its 7% to 10% long-term average return.

Private equity real estate investments pay disproportionately higher returns because of other factors beyond risk, such as lack of liquidity, long-term commitment, and lack of awareness among average investors. Most of all, the high minimum investment is $50,000 to $100,000 if you invest by yourself and $5,000 if you invest as a member of a co-investing club.

Don’t take my word for it. Check out this chart comparing the risk and returns for portfolios that include private equity real estate compared to standard 60/40 stock/bond portfolios:

Risk does impact return, but it’s far from the only factor. Don’t assume that all high-return investments come with equally high risk.

Final Thoughts

The list of financial fallacies goes on, from the “Rule of 100” to the 4% Rule. Some investors mistakenly believe that only accredited investors can invest in private equity real estate. Others believe that it’s impossible to retire before your 50s on a typical American salary. And the list goes on.

Don’t let financial assumptions go unchallenged. Always keep learning and updating your financial beliefs. You can achieve financial independence far faster than you think if you keep finding creative ways to boost your savings rate and keep expanding your investing expertise.

The Money Podcast

Kickstart your personal finance journey with Scott and Mindy as they break down the good, bad, and ugly of people’s personal money stories. From interviews with entrepreneurs and business owners to breakdowns of listener finances, you’ll get actionable advice on how to get out of debt and grow your money.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.